Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Naftogaz: Breach of Covenant & Debt Restructuring?

Caricato da

Alex VedenTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Naftogaz: Breach of Covenant & Debt Restructuring?

Caricato da

Alex VedenCopyright:

Formati disponibili

Emerging Markets

04 September 2009

Naftogaz

Breach of covenant & debt restructuring?

The debt-restructuring terms are still in question, but an indication has

been given. According to the IFRS report, the company is in negotiations to

restructure c. $1.6bn debt to foreign banks and is aiming to complete it

successfully by the end of 2009. The precise details of restructuring are still

unknown but the majority of sources are referring to possible exchange of the

Eurobonds into an issue of 3-5 years longer maturity with a state guarantee.

That said, investors have the following options:

Selling the bond as soon as possible. For any investors who bought the

issue at 40% of par last autumn profit taking looks very reasonable.

Holding the bond and most likely receiving 3-5 years state guaranteed paper

with 10%-13% coupon in exchange for Naftogaz 2009 eurobonds quoted

78.5/86 of par. This option seems quite attractive assuming that the

exchange will be done at par and most likely this is the main reason for the

quite high resistance of the Eurobond to negative news flow. However, we

note there is high execution risk in the deal, as some investors are clearly

thinking of suing the company for default. In addition, so far we have no

clear information that the bonds will be converted at par. On the other side

we still do not rule out the option that Ukrainian government and Naftogaz

are just shaking the boat for political purposes or trying to reduce the market

price of the Eurobond for repurchase. In this case risk-tolerant investors can

benefit.

Buying the bond at some 86% of par. Given the described risks and high

bid-offer spreads we would not recommend increasing positions. We believe

in the current situation the compensation for risk is not sufficient.

Suing the company for default. So far we have not found any clear evidence

of the event of default. One of the possibilities would be to refer to the

material adverse effect clause which exists in certain loan agreements of

Naftogaz, but we assume that this event would be very hard to prove.

Should the bankruptcy procedure be initiated this would be in the interest of

neither the company nor creditors given the weak financial situation in

Naftogaz. This could also cause a potential risk for Naftogaz payments for

Russian gas. We consider this scenario quite unlikely. Acting Minister of

Finance of Ukraine announced that the company is accumulating cash

($667m) to pay for August gas supplies before 7 September.

Naftogaz

Moodys

Caa2 (Negative)

S&P

NR

Fitch

CC (Negative)

Naftogaz 2009 eurobond Performance

100

90

80

70

60

50

40

30

20

PX_ASK

PX_BID

10

0

Se

p08

O

ct

-0

8

N

ov

-0

8

D

ec

-0

8

Ja

n09

Fe

b09

M

ar

-0

9

Ap

r09

M

ay

-0

9

Ju

n09

Ju

l-0

9

Au

g09

Se

p09

Naftogaz of Ukraine has actively been on the news recently after the

company unveiled FY 2008 financials and announced the restructuring of

its external debt. The company hired Credit Suisse as a consultant for

the restructuring and Credit Suisse was in charge of restructuring

Ukraines sovereign debt in 2000. Corlblow, representing the interests of

a group of Russian investors, is trying to escalate the Eurobond

repayment referring to a breach of the financial covenant in the

companys FY 2008 IFRS report. The group states that it would block any

action on the Eurobonds besides a full and timely repayment no later

than 30 September 2009. In July we had already warned that the situation

around the company is worsening. Investors still had a chance to get rid

of the bond at some 78.5% of par when we were writing this report. The

other option would be to wait for restructuring terms, but this would

incur certain risks especially given the currently unstable economic and

political situation in Ukraine.

Source: Bloomberg, Commerzbank Corporates&Markets

Analyst

Marina Vlasenko

+7 495 651 6033

marina.vlasenko@commerzbank.com

For important disclosure information please see pages 3 and 4

cbcm.commerzbank.com

CIS Credit Monitor

The company is not

planning to repurchase or

repay the eurobond

The companys statements have recently been controversial. On 3 September 2009 in the

Ukrainian edition of Kommersant newspaper deputy CEO Igor Didenko stated that the company

has no plan for full or partial repayment or repurchase of the Eurobond and does not have any

cash reserved for the repayment. We recall that previously Naftogaz always insisted that full

repayment of Eurobonds is part of the companys financial plan and therefore $500m is reserved

for the repayment.

