Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FDC LTD.: PCG Research

Caricato da

arun_algoTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FDC LTD.: PCG Research

Caricato da

arun_algoCopyright:

Formati disponibili

INVESTMENT IDEA 03 Dec 2016

PCG RESEARCH

FDC Ltd.

Industry CMP Recommendation Buying Range Target Time Horizon

BUY at CMP and add on

Pharmaceuticals Rs. 218 Rs. 192 - 218 Rs. 255 - 290 3-4 Quarters

Declines

HDFC Scrip Code FDCLTD Company Background

BSE Code 531599

FDC Ltd. is a domestic focused pharmaceuticals company with a 1.2% market share of the Indian

NSE Code FDC Pharmaceuticals Market (IPM). The Company is engaged in the manufacturing of Formulations (75% of

Bloomberg FDCLT FY16 revenues), APIs (6%) and Oral Rehydration Salts (ORS) (19%). Its therapeutic areas of focus include

Anti-Infectives, Ophthalmological, Vitamins / Minerals / Dietary supplements, Cardiac, Anti-Diabetes and

CMP as on 02 Dec-16 218 Dermatology. It has a range of functional foods and beverages. Its active pharmaceuticals ingredients

Equity Capital (Rs Cr) 17.9 (APIs) produced cover a range of therapeutic categories, such as Albuterol Sulfate, Bromhexine

Hydrochloride, Cinnarizine, Dihydrochloride, Flurbiprofen Sodium, Miconazole Nitrate and Timolol Maleate.

Face Value (Rs) 1 The major brands include Zifi, Electral, Enerzal, Vitcofol, Pyrimon, Zocon, Zipod, Cotaryl and Mycoderm.

FDC is a leading player in Oral Rehydration Salt (ORS) segment, with its well-known brand Electral and

Equity O/S (Cr) 17.9

Enerzal. It has multi-location manufacturing facilities for APIs, as well as finished dosage formulations

Market Cap (Rs cr) 3870 (FDFs).

Book Value (Rs) 59

Company has plants located at various parts of India such as at Roha Dist. Raigarh, Waluj and Sinnar in

Avg. 52 Week Maharashtra, Verna in Goa and Baddi in Himachal Pradesh. Company had 5,277 permanent employees as

95710

Volumes on March-2016 out of which 3,785 employees are engaged in the marketing and distribution activities; 850

52 Week High 244 MRs were added in Ophthalmology and Cardiac division during FY16. FDC also exports formulations to the

country like Denmark, UK, USA, Africa and Australia. Company derived exports revenues of Rs 130cr in

52 Week Low 165 FY16 (13% of Revenues); with a pick-up in ORS sales to Africa and Opthalmics solutions sales to US and

UK, where it has received regulatory clearances for its plants. We expect exports to pick up with ~20%

growth for the next 2-3 years.

Shareholding Pattern (%)

Promoters 68.9 We believe company would post faster revenue growth led by Exports formulations as company launches its

products in US markets and also traction from EU markets. Moreover, Company has strong hold on some of

Institutions 14.3 its products in ORS, Anti Infectives and Cardiac and those products would continue to do well in domestic

market. FDC has posted 9.2% revenue and 5.3% PAT cagr over FY13-16. We forecast 11% revenue cagr

Non Institutions 16.8

over FY16-19E led by strong traction from domestic business and exports revenue to post 18% cagr, given

the low base effect and US business to accelerate going forward. We expect 590bps margin surge over

FY16-19E driven by operating leverage tailwinds and focus on high margin products. Company has posted

EBITDA margin of 26.9% in H1 FY17. Accordingly, we have envisaged 25% PAT cagr over the same period

Kushal Rughani and expect company to post Rs17 EPS for FY19E. We recommend investors to BUY FDC at CMP of Rs218

kushal.rughani@hdfcsec.com and add on dips to Rs192 for sequential targets of Rs255 and Rs290 (based upon 17x FY19E earnings) over

the next 3-4 quarters.

Private Client Group - PCG RESEARCH Page |1

PCG RESEARCH

Investment Rationale

Q2 FY17 Update

FDCs Q2 FY17 revenues grew 10% YoY to Rs 290cr from Rs 265cr driven by Zifi, Electral and Enerzal. The

company has revised higher the prices of Electral and Enerzal tetra packs in the domestic market. We expect

these tetra packs to drive future growth as these are ready to drink, convenient to carry and have higher

margins.

EBIDTA margin surged 570bps to 28.5% from 22.8% in Q2, mainly due to the decline in raw material cost.

Material costs fell by 500bps YoY to 31.7% from 36.7% due to change in product mix, with higher revenues

from flagship brands and fall in prices of crude related chemicals. Other expenses declined by 130bps to

24.0% from 25.3%. We expect margin improvement led by new product launches, volume growth and price

increase up to 10% for non-NLEM (National List of Essential Medicines) products in April16. Net profit rose

39% YoY to Rs67cr from Rs 48cr led by strong margin improvement and lower tax rate.

H1 FY17: Revenues up 5.7% YoY, Margin expanded 380bps

FDC posted 5.7% increase in overall revenues during H1 FY17. The companys nine major brands are listed

among top 1,000 brands and contribute 50% to domestic revenues. Domestic revenues increased 6% yoy to

change in products mix and decline in raw material costs. Company has posted EBITDA margin of 26.9% in

H1 FY17. During Q1, company had made provision of Rs6cr; PAT came in at Rs 115cr, +21% yoy for H1

FY17.

