Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

#11. IP Right Sharing in Software Dev Outsourcing

Caricato da

dewimachfudCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

#11. IP Right Sharing in Software Dev Outsourcing

Caricato da

dewimachfudCopyright:

Formati disponibili

RESEARCH ARTICLE

AN EMPIRICAL ANALYSIS OF INTELLECTUAL

PROPERTY RIGHTS SHARING IN SOFTWARE

DEVELOPMENT OUTSOURCING1

Yuanyuan Chen

Department of Information Systems, National University of Singapore,

Singapore 117417, REPUBLIC OF SINGAPORE {discy@nus.edu.sg}

Anandhi Bharadwaj

Goizueta Business School, Emory University, Atlanta, GA 30322 U.S.A. {abharad@emory.edu}

Khim-Yong Goh

Department of Information Systems, National University of Singapore,

Singapore 117417, REPUBLIC OF SINGAPORE {gohky@comp.nus.edu.sg}

Software development outsourcing (SDO) contracts are plagued with ex post opportunism and underinvestment

problems. Property rights theory (PRT) argues that appropriate property rights allocation between vendors

and clients can reduce opportunism and incentivize relation-specific investments. We conduct an in-depth

content analysis of 171 real SDO contracts and empirically examine how project attributes and contract

parties bargaining power affect the allocation of intellectual property rights (IPR). We find that clients

retained more IPR when software development was modularized whereas they shared more IPR with vendors

in contracts that incorporated greater use of a vendors proprietary software. Greater levels of task complexity

were associated with more IPR sharing with vendors. We also find that the responsiveness of IPR to project

attributes varied across the different types of intellectual assets. For example, vendors were more likely to

obtain redeployment rights of know-how if they were contracted for novel software development projects.

However, clients were less likely to cede ownership of data and confidential information embedded in software

customization projects. We control for a variety of firm and transaction characteristics and the results we

obtain here are robust to concerns of endogeneity bias.

Keywords: Software development, outsourcing, contract design, intellectual property rights allocation,

property rights theory, incomplete contracts

Introduction1 cations, business process designs, technology and data archi-

tectural plans, algorithms, and source code (Gefen et al. 2008;

Software development outsourcing (SDO) is a knowledge- Walden 2005). These intellectual assets are created for the

intensive process where the contracting parties create a bundle core purposes of the clients business activities and in

of intellectual assets such as functional requirement specifi- accordance with specific instructions by the client. They

often embody the clients confidential information such as

business practices and pricing analytics. The intellectual

1

Ravi Bapna was the accepting senior editor for this paper. Yulin Fang assets generated in the SDO process are generally protected

served as the associate editor. as intellectual property (IP) (de Laat 2005; Harison 2008).

MIS Quarterly Vol. 41 No. 1, pp. 131-161/March 2017 131

Chen et al./IPR Sharing in Software Development Outsourcing

IP laws grant asset owners a bundle of IP rights (IPR) in- The limited empirical research on how IPR is allocated to

cluding ownership and usage rights to exploit the intellectual reduce ex post opportunism has either focus on a specific type

properties. In SDO, it is generally the case that clients hire of IPR (Anand and Khanna 2000; Elfenbein and Lerner 2003;

vendor firms under the work-made-for-hire principle, where Susarla 2012) or has treated IPR as a monolithic and

the default norm is for clients to retain all of the new IP indivisible bundle of rights (Whang 1992). Given that the

created in the project. However in practice, it is striking to responsiveness of contract parties investment efforts to the

observe that clients are often willing to share or cede some of allocation of IPR may depend on the value and the degree of

the ownership and usage rights to the vendors. For example, appropriability of individual IPR (Lerner and Merges 1998;

Carson and John (2013) reported that clients share at least Walden 2005), the allocation of individual IPR or combina-

some IPR with vendors when they outsource their research tions of IPR subsets may fulfill different contractual govern-

development and engineering projects. This is also observed ance functions. Therefore, previous research focusing on a

in SDO contracts when clients grant vendors the right to use specific dimension or lump sum effects of IPR has not been

or produce derivative software products for future use able to differentiate their value and effects clearly and has led

(Susarla et al. 2010; Walden 2005). However, in the case of to some ambiguous results (Adegbesan and Higgins 2011).

software contracts, there is no comprehensive understanding

of (1) the intellectual assets generated in SDO and the related The only prior studies that have analyzed IPR framework and

IPR involved and (2) the contingency factors that determine allocations in contracts are Lerner and Merges (1998),

when vendors are more likely to obtain IPR from clients. Adegbesan and Higgins (2011) and Carson and John (2013),

Understanding the first question is essential to securing the but these studies have not examined SDO contracts. The first

value generated in SDO as the means to create and exploit two papers examined IPR allocation in a biotechnology devel-

such value can vary considerably depending on the strategic opment alliance and focused on the impacts of biotechnology

and complementary use of different types of intellectual companies bargaining power (measured as the firms finan-

assets. We do not know enough about the appropriate ap- cial status) on the allocation of patent ownership. Carson and

proaches to protect different types of IPR in software and the John studied the role of IPR allocation as a dependence-

ways to exploit created values. Studying the determinants of balancing mechanism to change ex post bargaining power of

the allocation of IPR is a central issue in the negotiation of contract parties in R&D engineering outsourcing. Their

SDO contracts. IPR allocation matters because it can help findings may not be fully generalizable to the SDO context

reduce ex post opportunism and ensure that the contracting for the following two reasons. First, the primary exchange

parties are incentivized to invest relation-specific efforts hazard in software development outsourcing not only arises

(Grossman and Hart 1986; Hart and Moore 1990; Milgrom from contract parties bargaining power but also asset-

and Roberts 1992). specificity and uncertainty in software development projects.

Software development often intertwines with other operation

The purpose of this paper is to analyze the types of intel- and production activities within the client company (Gefen et

lectual properties generated in the SDO process and the al. 2008; Tiwana 2008a, 2008b). The linkage between differ-

determinants of IPR allocation. Although IPR in software ent functional activities and the interaction between client and

development has been studied in the IS literature, the focus vendors make the software development process complicated

has centered largely on the relative efficacy of various IP and difficult for parties to foresee and articulate contingencies

protection mechanisms such as copyrights and patents to in contracts, thereby increasing the hazard of ex post oppor-

protect against unauthorized use (Arora 1996; Leiponen 2008; tunism such as hold-up. Second, the contract partys response

Simon 1996). The literature on risks in software and IT out- to the incentive opportunity of IPR varies across industries

sourcing has focused on the typical project management risks and sectors. In industries where lead time or secrecy is

dealing with cost, quality, and schedule of the projects, with crucial, such as the case in the software industry, the incentive

the concomitant approaches to better planning, monitoring, effect of property rights allocation could be different from that

and control (Gefen et al. 2008; Keil et al. 2000; Krishnan et in biotechnology and engineering R&D contracts. In addi-

al. 2000; Tiwana 2008b, 2010; Tiwana and Keil 2009), but tion, the above three studies all focus on the allocation of

has remained largely silent on IP risks. Despite limited theo- patent ownership. Patent rights are not so prominent in SDO

retical work on allocation of IP rights in SDO (Walden 2005), contracts because software can be protected not only under

the software contract design literature has mainly focused on patent law but also under copyright and trade secret law. The

compensation mechanisms such as pricing structure and value and the appropriability of copyright or trade secret are

monetary incentives (Dey et al. 2010; Gopal et al. 2003; quite different from patent ownership given that these IPR are

Lichtenthaler and Ernst 2012) but has ignored the incentive governed by different rules. Against this backdrop and to the

opportunities from IP rights. best of our knowledge, our study represents the first attempt

132 MIS Quarterly Vol. 41 No. 1/March 2017

Chen et al./IPR Sharing in Software Development Outsourcing

at categorizing different types of IPR that are specified in IPR might be better measured by observing explicit

SDO contracts and the determinants of these IPR allocations contractual clauses rather than by questionnaire

using actual contracts signed between vendors and clients. scales. This approach might also allow better empi-

rical (and theoretical) discrimination between the

We begin by examining what IPR are generated in the SDO various aspects of IPR and their functioning

process. We refer to law textbooks (Bainbridge 2007) and the (p.1082).

literature in economics (Milgrom and Roberts 1992) and

software engineering (Kurbel 2008; Larman 2004; Pressman Subsequent related research can use our coding scheme and

2005) to identify key intellectual assets generated in the SDO content analysis methods to collect and analyze data from

process. We then conduct a comprehensive literature review explicit contractual clauses. Collectively, these contributions

of research in IPR to identify different types of ownership and extend and deepen our understanding of the research on IPR

usage rights that have been examined in the prior literature. allocation in SDO contracts in a novel and distinctive way.

