Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Credit Assessment in Determining The Feasibility of Debtors Using Profile Matching

Caricato da

inventionjournalsCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Credit Assessment in Determining The Feasibility of Debtors Using Profile Matching

Caricato da

inventionjournalsCopyright:

Formati disponibili

International Journal of Business and Management Invention

ISSN (Online): 2319 8028, ISSN (Print): 2319 801X

www.ijbmi.org || Volume 6 Issue 1 || January. 2017 || PP73-79

Credit Assessment in Determining The Feasibility of Debtors

Using Profile Matching

Husni Muharram Ritonga1, Hasrul Azwar Hasibuan2,

Andysah Putera Utama Siahaan3

1,2

Faculty of Economics and Business, 3Faculty of Computer Science Universitas Pembangunan Panca Budi

Jl. Jend. Gatot Subroto Km. 4,5 Sei Sikambing, 20122, Medan, Sumatera Utara, Indonesia

ABSTRACT: Credit assessment is a method used by banks or other financial institutions that are useful to

determine whether a prospective debtor is feasible or not get a loan. The way is to collect customer data taken

from the application data customer lending other than by using a statistical program that contains a history of

loan among other things on how the payment cycle is billing the customer, if the customer pays bills on time or

not, how many credits are still in progress. This assessment helps the banks to analyze credit applications

besides other qualitative factors. If the customer has a problem in the smooth payment, the information will be

known by funders. Profile Matching is the decision support system method to rank the client feasibility. It can

assess based on particular parameters given. There are several parameters to be considered. It helps banks or

other financial agents to pass the client borrowing money.

Keywords: Financial, Creditor, Debtor, Profile Matching

I. INTRODUCTION

Bank is a business entity that collects funds from the public in deposits and distributes to the public in

the credits. Speaking about the credit, can not be separated from the purpose of the banks themselves. The

purpose of banks is lending to a third party, public or debtor. Although people became the main target, in this

case, not all credit applications from prospective borrowers approved by the banks. Parties that determine

whether or not credit is agreed is a credit analyst team. Prospective debtors may have experienced rejection in

the credit application. Why is the credit application rejected when banks had qualified it? Many factors go into a

credit analyst before providing recommendations to agree or disagree to the debtor. They have filled the format

and method in writing with the form, format, and the depth of the specified bank. Also, the analysis was not

based on subjective considerations of the credit application.

Analysts have their way to provide an assessment of the feasibility to potential debtors. In the study, the

author tries to give examples of credit ratings with the Profile Matching method. This method has the aspects

and sub-aspects that have ratios respectively. Analysts can set the level comparison in every aspect. This method

gives a great influence to the admissibility of an application for credit. On a monthly basis, there are many

applications in creditors but not every application will be approved. This method aims to select some of all

entries in the given period. Bank expects that this method has a good contribution in choosing which candidates

are eligible to get a loan. By applying this method, an error in selecting consumer and bad credit could be

avoided.

II. THEORIES

2.1 Credit

The term credit comes from the Italian word "credare". It means "trust," is the confidence of the lender

(creditor) that the borrower (debtor) will recover the funds borrowed and interest thereon by the agreement

going on between the two sides [1]. A creditor will trust the debtors that they will not be bogged down in the

refund loans. Based on the Banking Law of the Republic of Indonesia Number 7 of 1992 that credit is the

provision of money under contracts or the borrowing and lending between banks and other parties who require

the borrower to repay the debt after a certain period with the amount of interest remuneration or profit sharing.

The existence of credit in the economy affair is already used since a long time ago. It is often heard or even

directly related to the credit in everyday life. The term loan is to be things that often we encounter in society.

The easiest example is an electronics store, where many of its products are sold not only by the cash purchase

system but also with the credit. Creditor right is to obtain payment, or the debtor's obligation is to make

payments at the time requested or in the future because of the delivery of money at present.