The companys nine major brands are in the list of top 1,000 brands and contributed 51% to the revenues.

FDCs four major products Zifi, Electral, Enerzal and Zifi CV grew faster than the market growth of 14%.

These four brands collectively contributed ~50% to the revenues and are likely to be future growth drivers.

We expect net profit to improve on price increases of non-NLEM products, New Launches, volume growth and

line extensions.

Key Highlights

The companys major brand Zifi and its line extensions had posted revenues of Rs 270cr in FY16,

contributed 32% of domestic revenues.

FDCs multivitamin brand Vitcofol had revenues of Rs 45cr and grew at 15.3%. The companys

antifungal brand Zocon had revenues of Rs 37cr and grew at 29% and is one of the fastest growing

antifungal brands in India.

Private Client Group - PCG RESEARCH Page |2

PCG RESEARCH

FDCs flagship brand Enerzal had posted revenues of Rs35cr in FY16. The company promotes the

product as sports drink at various sports events. FDC markets through chemists directly to

gymnasiums and health institutes. The brand is superior to competing brands contain caffeine,

whereas Enerzal is caffeine free and hence not habit forming.

Electral generated revenues of Rs140cr and grew 12% yoy despite being under price control. FDC

derived about 30% of its domestic revenues from price controlled products.

Company has launched Enerzal in Pet Bottle (Orange and Apple Flavour). Other Products are under

development / ready for launch.

During the year March 31, 2016, FDC has generated sales of Rs 6cr from APIs and Rs7.5cr from

finished formulations. The US Business for API's and formulations is expected to contribute

significantly to the growth of FDC's International business going forward.

In April 2016, Latanoprost 0.005% Ophthalmic Solution ANDA got US FDA approval. 20 Other product

approvals were received in Rest of the World markets of which 17 products (Ophthalmics, Liquids,

ORS) were registered in Sri Lanka, Philippines, Peru, Ethiopia, Zimbabwe, Hong Kong, Myanmar from

Waluj site. One tablet formulation was registered in Botswana from Goa III and one ORS product was

registered in Tanzania from Sinnar and Kit pack for Congo from Goa I.

Company has ramped up its R&D expenditure to 3.2% of revenues in FY16 vs. 2.5% in FY15. We

expect company to spend more on R&D (expect ~4% of revenues in the coming years)

Company History and other key details

FDC had started its business in 1936 as an importer of formulations, medical equipment and specialized

infant foods. In 1949 company set up its first manufacturing unit with the objective of manufacturing

indigenous formulations and absorbent cotton wool. In 1963, company entered into the ophthalmic

therapeutic segment, in which FDC commands ~20% market share at present. Company has one of the best

product portfolios in the ophthalmic segment catering to almost all-possible eye ailments.

In 1972, FDC entered into oral rehydration salts (ORS) with Electral. The product was introduced as a

substitute to IV fluids and it has become a household name in the last 25 years. FDC started this project in a

small setup at Jogeshwari with an initial capacity of 4000 packs per day and today it has separate

manufacturing facilities at Nashik and Waluj with total capacity of 2.3 lakh packs per day.

Private Client Group - PCG RESEARCH Page |3

PCG RESEARCH

In 1978, FDC started manufacturing bulk drugs at Roha. Company started with manufacture of Diazepam,

Metronidizole, Tinidizole, Trimethoprim, Hydroxy ethyl and Theophylline. Later on, it shifted focus to high

value low volume drugs such as Flurbiprofen, Timolol Maleate and Salbutamol sulphate, mainly the bulk

drugs, which were required for captive consumption and also had export potential. In 1983 Company started

foods division. Currently this division is known as nutraceuticals. In the developed nations of Europe and US,

nutraceuticals have become a major market. In the coming years, same trend is expected to be in the

domestic market, thus FDC would be benefited. FDC has launched few innovative products in this segment

and several are in the pipeline.

In 1989, Company setup a state of art manufacturing facility at Waluj, Aurangabad. This plant has UK

authority approval for sterile dosage forms. In 1996, FDC came out with maiden public issue at price of

Rs100 per share to set up the formulation plant at Nashik, part payment of two Form-Fill-Seal (FFS)

machines besides modernization/ expansion / integration of existing manufacturing facilities and R&D

centers. Today Nashik plant manufactures ORS formulations. It is to be noted that Adjusted for Split and

Bonus, FDC stock price has given fantastic returns from Rs10 to Rs440 in the span of 20 years (i.e. since

IPO).

In 1998, FDC established another manufacturing unit for solid dosage form at Goa with the objective of

manufacturing selected products going off patent for the international market. FDC has joint venture with

group of professionals in UK to export Ophthalmic range of formulations. In this JV, FDC has majority of the

stake. Company continues to focus on increasing export of ophthalmic dosage formulation to high margin

markets of EU.

Domestic Pharmaceuticals Outlook

The domestic pharma market was valued at Rs 878.7bn and grew at 13.5% in FY16 as per IMS MAT March

16 data. The 24 listed pharma companies generated revenues of Rs 494.5bn (56% of total) and grew at 12%

compared to the industry growth of 13.5%. This slow growth is attributed to some major drugs coming under

price control during the year. The 24 listed pharma companies have lions share of over 56% in the domestic

market, and their major brands are likely to drive the future growth of the industry.

