Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Definition of Capital Structure

Caricato da

Amna Nawaz0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

124 visualizzazioni3 pagineDefinition of Capital Structure

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoDefinition of Capital Structure

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

124 visualizzazioni3 pagineDefinition of Capital Structure

Caricato da

Amna NawazDefinition of Capital Structure

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

CHAPTER 2

REVIEW OF RELATED LITERATURE

The literature review helps in generating a framework for the study by

identifying the

important issues in capital structure and its theories that are relevant to the

study.

Therefore, this chapter is divided into several areas; general overview,

definition of capital

structure, theories of capital structure, theoretical determinants of capital

structure, bank

capital structure, Overview of Commercial Banks in Ethiopia. In this chapter,

a review of

related empirical literature is also presented.

2.1. General Overview

Corporate sector growth is vital to economic development. The issue of finance has been

identified as an immediate reason why businesses in developing countries fail to start or to

progress. It is imperative for firms to be able to finance their activities and grow over time if

they are ever to play an increasing and predominant role in providing employment as well as

income in terms of profits, dividends and wages to households. So, a path to development

could not be realized without enabling to evaluate the business environmental factors

particularly factors affecting access to finance. Consequently, managerial decisions related

to finance are at the center of the economic or business activities, which are the subject

matter of financial management discipline.

Financial management discipline has three major decision functions/activities:

i. Capital budgeting (Investment) Decision: deal with the efficient utilization of capital

or funds to acquire assets. It is more concerned with the size, type and percentage

composition of assets of a firm.

ii. Capital structure (financing) decisions: emphasize on the proper selection of mix of

capital i.e. debt vs. equity. It deals mainly with the size, type and percentage

composition of capital sources.

iii. Asset management decision: is the other decision area that deal with efficient

utilization of assets, being acquired through investment decision.

Here, the literature focuses on capital structure decisions general theories, and particularly

the related determinants of capital structure.

14

2.2. Definition of Capital Structure

There are many definitions given to capital structure of companies. Brealey and Myers

(1991) defined capital structure as comprising of debt, equity or hybrid securities issued by

the firm. VanHorn (1989) defined capital structure as the proportion of debt to the total

capital of the firms. Pandey (2005) defined capital structure as a choice of firms between

internal and external financial instruments.

From the definitions given by many previous researchers, capital structure of a firm

describes the way in which a firm raise capital needed to establish and expand its business

activities. It is a mixture of various types of equity and debt capital a firm maintains,

resulting from the firms financing decisions. The amount of debt that a firm uses to finance

its assets is called leverage. A firm with a lot of debt in its capital structure is said to be

highly levered. A firm with no debt is said to be unlevered. For example, a firm that sells

Birr 20 million in equity and Birr 80 million in debts is said to be 20 percent equity-financed

and 80 percent debt-financed. The firm's ratio of debt to total capital is 80 percent and is

referred to as the firm's leverage.

The term capital structure is used to represent the proportionate relationship between debt

and equity. Debt represents the creditors claim i.e. liabilities or borrowings. Equity includes

paid-up share capital, share premium, and reserve and surplus (retained earnings).

Managers, in the extent to pursue wealth maximization objective of a firm, should examine

the set of theories and at least major factors affecting the decision that help them choose the

optimal capital structure. Normally firms have option of choosing debt financing, equity

financing, or combination of the two, with the other option of internal financing mainly from

the retained earnings. Such dealings of financing decisions are, in fact, termed as Capital

Structure Decisions.

15

2.3. Capital Structure Theories

Beginning from Modigliani and Miller (1958)s irrelevance proposition, capital structure

puzzle has drawn a lot of attention. How do firms choose their capital structure? What are

the determinants of firm capital structure decisions? Numerous researches study in these

questions, however, the results are still ambiguous. This Section starts with the capital

structure irrelevancy theory. Following subsections give the overview of theories and

empirical studies that suggest that capital structure affects firms value.

