Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Retail Research: SIP in Equity Schemes - A Ready Reckoner

Caricato da

Dinesh ChoudharyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Retail Research: SIP in Equity Schemes - A Ready Reckoner

Caricato da

Dinesh ChoudharyCopyright:

Formati disponibili

09 Feb 2017

RETAIL RESEARCH

SIP in equity schemes - A Ready Reckoner

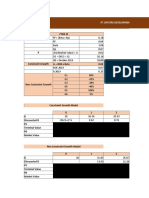

SIP Return (XIRR % p .a)

Scheme name Category Latest Latest 3 Years 5 Years 7 Years 10 Years Part of HSL

NAV Corpus Recommendation

(Value) (Rs in List

Crs) Average Returns(% p.a.)

Franklin India Large Cap 494.49 9365.19 13.20 18.30 16.44 15.56

Prima Plus - (G) 15.87 yes

SBI Blue Chip Large Cap 32.08 10104.31 12.94 17.83 16.03 14.31

Fund (G) 15.28 yes

ICICI Pru Top 100 Large Cap 280.33 1530.43 13.75 16.36 14.84 13.88

Fund - (G) 14.71 yes

ICICI Pru Value Multi Cap 126.72 14918.68 13.21 21.41 19.51 20.24

Discovery Fund

(G) 18.59 yes

Birla Sun Life Multi Cap 604.48 3294.57 19.22 22.74 18.69 16.08

Equity Fund (G) 19.18 yes

SBI Magnum Multi Cap 39.10 1391.84 17.44 20.93 17.43 14.37

Multi cap Fund

(G) 17.54 yes

DSP BR Multi Cap 183.84 1326.26 18.67 20.67 17.04 15.50

Opportunities

Fund (G)

17.97 yes

Sundaram Select Mid and Small Cap 433.63 4193.12 23.61 27.67 23.03 20.99

Midcap - (G)

23.82 yes

Franklin India Mid and Small Cap 48.67 4114.08 22.08 30.14 25.97 22.56

Smaller

Companies Fund

(G) 25.19 yes

DSP BR Small Mid and Small Cap 46.96 2499.38 23.23 26.50 21.79 20.42

And MidCap

Fund (G) 22.99 yes

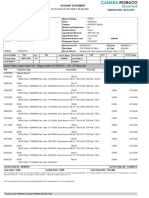

Canara Robeco Mid and Small Cap 72.91 1423.22 22.08 28.95 24.91 22.45

Emerging

Equities (G) 24.60 yes

L&T Midcap Mid and Small Cap 110.92 510.81 23.52 28.13 22.98 20.21

Fund (G) 23.71 yes

RETAIL RESEARCH Page |1

RETAIL RESEARCH

Reliance Tax ELSS 52.18 5870.86 14.34 21.27 18.85 17.58

Saver (ELSS)

Fund - (G) 18.01 yes

L&T Tax ELSS 44.52 1752.80 15.28 17.77 15.24 15.02

Advantage Fund

(G) 15.83 yes

DSP BR Tax Saver ELSS 39.44 1494.41 17.90 21.14 18.08 16.57

Fund (G) 18.42 yes

Birla Sun Life Equity Sectoral 599.88 3128.48 13.16 21.57 20.53 20.94

MNC Fund - (G) 19.05 yes

Reliance Banking Equity Sectoral - Banking 209.39 2180.09 16.93 19.04 16.26 17.65

Fund - (G) 17.47 yes

Birla Sun Life Equity Sectoral - 64.44 455.21 17.88 20.75 19.28 18.07

India Gen Next Consumption

Fund (G) 19.00 yes

UTI- Equity - Sectoral - 99.43 866.45 17.41 29.78 26.55 25.32

Transportation & Transportation

Logistics Fund

(G) 24.76 yes

Scheme : Indices

Nifty 50 6.36 9.91 9.11 9.09

S&P BSE Sensex 4.82 8.88 8.33 8.50

TRI Nifty 7.59 11.23 10.40 10.35

TRI Sensex 6.26 10.50 9.94 1.32

NAV date: Feb 08, 2017

Selection Methodology

The list of all diversified equity schemes (category-wise: large cap, multi cap, mid cap, ELSS and sectoral funds) was prepared.

Further filtration was done basis a minimum track record of 10 years and corpus size of Rs 200 crores.

The average of 3 years, 5 years, 7 years and 10 years returns was arrived at.

Final list was then prepared basis the descending order of the average returns.