The Indian pharmaceuticals market increased at a CAGR of 17.4% during 2005-16 with the market

increasing from US$6 billion in 2005 to US$36.7 billion in 2016 and is expected to post CAGR of 15.3% to

US$55 billion by 2020. By 2020, India is likely to be among the top three pharmaceutical markets by

incremental growth and sixth largest market globally in absolute size.

Private Client Group - PCG RESEARCH Page |4

PCG RESEARCH

We expect the key pharma brands to drive future growth of the domestic pharma industry as these have

higher recall in the doctors community. The domestic pharma market consists of branded generic market of

patent-expired products. Being the decision maker, the doctor will prefer familiar brands and those that have

demonstrated excellent therapeutic efficacy.

We expect the domestic pharma market driven by fast growing lifestyle segments, established brands and

effective brand promotion. A combination of all three factors would lead to strong company revenues and

industry growth.

Export Formulations to post strong revenue growth

Though Majority part of revenues is derived from domestic market; FDC also derives revenues from exports

formulations. Company caters to the country like Denmark, UK, USA, Africa and Australia. Company derived

exports revenues of Rs 130cr in FY16 (13% of Revenues); with a pick-up in ORS sales to Africa and

Opthalmic solutions sales to US and UK, where it has received regulatory clearances for its plants. We expect

exports sales to pick up with ~18% growth for the next 2-3 years. Currently, company has miniscule

exposure to US markets; company has filed several ANDAs and intends to focus more on R&D thus company

may surprise positively if US revenues scales up considerably.

FDC had acquired property at Jogeshwari, Erstwhile it was on lease

In Aug 2015, Company had purchased the property of ~8,700 Sq. mtrs located at Jogeshwari (West),

Mumbai for Rs 261cr which they were using on lease since 1949 and lease was going to expire in 2018. This

was the main reason for the surge in companys fixed assets and decline in investments during FY16.

Passed through US FDA inspection successfully

The US Food and Drug Administration (US FDA) has completed the inspection of the companys

manufacturing unit situated at Waluj in July 2016. US FDA had made two minor observations for which

appropriate steps shall be taken by the company. The USFDA carried out the audit of the facility in relation to

cGMP (Current Good Manufacturing Practices) norms and the abbreviated new drug application (ANDA) filed

by the company for Dorzolamide ophthalmic solution.

FDC Ltd has received the establishment inspection report (EIR) from US Food and Drug Administration (US

FDA) for its manufacturing unit situated at Baddi (Himachal Pradesh) with no observations. This approval

confirms the closure of inspection conducted in February 2016. The said audit was carried out in relation

to cGMP inspection and ANDA filed by the company for product cefixime tablets (Anti Infectives).

Private Client Group - PCG RESEARCH Page |5

PCG RESEARCH

Expect 11% revenue and 25% PAT CAGR over FY16-19E

FDC has posted 9.2% revenue and 5.3% PAT cagr over FY13-16. We forecast 11% revenue cagr over FY16-

19E led by strong traction from domestic business and exports revenue to surge 20%+, given the low base

effect and US business to accelerate going forward. FDC posted 5.7% revenue growth for H1 FY17 however

EBITDA margin surged 380bps yoy to 26.9%. We expect 590bps margin surge over FY16-19E driven by

operating leverage tailwinds, higher growth trajectory from exports formulations and focus on high margin

products. Accordingly, we have envisaged 25% PAT cagr over the same period and expect company to post

Rs17 EPS for FY19E. We recommend investors to BUY FDC at CMP of Rs218 and add on dips to Rs192 for

sequential targets of Rs255 and Rs290 (based upon 17x FY19E earnings) over the next 3-4 quarters.

Key Risks

The 30% of FDC domestic products portfolio is under NLEM which might impact on margin for the company.

Moreover, company highly depends on the top 4 Brands (~50% of Domestic Revenues); the slower growth in

those products may impact company negatively. Slower than expected exports formulations revenue may

lead to disappointment in financials.

Major Products in Domestic Market

Therapeutic Rev Cont (

Product Name Segment FY16 )

Zifi and its Ext. Anti Infectives Rs 270cr

Electral ORS Rs 140cr

Vitcofol Multivitamins Rs 45cr

Zocon Anti Fungal Rs 37cr

Amodep AT CVS -

Enerzal Nutraceuticals -

Source: Company, HDFC sec Research

Private Client Group - PCG RESEARCH Page |6

PCG RESEARCH

Company Positioning in IPM (#)

MAT MAT MAT

Therapy Mar Mar Mar

Segment 2016 2015 2014

Electrolytes 1 1 1

Opthal/Otolog 7 8 8

Energy Drink 1 2 2

Anti Infectives 12 12 11

Cardiac Care 33 32 32

Vit/Min/Nutris 36 34 35

Source: Company, HDFC sec Research,

Financial Summary (Rs cr)

(Rs Cr) FY14 FY15 FY16E FY17E FY18E FY19E

Sales 846 889 1006 1092 1243 1435

EBITDA 207 198 224 277 336 403

Net Profit 135 148 157 205 248 303

EPS (Rs) 7.6 8.3 8.8 11.5 13.9 17.0

P/E 28.8 26.4 24.8 19.0 15.7 12.9

EV/EBITDA 18.7 19.6 17.3 14.0 11.5 9.6

RoE 16.6 16.6 15.8 18.0 18.9 19.8

Source: Company, HDFC sec Research

Private Client Group - PCG RESEARCH Page |7

PCG RESEARCH

Revenues to witness 11% cagr over FY16-19E EBITDA and PAT to witness robust growth momentum

