Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ratio Analysis of MSN LABORATARIES

Caricato da

nawaz0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

15 visualizzazioni3 pagineBalance Sheets

Titolo originale

Balance Sheets

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBalance Sheets

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

15 visualizzazioni3 pagineRatio Analysis of MSN LABORATARIES

Caricato da

nawazBalance Sheets

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

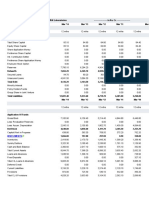

RATIO ANALYSIS

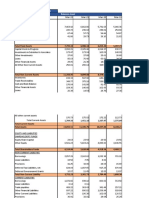

Balance sheet(In Crores) - MSN LABORATARIES.

Mar 2013- Mar 2012- Mar 2011- Mar2010- Mar 2009-

Particulars 14 13 12 11 10

12

Liabilities 12 Months 12 Months Months 12 Months 12 Months

Share Capital 7.92 7.92 7.92 7.92 7.92

Reserves & Surplus 126.27 124.8 116.05 97.4 82.68

Net Worth 134.19 132.72 123.97 105.33 90.61

Secured Loans 3.56 6.86 21.03 49.26 50.6

Unsecured Loans 4.38 5.85 6.2 9.09 6.8

TOTAL LIABILITIES 142.13 145.43 151.2 163.67 148.01

Assets

Gross Block 187.23 183.93 179.06 173.9 171.82

(-) Acc. Depreciation 108.99 101.56 93.56 85.74 78.59

Net Block 78.24 82.36 85.5 88.16 93.23

Capital Work in

Progress. 0.93 0.17 2.63 1.23 1.65

Investments. 0.05 0.05 0.05 0.05 0.05

Inventories 33.84 12.46 27.53 62.86 53.29

Sundry Debtors 11.68 11.59 10.52 12.7 11.28

Cash And Bank 23.1 36.19 26.5 14.96 8.16

Loans And Advances 42.14 43.48 39.39 23.32 15.65

Total Current Assets 110.75 103.73 103.94 113.85 88.38

Current Liabilities 17.76 12.33 17.58 26.28 26.77

Provisions 30.08 28.55 23.35 13.34 8.53

Total Current Liabilities 47.84 40.87 40.92 39.62 35.3

NET CURRENT ASSETS 62.91 62.85 63.02 74.23 53.08

Misc. Expenses 0 0 0 0 0

TOTAL ASSETS

(A+B+C+D+E) 142.13 145.43 151.2 163.67 148.01

Sri Sai Institute of Engineering and Technology, Ananthapuramu.

RATIO ANALYSIS

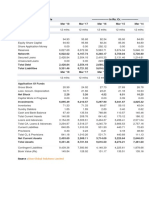

Profit & Loss(in crores) - MSN LABORATARIES.

Mar 2009-

Mar 2013-14 Mar 2012-13 Mar 2011-12 Mar2010-11 10

12 Months 12 Months 12 Months 12 Months 12 Months

INCOME:

Sales Turnover 120.8 140.91 192.58 189.07 154.68

Excise Duty 21.09 8.15 10.52 16.5 12.71

NET SALES 99.71 132.76 182.06 172.56 141.97

Other Income 0 0 0 0 0

TOTAL INCOME 102.02 135.61 184 173.42 142.98

EXPENDITURE:

Manufacturing Expenses 51.62 43.53 47.02 49.88 45.64

Material Consumed 20.67 40.62 68.82 60.31 40.37

Personal Expenses 12.73 11.34 11.29 9.83 8.76

Selling Expenses 1.48 2.09 6.62 5.41 3.96

Administrative Expenses 3.75 14.22 11.92 11.96 10.74

Expenses Capitalised 0 0 0 0 0

Provisions Made 0 0 0 0 0

TOTAL EXPENDITURE 90.26 111.8 145.66 137.39 109.48

Operating Profit 9.45 20.97 36.4 35.17 32.49

EBITDA 11.76 23.81 38.34 36.04 33.5

Depreciation 7.43 8.04 7.82 7.8 7.77

Other Write-offs 0 0 0 0 0

EBIT 4.33 15.77 30.52 28.24 25.73

Interest 0.47 0.88 3.4 6.55 4.95

EBT 3.86 14.9 27.12 21.69 20.78

Taxes 0 3.6 5.82 4.21 2.76

Profit and Loss for the Year 3.91 11.3 21.3 17.48 18.02

Non Recurring Items 0 0 0 0 0

Other Non Cash Adjustments 0 -0.1 -0.1 -0.5 0

Other Adjustments 0 0 0 0 0

REPORTED PAT 3.91 11.19 21.1 16.9 17.94

KEY ITEMS

Preference Dividend 0 0 0 0 0

Equity Dividend 2.1 2.1 2.1 1.87 1.87

Equity Dividend (%) 26.99 26.99 27 23.99 23.99

Shares in Issue (Lakhs) 77.74 77.74 77.74 77.74 77.74

EPS - Annualised (Rs) 5.03 14.4 27.15 21.74 23.08

Sri Sai Institute of Engineering and Technology, Ananthapuramu.

RATIO ANALYSIS

BIBLOGRAPHY

Financial Management - IM PANDEY

Fundamentals of financial management - PRASANNA CHANDRA

Financial management (principles & practice) - S.N.MAHESWARI

Financial decision making - JOHN J.HAMPTON

Business research methodology - KOTARI

Financial Management -KHAN and JAIN

Web sites

www.economictimes.com

www.moneycontrol.com

Sri Sai Institute of Engineering and Technology, Ananthapuramu.

Potrebbero piacerti anche

- Balance Sheet - in Rs. Cr.Documento3 pagineBalance Sheet - in Rs. Cr.jelsiya100% (1)

- 12 - Ishan Aggarwal - Shreyans Industries Ltd.Documento11 pagine12 - Ishan Aggarwal - Shreyans Industries Ltd.rajat_singlaNessuna valutazione finora

- Omaxe Ltd. Executive Summary under 40 charactersDocumento2 pagineOmaxe Ltd. Executive Summary under 40 charactersShreemat PattajoshiNessuna valutazione finora

- Financial Forecasting: Revenue, Costs, Profits, EPSDocumento54 pagineFinancial Forecasting: Revenue, Costs, Profits, EPSRonakk MoondraNessuna valutazione finora

- United Breweries Holdings LimitedDocumento7 pagineUnited Breweries Holdings Limitedsalini sasiNessuna valutazione finora

- Cma-Data Rajeshwar-1-12Documento12 pagineCma-Data Rajeshwar-1-12VIRAT SAXENANessuna valutazione finora

- Balance Sheet Analysis and Financial Ratios for Munjal Auto IndustriesDocumento29 pagineBalance Sheet Analysis and Financial Ratios for Munjal Auto Industriesaditya_behura4397Nessuna valutazione finora

- Balance Sheet of Empee DistilleriesDocumento4 pagineBalance Sheet of Empee DistilleriesArun PandiyanNessuna valutazione finora

- 2 - Aditya - Balaji TelefilmsDocumento12 pagine2 - Aditya - Balaji Telefilmsrajat_singlaNessuna valutazione finora

- Income Latest: Financials (Standalone)Documento3 pagineIncome Latest: Financials (Standalone)Vishwavijay ThakurNessuna valutazione finora

- Statement of Profit and LossDocumento10 pagineStatement of Profit and Losspallavi thakurNessuna valutazione finora

- Adlabs InfoDocumento3 pagineAdlabs InfovineetjogalekarNessuna valutazione finora

- Kalindee Rail Nirman: Balance SheetDocumento9 pagineKalindee Rail Nirman: Balance Sheetrajat_singlaNessuna valutazione finora