We have presented the final result of schemes which are recommended for SIP for each (category: large cap, multi cap, mid cap, ELSS and sectoral funds)

Benefits

Over a 3 and 5 year period mid and small cap funds have given far better returns than the index (Nifty 50, BSE Sensex).

SIP technique gives returns only in the long term as in the short-term if markets decline consistently, then returns may be lesser. It is better to stay invested for a longer period (e.g: 5 to 10 years) to obtain

the real benefits.

Multi cap and Mid Cap funds have given better returns which comes at a higher risk. Hence SIP in these categories will be more beneficial provided the risks involved are known and accepted

RETAIL RESEARCH Page |2

RETAIL RESEARCH

What is an SIP? Systematic investment plan (SIP) is a disciplined way of investing in mutual fund schemes where an investor can make regular and equal payments at regular intervals for periods to accumulate

wealth over long run. An SIP is a planned approach towards investments and helps you inculcate the habit of saving and building wealth for the future.

What is the structure of an SIP? SIP can be termed as a regular investment scheme where a stipulated amount of money (can be Rs. 50, Rs.100, Rs. 250, Rs. 500, etc) is invested daily, weekly, monthly,

quarterly or yearly, instead of investing money in bulk. It is similar to a regular savings scheme like a recurring deposit with a bank where one can put small amounts at periodic intervals. Investing in a mutual

fund through SIP allows participation in the equity markets systematically.

What is the rationale and importance of Systematic investing? Lump sum investing or investing in one go will be suitable only when there is a high degree of certainty that the market is going to go through

a rising trend. In common, equity markets are volatile in nature and prediction is very difficult. If an investor invests a bulk amount on a day and the market declines, the investor may panic and withdraw the

amount leading to a sizeable loss. Also for most investors, one-time investment may not be feasible due to a lack of resources.

In the case of systematic investment, it is not necessary for the investor to accumulate a huge amount at one go before making an investment. He can accumulate small amounts and invest regularly. An SIP

also enables investors to start investing in equity early.

The strategy behind starting a SIP with an equity scheme is to go on investing regardless of the market conditions. Investors have to keep SIP running for a longer period and do not stop it in downturns. Else,

he will lose out a chance to make money in the long term if he stops SIP midway when the market tanks.

What are the salient features of SIP? It is needless to say that for long-term wealth creation through equity market you need discipline and long term time horizon which are inherent features of SIP. The

following features of SIP makes it fit for equity market.

Simple and disciplined approach towards investment.

Investment possible with small sum of money invested regularly to accumulate wealth.

Based on concept of Rupee Cost Averaging.

Flexibility in terms of amount or quantity based SIP.

Flexible intervals like Daily/ Weekly/ Fortnightly/ Monthly/ Yearly basis.

What are the benefits of SIP? As common investor doesnt have enough time and resources, SIP proves to be a viable option for them. Listed below are the important benefits of this instrument.

Reduces Risk because of Rupee Cost Averaging.

SIP can be started with very small amount of money.

Timing the market is not necessary.

Long term financial goal can be aligned with SIP.

Disciplined approach towards Investment helps in controlling the emotions.

How does SIP help to reach Your Financial Goal? SIP is a perfect tool for people who have a specific, future financial requirement. By investing an amount of your choice every month, you can plan for and

meet financial goals, like funds for a childs education, a marriage in the family or a comfortable post retirement life.

What is Rupee Cost Averaging? Rupee cost averaging is an approach or a benefit wherein the investor gets while investing in equity market with a fixed amount of money at regular intervals like SIP route.

This ensures that the investor can buy more units when prices are low and less when prices are high. Ideally speaking, most investors want to buy stocks when the prices are low and sell them when prices

are high. But timing the market is time consuming and risky.

Rupee-cost averaging is popular among people who invest in volatile funds. If a fund's share price fluctuates a lot, rupee-cost averaging can help reduce the average cost per share over time when you are

investing, and increase your profit when you are systematically withdrawing your money.

RETAIL RESEARCH Page |3

RETAIL RESEARCH

A more successful investment strategy is to adopt the method called Rupee Cost Averaging. However, Rupee-cost averaging doesn't guarantee a profit or eliminate risk, and it won't protect you from a loss if

you sell shares at a market low. Before adopting this strategy, you should consider your ability to continue investing through periods of low price levels.

SIP helps in riding market volatility: In other way, we can say that the SIP helps the investor make profit from stock market volatility by automatically buying more units when prices are falling and fewer

units when prices are rising, thus lowering the average purchase price.

