Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

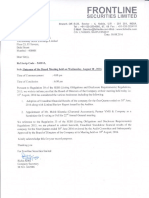

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Caricato da

Shyam SunderTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Caricato da

Shyam SunderCopyright:

Formati disponibili

5/24/2016

CCL_RESULTS_Q4_2016.html

General information about company

Scrip code

530457

Name of company

CINERAD COMMUNICTIONS

LIMITED.

Result Type

Main Format

Class of security

Equity

Date of start of financial year

01-04-2015

Date of end of financial year

31-03-2016

Date of board meeting when results were approved

19-05-2016

Date on which prior intimation of the meeting for considering financial results was informed to the

exchange

05-05-2016

Description of presentation currency

INR

Level of rounding used in financial results

Lakhs

Reporting Quarter

Yearly

Nature of report standalone or consolidated

Standalone

Whether results are audited or unaudited

Audited

Segment Reporting

Single segment

Description of single segment

One Segment

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

1/29

5/24/2016

CCL_RESULTS_Q4_2016.html

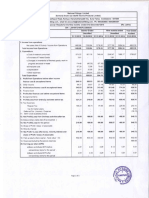

Quarterly & Half Yearly Financial Result by Companies Other than Banks

Particulars

3 months

ended (ddmm-yyyy)

Previous 3

months

ended (ddmm-yyyy)

Corresponding 3

months ended in the

previous year (ddmm-yyyy)

Year to date

figures for current

period ended (ddmm-yyyy)

Year to date figures

Previous

for previous period

accounting

ended (dd-mmyear ended

yyyy)

(dd-mm-yyyy)

Date of start of reporting

period

01-012016

01-10-2015

01-01-2015

01-04-2015

01-04-2014

01-04-2014

Date of end of reporting

period

31-032016

31-12-2015

31-03-2015

31-03-2016

31-03-2015

31-03-2015

Whether results are

audited or unaudited

Audited

Unaudited

Audited

Audited

Audited

Audited

Standalone

Standalone

Standalone

Standalone

Standalone

Nature of report

standalone or Standalone

consolidated

D

Part I

1

Revenue From Operations

Net sales or Revenue

from Operations

Other operating revenues

Total Revenue from

operations (net)

2

Expenses

(a)

Cost of materials

consumed

(b)

Purchases of stock-in-

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

2/29

5/24/2016

CCL_RESULTS_Q4_2016.html

trade

(c)

Changes in inventories of

finished goods, work-inprogress and stock-intrade

(d)

Employee benefit

expense

(e)

Depreciation and

amortisation expense

0.764

0.615

1.56

3.057

2.633

2.633

(f) Other Expenses

1

Expenses

2.289

2.691

2.49

11.4

11.615

11.615

Total other expenses

2.289

2.691

2.49

11.4

11.615

11.615

Total expenses

3.053

3.306

4.05

14.457

14.248

14.248

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

3/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Quarterly & Half Yearly Financial Result by Companies Other than Banks

Particulars

3 months

ended (ddmm-yyyy)

Previous 3

months

ended (ddmm-yyyy)

Corresponding 3

months ended in the

previous year (ddmm-yyyy)

Year to date

figures for current

period ended (ddmm-yyyy)

Year to date

figures for

previous period

ended (dd-mmyyyy)

Previous

accounting

year ended

(dd-mm-yyyy)

