Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Partnership Liquidation Installment

Caricato da

Akira Marantal Valdez0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

888 visualizzazioni1 paginaadvac

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoadvac

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

888 visualizzazioni1 paginaPartnership Liquidation Installment

Caricato da

Akira Marantal Valdezadvac

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

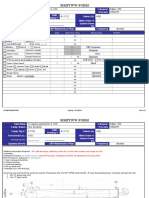

PARTNERSHIP LIQUIDATION INSTALLMENT

Problem A = AA and BB formed a partnership on July 1, 2015 to operate two stores

to be managed by each of them. The invested P30,000 and P20,000 and agreed to

share earning 60% and 40%, respectively. All their transactions were for cash and all

their subsequent transactions were handled through their respective personal bank

accounts as summarized below:

AA BB

Cash receipts P79,100 P65,245 5. Assuming the remaining noncash assets were sold at 60% of the carrying

Cash disbursement 62,275 70,695 value, the actual liquidating expenses on the second sale was P34,000 and

unrecorded liabilities was P75,000, how much is the total cash paid to all

On October 31, 2015, all remaining noncash assets in the two stores were sold for

cash of P60,000. The partnership was liquidated, and cash settlement was effected partners as final settlement??

Required: 6. Using assumption no. 5, how much is the final payment received by James?

1. In the distribution of the P60,000 cash, how much partners AA

received as an additional recovery? Problem B = James, Wade and Bosh of the Miami Heat Partnership has the

following account balances before liquidation.

Problem B = On December 31, 2015, Go Your Own Way partners J, A and C have Cash P 420,000 Liabilities P1,445,000

capital balances of P252,000, P368,000 and P305,000, respectively. The partnership Noncash assets 4,793,000 Loan from Bosh 100,000

has P275,000 liabilities and cash of P200,000. On May 1, 2016, the partnership

Loan to Wade 192,000 James Capital, 25% 1,120,000

decided to liquidate. Its net income from January to May 1, amounted to P348,000.

Receivable from James 44,000 Wade Capital, 15% 1,632,000

Its profit/loss distribution agreement calls for annual salaries of P134,400, P158,400,

Expenses, including Bosh Capital, 60% 2,240,000

and P115,200 for J, A, and C, respectively. Any remainder will be distributed as

follows: 25% to J, 25% to A, and 50% to C. salaries of partners 2,556,000

P240,000 each Revenues 1,468,000

Part of partners agreement, salaries given to partners are treated as expenses and

salaries are accrue quarterly. The salaries for the first quarter of 2016 were credited Before liquidation, it was discovered that the salaries given to the partners were

to salaries payable. The partnerships cash as of this date amounted to P250,000, credited to Salaries Payable and are still part of the total liabilities. No drawings were

the non-cash assets includes loans receivable from A amounted to P20,000 and its made as the period. During June, some noncash assets were sold that resulted to a

total liabilities amounted to P477,000, including salaries payable to partners.

gain of P72,000. Liquidation expenses of P124,000 were paid and additional

During June, noncash assets were sold for a certain amount. The partnership paid expenses amounting to P96,000 were expected to be incurred through the following

P75,000 of its liabilities to outside creditors. Liquidating expenses amounting to months of liquidating the partnership. Liabilities of outsiders amounting to P516,000

P35,800 were paid and cash will be withheld for the payment of its remaining were paid.

liabilities to outsiders. Required:

REQUIRED: 7. For Wade to receive P1,272,000 on the first distribution of cash which of the

2. How much were the noncash assets sold for in order for A to receive following statement is TRUE?

the amount priority to her before all partners will receive payments and an

a. The total maximum possible loss for the month of June amounted to

additional P150,000?

3. In satisfying the previous question, which of the following statement P1,789,000.

below is true? b. The total amount of cash paid to partners in June was amounted to

a. The non-cash assets were sold at P1,365,000. P3,736,000.

b. Partner A received cash of P275,100 as recovery of his interest in the c. The proceeds from the sale of non-cash assets sold in June was amounted

partnership. to P3,801,000.

c. Total cash paid to creditor and partners including cash withheld to settle in

d. The amount of cash withheld considered in the computation of maximum

full all liabilities owned to outside creditors was P1,329,200.

d. The total loss on sales of noncash assets was P615,000. possible loss is amounted to P96,000.