Combining these streams of literature, we derive eight types

of IPR that are critical for SDO contracts. Next, we build a The remainder of the paper is organized as follows. The

coding scheme to analyze the content in contract provisions following section discusses prior work on software develop-

in terms of how these IP rights were distributed between ment and IPR allocation; we then move on to develop our

contract parties. Drawing on prior theoretical and empirical hypotheses on the determinants of IPR sharing. Next, we

work on property rights and transaction cost economics, we describe our data, data analysis methods, and variables, which

then develop specific hypotheses to show how the relative are followed by the results, discussion, and conclusion.

vulnerability of the contracting parties to ex post opportunism

drives the need for IPR sharing in SDO contracts. The con-

tent analysis data coded from 171 actual SDO contracts are

used to test the hypotheses. Software Development and

Intellectual Property Rights

This study makes three significant contributions to the litera-

ture on SDO and contract design. First, we conduct a com- Intellectual Assets Involved in Software

prehensive analysis of IPR in SDO and develop a framework Development Processes

that specifies ownership rights of five valuable intellectual

assets (namely, preparatory materials, computer programs, Different intellectual assets are created in the different

databases, derivatives, and other works) and the usage rights software development stages. A typical software develop-

of these assets. This allows us to examine the value and ment process comprises several generic phases: requirements

characteristics of different types of intellectual assets and how gathering and analysis, design, construction, testing, debug-

the property rights of these assets are negotiated and allocated ging, and deployment (Kurbel 2008; Larman 2004; Pressman

independently or as a bundle. Second, our research con- 2005). Figure 1 depicts the stages of software development

tributes to the literature on contract design by empirically and the types of intellectual assets generated in each stage.

examining how IPR allocations serve as a governance Software development often starts with requirements

mechanism. SDO contracts are unique because software gathering and analysis which identify a programs functions

development requires relation-specific investments from and business investment requirements. The developer will

vendors and the outputs are mostly customer-specific. We then design software internal structures such as subroutines,

develop specific hypotheses that link the antecedent factors flow charts, task divisions of modules, and definition of data-

based on the indispensability of the contracting parties and the base structure. The requirement and the design stages often

degree of uncertainty in the contracting context to the require the most up-front time and investment in creating

propensity of the clients to share or cede specific IPR. Our preparatory materials. Once the program design is complete,

analysis and findings enable us to advance the literatures in the developer starts transposing the programs structural blue-

both incomplete contract design and software outsourcing risk print into the source code. The construction stage often

management while providing strategic implications for soft- requires the developer to be creative in conveying the blue-

ware outsourcing risk management. Finally, we develop a print into source code. The source code is subsequently

coding scheme that can be used to codify contract clauses in translated or compiled into machine-readable object code.

other IT service or technology development outsourcing When the coding is completed, the developer will use the

contracts. Contract design research is restricted by the avail- clients business data to test the program in order to find and

ability of contracting data. Most prior studies are either based correct any logical and syntactical errors. The testing and

on analytical modeling or survey data. As Carson and John debugging process generates multiple testing plans and

suggest in their paper, reports, as well as release documentation. After the success-

MIS Quarterly Vol. 41 No. 1/March 2017 133

Chen et al./IPR Sharing in Software Development Outsourcing

Figure 1. Decision Process and Intellectual Property Creation in SDO Project Time Line (adapted from

Gefen et al. 2008; Kurbel 2008)

ful completion of testing and debugging, the program is Types of IP Rights in SDO

deployed. The developer is expected to deliver the computer

program which consists of the source code, object code, The input and output works created in the SDO process are

compilation of the programs, and final product documen- subject to the protection of IP rights which are the exclusive

tation. rights granted by law over the use of creations of the minds

for a certain period of time.2 IP owners have exclusive

Conventional IP law suggests that the intellectual assets control over a collection of individual rights inherent within

generated in the SDO process can be classified into five types the property (Klein and Robinson 2011), including control

of properties: preparatory materials, databases, derivatives, over the use of a property as well as its returns (Milgrom and

other works, and software programs (Bainbridge 2007; Kep- Roberts 1992), the right to grant others use of the property, as

linger et al. 1984). The classification of these five types of well as the right to exclude anyone else from using the

works is based, first, on their roles in the inputoutput property without consent (Bainbridge 2007). Furthermore, IP

sequence of software development and, second, on the value owners are deemed to have the control of residual rights that

of each type of intellectual assets which is different due to are not explicitly specified in contracts (Grossman and Hart

their embedded knowledge, efforts spent, criticality, and 1986; Hart 1988; Hart and Moore 1990; Milgrom and Roberts

appropriability level. Preparatory materials refer to the 1992). For instance, under the IP laws of most countries, the

inputs for software development, including requirement client is the default property owner of the work-in-progress

specifications, algorithms, input/output formats, reports, and software based on the work-made-for-hire principle. Property

protocols, whereas derivative works are the works based on owners can keep the entire ownership for themselves or

one or more preexisting software program in which a work transfer it wholly to another party (sole ownership). Alter-

may be transformed, adapted, extended or modified (Bain- natively, they can share the IP ownership (joint ownership) or

bridge 2007) to facilitate development of the final product. selectively grant IP usage rights to others (Bainbridge 2007;

For example, translating an English version of a work to a Carson and John 2013).3 A few IS studies have examined

Japanese version is counted as making a derivative of the IPR in IT contracts. Elfenbein and Lerner (2003) studied

work. The derivative is also a protected intellectual asset.

Databases comprise clients business data for software 2

http://www.wto.org/english/tratop_e/trips_e/intel1_e.htm.

testing, database structure, data contents, and database

displays, etc. Other works such as logos and images are often 3

The differences between joint ownership and sole ownership are mainly

produced in software development processes. Source code, about restrictions of exploitation rights. Generally, a party of joint ownership

object code, compilation of programs, screen display, and shall get consent from the other co-owner in order to pledge, assign, sell or

alpha and beta release documentation are in the software otherwise dispose of its interest in the asset to third parties. The right to

program category which is the final output of the SDO license an IP to third parties is also restricted for joint ownership unless there

is a written agreement that specifies distribution of license costs and income

process.

between the co-owners (Bainbridge 2007; Keplinger et al. 1984).