Date of start of reporting

period

01-012016

01-10-2015

01-01-2015

01-04-2015

01-04-2014

01-04-2014

Date of end of reporting

period

31-032016

31-12-2015

31-03-2015

31-03-2016

31-03-2015

31-03-2015

Whether results are audited or

unaudited

Audited

Unaudited

Audited

Audited

Audited

Audited

Nature of report standalone or

Standalone Standalone

consolidated

Standalone

Standalone

Standalone

Standalone

Part I

Profit (loss) from

operations before other

income, finance costs and

exceptional items

4 Other income

5

Profit (loss) from ordinary

activates before finance

costs and exceptional items

6 Finance costs

Profit (loss) from ordinary

activities after finance costs

but before exceptional

items

-3.053

-3.306

-4.05

-14.457

-14.248

-14.248

2.665

8.482

12.59

11.147

12.594

12.594

-0.388

5.176

8.54

-3.31

-1.654

-1.654

-0.388

5.176

8.54

-3.31

-1.654

-1.654

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

4/29

5/24/2016

CCL_RESULTS_Q4_2016.html

8 Prior period items before tax

9 Exceptional items

-0.388

5.176

8.54

-3.31

-1.654

-1.654

1.446

-16.587

1.446

-16.587

-16.587

-1.834

5.176

25.127

-4.756

14.933

14.933

10

Profit (loss) from ordinary

activities before tax

11 Tax Expense

12

Net profit (loss) from

ordinary activities after tax

13 Extraordinary items

14

Net Profit Loss for the

period from continuing

operations

-1.834

5.176

25.127

-4.756

14.933

14.933

15

Profit (loss) from discontinuing

operations before tax

16

Tax expense of discontinuing

operations

17

Net profit (loss) from

discontinuing operation

after tax

18

Profit (loss) for period

before minority interest

-1.834

5.176

25.127

-4.756

14.933

14.933

21

Net Profit (loss) after taxes

minority interest and share

of profit (loss) of associates

-1.834

5.176

25.127

-4.756

14.933

14.933

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

5/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Quarterly & Half Yearly Financial Result by Companies Other than Banks

Particulars

Previous 3

Corresponding 3

3 months

Year to date figures Year to date figures

months ended months ended in the

ended (ddfor current period

for previous period

(dd-mmprevious year (dd-mmmm-yyyy)

ended (dd-mm-yyyy) ended (dd-mm-yyyy)

yyyy)

yyyy)

Previous

accounting year

ended (dd-mmyyyy)

Date of start of

reporting period

01-012016

01-10-2015

01-01-2015

01-04-2015

01-04-2014

01-04-2014

Date of end of

reporting period

31-032016

31-12-2015

31-03-2015

31-03-2016

31-03-2015

31-03-2015

Whether results

are audited or

unaudited

Audited

Unaudited

Audited

Audited

Audited

Audited

Nature of report

standalone or Standalone

consolidated

Standalone

Standalone

Standalone

Standalone

Standalone

Part I

22 Details of equity share capital

Paid-up equity

share capital

520

520

520

520

520

520

Face value of

equity share

capital

10

10

10

10

10

10

-343.502

-338.747

-338.747

23 Details of debt securities

Reserves

excluding

24

revaluation

reserve

26 Earnings per share

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

6/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Earnings per share

before

extraordinary

items

Basic earnings per

share before

extraordinary

items

-0.035

0.1

0.483

-0.091

0.287

0.287

Diluted earnings

per share before

extraordinary

items

-0.035

0.1

0.483

-0.091

0.287

0.287

ii Earnings per share after extraordinary items

Basic earnings per

share after

extraordinary

items

-0.035

0.1

0.483

-0.091

0.287

0.287

Diluted earnings

per share after

extraordinary

items

-0.035

0.1

0.483

-0.091

0.287

0.287

Disclosure of

30 notes on

financial results

Textual Information(1)

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

7/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Text Block

Textual Information(1)

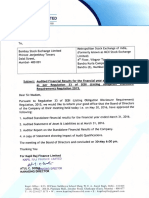

( 1 ). The above audited financial results after review of the Audit Committee were approved by the Board

of Directors at its meeting held on 19th May 2016. The statutory auditors of the Company have carried a

Limited Review of the Financial Result. ( 2 ). No invesors complaint remains pending at the quarter ended

on 31st March 2016. ( 3 ). Previous years figures have been regrouped / rearranged to conform to Current

years classification. ( 4 ). Company has only one segment and hence no separate segment result has been

given.

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

8/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Sub classification of income and expenses

Particulars

3 months

ended (ddmm-yyyy)

Previous 3

months

ended (ddmm-yyyy)

Corresponding 3

months ended in the

previous year (ddmm-yyyy)

Year to date

figures for current

period ended (ddmm-yyyy)

Year to date figures

for previous period

ended (dd-mmyyyy)

Previous

accounting

year ended

(dd-mm-yyyy)