What are the benefits of starting early? The early birds always have an advantage over those who are off the blocks late. They manage to save a decent pile for their requirements with much less fuss. Usually,

people at young age undermine the importance of saving small sums of money and keep procrastinating, pushing the start to a later date. Besides, they often perceive investing as a cumbersome process.

This is where SIP comes in handy, a good way to save through MFs is to set aside a certain amount of ones income for them. This, besides helping one make forced savings, also gives one a financial head

start.

What is power of compounding?

Compounding is the fact that the money you make off an investment can be reinvested to make even more money than your initial investment. The money you make goes back to work to make you even

more money than before.

Say you've invested Rs.10, 000 and it makes 10% interest per year. In the first year, you make Rs.1, 000 in interest. But in the second year, you'll make Rs.1, 100 (not only does your initial investment of

Rs.10,000 accrue interest but so does the additional Rs.1,000 you made in the first year). In the tenth year, you'll make Rs. 2,358. And in the 30th year you'll make Rs.15, 864. That's all without making another

investment beyond your initial Rs.10, 000. In 30 years, the power of compounding gets you from making Rs.1, 000 per year to making Rs.15, 864 per year.

Investing via SIP over long term is advisable Why?

i. To achieve long term goals: Long-term wealth creation through equity market requires disciplined approach and long term time horizon which are inherent features of SIP. Ideally speaking, SIP is a perfect

tool for people who have a specific, future financial requirement. By investing an amount of your choice every month, you can plan for and meet the long term financial goals, like funds for a childs education,

a marriage in the family or a comfortable post-retirement life. Secondly, staying invested over longer term in the equities helps to handle the fluctuation or volatility in the value of the stocks.

ii. Little Drops of Water Make the Mighty Ocean: Even investing a smaller amount in the equity market regularly over long period can end up with a large corpus in the investors hand.

iii. Investing through SIP for longer time frame achieved better results compared to short term periods: Historical data suggests that investing through SIP for longer time frame achieved better results

compared to short term periods.

iv. The longer the time-frame, the larger are the benefits of averaging: Equity markets are volatile and move in a cycle. They go up, peak, go down and then bottom. When one cycle is finished, the next begins.

SIPs make the market volatility and cycles work in favor of an investor and help in averaging out the cost. The concept is commonly referred to as rupee cost averaging. More units are purchased when a

schemes NAV is low (during market low) and fewer units when the NAV is high (during market up). Hence, when the two cases are taken together, the cost is averaged out. The longer the time frame, the

larger are the benefits of averaging.

Why one should not stop SIP?

Many investors make the mistake of discontinuing their SIP investments when market falls. This exit could impact the portfolio returns significantly as it fails to get the opportunity to average costs. As

discussed above, more units can be purchased when a schemes NAV is low (during market low) and fewer units can be bought when the NAV is high (during market up), hence the investor can achieve

averaging the cost out.

Investments through an SIP can ensure steady returns. Ideally speaking, it is difficult to time the market. Whereas, with an SIP, investors can ride safely during market downturns and manage better returns

if they stay invested through an entire market cycle.

RETAIL RESEARCH Page |4

RETAIL RESEARCH

SIP investors need not to worry about the fluctuations or ups and down that are seen in the equity market. You could grab better returns in the next 6 to 12 months period if you stay invested during market

falls.

SIP in ELSS:

The SIP option helps start tax planning from the beginning of the financial year. But investors have to keep in mind that every SIP installment is meant to be locked in for 3 years. Investments through

Systematic Investment Plan mode have grown firmly and given significantly higher returns over the longer term. Investors can prefer monthly or quarterly frequency to invest in ELSS schemes given the

current market condition. SIP works well across market cycles and helps to average out the cost of investment that are done in different periods.

Taxation in SIP:

The tax implication applicable to the SIP investment is as same as that of the lump sum investment in MF. The main point is that the taxation of SIPs depends on the dates of investments. In equity oriented

mutual fund schemes, under Growth option, the long term capital gain tax is exempt if the units are sold after a year of the date of purchase (as per the current law structure). In this case, to benefit out the

long term capital gain tax, every instalment should be held at least one year.

Likewise, in non-equity oriented schemes, to attain the Long Term Capital Gain Tax benefit (that is 20% with indexation), the units should be sold after 3 years from the date of allotment.

In ELSS, all the SIP instalments are locked in for three years.

There is an ideology behind selling the MF units that had invested through SIP as using the first-in-first-out (FIFO) method. That means sell the earliest units first.

Conclusion:

Over a 3 and 5 year period mid and small cap funds have given far better returns than the index (Nifty 50, BSE Sensex).

