Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Shift in Sectors by Mutual Funds Over Quarters: Retail Research

Caricato da

Dinesh ChoudharyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Shift in Sectors by Mutual Funds Over Quarters: Retail Research

Caricato da

Dinesh ChoudharyCopyright:

Formati disponibili

MUTUAL FUNDS 29 Sep 2016

RETAIL RESEARCH

Shift in sectors by Mutual Funds over Quarters

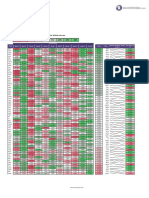

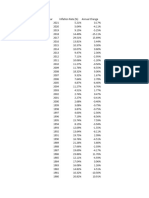

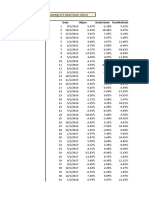

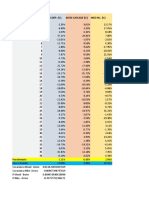

The following table displays the shift in the allocation in the sectors (equity) by the Indian mutual fund industry over various time periods. Banks, Software and

Pharmaceuticals have been the favored sectors by the MF industry comprising close to 40% of equity assets:

Change in Change in

Sector Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Sep-14 Dec-14 Mar-15 Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 last one last one

Quarter Year

BANKS 13.90% 17.31% 18.92% 19.63% 21.47% 18.84% 21.88% 20.42% 20.54% 20.87% 19.97% 19.92% 20.40% 0.48% -0.14%

SOFTWARE 6.99% 9.07% 9.20% 10.21% 10.43% 10.83% 10.20% 10.02% 9.26% 10.65% 9.83% 10.07% 8.93% -1.14% -0.33%

PHARMACEUTICALS 6.73% 7.51% 7.69% 7.79% 6.60% 7.45% 7.03% 7.27% 7.77% 8.35% 8.20% 7.66% 7.55% -0.11% -0.22%

AUTO 3.70% 3.92% 4.43% 4.27% 5.34% 6.43% 6.30% 6.69% 7.10% 7.05% 6.68% 6.67% 6.34% -0.33% -0.76%

FINANCE 4.81% 3.99% 4.71% 5.93% 5.39% 5.56% 5.95% 6.25% 6.28% 5.84% 5.85% 5.75% 6.84% 1.09% 0.56%

CONSUMER NON DURABLES 6.26% 7.29% 7.64% 7.56% 4.62% 4.89% 4.88% 5.12% 5.18% 5.23% 5.46% 5.85% 5.90% 0.05% 0.72%

CONSTRUCTION PROJECT 3.17% 2.05% 2.96% 3.06% 4.79% 3.81% 3.73% 4.19% 4.49% 4.07% 4.11% 3.99% 4.29% 0.30% -0.20%

PETROLEUM PRODUCTS 6.62% 6.42% 5.69% 5.41% 4.62% 4.43% 3.78% 3.79% 4.19% 4.03% 4.53% 4.42% 4.43% 0.01% 0.24%

INDUSTRIAL CAPITAL GOODS 7.32% 5.23% 3.13% 2.50% 3.97% 3.74% 4.50% 4.48% 4.15% 3.88% 3.97% 3.24% 3.11% -0.13% -1.04%

INDUSTRIAL PRODUCTS 2.29% 2.48% 2.75% 2.26% 3.53% 3.62% 3.84% 3.99% 3.67% 3.70% 3.68% 3.53% 3.47% -0.06% -0.20%

CEMENT 2.39% 1.83% 2.86% 3.04% 3.14% 3.34% 3.13% 3.41% 3.41% 3.34% 3.47% 3.85% 4.06% 0.21% 0.65%

AUTO ANCILLARIES 1.84% 2.01% 2.33% 2.37% 3.48% 3.61% 3.48% 3.52% 3.32% 3.15% 3.03% 3.07% 2.88% -0.19% -0.44%

POWER 6.47% 4.32% 3.50% 3.01% 2.60% 2.22% 2.09% 2.08% 2.03% 2.08% 2.21% 2.27% 2.39% 0.12% 0.36%

TRANSPORTATION 1.55% 0.96% 1.10% 1.40% 1.74% 1.92% 1.95% 2.02% 1.73% 1.76% 1.89% 2.03% 1.86% -0.17% 0.13%

TELECOM - SERVICES 2.17% 2.97% 2.60% 2.33% 1.44% 1.74% 1.54% 1.74% 1.59% 1.38% 1.36% 1.20% 1.26% 0.06% -0.33%

CONSUMER DURABLES 0.61% 0.59% 1.05% 1.00% 1.32% 1.53% 1.61% 1.59% 1.44% 1.36% 1.54% 1.75% 1.99% 0.24% 0.55%

CHEMICALS 0.42% 0.56% 1.03% 1.07% 1.06% 1.29% 1.42% 1.48% 1.42% 1.39% 1.39% 1.41% 1.44% 0.03% 0.02%

MEDIA & ENTERTAINMENT 2.58% 1.98% 1.87% 2.10% 1.26% 1.10% 1.10% 1.17% 1.30% 1.47% 1.63% 1.44% 1.43% -0.01% 0.13%