2.3.1. Capital Structure Irrelevancy Theory

(Modigliani Miller Theorem)

In the 1950s, two financial economists, Franco Modigliani and Merton Miller, made

significant contribution to the corporate finance and were rewarded decades later with a

Noble Prize in economics. They came up with the new propositions to explain the capital

structure theory and here starts the birth of modern capital structure theory. Their

contribution was to show that, under certain assumptions (known as the MM assumptions

and MM theory), the capital structure, or mix of debt and equity, does not have an impact on

the overall value of the firm. Theory of irrelevancy was presented in an era when research

was dominated by assumption that there is no interaction between a firms investment and

financial decisions of the firm.

Modigliani and Miller (1958) demonstrated that the market value of a firm is determined by

its earning power and the risk of its underlying assets, and independent of the way it chooses

to finance its investments or distributes dividends. Moreover, a firm can choose between

three methods of financing: issuing shares, borrowing or spending profits (as opposed to

disbursing them to shareholders as dividends). The theorem gets much more complicated,

but the basic idea is that under certain assumptions, it makes no difference whether a firm

finances itself with debt or equity.

Five years later, Modigliani and Miller (1963) introduced corporate taxes into their earlier

model by setting free the first assumption of no taxes. They argued that optimal capital

structure can be obtained for firms with 100 percent debt financing by having the tax shield

benefits of using debt. With tax introduced the value of levered firm becomes higher. This

was their correction model. Some researchers felt that Modigliani and Miller failed to

16

discuss in their article on the practical applications of their theory to individual firms and on

how well the theory explains observed facts, such as debt ratios, market reactions to security

issues and so on.

Thereafter, several empirical researches were conducted on the concept developed by

Modigliani and Miller. In most of the later studies, researchers like Durand et al. (1989)

accepted the importance of financial leverage in affecting the overall cost of capital, the

return to the shareholders and the value of a firm. They criticized the hypothesis of MM

theory, and maintained that several factors such as existence of imperfectness in the market,

the differences, existence of transaction cost and institutional restrictions and preferences for

the present income over the future to affect the capital structure study. These have relevance

in affecting the value of a firm and were ignored by MM.

Accordingly, if capital structure is irrelevant in a perfect market, then imperfections which

exist in the real world must be the cause of its relevance. In the next section we look at how,

when assumptions in the M&M model are relaxed, imperfections arise and how they are

dealt with. Subsequent literatures placed much emphasis on relaxing the assumptions made

by Modigliani and Miller, in particular considering agency costs (Jensen and Meckling,

1976; Myers, 1977; Harris and Raviv, 1990), signaling (Ross, 1977), asymmetric

information (Myers and Majluf, 1984; Myers, 1984), product/input market interactions

(Brander and Lewis, 1986; Titman, 1984), corporate control considerations (Harris and

Raviv, 1988) and taxes (Bradley et al., 1984).

The current state of capital structure comprises a wide variety of theoretical approaches but

no theory is universally accepted and practically applied (Myers, 2001; Harris and Raviv,

1991). According to Myers 2001 (p.81)

There is no universal theory of the debt-equity choice, and no reason to

expect one. There are several useful conditional theories however.

The major reason why financing matters include taxes, differences in information and

agency costs. The different theories of optimal capital structure depend on which economic

aspect and firm characteristic we focus on.

Potrebbero piacerti anche

- ACCA Financial Management - Mock Exam 1 - 1000225 PDFDocumento25 pagineACCA Financial Management - Mock Exam 1 - 1000225 PDFrash D100% (1)

- NIFTY Options Trading PDFDocumento9 pagineNIFTY Options Trading PDFsantosh kumari100% (5)

- DeloitteDocumento2 pagineDeloitteIzZa RiveraNessuna valutazione finora

- MACR - Module 5 - Valuation in M&ADocumento43 pagineMACR - Module 5 - Valuation in M&AManjunath RameshNessuna valutazione finora