Only restructuring is

expected to improve the

financial situation

Naftogaz financial situation was poor in FY2008 and in 2009, however certain efforts have

been made. The company largely suffered from the devaluation of the national currency with FX

losses recorded at UAH 8.7bn. As a result Naftogaz posted a UAH 2bn net loss. The companys

debt almost doubled in the year as it had to attract massive debt resources to cover a UAH

9.9bn operational cash outflow and UAH 3.6bn investment costs. Therefore the debt almost

doubled and Net debt/EBITDA ratio according to our calculations reached 5x. In 2009 the debt

remained high and was reported at UAH 35bn ($4.5bn) in total according to the May audit

commission. In 2009 the cash-flow situation in the company is known to be very tight due to the

lack of demand for gas from local consumers and limited ability to increase prices. The foreign

currency liquidity situation has also been under pressure with payments for gas executed with

regular scandals in the press. However, we have to note that the company managed to secure

UAH 7.3bn in loss compensation from the state budget (UAH 3.7bn already received) and it

received a considerable UAH 18.6bn injection of capital which it is planning to monetise by the

year end. It will also be able to increase prices by 20% as early as this autumn. On top, the

company extended its loan agreements with state banks for UAH 12.6bn from 2009 to 2010 and

is in talks to attract another UAH 11bn. The company believes that only in combination with debt

restructuring will it be able to continue its operations.

We believe that the case of Naftogaz is more a question of willingness than the ability to

pay as $3.3bn IMF tranche was supposed to cover the debt repayment by gas monopoly (See

CIS Notes: Ukraine, the sovereigns ability to pay published on 28 July by Barbara Nestor). Fitch

noted that Naftogaz debt restructuring will not be treated as sovereign default, but will threaten

the countrys perception on the credit market.

Corlblow wants to block

the restructuring and

insists on early repayment

The Action Group of Russian bondholders has recently announced in its blog

(http://www.ukrnaftogaz-default.com) that it will be trying to escalate the repayment of

$500m Naftogaz eurobond due on 30 September 2009. Corlblow company (Belize)

representing the interests of the group holds $112m of the companys $500m Eurobond. The

group states that its analysis of FY 2008 IFRS results points in the direction that Naftogaz was in

breach of the financial covenant under the underlying Standard Bank - Naftogaz loan agreement

as of 31 December 2008. The group refers to paragraph 14.11. "Naftogaz shall not, at any time,

permit Consolidated Net Indebtedness to exceed 75% of Consolidated Net Worth and shall

procure that, of such permitted Consolidated Net Indebtedness, the aggregate Indebtedness of

all Consolidated Subsidiaries shall not be, at any time, be greater than an amount equal to 30%

of Consolidated Net Worth. The group sees the critical ratio at 88.8% and believes that as

Naftogaz has exceeded the critical ratio it is in irreparable default and therefore owes immediate

repayment of the principal and accrued interest. On 2 September the Group asked the Trustee

to initiate the enforcement of early repayment.

We have not identified a

breach of covenant so far

However, we are not sure that the breach of financial covenant has actually taken place.

According to our calculation with respect to definitions given in the Prospectus, we have not

identified a breach of covenant (see Table 1). We see the critical ratio at 63% FYE 2008. In the

IFRS report of Naftogaz for FY 2008 the auditor (Ernst&Young) does not mention any breach of

financial covenant. The auditors refer only to a technical default which occurred due to the failure

of Naftogaz to publish its annual IFRS report within seven months after the reporting period (no

later than 31 July 2009). However, the report was finally submitted to trustee (BNY Mellon) by 1

September, right after the banking holiday, and therefore the technical default case was

resolved. We recall that it is quite typical for Naftogaz to delay IFRS publication and bondholders

have always provided waivers.