134 MIS Quarterly Vol. 41 No. 1/March 2017

Chen et al./IPR Sharing in Software Development Outsourcing

ownership of servers, customer data, and URL in e-commerce appropriability play a key role (Arora and Merges 2004;

website development contracts. Leiponen (2008) examined Teece 1986). Individual IPR may be granted and shared

ownership of service outputs such as design, process plan, and depending on the transactional environment and context

technology in consulting service agreements. (Carson and John 2013). Hence, it is necessary to understand

the IPR system holistically. Our study focuses on the

Usage rights are economic rights consisting of reproduction ownership of five types of intellectual assets and three usage

and distribution of intellectual property (Bainbridge 2007). IP rights that are economically important in SDO relationships

owners can authorize others to use, reproduce, or distribute a and that have been examined in prior literature, namely

part or the entirety of an intellectual asset and share the

proceeds from the IP usage. The usage rights can be granted (1) Right to use the developed software and source code for

in a limited way, for a limited time, and in a limited geo- a specific purpose after the contract ends, but not modify,

graphical scope or purpose of use. Prior IS research has reproduce, or sell the software. This right does not allow

examined several types of usage right in IT contracts. For the party to use the developed software, to sell, or to dis-

example, Anand and Khanna (2000) studied the license to use tribute the software program to the public.

in licensing agreements and Susarla (2012) investigated the

redeployment right of know-how and intellectual assets in IT (2) Right to redeploy the residual knowledge asset such as

outsourcing contracts. In the Carson and John (2013) study, information relating to ideas, concepts and techniques

distribution right was included as an important usage right for which are gained in the SDO process into projects for

R&D outsourcing relationships. These usage rights are also other parties. Different from the right to use which

valuable for software developers since they can use these grants the right to use the output of the SDO project, the

intellectual assets and know-how for other clients or use them redeployment right allows the rights holder to use the

to further develop their proprietary technologies. know-how and information gained in the SDO process,

and the residual intellectual assets that may not have

Prior contracting studies (in IS and non-IS) often consider IPR been clearly specified in SDO contracts.

as a subset of control rights to govern contractual

relationships (Elfenbein and Lerner 2003; Lerner and Merges (3) Right to sell the developed software to third parties in

1998). As summarized in Table 1, in addition to IPR, certain geographical regions and industries.

previous research has also examined the right to terminate the

contract at will (Lerner and Malmendier 2010; Ryall and

Sampson 2009; Susarla 2012), source code escrow (Susarla

Theory and Hypotheses

2012), non-compete clauses restricting vendors from com-

peting with clients ex post (Leiponen 2008; Mayer and

Intellectual Property Rights Allocation

Salomon 2006), and business restrictions on clients or

vendors (Elfenbein and Lerner 2003; Leiponen 2008). These

SDO contracts are inevitably incomplete because contracting

control rights are distinct from IPR since control rights are

parties are usually unable to exactly prescribe the system

allocated for control over the development and relationship

requirements, architecture, prototype designs, and deliver-

management processes whereas property rights are granted for

ables ex ante (Boehm 1989; Zmud 1980). Such contract

the outputs of software development (Lerner and Merges

incompleteness is exacerbated by unobservability and unveri-

1998). Empirical research also suggests that the allocation of

fiability of vendors actions and output quality in software

IPR and control rights respond to different contractual risks

development projects (Boehm 1989; Dey et al. 2010; Mayer

and criteria (Elfenbein and Lerner 2003). As our paper

and Salomon 2006). Given each partys fear of hold-up at the

focuses on IPR as a form of incentive to ensure the commit-

renegotiation stage, SDO contracts are often plagued with

ment to tasks, studying other forms of control rights are

severe underinvestments (Klein et al. 1978; Susarla 2012).

outside the scope of this research.4

The prior literature on contract design for software and IT

outsourcing has drawn heavily on incomplete contracting

The value of the intellectual properties may differ across firms

based on transaction cost economics (TCE) and the property

and contracting contexts in which knowledge, innovation, and

rights theory (PRT). These theories assume that due to

bounded rationality, contract parties cannot foresee all

4

possible future states of the world, thereby failing to specify

We also examined the distributions of these control rights for SDO contracts

a complete contract at the time of signing the contract

in our data sample. Less than 10% of SDO contracts in the sample specified

any of these control rights, indicating that the control rights are not

(Grossman and Hart 1986; Hart 1988; Hart and Moore 1990;

necessarily important in SDO contexts. In the interest of results generaliza- Williamson 1979, 1985). Contract parties who are strategic

bility, we did not include these control rights in our empirical analysis. and self-interest seeking will behave opportunistically to

MIS Quarterly Vol. 41 No. 1/March 2017 135

Chen et al./IPR Sharing in Software Development Outsourcing

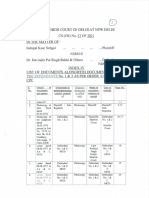

Table 1. Types of Property Rights and Other Rights Studied in Prior Literature

Right Definition Related Studies

Ownership

Core technology Ownership of copyright, patent, or trade mark of core Lerner and Malmendier (2010)

technology in the development Lerner and Merger (1998)

Assets Ownership of servers, customer data, and URL Carson and John (2013)

Elfenbein and Lerner (2003)

Lerner and Malmendier (2010)

Service output Ownership of service outputs (e.g., design, process plan Leiponen (2008)

and technology)

IP Usage Rights

Right to use Right to use developed technology and embedded Adegbesan and Higgins (2011)

technologies on expiration Anand and Khanna (2000)

Carson and John (2013)

Redeployment right Redeployment right of know-how and residual information Susarla (2012)

Right to sell Right to manufacture and sell final product Adegbesan and Higgins (2011)

Carson and John (2013)

Control Rights

Right to terminate Right to terminate the contract at convenience Lerner and Malmendier (2010)

contract Ryall and Sampson (2006)

Susarla (2012)

Source code escrow Vendors shall deposit a copy of source code to the escrow Susarla (2012)

agent

Non-compete Restricting vendors from competing with clients after the Leiponen (2008)

restriction end of contracts Mayer and Soloman (2006)

Business restriction on Exclusivity restricting client to outsource development Leiponen (2008)

clients projects to other vendors during the contract period

Business restriction on Restricting service firms/vendors from providing services to Elfenbein and Lerner (2003)

vendors clients competitors Leiponen (2008)

Financial right Vendors have right to receive royalty payments from client Carson and John (2013)

Kaplan and Strmberg (2004)

further their own interests to the detriment of the counterparty approach to the study of information assets and examined the

when a non-contracted occasion occurs (Williamson 1985). conditions under which ownership of information assets and

The contract party that invests more relation-specific assets in complementary physical assets should be transferred or

the production process is therefore likely to encounter oppor- owned by the party investing in non-contractible assets. The

tunistic behaviors from the other party (i.e., hold-up). The IT outsourcing literature has used the PRT approach to

investing party, anticipating this ex post hazard of oppor- address the primary concerns of underinvestment and hold-up

tunism, will therefore refrain from investments in relation- (Walden 2005). The literature has examined the monetary

specific assets, leading to less optimal contracting perfor- aspect of contractual governance (i.e., the pricing structure)

mance. To counter the opportunism and under-investment (Banerjee and Duflo 2000), and the optimal allocation of ex

problems, the PRT literature proposes that assigning property post contractual planning and decision making (Susarla 2012;

rights to the investing parties can induce incentives to invest Susarla et al. 2010).

critical resources in the relationship (Grossman and Hart

1986; Hart 1988; Hart and Moore 1990). Property rights PRT posits that when both contract parties expend relation-

owners have ownership of the intellectual assets and also the specific investments, property rights of both relation-specific

control rights to determine how the assets are to be used in assets invested in the production process and the output assets

circumstances not specified by contracts or laws (i.e., residual must be assigned to the party whose relation-specific invest-

control rights) (Grossman and Hart 1986; Milgrom and ment has relatively higher marginal effects on contract