In the credit, there is the principle of trust and prudence. Indicators of these beliefs are based on moral

beliefs, commercial, financial, and assurance. While confidence in the credit can be divided into two, pure and

reserve trust. Pure trust is when lenders extend credit to the debtor based only on trust without any warranty of

any kind [6][7]. For example, the debtor to borrow money from friends and was not accompanied by any

www.ijbmi.org

73 | Page

Credit Assessment in Determining The Feasibility of Debtors Using Profile Matching

collateral, only based on mutual trust. While the reserve trust, the lender providing credit or loans to borrowers

not only by faith alone but accompanied by a collateral matter. In lending at banks that are taking precedence is

collateral for the loan, so not only based on the principle of trust alone.

Humans require credit because humans have needs that sometimes must be purchased by installments. Human

needs are varied by the dignity that is always rising, while the ability to achieve something is limited. This

causes the human need assistance to meet the desires and ideals. To improve business or usability of goods,

people need material assistance from creditors. Provision of credit facilities has several objectives that must not

be separated from the mission of the company is established. Credit has several functions as follows:

1. Improve usability exchange

Credit can improve the usability of money. If the money just kept alone, it will not produce anything useful.

The money is to be useful to produce goods or services by credit recipients.

2. Improve traffic circulation of money.

In this case, the money given or distributed will circulate from one area to another so that a region strapped

with obtaining credit this region will receive additional money from other areas.

3. Improve usability of goods.

Loans granted by the bank's money will be used by the debtor to process into useful items that are not

useful or helpful.

4. Improve circulation of goods.

Credit can also add or facilitate the flow of goods from one area to another, so that the amount of goods

circulating from one area to another or credit increases may also increase the amount outstanding.

5. Maintain economic stability

By providing credit, it can be considered as economic stability because of the presence of loans will

increase the number of items required by the community. Then the credits can also help in exporting goods

from domestic to overseas thus increase foreign exchange.

6. Rise excitement of trying

The recipient will be able to increase the credits of the excitement of trying, especially for the customers

who have limited capital.

7. Improve distribution of income

The more loans, the better, especially regarding increasing revenue. If a credit is given to build the plant,

then the plant would require a workforce so, it may reduce unemployment. Besides, for the surrounding

community will also have to increase revenue such as kiosks or rent a house for rent or other services.

8. Improve international relations.

Regarding international loans will be able to increase mutual need between the recipient of the loan with the

lender. Lending by other countries will enhance cooperation in other fields.

1.

2.

3.

4.

5.

Credit has several elements. The elements contained in the provision of credit facilities are as follows:

Trust

Confidence is a belief against the lender for granted received back in the future according to the credit

period. The Bank provides trust from underlying why a credit can be brave in the drizzle.

Agreement

Agreement in an agreement that each party signed the rights and obligations of each. Agreements are in a

credit agreement and signed by both parties before the credit is disbursed.

Period

From the period that has been agreed on of lending by banks and credit repayment by the debtor.

Risks

In avoiding bad risks in the credit agreement, binding agreements have previously performed the guarantees

that are charged to the debtor or borrower.

Achievement

Achievement is an object of interest on an agreed fee by the bank and the debtor.

2.2 Profile Matching

Profile matching is a method often used as a mechanism for decision-making by assuming that there is an ideal

level of predictor variables that must be met by the subjects studied, instead of the minimum rate that must be

met or passed [2..5]. Here are some steps and formulation of the calculation method of profile matching:

1. Weighting

This phase will be determined the weight value of each aspect of using weights gap. Gap is the difference

between the value of the aspect and the target value. It can be obtained by this formula.

www.ijbmi.org

74 | Page

Credit Assessment in Determining The Feasibility of Debtors Using Profile Matching

2.

Core and Secondary Factor

This stage determines the weight value gap necessary criteria, each criterion grouped into two groups: core

factor and the secondary factor.

a. Core Factor

Core factor is the aspect most needed. The formula below is to calculate the core factor.