04 September 2009

CIS Credit Monitor

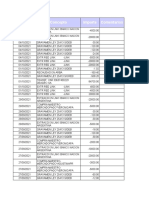

TABLE 1: Naftogaz financials

IFRS, UAHm

Sales

EBITDA*

Net Income

2007

2008

Change %, y-o-y

30,424

53,143

75%

6,020

6,807

13%

2942%

-66

-2,008

Interest Expense

-1,375

-1,383

1%

Total Debt

12,870

36,347

182%

of which: Short term

3,459

19,628

467%

Long-term

9,411

16,719

78%

587

2,604

344%

175%

Cash&Cash Equivalents

Net Debt

12,283

33,743

Equity

56,957

53,200

-7%

108,641

123,617

14%

Total Assets

Operation CF

5,885

-9,885

-268%

-5,803

-3,667

-37%

20%

13%

0%

-4%

Net debt/Equity (Covenant, )***

22%

63%

Debt/EBITDA ()**

2.14

5.34

Net debt/EBITDA (x)

2.04

4.96

CAPEX

Profitability ratios

EBITDA Margin (%)

Net Margin (%)

Debt ratios

EBITDA/Interest expense ()

Debt/Assets ()

4.4

4.9

0.12

0.29

* Adjusted for FX losses and impairment of property, plant and equipment

** Ratios based on EBITDA for the last 12 months

*** Commerzbank estimates

Source: Company Data, Commerzbank Corporates & Markets

04 September 2009

CIS Credit Monitor

This document has been created and published by the Corporates & Markets division of Commerzbank AG, Frankfurt/Main or Commerzbanks group companies

mentioned in the document. Commerzbank Corporates & Markets is the investment banking division of Commerzbank, integrating research, debt, equities, interest

rates and foreign exchange.

The relevant research analyst(s), as named on the front cover of this report, certify that (a) the views expressed in this research report accurately reflect

their personal views about the securities and companies mentioned in this document; and (b) no part of their compensation was, is, or will be directly or

indirectly related to the specific recommendation(s) or views expressed by them contained in this document. The research analyst(s) named on this

report are not registered / qualified as research analysts with FINRA. The research analyst(s) may not be associated persons of Dresdner Kleinwort

Securities LLC and therefore may not be subject to NASD Rule 2711 and incorporated NYSE Rule 472 restrictions on communications with a subject

company, public appearances and trading securities held by a research analyst.

It has not been determined in advance whether and in what intervals this document will be updated. Unless otherwise stated current prices refer to the

most recent trading days closing price.

Disclosures of potential conflicts of interest relating to Commerzbank AG, its affiliates, subsidiaries (together Commerzbank) and its relevant

employees with respect to the issuers, financial instruments and/or securities forming the subject of this document valid as of the end of the month prior

to publication of this document*:

.

*Updating this information may take up to ten days after month end.

Commerzbank Conflict of Interest:

Commerzbanks Policy on Management of Conflicts of Interest in Research (the Guiding Principles to promote the integrity and independence of research) is

available at:

https://cbcm.commerzbank.com/en/site/research/equity/disclaimer/index.jsp. This document complies with the Guiding Principles.

Ratings & Definitions

Explanation in terms of the ratings used are available at: https://cbcm.commerzbank.com/en/site/research/equity/ratingsanddefinitions/index.jsp.

Explanation of valuation parameters and risk assessment

Explanations in terms of the valuation parameters, the valuation system and the associated risks are available at:

https://cbcm.commerzbank.com/en/site/research/equity/disclaimer/ValuationParamatersAndRiskAssessment.jsp.

Disclaimer

This document is for information purposes only and does not take account of the specific circumstances of any recipient. The information contained herein does not

constitute the provision of investment advice. It is not intended to be and should not be construed as a recommendation, offer or solicitation to acquire, or dispose of,

any of the financial instruments and/or securities mentioned in this document and will not form the basis or a part of any contract or commitment whatsoever.

The information in this document is based on data obtained from sources believed by Commerzbank to be reliable and in good faith, but no representations,

guarantees or warranties are made by Commerzbank with regard to accuracy, completeness or suitability of the data. The opinions and estimates contained herein

reflect the current judgement of the author(s) on the data of this document and are subject to change without notice. The opinions do not necessarily correspond to

the opinions of Commerzbank. Commerzbank does not have an obligation to update, modify or amend this document or to otherwise notify a reader thereof in the

event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

The past performance of financial instruments is not indicative of future results. No assurance can be given that any financial instrument or issuer described herein

would yield favourable investment results. Any forecasts or price targets shown for companies and/or securities discussed in this document may not be achieved due

to multiple risk factors including without limitation market volatility, sector volatility, corporate actions, the unavailability of complete and accurate information and/or

the subsequent transpiration that underlying assumptions made by Commerzbank or by other sources relied upon in the document were inapposite.

Neither Commerzbank nor any of its respective directors, officers or employees accepts any responsibility or liability whatsoever for any expense, loss or damages

arising out of or in any way connected with the use of all or any part of this document.