Roberts 1992). Brynjolfsson (1994) extended the PRT performance (Grossman and Hart 1986; Hart and Moore

136 MIS Quarterly Vol. 41 No. 1/March 2017

Chen et al./IPR Sharing in Software Development Outsourcing

1990). Property rights to development output and inter- assets at stake that could be appropriated by the contract

mediate assets in SDO are prescribed to clients because they partner for other uses in the relationship. The greater the

provide the investment needed to fund the development magnitude of such concerns, the greater the extent to which

efforts. However, developers effort and investment on pro- the parties will retain IPR to protect the assets involved

jects are critical and oftentimes indispensable for the success (Oxley 1997; Teece 1986).

of the software development project. This is particularly true

when the clients source for a vendors specific expertise or Although contracting hazards play a key role in IPR

for the vendors proprietary technologies. To reduce hold-up allocation, there are additional factors that can influence IPR

opportunism and overcome underinvestment problems, the distribution between contract parties. Aghion and Tirole

PRT literature proposes that clients should cede some IPR to (1994) extend the PRT approach to study IPR allocation in a

vendors to induce behavior that optimizes project returns situation of resource restriction. They suggest that resource

(Carson and John 2013; Leiponen 2008; Susarla 2012; indispensibility and relative bargaining power, in addition to

Walden 2005). Since software development creates a bundle opportunism and underinvestment, also play a role in the

of intellectual properties, clients can choose to share the allocation of property rights. Resourse indispensibility refers

whole or a part of the bundle of properties with vendors (i.e., to the degree of substituability of rival products. In the

ownership sharing) or retain property ownership for them- absense of alternative resources, contract parties who control

selves while granting individual usage right to vendors (i.e., the indispensible assets will have relatively stronger bar-

usage right sharing) (Arora 1996; Arora and Merges 2004; gaining power. Therefore, it is reasonable to assume that they

Walden 2005). In this study, we refer to these types of IPR will use their dominant positions to negotiate for as many

ownership and usage distribution choices collectively as IPR rights as possible for themselves.

sharing.

The TCE and PRT theoretical propositions are supported by

Deciding the extent of IPR sharing is crucial in contract prior empirical literature which finds that allocation of pro-

design literature. Prior literature on contract design combines perty rights are subject to the contract partys indispensability

transaction cost theory with the PRT approach and identifies and bargaining power (Carson and John 2013; Elfenbein and

factors that influence the degree of opportunism and thereby Lerner 2003, 2012; Kaplan and Strmberg 2004; Leiponen

increase the pressure for IPR sharing. Ex post opportunism is 2008; Lerner and Malmendier 2010; Lerner and Merges 1998;

exacerbated by the degree of uncertainty in the contract Ryall and Sampson 2009). For example, Elfenbein and

(Williamson 1985), the extent of asset specificity in the Lerner (2003, 2012) found that the ownership of three impor-

relationship (Hart 1988; Williamson 1979), and the degree of tant assetsservers, URL, and customer datawas assigned

appropriability of IPR (Oxley 1997; Teece 1986). Uncer- to alliance partners whose contributions to Internet portal

tainty is defined as a lack of knowledge of future contin- development were relatively more indispensable. Kaplan and

gencies (Arrow 1974). A high level of environmental and Strmberg (2004) and Lerner and Merges (1998) tested the

task uncertainty as well as the contract parties behavioral bargaining power due to financial strength and found that

uncertainties can make it impossible to prescribe contin- contract parties with more financial resources retained more

gencies that may occur in the future, thereby increasing the residual control rights. Leiponen (2008) studied another

hazard of opportunism. Asset specificity refers to the degree source of indespensibility and bargaining powerservice

to which an asset can be redeployed to alternative uses and by providers innovation capabilitiesand found that more

alternative users without sacrifice of productive value innovative service providers retained more control over

(Williamson 1989, p. 142). Relationship-specific investments intellectual assets. Walden (2005) formulated five types of

have low values outside of the contractual relationship. When intellectual property ownership structures and posited that

a transaction requires specific investments in the production three factorsusefulness of software, resale value of the

process, an ex post quasi-rent is generated amounting to the software, and relative importance of specific investments

differences in values between the intended use of the specific affect the design of ownership structures in SDO contracts,

investment and the next best use of it. The firm that does not while Carson and John (2013) found that vendors had more

invest the specific assets may request a larger share of the IPR when there were greater environmental uncertainty and

quasi-rent from the investing party that has expended the asset specificity in the projects.

specific investments by threatening termination of the rela-

tionship (Klein et al. 1978). Anticipating this hold-up threat, In summary, a comprehensive review of the theoretical and

the investing party would bargain for a large share of quasi- empirical literature based on TCE and PRT shows that

rents in ex ante contract negotiations to secure their stake. contract parties asset indispensability and bargaining power,

Appropriability concerns also affect the extent of contractual along with the degree of uncertainty inherent in incomplete

safeguards in place, especially when parties have proprietary contracting, drive the need for IPR sharing as a useful govern-

MIS Quarterly Vol. 41 No. 1/March 2017 137

Chen et al./IPR Sharing in Software Development Outsourcing

ance mechanism (beyond simply relying on the pricing mech- projects with regard to communication requirements between

anism to align parties interests). Dependence on a vendors the clients and the vendors employees (Liao et al. 2010).

proprietary technology and the degree of modularity in However, for modification of existing systems, it is relatively

software design have served as useful mechanisms to examine easier for the clients to perform the requirements analysis and

the level of asset indispensability and contract parties develop precise systems specifications. In such cases, the

bargaining power respectively (Baldwin and Henkel 2014; vendors investment on relation-specific development is

Bush et al. 2010; Dourish and Edwards 2000; Pressman relatively smaller compared to that of totally new systems.

2005). To get to the question of project-related uncertainty,

we turn to the software engineering literature which has care- Once vendors begin the requirements analysis phase, their

fully examined software project characteristics and associated relation-specific assets are subject to the risk of hold-up by

risks (Boehm 1989; Cataldo and Herbsleb 2013; Na et al. clients (Susarla et al. 2010). Clients may try to renegotiate to

2004; Nidumolu 1995; Pressman 2005). Specifically, the derive more value from the project or they may even renege

degree of project complexity has been widely identified as a on the contracts if they discover the development project to be

key amplifier of project uncertainty and thereby tends to drive infeasible. For instance, the client can abandon the project

up project-specific risks (Gopal and Koka 2010; Gopal and completely or take the requirements specifications to contract

Sivaramakrishnan 2008; Mooi and Ghosh 2010; Susarla et al. with a new partner. Anticipating this, vendors are likely to be

2010; Tiwana 2010). Additionally, when clients require reluctant to invest upfront efforts. Based on PRT (Grossman

software customization and newness in the project, vendors and Hart 1986; Hart 1988; Hart and Moore 1990), such hold-

have to make relationship-specific commitments and this in up problems can be mitigated by allocating IPR to the vendor

turn induces hold-up and misappropriation opportunities, so as to generate the best possible incentives for motivating

consequently driving up the overall risks associated with the the vendor to expend maximum efforts in developing the new

project (Haines 2009; Hasan and Lokan 2013; Kurbel 2008; software system. Therefore, from an incentive perspective,

Wang 2002). Taken together, the above five factors deter- we hypothesize that

mine the degree of relative vulnerability of the contracting

parties to ex post opportunism and therefore we argue that H1: Vendors that are contracted for new software

these factors are explicitly considered by the client in deter- development projects are more likely to be assigned

mining the IPR sharing and allocation mechanisms. For individual IPR or gain more IPR in SDO contracts.

