Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Additional Income Tax Quizzer

Caricato da

Jolina ManceraCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Additional Income Tax Quizzer

Caricato da

Jolina ManceraCopyright:

Formati disponibili

TAXATION

Additional Quizzer

Income Taxation

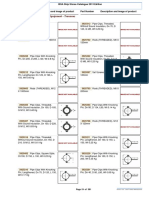

1.

ATTY. MACMOD, C.P.A.

2017-Edition

Mr. Cortez, Filipino, single, has the following transactions

for the current year:

Business gross income

P200,000

Allowable deductions (including bad

debts of P10k, only was written

off)

60,000

Loss from gambling

10,000

Other transactions:

Selling price, partnership interest

100,000

Investment in partnership in 2005

20,000

Gain on sale of capital asset held for 5

years

10,000

Loss on sale of capital asset held for

10 months

12,000

Loss on account of failure to exercise 3

month option to buy property

2,000

Liquidating dividend from Z Co.

150,000

Cost of investment in Z Co. in 2014

60,000

4.

Gross sales

Sales returns and allowances

Cost of goods sold

Gain on sale of capital assets held for 7

months

Loss on sale of capital assets held for

15 months

Interest income (BPI)

Allowable business expenses

Income tax due is:

a. P8,800

b. P 7,500

2.

c. P106,000

d. P101,000

7.

On January 1, 2015, lessor leased a lot with a building

thereon for a period of 10 years. It was agreed that the

lessee will pay the following:

a) Rent of P240,000 per year

b) Fire Insurance premium in the building of P16,000 per

year

c) Real property tax of P10,000 per year

Lessee will also construct a warehouse on the land at

a cost P3,600,000 with a useful life of 10 years

completed on June 30, 2017, which shall belong to

the lessor at the end of the lease.

440,000

60,000

36,000

96,000

Taxpayer, individual, married but legally separated,

supporting his mother, has the following transactions for

the current year:

Sales

Cost of sales

Operating expenses

Interest income from BDO

Interest Expense

Other transactions:

a. Sale of office equipment held for 5

years:

Selling price

Cost

Accumulated deprecation

b. Sale of family van held for 3 years:

Selling price

Cost

P2,000,000

1,150,000

560,000

10,000

20,000

100,000

120,000

80,000

300,000

210,000

c. Sale of family car held for 18 months:

Selling price

480,000

Cost

500,000

Taxpayer will report a taxable income of:

a. P305,000

c. P360,000

b. P335,000

d. P318,300

Page 2 of 3

www.prtc.com.ph

c. P12,000

d. P9,625

Lito an official of ABC Corporation asked for an earlier

retirement because he was emigrating to Canada, he was

paid to P2M separation pay in recognition of his valuable

services to the corporation plus P300,000 13 th month pay,

Nelson another official was separated due to his failing

eyesight. He was given P1M separation pay. Rico was

separated for violating company rules but was given

P300,000 separation pay. Ben opted to retire at 55 years

old after working for 10 years in the company. He received

P1M. The total income subject to withholding tax on the

above payment is :

a. P 2,600,000

c. P3,300,000

b. P2,270,00

d. P2,518,000

The taxpayer will report a taxable net income of:

a. P472,000

c. P445,400

b. P480,400

d. P278,400

3.

5,000

50,000

580,000

6.

P200,000

1,440,000

660,000

12,000

42,000

10,000

On October 1of current year, Dragon Girl Co. leased a

residential house for the use of one of its executives, Mr.

Kurukuru, a special alien employee. The rent agreed upon

was P170,000 per month. The FBT monthly is:

a. P 54,400

c. P40,000

b. P524,000

d. P15,000

A Taxpayer, married with a 2 year old child, has the

following transactions for the current year:

Salaries received as employee

Sales

Cost of goods sold

Deductions:

Operating Expenses

Loss due to fire (properly reported)

Contributions:

To a government priority project in

education

To Quiapo church

Other income:

Rent

Capital gain from sale of CAR Family

held for 3 years

P1,100,000

200,000

300,000

5.

Note: Last year, Mr. Cortez had a net income of P65,000 and a

net capital loss of P92,000.

The taxable net income is:

a. P196,000

b. P141,000

ABS Corporation, a domestic corporation now on its 5th

year of operation provided the following data:

The Lessor shall report for year 2017, as income from

lease the total amount of:

a. P 336,000

c. P 326,000

b. P 366,000

d. P 1,296,000

8.