4. How much is the loss on realization on sale of noncash assets? 8. What is the total payment made to partners on the month of June?

5. Between J and C, who gets higher recovery of their interest in the 9. How much is the cash realized from the first sale of assets?

partnership? 10. How much is the carrying value of noncash sold on the first sale?

6. How much is the total cash paid to all partners? 11. What is the cash balance after all payments made on the month of June?

7. How much is the total cash received by Partner J?

8. How much is the total cash received by Partner A?

Problem C = A balance sheet for the partnership James, Wade and Bosh who share

9. How much is the total cash received by Partner C?

profits in the ratio of 2:1:1, shows the following balances just before liquidation:

Quiz 2 Cash P 120,000 Liabilities P 200,000

Problem C = James, Wade and Bosh are partners who share profits and losses as Other Assets 595,000 James, Capital 220,000

follows: James 45%, Wade 15% and Bosh 40%. The Statement of Financial Position Wade, Capital 155,000

of Miami Heat Partnership as of December 31, 2015 is given below: Bosh, Capital 140,000

Assets Liabilities and Capital On the first month of the liquidation, assets with book value of P380,000 are sold for

Cash P268,000 Liabilities P 532,000 P345,000. Liquidation expenses of P10,000 are paid, and additional liquidation

Noncash assets P1,940,00 Loan Payable to James 44,000 expenses are anticipated. Liabilities are paid amounting P74,000 and sufficient cash

0 is retained to insure the payment to creditors before making payment to partners. On

James, Capital 694,000 the first payment to partners, Wade receives P82,500.

Wade, Capital 354,000 Required:

Bosh, Capital 584,000

12. The total cash distributed to the partners in the first installment.

Total P2,208,00 Total P2,208,000

13. The amount of cash withheld for the anticipation of liquidation expenses

0

and unpaid liabilities is:

On January 1, 2015 the partners decided to liquidate. For the month of January, 14. How much is the cash received by Bosh and Wade during first installment?

some assets were sold at a gain of P56,000. Payment to partner Wade from the initial 15. Continuation: If the remaining book value of other assets was sold for P175,000

sale of assets was P180,000. Cash withheld for possible liquidation and and payment for unpaid liabilities and liquidation expense were made. How much

unrecognized liabilities amounted to P146,800. liquidation expenses was paid, if James received P80,000 in the final

Required: settlement?

1. Which of the following statement is true?

a. The book / carrying value of the noncash assets sold in January amounted Isaiah 55:8-9

to P982,800. "For My thoughts are not your thoughts, Nor are your ways My ways," says the

b. Payment to partner James from the initial sale of assets was P172,000. LORD. "For as the heavens are higher than the earth, So are My ways higher

c. The total amount of cash paid and distributed for the month of January is than your ways, And My thoughts than your thoughts.(NKJV)

P1,048,000.

d. The share of Bosh in the maximum possible loss is P427,680. - For God is the source of wisdom, Pray to Him. Dont quit, for He is

2. How much is the total cash paid to James on first installment? with You. Believe and you will receive.

3. How much is the total maximum possible loss in the month of January? God bless You.

4. How much is the realized from the first sale of non-cash assets?

Potrebbero piacerti anche

- AFAR 01 Partnership AccountingDocumento6 pagineAFAR 01 Partnership AccountingAriel DimalantaNessuna valutazione finora

- LiquiDocumento3 pagineLiquiPremium Netflix0% (1)

- Partnership ReviewDocumento5 paginePartnership ReviewAirille CarlosNessuna valutazione finora

- 02Documento3 pagine02Jodel Castro100% (1)

- Assets: Name: Date: Professor: Section: ScoreDocumento2 pagineAssets: Name: Date: Professor: Section: ScoreAndrea Florence Guy VidalNessuna valutazione finora

- PARTNERSHIPDocumento6 paginePARTNERSHIPWynie AreolaNessuna valutazione finora

- Partnership Liquidation QuizDocumento5 paginePartnership Liquidation QuizAlexis TRADIO100% (1)

- Intermediate Accounting - Activity 1Documento35 pagineIntermediate Accounting - Activity 1Verlyn ElfaNessuna valutazione finora