Commerzbank may provide hyperlinks to websites of entities mentioned in this document, however the inclusion of a link does not imply that Commerzbank

endorses, recommends or approves any material on the linked page or accessible from it. Commerzbank does not accept responsibility whatsoever for any such

material, nor for any consequences of its use.

This document is for the use of the addressees only and may not be reproduced, redistributed or passed on to any other person or published, in whole or in part, for

any purpose, without the prior, written consent of Commerzbank. The manner of distributing this document may be restricted by law or regulation in certain countries,

including the United States. Persons into whose possession this document may come are required to inform themselves about and to observe such restrictions.

By accepting this document, a recipient hereof agrees to be bound by the foregoing limitations.

Additional notes to readers in the following countries:

Germany: Commerzbank AG is registered in the Commercial Register at Amtsgericht Frankfurt under the number HRB 32000. Commerzbank AG is supervised by

the German regulator Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin), Lurgiallee 12, 60439 Frankfurt am Main, Germany.

United Kingdom: This document has been issued or approved for issue in the United Kingdom by Commerzbank AG London Branch. Commerzbank AG, London

Branch is authorised by Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin) and subject to limited regulation by the Financial Services Authority. Details on the

extent of our regulation by the Financial Services Authority are available from us on request. This document is directed exclusively to eligible counterparties and

professional clients. It is not directed to retail clients. No persons other than an eligible counterparty or a professional client should read or rely on any information in

this document. Commerzbank AG, London Branch does not deal for or advise or otherwise offer any investment services to retail clients.

United States:

Commerzbank Capital Markets Corporation (CCMC): This document has been approved for distribution in the US under applicable US law by CCMC, a wholly

owned subsidiary of Commerzbank and a US registered broker-dealer. Any transaction by US persons must be effected with CCMC. Under applicable US law;

information regarding clients of CCMC may be distributed to other companies within the Commerzbank group.

Dresdner Kleinwort Securities LLC: Where this document has been approved for distribution in the US, such distribution is by either: (i) Dresdner Kleinwort

Securities LLC; or (ii) other Commerzbank companies to US Institutional Investors and Major US Institutional Investors only; or (iii) if the document relates to non-US

exchange traded futures, Dresdner Kleinwort Limited. Dresdner Kleinwort Securities LLC, or in case (iii) Dresdner Kleinwort Limited, accepts responsibility for this

document in the US. Any US persons wishing to effect a transaction through Commerzbank group (a) in any security mentioned in this document may only do so

through Dresdner Kleinwort Securities LLC, telephone: (+1 212) 429 2000; or (b) in a non-US exchange traded future may only do so through Dresdner Kleinwort

Limited, telephone: (+ 11 44) 20 7623 8000; or (c) in a banking product may only do so through Commerzbank AG New York Branch, telephone (+1 212) 969 2700.

4 September 2009

CIS Credit Monitor

European Economic Area: Where this document has been produced by a legal entity outside of the EEA, the document has been re-issued by Commerzbank AG,

London Branch for distribution into the EEA.

Singapore: This document is being distributed for Commerzbank in Singapore by Commerzbank AG, Singapore Branch purely as a resource and for general

informational purposes only, and is intended for general circulation. Accordingly, this research document does not take into account the specific investment

objectives, financial situation, or needs of any particular person and is exempted from the same by Regulation 34 of the Financial Advisers Regulations ("FAR") (as

required under Section 27 of the Financial Advisers Act (Cap. 110) of Singapore ("FAA")).

Hong Kong: This document is being distributed in Hong Kong by Commerzbank AG, London Branch. Unless permitted to do so by the securities laws of Hong

Kong, no person may issue or have in its possession for the purposes of issue this document, whether in Hong Kong or elsewhere, which is directed at, or the

contents of which are likely to be accessed or read by, the public in Hong Kong, other than with respect to the securities referred to in this document which are or are

intended to be disposed of only to persons outside Hong Kong or only to "professional investors" within the meaning of the Securities and Futures Ordinance

(Cap.571) of Hong Kong and any rules made thereunder, and to persons whose ordinary business is to buy and sell shares or debentures.

Japan: Commerzbank AG, Tokyo Branch is responsible for the distribution of Research in Japan. Commerzbank AG, Tokyo Branch is regulated by the Japanese

Financial Services Agency (FSA).