PESTICIDES 0.76% 0.68% 0.59% 0.66% 0.91% 1.08% 1.04% 1.19% 1.28% 1.19% 1.15% 1.23% 1.34% 0.11% 0.06%

DERIVATIVES 1.37% 0.74% 1.08% 1.16% 0.86% 2.02% 1.14% 0.98% 1.24% 1.15% 1.01% 0.99% 1.07% 0.08% -0.17%

CONSTRUCTION 2.32% 1.64% 1.55% 1.23% 1.14% 1.05% 1.08% 1.23% 1.18% 1.10% 1.19% 1.09% 1.09% 0.00% -0.09%

OIL 4.36% 3.27% 3.07% 3.52% 2.59% 2.33% 1.72% 1.16% 1.04% 0.86% 0.92% 0.82% 0.70% -0.12% -0.34%

TEXTILE PRODUCTS 0.33% 0.87% 0.64% 0.66% 0.64% 0.69% 0.76% 0.81% 0.89% 0.92% 1.01% 0.88% 0.88% 0.00% -0.01%

FERROUS METALS 2.72% 2.72% 2.26% 1.31% 1.23% 1.11% 0.96% 0.76% 0.82% 0.66% 0.82% 0.82% 0.86% 0.04% 0.04%

Source: SEBI.

In the above table, cells highlighted by green are the top three sectors which saw an increase in the exposure by the mutual fund industry compared to last one year

data (comparing June 2015 & June 2016) (as well as in last one quarter comparing Mar 2016 and June 2016) while the cells highlighted by yellow are the top three

sectors that saw a decrease in the exposure during the period.

Analyst: DhuraivelGunasekaran (dhuraivel.gunasekaran@hdfcsec.com)

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022) 2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com.

Disclaimer: Mutual Funds investments are subject to risk. Past performance is no guarantee for future performance.This document has been prepared by HDFC Securities Limited and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to

others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or

options on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients.

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may be contrary with those of the other Research teams (Institutional, PCG) of

HDFC Securities Ltd. HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475.

RETAIL RESEARCH Page |1

Potrebbero piacerti anche

- Nicaraguan monthly weighted interest rates 2021Documento2 pagineNicaraguan monthly weighted interest rates 2021mariaNessuna valutazione finora

- Ponderada Bancos 2020Documento2 paginePonderada Bancos 2020Victoria GriosNessuna valutazione finora

- Salinan REVISI Window Dressing CalcDocumento148 pagineSalinan REVISI Window Dressing CalcPTPN XIIINessuna valutazione finora

- Vix Hedges: Institute of Trading & Portfolio ManagementDocumento9 pagineVix Hedges: Institute of Trading & Portfolio ManagementHakam DaoudNessuna valutazione finora

- Coca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsDocumento6 pagineCoca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsVibhor Dutt SharmaNessuna valutazione finora

- Net Income Based Operating Income Based EBITDA Based Gross Income BasedDocumento2 pagineNet Income Based Operating Income Based EBITDA Based Gross Income BasedAl-Quran DailyNessuna valutazione finora

- Monthly Weighted Interest Rates Nicaragua 2017-2018Documento2 pagineMonthly Weighted Interest Rates Nicaragua 2017-2018Erika SalazarNessuna valutazione finora

- 06 - Uas Pai - Ida Ayu Made Dwi PuspitaDocumento7 pagine06 - Uas Pai - Ida Ayu Made Dwi PuspitaGus TutNessuna valutazione finora