1600 450

1400 400

1200 350

1000 300

Rs Cr

800 250

600 200

400 150

200 100

0 50

FY13 FY14 FY15 FY16 FY17E FY18E FY19E FY14 FY15 FY16 FY17E FY18E FY19E

Source: Company, HDFC sec Research Source: Company, HDFC sec Research

FY16 Intl Revenues Split (%)

20 Denmark

UK

32

USA

5 Aus & NZ

7 Africa

Malaysia

10 Others

14

12

Source: Company, HDFC sec Research

Private Client Group - PCG RESEARCH Page |8

PCG RESEARCH

OPM to surge 590bps over FY16-19E

30.0

25.0

%

20.0

15.0

10.0

FY14 FY15 FY16 FY17E FY18E FY19E

Source: Company, HDFC sec Research

Strong Return Ratios (%)

25.0

20.0

15.0

10.0

5.0

FY14 FY15 FY16 FY17E FY18E FY19E

RoE RoCE

Source: Company, HDFC sec Research

Private Client Group - PCG RESEARCH Page |9

PCG RESEARCH

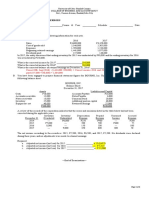

Income Statement (Consolidated) Balance Sheet (Consolidated)

(Rs Cr) FY14 FY15 FY16 FY17E FY18E FY19E (Rs Cr) FY14 FY15 FY16 FY17E FY18E FY19E

Net Revenue 846 889 1006 1092 1243 1435

SOURCE OF FUNDS

Growth (%) 9.4 5.1 13.2 8.5 13.8 15.5 Share Capital 17.9 17.9 17.9 17.9 17.9 17.9

Operating Expenses 639 691 783 815 907 1032 Reserves 827 919 1032 1191 1376 1593

EBITDA 207 198 224 276 336 403 Shareholders' Funds 845 937 1050 1209 1394 1611

Growth (%) 14.6 -4.2 12.8 23.6 21.5 20.0 Long term Debt 1 1 1 1 1 1

EBITDA Margin (%) 24.5 22.3 22.2 25.3 27.0 28.1 Net Deferred Taxes 30 23 19 19 19 19

Depreciation 25 39 34 34 37 40 Long Term Provisions & Others 1 1 1 1 1 1

EBIT 182 159 190 242 299 363 Total Source of Funds 877 962 1070 1257 1446 1680

Other Income 39 46 32 41 45 53 APPLICATION OF FUNDS

Interest 3.1 2.0 1.4 1.1 2.0 2.0 Net Block 300 420 694 716 734 788

PBT 218 203 220 282 342 414 Non Current Investments 187 217 35 83 172 222

83 56 63 79 96 116 Long Term Loans & Advances 130 8 8 10 14 19

Tax

RPAT 135 148 157 205 248 303 Total Non Current Assets 617 645 737 809 920 1029

Inventories 103 123 131 132 160 177

Growth (%) -12.7 9.2 6.5 30.4 21.3 21.9

7.6 8.3 8.8 11.5 13.9 17.0 Trade Receivables 57 61 63 74 86 101

EPS

Source: Company, HDFC sec Research Cash & Equivalents 22 15 18 68 86 121

Other Current Assets (incl Curr Invests) 253 303 283 341 370 441

Total Current Assets 436 502 496 614 702 840

Trade Payables 79 87 83 86 95 110

Other Current Liab & Provisions 100 101 81 80 80 79

Total Current Liabilities 179 188 164 166 175 189

Net Current Assets 256 314 331 449 527 651

Total Application of Funds 877 962 1070 1257 1446 1680

Source: Company, HDFC sec Research

Private Client Group - PCG RESEARCH P a g e | 10

PCG RESEARCH

Cash Flow Statement (Consolidated) Key Ratio (Consolidated)

(Rs Cr) FY14 FY15 FY16 FY17E FY18E FY19E Key Ratios (%) FY14 FY15 FY16 FY17E FY18E FY19E

Reported PBT 218 203 220 282 342 414 EBITDA Margin 24.5 22.3 22.2 25.3 27.0 28.1

Non-operating & EO items -39 -46 -32 -41 -45 -53 EBIT Margin 21.5 17.9 18.9 22.2 24.1 25.3

Interest Expenses 3 2 1 1 2 2 APAT Margin 16.0 16.6 15.6 18.8 20.0 21.1

Depreciation 25 39 34 34 37 40 RoE 16.6 16.6 15.8 18.0 18.9 19.8

Working Capital Change -13 -72 -19 -68 -60 -90 RoCE 21.5 17.3 18.7 21.1 22.6 23.8

Tax Paid -83 -56 -63 -79 -96 -116 Solvency Ratio

OPERATING CASH FLOW ( a ) 111 71 141 130 180 198 Net Debt/EBITDA (x) -1.2 -1.4 -1.2 -1.4 -1.2 -1.3