Date of start of reporting

period

01-012016

01-10-2015

01-01-2015

01-04-2015

01-04-2014

01-04-2014

Date of end of reporting

period

31-032016

31-12-2015

31-03-2015

31-03-2016

31-03-2015

31-03-2015

Whether results are

audited or unaudited

Audited

Unaudited

Audited

Audited

Audited

Audited

Standalone

Standalone

Standalone

Standalone

Standalone

Nature of report

Standalone

standalone or consolidated

Subclassification of income and expenses

4 Employee benefit expense [Abstract]

Salaries and wages

0.764

0.605

1.56

3.002

2.583

2.583

Contribution to provident and other funds

Contribution to provident

and other funds for

contract labour

Contribution to provident

and other funds for others

0.01

0.055

0.05

0.05

Total contribution to

provident and other

funds

0.01

0.055

0.05

0.05

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

9/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Expense on employee

stock option scheme and

employee stock purchase

plan

Commission employees

Employee medical

insurance expenses

Leave encashment

expenses

Gratuity

Pension schemes

Voluntary retirement

compensation

Other retirement benefits

Staff welfare expense

Other employee related

expenses

Total employee benefit

expense

0.764

0.615

1.56

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

3.057

2.633

2.633

10/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Sub classification of income and expenses

Particulars

3 months

ended (ddmm-yyyy)

Previous 3

months

ended (ddmm-yyyy)

Corresponding 3

months ended in the

previous year (ddmm-yyyy)

Year to date

Year to date

Previous

figures for current figures for previous

accounting

period ended (ddperiod ended (ddyear ended

mm-yyyy)

mm-yyyy)

(dd-mm-yyyy)

Date of start of reporting

period

01-012016

01-10-2015

01-01-2015

01-04-2015

01-04-2014

01-04-2014

Date of end of reporting

period

31-032016

31-12-2015

31-03-2015

31-03-2016

31-03-2015

31-03-2015

Whether results are audited

or unaudited

Audited

Unaudited

Audited

Audited

Audited

Audited

Nature of report standalone

Standalone

or consolidated

Standalone

Standalone

Standalone

Standalone

Standalone

Subclassification of income and expenses

6

Breakup of other expenses [Abstract]

Consumption of stores and

spare parts

2 Power and fuel

3 Rent

0.462

0.462

1.764

1.98

1.98

4 Repairs to building

5 Repairs to machinery

6 Insurance

7

Rates and taxes excluding taxes on income

Central excise duty

Purchase tax

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

11/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Other cess taxes

Cost taxes other levies by

government local authorities

Provision wealth tax

Total rates and taxes

excluding taxes on

income

8

Research development

expenditure

Subscriptions membership

fees

10 Electricity expenses

0.063

0.063

0.053

0.053

11 Telephone postage

0.037

0.037

0.029

0.029

12 Printing stationery

0.035

0.683

0.755

0.756

0.756

0.075

0.345

0.13

0.536

0.874

0.874

13

Information technology

expenses

14 Travelling conveyance

15 Catering canteen expenses

16 Entertainment expenses

17 Legal professional charges

18

Training recruitment

expenses

19 Vehicle running expenses

20 Safety security expenses

21 Directors sitting fees

22 Managerial remuneration

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

12/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Remuneration to directors

Salary to directors

0.6

0.6

2.4

2.4

2.4

0.6

0.6

2.4

2.4

2.4

0.6

0.6

2.4

2.4

2.4

27 Custodial fees

0.257

0.258

0.515

0.337

0.337

28 Bank charges

0.001

0.001

0.004

0.004

0.094

0.181

0.645

0.829

0.829

Commission to directors

Other benefits to directors

Total remuneration to

directors

Remuneration to managers

Salary to managers

Commission to managers

Other benefits to managers

Total remuneration to

managers

Total managerial

remuneration

23 Donations subscriptions

24 Books periodicals

25

Seminars conference

expenses

26 Registration filing fees

29 Guest house expenses

30

Advertising promotional

expenses

31

After sales service

expenses

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

13/29

5/24/2016

CCL_RESULTS_Q4_2016.html

32 Warranty claim expenses

33

Commission paid sole

selling agents

34

Commission paid other

selling agents

35

Commission paid sole

buying agents

36

Transportation distribution

expenses

37

Secondary packing

expenses

38 Discounting charges

39 Guarantee commission

40

Cost repairs maintenance

other assets

41 Cost information technology

Cost software

Cost hardware

Cost communication

connectivity

Total cost information

technology

42 Cost transportation

Cost freight

Cost octroi

Cost loading and unloading

Cost other transporting

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

14/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Total cost transportation