- 32 - Akshita - Sun Pharmaceuticals Industries.Documento36 pagine32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNessuna valutazione finora

- Accounts Term PaperDocumento86 pagineAccounts Term PaperVikramjit ਮਿਨਹਾਸNessuna valutazione finora

- Analysis of TTK Prestige Annual Report 2009Documento9 pagineAnalysis of TTK Prestige Annual Report 2009jainchetan2008Nessuna valutazione finora

- Praj Industries Ltd. - Research Center Balance Sheet AnalysisDocumento19 paginePraj Industries Ltd. - Research Center Balance Sheet AnalysisnehaNessuna valutazione finora

- Quarterly Income Statement and Balance Sheet ReportDocumento9 pagineQuarterly Income Statement and Balance Sheet ReportCa Aspirant Shaikh UsamaNessuna valutazione finora

- Vinati OrganicsDocumento6 pagineVinati Organicsalistair7682Nessuna valutazione finora

- Sagar CementsDocumento33 pagineSagar Cementssarbjeetk21Nessuna valutazione finora

- FSA-Case Study QuestionDocumento2 pagineFSA-Case Study QuestionaKSHAT sHARMANessuna valutazione finora

- Eveready Industries India Balance Sheet - in Rs. Cr.Documento5 pagineEveready Industries India Balance Sheet - in Rs. Cr.Jb SinghaNessuna valutazione finora

- P & L A/C Sanghicement Amt. %: IncomeDocumento5 pagineP & L A/C Sanghicement Amt. %: IncomeMansi VyasNessuna valutazione finora

- Cma-Data RajeshwarDocumento16 pagineCma-Data RajeshwarVIRAT SAXENANessuna valutazione finora

- Data Patterns Income&CashFlow - 4 Years - 19052020Documento8 pagineData Patterns Income&CashFlow - 4 Years - 19052020Sundararaghavan RNessuna valutazione finora

- Project of Tata MotorsDocumento7 pagineProject of Tata MotorsRaj KiranNessuna valutazione finora

- Profit and Loss: Rs. CR IncomeDocumento2 pagineProfit and Loss: Rs. CR IncomeRavi KumarNessuna valutazione finora

- Profit and Loss Account of Akzo NobelDocumento15 pagineProfit and Loss Account of Akzo NobelKaizad DadrewallaNessuna valutazione finora

- Transport Logistics Profitability and Cost Efficiency Over TimeDocumento13 pagineTransport Logistics Profitability and Cost Efficiency Over TimeAninda DuttaNessuna valutazione finora

- Ramco Cements StandaloneDocumento13 pagineRamco Cements StandaloneTao LoheNessuna valutazione finora

- Coca-Cola Co Financials at a Glance (2008-2017Documento6 pagineCoca-Cola Co Financials at a Glance (2008-2017SibghaNessuna valutazione finora

- RatiosDocumento2 pagineRatiosnishantNessuna valutazione finora

- Ratios FinDocumento16 pagineRatios Fingaurav sahuNessuna valutazione finora

- Investment Valuation Ratios Over 5 YearsDocumento16 pagineInvestment Valuation Ratios Over 5 Yearsgaurav sahuNessuna valutazione finora

- Ratios FinancialDocumento16 pagineRatios Financialgaurav sahuNessuna valutazione finora

- Ratios FinDocumento30 pagineRatios Fingaurav sahuNessuna valutazione finora

- Arch Pharmalabs API Manufacturing SitesDocumento6 pagineArch Pharmalabs API Manufacturing SitesChandan VirmaniNessuna valutazione finora

- Axis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKDocumento2 pagineAxis Bank - Consolidated Key Financial Ratios Banks - Private Sector Consolidated Key Financial Ratios of Axis Bank - BSE: 532215, NSE: AXISBANKr79qwkxcfjNessuna valutazione finora

- Key Financial Ratios of Shree CementsDocumento2 pagineKey Financial Ratios of Shree CementsTrollNessuna valutazione finora