- Equity Research Report HDFC BankDocumento4 pagineEquity Research Report HDFC BankNikhil KumarNessuna valutazione finora

- ASIGNACION 3 FinanzasDocumento3 pagineASIGNACION 3 FinanzasNeryvelisse MedinaNessuna valutazione finora

- PS 1Documento4 paginePS 1BlackRoseNessuna valutazione finora

- Capital Structure Analysis of Lafarge SuDocumento21 pagineCapital Structure Analysis of Lafarge SuRakibul IslamNessuna valutazione finora

- Chaitanya Chemicals - Capital Structure - 2018Documento82 pagineChaitanya Chemicals - Capital Structure - 2018maheshfbNessuna valutazione finora

- Financial ManagementDocumento34 pagineFinancial ManagementNidhi GuptaNessuna valutazione finora

- Capital Structure of Banking Companies in IndiaDocumento21 pagineCapital Structure of Banking Companies in IndiaAbhishek Soni43% (7)

- A Study of Capital Structure ManagementDocumento94 pagineA Study of Capital Structure ManagementBijaya DhakalNessuna valutazione finora

- An Evaluation of Capital Structure and Profitability of Business OrganizationDocumento16 pagineAn Evaluation of Capital Structure and Profitability of Business OrganizationPushpa Barua0% (1)

- Effect of Capital Structure On The Profitability of Selected Companies in NigeriaDocumento8 pagineEffect of Capital Structure On The Profitability of Selected Companies in Nigeriasuela100% (1)

- Capital Structure and Firm Performance An Analysis of Manufacturing Firms in TurkeyDocumento10 pagineCapital Structure and Firm Performance An Analysis of Manufacturing Firms in TurkeyKulsoomNessuna valutazione finora

- Capital Structure Analysis AT Bharathi CementDocumento17 pagineCapital Structure Analysis AT Bharathi CementMohmmedKhayyumNessuna valutazione finora

- Capital Structure Analysis HeritageDocumento91 pagineCapital Structure Analysis HeritageKavitha LuckyNessuna valutazione finora

- CAPITAL STRUCTURE Ultratech 2018Documento75 pagineCAPITAL STRUCTURE Ultratech 2018jeevanNessuna valutazione finora

- DD Icici UppalDocumento14 pagineDD Icici Uppalferoz khanNessuna valutazione finora

- A Comprehensive Study On Financial Planning and ForecastingDocumento66 pagineA Comprehensive Study On Financial Planning and ForecastingInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- A Study On Capital Structure in Sri Pathi Paper and Boards Pvt. LTD., SivakasiDocumento69 pagineA Study On Capital Structure in Sri Pathi Paper and Boards Pvt. LTD., SivakasiGold Gold50% (4)

- Fixed Assets NTPCDocumento59 pagineFixed Assets NTPCkshashankNessuna valutazione finora

- Risk ManagementDocumento35 pagineRisk Managementfafese7300Nessuna valutazione finora

- A Study On Capital Structure and Financial Performance of Indian Textile IndustryDocumento10 pagineA Study On Capital Structure and Financial Performance of Indian Textile IndustryIAEME PublicationNessuna valutazione finora

- Ebit Eps AnalysisDocumento22 pagineEbit Eps AnalysisPiyuksha PargalNessuna valutazione finora

- Mutual Fund Performance in Bangladesh - An Empirical StudyDocumento19 pagineMutual Fund Performance in Bangladesh - An Empirical Studysouthern.edu100% (1)

- Capital Structure - AmbujaDocumento14 pagineCapital Structure - AmbujaKitten KittyNessuna valutazione finora

- IMPACT OF CAPITAL STRUCTURE ON PROFITABILITY NoorDocumento41 pagineIMPACT OF CAPITAL STRUCTURE ON PROFITABILITY Noorsaqib100% (1)

- Synopsis On Capital StructureDocumento11 pagineSynopsis On Capital StructureSanjay MahadikNessuna valutazione finora