Based on the above problem the lessee can deduct the

total rental expenses of:

a. P 516,000

c. P 636,000

b. P 506,000

d. P 756,000

9.

Mr. X insured himself for P1M. After several months he

died when he was able to pay a total amount of P100,000.

His beneficiary, his brother received the P1M insurance

proceeds. Mr. Y on the other hand insured himself for

P1M. After 20 years he survived the insurance policy and

received return on his premiums. He received P1M from

the insurance company although he was only able to pay

P700,000.

The total income subject to tax is _______________?

a. P 300,000

c. P 1,200,000

b. P 1,300,000

d. P 900,000

10. A tax payer was a victim of a vehicular accident who filed

a case against the offender. The court awarded him the

following;

P1.502A

a.

Actual damages for expenses paid in

the hospital

P 200,000

b. Attorneys fee he paid to his

lawyer

50,000

c. Actual damages for lost arm

250,000

d. Moral damages

100,000

e. Exemplary damages

100,000

f. Salaries for 6 months when the tax

payer was in theHospital, absent

from his job w/ a monthly salary of P 50,000

300,000

The total income subject to tax is _______________?

a. P 300,000

c. P 700,000

b. P 500,000

d. P 100,000

11. A tax payer provided the following data

Sales

Sales returns & discounts

COGS

Operating expenses

P

P

P

P

12M

2M

4M

2M

Using Optional Standard Deduction, the taxable net

income

if

the

taxpayer

is

a

corporation

is

_______________.

a. P 3,600,000

c. P 5,900,000

b. P 5,850,000

d. P 6,000,000

15. His Taxable Net Income is ________________

a. P350,000

c. P340,000

b.

320,000

d. P300,000

16. If he has no commission income, his Taxable Net Income

is ___________

a. P150,000

c. P120,000

b.

270,000

d. P100,000

17. If he has no commission income & professional income,

his Taxable Net Income is_______________

a. P70,000

c. P120,000

b.

50,000

d. P 0

18. Which is a taxable fringe benefit?

a. those given to rank and file employees

b. contribution of employer to health and hospitalization

and vacation expenses of employee

c. those exempted under special and laws.

d. De minimis benefits

12. Based on the same data above, using OSD, the taxable

net income if the taxpayer is individual, married w/5

minor children is ____________________.

a. P 5,900,000

c. P 3,600,000

b. P 5,100,000

d. P 5,050,000

19. Which of the following statements is incorrect?

a. To be subject to final tax passive income must be

from Philippine sources.

b. An income which is subject to final tax is excluded

from the computation of income subject to Section 24

(A).

c. Lotto winnings in foreign countries are exempt from

income taxation in the Philippines.

d. An income which is subject to non creditable

withholding tax is excluded in the computation of

income subject to Section 24 (A).

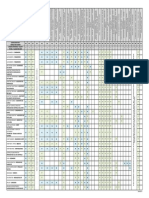

13. Mr. X provided the following data:

Salaries

Fringe benefits as Vice Pres.

Rice Subsidy for 1 yr(P2k x 12 mos.)

13th month pay& other bonuses

Representation and travel allowance

(RATA)

Int. inc. from BPI (30% longterm)

Royalty income (10% books)

20. Which of the following statements is not correct?

a. Interest income from long term deposit is exempt

from income tax.

b. Winnings from Philippine Charity Sweepstakes are

exempt from income tax.

c. Royalties on books, literary works and musical

composition are subject to 10% creditable withholding

tax.

d. A prize of P10,000 is subject tobasic tax.

P450,000

75,000

24,000

100,000

20,000

200,000

100,000

The salaries are net ofP50,000 withholding tax but gross

of P10,000 SSS, union dues &Pag-ibig contributions. Mr.

Mr. X is married with 5 minor children.

The Taxable Net Income is _____________.

a. P364,000

c. P664,000

b. P314,000

d. P382,000

14. The Final Tax (total) on Passive Income

a. P47,000

c. P50,000

b. P60,000

d. P48,000

Mr. Bayabas provided the following data.

Salary for the year (P10,000 for 12

months, MWE-P10,000/mo.)