expositional clarity, we take the clients perspective and

develop hypotheses relating these five factors to IPR sharing

between clients and vendors. Task Complexity

A complex task consists of multiple and possibly unknown

Project Newness dimensions that are associated with project and performance

uncertainties (Nidumolu 1995). In a complex software

In SDO, vendors are commonly hired to develop new soft- project, not only are the functionalities and specifications of

ware systems for the client, which could mean either devel- the final output difficult to define, but development costs and

oping a program from scratch or adding new functionalities to delivery dates are difficult to estimate at the contracting stage

an existing program. New software projects often pose addi- (Kalnins and Mayer 2004; Susarla et al. 2010; Wang 2002).

tional challenges to vendors, stemming from a lack of under- Moreover, complex software development often requires

standing about the project requirements as well as the needs frequent changes on the agreed-upon requirements and archi-

of potential end users (Humphrey 1995; Nidumolu 1995; tectural design (Holmstrom and Milgrom 1991; Prendergast

Pressman 2005). Hence, new software development projects 2002). Such project uncertainties raise the difficulty and costs

demand a high level of relation-specific investments from of contracting (Holmstrom and Milgrom 1991; Prendergast

vendors. Requirements analysis is the most important stage 2002). For example, in a study of IT contracts, Anderson and

in the software development process, especially for applica- Dekker (2005) found that the complexity of IT products and

tions that are novel and involve unstructured tasks (Zmud ex ante uncertainties about the quality and performance speci-

1980). Vendors have to develop a deep understanding of the fications of the IT transaction were associated with hold-up

clients business processes, and spend hours interviewing end problems and higher contracting costs.

users to elicit their requirements for information display.

Vendors are also required to invest upfront efforts in trans- Task complexity also increases performance uncertainty. In

lating these requirements into detailed design specifications complex development projects, the outcome of the project is

before the coding phase can begin (Kurbel 2008). These are difficult to estimate and measure regardless of the estimation

among the most time-consuming and challenging outsourcing techniques used (Kurbel 2008; Nidumolu 1995). Frequent

138 MIS Quarterly Vol. 41 No. 1/March 2017

Chen et al./IPR Sharing in Software Development Outsourcing

adaptation of requirements analysis in the software develop- When clients choose to have customized software developed,

ment process makes it impossible to predict SDO performance it is an effective signal of the uniqueness of the firms IT and

outcomes such as actual costs, completion time, system business context. Customized software embodies firm-

benefits, the softwares compatibility with the clients existing specific knowledge that clients normally would not want their

systems, and the softwares technical performance such as competitors to access. However in SDO, the clients will have

functional errors and bugs (Gefen et al. 2008; Kalnins and to share with vendors their specific business requirements,

Mayer 2004; Nidumolu 1995). Such performance uncertain- practices, and trade secrets that might be significant sources

ties give contractors an incentive to shirk and cut corners on of competitive advantage to them (Dittrich et al. 2009; Haines

a project. In addition, incomplete requirements specification 2009; Hasan and Lokan 2013; Walter 2003). The knowledge

and ambiguous design inevitably result in higher coordination assets created and exchanged during the SDO processes repre-

costs. For these reasons, the rate of failure is higher for com- sent valuable IP and are subject to potential expropriation

plex software projects. Complex projects, therefore, require (Arora and Merges 2004; Oxley 1997). In transactions where

higher relation-specific investments from the vendor, such as appropriation problems are greater, explicit provision for

greater investments in communication and closer coordination property rights are used to protect vulnerable parties (Teece

with the client (Clemons and Hitt 2004). When these projects 1986; Williamson 1991). Client firms are therefore more

fail or when the clients end the contracts prematurely, the likely to be motivated to retain the full IPR to the final

relation-specific investments will become sunk costs for ven- product as well as to all the intermediate knowledge assets if

dors. Vendors may thus have a lower incentive to commit they feel appropriation issues are critical.

effort to the project, especially when their efforts are non-

contractible. Viewed from the vendors perspective, developing custom

software is labor intensive (Dibbern et al. 2004) and vendors

To mitigate the risk of underinvestment, PRT holds that when often need to acquire unique skills and business knowledge in

contracts are incomplete, the party that owns or controls an order to complete the particular customization (Wang 2002).

asset will collect the residual returns on its own non- Such investments are highly client-specific and not readily

contractible investment and will therefore be motivated to transferable to alternative uses without losing substantial

make these investments (Hart and Moore 1990). Thus, by value, thereby reducing the vendors bargaining position in ex

granting certain ownership or usage rights to the vendor, the post renegotiations. Moreover, vendors often need to coor-

client firm is likely to induce higher motivation on the dinate closely with clients personnel in order to complete

vendors part to put in the requisite efforts, leading to our next custom development tasks. The interdependencies between

hypothesis: clients and vendors create a potential hold-up problem for

vendors because vendors are responsible for completing

H2: Vendors that are contracted in software projects within time-bound deadlines, but in cases of inter-

development projects with a higher level of task dependence, the vendor has to rely on the clients personnel

complexity are more likely to be assigned individual to make progress on the necessary tasks (Mayer 2006; Mayer

IPR or gain more IPR in SDO contracts. and Salomon 2006). The vendor anticipating this vulner-

ability could potentially under invest unless sufficient safe-

guards are provided. A call to PRT would suggest that

Customization vendors should be allocated IPR as a safeguard against

potential opportunistic behaviors.

Customization is the tailoring of software for a specific user

(organization or business unit) and differs from the develop- The above discussion suggests that clients are likely to be

ment of generic software (off-the-shelf software packages) pulled in both directions, toward greater sharing of IPR to

that is designed for the mass market (Dittrich et al. 2009; motivate vendors against underinvestment of efforts, and

Haines 2009; Hasan and Lokan 2013). Customized software toward little or no sharing of IPR to protect their own IP

typically incorporates knowledge components and business assets. However, to balance the dependence on vendors in

rules that are specialized to the end users. Such personaliza- customized software projects, substitutive incentives such as

tion has been shown to improve both usage and productivity time and materials pricing and other monetary incentives

of computer systems and research suggests that it even (e.g., bonus payments for vendor performance) could be used

increases the sense of end-user empowerment (Dittrich et al. to sufficiently motivate the vendors and to counter the risk of

2009; Fischer and Scharff 2000). In fact, research in software underinvestment. On the other hand, it is difficult to come up

engineering emphasizes the importance of user goals, prefer- with alternative mechanisms to protect the clients specific

ences, and skills in designing customized software (Hui et al. investments and intellectual properties other than through

2003). explicit IPR embedded in the contracts. With increasing

MIS Quarterly Vol. 41 No. 1/March 2017 139

Chen et al./IPR Sharing in Software Development Outsourcing

investments in specific assets, the clients quasi-rents increase threatening to withhold resources. Under such conditions, the

and, anticipating this, clients would expect more ex ante tenets of the PRT predict a greater degree of IPR allocated to

contractual safeguards in the form of higher IPR allocated to the party with the better bargaining position (Aghion and

themselves. Therefore, we hypothesize that Tirole 1994). Therefore, we hypothesize that

H3: Vendors that are contracted in customized H4: Vendors that are contracted in software

software development projects are less likely to be development projects based on vendors proprietary

assigned individual IPR or gain less IPR in SDO technology are more likely to be assigned individual

contracts. IPR or gain more IPR in SDO contracts.