- MSSP - Guaranteed Surrender Value Factors - tcm47-71735Documento9 pagineMSSP - Guaranteed Surrender Value Factors - tcm47-71735Sheetal KumariNessuna valutazione finora

- Mostrarreporte Merval Junio 2020Documento15 pagineMostrarreporte Merval Junio 2020enriqueNessuna valutazione finora

- Tarea 4 - Riesgo y Rendimiento Parte 1Documento30 pagineTarea 4 - Riesgo y Rendimiento Parte 1Edgard Alberto Cuellar IriarteNessuna valutazione finora

- Key Tenets To Reduce Risks While Investing in EquitDocumento8 pagineKey Tenets To Reduce Risks While Investing in EquitdigthreeNessuna valutazione finora

- var_RINDocumento2 paginevar_RINRaul Ronaldo Romero TolaNessuna valutazione finora

- Caso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALDocumento12 pagineCaso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALMARLEN GUADALUPE MEDINA SERRANONessuna valutazione finora

- Reporte de Ratios ArgentinaDocumento15 pagineReporte de Ratios Argentinawalter_lezcano164501Nessuna valutazione finora

- Reporte de Ratios Nasdaq - Mayo 2020Documento10 pagineReporte de Ratios Nasdaq - Mayo 2020Pety SuarNessuna valutazione finora

- Comisiones Multiproductos.Documento3 pagineComisiones Multiproductos.larry.01.laysNessuna valutazione finora

- Reporte de RatiosDocumento13 pagineReporte de RatiosSebatiaa IbarraNessuna valutazione finora

- Summary StatisticsDocumento3 pagineSummary StatisticsNguyenNessuna valutazione finora

- OMS Head Circumference Percentiles Calculator for Infant AgeDocumento1 paginaOMS Head Circumference Percentiles Calculator for Infant AgeSolhana MendietaNessuna valutazione finora

- MacroDocumento4 pagineMacroLina M Galindo GonzalezNessuna valutazione finora

- Caso #4 Port A Folio de ADocumento18 pagineCaso #4 Port A Folio de Aapi-3747777100% (2)

- Annual Returns and Risk Analysis of S&P 500 and GoldDocumento28 pagineAnnual Returns and Risk Analysis of S&P 500 and GoldAditya JandialNessuna valutazione finora

- India Inflation Rate 1960-2022: Historical Data & Annual Changes Less Than 40 CharactersDocumento3 pagineIndia Inflation Rate 1960-2022: Historical Data & Annual Changes Less Than 40 CharactersGouravNessuna valutazione finora

- Gantt - Brisas de Pencahue II 284 Viv (DS 49) - REPROGRAMACION 13-10Documento424 pagineGantt - Brisas de Pencahue II 284 Viv (DS 49) - REPROGRAMACION 13-10jneiracNessuna valutazione finora

- US Large Cap Historical ReturnsDocumento15 pagineUS Large Cap Historical ReturnsiuNessuna valutazione finora

- Comprador TaxasDocumento4 pagineComprador TaxasRenan MartinelliNessuna valutazione finora

- Inversion 6 EmpresasDocumento12 pagineInversion 6 EmpresasJassmin Atarama carreñoNessuna valutazione finora

- Apuntes 29-Oct-2020Documento13 pagineApuntes 29-Oct-2020Gabriel D. Diaz VargasNessuna valutazione finora

- Tanque AcueductosDocumento3 pagineTanque AcueductosplguevarasNessuna valutazione finora

- Ejercicio 1 AnálisisDocumento7 pagineEjercicio 1 AnálisisscawdarkoNessuna valutazione finora

- Shivam Khanna BM 019159 FmueDocumento10 pagineShivam Khanna BM 019159 FmueBerkshire Hathway coldNessuna valutazione finora

- Shivam Khanna BM 019159 FmueDocumento10 pagineShivam Khanna BM 019159 FmueBerkshire Hathway coldNessuna valutazione finora

- Data 2 Inflation RateDocumento1 paginaData 2 Inflation RateYoussef NabilNessuna valutazione finora

- Credibility and visits of PAN and MORENA activists and promotional materialsDocumento35 pagineCredibility and visits of PAN and MORENA activists and promotional materialsDiana del C. Rodriguez Garcia.Nessuna valutazione finora