SIP technique gives returns only in the long term as in the short-term if markets decline consistently, then returns may be lesser. It is better to stay invested for a longer period (e.g: 5 to 10 years) to obtain

the real benefits.

Multi cap and Mid Cap funds have given better returns which comes at a higher risk. Hence SIP in these categories will be more beneficial provided the risks involved are known and accepted

RETAIL RESEARCH Page |5

RETAIL RESEARCH

Senior Analyst: Prashant Mehta (prashant.mehta@hdfcsec.com)

RETAIL RESEARCH Tel: (022) 3075 3400 Fax: (022) 2496 5066 Corporate Office

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042 Phone: (022) 3075 3400 Fax: (022)

2496 5066 Website: www.hdfcsec.com Email: hdfcsecretailresearch@hdfcsec.com

Disclaimer: Mutual Funds and Debt investments are subject to risk. Past performance is no guarantee for future performance this document has been prepared by HDFC Securities Limited and is meant for sole

use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be taken as an offer to sell or a solicitation to buy any security.

The information contained herein is from sources believed reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may have from time to time positions or options

on, and buy and sell securities referred to herein. We may from time to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for

non-Institutional Clients

This report has been prepared by the Retail Research team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or

may not match or may be contrary with those of the other Research teams (Institutional, PCG) of HDFC Securities Ltd.HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no.

INH000002475."

RETAIL RESEARCH Page |6

Potrebbero piacerti anche

- SIP Performance of Select Equity Schemes Leaflet - November 2023Documento4 pagineSIP Performance of Select Equity Schemes Leaflet - November 2023Tanuj BhattNessuna valutazione finora

- Suresh Rathi Securities PVT LTD.: Ronak JajooDocumento17 pagineSuresh Rathi Securities PVT LTD.: Ronak JajooRonak JajooNessuna valutazione finora

- MF Funds ListDocumento4 pagineMF Funds ListMukund PandavNessuna valutazione finora

- LT PerformanceDocumento4 pagineLT Performancekumar inderNessuna valutazione finora

- IP Atch: Sip WatchDocumento4 pagineIP Atch: Sip WatchTP Surya Prakash CfpNessuna valutazione finora

- TG5 K9 Pgas Raja NPMDocumento10 pagineTG5 K9 Pgas Raja NPMGiovanni HebertNessuna valutazione finora

- Retail Research: Concentrated and Diversified Equity Mutual Fund SchemesDocumento4 pagineRetail Research: Concentrated and Diversified Equity Mutual Fund SchemesDinesh ChoudharyNessuna valutazione finora

- NJ Star Funds Jan-Mar 2022Documento4 pagineNJ Star Funds Jan-Mar 2022Suresh TrivediNessuna valutazione finora

- SIP Performance of Select Equity Schemes Leaflet (As On Feb 28, 2023)Documento4 pagineSIP Performance of Select Equity Schemes Leaflet (As On Feb 28, 2023)vadlamudi krishnaprasadNessuna valutazione finora

- April 19Documento52 pagineApril 19sahithi reddyNessuna valutazione finora

- SIP Performance For Select Schemes Leaflet (As On 29th April 2022)Documento4 pagineSIP Performance For Select Schemes Leaflet (As On 29th April 2022)Akash BNessuna valutazione finora

- ValueResearchFundcard SBISmallCapFund DirectPlan 2019nov11Documento4 pagineValueResearchFundcard SBISmallCapFund DirectPlan 2019nov11asddsffdsfNessuna valutazione finora

- MF Ready Reckoner Schemes Oct 2016Documento4 pagineMF Ready Reckoner Schemes Oct 2016Murali Krishna DNessuna valutazione finora

- Sip Watch: SIP Return As On 30th April 2018Documento6 pagineSip Watch: SIP Return As On 30th April 2018kaustubhavyasNessuna valutazione finora

- Ratios WorksheetDocumento8 pagineRatios WorksheetSakshi GargNessuna valutazione finora

- Client Wise Detail Report: As On 31 Oct 2023Documento2 pagineClient Wise Detail Report: As On 31 Oct 2023smitaghike23Nessuna valutazione finora

- Kotak Standard Multicap Fund (G)Documento4 pagineKotak Standard Multicap Fund (G)Rudhra MoorthyNessuna valutazione finora

- Staywealthy Investment Services: Portfolio Valuation SummaryDocumento2 pagineStaywealthy Investment Services: Portfolio Valuation SummaryGauri TripathiNessuna valutazione finora

- Top Mutual FundsDocumento6 pagineTop Mutual FundsPubg UpdateNessuna valutazione finora