- Common Sized Balance Sheet As at 31st December, 2018: Acc LimitedDocumento6 pagineCommon Sized Balance Sheet As at 31st December, 2018: Acc LimitedVandita KhudiaNessuna valutazione finora

- 2023 Financial Forecast and Historical ResultsDocumento8 pagine2023 Financial Forecast and Historical ResultsSimran GargNessuna valutazione finora

- Deepak Nitrite - Industry Analysis and Recommendation to BuyDocumento14 pagineDeepak Nitrite - Industry Analysis and Recommendation to BuySujay SinghviNessuna valutazione finora

- Term Paper Sandeep Anurag GautamDocumento13 pagineTerm Paper Sandeep Anurag GautamRohit JainNessuna valutazione finora

- Annual Accounts 2021Documento11 pagineAnnual Accounts 2021Shehzad QureshiNessuna valutazione finora

- UTV Software Communications LTDDocumento4 pagineUTV Software Communications LTDNeesha PrabhuNessuna valutazione finora

- Financial Ratios of Federal BankDocumento35 pagineFinancial Ratios of Federal BankVivek RanjanNessuna valutazione finora

- Balance Sheet of Indiabulls - in Rs. Cr.Documento3 pagineBalance Sheet of Indiabulls - in Rs. Cr.MubeenNessuna valutazione finora

- AhujaDocumento7 pagineAhujaShashikant Pandit RajnikantNessuna valutazione finora

- Institute Program Year Subject Project Name Company Competitor CompanyDocumento37 pagineInstitute Program Year Subject Project Name Company Competitor CompanyEashaa SaraogiNessuna valutazione finora

- Indian Oil Corporation LTDDocumento50 pagineIndian Oil Corporation LTDpriyankagrawal7Nessuna valutazione finora

- Financial HighlightsDocumento3 pagineFinancial HighlightsSalman SaeedNessuna valutazione finora

- Renuka Sugars P and L AccntDocumento13 pagineRenuka Sugars P and L AccntDivya NadarajanNessuna valutazione finora

- Reliance Industries LTD (RIL IN) - GrowthDocumento8 pagineReliance Industries LTD (RIL IN) - GrowthMayank kapoorNessuna valutazione finora

- Financial Analysis of NBFCDocumento14 pagineFinancial Analysis of NBFCPKNessuna valutazione finora

- AMULDocumento22 pagineAMULsurprise MFNessuna valutazione finora

- Financial Ratios of Zee Entertainment Over 5 YearsDocumento2 pagineFinancial Ratios of Zee Entertainment Over 5 Yearssagar naikNessuna valutazione finora

- Key Financial Ratios of NTPC: - in Rs. Cr.Documento3 pagineKey Financial Ratios of NTPC: - in Rs. Cr.Vaibhav KundalwalNessuna valutazione finora

- Apollo Hospitals Enterprise LimitedDocumento4 pagineApollo Hospitals Enterprise Limitedpaigesh1Nessuna valutazione finora

- Illustration Acc FMDocumento22 pagineIllustration Acc FMHEMACNessuna valutazione finora

- Schaum's Outline of Basic Business Mathematics, 2edDa EverandSchaum's Outline of Basic Business Mathematics, 2edValutazione: 5 su 5 stelle5/5 (1)

- Project Title ListDocumento24 pagineProject Title ListnawazNessuna valutazione finora

- ..Advertisingsalespromotion@DECCAN CEMENTSDocumento69 pagine..Advertisingsalespromotion@DECCAN CEMENTSnawazNessuna valutazione finora

- A Project Report On Financial Performance Based On Ratios at HDFC BankDocumento75 pagineA Project Report On Financial Performance Based On Ratios at HDFC BanknawazNessuna valutazione finora

- RequiredDocumento2 pagineRequirednawazNessuna valutazione finora

- Job SatisfactionDocumento89 pagineJob SatisfactionnawazNessuna valutazione finora