Vendors Proprietary Technology Software Modularity

Although cost reduction is still the most common motivation We next turn our attention to software design modularity and

for software outsourcing (Lacity et al. 2009), many companies examine its implications for the extent of IPR shared with

have outsourced for more strategic reasons which include vendors. Modularity has emerged as a general set of

gaining access to leading-edge technologies and know-how to principles for software design and refers to the manner in

improve business or process performance (DiRomauldo and which a high level design is decomposed into constituent

Gurbaxani 1998). For example, even though Microsoft has subsystems (modules) that can communicate through

strong in-house software development capabilities, it hired standardized interfaces (Baldwin and Clark 2000). By

Inktomi to develop supporting software for Microsofts search adopting a more modular design, one avoids what would

engine. The main purpose of the contract was to access otherwise be an unmanageable spaghetti tangle of systemic

Inktomis proprietary coupled cluster technology that enables interconnections (Jordan and Lowe 2004). Work in the

the connection of multiple computers to operate as a single strategic management literature has examined the effect of

computing system. modularity on alliance control (Bush et al. 2010; Sanchez and

Mahoney 1996; Tiwana 2008a, 2008b) and has shown that

When vendors are hired to develop software using their that the design principles of loose coupling and standardized

proprietary technology, their preference, unless explicitly interfaces provide a form of embedded coordination that

controlled by the client, would be to make architectural design renders redundant overt managerial supervision (Sanchez and

choices that exploit their proprietary designs and technologies Mahoney 1996).

(which could include design methodology, development tools,

and other proprietary code needed to develop the new In software outsourcing, design modularity can be an impor-

software). Software development knowledge tends to be tant consideration both in the boundary between the out-

complex and involves a large number of different individuals sourced system and the clients base systems as well as,

and interacting technologies and routines. The connections among the different components of the new system. Modu-

between these elements are often highly context-specific. larity insulates the client from new and unfamiliar underlying

Therefore, the vendors proprietary technology and contextual technologies used by the vendor and affords the client the

knowledge become indispensable resources and clients will ability to plug its existing (base) systems into the new system

not be able to continue the focal software development project without changing its base applications (Kurbel 2008). Clients

without the vendors cooperation. In some circumstances, can apportion development tasks to multiple vendors with

vendors have accumulated innovation capabilities that exploit different skill sets. Multi-vendor sourcing helps to protect

their proprietary systems and can make unique intellectual clients from vendor opportunism by reducing the lock-in risk

contributions to the clients project. Thus, vendors can derive that is inherent when working with a single vendor. More-

bargaining power from the valuable resources they bring to over, modular systems are easier to change and replace,

the software development process and negotiate for more thereby reducing the overall control that a vendor can exercise

ownership or usage rights of the generated intellectual assets both in the current project as well as in future work (e.g.,

(Emerson 1962; Heiskanen et al. 2008; Mayer and Salomon through maintenance contracts). Therefore, modularity

2006; Mesquita et al. 2008). As vendors proprietary tech- reduces resource-dependence of the client and thereby

nologies becomes indispensable to the success of SDO weakens ex post bargaining positions of the vendor. Further-

projects, clients will be more likely to share ownership or more, modularity in software design helps protect the clients

usage rights with vendors as a form of incentive mechanism knowledge base from risks of misappropriation because no

to encourage valuable resource deployment. At the same single vendor is likely to gain access to the entire domain of

time, this can overcome opportunistic bargaining by vendors knowledge possessed by the client. Since the client will only

140 MIS Quarterly Vol. 41 No. 1/March 2017

Chen et al./IPR Sharing in Software Development Outsourcing

need to share with each vendor the knowledge needed for between the years 1992 and 2007 (both years inclusive). To

their particular subsystem as well as the interface knowledge maintain generality in our analysis, we excluded transactions

common to all vendors, this can significantly lower appro- where (1) the contract was a renegotiation or restatement of

priability concerns (Baldwin and Henkel 2014). a previous agreement between the two firms, (2) one firm had

a controlling interest in the other firm (greater than 50%), and

Modularity of products has also been shown to increase the (3) multiple vendors were specified in the same contract. We

level of standardization within an industry. For example, in also dropped 43 contracts due to substantial missing informa-

manufactured products such as bicycles (Galvin and Morkel tion. Our final sample comprised 171 SDO contracts span-

2001), it has been shown that increasing modularity in design ning 13 industries, of which 163 agreements were signed by

fragmented the industry into a series of largely independent U.S. companies and 8 by UK companies. 121 agreements

subcontractors hired primarily through market-based con- were with U.S. vendors and the remaining 50 were signed

tracts. The fragmentation of the industry based on specialized with vendors from 20 different countries. About 59% of the

capabilities led to economic efficiencies and lower barriers to clients were from high technology industries. The frequency

entry. Even though designing software remains a more distribution of the sample across industries was found to be

complex activity than bicycle manufacturing, it is likely that similar to those of other licensing agreements and alliance

the effects of greater modularity will have a similar impact on contracts which have been studied in prior literature (Anand

at least some segments of the software industry. The overall and Khanna 2000; Oxley 1997). Of the 171 contracts in the

effect would be to reduce the clients dependence on the final sample, 55 contracts released contract values, ranging

vendor and thereby to lower bargaining power for the vendors from a maximum exceeding $650 million to a minimum of

and lower willingness on the part of the clients to share or $20,000, with an average value of $5.66 million. A total of

cede IPR to the vendors. Therefore, we hypothesize the 54 contracts were for simple enhancements or for adaptive or

following: perfective changes to an existing system; 76 other contracts

involved reengineering an existing system; another 41

H5: Vendors that are contracted in software required vendors to develop new systems, interfaces, or appli-

development projects to develop modular systems cations. We were able to collect contract length information

(i.e., outsourced software has well-defined interfaces for 169 agreements from the contracts, the firms 10-K

with the clients existing systems) are less likely to reports, and press releases. The length of the contracts ranged

be assigned individual IPR or gain less IPR in SDO from 3 months to 300 months with a mean length of 29.8

contracts. months and a standard deviation of 29.1. Overall, about 71%

of the contracts used a flexible pricing structure (T&M and

cost-plus). About 39% of the contracts in the sample were

signed after the year 2000, with 20% of the clients having had

Empirical Analysis prior business interactions with the vendors.

Data Collection and Measures The data obtained from software contracts were supplemented

with additional variables that served as controls for the empi-

Data for our study comes from software development con-

rical analysis. For each contract, we searched the Factiva

tracts culled from the U.S. Securities and Exchange Commis-

News archive using client and vendor company names to find

sion (SEC) and further augmented with data from ICC full-

contract-related press releases. In addition, we collected

text annual reports for international company profiles.5 The

dominant client information from COMPUSTAT, CRSP, and

SEC regulations (17 C.F.R. Part 229) require publicly-listed

the firms financial statements. Statement of Financial

companies to disclose material contracts6 in their financial

Accounting Standards (FASB) No. 14 requires firms to dis-

filings and software development contracts are frequently

close the identity of any customer representing more than

included in the filings of companies registered in the United

10% of the total sales of a firm. We collected the customer

States. We initially collected 215 SDO contracts signed

abbreviations from the COMPUSTAT industry segment files

and followed the matching procedure used by Fee and

5

ICC Full-text Quoted Company Annual Report contains the annual reports

Thomas (2004) to get the full company names from CRSP.

published by 2,800 British companies listed on the London Stock Exchange When vendors were not publicly traded companies, we

and the top 500 European companies. collected information on dominant clients from the Business

Relationship and Risk Factors sections of the clients

6

Material contracts are generally understood as any contract upon which the financial statements and further searched contract information

registrants business is substantially dependent, as in the case ofagree- from other press releases. For nonpublicly listed firms, data

ment[s] to use a patent, formula, trade secret, process or trade name (SEC

about their revenue and the number of employees were culled

regulations (17 C.F.R. Part 229)).