Capex -17 -158 -311 -15 -45 -75 Net D/E -0.3 -0.3 -0.3 -0.3 -0.3 -0.3

94 -87 -170 115 135 123 Interest Coverage 66.7 99.1 155.3 242.5 167.9 201.6

Free Cash Flow

Investments 58 -30 182 -48 -89 -50 PER SHARE DATA

EPS 7.6 8.3 8.8 11.5 13.9 17.0

Non-operating income 39 46 32 41 45 53

CEPS 9.0 10.4 10.7 13.4 16.0 19.2

INVESTING CASH FLOW ( b ) 80 -142 -97 -22 -89 -72

BV 47.3 52.5 58.8 67.7 78.0 90.2

Debt Issuance / (Repaid) -1 0 0 0 0 0

Dividend 2.3 2.3 2.3 2.8 3.5 4.4

Interest Expenses -3 -2 -1 -1 -2 -2

VALUATION

FCFE 90 -89 -171 114 133 121

P/E 28.8 26.4 24.8 19.0 15.7 12.9

Share Capital Issuance 0 0 0 0 0 0

P/BV 4.6 4.2 3.7 3.2 2.8 2.4

Dividend -46 -46 -46 -57 -71 -89

EV/EBITDA 18.7 19.6 17.3 14.0 11.5 9.6

FINANCING CASH FLOW ( c ) -50 -48 -47 -58 -73 -91 4.6 4.4 3.9 3.6 3.1 2.7

EV / Revenues

NET CASH FLOW (a+b+c) 142 -119 -3 49 18 35

Div Yield (%) 1.0 1.0 1.0 1.3 1.6 2.0

Source: Company, HDFC sec Research

Div Payout Ratio (%) 29.7 27.2 25.6 24.4 25.2 25.7

Source: Company, HDFC sec Research

Private Client Group - PCG RESEARCH P a g e | 11

PCG RESEARCH

Price Movement Chart

300

250

200

150

100

50

Apr-16

Sep-16

May-16

Jul-16

Feb-16

Dec-15

Jun-16

Oct-16

Nov-16

Jan-16

Dec-16

Mar-16

Aug-16

Rating Definition:

Buy: Stock is expected to gain by 10% or more in the next 1 Year.

Sell: Stock is expected to decline by 10% or more in the next 1 Year.

Private Client Group - PCG RESEARCH P a g e | 12

PCG RESEARCH

I, Kushal Rughani, MBA, author and the name subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject

issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its

Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further

Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any holding in stock No

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or

arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for information

purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as an

offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any

locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities

Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not

be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd .

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived

from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for,

any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies)

mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and

other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any

action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the

dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or

may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other

assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research

report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not

based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different

conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an

officer, director or employee of the subject company. We have not received any compensation/benefits from the Subject Company or third party in connection with the Research Report.

HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg

(East), Mumbai 400 042

HDFC securities Limited, 4th Floor, Above HDFC Bank, Astral Tower, Nr. Mithakali 6 Road, Navrangpura, Ahmedabad-380009, Gujarat.

Website: www.hdfcsec.com Email: pcg.advisory@hdfcsec.com

Private Client Group - PCG RESEARCH P a g e | 13

Potrebbero piacerti anche

- Business Cup Level 1 Quiz BeeDocumento28 pagineBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNessuna valutazione finora

- Phuket CaseDocumento4 paginePhuket Casejperez1980100% (1)

- Aarti Industries Q1 FY22 Results Present Record PerformanceDocumento24 pagineAarti Industries Q1 FY22 Results Present Record PerformancerohitnagrajNessuna valutazione finora

- Fundamental Analysis of SRF Ltd in 40 CharactersDocumento7 pagineFundamental Analysis of SRF Ltd in 40 CharactersKunal JainNessuna valutazione finora

- HappyDocumento13 pagineHappykhushal jainNessuna valutazione finora

- Glenmark Pharmaceuticals Business ModelDocumento12 pagineGlenmark Pharmaceuticals Business ModelKanv GargNessuna valutazione finora

- Sun Pharmaceutical Industries 210618Documento5 pagineSun Pharmaceutical Industries 210618saran21Nessuna valutazione finora

- Indoco Remedies: Triggers in Place To Fuel Future GrowthDocumento10 pagineIndoco Remedies: Triggers in Place To Fuel Future Growthanandrai2Nessuna valutazione finora

- Top Recommendation - 140911Documento51 pagineTop Recommendation - 140911chaltrikNessuna valutazione finora

- Valiant Organic BP Wealth 280122Documento19 pagineValiant Organic BP Wealth 280122Grim ReaperNessuna valutazione finora

- 1182311122021672glenmark Pharma Q2FY22Documento5 pagine1182311122021672glenmark Pharma Q2FY22Prajwal JainNessuna valutazione finora

- ShilpaMedicare BUY BPWealth 18.05.18Documento22 pagineShilpaMedicare BUY BPWealth 18.05.18Bethany CaseyNessuna valutazione finora

- INDIA PESTICIDES-IC by JM FinancialsDocumento22 pagineINDIA PESTICIDES-IC by JM Financialssiva kNessuna valutazione finora

- Diwali Picks 2019Documento23 pagineDiwali Picks 2019Ravi RajanNessuna valutazione finora

- S H Kelkar & Co - Initiating CoverageDocumento24 pagineS H Kelkar & Co - Initiating Coveragejignesh100% (2)

- Muhurat Picks 2015: Company CMP Target Upside (%)Documento12 pagineMuhurat Picks 2015: Company CMP Target Upside (%)abhijit99541623974426Nessuna valutazione finora

- Sunp 28 5 23 PLDocumento8 pagineSunp 28 5 23 PLraj patilNessuna valutazione finora

- Natco Pharma LTD: Exports Overshadow Domestic Challenges..Documento5 pagineNatco Pharma LTD: Exports Overshadow Domestic Challenges..Kiran KudtarkarNessuna valutazione finora

