Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2015 CRP, Certificate of Rent Paid: R48.0908.000 Morrison 6

Caricato da

bmptechnicianTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2015 CRP, Certificate of Rent Paid: R48.0908.000 Morrison 6

Caricato da

bmptechnicianCopyright:

Formati disponibili

2015 CRP, Certificate of Rent Paid

Purpose of CRP

Eligible renters (see eligibility requirements below) may receive a refund based on property taxes paid on their principal place of

residence in Minnesota and their income.

The landlord is required to give each renter a completed CRP, Certificate of Rent Paid, no later than January 31, 2016.

Renters will need this CRP to apply for a property tax refund.

You must file Form M1PR and include all CRPs to claim a refund. Your refund will be denied or delayed if you do not include

all CRPs when filing Form M1PR.

Roommates: The landlord is required to give each unmarried renter living in a unit a separate CRP showing that each roommate

paid an equal portion of the rent, regardless of the portion actually paid or whose names are on the lease.

Renters name and address of the unit rented Owners or managing agents name and address (including zip code)

Michael Cramer

53 East Broadway Suite B

Little Falls MN 56345

Property ID number or parcel number County Number of units on this property

R48.0908.000 Morrison 6

Rented from (MM/DD/YYYY): to (MM/DD/YYYY): Total months rented

To be Completed by Landlord

Number of adults living in unit

Place an X in box if count

(count married couple as 1)

includes married couple

Place an X if: Nursing home Intermediate care facility Adult foster care Assisted living

A. Amount paid for the renter by medical assistance (Medicaid) . . . . . . . . . . . . . . . . .

B. Group Residential Housing (GRH) payments received by landlord

on behalf of this renter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 Rent paid to you by this individual renter or married couple for 2015 (round to nearest whole dollar) . . . . . . . . 1

If a government housing agency paid you part of the rent for this unit, place an X in this box,

but do not include the amounts paid by the government agency in line 1.

Place an X in this box if rent was for a mobile home lot.

Place an X in this box if this renter received reduced rent for being caretaker.

Enter the rent reduction for this renter that is included on line 1 here:

2 The percentage for all renters is 17 percent (.17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 17 %

3 Multiply line 1 by line 2. Renters: Include this amount on line 9 of Form M1PR (round to nearest whole dollar) . 3

Landlords

Signature

Landlord: I declare that this certificate is correct and complete to the best of my knowledge and belief.

Owners or agents signature Date Business phone

Eligibility Requirements for Renters

You may qualify for the property tax refund if all of the following conditions apply to you for 2015:

Important Information for Renters

You were a full-year or part-year resident of Minnesota;

You cannot be claimed as a dependent on someone elses 2015 federal income tax return; and

Your total household income is less than $58,490. (Household income is your federal adjusted gross income plus most nontax-

able income. If you are married and living together, both incomes are included in household income. If you are single, use your

income only; do not include the income of any other person living with you. Also, to arrive at your total household income, a

subtraction is allowed if you have dependents, if you contribute to a qualified retirement plan, or if you or your spouse are age 65

or older or disabled.)

If you meet the above eligibility requirements, complete Form M1PR, Homeowners Homestead Credit Refund and Renters Property

Tax Refund, to determine the amount of your refund. You must include this CRP when you file your return. Your refund will be delayed

or denied if you do not include your CRP(s) when you file Form M1PR.

You can find Form M1PR and other tax-related information on our website at www.revenue.state.mn.us.

If you have questions, call the department at 651-296-3781 or 1-800-652-9094 .

If you qualify, complete and file Form M1PR. You must include this CRP when you file your M1PR return. Your refund will be

delayed or denied if you do not include this CRP when you file your M1PR.

Make copies of your Form M1PR and this form and keep them with your records.

Potrebbero piacerti anche

- Real Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsDa EverandReal Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsNessuna valutazione finora

- 2009 Pa-1000rcDocumento1 pagina2009 Pa-1000rcradreporterNessuna valutazione finora

- Real Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsDa EverandReal Estate Terminology: Property Management, Financing, Construction, Agents and Brokers TermsNessuna valutazione finora

- RTB 32Documento3 pagineRTB 32armaanNessuna valutazione finora

- The Multifamily Millionaire, Volume I: Achieve Financial Freedom by Investing in Small Multifamily Real EstateDa EverandThe Multifamily Millionaire, Volume I: Achieve Financial Freedom by Investing in Small Multifamily Real EstateValutazione: 5 su 5 stelle5/5 (7)

- 2018 4028 rtb1Documento6 pagine2018 4028 rtb1Emma ArmitageNessuna valutazione finora