- 61b0a0056fbe6.1638965253.SIP Report 27092021Documento3 pagine61b0a0056fbe6.1638965253.SIP Report 27092021delightadvertisementNessuna valutazione finora

- ValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Documento6 pagineValueResearchFundcard CanaraRobecoEquityTaxSaver 2010dec27Prakash SainiNessuna valutazione finora

- ValueResearchFundcard IDFCInfrastructureFund RegularPlan 2019may17Documento4 pagineValueResearchFundcard IDFCInfrastructureFund RegularPlan 2019may17ChittaNessuna valutazione finora

- ACE - 66kV GIS 03.09.2022Documento236 pagineACE - 66kV GIS 03.09.2022Chandan KumarNessuna valutazione finora

- Dashboard Performance Outlet 28feb23 (Tentative)Documento62 pagineDashboard Performance Outlet 28feb23 (Tentative)octoharryNessuna valutazione finora

- HDFC EquityDocumento6 pagineHDFC EquityDarshan ShettyNessuna valutazione finora

- Olm Page38 20110518Documento1 paginaOlm Page38 20110518OutlookMagazineNessuna valutazione finora

- 01 Adm 05695 RumaDas 20220328 Portfolio DetailedDocumento26 pagine01 Adm 05695 RumaDas 20220328 Portfolio DetailedAnirNessuna valutazione finora

- FWD+Funds+Performance+as+of+31+Jul+2022 FinexisDocumento1 paginaFWD+Funds+Performance+as+of+31+Jul+2022 FinexisSrinivasa Rao KanaparthiNessuna valutazione finora

- MF COMPARISON - Large & MidDocumento3 pagineMF COMPARISON - Large & MidRajkumar GNessuna valutazione finora

- MF COMPARISON - MidcapDocumento3 pagineMF COMPARISON - MidcapRajkumar GNessuna valutazione finora

- Data in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesDocumento2 pagineData in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesPraful ThakreNessuna valutazione finora

- ValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Documento4 pagineValueResearchFundcard DSPSmallCapFund DirectPlan 2019jun29Chiman RaoNessuna valutazione finora

- MF DoneDocumento10 pagineMF DoneVIREN GOHILNessuna valutazione finora

- AlibabaDocumento101 pagineAlibabaSHRESTH NEHRANessuna valutazione finora

- Data in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesDocumento2 pagineData in Respect Fund of Funds Domestic Is Shown For Information Only. The Same Is Included in The Respective Underlying SchemesKIranNessuna valutazione finora

- Britannia Peer AnalysisDocumento3 pagineBritannia Peer AnalysisVedantam GuptaNessuna valutazione finora

- SynopsisDocumento1 paginaSynopsisntkmistryNessuna valutazione finora

- SIP Performance One Pager - August 2021Documento2 pagineSIP Performance One Pager - August 2021Rony BNessuna valutazione finora

- B D E (BDE) : LUE ART XpressDocumento18 pagineB D E (BDE) : LUE ART XpresshemantNessuna valutazione finora

- Cummins India Financial ModelDocumento52 pagineCummins India Financial ModelJitendra YadavNessuna valutazione finora

- Antm FinalllllDocumento3 pagineAntm FinalllllRenita KhofifahNessuna valutazione finora

- Chapter 16: Tool Kit For Working Capital ManagementDocumento23 pagineChapter 16: Tool Kit For Working Capital ManagementosamaNessuna valutazione finora

- Fundcard: Axis Long Term Equity FundDocumento4 pagineFundcard: Axis Long Term Equity FundprashokkumarNessuna valutazione finora

- ValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09Documento6 pagineValueResearchFundcard PrincipalPersonalTaxSaver 2010nov09ksrygNessuna valutazione finora

- MF COMPARISON - Small CapDocumento3 pagineMF COMPARISON - Small CapRajkumar GNessuna valutazione finora

- AZ and Eazy JetDocumento3 pagineAZ and Eazy JetAleem ShahidNessuna valutazione finora

- GMO Quality-FundDocumento2 pagineGMO Quality-Fundb1OSphereNessuna valutazione finora

- Fund Performance 16 Jul 2021 1112Documento6 pagineFund Performance 16 Jul 2021 1112akash bangaNessuna valutazione finora

- Performance During Q4: FY17-18: The Star ShineDocumento38 paginePerformance During Q4: FY17-18: The Star Shinearti guptaNessuna valutazione finora

- Tugas 5 TPAIDocumento6 pagineTugas 5 TPAIGiovanni HebertNessuna valutazione finora