- Histórico del IPC en ColombiaDocumento11 pagineHistórico del IPC en ColombiaDIEGO ALEJANDRO CARVAJAL AGUILARNessuna valutazione finora

- QuanticoDocumento7 pagineQuanticoAbdelrahman AkeedNessuna valutazione finora

- Dangan Warehouse Progress Report SummaryDocumento13 pagineDangan Warehouse Progress Report SummaryJake MonteroNessuna valutazione finora

- Pakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Documento5 paginePakistan Inflation RATE (%) Exchange Rate (LCU Per USD, Period Avg) Foreign Reserve (Million $) Unemployment RATE (%)Neelofer GulNessuna valutazione finora

- Tahun Nama/Kode Perusahaan Womf Yule Kias Close Dividen Close Dividen Close DividenDocumento4 pagineTahun Nama/Kode Perusahaan Womf Yule Kias Close Dividen Close Dividen Close DividenRendy AlbarsyaNessuna valutazione finora

- Lumax IndustriesDocumento33 pagineLumax IndustriesAshutosh GuptaNessuna valutazione finora

- SN Date Wipro Kotak Bank TechmahindrDocumento7 pagineSN Date Wipro Kotak Bank TechmahindrnavNessuna valutazione finora

- Date Blue Dart Bluestarco Blue Dart BluestarcoDocumento9 pagineDate Blue Dart Bluestarco Blue Dart BluestarcoBerkshire Hathway coldNessuna valutazione finora

- Nasdaq Ratios and Heatmap for June 28 2021Documento10 pagineNasdaq Ratios and Heatmap for June 28 2021Axel VarelaNessuna valutazione finora

- October 2022 Monthly Gold CompassDocumento84 pagineOctober 2022 Monthly Gold CompassburritolnxNessuna valutazione finora

- MES Mead Corp. (%) Boise Cascade (%) Nike Inc. (%)Documento4 pagineMES Mead Corp. (%) Boise Cascade (%) Nike Inc. (%)Enrique de Jesús Ramos CastelanNessuna valutazione finora

- Date Crisil Sunpharma Crisil SunpharmaDocumento9 pagineDate Crisil Sunpharma Crisil SunpharmaBerkshire Hathway coldNessuna valutazione finora

- Bitcoin Price HistoryDocumento2 pagineBitcoin Price HistoryLemuel Kim TabinasNessuna valutazione finora

- I Bond Rate ChartDocumento1 paginaI Bond Rate ChartRandy MarmerNessuna valutazione finora

- Cohort Analysis TemplateDocumento117 pagineCohort Analysis TemplateKalpesh JajuNessuna valutazione finora

- Ενότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησης (1)Documento43 pagineΕνότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησης (1)agis.condtNessuna valutazione finora

- Lap Rasio Keuangan BSM & Bank Mandiri Tahunan 2011-2020Documento4 pagineLap Rasio Keuangan BSM & Bank Mandiri Tahunan 2011-2020Reinn DayiNessuna valutazione finora

- PPD Langkawi June 2019 j-QAF Program Achievement ReportDocumento1 paginaPPD Langkawi June 2019 j-QAF Program Achievement ReportJohari AbdullahNessuna valutazione finora

- DAFNA FactSheetDocumento2 pagineDAFNA FactSheetfxarb098Nessuna valutazione finora

- Top destinations for veterinary product exports from ColombiaDocumento152 pagineTop destinations for veterinary product exports from ColombiaDiego OchoaNessuna valutazione finora

- Kingfisher School of Business and Finance: Lucao District, Dagupan City, PangasinanDocumento8 pagineKingfisher School of Business and Finance: Lucao District, Dagupan City, Pangasinansecret 12Nessuna valutazione finora

- SP 500 Eps EstDocumento43 pagineSP 500 Eps Est이일환Nessuna valutazione finora

- Corporate Finance Group 10 Textile Industry OverviewDocumento16 pagineCorporate Finance Group 10 Textile Industry OverviewAnkit saurabhNessuna valutazione finora

- Portfolio Optimization ResultsDocumento229 paginePortfolio Optimization ResultsvaskoreNessuna valutazione finora

- All About Forensic AuditDocumento8 pagineAll About Forensic AuditDinesh ChoudharyNessuna valutazione finora

