Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

F1040nre 2012 PDF

Caricato da

Johanna AriasTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

F1040nre 2012 PDF

Caricato da

Johanna AriasCopyright:

Formati disponibili

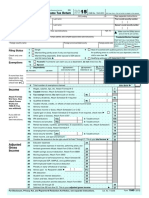

Form 1040NR-EZ U.S. Income Tax Return for Certain OMB No.

1545-0074

Nonresident Aliens With No Dependents

Department of the Treasury

Information about Form 1040NR-EZ and its instructions is at www.irs.gov/form1040nrez.

2012

Internal Revenue Service

Your first name and initial Last name Identifying number (see instructions)

Please print Present home address (number, street, and apt. no., or rural route). If you have a P.O. box, see instructions.

or type.

See

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

separate

instructions.

Foreign country name Foreign province/state/county Foreign postal code

Filing Status

1 Single nonresident alien 2 Married nonresident alien

Check only one box.

3 Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . . 3

Attach 4 Taxable refunds, credits, or offsets of state and local income taxes . . . . . . 4

Form(s) 5 Scholarship and fellowship grants. Attach Form(s) 1042-S or required statement. . 5

W-2 or 6 Total income exempt by a treaty from page 2, Item J(1)(e) . 6

1042-S

7 Add lines 3, 4, and 5 . . . . . . . . . . . . . . . . . . . . . 7

here.

Also 8 Scholarship and fellowship grants excluded . . . . . 8

attach 9 Student loan interest deduction . . . . . . . . . 9

Form(s) 10 Subtract the sum of line 8 and line 9 from line 7. This is your adjusted gross income . 10

1099-R if 11 Itemized deductions . . . . . . . . . . . . . . . . . . . . . 11

tax was 12 Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . 12

withheld. 13 Exemption . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Taxable income. Subtract line 13 from line 12. If line 13 is more than line 12, enter -0- 14

15 Tax. Find your tax in the tax table in the instructions . . . . . . . . . . . 15

16 Unreported social security and Medicare tax from Form: a 4137 b 8919 16

Enclose, 17 Add lines 15 and 16. This is your total tax . . . . . . . . . . . . . 17

but do not 18a Federal income tax withheld from Form(s) W-2 and 1099-R 18a

attach, any b Federal income tax withheld from Form(s) 1042-S . . . 18b

payment. 19 2012 estimated tax payments and amount applied from 2011 return 19

20 Credit for amount paid with Form 1040-C . . . . . 20

21 Add lines 18a through 20. These are your total payments . . . . . . . . 21

22 If line 21 is more than line 17, subtract line 17 from line 21. This is the amount you overpaid 22

Refund

23a Amount of line 22 you want refunded to you. If Form 8888 is attached, check here 23a

b Routing number c Type: Checking Savings

d Account number

Direct e If you want your refund check mailed to an address outside the United States not

deposit?

shown above, enter that address here:

See

instructions.

24 Amount of line 22 you want applied to your 2013 estimated tax 24

Amount 25 Amount you owe. Subtract line 21 from line 17. For details on how to pay, see instructions 25

You Owe 26 Estimated tax penalty (see instructions) . . . . . . . 26

Third Do you want to allow another person to discuss this return with the IRS (see instructions)? Yes. Complete the following. No

Party

Designee Designees

name

Phone

no.

Personal identification

number (PIN)

Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct, and accurately list all amounts and sources of U.S. source income I received during the tax year. Declaration of

Here preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Keep a copy of Your signature Date Your occupation in the United States

this return for

your records.

Print/Type preparers name Preparer's signature Date PTIN

Paid Check if

self-employed

Preparer

Use Only Firms name Firm's EIN

Firm's address Phone no.

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see instructions. Cat. No. 21534N Form 1040NR-EZ (2012)

Form 1040NR-EZ (2012) Page 2

Schedule OI- Other Information (see instructions)

Answer all questions

A Of what country or countries were you a citizen or national during the tax year?

B In what country did you claim residence for tax purposes during the tax year?

C Have you ever applied to be a green card holder (lawful permanent resident) of the United States? . . . . Yes No

D Were you ever:

1. A U.S. citizen? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

2. A green card holder (lawful permanent resident) of the United States? . . . . . . . . . . . Yes No

If you answer Yes to (1) or (2), see Pub. 519, chapter 4, for expatriation rules that may apply to you.

E If you had a visa on the last day of the tax year, enter your visa type. If you did not have a visa, enter your U.S. immigration

status on the last day of the tax year.