- Ebit Capex Change in WC FCF: Risk Free Rate 1.67% Market Return (S&P 500) 9.30% Beta 1.13Documento5 pagineEbit Capex Change in WC FCF: Risk Free Rate 1.67% Market Return (S&P 500) 9.30% Beta 1.13Paul GhanimehNessuna valutazione finora

- ValueResearchFundcard ReligareContra 2010dec12Documento6 pagineValueResearchFundcard ReligareContra 2010dec12Sivaraman SenapathiNessuna valutazione finora

- Dupont Analysis of Asian PaintsDocumento4 pagineDupont Analysis of Asian Paintsdeepaksg787Nessuna valutazione finora

- Wealth Management PSDADocumento16 pagineWealth Management PSDAaditi anandNessuna valutazione finora

- Sriji Granites 30 Lacs CC Cma Data - XLSX Revised 19.11.2015Documento18 pagineSriji Granites 30 Lacs CC Cma Data - XLSX Revised 19.11.2015SURANA1973Nessuna valutazione finora

- Top Story:: MEG: MEG Says 1H20 Reservations Hit Php38BilDocumento4 pagineTop Story:: MEG: MEG Says 1H20 Reservations Hit Php38BilJNessuna valutazione finora

- Exxon Mobil PDFDocumento65 pagineExxon Mobil PDFivan.maldonadoNessuna valutazione finora

- Table 6.1 National Savings Schemes (Net Investment)Documento2 pagineTable 6.1 National Savings Schemes (Net Investment)sidraNessuna valutazione finora

- David Windover-The Triangle Trading Method-EnDocumento156 pagineDavid Windover-The Triangle Trading Method-EnDinesh Choudhary0% (1)

- FAQ - Related To Forensic Audit Resolution Plans and Additional InformationDocumento2 pagineFAQ - Related To Forensic Audit Resolution Plans and Additional InformationDinesh ChoudharyNessuna valutazione finora

- All About Forensic AuditDocumento8 pagineAll About Forensic AuditDinesh ChoudharyNessuna valutazione finora

- Equity Linked Savings Schemes (ELSS) : Retail ResearchDocumento4 pagineEquity Linked Savings Schemes (ELSS) : Retail ResearchDinesh ChoudharyNessuna valutazione finora

- Retail Research: Franklin India Prima Plus FundDocumento3 pagineRetail Research: Franklin India Prima Plus FundDinesh ChoudharyNessuna valutazione finora

- Safe Software FME Desktop v2018Documento1 paginaSafe Software FME Desktop v2018Dinesh ChoudharyNessuna valutazione finora

- MotiveWave Volume AnalysisDocumento49 pagineMotiveWave Volume AnalysisDinesh ChoudharyNessuna valutazione finora

- Retail Research: Identifying Turnaround Equity Mutual Fund SchemesDocumento4 pagineRetail Research: Identifying Turnaround Equity Mutual Fund SchemesDinesh ChoudharyNessuna valutazione finora

- ApplicationForm (GH FLATS)Documento15 pagineApplicationForm (GH FLATS)Dinesh ChoudharyNessuna valutazione finora

- Retail Research: MF Ready ReckonerDocumento3 pagineRetail Research: MF Ready ReckonerDinesh ChoudharyNessuna valutazione finora

- Shift in Sectors by Mutual Funds Over Quarters: Retail ResearchDocumento1 paginaShift in Sectors by Mutual Funds Over Quarters: Retail ResearchDinesh ChoudharyNessuna valutazione finora

- Monthly Report - Nov 2016: Retail ResearchDocumento10 pagineMonthly Report - Nov 2016: Retail ResearchDinesh ChoudharyNessuna valutazione finora

- Equity MF SIP Baskets For 2017: Retail ResearchDocumento2 pagineEquity MF SIP Baskets For 2017: Retail ResearchDinesh ChoudharyNessuna valutazione finora

- Retail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDocumento8 pagineRetail Research: Changes in Shareholding in Listed Companies by MF Industry During June '16 QuarterDinesh ChoudharyNessuna valutazione finora

- HSL PCG "Currency Daily": 08 February, 2017Documento6 pagineHSL PCG "Currency Daily": 08 February, 2017Dinesh ChoudharyNessuna valutazione finora

- Post Budget Impact Analysis - MF & Debt: Retail ResearchDocumento2 paginePost Budget Impact Analysis - MF & Debt: Retail ResearchDinesh ChoudharyNessuna valutazione finora