- Rental Property Investing: A Handbook and Guide for Becoming a Landlord!Da EverandRental Property Investing: A Handbook and Guide for Becoming a Landlord!Nessuna valutazione finora

- RTB 1Documento6 pagineRTB 1Alicia TangenNessuna valutazione finora

- 10 Costly Mistakes Tenants Make When Negotiating a Commercial Lease or RenewalDa Everand10 Costly Mistakes Tenants Make When Negotiating a Commercial Lease or RenewalNessuna valutazione finora

- Rent PaidDocumento2 pagineRent PaidArchibald BareassoleNessuna valutazione finora

- TPA Rental ApplicationDocumento2 pagineTPA Rental ApplicationPatrick NolanNessuna valutazione finora

- rtb1 FormDocumento6 paginertb1 FormJonathan HarrisNessuna valutazione finora

- Residential Tenancy Agreement BetweenDocumento6 pagineResidential Tenancy Agreement BetweenkushNessuna valutazione finora

- Tenant Address: I, The Landlord, Am Hereby Giving You Two Months' Notice To Move Out of The Rental Unit Located atDocumento2 pagineTenant Address: I, The Landlord, Am Hereby Giving You Two Months' Notice To Move Out of The Rental Unit Located atSimi CreationsNessuna valutazione finora

- Rtb1 Form DluhcDocumento17 pagineRtb1 Form DluhcLakshannruganNessuna valutazione finora

- Tenancy ActDocumento6 pagineTenancy ActTerrace Redi-MixNessuna valutazione finora

- Rental Agreement (Month To Month)Documento7 pagineRental Agreement (Month To Month)Arthur BorgesNessuna valutazione finora

- Residential Tenancy Agreement BetweenDocumento6 pagineResidential Tenancy Agreement BetweenAnkaNessuna valutazione finora

- Commission Agreement Template 16Documento3 pagineCommission Agreement Template 16Hiền TrầnNessuna valutazione finora

- Financial WorksheetDocumento4 pagineFinancial Worksheetoscar5607Nessuna valutazione finora

- RTB 1Documento6 pagineRTB 1AA SpamsNessuna valutazione finora

- Form Directions:: To The Tenant(s)Documento2 pagineForm Directions:: To The Tenant(s)Joel BharathNessuna valutazione finora

- Caution:: Schedule H or H-EZ Must Be Completed and Filed With This Rent CertificateDocumento3 pagineCaution:: Schedule H or H-EZ Must Be Completed and Filed With This Rent CertificateVedvyasNessuna valutazione finora

- RTB 1 CDocumento6 pagineRTB 1 CPayam LotfiNessuna valutazione finora

- Contrato de RentaDocumento6 pagineContrato de RentaSandra GuadarramaNessuna valutazione finora

- California Lease AgreementDocumento11 pagineCalifornia Lease AgreementJoniTay802Nessuna valutazione finora

- Dvs Exit Sheet Final 2019Documento2 pagineDvs Exit Sheet Final 2019diversified1Nessuna valutazione finora

- Renter's Certificate of Property Taxes Paid: How To Use This FormDocumento1 paginaRenter's Certificate of Property Taxes Paid: How To Use This FormMichael OluwaseunNessuna valutazione finora

- N12 Notice To End Your Tenancy Because The Landlord, A Purchaser or A Family Member Requires The Rental UnitDocumento2 pagineN12 Notice To End Your Tenancy Because The Landlord, A Purchaser or A Family Member Requires The Rental UnitmaryNessuna valutazione finora

- Residential Rental Agreement: No More Than 5 YearsDocumento10 pagineResidential Rental Agreement: No More Than 5 YearsAksirullah HakimiNessuna valutazione finora

- Edit-Chicago-Residential-Lease 2018 v5Documento24 pagineEdit-Chicago-Residential-Lease 2018 v5api-450678717Nessuna valutazione finora

- Rental Applications Suite.Documento3 pagineRental Applications Suite.rakianamNessuna valutazione finora

- Residential LeaseDocumento7 pagineResidential LeaseWill HNessuna valutazione finora

- Room Rental Agreement 2Documento3 pagineRoom Rental Agreement 2CamsNessuna valutazione finora

- HPK Residential Tenancy Agreement NPDocumento8 pagineHPK Residential Tenancy Agreement NPyourxmen2910Nessuna valutazione finora

- Exclusive Right To Market Property AgreementDocumento5 pagineExclusive Right To Market Property Agreementkat perezNessuna valutazione finora

- Sample Tenancy AgreementDocumento8 pagineSample Tenancy AgreementewesleykimNessuna valutazione finora