43 Cost lease rentals

44 Cost effluent disposal

45

Provision for cost of

restoration

46 Cost warehousing

47 Cost water charges

48 Cost reimbursable expenses

49 Cost technical services

50 Cost royalty

51

Provision bad doubtful debts

created

52

Provision bad doubtful loans

advances created

53 Adjustments to carrying amounts of investments

Provision diminution value

current investments created

Provision diminution value

long-term investments

created

Total adjustments to

carrying amounts of

investments

54 Net provisions charged

Provision warranty claims

created

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

15/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Provision statutory liabilities

created

Provision restructuring

created

Other provisions created

Total net provisions

charged

55 Discount issue shares debentures written off

Discount issue shares

written off

Discount issue debentures

written off

Total discount issue

shares debentures

written off

56 Write-off assets liabilities

Miscellaneous expenditure written off

Financing charges written

off

Voluntary retirement

compensation written off

Technical know-how

written off

Other miscellaneous

expenditure written off

Total miscellaneous

expenditure written off

Fixed assets written off

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

16/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Inventories written off

Investments written off

Bad debts written off

Bad debts advances written

off

Other assets written off

Liabilities written off

Total write-off assets

liabilities

57

Loss on disposal of

intangible asset

Loss on disposal, discard,

demolishment and

58

destruction of depreciable

tangible asset

59 Contract cost

Site labour supervision cost

contracts

Material cost contract

Depreciation assets

contracts

Cost transportation assets

contracts

Hire charges assets

contracts

Cost design technical

assistance contracts

Warranty cost contracts

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

17/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Other claims contracts

Sale material scrap other

assets contracts

Overhead costs apportioned contracts

Insurance cost apportioned

contract

Design technical assistance

apportioned contracts

Other overheads

apportioned contracts

Total overhead costs

apportioned contracts

Total contract cost

60 Cost dry wells

Operating and maintenance

cost of emission and other

61

pollution reduction

equipments

62 Payments to auditor

Payment for audit services

Payment for taxation

matters

0.286

0.286

0.298

0.298

Payment for company law

matters

0.15

0.15

0.15

0.15

Payment for management

services

0.05

0.05

0.03

0.03

Payment for other services

Payment for reimbursement

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

18/29

5/24/2016

CCL_RESULTS_Q4_2016.html

of expenses

Total payments to

auditor

0.486

0.486

0.478

0.478

0.179

0.162

2.36

4.198

3.875

3.875

2.289

2.691

2.49

11.4

11.615

11.615

63 Payments to cost auditor

Payment for cost audit

charges

Payment for cost

compliance report

Payment for other cost

services

Payment to cost auditor for

reimbursement of expenses

Total payments to cost

auditor

64 Miscellaneous expenses

Total other expenses

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

19/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Sub classification of income and expenses

Particulars

Year to date

Previous 3 Corresponding 3

3 months

figures for

months

months ended in

ended (ddcurrent period

ended (dd- the previous year

mm-yyyy)

ended (dd-mmmm-yyyy)

(dd-mm-yyyy)

yyyy)

Year to date

figures for

previous period

ended (dd-mmyyyy)

Previous

accounting

year ended

(dd-mmyyyy)

Date of start of reporting period

01-012016

01-102015

01-01-2015

01-04-2015

01-04-2014

01-04-2014

Date of end of reporting period

31-032016

31-122015

31-03-2015

31-03-2016

31-03-2015

31-03-2015

Whether results are audited or unaudited

Audited

Unaudited

Audited

Audited

Audited

Audited

Standalone

Standalone

Standalone

Standalone

Nature of report standalone or

Standalone Standalone

consolidated

Subclassification of income and expenses

7

Disclosure of other income

(a)