Overtime pay

Hazard pay

Holiday pay

Commission income as additional

compensation income from the same

company

Professional income as dentist

Prof. expenses

P120,000

20,000

20,000

10,000

50,000

250,000

50,000

Tax payer is single with legally adopted child.

Page 3 of 3

www.prtc.com.ph

21. Which of the following income of an individual taxpayer is

subject to final tax?

a. P10,000 prize in Manila won by a resident citizen.

b. Dividend received by a resident citizen from a resident

corporation.

c. Shares in the net income of a general professional

partnership received by a resident alien.

d. Dividend received by a non-resident alien from a

domestic corporation.

22. A Corp. prov. the following data:

Sales

P10,000,000

COGS

4,000,000

Other income

Rent

1,000,000

Int. Income, BPI

2,000,000

Royalty Income

500,000

Oper. Exp.

6,900,000

Compute:

a. NIT

b. MCIT

c. Income tax due excluding

Final taxes

d. Total taxes due

Including final taxes

e. Is your answer for Income Tax due (c)

Same if the Corp. is a hospital? Why?

P1.502A

Potrebbero piacerti anche

- Costing of Service SectorDocumento42 pagineCosting of Service SectorSaumya AllapartiNessuna valutazione finora

- Introduction To AccountingDocumento51 pagineIntroduction To Accountingmonkey bean100% (1)

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityDa EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNessuna valutazione finora

- Audit For Non Profit Organisation Assignment.Documento3 pagineAudit For Non Profit Organisation Assignment.Tumaini EdwardNessuna valutazione finora

- Financial Accounting I Final Practice Exam 1Documento14 pagineFinancial Accounting I Final Practice Exam 1misterwaterr100% (1)

- Finance Chart of AccountsDocumento1 paginaFinance Chart of AccountscahyoNessuna valutazione finora

- Full Cost Accounting: Dela Cruz, Roma Elaine Aguila, Jean Ira Bucad, RoceloDocumento72 pagineFull Cost Accounting: Dela Cruz, Roma Elaine Aguila, Jean Ira Bucad, RoceloJean Ira Gasgonia Aguila100% (1)

- Value Added Tax - Part 1: - The Regular Output VATDocumento25 pagineValue Added Tax - Part 1: - The Regular Output VATAjey MendiolaNessuna valutazione finora

- Fundamental and Technical AnalysisDocumento17 pagineFundamental and Technical AnalysisdhanendrapardhiNessuna valutazione finora

- Case 9-30 Master Budget With Supporting SchedulesDocumento2 pagineCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- BookkeepingDocumento34 pagineBookkeepingABBYGAIL DAVIDNessuna valutazione finora

- Financial Accounting I Final Practice Exam 1 - SolutionDocumento5 pagineFinancial Accounting I Final Practice Exam 1 - SolutionmisterwaterrNessuna valutazione finora

- Tax 2 IntroductionDocumento16 pagineTax 2 IntroductionRizzle RabadillaNessuna valutazione finora

- Advanced Accounting Chapter 2 Comprehensive ProblemDocumento4 pagineAdvanced Accounting Chapter 2 Comprehensive ProblemmisterwaterrNessuna valutazione finora

- Financial Accounting Part 3Documento24 pagineFinancial Accounting Part 3dannydolyNessuna valutazione finora

- Foreign Currency Derivatives (Chapter 8) : Forwards, Futures and OptionsDocumento52 pagineForeign Currency Derivatives (Chapter 8) : Forwards, Futures and Optionsarmando.chappell1005Nessuna valutazione finora

- Break-Even Analysis/Cvp AnalysisDocumento41 pagineBreak-Even Analysis/Cvp AnalysisMehwish ziadNessuna valutazione finora

- BS in Accounting Technology in The PhilippinesDocumento12 pagineBS in Accounting Technology in The PhilippinesJan Mikko U. BautistaNessuna valutazione finora

- Chapter 4 DerivativesDocumento38 pagineChapter 4 DerivativesTamrat KindeNessuna valutazione finora

- CFI Team 05072022 - Income StatementDocumento8 pagineCFI Team 05072022 - Income StatementDR WONDERS PIBOWEINessuna valutazione finora

- The Balanced Scorecard: A Tool To Implement StrategyDocumento39 pagineThe Balanced Scorecard: A Tool To Implement StrategyAilene QuintoNessuna valutazione finora