- Cost of Capital BDocumento42 pagineCost of Capital BParveen KumarNessuna valutazione finora

- Portfolio Management Banking SectorDocumento133 paginePortfolio Management Banking SectorNitinAgnihotri100% (1)

- Capital Budgeting SHARIBDocumento103 pagineCapital Budgeting SHARIBfarzijii4Nessuna valutazione finora

- A Comprehensive Study On Financial Planning and ForecastingDocumento31 pagineA Comprehensive Study On Financial Planning and ForecastingInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Venture CapitalDocumento83 pagineVenture Capitalanu singhNessuna valutazione finora

- Capital Structure - Bharati CementDocumento14 pagineCapital Structure - Bharati CementMohmmedKhayyumNessuna valutazione finora

- Hypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDDocumento25 pagineHypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDlovels_agrawal6313Nessuna valutazione finora

- Dimensions of Working Capital ManagementDocumento22 pagineDimensions of Working Capital ManagementRamana Rao V GuthikondaNessuna valutazione finora

- Assignment On Dividend PolicyDocumento20 pagineAssignment On Dividend PolicyNayem Islam75% (4)

- Project Presentation ON " An Analysis of Capital Structure For Hindustan Unilever Limited."Documento14 pagineProject Presentation ON " An Analysis of Capital Structure For Hindustan Unilever Limited."Raja Sekar0% (1)

- Capital Budgeting Is Finance Terminology For The Process of Deciding Whether or Not To Undertake An Investment Project.Documento14 pagineCapital Budgeting Is Finance Terminology For The Process of Deciding Whether or Not To Undertake An Investment Project.Utkarsh BajpaiNessuna valutazione finora

- Capital Structure and Its Impact On ProfitabilityDocumento26 pagineCapital Structure and Its Impact On ProfitabilityRajesh Mer100% (1)

- Research ProposalDocumento7 pagineResearch Proposalpachpind jayeshNessuna valutazione finora

- ConclusionDocumento3 pagineConclusionAsadvirkNessuna valutazione finora

- Capital Budgeting: Net Present ValueDocumento3 pagineCapital Budgeting: Net Present Valuepratibha2031Nessuna valutazione finora

- Numericals On Capital Structure Theories - KDocumento12 pagineNumericals On Capital Structure Theories - KnidhiNessuna valutazione finora

- MBA Project On Working CapitalDocumento57 pagineMBA Project On Working CapitalVijai PillarsettiNessuna valutazione finora

- Review of Literature PriyaDocumento3 pagineReview of Literature Priyadeepusrajan75% (4)

- Capital Budgeting Modify 1Documento72 pagineCapital Budgeting Modify 1bhaskarganeshNessuna valutazione finora

- Final Accounts Illustration ProblemsDocumento11 pagineFinal Accounts Illustration ProblemsSarath kumar CNessuna valutazione finora

- Fundamental and Technical Anlaysis of Private Bank SectorDocumento51 pagineFundamental and Technical Anlaysis of Private Bank SectorShirish TawdeNessuna valutazione finora

- Cost of Capital of MncsDocumento19 pagineCost of Capital of MncsNikhil MukhiNessuna valutazione finora

- Internal FinancingDocumento9 pagineInternal FinancingRavi Garg100% (1)

- 13 Capital Structure (Slides) by Zubair Arshad PDFDocumento34 pagine13 Capital Structure (Slides) by Zubair Arshad PDFZubair ArshadNessuna valutazione finora

- Js - Camels AnalysisDocumento7 pagineJs - Camels AnalysisTammy DavisNessuna valutazione finora

- Capital Structure Dessertation FinalDocumento29 pagineCapital Structure Dessertation FinalBasavaraj MtNessuna valutazione finora

- Solved - United Technologies Corporation (UTC), Based in Hartfor...Documento4 pagineSolved - United Technologies Corporation (UTC), Based in Hartfor...Saad ShafiqNessuna valutazione finora