Interest income

Interest income on current investments

Interest on fixed deposits, current

investments

Interest from customers on amounts

overdue, current investments

Interest on current intercorporate deposits

Interest on current debt securities

Interest on current government securities

Interest on other current investments

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

20/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Total interest income on current

investments

Interest income on long-term investments

Interest on fixed deposits, long-term

investments

Interest from customers on amounts

overdue, long-term investments

Interest on long-term intercorporate

deposits

Interest on long-term debt securities

Interest on long-term government

securities

Interest on other long-term investments

Total interest income on long-term

investments

Total interest income

(b) Dividend income

Dividend income current investments

Dividend income current investments

from subsidiaries

Dividend income current equity securities

Dividend income current mutual funds

Dividend income current investments

from others

Total dividend income current

investments

Dividend income long-term investments

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

21/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Dividend income long-term investments

from subsidiaries

Dividend income long-term equity

securities

Dividend income long-term mutual funds

Dividend income long-term investments

from others

Total dividend income long-term

investments

Total dividend income

(C) Net gain/loss on sale of investments

Net gain/loss on sale of current

investments

2.665

8.482

12.59

11.147

12.594

12.594

2.665

8.482

12.59

11.147

12.594

12.594

Net gain/loss on sale of long-term

investments

Total net gain/loss on sale of

investments

(d) Rental income on investment property

Rental income on investment property,

current

Rental income on investment property,

long-term

Total rental income on investment

property

(e) Other non-operating income

Net gain/loss on foreign currency

fluctuations treated as other income

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

22/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Surplus on disposal, discard,

demolishment and destruction of

depreciable tangible asset

Gain on disposal of intangible asset

Amount credited to profit and loss as

transfer from revaluation reserve on

account of additional depreciation

charged on revalued tangible assets

Excess provision diminution in value

investment written back

Excess provisions bad doubtful debts

advances written back

Income government grants subsidies

Income export incentives

Income import entitlements

Income insurance claims

Income from subsidiaries

Interest and income tax refund

Income on brokerage commission

Income on sales tax benefit

Excess provisions written back

Other allowances deduction other income

Miscellaneous other non-operating

income

Total other non-operating income

Income from pipeline transportation

Total other income

2.665

8.482

12.59

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

11.147

12.594

12.594

23/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Disclosure of notes on income and

expense explanatory

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

24/29

5/24/2016

CCL_RESULTS_Q4_2016.html

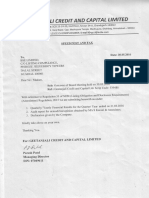

Statement of Asset and Liabilities

Current year ended (dd-mmyyyy)

Previous year ended (dd-mmyyyy)

Date of start of reporting period

01-04-2015

01-04-2014

Date of end of reporting period

31-03-2016

31-03-2015

Audited

Audited

Standalone

Standalone

Particulars

Whether results are audited or unaudited

Nature of report standalone or consolidated

Equity and liabilities

1

Shareholders' funds

Share capital

Reserves and surplus

Money received against share warrants

Total shareholders' funds

520

520

-343.502

-338.747

176.498

181.253

Share application money pending allotment

Deferred government grants

Non-current liabilities

Long-term borrowings

Deferred tax liabilities (net)

Foreign currency monetary item translation difference liability

account

Other long-term liabilities

Long-term provisions

Total non-current liabilities

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

25/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Current liabilities

Short-term borrowings

Trade payables

Other current liabilities

0.808

0.626

Short-term provisions

0.006

0.006

Total current liabilities

0.814

0.632

Total equity and liabilities

177.312

181.885

Tangible assets

Producing properties

Intangible assets

Preproducing properties

Tangible assets capital work-in-progress

Intangible assets under development or work-in-progress

Assets

1

Non-current assets

(i) Fixed assets

Total fixed assets

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

26/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Statement of Asset and Liabilities

Current year ended (dd-mmyyyy)

Previous year ended (dd-mmyyyy)

Date of start of reporting period

01-04-2015

01-04-2014

Date of end of reporting period

31-03-2016

31-03-2015

Audited

Audited

Standalone

Standalone

Particulars

Whether results are audited or unaudited

Nature of report standalone or consolidated

(ii)

Non-current investments

145

(v)

Deferred tax assets (net)

17.45

18.896

(vi)