- IFRS 16 LeaseDocumento64 pagineIFRS 16 LeaseTanvir HossainNessuna valutazione finora

- MF Working CapitalDocumento81 pagineMF Working CapitalJansen Alonzo BordeyNessuna valutazione finora

- IM Accounting Fundamentals Service BusinessDocumento185 pagineIM Accounting Fundamentals Service BusinessjeffreysonbelenNessuna valutazione finora

- ACC-553 Federal Taxation Midterm Exam (Keller)Documento9 pagineACC-553 Federal Taxation Midterm Exam (Keller)robertmoreno0% (1)

- Module 2 Conceptual Frameworks and Accounting Standards PDFDocumento7 pagineModule 2 Conceptual Frameworks and Accounting Standards PDFJonabelle DalesNessuna valutazione finora

- Accounting Sample 1Documento6 pagineAccounting Sample 1AmnaNessuna valutazione finora

- Cost Volume Profit Analysis Review NotesDocumento17 pagineCost Volume Profit Analysis Review NotesAlexis Kaye DayagNessuna valutazione finora

- Financial Statement Presentation, Closing The Books and Financial AnalysisDocumento8 pagineFinancial Statement Presentation, Closing The Books and Financial AnalysisShaila MarceloNessuna valutazione finora

- Cfas Paa 1 ReviewerDocumento44 pagineCfas Paa 1 ReviewerGleah Mae GonzagaNessuna valutazione finora

- Clip 12Documento2 pagineClip 12ATLASNessuna valutazione finora

- Service Organization Segment ReportingDocumento6 pagineService Organization Segment ReportingAudrey LouelleNessuna valutazione finora

- FHV - Inventories PPT (10032020)Documento60 pagineFHV - Inventories PPT (10032020)Kristine TiuNessuna valutazione finora

- HO No. 3 - Business TaxDocumento4 pagineHO No. 3 - Business TaxMariella Louise CatacutanNessuna valutazione finora

- Auditing QuestionsDocumento10 pagineAuditing Questionssalva8983Nessuna valutazione finora

- Business CombinationDocumento21 pagineBusiness CombinationSamNessuna valutazione finora

- Acc7 Perf MeasuresDocumento7 pagineAcc7 Perf MeasuresZerjo CantalejoNessuna valutazione finora

- Workshop On Deferred TaxationDocumento21 pagineWorkshop On Deferred TaxationYusuf KhanNessuna valutazione finora

- Impairment of AssetsDocumento19 pagineImpairment of AssetsTareq SojolNessuna valutazione finora

- Percent of Sales Method and ROE Answer: D Diff: TDocumento1 paginaPercent of Sales Method and ROE Answer: D Diff: TKaye JavellanaNessuna valutazione finora

- 41 DepletionDocumento5 pagine41 DepletionjsemlpzNessuna valutazione finora

- Ch01 fm202 Finance Small Business EnterpriseDocumento9 pagineCh01 fm202 Finance Small Business Enterprisepratik_483Nessuna valutazione finora

- Management Reporting A Complete Guide - 2019 EditionDa EverandManagement Reporting A Complete Guide - 2019 EditionNessuna valutazione finora

- Toa Interim ReportingDocumento17 pagineToa Interim ReportingEmmanuel SarmientoNessuna valutazione finora

- Palawan State University - BS Petroleum Engineering CurriculumDocumento3 paginePalawan State University - BS Petroleum Engineering CurriculumPaolo SalvatierraNessuna valutazione finora

- What Is Ratio AnalysisDocumento19 pagineWhat Is Ratio AnalysisMarie Frances Sayson100% (1)

- Lecture 4 - Cost Quality (Extra Notes) - With AnswerDocumento7 pagineLecture 4 - Cost Quality (Extra Notes) - With AnswerHafizah Mat NawiNessuna valutazione finora

- 13Documento63 pagine13amysilverbergNessuna valutazione finora

- Sample Exam 2Documento16 pagineSample Exam 2Zenni T XinNessuna valutazione finora

- 2006 THE CPA LICENSURE EXAMINATION SYLLABUS For Audit Theory and Audit ProblemsDocumento5 pagine2006 THE CPA LICENSURE EXAMINATION SYLLABUS For Audit Theory and Audit ProblemsNina Almonidovar-MacutayNessuna valutazione finora