- College of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMDocumento4 pagineCollege of Accountancy and Finance: 1st Semester, S.Y. 2018-2019 Page 1 of 4 Prof. GMPpp BbbNessuna valutazione finora

- AdvaccDocumento3 pagineAdvaccMontessa GuelasNessuna valutazione finora

- Quiz - PartnershipDocumento2 pagineQuiz - PartnershipLeisleiRagoNessuna valutazione finora

- Practical Accounting 2 Review Prelim Exam SolutionsDocumento5 paginePractical Accounting 2 Review Prelim Exam SolutionsRen EyNessuna valutazione finora

- AFAR-01 PartnershipDocumento6 pagineAFAR-01 PartnershipRamainne Ronquillo0% (1)

- Aud. Prob.Documento16 pagineAud. Prob.Ria Alanis CastilloNessuna valutazione finora

- Partnership Liquidation QuizDocumento4 paginePartnership Liquidation QuizMark Francis Solante100% (1)

- AFAR 1 Exams 2020Documento7 pagineAFAR 1 Exams 2020RJ Kristine DaqueNessuna valutazione finora

- Acctg 112Documento3 pagineAcctg 112Rathew Cassey PencilNessuna valutazione finora

- FINACC-Homework Exercise 2Documento3 pagineFINACC-Homework Exercise 2Jomel BaptistaNessuna valutazione finora

- Suggested AnswersDocumento18 pagineSuggested AnswersEl YangNessuna valutazione finora

- Polytechnic University of the Philippines Junior Philippine Institute of Accountants MOCK FINAL EXAMINATION Fundamentals of Accounting, Part 2Documento10 paginePolytechnic University of the Philippines Junior Philippine Institute of Accountants MOCK FINAL EXAMINATION Fundamentals of Accounting, Part 2Plu AldiniNessuna valutazione finora

- Lump-sum and installment liquidation statementsDocumento1 paginaLump-sum and installment liquidation statementsJo Vee VillanuevaNessuna valutazione finora

- Balbin, Ma. Margarette P. Assignment #1Documento7 pagineBalbin, Ma. Margarette P. Assignment #1Margaveth P. BalbinNessuna valutazione finora

- Auditing Problems SolvedDocumento9 pagineAuditing Problems SolvedGlizette SamaniegoNessuna valutazione finora

- MODULE 9 - Partnership Liquidation (Installment)Documento9 pagineMODULE 9 - Partnership Liquidation (Installment)Gab Ignacio100% (1)

- Problem 44Documento2 pagineProblem 44Arian AmuraoNessuna valutazione finora

- MAS 09 - Quantitative TechniquesDocumento6 pagineMAS 09 - Quantitative TechniquesClint Abenoja0% (1)

- Problem 1-8Documento11 pagineProblem 1-8JPIA-UE Caloocan '19-20 AcademicsNessuna valutazione finora

- Use The Fact Pattern Below For The Next Three Independent CasesDocumento5 pagineUse The Fact Pattern Below For The Next Three Independent CasesMichael Bongalonta0% (1)

- St. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingDocumento3 pagineSt. Vincent College of Cabuyao: Brgy. Mamatid, City of Cabuyao, Laguna Advance Financial Accounting and ReportingGennelyn Grace Peñaredondo100% (1)

- Auditing ProblemsDocumento9 pagineAuditing ProblemsJillNessuna valutazione finora

- Accounting For Partnership DissolutionDocumento19 pagineAccounting For Partnership DissolutionMelanie kaye ApostolNessuna valutazione finora

- Partnership Dissolution: QuizDocumento5 paginePartnership Dissolution: QuizLee SuarezNessuna valutazione finora

- Pure ProblemsDocumento7 paginePure Problemschristine anglaNessuna valutazione finora

- Business Combi TsetDocumento28 pagineBusiness Combi Tsetsamuel debebeNessuna valutazione finora

- MOCK RETENTION EXAM 2017 CORPORATION THEORIES AND PROBLEMSDocumento12 pagineMOCK RETENTION EXAM 2017 CORPORATION THEORIES AND PROBLEMSBrian Christian VillaluzNessuna valutazione finora