MIS Quarterly Vol. 41 No. 1/March 2017 141

Chen et al./IPR Sharing in Software Development Outsourcing

from company websites and Bloomberg Businessweek data- right to use the developed software, redeployment right of

base for small and medium size companies. We downloaded know-how, and right to sell developed softwareare critical

the lists of IT technology companies from three online economic rights in software development relationships. Each

resources: the Fortune 1000 technology firms, the Informa- of the usage rights was coded as 1 if the client retained the

tion Week list of 500 technology companies, and the Inter- sole ownership of the software program (i.e., vendors did not

national Association of Outsourcing Professionals (IAOP) have joint or sole ownership) and granted the usage right to

Global Outsourcing 100 and sub-lists. Vendors reputation the vendor, and coded as 0 if the vendor did not have property

was coded based on whether the vendor was included in any ownership and the focal usage right (Adegbesan and Higgins

of these lists. Country-level software piracy rates were col- 2011; Elfenbein and Lerner 2012; Lerner and Malmendier

lected from the Business Software Alliances (BSA) annual 2010; Susarla 2012). Panel B in Table 3 shows that out of 90

piracy studies (BSA 2008; IPRC 2003) and were used as contracts where clients held sole ownership of software pro-

indicators of the legal protection environment for IPR. gram, about 41% granted vendors the right to sell developed

software and share proceeds with clients; only about 34% of

the contracts allowed vendors to use or modify the software

Dependent Variable program and code after the contract ended; and less than 18%

of vendors gained the right to redeploy residual information

We coded two dependent variables: the propensity for in other projects. Cross frequency analysis between the usage

sharing individual IPR with vendors and the extent of IPR rights indicated that less than 60% of client owners authorized

allocated to vendors. Referring to the economics and IT vendors both the right to use and the right to sell simul-

contract design literature (e.g., Carson and John 2013; taneously and only about 40% of vendors who were granted

Elfeibein and Lerner 2003; Leiponen 2008; Lerner and right to use software also had the right to redeploy residual

Malmendier 2010; Milgrow and Roberts 1992; Susarla 2010), information and know-how gained in the SDO process.

we developed a coding scheme to code the five types of

ownership rights and the three usage rights in each of the 171 Extent of Ownership/Usage Rights. The extent of vendor

contracts (see Table 2). ownership and usage rights were also used as dependent

variables to capture the total number of asset ownership

Ownership refers to the rights for full control over the pro- (either joint or sole ownership) and usage rights assigned to

perty and to the proceeds generated by the property. Each of vendors. The mean of the extent of ownership is 1.65 with a

the five types of assetssoftware program, database, standard deviation of 2.14, whereas the mean of the extent of

preparative material, derivatives, and otherswas coded as usage rights is 0.93 with a standard deviation of 0.90,

1 if ownership was assigned to the client, 2 if there was joint demonstrating a different rights allocation strategy between

ownership, and 3 if it was assigned to the vendor (Elfeibein ownership and usage rights and that asset ownerships were

and Lerner 2003). Panel A of Table 3 provides the frequen- bundled but usage rights were often assigned separately.

cies and cross frequencies of the five ownerships for all of the

contracts in the sample. As expected, most of the SDO con-

tracts assigned IPR ownership to clients. Overall, less than Explanatory Variables

37% of the sample contracts allocated sole ownership of any

of the five assets to vendors. For example, about 37% of the The measures of the five SDO project characteristics

sample assigned ownership of developed software to vendors, namely, extent of project newness (newness), task complexity

with only 28% giving vendors ownership of the database (complexity), customization (customization), vendor proprie-

created during the software development processes. Cross tary technology (proprietary), and software modularity

tabulation shows that at least 70% of contracts assign bundles (modularity)were coded from the Recital and Task and

of ownership rights to vendors. For instance, ownership of Technology Description sections in the SDO contracts. We

software program clustered with ownership of preparative coded newness as a three-level categorical variable based on

materials at a rate of 95%. Owning both assets gives vendors the levels of newness in the requirement specifications

the traceability to link software development requirements to (Kurbel 2008), coded as 2 if the vendor was contracted to

corresponding design artifacts, code, and test cases to support develop completely new systems or applications, as 1 if it was

numerous software engineering activities and software modi- to reengineer or add new functionalities to an established

fications (Pressman 2005). system, and as 0 if it was to do simple enhancement or modi-

fications on the clients existing system. Complexity mea-

Usage Rights. Clients, as property owners, can choose to sures the levels of difficulty in specifying task descriptions,

retain property ownership and grant usage rights to vendors performance measurements, and verifications in contracts

or share the proceeds from the property. Three usage rights (Lerner and Malmendier 2010). This measure for software

142 MIS Quarterly Vol. 41 No. 1/March 2017

Chen et al./IPR Sharing in Software Development Outsourcing

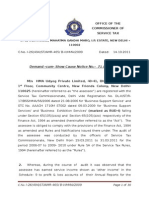

Table 2. Coding Scheme for IPR Specifications

Type of IPR References Examples

Ownership of Bainbridge Example 1: Client Ownership

developed soft- (2007); [PrintOnTheNet.com, Inc., and Ducat Commerce, LLC] Developer agrees that the development of

ware program Keplinger et the printing related work of the Software is work made for hire within the meaning of the

Categorical (1-3) al. (1984) Copyright Act of 1976, as amended, and that the Software shall be the sole property of Buyer.

Example 2: Joint ownership

[U S West Communications, Inc. and OneLink Communications, Inc] In the course of or as a result

of performance under this agreement, inventions, discoveries, adaptations, ideas, specifications,

functional requirements, business and technical information, computer or other apparatus

programs, software, copyrightable material, documentation, trade secrets, trademarks, and other

ideas, knowledge or data, unless specified otherwise in this agreement, all such intellectual

property shall belong jointly to both Parties.

Ownership of Bainbridge Example 1: Client ownership

material for (2007); [PrintOnTheNet.com, Inc., and Ducat Commerce, LLC] Developer hereby assigns to Buyer, without

developed Keplinger et further compensation, all of its right, title and interests in any and all related materials with respect

software program al. (1984) to the Software (in the form of notes, sketches, drawings and as may otherwise be specified by

Categorical (1-3) Buyer).

Example 2: Vendor ownership

[Avesis and National Computer Services] The software, programs, and related documentation

developed by National for Avesis pursuant to this agreement shall be owned by National

(Developer).

Ownership of Bainbridge Example 1: Client ownership

database for (2007); [Avesis and National Computer Services] All of the information, data and contents of databases

software Keplinger et and reports developed and compiled by National for Avesis pursuant to this agreement shall be the

development al. (1984) property of Avesis.

Categorical (1-3) Example 2: Joint ownership

[mPhase and Lucent] All developed information, data and test results created jointly by one or more

employees, contractors, consultants or agents of one Party working in conjunction with one or more

employees, contractors, consultants or agents of the other party during the development period,

and as a direct result of work performed under this agreement, shall be owned jointly by both

parties.

Ownership of the Bainbridge Example: Client has right to make derivatives

derivative from (2007); [Federated Systems Group, Inc and Mobinetix Systems, Inc] The Buyer may use the New Software

developed Keplinger et to prepare derivative works of the Software, and may otherwise modify, enhance, reverse engineer,

software program al. (1984) decompile or otherwise handle it. All enhancements developed by the Buyer, including all modifi-

Categorical (1-3) cations and derivative works shall become and remain the sole and exclusive property of the

Buyer.

Ownership of other Bainbridge Example: Client owns ownership

assets not (2007); [American Insurance & Syntel 2000] To the extent that any Work Product, under applicable law,

specified in the Keplinger et may not be considered works made for hire, Syntel hereby irrevocably assigns and transfers to AH

contract or not al. (1984) the ownership of all rights, title and interests in such Work Product (including copyrights, whether

related to the published or unpublished and patents and all other intellectual property rights thereto)....Upon

developed termination of the Agreement for any reason, any Work Product will be delivered to AH with Syntel

software retaining no copies of Work Product.