- Bank Reconciliation: Financial Accounting & Reporting 1Documento20 pagineBank Reconciliation: Financial Accounting & Reporting 1Malvin Roix OrenseNessuna valutazione finora

- PpeDocumento5 paginePpeSheila Mae AramanNessuna valutazione finora

- Vat NotesDocumento7 pagineVat NotesZulqarnainNessuna valutazione finora

- Agreed Upon Procedures vs. Consulting EngagementsDocumento49 pagineAgreed Upon Procedures vs. Consulting EngagementsCharles B. Hall100% (1)

- Chapter 06 Intercompany Profit Transactions Plant AssetsDocumento28 pagineChapter 06 Intercompany Profit Transactions Plant AssetsJonathan VidarNessuna valutazione finora

- Accounting For Non-Accountant HandoutDocumento26 pagineAccounting For Non-Accountant HandoutROMMUEL TOLENTINONessuna valutazione finora

- The Utease CorporationDocumento8 pagineThe Utease CorporationFajar Hari Utomo0% (1)

- The Making of A CpaDocumento46 pagineThe Making of A CpaMark Alyson NginaNessuna valutazione finora

- Accounts Receivable and Inventory ManagementDocumento16 pagineAccounts Receivable and Inventory ManagementAbbyRefuerzoBalingitNessuna valutazione finora

- AP& p1 - Correction of ErrorsDocumento7 pagineAP& p1 - Correction of ErrorsJolina Mancera67% (3)

- ToA.1830 - Accounting Changes and Errors - OnlineDocumento3 pagineToA.1830 - Accounting Changes and Errors - OnlineJolina ManceraNessuna valutazione finora

- FinaleDocumento22 pagineFinaleJolina ManceraNessuna valutazione finora

- p1 & AP - IntangiblesDocumento13 paginep1 & AP - IntangiblesJolina Mancera100% (3)

- ToA.1827 Earnings Per Share OnlineDocumento3 pagineToA.1827 Earnings Per Share OnlineJolina ManceraNessuna valutazione finora

- AP - Ppe, Int. & Invest PropDocumento15 pagineAP - Ppe, Int. & Invest PropJolina ManceraNessuna valutazione finora

- ToA.1823 Share-Based Payment OnlineDocumento2 pagineToA.1823 Share-Based Payment OnlineJolina Mancera0% (1)

- ToA.1822 Employee Benefits OnlineDocumento3 pagineToA.1822 Employee Benefits OnlineJolina ManceraNessuna valutazione finora

- Accounting Changes and Error CorrectionsDocumento48 pagineAccounting Changes and Error CorrectionsJolina ManceraNessuna valutazione finora

- At.1822 Comprehensive DrillDocumento11 pagineAt.1822 Comprehensive DrillJolina ManceraNessuna valutazione finora

- Cash To AccrualDocumento1 paginaCash To AccrualJolina ManceraNessuna valutazione finora

- 1Documento2 pagine1Jolina ManceraNessuna valutazione finora

- Bibliography NewDocumento1 paginaBibliography NewJolina ManceraNessuna valutazione finora

- Questionnaire Part 1 5Documento5 pagineQuestionnaire Part 1 5Jolina ManceraNessuna valutazione finora

- PKPH Mad Minute Info v3Documento2 paginePKPH Mad Minute Info v3Jolina ManceraNessuna valutazione finora

- Training Module For BeginnersDocumento2 pagineTraining Module For BeginnersJolina ManceraNessuna valutazione finora

- San Miguel Pure Foods Company Inc. Audit Objective Account ObjectiveDocumento2 pagineSan Miguel Pure Foods Company Inc. Audit Objective Account ObjectiveJolina ManceraNessuna valutazione finora

- Mahindra First Choice Wheels LTD: 4-Wheeler Inspection ReportDocumento5 pagineMahindra First Choice Wheels LTD: 4-Wheeler Inspection ReportRavi LoveNessuna valutazione finora

- Carte EnglezaDocumento112 pagineCarte EnglezageorgianapopaNessuna valutazione finora

- Report On Monitoring and Evaluation-Ilagan CityDocumento5 pagineReport On Monitoring and Evaluation-Ilagan CityRonnie Francisco TejanoNessuna valutazione finora

- HG32High-Frequency Welded Pipe Mill Line - Pakistan 210224Documento14 pagineHG32High-Frequency Welded Pipe Mill Line - Pakistan 210224Arslan AbbasNessuna valutazione finora