NCF

NC

IC

:

:

:

Core Factor Value

Total Weight Core Factor

Total Item Core Factor

b. Secondary Factor

Secondary factors are the items other than that of the core aspects of factors. The formula for calculating the

secondary factor is as follows:

NSF

NS

IS

3.

Secondary Factor Value

Total Weight Secondary Factor

Total Item Secondary Factor

Total Value Calculation

From the core calculation factors and secondary factors of every aspect, and then calculated the total value

of each aspect of the estimated effect on the performance of each profile. To calculate the total value of

each aspect, the following formula is used.

N

NCF

NSF

X%

4.

:

:

:

:

:

:

:

Total value of each aspect

Average Core Factor

Average Secondary Factor

Percentage value is entered

Ranking

The final result of the profile matching process is a ranking which refers to the calculation results shown by

this formula:

R

NCF

NSF

:

:

:

Rank value

Core Factor value

Secondary Factor value

III. PROPOSED WORK

3.1 Assessment Criteria

Before a credit facility granted, the bank must be sure that the loans should be completely paid [8].

Confidence is gained from the study of credit before the credit was disbursed. Research of credit by banks can

be done in various ways to gain the confidence of its customers, such as through a correct assessment procedure

and earnest. In conducting the criteria and aspects assessments remain the same. Usually, the common criteria

assessment should be made by banks to get customers who deserve to be given.

1. Character

The character is the nature or character of the individual. The nature or character of the person who will be

given the credit really should be trusted. In this case, the bank believes is true that the prospective debtor

has a good reputation, it always means keeping promises and not involved matters relating to crime, for

example, a gambler, a drunkard, or a swindler. To be able to read the nature or character of prospective

borrowers can be seen from the customer background, both the background and the work of a personal

nature as a way of life or enslaving lifestyle, family situation, hobbies, and social life.

www.ijbmi.org

75 | Page

Credit Assessment in Determining The Feasibility of Debtors Using Profile Matching

2.

Capacity

Capacity is an analysis to determine the ability of customers to pay for the credit. Banks should know with

certainty on the ability of prospective borrowers by analyzing its business from time to time. Revenue

increases are expected in the future are always able to make the repayment on credit. Meanwhile, when an

estimated incapable, the bank may reject the request of prospective borrowers. The name of capability often

is called capacity.

3. Capital

Capital is the condition of property owned by the company that managed the prospective borrowers. Banks

must examine the debtor in addition to the amount of capital is also its structure. To see whether the

effective use of capital, it can be seen from the financial statements presented by performing such

measurements regarding liquidity and solvency, profitability and other sizes.

4. Condition

Financing provided also need to consider the economic conditions associated with the prospective

customer's business prospects. Condition assessment and business fields financed should have good

prospects, so the possibility of problematic loans is relatively small.

5. Behaviour

Behaviour is to assess the customer regarding personality every day and his personality in the past.

Personality assessment also includes attitudes, emotions, behavior and actions of customers in the face of a

problem and resolve it.

6. Party

The party is to classify customers into classifications or certain groups based capital, loyalty, and character

so that customers can be categorized into specific groups and will get different credit facilities from banks.

7. Purpose

The purpose is the aim of the customer in taking credit, including credit desired types of customers. The

purpose lines of credit can vary as needed. For example, whether for working capital, investment,

consumption, productive and others.

8. Prospect

Prospect is assessing the customer's business in the future whether favorable or not, in other words, have a

prospect or vice versa. It is important because if a credit facility financed without having prospects, not only

banks but also the loss of customers.

9. Payment

Payment is a measure of how customers return the loans that have been taken or from any source of funds

for repayment of credit. The more sources of income of the debtor, the better. So that if other businesses

will cover one attempt losers.

10. Profitability

Profitability is to analyze how the client's ability to seek profit. Profitability measured from period to

period, whether it will remain the same or will increase, especially with the extra credits that will be earned.