- Kota Tutoring: Financing The ExpansionDocumento7 pagineKota Tutoring: Financing The ExpansionAmanNessuna valutazione finora

- Executive Summary of PJTDocumento3 pagineExecutive Summary of PJTnani66215487100% (1)

- Financial Performance Dora-2016Documento50 pagineFinancial Performance Dora-2016Lavanya100% (1)

- Ratio AnalysisDocumento25 pagineRatio Analysismba departmentNessuna valutazione finora

- A Study Applying DCF Technique For Valuing Indian IPO's Case Studies of CCDDocumento11 pagineA Study Applying DCF Technique For Valuing Indian IPO's Case Studies of CCDarcherselevators100% (1)

- Gamification in Consumer Research A Clear and Concise ReferenceDa EverandGamification in Consumer Research A Clear and Concise ReferenceNessuna valutazione finora

- Term Paper New SeniDocumento7 pagineTerm Paper New SeniBiniyam YitbarekNessuna valutazione finora

- Capital Structure Determinants-ArticleDocumento15 pagineCapital Structure Determinants-ArticlePrashant SharmaNessuna valutazione finora

- Efficiency of Islamic and Conventional 2. LiteratureDocumento5 pagineEfficiency of Islamic and Conventional 2. LiteratureAmna NawazNessuna valutazione finora

- Results On Banking Efficiency in Turkey 4. FindingsDocumento5 pagineResults On Banking Efficiency in Turkey 4. FindingsAmna NawazNessuna valutazione finora

- Factors Affecting The Efficiency of Islamic and Conventional Banks in TurkeyDocumento3 pagineFactors Affecting The Efficiency of Islamic and Conventional Banks in TurkeyAmna NawazNessuna valutazione finora

- Example (Assignment)Documento3 pagineExample (Assignment)Amna NawazNessuna valutazione finora

- Measuring The Cost of LivingDocumento4 pagineMeasuring The Cost of LivingAmna NawazNessuna valutazione finora

- And Compute The Index:: - The Inflation Rate Is Calculated As FollowsDocumento4 pagineAnd Compute The Index:: - The Inflation Rate Is Calculated As FollowsAmna NawazNessuna valutazione finora

- Demand and Supply: Elasticities and Government-Set PricesDocumento3 pagineDemand and Supply: Elasticities and Government-Set PricesAmna NawazNessuna valutazione finora

- What Is EducationDocumento9 pagineWhat Is EducationAmna NawazNessuna valutazione finora

- Difficulty IndexDocumento2 pagineDifficulty IndexAmna NawazNessuna valutazione finora

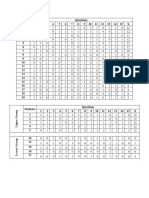

- Students Questions 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 X 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19Documento3 pagineStudents Questions 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 X 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19Amna NawazNessuna valutazione finora

- Sukuk Markets: Sukuk Issuer, Entered This Market in Mid-2001. The First Sukuk Issued by ADocumento4 pagineSukuk Markets: Sukuk Issuer, Entered This Market in Mid-2001. The First Sukuk Issued by AAmna NawazNessuna valutazione finora

- Example (Assignment)Documento3 pagineExample (Assignment)Amna NawazNessuna valutazione finora

- Capital Structure TheoriesDocumento3 pagineCapital Structure TheoriesAmna NawazNessuna valutazione finora

- Meezan ExampleDocumento5 pagineMeezan ExampleAmna NawazNessuna valutazione finora

- Active Strategies: Strategic InvestmentDocumento1 paginaActive Strategies: Strategic InvestmentAmna NawazNessuna valutazione finora

- Cost of Capital (Sermayesi Maliyet)Documento2 pagineCost of Capital (Sermayesi Maliyet)Amna NawazNessuna valutazione finora

- MultinationalDocumento9 pagineMultinationalAmna NawazNessuna valutazione finora