- 4.1 Data Analysis and Interpretation: 4.1current RatioDocumento22 pagine4.1 Data Analysis and Interpretation: 4.1current RationawazNessuna valutazione finora

- Ratio AnalyisisDocumento49 pagineRatio AnalyisisnawazNessuna valutazione finora

- Venture Capital in INDIADocumento83 pagineVenture Capital in INDIAnawaz100% (2)

- RequiredDocumento2 pagineRequirednawazNessuna valutazione finora

- Marketing Strategies of Hero Moto CorpDocumento97 pagineMarketing Strategies of Hero Moto Corpnawaz50% (2)

- .... WCM at Bahety Chemicals & Minerals PVT - Ltd.Documento90 pagine.... WCM at Bahety Chemicals & Minerals PVT - Ltd.nawaz100% (1)

- Financial AnalysisDocumento84 pagineFinancial AnalysisnawazNessuna valutazione finora

- Balance Sheet of JYOTHI Brass Metal Works (2010-20014) : - in Rs. Cr.Documento4 pagineBalance Sheet of JYOTHI Brass Metal Works (2010-20014) : - in Rs. Cr.nawazNessuna valutazione finora

- Comparative Analysis of Mutualfund of HDFC & Icici - SharekhanDocumento49 pagineComparative Analysis of Mutualfund of HDFC & Icici - SharekhanPrathapReddyNessuna valutazione finora

- Table of ContentDocumento63 pagineTable of ContentnawazNessuna valutazione finora

- .... Life-Insurance ING-VysyaDocumento64 pagine.... Life-Insurance ING-VysyanawazNessuna valutazione finora

- Comparitive Analysis of Mutual Funds With Equity Shares Project ReportDocumento83 pagineComparitive Analysis of Mutual Funds With Equity Shares Project ReportRaghavendra yadav KM78% (69)

- New Microsoft Office Word DocumentDocumento13 pagineNew Microsoft Office Word DocumentnawazNessuna valutazione finora

- Retail BankingDocumento64 pagineRetail Bankingdk6666Nessuna valutazione finora

- Sales and Promotion of Pepsi: A Project Report OnDocumento124 pagineSales and Promotion of Pepsi: A Project Report OnnawazNessuna valutazione finora

- Working Capital Management Marathon Electric India Pvt. LTD.Documento63 pagineWorking Capital Management Marathon Electric India Pvt. LTD.nawazNessuna valutazione finora

- Nike Project ReportDocumento27 pagineNike Project Reporttarun100% (3)

- Ranbaxy Balance SheetDocumento5 pagineRanbaxy Balance SheetnawazNessuna valutazione finora

- Wcm-9-Shriram Pistons & Rings LTDDocumento91 pagineWcm-9-Shriram Pistons & Rings LTDnawazNessuna valutazione finora

- Customer Satisfaction For Fastrack WatchesDocumento83 pagineCustomer Satisfaction For Fastrack Watchesmoula nawazNessuna valutazione finora

- Balachandrareddy DataDocumento53 pagineBalachandrareddy DatanawazNessuna valutazione finora

- Strategies of Buying and Selling of MutualFunds - HDFCDocumento77 pagineStrategies of Buying and Selling of MutualFunds - HDFCnawazNessuna valutazione finora

- MSN BalacesheetsDocumento16 pagineMSN BalacesheetsnawazNessuna valutazione finora

- Working Capital ProjectDocumento100 pagineWorking Capital ProjectJithesh RajinivasNessuna valutazione finora

- Macr 009Documento1 paginaMacr 009Graal GasparNessuna valutazione finora

- True or False Conceptual Framework Set 2Documento2 pagineTrue or False Conceptual Framework Set 2Demi Pardillo100% (1)