- Partnership Operations Assignment 2Documento1 paginaPartnership Operations Assignment 2Rona S. Pepino - AguirreNessuna valutazione finora

- Intermediate Accounting - Petty Cash Journal EntriesDocumento2 pagineIntermediate Accounting - Petty Cash Journal EntriesSean Lester S. NombradoNessuna valutazione finora

- Partnership Formation Problems SolvedDocumento13 paginePartnership Formation Problems Solvedmaria evangelistaNessuna valutazione finora

- Additional ProblemsDocumento3 pagineAdditional Problems가 푸 레멜 린 메Nessuna valutazione finora

- Bac Elims: Effortless RoundDocumento3 pagineBac Elims: Effortless RoundTracy Miranda BognotNessuna valutazione finora

- Partnership Liquidation Quiz AnswersDocumento4 paginePartnership Liquidation Quiz AnswersMikaella BengcoNessuna valutazione finora

- Prequalifying ExaminationDocumento6 paginePrequalifying ExaminationVincent Villalino LabrintoNessuna valutazione finora

- CORPORATE LIQUIDATION Explanation - PPSXDocumento21 pagineCORPORATE LIQUIDATION Explanation - PPSXLarpii MonameNessuna valutazione finora

- Installment SalesDocumento3 pagineInstallment SalesLyanna MormontNessuna valutazione finora

- Partnership Formation AccountingDocumento7 paginePartnership Formation AccountingSienna PrcsNessuna valutazione finora

- AFAR - Partnership OperationDocumento21 pagineAFAR - Partnership OperationReginald ValenciaNessuna valutazione finora

- Activity 1.1 PDFDocumento2 pagineActivity 1.1 PDFDe Nev OelNessuna valutazione finora

- Financial Assets Guide - Cash, Receivables, Investments & DerivativesDocumento5 pagineFinancial Assets Guide - Cash, Receivables, Investments & DerivativesYami HeatherNessuna valutazione finora

- Partnership Liquidation DistributionDocumento2 paginePartnership Liquidation DistributionIvy BautistaNessuna valutazione finora

- Rmbe Afar For PrintingDocumento18 pagineRmbe Afar For PrintingjxnNessuna valutazione finora

- Name: Date: Subject: Section and Time:: Problem 1Documento16 pagineName: Date: Subject: Section and Time:: Problem 1Marie GarpiaNessuna valutazione finora

- Quiz - M1 M2Documento12 pagineQuiz - M1 M2Jenz Crisha PazNessuna valutazione finora

- Construction Contract Percentage Completion QuizDocumento4 pagineConstruction Contract Percentage Completion QuizJason GubatanNessuna valutazione finora

- Problem A James, Wade, Allen and Bosh Are Partners Sharing Profits and Losses Equally. The Partnership IsDocumento4 pagineProblem A James, Wade, Allen and Bosh Are Partners Sharing Profits and Losses Equally. The Partnership Ispatrise siosonNessuna valutazione finora

- Torrent Downloaded FromDocumento4 pagineTorrent Downloaded FromJULIUS L. LEVENNessuna valutazione finora

- ADVANCED ACCOUNTING PART 1 QUIZZESDocumento5 pagineADVANCED ACCOUNTING PART 1 QUIZZESAnne Camille AlfonsoNessuna valutazione finora

- Partnership Formation and Operation.Documento4 paginePartnership Formation and Operation.May RamosNessuna valutazione finora

- Partnership Liquidation AccountingDocumento4 paginePartnership Liquidation AccountingCHRISTINE TABULOGNessuna valutazione finora

- Quiz 2 SolutionsDocumento5 pagineQuiz 2 SolutionsAngel Alejo AcobaNessuna valutazione finora

- AfarDocumento6 pagineAfarRolando PasamonteNessuna valutazione finora

- Module 2 Ver 3.1Documento81 pagineModule 2 Ver 3.1Akira Marantal Valdez100% (1)

- Partnership essentials under 40 charsDocumento26 paginePartnership essentials under 40 charskat perezNessuna valutazione finora

- Stratma External AGTANGDocumento8 pagineStratma External AGTANGAkira Marantal ValdezNessuna valutazione finora

- Stratma External AGTANG 123Documento1 paginaStratma External AGTANG 123Akira Marantal ValdezNessuna valutazione finora