F Have you ever changed your visa type (nonimmigrant status) or U.S. immigration status? . . . . . . . Yes No

If you answered Yes, indicate the date and nature of the change.

G List all dates you entered and left the United States during 2012 (see instructions).

Note. If you are a resident of Canada or Mexico AND commute to work in the United States at frequent

intervals, check the box for Canada or Mexico and skip to item H . . . . . . . . . . . . Canada Mexico

Date entered United States Date departed United States Date entered United States Date departed United States

mm/dd/yy mm/dd/yy mm/dd/yy mm/dd/yy

H Give number of days (including vacation, nonworkdays, and partial days) you were present in the United States during:

2010 , 2011 , and 2012 .

I Did you file a U.S. income tax return for any prior year? . . . . . . . . . . . . . . . . . . Yes No

If Yes, give the latest year and form number you filed

J Income Exempt from TaxIf you are claiming exemption from income tax under a U.S. income tax treaty with a foreign country,

complete (1) and (2) below. See Pub. 901 for more information on tax treaties.

1. Enter the name of the country, the applicable tax treaty article, the number of months in prior years you claimed the

treaty benefit, and the amount of exempt income in the columns below. Attach Form 8833 if required (see instructions).

(b) Tax treaty (c) Number of months (d) Amount of exempt

(a) Country

article claimed in prior tax years income in current tax year

(e) Total. Enter this amount on Form 1040NR-EZ, line 6. Do not enter it on line 3 or line 5 . . . . . .

2. Were you subject to tax in a foreign country on any of the income shown in 1(d) above? . . . . . Yes No

Form 1040NR-EZ (2012)

Potrebbero piacerti anche

- 2011 1040NR-EZ Form - SampleDocumento2 pagine2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- 1040x2 PDFDocumento2 pagine1040x2 PDFolddiggerNessuna valutazione finora

- Form 1041Documento4 pagineForm 1041topsytables50% (4)

- F 1040Documento2 pagineF 1040Sue BosleyNessuna valutazione finora

- FTF1302745105156Documento5 pagineFTF13027451051562sly4youNessuna valutazione finora

- FTF1301242185129Documento3 pagineFTF1301242185129Donna SchatzNessuna valutazione finora

- Week 2 Form 1040Documento2 pagineWeek 2 Form 1040Linda100% (2)

- F 1040Documento2 pagineF 1040Kevin RowanNessuna valutazione finora

- U.S. Individual Income Tax ReturnDocumento2 pagineU.S. Individual Income Tax ReturnHamzah B ShakeelNessuna valutazione finora

- Hong Thien PhuocBui2018Documento6 pagineHong Thien PhuocBui2018Thien BaoNessuna valutazione finora

- U.S. Individual Income Tax Return 1040A: Filing StatusDocumento3 pagineU.S. Individual Income Tax Return 1040A: Filing StatusYosbanyNessuna valutazione finora

- AlaAL ZAALIG2011Documento5 pagineAlaAL ZAALIG2011Ala AlzaaligNessuna valutazione finora

- U.S. Departing Alien Income Tax ReturnDocumento14 pagineU.S. Departing Alien Income Tax ReturnViorel OdajiuNessuna valutazione finora

- Income Tax Fundamentals Chapter 4 Comprehensive Problem 1Documento2 pagineIncome Tax Fundamentals Chapter 4 Comprehensive Problem 1AU Sharma0% (1)

- Insights On Legal Writing - My Lawsan LectureDocumento9 pagineInsights On Legal Writing - My Lawsan LectureAisha Muktar100% (1)

- Glacier Tax User GuideDocumento5 pagineGlacier Tax User Guideinter4ever77Nessuna valutazione finora

- NATH f1040Documento2 pagineNATH f1040Spencer NathNessuna valutazione finora

- Fernando Vazquez567935467Documento21 pagineFernando Vazquez567935467Richivee100% (2)

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDocumento3 pagine2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedNessuna valutazione finora

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnDa EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNessuna valutazione finora

- Form 1040Documento2 pagineForm 1040Jessi100% (6)

- Submitting Your U.S. Tax Documents: Print, Sign, MailDocumento5 pagineSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- 1040 Exam Prep: Module I: The Form 1040 FormulaDa Everand1040 Exam Prep: Module I: The Form 1040 FormulaValutazione: 1 su 5 stelle1/5 (3)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Da EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Valutazione: 3.5 su 5 stelle3.5/5 (17)