Australia: Commerzbank AG does not hold an Australian financial services licence. This document is being distributed in Australia to wholesale customers pursuant

to an Australian financial services licence exemption for Commerzbank AG under Class Order 04/1313. Commerzbank AG is regulated by Bundesanstalt fr

Finanzdienstleistungsaufsicht (BaFin) under the laws of Germany which differ from Australian laws.

Commerzbank AG 2009. All rights reserved. version 9.09

Commerzbank Corporates & Markets

Frankfurt

London

New York

Commerzbank AG

Commerzbank AG

London Branch

60 Gracechurch Street,

London

EC3V 0HR

Tel: + 44 20 7653 7000

Fax: + 44 20 7653 7400

Commerzbank Capital

Markets Corp.

2 World Financial Center, 31st floor

New York,

NY 10281-1050

Tel: +1 212 703 4000

Fax: +1 212 703 4201

DLZ - Gebude 2, Hndlerhaus

Mainzer Landstrae 153

60327 Frankfurt

4 September 2009

Potrebbero piacerti anche

- Vost Ar08engDocumento82 pagineVost Ar08engLeBron JamesNessuna valutazione finora

- TF WorkDocumento11 pagineTF WorkMay Jutamanee LeangvichajalearnNessuna valutazione finora

- Commerzbank ForecastDocumento16 pagineCommerzbank ForecastgordjuNessuna valutazione finora

- JPM Global Fixed Income 2012-03-17 810381Documento72 pagineJPM Global Fixed Income 2012-03-17 810381deepdish7Nessuna valutazione finora

- F3 Sept 2011 AnswersDocumento13 pagineF3 Sept 2011 AnswersJerome ChettyNessuna valutazione finora

- BNP Informe ArgDocumento8 pagineBNP Informe ArgfacundoenNessuna valutazione finora

- Pro Quest ExportDocumento6 paginePro Quest ExportIB_mskNessuna valutazione finora

- Banks Break Ranks To Deal With Stick As Saipem Rights Goes WrongDocumento13 pagineBanks Break Ranks To Deal With Stick As Saipem Rights Goes WrongpierrefrancNessuna valutazione finora

- Equity Strategy: The 5 Top Picks For FebruaryDocumento26 pagineEquity Strategy: The 5 Top Picks For Februarymwrolim_01Nessuna valutazione finora

- Joint World Bank/IMF Debt Sustainability AnalysisDocumento13 pagineJoint World Bank/IMF Debt Sustainability AnalysisAlex BaptistaNessuna valutazione finora

- Eurozona 02.10.12 (Dokument V AJ)Documento5 pagineEurozona 02.10.12 (Dokument V AJ)Ivana LeváNessuna valutazione finora

- Oceanis Q3 Market ReportDocumento12 pagineOceanis Q3 Market ReportIneffAble MeloDyNessuna valutazione finora

- Assignment 2 - Group D4Documento6 pagineAssignment 2 - Group D4Anushree PareekNessuna valutazione finora

- PHPWH DGR 3Documento5 paginePHPWH DGR 3fred607Nessuna valutazione finora

- Moody's TitlosDocumento6 pagineMoody's TitlosVasilis TsekourasNessuna valutazione finora

- Sunares TSR 04 2012 EnglishDocumento3 pagineSunares TSR 04 2012 EnglishUdo SutterlütyNessuna valutazione finora

- HVB On Q3 FY 2010Documento7 pagineHVB On Q3 FY 2010Felix FischerNessuna valutazione finora

- GSL Investment Memo and ModelDocumento12 pagineGSL Investment Memo and ModelMarcos CostantiniNessuna valutazione finora

- ABS Insight - April 2011Documento2 pagineABS Insight - April 2011UpnaPunjabNessuna valutazione finora

- Contrarian CapDocumento8 pagineContrarian CapjamesbrentsmithNessuna valutazione finora

- Topical Appendix: Recent Developments in Financial MarketsDocumento10 pagineTopical Appendix: Recent Developments in Financial MarketsOlgutza DiamondNessuna valutazione finora

- Fixing The Euro ZoneDocumento11 pagineFixing The Euro ZoneAlexandra DarmanNessuna valutazione finora

- Eurozone: Outlook For Financial ServicesDocumento20 pagineEurozone: Outlook For Financial ServicesEuglena VerdeNessuna valutazione finora