11. Protection

The goal is to keep the loans get guaranteed protection, so the loans completely safe. The protection

provided by the debtor may be a guarantee of goods or people or insurance.

3.2 Assessment Instrument

The intended instrument is a device that meets the requirements, so it can be used as a tool to measure an object

measuring or collecting data about a variable. In the field of research, the instrument is defined as a tool to

collect data on the variables of research for research needs. In the economic field, the instrument used to

measure the level of credit capacity; factors suspected to have a relationship or effect on credit quality. Table 1

shows the modeling of the instruments used.

Table 1 Assessment instrument

Variable

Ability

Personality

Feasibility

Instrument

(A) Character

(B) Capacity

(C) Capital

(D) Condition

(E) Behaviour

(F) Party

(G) Purpose

(H) Prospect

(I) Payment

(J) Profitability

(K) Protection

www.ijbmi.org

76 | Page

Credit Assessment in Determining The Feasibility of Debtors Using Profile Matching

Table 2 Scoring system

REMARK

Disagree

Neutral

Agree

SCORE

1

2

3

Table 2 shows the scoring system using Likert scale. There are three options in answering the questionnaire.

They are DISAGREE, NEUTRAL, and AGREE.

IV. EVALUATION

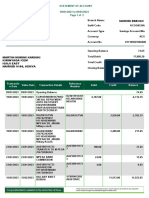

This section is the test of the provided instrument obtained earlier. The assessment must be converted

into the Likert scale from "1" to "3". For this test, there will be five debtors who have different parameters.

Table 3 shows the debtors data in three categories.

Table 3 Scoring data

ABILITY

DEBTORS

1

2

3

4

5

DEBTOR 1

DEBTOR 2

DEBTOR 3

DEBTOR 4

DEBTOR 5

CF

SF

SF

CF

2

3

1

2

1

3

2

2

3

2

1

1

3

1

3

2

2

3

3

2

PERSONALITY

DEBTORS

1

2

3

4

5

DEBTOR 1

DEBTOR 2

DEBTOR 3

DEBTOR 4

DEBTOR 5

CF

CF

SF

3

2

1

2

1

3

2

2

1

2

FEASIBILITY

H

I

SF

SF

2

3

2

2

2

2

2

3

2

3

DEBTORS

1

2

3

4

5

DEBTOR 1

DEBTOR 2

DEBTOR 3

DEBTOR 4

DEBTOR 5

1

2

3

2

1

J

CF

3

3

3

3

3

K

CF

1

1

1

1

1

Table 4 : Target Value

TARGET

Table 4 shows the target value of each parameter. Data is categorized into three aspects, Ability,

Personality, and Feasibility. There area eleven parameters. Each of them is filled with the previous score and

compared with the existing target value. Table 5 shows the gap value obtained.

www.ijbmi.org

77 | Page

Credit Assessment in Determining The Feasibility of Debtors Using Profile Matching

Table 5 Gap value

ABILITY

DEBTORS

1

2

3

4

5

DEBTOR 1

DEBTOR 2

DEBTOR 3

DEBTOR 4

DEBTOR 5

CF

SF

SF

CF

0

1

-1

0

-1

1

0

0

1

0

-1

-1

1

-1

1

0

0

1

1

0

PERSONALITY

DEBTORS

1

2

3

4

5

DEBTOR 1

DEBTOR 2

DEBTOR 3

DEBTOR 4

DEBTOR 5

CF

CF

SF

2

0

0

1

0

1

1

2

1

1

0

1

2

1

0

FEASIBILITY

DEBTORS

1

2

3

4

5

DEBTOR 1

DEBTOR 2

DEBTOR 3

DEBTOR 4

DEBTOR 5

SF

SF

CF

CF

0

0

0

0

0

1

0

0

1

1

1

1

1

1

1

-1

-1

-1

-1

-1

After the gap values are retrieved, those values will be converted into Profile Matching rule using the gap rule as

seen in Table 6. The Core and Secondary Factors are retrieved from the values by using the earlier formulas. It

must have determined which are the core factors and secondary factors.