- Tenancy Application Form: 1. To Be Completed by Letting Agent OnlyDocumento5 pagineTenancy Application Form: 1. To Be Completed by Letting Agent OnlyCarolinaMoisaNessuna valutazione finora

- Form 1 Standard Ten AgreeDocumento4 pagineForm 1 Standard Ten Agreechartreuse_pinkNessuna valutazione finora

- Right To Acquire RTA1 Form 2022Documento7 pagineRight To Acquire RTA1 Form 2022Hajar NachitNessuna valutazione finora

- 04 FormsmergedDocumento9 pagine04 FormsmergedMarissa TrinidadNessuna valutazione finora

- Residential Tenancy Agreement BetweenDocumento6 pagineResidential Tenancy Agreement BetweendamonNessuna valutazione finora

- Blank Residential LeaseDocumento7 pagineBlank Residential Leasesean100% (1)

- Rental Application Form For TenantDocumento2 pagineRental Application Form For TenantDenisTitovNessuna valutazione finora

- Rental Agreement RoomDocumento3 pagineRental Agreement RoomAbebeNessuna valutazione finora

- Minnesota Department of Revenue Form M1PR (2017) - Homestead Credit Refund (Homeowners)Documento2 pagineMinnesota Department of Revenue Form M1PR (2017) - Homestead Credit Refund (Homeowners)HansenNessuna valutazione finora

- RTB 5Documento6 pagineRTB 5shop securityNessuna valutazione finora

- 0905 South Side Exclusive Rental Listing Contract PDFDocumento2 pagine0905 South Side Exclusive Rental Listing Contract PDFUrbanSearchDocsNessuna valutazione finora

- California Month To Month Rental AgreementDocumento12 pagineCalifornia Month To Month Rental AgreementVeronica LopezNessuna valutazione finora

- 2020 Chicago Residential Lease Important Message For Completing LeaseDocumento24 pagine2020 Chicago Residential Lease Important Message For Completing LeaseLJANessuna valutazione finora

- Ast Draft Hlyr6 030221Documento9 pagineAst Draft Hlyr6 030221Bogdan DobosNessuna valutazione finora

- Letter of Offer (Tenant)Documento2 pagineLetter of Offer (Tenant)jolynnNessuna valutazione finora

- PM Agreement FormDocumento10 paginePM Agreement FormIva KisiovaNessuna valutazione finora

- Intent To Rent FormDocumento1 paginaIntent To Rent Formmikiwes89Nessuna valutazione finora

- Covid 19 Hardship RequestDocumento2 pagineCovid 19 Hardship RequestThitta Raphael EspinosaNessuna valutazione finora

- Residential Tenancy AgreementDocumento6 pagineResidential Tenancy Agreementtrajan77777Nessuna valutazione finora

- Tenant Rent Record Template: PurposeDocumento8 pagineTenant Rent Record Template: PurposeWanjiNessuna valutazione finora

- ApplicationDocumento4 pagineApplicationapi-169211119Nessuna valutazione finora

- Residential Tenancy AgreementDocumento4 pagineResidential Tenancy AgreementDaniel WhiteNessuna valutazione finora

- Realty Transfer Tax Statement of Value REV 183Documento2 pagineRealty Transfer Tax Statement of Value REV 183maria-bellaNessuna valutazione finora

- 39 1 Vijay KelkarDocumento14 pagine39 1 Vijay Kelkargrooveit_adiNessuna valutazione finora

- TOEFLDocumento15 pagineTOEFLMega Suci LestariNessuna valutazione finora

- University of Mumbai Project On Investment Banking Bachelor of CommerceDocumento6 pagineUniversity of Mumbai Project On Investment Banking Bachelor of CommerceParag MoreNessuna valutazione finora

- TaylorismDocumento41 pagineTaylorismSoujanyaNessuna valutazione finora

- Nabl 500Documento142 pagineNabl 500Vinay SimhaNessuna valutazione finora

- Clean Wash EN 2Documento2 pagineClean Wash EN 2Sean HongNessuna valutazione finora

- Chapter 6 - An Introduction To The Tourism Geography of EuroDocumento12 pagineChapter 6 - An Introduction To The Tourism Geography of EuroAnonymous 1ClGHbiT0JNessuna valutazione finora

- Vol. 1: Basic Planning: Overseas Customer Service Facility GuideDocumento35 pagineVol. 1: Basic Planning: Overseas Customer Service Facility GuideMishell TatianaNessuna valutazione finora

