Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Appendix 1 Consumption Tax Structure

Caricato da

Junnel Yanilla0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni1 paginahhh

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentohhh

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

8 visualizzazioni1 paginaAppendix 1 Consumption Tax Structure

Caricato da

Junnel Yanillahhh

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

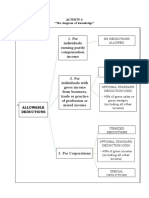

Appendix 1 The concept structure of consumption taxes

THE CONCEPT STRUCTURE OF CONSUMPTION TAXES

Chapter 1

Introduction to

CONSUMPTION

Consumption tax

Domestic consumption - TAXABLE Foreign consumption

(Export)

EFFECTIVELY NOT

From abroad From domestic sellers

TAX (Importatio (Sales or Receipts)

BASIS

EXEMPT Chapter 2 exempt

Exempt Exempt sales import

CONSUMPT Chapter 4 exempt

importation

VAT ON Services specifically

IMPORTATION subject to % tax Chapter 5

Percentage

Below VAT threshold tax

TAXABLE (3% general

EXEMP

CONSUMPT VATABL T Chapter 6

ION E Above VAT threshold 10 Value

Chapter 2 (12% value added 0-RATED added tax

VAT on

importation

VAT Chapter 3

BUSINESS TAX Introduction to Business

tax

Potrebbero piacerti anche

- Tax 2 NotesDocumento2 pagineTax 2 NotesMark LapidNessuna valutazione finora

- Importation by Importers) : Income Tax Vs Consumption TaxDocumento2 pagineImportation by Importers) : Income Tax Vs Consumption TaxMark LapidNessuna valutazione finora

- CA Inter Income Tax Basic ConceptDocumento16 pagineCA Inter Income Tax Basic Concepttauseefalam917Nessuna valutazione finora

- TXVNM - Lecturer Notes 2023Documento257 pagineTXVNM - Lecturer Notes 2023huyen9bbbbbNessuna valutazione finora

- Scope of TaxDocumento12 pagineScope of TaxHajra MalikNessuna valutazione finora

- Icai International TaxDocumento5 pagineIcai International TaxDheeraj YadavNessuna valutazione finora

- 2020 Tax Updates by Atty. Jackie Lou Lamug, CPA PDFDocumento112 pagine2020 Tax Updates by Atty. Jackie Lou Lamug, CPA PDFNhel JoeNessuna valutazione finora

- Chapter 1 Introduction To Consumption TaxesDocumento1 paginaChapter 1 Introduction To Consumption TaxesMicko LagundinoNessuna valutazione finora

- Module 3 PDFDocumento16 pagineModule 3 PDFJennifer AdvientoNessuna valutazione finora

- Consumption TaxDocumento6 pagineConsumption TaxSha MagondacanNessuna valutazione finora

- Taxation Management: Prof. Naveed Iqbal CHDocumento14 pagineTaxation Management: Prof. Naveed Iqbal CHBader ZiaNessuna valutazione finora

- Chapter 7 Introduction-to-Regular-Income-TaxDocumento20 pagineChapter 7 Introduction-to-Regular-Income-TaxLouella CunananNessuna valutazione finora

- Bustax Chapters 1 4Documento6 pagineBustax Chapters 1 4Naruto UzumakiNessuna valutazione finora

- Tax LawsDocumento7 pagineTax Lawsbesong marlonNessuna valutazione finora

- Input - Output TaxDocumento23 pagineInput - Output TaxLipu MohapatraNessuna valutazione finora

- Mechanics of VAT - Zimbabwe Revenue Authority (ZIMRA)Documento2 pagineMechanics of VAT - Zimbabwe Revenue Authority (ZIMRA)Tinashe MukukuNessuna valutazione finora

- For Individuals Earning Purely Compensation Income: Allowable DeductionsDocumento4 pagineFor Individuals Earning Purely Compensation Income: Allowable DeductionsJAN FEVRIER OLETENessuna valutazione finora

- Module 07 Introduction To Regular Income Tax 3 2Documento21 pagineModule 07 Introduction To Regular Income Tax 3 2Joshua BazarNessuna valutazione finora

- Concept of Consumption and Consumption Taxes and Vat On ImportationDocumento4 pagineConcept of Consumption and Consumption Taxes and Vat On ImportationJamaica DavidNessuna valutazione finora

- Taxation-Reforms PRESENTATIONDocumento17 pagineTaxation-Reforms PRESENTATIONRaman KumarNessuna valutazione finora

- Introduction To Consumption Taxes NotesDocumento2 pagineIntroduction To Consumption Taxes NotesSelene DimlaNessuna valutazione finora

- Module IV. Minimum Corporate Income Tax IAET GITDocumento11 pagineModule IV. Minimum Corporate Income Tax IAET GITPinky DanqueNessuna valutazione finora

- Module 07 - Overview of Regular Income TaxationDocumento32 pagineModule 07 - Overview of Regular Income TaxationTrixie OnglaoNessuna valutazione finora

- Income-Taxation-Chapter-7-9 2Documento16 pagineIncome-Taxation-Chapter-7-9 2Milarose Ablay-MacawiliNessuna valutazione finora