Table 6 Gap rule

GAP

VALUE

0

1

-1

2

-2

4

4,5

3,5

5

3

Table 7 Core Factor and Secondary Factor of Ability

WEIGHT

1 DEBTOR 1

2 DEBTOR 2

3 DEBTOR 3

4 DEBTOR 4

5 DEBTOR 5

PERFORMANCE

4,00

4,50

3,50

4,50

4,00

3,50

3,50

4,00

4,50

4,00

4,50

3,50

3,50

4,00

4,50

CF

4,00

4,25

4,00

4,25

3,75

4,00

4,00

4,50

4,50

4,00

SF

4,00

3,75

4,25

4,00

4,25

Table 8 Core Factor and Secondary Factor of Personality

WEIGHT

1 DEBTOR 1

2 DEBTOR 2

3 DEBTOR 3

4 DEBTOR 4

5 DEBTOR 5

MOTIVATION

5,00

4,50

4,00

4,00

4,50

4,50

4,00

5,00

5,00

4,50

4,50

4,50

4,00

4,50

4,00

CF

4,75

4,25

4,50

4,50

4,25

SF

4,00

4,50

5,00

4,50

4,00

Table 9 Core Factor and Secondary Factor of Feasibility

WEIGHT

1 DEBTOR 1

2 DEBTOR 2

3 DEBTOR 3

4 DEBTOR 4

5 DEBTOR 5

JOB TRAINING

4,00

4,50

4,50

4,00

4,00

4,50

4,00

4,00

4,50

4,00

4,50

4,50

4,00

4,50

4,50

www.ijbmi.org

3,50

3,50

3,50

3,50

3,50

CF

4,00

4,00

4,00

4,00

4,00

SF

4,25

4,00

4,00

4,25

4,25

78 | Page

Credit Assessment in Determining The Feasibility of Debtors Using Profile Matching

Table 7 to 9 are the calculation of all aspects. There are core and secondary factors inside. As the values are

obtained, the average value of the ratio of 6:4 (adjustable) between the core and secondary factor is initiated.

The following table shows the N1, N2 and N3 as the aspect values.

Table 10 Aspect Values

1

2

3

4

5

DEBTOR 1

DEBTOR 2

DEBTOR 3

DEBTOR 4

DEBTOR 5

N1

4,00

4,05

4,10

4,15

3,95

N2

4,45

4,35

4,70

4,50

4,15

N3

4,10

4,00

4,00

4,10

4,10

The aspect ratio is 4:2:4 (adjustable). The rank is calculated based on this ratio. The final score is the average of

the N1, N2 and N3. Table 11 shows the final score of this case.

Table 11 Result of Final Score

RANKING

1

2

3

4

5

DEBTOR 1

DEBTOR 2

DEBTOR 3

DEBTOR 4

DEBTOR 5

VALUES

N1

N2

4,00

4,45

4,05

4,35

4,10

4,70

4,15

4,50

3,95

4,15

N3

4,10

4,00

4,00

4,10

4,10

R

4,13

4,09

4,18

4,20

4,05

Table 11 illustrates the results of the Profile Matching method. DEBTOR 4 gained the highest opportunity to get

the loan. For example, if the bank let three applicants, DEBTOR 2 and DEBTOR 5 are not nominated.

V. CONCLUSION

Credit loans are very useful for the general public. However, there are some requirements that must be

met for the loan successfully obtained. Profile Matching Method is a good technique to see who will qualify for

the mortgage loan. This method can examine some aspects related to the debtor. Analysts can set the desired

target value. The drawback of this system is the absence of tolerance humanly to consider a debtor to obtain a

loan.

REFERENCES

[1].

[2].

[3].

[4].

[5].

[6].