Foreign currency monetary item translation difference asset

account

2.13

1.88

19.58

165.776

Current investments

Inventories

Trade receivables

142.683

7.06

15.049

9.049

Total current assets

157.732

16.109

Total assets

177.312

181.885

(vii) Long-term loans and advances

(viii) Other non-current assets

Total non-current assets

Current assets

Cash and bank balances

Short-term loans and advances

Other current assets

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

27/29

5/24/2016

CCL_RESULTS_Q4_2016.html

Disclosure of notes on assets and liabilities

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

28/29

5/24/2016

CCL_RESULTS_Q4_2016.html

file://nsdlsvr/Company/Company/1_CINERAD/CINERAD_Qtr_%20RESULT/2015-16/CINERAD_Q4_2015-16/CCL_RESULTS_Q4_2016.html

29/29

Potrebbero piacerti anche

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento49 pagineStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For June 30, 2016 (Result)Documento18 pagineStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento7 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento14 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento23 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento8 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento7 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento9 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento20 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For June 30, 2016 (Result)Documento7 pagineStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento24 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento11 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento12 pagineStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Documento8 pagineFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For June 30, 2016 (Result)Documento7 pagineStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento15 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Documento1 paginaPDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaNessuna valutazione finora

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Documento9 pagineStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento10 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Segment AnalysisDocumento53 pagineSegment AnalysisamanNessuna valutazione finora

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Documento5 pagineAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Documento11 pagineStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Revised Financial Results For March 31, 2016 (Result)Documento10 pagineRevised Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento15 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Updates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento7 pagineUpdates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento2 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Documento6 pagineStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento2 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento8 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Documento7 pagineStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Documento3 pagineFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento15 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2015 (Result)Documento3 pagineStandalone Financial Results For March 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento5 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNessuna valutazione finora

- Segment Reporting: Analysis of Two CompaniesDocumento6 pagineSegment Reporting: Analysis of Two CompaniesRajshekhar BoseNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- MFRS 8Documento31 pagineMFRS 8Anas AjwadNessuna valutazione finora

- Standalone & Consolidated Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Documento8 pagineStandalone & Consolidated Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Useful To The Users of The Financial StatementsDocumento3 pagineUseful To The Users of The Financial StatementsBrian VillaluzNessuna valutazione finora

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento7 pagineStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Signed LGE FY16 Q1 English Report Separate PDFDocumento62 pagineSigned LGE FY16 Q1 English Report Separate PDFvinodNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Documento3 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19Da EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19Nessuna valutazione finora

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Da EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Nessuna valutazione finora

- Mutual Fund Holdings in DHFLDocumento7 pagineMutual Fund Holdings in DHFLShyam SunderNessuna valutazione finora

- JUSTDIAL Mutual Fund HoldingsDocumento2 pagineJUSTDIAL Mutual Fund HoldingsShyam SunderNessuna valutazione finora

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 pagineOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNessuna valutazione finora

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 pagineSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNessuna valutazione finora

- Financial Results For Mar 31, 2014 (Result)Documento2 pagineFinancial Results For Mar 31, 2014 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 paginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderNessuna valutazione finora

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 paginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNessuna valutazione finora

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 pagineExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNessuna valutazione finora

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 pagineFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNessuna valutazione finora

- Financial Results For Dec 31, 2013 (Result)Documento4 pagineFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 pagineSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 pagineFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento3 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results For September 30, 2013 (Result)Documento2 pagineFinancial Results For September 30, 2013 (Result)Shyam SunderNessuna valutazione finora

- PDF Processed With Cutepdf Evaluation EditionDocumento3 paginePDF Processed With Cutepdf Evaluation EditionShyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For June 30, 2016 (Result)Documento2 pagineStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento11 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 pagineTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Investor Presentation For December 31, 2016 (Company Update)Documento27 pagineInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Inventory Write-Off Definition PDFDocumento7 pagineInventory Write-Off Definition PDFPadmakrishnanNessuna valutazione finora

- Intercompany Inventory and Land Profits: Solutions Manual, Chapter 8Documento76 pagineIntercompany Inventory and Land Profits: Solutions Manual, Chapter 8Gillian Snelling100% (3)

- Impact of R12 Design in Procure To Pay Accounting FlowDocumento11 pagineImpact of R12 Design in Procure To Pay Accounting Flowmanishsingh_inNessuna valutazione finora

- Write-Off Procedures: Financial Management Act 2006Documento3 pagineWrite-Off Procedures: Financial Management Act 2006Nina LintottNessuna valutazione finora