- SummaryDocumento30 pagineSummaryAkira Marantal Valdez0% (1)

- Chapter 18 Int. AccountingDocumento50 pagineChapter 18 Int. AccountingVaniamarie VasquezNessuna valutazione finora

- Quiz 3 - Normal and AbnormalDocumento1 paginaQuiz 3 - Normal and AbnormalAkira Marantal ValdezNessuna valutazione finora

- Upcoming CAT Review and Exam SchedulesDocumento1 paginaUpcoming CAT Review and Exam SchedulesAkira Marantal ValdezNessuna valutazione finora

- Niat 2017 PDFDocumento1 paginaNiat 2017 PDFEnnavy YongkolNessuna valutazione finora

- Process Costing - Loss UnitsDocumento10 pagineProcess Costing - Loss UnitsAkira Marantal ValdezNessuna valutazione finora

- Analysis Reviewer BusfinDocumento2 pagineAnalysis Reviewer BusfinAkira Marantal ValdezNessuna valutazione finora

- Thesis AppendicesDocumento3 pagineThesis AppendicesAkira Marantal ValdezNessuna valutazione finora

- Installment Sales ReviewerDocumento3 pagineInstallment Sales ReviewerErika78% (9)

- Analysis On AdcomaDocumento6 pagineAnalysis On AdcomaAkira Marantal ValdezNessuna valutazione finora

- Process Costing - Max CorporationDocumento9 pagineProcess Costing - Max CorporationAkira Marantal ValdezNessuna valutazione finora

- Advac AssignmentDocumento5 pagineAdvac AssignmentAkira Marantal ValdezNessuna valutazione finora

- Take Home Quiz 1Documento9 pagineTake Home Quiz 1Akira Marantal Valdez100% (1)

- Advanced Accounting - PART 1Documento6 pagineAdvanced Accounting - PART 1Akira Marantal ValdezNessuna valutazione finora

- Multiple Choice Problems 2Documento14 pagineMultiple Choice Problems 2Akira Marantal ValdezNessuna valutazione finora

- Advanced AccountingDocumento14 pagineAdvanced AccountingAries Bautista100% (2)

- Cost Accounting ReportDocumento22 pagineCost Accounting ReportAkira Marantal ValdezNessuna valutazione finora

- Advanced Accounting - Estimating Recovery for CreditorsDocumento6 pagineAdvanced Accounting - Estimating Recovery for CreditorsAkira Marantal ValdezNessuna valutazione finora

- Class activity chapter 6 memory and learningDocumento3 pagineClass activity chapter 6 memory and learningAkira Marantal ValdezNessuna valutazione finora

- Process Costing - Loss UnitsDocumento10 pagineProcess Costing - Loss UnitsAkira Marantal ValdezNessuna valutazione finora

- Qty Schedule - 1-10-17Documento14 pagineQty Schedule - 1-10-17Akira Marantal ValdezNessuna valutazione finora

- Cfs 2millions 2017Documento9 pagineCfs 2millions 2017Akira Marantal ValdezNessuna valutazione finora

- Class activity chapter 6 memory and learningDocumento3 pagineClass activity chapter 6 memory and learningAkira Marantal ValdezNessuna valutazione finora

- 2013 Year End Assessment Market ActivitiesDocumento9 pagine2013 Year End Assessment Market ActivitiesAkira Marantal ValdezNessuna valutazione finora

- Actual Materials Qty Schedule Units WDDocumento8 pagineActual Materials Qty Schedule Units WDAkira Marantal ValdezNessuna valutazione finora

- Iron FoundationsDocumento70 pagineIron FoundationsSamuel Laura HuancaNessuna valutazione finora

- It ThesisDocumento59 pagineIt Thesisroneldayo62100% (2)

- A1. Coordinates System A2. Command Categories: (Exit)Documento62 pagineA1. Coordinates System A2. Command Categories: (Exit)Adriano P.PrattiNessuna valutazione finora

- Reduce Home Energy Use and Recycling TipsDocumento4 pagineReduce Home Energy Use and Recycling Tipsmin95Nessuna valutazione finora