- Deepak Nitrite - Initiation Report Asit Mehta Jan 2017Documento20 pagineDeepak Nitrite - Initiation Report Asit Mehta Jan 2017divya chawlaNessuna valutazione finora

- Esearch Eport: Riddhi Siddhi Gluco Biols LTDDocumento9 pagineEsearch Eport: Riddhi Siddhi Gluco Biols LTDanny2k1Nessuna valutazione finora

- HikalDocumento22 pagineHikalADNessuna valutazione finora

- P I Industries - A Niche Agri CSM Company - Initiating CoverageDocumento11 pagineP I Industries - A Niche Agri CSM Company - Initiating CoverageshahavNessuna valutazione finora

- Atul Ltd.Documento4 pagineAtul Ltd.Fast SwiftNessuna valutazione finora

- Faze Three Initial (HDFC)Documento11 pagineFaze Three Initial (HDFC)beza manojNessuna valutazione finora

- IEA Report 6th FebruaryDocumento19 pagineIEA Report 6th FebruarynarnoliaNessuna valutazione finora

- P.I. Industries (PI IN) : Q1FY21 Result UpdateDocumento7 pagineP.I. Industries (PI IN) : Q1FY21 Result UpdatewhitenagarNessuna valutazione finora

- Exide LTD Market Impact Q1FY19Documento2 pagineExide LTD Market Impact Q1FY19Shihab MonNessuna valutazione finora

- Atul LTD Buy Report IIFLDocumento6 pagineAtul LTD Buy Report IIFLBhaveek OstwalNessuna valutazione finora

- HSIE Results Daily - 10 Feb 24-202402100803391611264Documento11 pagineHSIE Results Daily - 10 Feb 24-202402100803391611264adityazade03Nessuna valutazione finora

- GSK Consumer Healthcare Coverage InitiationDocumento26 pagineGSK Consumer Healthcare Coverage InitiationChaitanya JagarlapudiNessuna valutazione finora

- Dishman PharmaDocumento8 pagineDishman Pharmaapi-234474152Nessuna valutazione finora

- Stock AnalysisDocumento6 pagineStock AnalysisJulia KujurNessuna valutazione finora

- Confidence Petroleum India 020119Documento17 pagineConfidence Petroleum India 020119saran21Nessuna valutazione finora

- Cipla 07092021Documento6 pagineCipla 07092021gbNessuna valutazione finora

- PI Industries Ltd. - Initiating CoverageDocumento19 paginePI Industries Ltd. - Initiating Coverageequityanalystinvestor100% (1)

- IEA Report 10th May 2017Documento28 pagineIEA Report 10th May 2017narnoliaNessuna valutazione finora

- Aarti Industries LTDDocumento5 pagineAarti Industries LTDViju K GNessuna valutazione finora

- ConCall Research Note PI 050311Documento6 pagineConCall Research Note PI 050311equityanalystinvestorNessuna valutazione finora

- Camlin Fine Sciences: PCG ResearchDocumento12 pagineCamlin Fine Sciences: PCG ResearchumaganNessuna valutazione finora

- HDFC Weekly May20Documento18 pagineHDFC Weekly May20HarishKumarNessuna valutazione finora

- Sun Pharma: Promising Specialty PipelineDocumento8 pagineSun Pharma: Promising Specialty PipelineDinesh ChoudharyNessuna valutazione finora

- Panasonic Carbon India Co. Ltd. (07-04-2017) .Documento1 paginaPanasonic Carbon India Co. Ltd. (07-04-2017) .Ashutosh GuptaNessuna valutazione finora

- Blend Q4 Fy20Documento6 pagineBlend Q4 Fy20Ni007ckNessuna valutazione finora

- India Specialty Chemicals Sector - 16 October 2020Documento154 pagineIndia Specialty Chemicals Sector - 16 October 2020Pramod GuptaNessuna valutazione finora

- Alembic Pharma LTD: Stock Price & Q4 Results of Alembic Pharma - HDFC SecuritiesDocumento10 pagineAlembic Pharma LTD: Stock Price & Q4 Results of Alembic Pharma - HDFC SecuritiesHDFC SecuritiesNessuna valutazione finora

- Radico Khaitan - ICDocumento21 pagineRadico Khaitan - ICMaulik ChhedaNessuna valutazione finora

- ICICI - Piramal PharmaDocumento4 pagineICICI - Piramal PharmasehgalgauravNessuna valutazione finora

- Balaji Amines Mar 2019Documento74 pagineBalaji Amines Mar 2019hiteshaNessuna valutazione finora

- SharekhanTopPicks 070511Documento7 pagineSharekhanTopPicks 070511Avinash KowkuntlaNessuna valutazione finora

- WPIL Company Report Highlights Growth OutlookDocumento2 pagineWPIL Company Report Highlights Growth OutlookRajeev GargNessuna valutazione finora

- Aarti Ind: SalesDocumento10 pagineAarti Ind: Salespeaceful investNessuna valutazione finora

- D&L Industries Reports 12% Rise in Q1 Net Income on Strong Specialties GrowthDocumento3 pagineD&L Industries Reports 12% Rise in Q1 Net Income on Strong Specialties GrowthPaul Michael AngeloNessuna valutazione finora

- Medium Term Call - Glenmark PharmaDocumento5 pagineMedium Term Call - Glenmark PharmavyasmusicNessuna valutazione finora

- Sun Pharma 4QFY19 Results UpdateDocumento10 pagineSun Pharma 4QFY19 Results UpdateHarshul BansalNessuna valutazione finora