- 1040 NR EzDocumento2 pagine1040 NR EzElena Alexandra CărăvanNessuna valutazione finora

- Revenue Law and TaxationDocumento33 pagineRevenue Law and TaxationLUKWAGO GERALD100% (3)

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsDa Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNessuna valutazione finora

- Ronquillo vs. RocoDocumento1 paginaRonquillo vs. RocorienaanaaNessuna valutazione finora

- Pil Delhi High CourtDocumento12 paginePil Delhi High CourtDevasish Bisht100% (1)

- Rutkin V UsDocumento10 pagineRutkin V Usבנדר-עלי אימאם טינגאו בתולהNessuna valutazione finora

- Norma AtexDocumento4 pagineNorma AtexV_VicNessuna valutazione finora

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocumento2 pagine1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No Dependentspixel986Nessuna valutazione finora

- Form 1040nrez 2010Documento2 pagineForm 1040nrez 2010David A. VestNessuna valutazione finora

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDocumento2 pagine1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsRajesh Kumar ReddyNessuna valutazione finora

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocumento2 pagineAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranNessuna valutazione finora

- Amended U.S. Individual Income Tax ReturnDocumento2 pagineAmended U.S. Individual Income Tax ReturnJohnNessuna valutazione finora

- Amended U.S. Individual Income Tax ReturnDocumento2 pagineAmended U.S. Individual Income Tax Returnmarxvera158Nessuna valutazione finora

- 2021 Form 1040-NRDocumento2 pagine2021 Form 1040-NRvalentynad74Nessuna valutazione finora

- Installment Agreement RequestDocumento2 pagineInstallment Agreement Request0scarNessuna valutazione finora

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocumento2 pagineAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any Changesgolcha_edu532Nessuna valutazione finora

- Form 9465-PDF Reader ProDocumento2 pagineForm 9465-PDF Reader ProEdward FederisoNessuna valutazione finora

- U.S. Individual Income Tax ReturnDocumento2 pagineU.S. Individual Income Tax Returnapi-310622354Nessuna valutazione finora

- Untitled PDFDocumento2 pagineUntitled PDFjenny abbottNessuna valutazione finora

- Irs Form 9465 ExampleDocumento2 pagineIrs Form 9465 ExampleScottNessuna valutazione finora

- U.S. Individual Income Tax ReturnDocumento2 pagineU.S. Individual Income Tax Returnapi-173610472Nessuna valutazione finora

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDocumento5 pagineU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyNessuna valutazione finora

- Amended U.S. Corporation Income Tax Return: Fill in Applicable Items and Use Part II On The Back To Explain Any ChangesDocumento4 pagineAmended U.S. Corporation Income Tax Return: Fill in Applicable Items and Use Part II On The Back To Explain Any ChangesMoose112Nessuna valutazione finora

- HTTPSWWW Irs Govpubirs-Pdff1040sa PDFDocumento1 paginaHTTPSWWW Irs Govpubirs-Pdff1040sa PDFAppaNessuna valutazione finora

- Itemized Deductions: Medical and Dental ExpensesDocumento1 paginaItemized Deductions: Medical and Dental ExpensesnuseNessuna valutazione finora

- Resume of Srpeak4Documento2 pagineResume of Srpeak4api-25647173Nessuna valutazione finora

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDocumento6 pagineCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620Nessuna valutazione finora

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocumento2 pagineAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesEri TakataNessuna valutazione finora

- 1120s PDFDocumento5 pagine1120s PDFBreann MorrisNessuna valutazione finora

- F 709Documento5 pagineF 709Bogdan PraščevićNessuna valutazione finora

- United States Gift (And Generation-Skipping Transfer) Tax ReturnDocumento5 pagineUnited States Gift (And Generation-Skipping Transfer) Tax ReturnpdizypdizyNessuna valutazione finora

- United States Estate (And Generation-Skipping Transfer) Tax ReturnDocumento2 pagineUnited States Estate (And Generation-Skipping Transfer) Tax Returndouglas jonesNessuna valutazione finora

- Form 1040Documento3 pagineForm 1040Peng JinNessuna valutazione finora

- f1040x PDFDocumento2 paginef1040x PDFAlexNessuna valutazione finora

- F 1040 SaDocumento1 paginaF 1040 Sahgfed4321Nessuna valutazione finora

- BilndDocumento3 pagineBilndxabehe6146Nessuna valutazione finora

- U.S. Departing Alien Income Tax Return: Print or TypeDocumento4 pagineU.S. Departing Alien Income Tax Return: Print or TypeDavid WebbNessuna valutazione finora