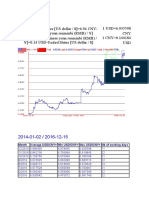

- Month Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysDocumento3 pagineMonth Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysZahid RizvyNessuna valutazione finora

- Family Dollar ReleaseDocumento1 paginaFamily Dollar ReleaseNewzjunkyNessuna valutazione finora

- BCG Tata GroupDocumento3 pagineBCG Tata GroupChetanTejani100% (2)

- Ten Principles of UN Global CompactDocumento2 pagineTen Principles of UN Global CompactrisefoxNessuna valutazione finora

- Rasanga Curriculum VitaeDocumento5 pagineRasanga Curriculum VitaeKevo NdaiNessuna valutazione finora

- 3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeDocumento4 pagine3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeLab Lee0% (1)

- Salary Slip Template V12Documento5 pagineSalary Slip Template V12Matthew NiñoNessuna valutazione finora

- CCM Parameters vs. J1939 ParametersDocumento3 pagineCCM Parameters vs. J1939 Parameterszxy320dNessuna valutazione finora

- IS-LM: An Explanation - John Hicks - Journal of Post Keynesian Economic - 1980Documento16 pagineIS-LM: An Explanation - John Hicks - Journal of Post Keynesian Economic - 1980tprug100% (2)

- The Vertical Garden City: Towards A New Urban Topology: Chris AbelDocumento11 pagineThe Vertical Garden City: Towards A New Urban Topology: Chris AbelDzemal SkreboNessuna valutazione finora

- Internal Audit Checklist Sample PDFDocumento3 pagineInternal Audit Checklist Sample PDFFernando AguilarNessuna valutazione finora

- Traffic and Highway Engineering 5th Edition Garber Solutions ManualDocumento27 pagineTraffic and Highway Engineering 5th Edition Garber Solutions Manualsorrancemaneuverpmvll100% (32)

- Table of ContentsDocumento6 pagineTable of ContentsRakeshKumarNessuna valutazione finora

- SWIFT Trade Finance Messages and Anticipated Changes 2015Documento20 pagineSWIFT Trade Finance Messages and Anticipated Changes 2015Zayd Iskandar Dzolkarnain Al-HadramiNessuna valutazione finora

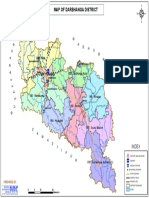

- DARBHANGA MapDocumento1 paginaDARBHANGA MapRISHIKESH ANANDNessuna valutazione finora

- IELTS Writing Task 1 Sample - Bar Chart - ZIMDocumento28 pagineIELTS Writing Task 1 Sample - Bar Chart - ZIMPhương Thư Nguyễn HoàngNessuna valutazione finora

- Chapter 7 ExercisesDocumento2 pagineChapter 7 ExercisesShesheng ComendadorNessuna valutazione finora

- Report On Brick - 1Documento6 pagineReport On Brick - 1Meghashree100% (1)

- The Political Economy of Communication (Second Edition)Documento2 pagineThe Political Economy of Communication (Second Edition)Trop JeengNessuna valutazione finora

- Pradhan Mantri Awas Yojana PDFDocumento17 paginePradhan Mantri Awas Yojana PDFKD Ltd.Nessuna valutazione finora

- A Comparative Evaluation Between National and International Trade and Explain The Concept of Geographical Indication and ItDocumento15 pagineA Comparative Evaluation Between National and International Trade and Explain The Concept of Geographical Indication and ItPhalguni Mutha100% (1)

- TerraCycle Investment GuideDocumento21 pagineTerraCycle Investment GuideMaria KennedyNessuna valutazione finora

- Clean Mama's Guide to a Healthy Home: The Simple, Room-by-Room Plan for a Natural HomeDa EverandClean Mama's Guide to a Healthy Home: The Simple, Room-by-Room Plan for a Natural HomeValutazione: 5 su 5 stelle5/5 (2)

- Summary of Goodbye, Things: The New Japanese Minimalism by Fumio SasakiDa EverandSummary of Goodbye, Things: The New Japanese Minimalism by Fumio SasakiValutazione: 4.5 su 5 stelle4.5/5 (5)

- Simplified Organization: Learn to Love What Must Be DoneDa EverandSimplified Organization: Learn to Love What Must Be DoneNessuna valutazione finora

- The Martha Manual: How to Do (Almost) EverythingDa EverandThe Martha Manual: How to Do (Almost) EverythingValutazione: 4 su 5 stelle4/5 (11)

- The Gentle Art of Swedish Death Cleaning: How to Free Yourself and Your Family from a Lifetime of ClutterDa EverandThe Gentle Art of Swedish Death Cleaning: How to Free Yourself and Your Family from a Lifetime of ClutterValutazione: 4 su 5 stelle4/5 (467)