- Module 07 Introduction To Regular Income TaxDocumento21 pagineModule 07 Introduction To Regular Income TaxJeon KookieNessuna valutazione finora

- ACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XDocumento8 pagineACFrOgCJ87XweE1ORK13I2yjbAMpCA3F8IcGcpwOM7Zst d62VpOa - XyXN MuGeegYkBFHwEvDzNOO7UyAo3ZaahtGIUUtsLu9puasYbmvQsTO8CMisioK4V7tRmWf MWfXFiQHjT0hWqlhMM4XAngelica PagaduanNessuna valutazione finora

- 01 BustaxDocumento10 pagine01 BustaxJake Raphael Cruz CalaguasNessuna valutazione finora

- Tax Summary 2019 Ver.1Documento163 pagineTax Summary 2019 Ver.1Aiko Cherrie NakamuraNessuna valutazione finora

- WTS Dhruva VAT Handbook PDFDocumento40 pagineWTS Dhruva VAT Handbook PDFFaraz AkhtarNessuna valutazione finora

- Regular Income TaxationDocumento6 pagineRegular Income TaxationAnabel Lajara AngelesNessuna valutazione finora

- Approach To Income Taxation)Documento26 pagineApproach To Income Taxation)Jared AcunaNessuna valutazione finora

- Gst-Act: Goods and Services Tax. One Nation-One TaxDocumento63 pagineGst-Act: Goods and Services Tax. One Nation-One TaxKunal ChawlaNessuna valutazione finora

- Module 3 Tax On CorporationsDocumento33 pagineModule 3 Tax On Corporationscha1150% (2)

- Regular Income TaxationDocumento6 pagineRegular Income TaxationAnabel Lajara Angeles0% (1)

- Comparison Between MAT and AMTDocumento1 paginaComparison Between MAT and AMTManoj Thakar100% (1)

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocumento2 pagine1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJohn Lesther PabiloniaNessuna valutazione finora

- Business Tax Chapter 1Documento3 pagineBusiness Tax Chapter 1Mamin ChanNessuna valutazione finora

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocumento1 pagina1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNessuna valutazione finora

- Case Studies in MAT 2021Documento5 pagineCase Studies in MAT 2021kanchan palNessuna valutazione finora

- Withholding Income Tax Regime (WHT Rates Card) : Facilitation GuideDocumento48 pagineWithholding Income Tax Regime (WHT Rates Card) : Facilitation GuideKamran KhanNessuna valutazione finora

- Jpia-Hau: Business and Transfer TaxationDocumento12 pagineJpia-Hau: Business and Transfer Taxationronniel tiglaoNessuna valutazione finora

- Module 07 - Introduction To Regular Income TaxDocumento25 pagineModule 07 - Introduction To Regular Income TaxJANELLE NUEZNessuna valutazione finora

- CH 2Documento38 pagineCH 2Muhammad HarisNessuna valutazione finora

- Tax 01 Introduction To Consumption TaxesDocumento3 pagineTax 01 Introduction To Consumption TaxesShiela LlenaNessuna valutazione finora

- Tax BT Introduction To VATDocumento5 pagineTax BT Introduction To VATJoshua Phillip TorcedoNessuna valutazione finora

- Facilitation Guide: Withholding Tax Regime (Income Tax) Under The Income Tax Ordinance, 2001Documento39 pagineFacilitation Guide: Withholding Tax Regime (Income Tax) Under The Income Tax Ordinance, 2001Siraj ul HaqNessuna valutazione finora

- INTX211 OverviewDocumento1 paginaINTX211 OverviewJemima FernandezNessuna valutazione finora

- Tax 301 - Midterm Activity 1Documento4 pagineTax 301 - Midterm Activity 1Nicole TeruelNessuna valutazione finora

- 3E-Fii - KICPAA Webinar On ToI - 4 Mar 2022Documento21 pagine3E-Fii - KICPAA Webinar On ToI - 4 Mar 2022Vuthy DaraNessuna valutazione finora

- Aiias Economy Pt365 2022Documento63 pagineAiias Economy Pt365 2022Ismart ShankarNessuna valutazione finora

- CTAA 031 Ch. 32 (SILKE) Ch. 30 (NOTES)Documento29 pagineCTAA 031 Ch. 32 (SILKE) Ch. 30 (NOTES)Given RefilweNessuna valutazione finora

- Taxable IncomeDocumento18 pagineTaxable Incomerav danoNessuna valutazione finora

- Goods & Services Act FinalDocumento78 pagineGoods & Services Act FinalParvesh AghiNessuna valutazione finora

- (Beda Alabang) Taxation Law Review Income Tax Etc (Finals Part)Documento30 pagine(Beda Alabang) Taxation Law Review Income Tax Etc (Finals Part)Eric RamilNessuna valutazione finora

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDocumento2 pagineQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNessuna valutazione finora

- Intro To Business TaxDocumento5 pagineIntro To Business TaxLove RosalunaNessuna valutazione finora