- F 1040 NRDocumento5 pagineF 1040 NRsrao_919525Nessuna valutazione finora

- Solution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, HigginsDocumento2 pagineSolution Manual For Concepts in Federal Taxation 2018 25th Edition Murphy, Higginsa882650259Nessuna valutazione finora

- Buebos CaseDocumento2 pagineBuebos CaseMarry Jhaenne Taguidang DinangwatanNessuna valutazione finora

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocumento2 pagineNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNessuna valutazione finora

- Burgess: Plaintiffs' Initial DisclosuresDocumento19 pagineBurgess: Plaintiffs' Initial DisclosuresTony OrtegaNessuna valutazione finora

- B8 Ipsas - 32 PDFDocumento60 pagineB8 Ipsas - 32 PDFEZEKIELNessuna valutazione finora

- Integrity PDFDocumento78 pagineIntegrity PDFwongdmkNessuna valutazione finora

- Contentio Writers NDA Kavita AdhikariDocumento2 pagineContentio Writers NDA Kavita Adhikarikavita adhikariNessuna valutazione finora

- Heirs of Tan Vs Pollescas PDFDocumento12 pagineHeirs of Tan Vs Pollescas PDFJemNessuna valutazione finora

- Case Laws of TortDocumento6 pagineCase Laws of TortNilabh SagarNessuna valutazione finora

- Vantage Airport Group (UK) Directors' Report & Financial Statements (2011)Documento15 pagineVantage Airport Group (UK) Directors' Report & Financial Statements (2011)ChristianErikssonNessuna valutazione finora

- 2023.05.02 - Appellant Opening Brief (US v. Sastrom)Documento80 pagine2023.05.02 - Appellant Opening Brief (US v. Sastrom)Max RodriguezNessuna valutazione finora

- 9 9 Indian Criminal Justice System in IndiaDocumento395 pagine9 9 Indian Criminal Justice System in IndiaSankar Nath ChakrabortyNessuna valutazione finora

- ContractDocumento4 pagineContractNelmar ArananNessuna valutazione finora

- ITT For Supply & Fixing of Conference Table & ChairDocumento17 pagineITT For Supply & Fixing of Conference Table & ChairAnshuman AgrawalNessuna valutazione finora

- 46.people vs. Delim, 396 SCRA 386, G.R. No. 142773, Jan. 28, 2003Documento57 pagine46.people vs. Delim, 396 SCRA 386, G.R. No. 142773, Jan. 28, 2003Malagant EscuderoNessuna valutazione finora

- Air Trnsportation Office vs. Spouses Ramos GR NO. 159402 FEBRUARY 23, 2011Documento5 pagineAir Trnsportation Office vs. Spouses Ramos GR NO. 159402 FEBRUARY 23, 2011Rica Santos-vallesteroNessuna valutazione finora

- United States v. Dianne Sutherland, United States of America v. Alan W. Fini, 929 F.2d 765, 1st Cir. (1991)Documento20 pagineUnited States v. Dianne Sutherland, United States of America v. Alan W. Fini, 929 F.2d 765, 1st Cir. (1991)Scribd Government DocsNessuna valutazione finora

- Doctrine of State ResponsibilityDocumento1 paginaDoctrine of State ResponsibilityLorenz James LuistroNessuna valutazione finora

- Knights Inn LawsuitDocumento9 pagineKnights Inn LawsuitTom JohanningmeierNessuna valutazione finora

- Data Protection Concept NoteDocumento3 pagineData Protection Concept Noteyagnesh2005Nessuna valutazione finora

- Jamia Millia Islamia University Faculty of LawDocumento18 pagineJamia Millia Islamia University Faculty of LawShimran ZamanNessuna valutazione finora

- Solution Manual For Walston Dunham Introduction To Law 7thDocumento34 pagineSolution Manual For Walston Dunham Introduction To Law 7thzanewilliamhzkbr100% (26)

- Chapter One: Preliminary ProvisionsDocumento5 pagineChapter One: Preliminary ProvisionsMau AntallanNessuna valutazione finora

- Kiesling v. Troughton, 10th Cir. (1997)Documento7 pagineKiesling v. Troughton, 10th Cir. (1997)Scribd Government DocsNessuna valutazione finora

- NVD-018 LoU SRM For VendorDocumento3 pagineNVD-018 LoU SRM For VendorFirman SyahNessuna valutazione finora