- Retail Research: Concentrated and Diversified Equity Mutual Fund SchemesDocumento4 pagineRetail Research: Concentrated and Diversified Equity Mutual Fund SchemesDinesh ChoudharyNessuna valutazione finora

- Report PDFDocumento10 pagineReport PDFDinesh ChoudharyNessuna valutazione finora

- HSL PCG "Currency Daily": 03 February, 2017Documento6 pagineHSL PCG "Currency Daily": 03 February, 2017Dinesh ChoudharyNessuna valutazione finora

- Report PDFDocumento3 pagineReport PDFDinesh ChoudharyNessuna valutazione finora

- HSL PCG "Currency Daily": 01 March, 2017Documento6 pagineHSL PCG "Currency Daily": 01 March, 2017Dinesh ChoudharyNessuna valutazione finora

- Indian Currency Market: Retail ResearchDocumento6 pagineIndian Currency Market: Retail ResearchDinesh ChoudharyNessuna valutazione finora

- HSL PCG "Currency Daily": 28 February, 2017Documento6 pagineHSL PCG "Currency Daily": 28 February, 2017Dinesh ChoudharyNessuna valutazione finora

- HSL PCG "Currency Daily": 02 February, 2017Documento6 pagineHSL PCG "Currency Daily": 02 February, 2017Dinesh ChoudharyNessuna valutazione finora

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017Documento16 pagineHSL PCG "Currency Insight"-Weekly: 04 February, 2017Dinesh ChoudharyNessuna valutazione finora

- HSL PCG "Currency Daily": 02 March, 2017Documento6 pagineHSL PCG "Currency Daily": 02 March, 2017Dinesh ChoudharyNessuna valutazione finora

- HSL PCG "Currency Daily": 09 February, 2017Documento6 pagineHSL PCG "Currency Daily": 09 February, 2017Dinesh ChoudharyNessuna valutazione finora

- Indraprastha Gas Limited - SWOT AnalysisDocumento27 pagineIndraprastha Gas Limited - SWOT Analysissujaysarkar850% (1)

- Philippine Financial Reporting Standards Number Title Effective DateDocumento3 paginePhilippine Financial Reporting Standards Number Title Effective DateBam PamNessuna valutazione finora

- Stock Mock - Backtest Index StrategiesDocumento95 pagineStock Mock - Backtest Index StrategiesThE BoNg TeChniCaLNessuna valutazione finora

- Anlagenbau Moebel Englisch 72 CNC MachineDocumento22 pagineAnlagenbau Moebel Englisch 72 CNC MachinemacNessuna valutazione finora

- Private Equity Real Estate: NorthfieldDocumento26 paginePrivate Equity Real Estate: NorthfieldchrisjohnlopezNessuna valutazione finora

- Dec 2006 - AnsDocumento13 pagineDec 2006 - AnsHubbak Khan75% (4)

- The John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)Documento10 pagineThe John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)aicellNessuna valutazione finora

- State of India's Environment, A Citizens Report: Rich Lands Poor People, Is 'Sustainable' Mining Possible?Documento364 pagineState of India's Environment, A Citizens Report: Rich Lands Poor People, Is 'Sustainable' Mining Possible?Girish Arora100% (1)

- Canara Robeco Equity Hybrid Fund - Regular Monthly IDCW (GBDP) - ISIN: INF760K01068Documento2 pagineCanara Robeco Equity Hybrid Fund - Regular Monthly IDCW (GBDP) - ISIN: INF760K01068brotoNessuna valutazione finora

- Howard Sherman - MSCIDocumento18 pagineHoward Sherman - MSCISid KaulNessuna valutazione finora

- Kotak Mahindra Bank Limited StandaloneDocumento45 pagineKotak Mahindra Bank Limited Standalonemayank04Nessuna valutazione finora

- Icici ProjectDocumento30 pagineIcici Projectrupesdey84Nessuna valutazione finora

- Corporate Finance ProjectDocumento13 pagineCorporate Finance ProjectShailesh KumarNessuna valutazione finora

- Chasecase PaperDocumento10 pagineChasecase PaperadtyshkhrNessuna valutazione finora

- The Pitch and Business Plan For Investors and Partners PDFDocumento6 pagineThe Pitch and Business Plan For Investors and Partners PDFparamedicboy1Nessuna valutazione finora

- Needs Based Scholarships Application Form-2016-17 PDFDocumento7 pagineNeeds Based Scholarships Application Form-2016-17 PDFSadiqKannerNessuna valutazione finora

- Internal Reconstruction - Theory NotesDocumento3 pagineInternal Reconstruction - Theory NotesNaomi SaldanhaNessuna valutazione finora