- Pe Report Oct 2009Documento4 paginePe Report Oct 2009aacmasterblasterNessuna valutazione finora

- Anglo Interim Report 2009Documento64 pagineAnglo Interim Report 2009grumpyfeckerNessuna valutazione finora

- Charity Appeal Reaches 200,000: Rating Agency Drops Eurozone BombshellDocumento32 pagineCharity Appeal Reaches 200,000: Rating Agency Drops Eurozone BombshellCity A.M.Nessuna valutazione finora

- A Practitioner's Guide To European Leveraged Finance: First EditionDocumento27 pagineA Practitioner's Guide To European Leveraged Finance: First Editionioko iokovNessuna valutazione finora

- February 24, 2014 Fixed Income Market Review: Pham Luu Hung (MR.) Associate DirectorDocumento6 pagineFebruary 24, 2014 Fixed Income Market Review: Pham Luu Hung (MR.) Associate DirectorChrispy DuckNessuna valutazione finora

- Ukraine's Debt Restructuring: Ukraine's Deal With Its Creditors Is Less Impressive Than It AppearsDocumento2 pagineUkraine's Debt Restructuring: Ukraine's Deal With Its Creditors Is Less Impressive Than It AppearsАня РалеваNessuna valutazione finora

- Indebs Est EuropeDocumento23 pagineIndebs Est EuropeMonica OneaNessuna valutazione finora

- Strategy Radar - 2012 - 1109 XX High Level Snapshot On ReinsuranceDocumento2 pagineStrategy Radar - 2012 - 1109 XX High Level Snapshot On ReinsuranceStrategicInnovationNessuna valutazione finora

- BridgewaterDocumento17 pagineBridgewaterMatthew Cain100% (2)

- TD BANK JUN 28 TD Economic G 20 Summit ReviewDocumento3 pagineTD BANK JUN 28 TD Economic G 20 Summit ReviewMiir ViirNessuna valutazione finora

- Legal Aspects of The Debt StockDocumento6 pagineLegal Aspects of The Debt StockMajchi1991Nessuna valutazione finora

- The Greek Public Debt Misery The Right Cure Should Follow The Right Diagnosis ZDDocumento2 pagineThe Greek Public Debt Misery The Right Cure Should Follow The Right Diagnosis ZDBruegelNessuna valutazione finora

- SPEX Issue 8Documento10 pagineSPEX Issue 8SMU Political-Economics Exchange (SPEX)Nessuna valutazione finora

- Barclays - The Emerging Markets Quarterly - Vietnam - Sep 2012Documento3 pagineBarclays - The Emerging Markets Quarterly - Vietnam - Sep 2012SIVVA2Nessuna valutazione finora

- Fund Managers Report: July 2011Documento13 pagineFund Managers Report: July 2011Huzaifa MarviNessuna valutazione finora

- The Pensford Letter - 3.12.12Documento5 pagineThe Pensford Letter - 3.12.12Pensford FinancialNessuna valutazione finora

- Deutsche Bank - Five Years After Subprime: Lending Trends in Europe and The USDocumento2 pagineDeutsche Bank - Five Years After Subprime: Lending Trends in Europe and The USkentselveNessuna valutazione finora

- Bopcom 11/17Documento10 pagineBopcom 11/17LORD. JAPHET NDONGONessuna valutazione finora

- Corsair Capital Q3 2010Documento5 pagineCorsair Capital Q3 2010tigerjcNessuna valutazione finora

- Eurozone Forecast Summer2011 GreeceDocumento8 pagineEurozone Forecast Summer2011 GreeceBenin Uthup ThomasNessuna valutazione finora

- Moment - of - Truth - Martn WolfDocumento3 pagineMoment - of - Truth - Martn Wolf3bandhuNessuna valutazione finora

- CanadianInvestors - January 3rd, 2013Documento7 pagineCanadianInvestors - January 3rd, 2013Adrian_Michael_858Nessuna valutazione finora

- Week in Focus: Sovereign Debt Crisis: What Can Be Done If It Escalates?Documento16 pagineWeek in Focus: Sovereign Debt Crisis: What Can Be Done If It Escalates?timurrsNessuna valutazione finora

- Deutsche BraueraiDocumento5 pagineDeutsche BraueraiSilvia CoranNessuna valutazione finora