[7].

[8].

Jogiyanto, Analisis dan Desain Sistem Informasi : Pendekatan Terstruktur, Teori dan Praktek Aplikasi Bisnis, vol. 23, Yogyakarta:

Andi Offset, 2005, p. 107115.

Z. Tharo and A. P. U. Siahaan, "Profile Matching in Solving Rank Problem," IOSR Journal of Electronics and Communication

Engineering, vol. 11, no. 5, pp. 73-76, 2016.

A. P. U. Siahaan, "Fuzzification of College Adviser Proficiency Based on Specific Knowledge," International Journal of Advanced

Research in Computer Science and Software Engineering, vol. 6, no. 7, pp. 164-168, 2016.

Kusrini, Konsep dan Aplikasi Sistem Pendukung Keputusan, Yogyakarta: Andi Offset, 2007.

D. J. Power, Decision Support Systems : Concepts and Resources For Manager, USA: Greenwood, 2002.

S. Leksono, "The Implementation of Kredit Usaha Rakyat Granting on Market Traders Who Are the Customers of Bank Rakyat

Indonesia in Tawangalun Banyuwangi," Journal of Marketing and Consumer Research, vol. 19, no. 1, pp. 63-69, 2016.

"Usaha Mikro, Kecil, dan Menengah dan Bank," Undang-Undang Republik Indonesia, vol. 20, 2008.

H. A. Hasibuan, R. B. Purba and A. P. U. Siahaan, "Productivity Assessment (Performance, Motivation, and Job Training) Using

Profile Matching," SSRG International Journal of Economics and Management Studies, vol. 3, no. 6, pp. 73-77, 2016.

www.ijbmi.org

79 | Page

Potrebbero piacerti anche

- The Effect of Transformational Leadership, Organizational Commitment and Empowerment On Managerial Performance Through Organizational Citizenship Behavior at PT. Cobra Direct Sale IndonesiaDocumento9 pagineThe Effect of Transformational Leadership, Organizational Commitment and Empowerment On Managerial Performance Through Organizational Citizenship Behavior at PT. Cobra Direct Sale Indonesiainventionjournals100% (1)

- Effects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - NigeriaDocumento12 pagineEffects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeriainventionjournals100% (1)

- Islamic Insurance in The Global EconomyDocumento3 pagineIslamic Insurance in The Global EconomyinventionjournalsNessuna valutazione finora

- A Discourse On Modern Civilization: The Cinema of Hayao Miyazaki and GandhiDocumento6 pagineA Discourse On Modern Civilization: The Cinema of Hayao Miyazaki and GandhiinventionjournalsNessuna valutazione finora

- Muslims On The Margin: A Study of Muslims OBCs in West BengalDocumento6 pagineMuslims On The Margin: A Study of Muslims OBCs in West BengalinventionjournalsNessuna valutazione finora

- An Appraisal of The Current State of Affairs in Nigerian Party PoliticsDocumento7 pagineAn Appraisal of The Current State of Affairs in Nigerian Party PoliticsinventionjournalsNessuna valutazione finora

- The Social Composition of Megaliths in Telangana and Andhra: An Artefactual AnalysisDocumento7 pagineThe Social Composition of Megaliths in Telangana and Andhra: An Artefactual AnalysisinventionjournalsNessuna valutazione finora

- Effects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeria.Documento12 pagineEffects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeria.inventionjournalsNessuna valutazione finora

- The Network Governance in Kasongan Industrial ClusterDocumento7 pagineThe Network Governance in Kasongan Industrial ClusterinventionjournalsNessuna valutazione finora

- Negotiated Masculinities in Contemporary American FictionDocumento5 pagineNegotiated Masculinities in Contemporary American FictioninventionjournalsNessuna valutazione finora

- The Usage and Understanding of Information and Communication Technology On Housewife in Family Welfare Empowerment Organization in Manado CityDocumento10 pagineThe Usage and Understanding of Information and Communication Technology On Housewife in Family Welfare Empowerment Organization in Manado CityinventionjournalsNessuna valutazione finora