- ApplicationForm (GH FLATS)Documento15 pagineApplicationForm (GH FLATS)Dinesh ChoudharyNessuna valutazione finora

- Methodology Document of NIFTY Sectoral Index Series: January 2020Documento16 pagineMethodology Document of NIFTY Sectoral Index Series: January 2020Sumit KhatanaNessuna valutazione finora

- Forensic Review Under IBC 1711 PDFDocumento22 pagineForensic Review Under IBC 1711 PDFaaryan0001Nessuna valutazione finora

- Retail Research: Franklin India Prima Plus FundDocumento3 pagineRetail Research: Franklin India Prima Plus FundDinesh ChoudharyNessuna valutazione finora

- 04peter Steidlmayer Kevin Koy-Markets and Market Logic-EnDocumento171 pagine04peter Steidlmayer Kevin Koy-Markets and Market Logic-EnDinesh Choudhary100% (1)

- WIPRO - Pick of The Week-280119Documento15 pagineWIPRO - Pick of The Week-280119Dinesh ChoudharyNessuna valutazione finora

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationDocumento2 pagineFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyNessuna valutazione finora

- AZB Capital Markets Update ICDR 2018 PDFDocumento120 pagineAZB Capital Markets Update ICDR 2018 PDFpalo_909961085Nessuna valutazione finora

- MotiveWave Volume AnalysisDocumento49 pagineMotiveWave Volume AnalysisDinesh ChoudharyNessuna valutazione finora

- David Windover-The Triangle Trading Method-EnDocumento156 pagineDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- Equity Linked Savings Schemes (ELSS) : Retail ResearchDocumento4 pagineEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyNessuna valutazione finora

- HSL PCG Pick-Of-The-Week - Reliance Industries - 040219Documento17 pagineHSL PCG Pick-Of-The-Week - Reliance Industries - 040219Dinesh ChoudharyNessuna valutazione finora

- Triangle Trading MethodDocumento14 pagineTriangle Trading Methodxagus100% (1)

- Safe Software FME Desktop/Server v2018 Data TransformationDocumento1 paginaSafe Software FME Desktop/Server v2018 Data TransformationDinesh ChoudharyNessuna valutazione finora

- Membership FormDocumento3 pagineMembership FormDinesh ChoudharyNessuna valutazione finora

- Retail Research: MF Ready ReckonerDocumento3 pagineRetail Research: MF Ready ReckonerDinesh ChoudharyNessuna valutazione finora

- Equity MF SIP Baskets For 2017: Retail ResearchDocumento2 pagineEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNessuna valutazione finora

- Monthly Report - Nov 2016: Retail ResearchDocumento10 pagineMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyNessuna valutazione finora

- ReportDocumento8 pagineReportDinesh ChoudharyNessuna valutazione finora

- ApplicationForm (GH FLATS)Documento7 pagineApplicationForm (GH FLATS)gauravghaiNessuna valutazione finora

- ReportDocumento9 pagineReportDinesh ChoudharyNessuna valutazione finora

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesDocumento4 pagineRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyNessuna valutazione finora

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocumento8 pagineRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyNessuna valutazione finora

- ReportDocumento3 pagineReportDinesh ChoudharyNessuna valutazione finora

- Report PDFDocumento10 pagineReport PDFDinesh ChoudharyNessuna valutazione finora

- ReportDocumento8 pagineReportDinesh ChoudharyNessuna valutazione finora

- ReportDocumento15 pagineReportDinesh ChoudharyNessuna valutazione finora

- Report PDFDocumento3 pagineReport PDFDinesh ChoudharyNessuna valutazione finora

- Sesi 14 - Pemodelan Berbasis Agen - 2Documento20 pagineSesi 14 - Pemodelan Berbasis Agen - 2nimah tsabitahNessuna valutazione finora

- Group 6 - Mid-Term - PNJ PosterDocumento1 paginaGroup 6 - Mid-Term - PNJ PosterMai SươngNessuna valutazione finora

- DTC Agreement Between Cyprus and United StatesDocumento30 pagineDTC Agreement Between Cyprus and United StatesOECD: Organisation for Economic Co-operation and DevelopmentNessuna valutazione finora