- GROUP1TPTM5001GROUPASSIGNMENTS22011Documento23 pagineGROUP1TPTM5001GROUPASSIGNMENTS22011Rahul SuriNessuna valutazione finora

- Rebuilding Business and Investment in Post-Conflict Sierra LeoneDocumento23 pagineRebuilding Business and Investment in Post-Conflict Sierra LeoneInternational Finance Corporation (IFC)Nessuna valutazione finora

- 022 Alok Sahu PDFDocumento49 pagine022 Alok Sahu PDFKishor KhatikNessuna valutazione finora

- "Merchant Banking: Primary and Secondary Markets": Summer Internship Project Report A.K. Capital Services LimitedDocumento78 pagine"Merchant Banking: Primary and Secondary Markets": Summer Internship Project Report A.K. Capital Services LimitedorangeponyNessuna valutazione finora

- A Study of Consumer Behavior in Relation To Insurance Products in IDBIDocumento9 pagineA Study of Consumer Behavior in Relation To Insurance Products in IDBIPurnanand SathuaNessuna valutazione finora

- Globe: Analyst Briefing MaterialsDocumento11 pagineGlobe: Analyst Briefing MaterialsBusinessWorldNessuna valutazione finora

- Bank Reconciliation (Documento22 pagineBank Reconciliation (mahNessuna valutazione finora

- HomeDesignTrendsVol3No2 PDFDocumento158 pagineHomeDesignTrendsVol3No2 PDFAngel VelezNessuna valutazione finora

- Premium Case DigestsDocumento8 paginePremium Case DigestsGladysAnneMiqueNessuna valutazione finora

- Case MatleDocumento11 pagineCase MatleKartika Putri TamaylaNessuna valutazione finora

- Job Satisfaction ProjectDocumento36 pagineJob Satisfaction ProjectGulam Hussain79% (24)

- UBL Operations ManagementDocumento18 pagineUBL Operations ManagementSaad HamidNessuna valutazione finora

- Starbucks Company ProfileDocumento2 pagineStarbucks Company Profilearaby_mhNessuna valutazione finora

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantDa EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantValutazione: 4 su 5 stelle4/5 (104)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsDa EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNessuna valutazione finora

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsDa EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsValutazione: 4 su 5 stelle4/5 (4)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Da EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Valutazione: 5 su 5 stelle5/5 (89)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassDa EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNessuna valutazione finora

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Da EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Valutazione: 3.5 su 5 stelle3.5/5 (9)

- The Best Team Wins: The New Science of High PerformanceDa EverandThe Best Team Wins: The New Science of High PerformanceValutazione: 4.5 su 5 stelle4.5/5 (31)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationDa EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationValutazione: 4.5 su 5 stelle4.5/5 (18)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonDa EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonValutazione: 5 su 5 stelle5/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDa EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNessuna valutazione finora

- How To Budget And Manage Your Money In 7 Simple StepsDa EverandHow To Budget And Manage Your Money In 7 Simple StepsValutazione: 5 su 5 stelle5/5 (4)

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouDa EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouValutazione: 4 su 5 stelle4/5 (2)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessDa EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessValutazione: 4.5 su 5 stelle4.5/5 (4)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyDa EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyValutazione: 5 su 5 stelle5/5 (1)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherDa EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherValutazione: 5 su 5 stelle5/5 (14)

- You Need a Budget: The Ultimate Guide to Budgeting and Financial Planning for Everyday People, Discover Proven Methods on How to Plan Your Finances to Achieve Your Financial GoalsDa EverandYou Need a Budget: The Ultimate Guide to Budgeting and Financial Planning for Everyday People, Discover Proven Methods on How to Plan Your Finances to Achieve Your Financial GoalsValutazione: 4.5 su 5 stelle4.5/5 (14)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitDa EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNessuna valutazione finora

- The Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomDa EverandThe Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomValutazione: 4.5 su 5 stelle4.5/5 (2)

- Passive Income Ideas: A Comprehensive Guide to Building Multiple Streams of Income Through Digital World and Offline Businesses to Gain the Financial FreedomDa EverandPassive Income Ideas: A Comprehensive Guide to Building Multiple Streams of Income Through Digital World and Offline Businesses to Gain the Financial FreedomValutazione: 5 su 5 stelle5/5 (1)

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationDa EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationValutazione: 4.5 su 5 stelle4.5/5 (5)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitDa EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitValutazione: 4.5 su 5 stelle4.5/5 (9)