- The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and OrganizingDa EverandThe Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and OrganizingValutazione: 4 su 5 stelle4/5 (2997)

- Decluttering at the Speed of Life: Winning Your Never-Ending Battle with StuffDa EverandDecluttering at the Speed of Life: Winning Your Never-Ending Battle with StuffValutazione: 4.5 su 5 stelle4.5/5 (578)

- Declutter Like a Mother: A Guilt-Free, No-Stress Way to Transform Your Home and Your LifeDa EverandDeclutter Like a Mother: A Guilt-Free, No-Stress Way to Transform Your Home and Your LifeValutazione: 4.5 su 5 stelle4.5/5 (164)

- How to Keep House While Drowning: A Gentle Approach to Cleaning and OrganizingDa EverandHow to Keep House While Drowning: A Gentle Approach to Cleaning and OrganizingValutazione: 4.5 su 5 stelle4.5/5 (847)

- Success at Home with ADHD.: Practical Organization Strategies to Make Your Life Easier.Da EverandSuccess at Home with ADHD.: Practical Organization Strategies to Make Your Life Easier.Valutazione: 4 su 5 stelle4/5 (17)

- It's All Too Much: An Easy Plan for Living a Richer Life with Less StuffDa EverandIt's All Too Much: An Easy Plan for Living a Richer Life with Less StuffValutazione: 4 su 5 stelle4/5 (232)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyDa EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNessuna valutazione finora

- The Joy of Less: A Minimalist Guide to Declutter, Organize, and SimplifyDa EverandThe Joy of Less: A Minimalist Guide to Declutter, Organize, and SimplifyValutazione: 4 su 5 stelle4/5 (278)

- Upcycling: 20 Creative Projects Made from Reclaimed MaterialsDa EverandUpcycling: 20 Creative Projects Made from Reclaimed MaterialsNessuna valutazione finora

- Summary of KC Davis's How to Keep House While DrowningDa EverandSummary of KC Davis's How to Keep House While DrowningValutazione: 5 su 5 stelle5/5 (1)

- How to Keep House While Drowning: A Gentle Approach to Cleaning and OrganizingDa EverandHow to Keep House While Drowning: A Gentle Approach to Cleaning and OrganizingValutazione: 4.5 su 5 stelle4.5/5 (79)

- Let It Go: Downsizing Your Way to a Richer, Happier LifeDa EverandLet It Go: Downsizing Your Way to a Richer, Happier LifeValutazione: 4.5 su 5 stelle4.5/5 (67)

- The Buy Nothing, Get Everything Plan: Discover the Joy of Spending Less, Sharing More, and Living GenerouslyDa EverandThe Buy Nothing, Get Everything Plan: Discover the Joy of Spending Less, Sharing More, and Living GenerouslyValutazione: 4 su 5 stelle4/5 (40)

- How to Manage Your Home Without Losing Your Mind: Dealing with Your House's Dirty Little SecretsDa EverandHow to Manage Your Home Without Losing Your Mind: Dealing with Your House's Dirty Little SecretsValutazione: 5 su 5 stelle5/5 (339)

- Carpentry Made Easy - The Science and Art of Framing - With Specific Instructions for Building Balloon Frames, Barn Frames, Mill Frames, Warehouses, Church SpiresDa EverandCarpentry Made Easy - The Science and Art of Framing - With Specific Instructions for Building Balloon Frames, Barn Frames, Mill Frames, Warehouses, Church SpiresValutazione: 1 su 5 stelle1/5 (2)

- Building Outdoor Furniture: Classic Deck, Patio & Garden Projects That Will Last a LifetimeDa EverandBuilding Outdoor Furniture: Classic Deck, Patio & Garden Projects That Will Last a LifetimeNessuna valutazione finora

- Martha Stewart's Organizing: The Manual for Bringing Order to Your Life, Home & RoutinesDa EverandMartha Stewart's Organizing: The Manual for Bringing Order to Your Life, Home & RoutinesValutazione: 4 su 5 stelle4/5 (11)

- Kintsugi Wellness: The Japanese Art of Nourishing Mind, Body, and SpiritDa EverandKintsugi Wellness: The Japanese Art of Nourishing Mind, Body, and SpiritValutazione: 4.5 su 5 stelle4.5/5 (3)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- How to Build a House: A Practical, Common-Sense Guide to Residential ConstructionDa EverandHow to Build a House: A Practical, Common-Sense Guide to Residential ConstructionValutazione: 4 su 5 stelle4/5 (5)