- Cape, Jessielyn Vea C. PCBET-01-301P AC9/ THURSAY/ 9:00AM-12:00PMDocumento5 pagineCape, Jessielyn Vea C. PCBET-01-301P AC9/ THURSAY/ 9:00AM-12:00PMhan jisungNessuna valutazione finora

- BCBS 239 Compliance: A Comprehensive ApproachDocumento7 pagineBCBS 239 Compliance: A Comprehensive ApproachCognizantNessuna valutazione finora

- Contract Close-OutDocumento3 pagineContract Close-OutParents' Coalition of Montgomery County, MarylandNessuna valutazione finora

- Client Info Sheet - PR PetroleumDocumento4 pagineClient Info Sheet - PR PetroleumAnonymous E5GfQD7dhZNessuna valutazione finora

- Pizza BillDocumento2 paginePizza BillManjunatha APNessuna valutazione finora

- Mathematical Methods for Economics: Calculating DerivativesDocumento8 pagineMathematical Methods for Economics: Calculating DerivativesLennard PangNessuna valutazione finora

- Unincorporated Business TrustDocumento9 pagineUnincorporated Business TrustSpencerRyanOneal98% (42)

- Gmail - Payment Confirmation - Cambridge College of Business & ManagementDocumento2 pagineGmail - Payment Confirmation - Cambridge College of Business & Managementslinky1Nessuna valutazione finora

- Business Studies Glossary PDFDocumento8 pagineBusiness Studies Glossary PDFAbdulaziz SaifuddinNessuna valutazione finora

- Find stock prices for delisted companies in DatastreamDocumento3 pagineFind stock prices for delisted companies in Datastreamprofjblaze2Nessuna valutazione finora

- Operations and Supply Chain Management B PDFDocumento15 pagineOperations and Supply Chain Management B PDFAnonymous sMqylHNessuna valutazione finora

- Aavin Summer Internship ReportDocumento45 pagineAavin Summer Internship Reportmo25% (4)

- Operation and Product Management: LT Col Tauhidul IslamDocumento23 pagineOperation and Product Management: LT Col Tauhidul IslamOptimistic EyeNessuna valutazione finora

- Valliammai Engineering College Question Bank on International Business ManagementDocumento11 pagineValliammai Engineering College Question Bank on International Business ManagementKamalesh SriramNessuna valutazione finora

- UST Golden Notes 2011 - Torts and Damages PDFDocumento50 pagineUST Golden Notes 2011 - Torts and Damages PDFpot420_aivan50% (2)

- Case 1 Is Coca-Cola A Perfect Business PDFDocumento2 pagineCase 1 Is Coca-Cola A Perfect Business PDFJasmine Maala50% (2)

- Bukit Asam Anual ReportDocumento426 pagineBukit Asam Anual Reportwandi_borneo8753Nessuna valutazione finora

- The ArcSight Compliance Tool KitDocumento24 pagineThe ArcSight Compliance Tool Kitsrmv59Nessuna valutazione finora

- Denali Investors Partner Letter - 2014 Q2Documento6 pagineDenali Investors Partner Letter - 2014 Q2ValueInvestingGuy100% (1)

- Some Information About The Exam (Version 2023-2024 Groep T)Documento17 pagineSome Information About The Exam (Version 2023-2024 Groep T)mawiya1535Nessuna valutazione finora

- Franchise Rule Compliance Guide - FTC - GovDocumento154 pagineFranchise Rule Compliance Guide - FTC - GovFranchise InformationNessuna valutazione finora

- A Project Report: Kurukshetra University, KurukshetraDocumento74 pagineA Project Report: Kurukshetra University, KurukshetrasudhirNessuna valutazione finora

- A Literature Review OF Diversity Management Research &theoriesDocumento16 pagineA Literature Review OF Diversity Management Research &theoriessammi112233Nessuna valutazione finora

- Japan - Success, Problems and ImpactDocumento17 pagineJapan - Success, Problems and ImpactYujia JinNessuna valutazione finora

- Profit & Loss: Velka Engineering LTDDocumento10 pagineProfit & Loss: Velka Engineering LTDparthsavaniNessuna valutazione finora

- NFJPIA Mock Board 2016 - AuditingDocumento8 pagineNFJPIA Mock Board 2016 - AuditingClareng Anne100% (1)

- CRM Software Services IndiaDocumento1 paginaCRM Software Services IndiaSales MantraNessuna valutazione finora