- Literary Conviviality and Aesthetic Appreciation of Qasa'id Ashriyyah (Decaodes)Documento5 pagineLiterary Conviviality and Aesthetic Appreciation of Qasa'id Ashriyyah (Decaodes)inventionjournalsNessuna valutazione finora

- Inter-Caste or Inter-Religious Marriages and Honour Related Violence in IndiaDocumento5 pagineInter-Caste or Inter-Religious Marriages and Honour Related Violence in IndiainventionjournalsNessuna valutazione finora

- Student Engagement: A Comparative Analysis of Traditional and Nontradional Students Attending Historically Black Colleges and UniversitiesDocumento12 pagineStudent Engagement: A Comparative Analysis of Traditional and Nontradional Students Attending Historically Black Colleges and Universitiesinventionjournals100% (1)

- The Impact of Leadership On Creativity and InnovationDocumento8 pagineThe Impact of Leadership On Creativity and InnovationinventionjournalsNessuna valutazione finora

- E0606012850 PDFDocumento23 pagineE0606012850 PDFinventionjournalsNessuna valutazione finora

- Effect of P-Delta Due To Different Eccentricities in Tall StructuresDocumento8 pagineEffect of P-Delta Due To Different Eccentricities in Tall StructuresinventionjournalsNessuna valutazione finora

- A Critical Survey of The MahabhartaDocumento2 pagineA Critical Survey of The MahabhartainventionjournalsNessuna valutazione finora

- Non-Linear Analysis of Steel Frames Subjected To Seismic ForceDocumento12 pagineNon-Linear Analysis of Steel Frames Subjected To Seismic ForceinventionjournalsNessuna valutazione finora

- D0606012027 PDFDocumento8 pagineD0606012027 PDFinventionjournalsNessuna valutazione finora

- C0606011419 PDFDocumento6 pagineC0606011419 PDFinventionjournalsNessuna valutazione finora

- F0606015153 PDFDocumento3 pagineF0606015153 PDFinventionjournalsNessuna valutazione finora

- E0606012850 PDFDocumento23 pagineE0606012850 PDFinventionjournalsNessuna valutazione finora

- H0606016570 PDFDocumento6 pagineH0606016570 PDFinventionjournalsNessuna valutazione finora

- C0606011419 PDFDocumento6 pagineC0606011419 PDFinventionjournalsNessuna valutazione finora

- F0606015153 PDFDocumento3 pagineF0606015153 PDFinventionjournalsNessuna valutazione finora

- Non-Linear Analysis of Steel Frames Subjected To Seismic ForceDocumento12 pagineNon-Linear Analysis of Steel Frames Subjected To Seismic ForceinventionjournalsNessuna valutazione finora

- H0606016570 PDFDocumento6 pagineH0606016570 PDFinventionjournalsNessuna valutazione finora

- Development of Nighttime Visibility Assessment System For Road Using A Low Light CameraDocumento5 pagineDevelopment of Nighttime Visibility Assessment System For Road Using A Low Light CamerainventionjournalsNessuna valutazione finora

- D0606012027 PDFDocumento8 pagineD0606012027 PDFinventionjournalsNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5782)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedDocumento3 pagineThe Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedMohd AqdasNessuna valutazione finora

- 048R. PT Multi Teknik Bersama, Proy RS. INDRIYATI-BoyolaliDocumento1 pagina048R. PT Multi Teknik Bersama, Proy RS. INDRIYATI-Boyolaliabdul chalikNessuna valutazione finora

- Evaluating Non-Performing Loans of Bangladeshi BanksDocumento4 pagineEvaluating Non-Performing Loans of Bangladeshi Banksrafiddu89% (9)

- American Economic Association The American Economic ReviewDocumento9 pagineAmerican Economic Association The American Economic ReviewWazzupWorldNessuna valutazione finora