- Investor Presentation For December 31, 2016 (Company Update)Documento9 pagineInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Indag Rubber Note Jan20 2016Documento5 pagineIndag Rubber Note Jan20 2016doodledeeNessuna valutazione finora

- IEA Report 27th April 2017Documento30 pagineIEA Report 27th April 2017narnoliaNessuna valutazione finora

- AngelBrokingResearch SHKelkar&Company IPONote 271015Documento11 pagineAngelBrokingResearch SHKelkar&Company IPONote 271015durgasainathNessuna valutazione finora

- DR Reddy's Lab - 27-11-2019 - IC - ULJK PDFDocumento21 pagineDR Reddy's Lab - 27-11-2019 - IC - ULJK PDFP VinayakamNessuna valutazione finora

- Gland Pharma LTD - Initiating CoverageDocumento14 pagineGland Pharma LTD - Initiating CoverageBorn StarNessuna valutazione finora

- FI Alpha-CoromandelInternationalLimitedDocumento7 pagineFI Alpha-CoromandelInternationalLimitedAkshaya SrihariNessuna valutazione finora

- 14fast Native Structure Reading in C# Using Dynamic Assemblies - CodeProjectDocumento6 pagine14fast Native Structure Reading in C# Using Dynamic Assemblies - CodeProjectarun_algoNessuna valutazione finora

- Indian Rupee Currency Market Technical Analysis and Hedging StrategiesDocumento6 pagineIndian Rupee Currency Market Technical Analysis and Hedging Strategiesarun_algoNessuna valutazione finora

- En Bloc,: No.l 34IRGIDHC/2021Documento2 pagineEn Bloc,: No.l 34IRGIDHC/2021arun_algoNessuna valutazione finora

- 0.1 New in ZUP From Version 151 Onwards. Im... Onix-TradeDocumento18 pagine0.1 New in ZUP From Version 151 Onwards. Im... Onix-Tradearun_algoNessuna valutazione finora

- HSL PCG "Currency Daily": 05 January, 2017Documento6 pagineHSL PCG "Currency Daily": 05 January, 2017arun_algoNessuna valutazione finora

- Hands-On Lab: Linq Project: Unified Language Features For Object and Relational QueriesDocumento24 pagineHands-On Lab: Linq Project: Unified Language Features For Object and Relational Queriesarun_algoNessuna valutazione finora

- 08add - Edit - Search With Highlighting Pattern Dialog - ReSharperDocumento9 pagine08add - Edit - Search With Highlighting Pattern Dialog - ReSharperarun_algoNessuna valutazione finora

- ChangePro software reviewDocumento6 pagineChangePro software reviewarun_algoNessuna valutazione finora

- 14fast Native Structure Reading in C# Using Dynamic Assemblies - CodeProjectDocumento6 pagine14fast Native Structure Reading in C# Using Dynamic Assemblies - CodeProjectarun_algoNessuna valutazione finora

- Reset A MySQL Root Password PDFDocumento3 pagineReset A MySQL Root Password PDFarun_algoNessuna valutazione finora

- 08add - Edit - Search With Highlighting Pattern Dialog - ReSharperDocumento9 pagine08add - Edit - Search With Highlighting Pattern Dialog - ReSharperarun_algoNessuna valutazione finora

- HSL PCG "Currency Daily": 06 January, 2017Documento6 pagineHSL PCG "Currency Daily": 06 January, 2017arun_algoNessuna valutazione finora

- 08add - Edit - Search With Highlighting Pattern Dialog - ReSharperDocumento9 pagine08add - Edit - Search With Highlighting Pattern Dialog - ReSharperarun_algoNessuna valutazione finora

- ChangePro software reviewDocumento6 pagineChangePro software reviewarun_algoNessuna valutazione finora

- OIDocumento13 pagineOIarun_algoNessuna valutazione finora

- HSL PCG “CURRENCY DAILYDocumento6 pagineHSL PCG “CURRENCY DAILYarun_algoNessuna valutazione finora

- Indian Rupee Currency Market Moves and Hedging StrategiesDocumento6 pagineIndian Rupee Currency Market Moves and Hedging Strategiesarun_algoNessuna valutazione finora

- HSL PCG "Currency Daily": 11 January, 2017Documento6 pagineHSL PCG "Currency Daily": 11 January, 2017arun_algoNessuna valutazione finora

- HSL PCG "Currency Daily": 19 January, 2017Documento6 pagineHSL PCG "Currency Daily": 19 January, 2017arun_algoNessuna valutazione finora

- ReportDocumento6 pagineReportarun_algoNessuna valutazione finora

- HSL Techno Edge: Retail ResearchDocumento3 pagineHSL Techno Edge: Retail Researcharun_algoNessuna valutazione finora

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017Documento16 pagineHSL PCG "Currency Insight"-Weekly: 07 January, 2017arun_algoNessuna valutazione finora

- HSL Techno Edge: Retail ResearchDocumento3 pagineHSL Techno Edge: Retail Researcharun_algoNessuna valutazione finora

- HSL PCG "Currency Daily": 18 January, 2017Documento6 pagineHSL PCG "Currency Daily": 18 January, 2017arun_algoNessuna valutazione finora

- HSL PCG "Currency Daily": 17 January, 2017Documento6 pagineHSL PCG "Currency Daily": 17 January, 2017arun_algoNessuna valutazione finora

- HSL PCG "Currency Daily": 18 January, 2017Documento6 pagineHSL PCG "Currency Daily": 18 January, 2017arun_algoNessuna valutazione finora