- Revised MBE SyllabusDocumento24 pagineRevised MBE SyllabusRichard GaurabNessuna valutazione finora

- Mas 15Documento11 pagineMas 15Christine Jane AbangNessuna valutazione finora

- Deloitte Op Risk WorkshopDocumento78 pagineDeloitte Op Risk WorkshopindraNessuna valutazione finora

- Functions of Stock ExchangeDocumento2 pagineFunctions of Stock ExchangeGokulKarwaNessuna valutazione finora

- FIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New IssuesDocumento6 pagineFIN221: Lecture 2 Notes Securities Markets: - Initial Public Offerings Versus Seasoned New Issuestania_afaz2800Nessuna valutazione finora

- Trustee's Motion To File Documents Under Seal (12-22)Documento9 pagineTrustee's Motion To File Documents Under Seal (12-22)FloridaLegalBlogNessuna valutazione finora

- NHPCDocumento418 pagineNHPCMohinish BhardwajNessuna valutazione finora

- 50 Warren Buffett Quotes On Life, Investing and Happiness - InvestingAnswersDocumento3 pagine50 Warren Buffett Quotes On Life, Investing and Happiness - InvestingAnswerskuky6549369Nessuna valutazione finora

- Gitman 12e 525314 IM ch11rDocumento22 pagineGitman 12e 525314 IM ch11rAnn!3100% (1)

- Fin 4610 HW#1Documento23 pagineFin 4610 HW#1Michelle Lam100% (2)

- Morganstanley Co IncDocumento47 pagineMorganstanley Co IncWilliam Masterson ShahNessuna valutazione finora

- New Trader F AqsDocumento211 pagineNew Trader F AqsKevin Bunyan100% (2)

- 2015-2019 Bar Qs To Answer in Mercantile LawDocumento30 pagine2015-2019 Bar Qs To Answer in Mercantile LawAndrea Ivy DyNessuna valutazione finora

- ICAAPDocumento84 pagineICAAPjugokrst4246100% (1)

- Corporations: Corporation LawDocumento169 pagineCorporations: Corporation Lawbob100% (1)

- Scanware V OgburnDocumento9 pagineScanware V OgburnGeorge SharpNessuna valutazione finora

- Indian Basel Related For CAIIB Questions & AnswersDocumento76 pagineIndian Basel Related For CAIIB Questions & AnswersJessi LNessuna valutazione finora

- RMO No 17-2017Documento2 pagineRMO No 17-2017fatmaaleahNessuna valutazione finora

- Ayala Corp Class B Preferred Shares - Preliminary ProspectusDocumento387 pagineAyala Corp Class B Preferred Shares - Preliminary ProspectusEunjina MoNessuna valutazione finora

- Equity Investment Strategy Channa Amaratunga PDFDocumento18 pagineEquity Investment Strategy Channa Amaratunga PDFSukumar A.KNessuna valutazione finora

- Blurb-23 File-207 Vista Land Ar FaDocumento143 pagineBlurb-23 File-207 Vista Land Ar FariacajandingNessuna valutazione finora

- Special Laws in Transporation (B) : Atty. Vivencio F. Abaño - 8Documento2 pagineSpecial Laws in Transporation (B) : Atty. Vivencio F. Abaño - 8PiaTinioNessuna valutazione finora

- T G, B & D R: HE Loom OOM OOM EportDocumento18 pagineT G, B & D R: HE Loom OOM OOM EportYi WeiNessuna valutazione finora

- Risk, Return and Portfolio Theory: Chapter ThreeDocumento74 pagineRisk, Return and Portfolio Theory: Chapter ThreeWegene Benti UmaNessuna valutazione finora

- WP5 EpsteinDocumento26 pagineWP5 EpsteinererereretrterNessuna valutazione finora

- Assignment - Sources of CapitalDocumento14 pagineAssignment - Sources of Capitalabayomi abayomiNessuna valutazione finora