- Petroflo Trading Company: Cash Payment VoucherDocumento10 paginePetroflo Trading Company: Cash Payment Vouchermuhammad ihtishamNessuna valutazione finora

- Tender Document: Airports Authority of IndiaDocumento24 pagineTender Document: Airports Authority of Indiarafikul123Nessuna valutazione finora

- Error CorrectionDocumento2 pagineError CorrectionPaula De RuedaNessuna valutazione finora

- Jun 2007 - AnsDocumento10 pagineJun 2007 - AnsHubbak KhanNessuna valutazione finora

- MATERIALDocumento23 pagineMATERIALPocari OnceNessuna valutazione finora

- Bond Valuation SensitivityDocumento47 pagineBond Valuation SensitivityNino Natradze100% (1)

- BSN Giro Account Statement for Alister MaribenDocumento4 pagineBSN Giro Account Statement for Alister MaribenAlister MaribenNessuna valutazione finora

- How To Calculate NPV (With Downloadable Calculator)Documento7 pagineHow To Calculate NPV (With Downloadable Calculator)Richard Obeng KorantengNessuna valutazione finora

- En Safe Pay HealthDocumento21 pagineEn Safe Pay HealthOCTASYSTEMSNessuna valutazione finora

- CF (MBF131) Exam QDocumento13 pagineCF (MBF131) Exam QSai Set NaingNessuna valutazione finora

- Grade 12 AccountsDocumento6 pagineGrade 12 AccountsJane MalhanganaNessuna valutazione finora

- Option Chain Manual FullDocumento29 pagineOption Chain Manual FullProduction 18-22Nessuna valutazione finora

- 'Spot Rate': Nvestopedia Explains 'Forward Exchange Contract'Documento2 pagine'Spot Rate': Nvestopedia Explains 'Forward Exchange Contract'Smriti KhannaNessuna valutazione finora

- Pledge-Contract Act: Simar MakkarDocumento8 paginePledge-Contract Act: Simar MakkarPearl LalwaniNessuna valutazione finora

- F BirDocumento5 pagineF Birchari cruzmanNessuna valutazione finora

- Death of A Partner Test SPCC 23-24 Accounts - Docx (2)Documento5 pagineDeath of A Partner Test SPCC 23-24 Accounts - Docx (2)Shivansh JaiswalNessuna valutazione finora

- Systems of Public Debt Management in The PhilippinesDocumento60 pagineSystems of Public Debt Management in The PhilippinesEarl Jan SantosNessuna valutazione finora

- Chapter 3 ReceivablesDocumento22 pagineChapter 3 ReceivablesCale Robert RascoNessuna valutazione finora

- Final Draft Philippines Case StudyDocumento43 pagineFinal Draft Philippines Case StudyDarwin SolanoyNessuna valutazione finora

- Receipt 1 PDFDocumento3 pagineReceipt 1 PDFsomenathbasakNessuna valutazione finora

- Wealthcon India Issue 7 Highlights Financial TopicsDocumento112 pagineWealthcon India Issue 7 Highlights Financial TopicsAmol WaghmareNessuna valutazione finora

- Sample Midterm Exam 2 Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkDocumento2 pagineSample Midterm Exam 2 Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkRick CortezNessuna valutazione finora

- Global Finance - Introduction ADocumento268 pagineGlobal Finance - Introduction AfirebirdshockwaveNessuna valutazione finora

- Opportunities and Challenges of E - Payment System in IndiaDocumento9 pagineOpportunities and Challenges of E - Payment System in IndiaSUJITH THELAPURATHNessuna valutazione finora

- Martin Murimi KariukiDocumento2 pagineMartin Murimi KariukiKameneja LeeNessuna valutazione finora

- Money Growth Inflation GuideDocumento2 pagineMoney Growth Inflation GuideQuy Nguyen QuangNessuna valutazione finora