- Wikborg Global Offshore Projects DEC15Documento13 pagineWikborg Global Offshore Projects DEC15sam ignarskiNessuna valutazione finora

- The European Redemption Pact: An Illustrative GuideDocumento23 pagineThe European Redemption Pact: An Illustrative Guidecottard2013Nessuna valutazione finora

- Economist Insights 2013 07 29Documento2 pagineEconomist Insights 2013 07 29buyanalystlondonNessuna valutazione finora

- Market Outlook Market Outlook: Dealer's DiaryDocumento14 pagineMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Managing Director: Charles H. Da ADocumento3 pagineManaging Director: Charles H. Da Aakis7415Nessuna valutazione finora

- OSHEAcreditjune 22Documento2 pagineOSHEAcreditjune 22irisheconomy100% (2)

- Cityam 2011-10-20Documento36 pagineCityam 2011-10-20City A.M.Nessuna valutazione finora

- Inside Credit: European Corporate, Sovereign, and Public Agency Issuance Surges in September, Ahead of Potential VolatilityDocumento9 pagineInside Credit: European Corporate, Sovereign, and Public Agency Issuance Surges in September, Ahead of Potential Volatilityapi-228714775Nessuna valutazione finora

- Phpvvu NG PDocumento5 paginePhpvvu NG Pfred607Nessuna valutazione finora

- Lloyds TSB Bank PLC: Interim Management Report For The Half-Year To 30 June 2009Documento31 pagineLloyds TSB Bank PLC: Interim Management Report For The Half-Year To 30 June 2009saxobobNessuna valutazione finora

- The effects of investment regulations on pension funds performance in BrazilDa EverandThe effects of investment regulations on pension funds performance in BrazilNessuna valutazione finora

- The Impending Monetary Revolution, the Dollar and GoldDa EverandThe Impending Monetary Revolution, the Dollar and GoldNessuna valutazione finora

- SSRN Id686430Documento47 pagineSSRN Id686430Alex VedenNessuna valutazione finora

- energyXXI PDFDocumento122 pagineenergyXXI PDFAlex VedenNessuna valutazione finora

- Gazprom Investor Day Presentation 05-02-09Documento48 pagineGazprom Investor Day Presentation 05-02-09Alex VedenNessuna valutazione finora

- energyXXI PDFDocumento122 pagineenergyXXI PDFAlex VedenNessuna valutazione finora

- CLL 2010 08 PresentationDocumento55 pagineCLL 2010 08 PresentationAlex VedenNessuna valutazione finora

- 2008 Refinary in UkrDocumento6 pagine2008 Refinary in UkrAlex VedenNessuna valutazione finora

- 2010 Gas Electricity MarketsDocumento163 pagine2010 Gas Electricity MarketsAlex VedenNessuna valutazione finora

- 2006 Gas Market in UkrDocumento30 pagine2006 Gas Market in UkrAlex VedenNessuna valutazione finora

- CRS Report For Congress: World Oil Demand and Its Effect On Oil PricesDocumento23 pagineCRS Report For Congress: World Oil Demand and Its Effect On Oil PricesAli Ahmed AliNessuna valutazione finora

- Annual Energy Outlook 2010 With Projections To 2035Documento349 pagineAnnual Energy Outlook 2010 With Projections To 2035pavilicNessuna valutazione finora

- Cub Energy Reverse TakeoverDocumento331 pagineCub Energy Reverse TakeoverAlex VedenNessuna valutazione finora

- Report Diagnostic Analysis 310715 EngDocumento63 pagineReport Diagnostic Analysis 310715 EngAlex VedenNessuna valutazione finora

- TSX Guide To The Capital Pool Company Program 2015-05-26 enDocumento4 pagineTSX Guide To The Capital Pool Company Program 2015-05-26 enAlex VedenNessuna valutazione finora

- Fail To PrepareDocumento19 pagineFail To PrepareAlex VedenNessuna valutazione finora

- TSX Guide To The Capital Pool Company Program 2015-05-26 enDocumento4 pagineTSX Guide To The Capital Pool Company Program 2015-05-26 enAlex VedenNessuna valutazione finora

- Political Scenarios For Ukraine Aug'2014Documento8 paginePolitical Scenarios For Ukraine Aug'2014Alex VedenNessuna valutazione finora

- 75 Common and Uncommon Errors in Valuation!!!Documento0 pagine75 Common and Uncommon Errors in Valuation!!!Alex VedenNessuna valutazione finora