- Black Hole Safety Brochure Trifold FinalDocumento2 pagineBlack Hole Safety Brochure Trifold Finalvixy1830Nessuna valutazione finora

- PPT-QC AcDocumento34 paginePPT-QC AcAmlan Chakrabarti Calcutta UniversityNessuna valutazione finora

- Matrices and Vectors. - . in A Nutshell: AT Patera, M Yano October 9, 2014Documento19 pagineMatrices and Vectors. - . in A Nutshell: AT Patera, M Yano October 9, 2014navigareeNessuna valutazione finora

- ISSA2013Ed CabinStores v100 Часть10Documento2 pagineISSA2013Ed CabinStores v100 Часть10AlexanderNessuna valutazione finora

- Analysis of MMDR Amendment ActDocumento5 pagineAnalysis of MMDR Amendment ActArunabh BhattacharyaNessuna valutazione finora

- DR Afwan Fajri - Trauma - Juli 2023Documento82 pagineDR Afwan Fajri - Trauma - Juli 2023afwan fajriNessuna valutazione finora

- Marine-Derived Biomaterials For Tissue Engineering ApplicationsDocumento553 pagineMarine-Derived Biomaterials For Tissue Engineering ApplicationsDobby ElfoNessuna valutazione finora

- Retail Operations ManualDocumento44 pagineRetail Operations ManualKamran Siddiqui100% (2)

- NZ2016SH (32k) - e - NSC5026D 3.3V +100ppmDocumento2 pagineNZ2016SH (32k) - e - NSC5026D 3.3V +100ppmDumarronNessuna valutazione finora

- BBAG MPR and STR LISTSDocumento25 pagineBBAG MPR and STR LISTShimanshu ranjanNessuna valutazione finora

- 5 24077 Rev2 PDFDocumento3 pagine5 24077 Rev2 PDFJavier GarcíaNessuna valutazione finora

- Steve Jobs TalkDocumento3 pagineSteve Jobs TalkDave CNessuna valutazione finora

- M.Sc. Steel Structures LEC. #7 Plastic Analysis and Design: Dr. Qasim Shaukat KhanDocumento43 pagineM.Sc. Steel Structures LEC. #7 Plastic Analysis and Design: Dr. Qasim Shaukat KhanSSNessuna valutazione finora

- Team 6 - Journal Article - FinalDocumento8 pagineTeam 6 - Journal Article - FinalAngela Christine DensingNessuna valutazione finora

- PMDG 737NGX Tutorial 2 PDFDocumento148 paginePMDG 737NGX Tutorial 2 PDFMatt HenryNessuna valutazione finora

- Alto Hotel Melbourne GreenDocumento2 pagineAlto Hotel Melbourne GreenShubham GuptaNessuna valutazione finora

- Rwamagana s5 Mathematics CoreDocumento4 pagineRwamagana s5 Mathematics Coreevariste.ndungutse1493Nessuna valutazione finora

- Tutorial 6Documento3 pagineTutorial 6Lai Qing YaoNessuna valutazione finora

- Molde Soldadura TADocumento1 paginaMolde Soldadura TAMarcos Ivan Ramirez AvenaNessuna valutazione finora

- Heat Pyqs NsejsDocumento3 pagineHeat Pyqs NsejsPocketMonTuberNessuna valutazione finora

- ACTIX Basic (Sample CDMA)Documento73 pagineACTIX Basic (Sample CDMA)radhiwibowoNessuna valutazione finora

- NOV23 Nomura Class 6Documento54 pagineNOV23 Nomura Class 6JAYA BHARATHA REDDYNessuna valutazione finora

- CNC - Rdmacror: Public Static Extern Short Ushort Short Short ShortDocumento3 pagineCNC - Rdmacror: Public Static Extern Short Ushort Short Short ShortKession HouNessuna valutazione finora

- Distillation ColumnDocumento22 pagineDistillation Columndiyar cheNessuna valutazione finora

- Offshore Training Matriz Matriz de Treinamentos OffshoreDocumento2 pagineOffshore Training Matriz Matriz de Treinamentos OffshorecamiladiasmanoelNessuna valutazione finora

- MBA-7002-20169108-68 MarksDocumento17 pagineMBA-7002-20169108-68 MarksN GNessuna valutazione finora