- Chapter 4Documento30 pagineChapter 4one loveNessuna valutazione finora

- Model EOQ AnswerDocumento7 pagineModel EOQ Answershafvan_786Nessuna valutazione finora

- 2015-16 F.4 Form Test 2Documento18 pagine2015-16 F.4 Form Test 2廖籽藍Nessuna valutazione finora

- Lesson 10 Marketing Strategies and TechniquesDocumento4 pagineLesson 10 Marketing Strategies and TechniquesralflademoraNessuna valutazione finora

- Appraisal - Cost ApproachDocumento4 pagineAppraisal - Cost ApproachBaguma Grace GariyoNessuna valutazione finora

- Chapter 3 HRDocumento47 pagineChapter 3 HRAnonymous s98FwgOYCNessuna valutazione finora

- Valuation-Methods and ParametersDocumento15 pagineValuation-Methods and ParametersPranav Chaudhari100% (2)

- Literature Review of Ratio Analysis PDFDocumento5 pagineLiterature Review of Ratio Analysis PDFea86yezd100% (1)

- BpmToolbox 6.0-Forecast Business Planning Model Example (Basic)Documento50 pagineBpmToolbox 6.0-Forecast Business Planning Model Example (Basic)Neeraj NamanNessuna valutazione finora

- Welsh Hotel Cost-Volume-Profit Analysis and UncertaintyDocumento6 pagineWelsh Hotel Cost-Volume-Profit Analysis and UncertaintyramondNessuna valutazione finora

- Systems Design: Job-Order CostingDocumento60 pagineSystems Design: Job-Order Costingrachim04Nessuna valutazione finora

- Acct Statement - XX7767 - 03072023Documento9 pagineAcct Statement - XX7767 - 03072023Devaj BajajNessuna valutazione finora

- Marketing guidance for new wheat flour brandDocumento3 pagineMarketing guidance for new wheat flour brandraj chauhanNessuna valutazione finora

- How to Write a Business Plan in 40 StepsDocumento14 pagineHow to Write a Business Plan in 40 StepsThirdaine Medz GañaNessuna valutazione finora

- IQN CPMA Body of Knowledge 2023Documento167 pagineIQN CPMA Body of Knowledge 2023shatilNessuna valutazione finora

- LESSON9Documento10 pagineLESSON9Carl Daniel DoromalNessuna valutazione finora

- 3 - Statement of Cash FlowsDocumento29 pagine3 - Statement of Cash Flowselriatagat85Nessuna valutazione finora

- D-Marin Job Description Marketing ManagerDocumento2 pagineD-Marin Job Description Marketing ManagersarathNessuna valutazione finora

- Building An SMB Ecommerce and Digital Marketplace: B2B Platform DesignDocumento10 pagineBuilding An SMB Ecommerce and Digital Marketplace: B2B Platform Designsamiksha ayushNessuna valutazione finora

- Power Grid Fpo RHPDocumento537 paginePower Grid Fpo RHPGaurav SaxenaNessuna valutazione finora

- Economics of Strategy: Fifth EditionDocumento44 pagineEconomics of Strategy: Fifth EditionSachin SoniNessuna valutazione finora

- Chapter 9 PracticeDocumento4 pagineChapter 9 Practicexabir54952Nessuna valutazione finora

- Ratios Test PaperDocumento7 pagineRatios Test Papermeesam2100% (1)

- Q4 FY22 InfographicDocumento1 paginaQ4 FY22 InfographicawarialocksNessuna valutazione finora

- BIWS LBO Case Study - VFDocumento2 pagineBIWS LBO Case Study - VFLoïc HalleuxNessuna valutazione finora

- Three Stage Growth ModelDocumento12 pagineThree Stage Growth ModelNavleen KaurNessuna valutazione finora

- Chapter 3 Appendix ADocumento16 pagineChapter 3 Appendix AJingjing ZhuNessuna valutazione finora

- Value Chain AnalysisDocumento19 pagineValue Chain Analysisnisha67% (3)