- Introduction To Internal Reconstruction of CompaniesDocumento17 pagineIntroduction To Internal Reconstruction of CompaniesMichael NyaongoNessuna valutazione finora

- Jasmine LTD: Exercise 6.8 Calculation of Deferred Tax, and Prior Year AmendmentDocumento5 pagineJasmine LTD: Exercise 6.8 Calculation of Deferred Tax, and Prior Year AmendmentSiRo WangNessuna valutazione finora

- Chapter 4 Financial AssetsDocumento54 pagineChapter 4 Financial AssetsAddisalem MesfinNessuna valutazione finora

- History and Background of Life Cycle CostingDocumento10 pagineHistory and Background of Life Cycle CostingTasha Derahman100% (1)

- 19017comp Sugans Pe2 Accounting Cp9 4Documento56 pagine19017comp Sugans Pe2 Accounting Cp9 4Maaz KaziNessuna valutazione finora

- Internal Control and Internal CheckDocumento18 pagineInternal Control and Internal CheckSuyash PatidarNessuna valutazione finora

- Lecture # 13 Kp-Delegation-Of-Financial-Power-Rules-2018Documento60 pagineLecture # 13 Kp-Delegation-Of-Financial-Power-Rules-2018Sultan ShahNessuna valutazione finora

- Balance sheet and income statement for manufacturing companyDocumento5 pagineBalance sheet and income statement for manufacturing companyUru BhalodeNessuna valutazione finora

- Solution Manual For Financial Accounting in An Economic Context Pratt 9th EditionDocumento26 pagineSolution Manual For Financial Accounting in An Economic Context Pratt 9th EditionArielCooperbzqsp100% (81)

- ACC 577 Quiz Week 2Documento11 pagineACC 577 Quiz Week 2MaryNessuna valutazione finora

- R12 How To Diagnose and Reconcile AAP 728871.1Documento13 pagineR12 How To Diagnose and Reconcile AAP 728871.1kkpareekNessuna valutazione finora

- Problem 4. 2Documento3 pagineProblem 4. 2NELVA QABLINANessuna valutazione finora

- Installment Sales ReviewerDocumento5 pagineInstallment Sales ReviewerJymldy EnclnNessuna valutazione finora

- 2007 MFI BenchmarksDocumento42 pagine2007 MFI BenchmarksVũ TrangNessuna valutazione finora

- AP 500Q Pages 1 19 Quizzer Audit of Current AssetsDocumento19 pagineAP 500Q Pages 1 19 Quizzer Audit of Current AssetsJessa Crystal QuinagonNessuna valutazione finora

- Calculate Net Profit for Managerial PayDocumento3 pagineCalculate Net Profit for Managerial Paysonika7Nessuna valutazione finora

- MGM MIRAGE Accounts Receivable Case StudyDocumento4 pagineMGM MIRAGE Accounts Receivable Case Study廖威翔Nessuna valutazione finora

- Adjusting For Bad DebtsDocumento16 pagineAdjusting For Bad DebtssamahaseNessuna valutazione finora

- Acc 109 P3 Quiz No 2Documento2 pagineAcc 109 P3 Quiz No 2Wilmz SalacsacanNessuna valutazione finora

- LCNRV Inventory MeasurementDocumento13 pagineLCNRV Inventory MeasurementRNessuna valutazione finora

- Financial Accounting Chapter 7Documento57 pagineFinancial Accounting Chapter 7Waqas MazharNessuna valutazione finora

- Borrowing Costs PDFDocumento9 pagineBorrowing Costs PDFanjcabsNessuna valutazione finora

- Accounts Receivable QuizzerDocumento4 pagineAccounts Receivable Quizzerknorrpampapakang67% (3)

- Profit and Loss AccountDocumento22 pagineProfit and Loss AccountSHRUTI100% (1)

- Balaji Balakrishnan - FCR220906CR906137696 - UnlockedDocumento4 pagineBalaji Balakrishnan - FCR220906CR906137696 - UnlockedclmnNessuna valutazione finora

- VLCC Profit Loss 2012 PDFDocumento45 pagineVLCC Profit Loss 2012 PDFAnkit SinghalNessuna valutazione finora