- ReportDocumento6 pagineReportarun_algoNessuna valutazione finora

- HSL PCG "Currency Daily": 25 January, 2017Documento6 pagineHSL PCG "Currency Daily": 25 January, 2017arun_algoNessuna valutazione finora

- HSL PCG "Currency Daily": 31 January, 2017Documento6 pagineHSL PCG "Currency Daily": 31 January, 2017arun_algoNessuna valutazione finora

- HSL PCG Currency Daily OutlookDocumento6 pagineHSL PCG Currency Daily Outlookarun_algoNessuna valutazione finora

- Corporation Tax Act 2016 (75.02)Documento65 pagineCorporation Tax Act 2016 (75.02)MrNessuna valutazione finora

- 2013 Market in ReviewDocumento14 pagine2013 Market in Reviewg_nasonNessuna valutazione finora

- Bajaj Auto Limited - Final ReportDocumento10 pagineBajaj Auto Limited - Final ReportKaushik KgNessuna valutazione finora

- QUIZ in AUDIT OF SHAREHOLDERS EQUITYDocumento2 pagineQUIZ in AUDIT OF SHAREHOLDERS EQUITYLugh Tuatha DeNessuna valutazione finora

- Icis Top 100Documento6 pagineIcis Top 100GhanshyamNessuna valutazione finora

- BUSINESS COMBINATION GuerreroDocumento13 pagineBUSINESS COMBINATION GuerreroJohn Lexter Macalber100% (2)

- Advanced Financial Accounting - Slides Lecture 21Documento16 pagineAdvanced Financial Accounting - Slides Lecture 21DiljanKhanNessuna valutazione finora

- NDC Vs Madrigal Wan Hai DigestDocumento2 pagineNDC Vs Madrigal Wan Hai DigestAlexis Anne P. ArejolaNessuna valutazione finora

- Cost SheetDocumento4 pagineCost SheetAuthentic StagNessuna valutazione finora

- Question 1Documento12 pagineQuestion 1lalaNessuna valutazione finora

- FC 10.0 Starter Kit For IFRS Configuration DesignDocumento67 pagineFC 10.0 Starter Kit For IFRS Configuration DesignKsuNessuna valutazione finora

- Cadbury and Nestle: Economic Analysis ofDocumento35 pagineCadbury and Nestle: Economic Analysis ofshrey narulaNessuna valutazione finora

- UAE Corporate Tax by CA AG and CA UPDocumento170 pagineUAE Corporate Tax by CA AG and CA UPAmrit ShivlaniNessuna valutazione finora

- Principles of Managerial Finance: Fifteenth Edition, Global EditionDocumento85 paginePrinciples of Managerial Finance: Fifteenth Edition, Global EditionAlbertus GaniNessuna valutazione finora

- A Future For Mobile Operators The Keys To Successful ReinventionDocumento8 pagineA Future For Mobile Operators The Keys To Successful ReinventionJunaid NaeemNessuna valutazione finora

- Bir Vat (Case)Documento16 pagineBir Vat (Case)Jay Ryan Sy BaylonNessuna valutazione finora

- Sample Chart of AccountsDocumento3 pagineSample Chart of Accountsanah ÜNessuna valutazione finora

- Commercial Law HighlightsDocumento30 pagineCommercial Law Highlightsเจียนคาร์โล การ์เซียNessuna valutazione finora

- Oracle r12 Sla OverviewDocumento19 pagineOracle r12 Sla OverviewfreewillsoulNessuna valutazione finora

- SAP Standard Reports - ERP Operations - SCN WikiDocumento10 pagineSAP Standard Reports - ERP Operations - SCN WikiSidharth KumarNessuna valutazione finora

- Agamata Relevant Costing Chap 9 Short Term Decision PDFDocumento2 pagineAgamata Relevant Costing Chap 9 Short Term Decision PDFJaira MoradaNessuna valutazione finora

- PT Gihon Telekomunikasi Indonesia TBK Dan Entitas Anak / and SubsidiaryDocumento62 paginePT Gihon Telekomunikasi Indonesia TBK Dan Entitas Anak / and SubsidiaryDhen NurdiansyahNessuna valutazione finora

- Assignment 02 Correction of Errors Answer KeyDocumento1 paginaAssignment 02 Correction of Errors Answer KeyDan Andrei BongoNessuna valutazione finora

- Buyers Attitude Towards J.K.tyres ProjectDocumento51 pagineBuyers Attitude Towards J.K.tyres ProjectSourav Coomar Doss100% (1)

- An Examination of The MWSS Concession Agreements As A Means of Investing Through Principal-Agent Contracted-Out Operations in The Water Utility SectorDocumento228 pagineAn Examination of The MWSS Concession Agreements As A Means of Investing Through Principal-Agent Contracted-Out Operations in The Water Utility SectoryajtripackNessuna valutazione finora

- Financial Reporting by New Zealand Charities - Finding A Way ForwardDocumento30 pagineFinancial Reporting by New Zealand Charities - Finding A Way ForwardRay BrooksNessuna valutazione finora

- Canara Bank Employees Pension Regulations, 1995Documento84 pagineCanara Bank Employees Pension Regulations, 1995Latest Laws TeamNessuna valutazione finora

- CA Power of Attorney FORM & Info 87-68.200Documento29 pagineCA Power of Attorney FORM & Info 87-68.200JugyNessuna valutazione finora