- Circular 98 17 2019 GSTDocumento4 pagineCircular 98 17 2019 GSTBS Nanjunda SwamyNessuna valutazione finora

- Chapter 12: Assessment of Various Entities: Section - A: Statutory UpdateDocumento49 pagineChapter 12: Assessment of Various Entities: Section - A: Statutory UpdateAmol TambeNessuna valutazione finora

- Simple Vapour Compression SystemDocumento1 paginaSimple Vapour Compression SystemJunnel YanillaNessuna valutazione finora

- Data From PAGDocumento11 pagineData From PAGJunnel YanillaNessuna valutazione finora

- Chapter 13-ADocumento4 pagineChapter 13-AJunnel YanillaNessuna valutazione finora

- BaseballDocumento34 pagineBaseballJunnel YanillaNessuna valutazione finora

- Job Description Community CoordinatorDocumento4 pagineJob Description Community CoordinatorJay ChandraNessuna valutazione finora

- DAS Trader Pro Video Series: Hot Key ScriptsDocumento12 pagineDAS Trader Pro Video Series: Hot Key ScriptsvasseNessuna valutazione finora

- 5.1PUNNF Brochure 2Documento10 pagine5.1PUNNF Brochure 2Darlington EzeNessuna valutazione finora

- Adaptive Selling BehaviorDocumento18 pagineAdaptive Selling BehaviorArkaprabha RoyNessuna valutazione finora

- CSC ExamDocumento14 pagineCSC ExamSANJAYNessuna valutazione finora

- 51 Checklist Buy BackDocumento3 pagine51 Checklist Buy BackvrkesavanNessuna valutazione finora

- Chapter 7: Internal Controls I: True/FalseDocumento10 pagineChapter 7: Internal Controls I: True/FalseThảo NhiNessuna valutazione finora

- Introduction To Financial Accounting 1a NotesDocumento52 pagineIntroduction To Financial Accounting 1a NotesNever DoviNessuna valutazione finora

- Solutions For GST Question BankDocumento73 pagineSolutions For GST Question BankSuprajaNessuna valutazione finora

- QualityDocumento29 pagineQualitySotepNessuna valutazione finora

- Computer Science AICTEDocumento2 pagineComputer Science AICTEchirag suresh chiruNessuna valutazione finora

- John Menard KeynesDocumento3 pagineJohn Menard KeynesSanthoshTelu100% (1)

- Beams AdvAcc11 ChapterDocumento21 pagineBeams AdvAcc11 Chaptermd salehinNessuna valutazione finora

- Bu040815 PDFDocumento86 pagineBu040815 PDFNikita JoshiNessuna valutazione finora

- Non Current Assets 2019ADocumento4 pagineNon Current Assets 2019AKezy Mae GabatNessuna valutazione finora

- IA RoqueDocumento52 pagineIA RoqueTrisha RafalloNessuna valutazione finora

- ICUMSA 45 Specifications and Proceduers - 230124 - 134605Documento3 pagineICUMSA 45 Specifications and Proceduers - 230124 - 134605Alexandre de Melo0% (1)

- Module 6 SDMDocumento34 pagineModule 6 SDMdharm287Nessuna valutazione finora

- India's Economy and Society: Sunil Mani Chidambaran G. Iyer EditorsDocumento439 pagineIndia's Economy and Society: Sunil Mani Chidambaran G. Iyer EditorsАнастасия ТукноваNessuna valutazione finora

- ABC Practice Problems Answer KeyDocumento10 pagineABC Practice Problems Answer KeyKemberly AribanNessuna valutazione finora

- Benihana of Tokyo Case AnalysisDocumento2 pagineBenihana of Tokyo Case AnalysisJayr Padillo33% (3)

- Logistics and Supply Chain Innovation Bridging The Gap Between Theory and Practice PDFDocumento432 pagineLogistics and Supply Chain Innovation Bridging The Gap Between Theory and Practice PDFSanjay SudhakaranNessuna valutazione finora

- Criticisms of The Ifrs Conceptual FrameworkDocumento9 pagineCriticisms of The Ifrs Conceptual FrameworkTHOMAS ANSAHNessuna valutazione finora

- Coke Vs PepsiDocumento3 pagineCoke Vs PepsiKanishk MendevellNessuna valutazione finora

- Case Study WilkersonDocumento2 pagineCase Study WilkersonHIMANSHU AGRAWALNessuna valutazione finora

- International Facility Management Association Certified Facility Manager® (CFM®) Competency GuideDocumento11 pagineInternational Facility Management Association Certified Facility Manager® (CFM®) Competency Guidegangulyranjith6112Nessuna valutazione finora

- Global Study On Interactions Between Social Processes and Participatory Guarantee SystemsDocumento90 pagineGlobal Study On Interactions Between Social Processes and Participatory Guarantee SystemsedgoitesNessuna valutazione finora

- Bba PDFDocumento50 pagineBba PDFLakhan KumarNessuna valutazione finora

- Name: Grade: SubjectDocumento5 pagineName: Grade: SubjectArkar.myanmar 2018100% (1)

- TaxDocumento4 pagineTaxMendoza KelvinNessuna valutazione finora