- Fail To PrepareDocumento19 pagineFail To PrepareAlex VedenNessuna valutazione finora

- Vietnam Financial Structure: The Overview of Direct and Indirect Finance in Viet Nam 1Documento5 pagineVietnam Financial Structure: The Overview of Direct and Indirect Finance in Viet Nam 1Hiền NguyễnNessuna valutazione finora

- Financial Secrets Are Debt Free - Seminar 1 - Introduction To Natural LawDocumento110 pagineFinancial Secrets Are Debt Free - Seminar 1 - Introduction To Natural LawJ.D Worldclass90% (10)

- BIN Checker, Online BIN List Lookup From Free BIN DatabaseDocumento1 paginaBIN Checker, Online BIN List Lookup From Free BIN DatabaseROMEO PEPNIKUNessuna valutazione finora

- Analogy ParagraphDocumento1 paginaAnalogy ParagraphAllister Lloyd Ching100% (4)

- Movimientos HistoricosDocumento22 pagineMovimientos HistoricosVerónica RodNessuna valutazione finora

- EcbDocumento210 pagineEcbhnkyNessuna valutazione finora

- Economics 2 XiiDocumento17 pagineEconomics 2 Xiiapi-3703686Nessuna valutazione finora

- PaperDocumento4 paginePaperamirNessuna valutazione finora

- IT Head DataDocumento2 pagineIT Head DataTejas SuryawanshiNessuna valutazione finora

- Annual Report 2017 PDFDocumento216 pagineAnnual Report 2017 PDFemmanuelNessuna valutazione finora

- Digest Revised: Au Amwao Full DescriptionDocumento1 paginaDigest Revised: Au Amwao Full DescriptionMackie SaidNessuna valutazione finora

- Setting Credit LimitDocumento5 pagineSetting Credit LimitYuuna Hoshino100% (1)

- Financial Analysis Through RatiosDocumento8 pagineFinancial Analysis Through RatiosChandramouli KolavasiNessuna valutazione finora

- T AccountsDocumento4 pagineT AccountsMaks MaksNessuna valutazione finora

- Johor Corp 2008Documento209 pagineJohor Corp 2008khairulkamarudinNessuna valutazione finora

- Project Fin323Documento22 pagineProject Fin323Alwasat ComputerNessuna valutazione finora

- EMV OverviewDocumento51 pagineEMV OverviewManish ChofflaNessuna valutazione finora

- Securitisation of Financial AssetsDocumento27 pagineSecuritisation of Financial Assetsvahid100% (3)

- Solution To Tutorial 6Documento4 pagineSolution To Tutorial 6Yuki TanNessuna valutazione finora

- 8 Money HacksDocumento5 pagine8 Money Hacksmr.sharma1192% (13)

- Philippine National Bank v. Intermediate Appellate CourtDocumento4 paginePhilippine National Bank v. Intermediate Appellate CourtryiotatlawNessuna valutazione finora

- Resolutions SAC 2ndeditionDocumento193 pagineResolutions SAC 2ndeditionWan Ruschdey100% (1)

- 1 2015 Year in Review (Colum 2015)Documento135 pagine1 2015 Year in Review (Colum 2015)LurzizareNessuna valutazione finora

- Recent Trends in BankingDocumento7 pagineRecent Trends in BankingArun KCNessuna valutazione finora

- Kalpana Bisen Paper On Dress CodeDocumento19 pagineKalpana Bisen Paper On Dress CodeKalpana BisenNessuna valutazione finora

- Chargeback Dispute Form For Debit Card Transaction PDFDocumento1 paginaChargeback Dispute Form For Debit Card Transaction PDFManirul Sarkar50% (2)

- Consultation Paper On The ITS On Supervisory ReportingDocumento69 pagineConsultation Paper On The ITS On Supervisory ReportingGeanina DavidNessuna valutazione finora

- International Introduction To Securities & Investment Ed15-209-250-3Documento1 paginaInternational Introduction To Securities & Investment Ed15-209-250-3Vijaykumar HegdeNessuna valutazione finora

- Fi32rk14 LR PDFDocumento44 pagineFi32rk14 LR PDFGina JamesNessuna valutazione finora

- Project Presentation: Token Sale ProposalDocumento18 pagineProject Presentation: Token Sale ProposalyogiNessuna valutazione finora