- Simple Future Vs Future Continuous Vs Future PerfectDocumento6 pagineSimple Future Vs Future Continuous Vs Future PerfectJocelynNessuna valutazione finora

- San Mateo Daily Journal 05-06-19 EditionDocumento28 pagineSan Mateo Daily Journal 05-06-19 EditionSan Mateo Daily JournalNessuna valutazione finora

- Intracardiac Echo DR SrikanthDocumento107 pagineIntracardiac Echo DR SrikanthNakka SrikanthNessuna valutazione finora

- CSEC Geography June 2014 P1Documento14 pagineCSEC Geography June 2014 P1Josh Hassanali100% (1)

- Does social media improve or impede communicationDocumento3 pagineDoes social media improve or impede communicationUmar SaleemNessuna valutazione finora

- The Free Little Book of Tea and CoffeeDocumento83 pagineThe Free Little Book of Tea and CoffeeNgopi YukNessuna valutazione finora

- Simptww S-1105Documento3 pagineSimptww S-1105Vijay RajaindranNessuna valutazione finora

- Dealer DirectoryDocumento83 pagineDealer DirectorySportivoNessuna valutazione finora

- GravimetryDocumento27 pagineGravimetrykawadechetan356Nessuna valutazione finora

- THE LEGEND OF SITU BAGENDIT by AIN 9CDocumento2 pagineTHE LEGEND OF SITU BAGENDIT by AIN 9CwahyubudionoNessuna valutazione finora

- Adorno - Questions On Intellectual EmigrationDocumento6 pagineAdorno - Questions On Intellectual EmigrationjimmyroseNessuna valutazione finora

- Legend of The Galactic Heroes, Vol. 10 Sunset by Yoshiki Tanaka (Tanaka, Yoshiki)Documento245 pagineLegend of The Galactic Heroes, Vol. 10 Sunset by Yoshiki Tanaka (Tanaka, Yoshiki)StafarneNessuna valutazione finora

- Project Management-New Product DevelopmentDocumento13 pagineProject Management-New Product DevelopmentRahul SinghNessuna valutazione finora

- Mr. Bill: Phone: 086 - 050 - 0379Documento23 pagineMr. Bill: Phone: 086 - 050 - 0379teachererika_sjcNessuna valutazione finora

- Freeing Music Education From Schooling: Toward A Lifespan Perspective On Music Learning and TeachingDocumento24 pagineFreeing Music Education From Schooling: Toward A Lifespan Perspective On Music Learning and TeachingRockyNessuna valutazione finora

- The Best Chess BooksDocumento3 pagineThe Best Chess BooksJames Warren100% (1)

- MAY-2006 International Business Paper - Mumbai UniversityDocumento2 pagineMAY-2006 International Business Paper - Mumbai UniversityMAHENDRA SHIVAJI DHENAKNessuna valutazione finora

- Second Year Memo DownloadDocumento2 pagineSecond Year Memo DownloadMudiraj gari AbbaiNessuna valutazione finora

- Week 4-LS1 Eng. LAS (Types of Verbals)Documento14 pagineWeek 4-LS1 Eng. LAS (Types of Verbals)DONALYN VERGARA100% (1)

- 02 Activity 1 (4) (STRA)Documento2 pagine02 Activity 1 (4) (STRA)Kathy RamosNessuna valutazione finora

- Sigmund Freud QuotesDocumento7 pagineSigmund Freud Quotesarbeta100% (2)

- Written Test Unit 7 & 8 - Set ADocumento4 pagineWritten Test Unit 7 & 8 - Set ALaura FarinaNessuna valutazione finora

- Diabetic Foot InfectionDocumento26 pagineDiabetic Foot InfectionAmanda Abdat100% (1)

- Centre's Letter To States On DigiLockerDocumento21 pagineCentre's Letter To States On DigiLockerNDTVNessuna valutazione finora

- Https WWW - Gov.uk Government Uploads System Uploads Attachment Data File 274029 VAF4ADocumento17 pagineHttps WWW - Gov.uk Government Uploads System Uploads Attachment Data File 274029 VAF4ATiffany Maxwell0% (1)

- Spiritual Warfare - Mystery Babylon The GreatDocumento275 pagineSpiritual Warfare - Mystery Babylon The GreatBornAgainChristian100% (7)