Categorical (1-3)

Right to use Adegbesan Example: Client owns ownership but client grants Vendor the right to use technology after

technology after its and Higgins the end of the contract

creation and (2011); [CCSI and Pencom] Limited license of software package. Subject to CCSIs acceptance of the

contract termina- Carson and Phase Three Deliverables, CCSI will grant to PENCOM the worldwide right and license to use a

tion, Binary (0/1) John (2013); functionality, structure, sequence, or organization similar to that contained in the software package

Lerner and in developing software for third parties where PENCOM performs such development without

Merges reference to the software package.

(1998)

MIS Quarterly Vol. 41 No. 1/March 2017 143

Chen et al./IPR Sharing in Software Development Outsourcing

Table 2. Coding Scheme for IPR Specifications (Continued)

Type of IPR References Examples

Right to sell the Adegbesan Example: Client owns ownership but grants vendor the right to sell or license the created

created technology and Higgins software

to other third party, (2011); [eMed and AWARE] eMed shall have the exclusive right to use and sublicense software developed

Binary (0/1) Carson and by AWARE for medical use....AWARE shall have the exclusive right to distribute software and other

John (2013); components included in the Work Product but AWARE shall not distribute the Work Product to the

Lerner and following companies in medical and healthcare industries

Merges

(1998)

Right to redeploy Susarla et al. Example: Client owns ownership but grants vendor the right to redeploy knowledge assets

knowledge assets (2010) in the third partys project

in other projects, [Carnival Cruise & Allin (2001)] Allin will not be precluded from using Residual Information in the

Binary (0/1) field of IT consulting and integration for itself or for other customer. The term Residual

Information shall mean information relating to ideas, concepts and techniques which are related to

Allins business activities.

Non-compete (0/1) Leiponen Example: Vendor cannot compete with the Client after the end of the contract:

(2008); Mayer During the term of this Agreement and for a period of 12 months after the termination of the

and Soloman Developers service, the Developer will not be interested or concerned in any business which

(2006) develops, manufactures, produces, provides, markets, distributes or otherwise deals in products or

services or both which are of a type similar to the products or services which are developed,

manufactured, produced, provided, marketed, distributed or otherwise dealt in by the Company now

or at any time during the term of the Developers consulting services. Such restriction will apply

within the geographical area of business operations in which the Company has an office and

carries on business or has carried on business within the 12 month period ending on the date of

termination of the Developers service.

Table 3. Frequency and Cross-Frequency of Individual IPR

Panel A: Ownerships (n = 171)

Client Joint Vendor Cross-Frequency (%)

Types N Freq(%) N Freq(%) N Freq(%) Program Database Material Derivative

Program 90 52.63 18 10.53 63 36.84

Database 105 61.40 18 10.53 48 28.07 76.19

Material 93 54.39 18 10.53 60 35.09 95.24 80.00

Derivative 102 59.65 19 11.11 50 29.24 76.19 70.83 75.00

Other 84 49.12 26 15.20 61 35.67 88.89 91.67 90.00 73.77

Panel B: Usage rights sharing when clients own the sole ownership of software program (n = 90)

Vendor Cross-Frequency (%)

N Freq(%) Use Redeploy

Use 31 34.44

Redeploy 16 17.78 39.29

Sell 37 41.11 58.89 18.89

complexity has been used in several studies (Dey et al. 2010; and quality requirements for deliverables, as 1 (medium) if

Gefen et al. 2008; Gopal and Sivaramakrishnan 2008; Gopal parts of technical description were specified in the contract

et al. 2003). Referring to the scale of software complexity without corresponding quality measurement criteria, and as 2

developed by Gefen et al. (2008, p. 551), we coded com- (high) when the contract had little by way of details regarding

plexity based on the levels of extensiveness of task descrip- the task or when the description was very generic. High

tion; it was coded as 0 (low) if it was easy to specify a clear levels of task complexity denote low levels of contractibility.

and extensive technical description, deliverable milestones, Following Susarla (2012), we coded customization as 1 if the

144 MIS Quarterly Vol. 41 No. 1/March 2017

Chen et al./IPR Sharing in Software Development Outsourcing

contract required the vendor to have domain knowledge and To ensure coding consistency and reliability, two under-

skills unique to the clients business to develop custom soft- graduate law degree students independently carried out the

ware or to customize existing software, and as 0 if neither of coding of all the contracts and the supplementary data (control

these conditions held. Proprietary indicates the indispen- variables). Examples of sample provisions from actual

sability of the vendors to the contract and was coded as 1 or contracts were provided to the coders who were trained

0 based on whether or not the contract specified that the extensively with a few comprehensive contracts. We checked

vendor firm would utilize its copyrighted or patented tech- the inter-coder reliability for all variable coding and found

nologies for the SDO task. Modularity was coded as 1 if the them to be high (Cohens k = 0.81 or above). Two senior

project was to develop a subsystem of an existing system and computer science degree students also independently coded

the contract provided specifications for user exits to link the all the contracts and supplementary information following the

software to the existing systems (Kurbel 2008), and 0 same coding scheme to further ensure the reliability of the

otherwise. coding scheme among students with different domain knowl-

edge backgrounds. Throughout the coding process, the results

of the recoding were almost identical to the previous law

Controls degree students results. Overall, we believe that this process

resulted in a highly reliable coding of the contract and

In order to control for alternative explanations and other supplementary data. Table 5 provides the summary statistics

potential confounds, we included several additional variables and correlations of the main variables in our empirical

that served as important controls: (1) flexible pricing struc- analysis.

ture (Gopal and Koka 2010), (2) prior inter-firm interaction

between contract parties (Goo et al. 2009; Rai et al. 2009),7

(3) dominant client (Banerjee and Duflo 2000; Fee et al. Model Estimation and Results

2006; Fee and Thomas 2004; Susarla et al. 2010), (4) ven-

dors reputation (Banerjee and Duflo 2000; McGuire et al. We propose an econometric model that explains a vendors

1988; Preston and OBannon 1997; Susarla et al. 2010), ownerships and usage rights as a function of the variables

(5) software piracy level in the vendors operating countries featured in the hypotheses, along with all the controls

(Marron and Steel 2000; Moores and Chang 2006), described above. The first set of dependent variablesthe

(6) log(vendors age) indicating vendors relative experience, propensity of individual ownership and usage rights

(7) high-tech client indicating whether the client is in a high- sharingare ordinal and binary variables respectively; and

tech industry8 (Francis and Schipper 1999), (8) log(clients the second set of dependent variablesthe extent of owner-

age), (9) clients size, (10) log(contract length) (Susarla et al. ships and usage rights sharingare ordinal.

2010), and (11) year dummy to capture other unaccounted

time-period effects by using the year 2000 as the cut-off point. Care was taken to address potential endogeneity concerns in

In some circumstances, the client may have granted the ven- our econometric specification. First, IPR assigned to the

dor the right to sell but simultaneously used a non-compete vendor is typically negotiated during the contracting process

clause to restrict the vendor from competing with the clients and may be co-determined with other governance mechanisms

business, for example, by selling software directly to the such as pricing structure (i.e., simultaneity and self-selection

clients customers. This type of non-compete restriction will issues). As depicted in Figure 1, the typical arrangement in

reduce the value of the vendors usage rights. Hence, we SDO is for the client to search and identify a vendor company

included a non-compete control dummy to indicate whether to develop and implement a software system with stated