Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Alternative Investment Funds A Robust Platform For Alternative Assets

Caricato da

Bhaskar ShanmugamTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Alternative Investment Funds A Robust Platform For Alternative Assets

Caricato da

Bhaskar ShanmugamCopyright:

Formati disponibili

ALTERNATIVE

INVESTMENT

FUNDS

A Robust Platform for

Alternative Assets

This document neither constitutes an offer or an invitation to offer, or solicitation or a recommendation to enter into any transaction nor does it

constitute any prediction of likely future movements in rates or prices. IFMR Trust or any of its group companies (We) have sent you this

document, in its capacity as a potential counterparty acting at arms length, for purposes of discussion only. We are not acting in any way as an

adviser or in a fiduciary capacity. We therefore strongly suggest that recipients seek their own independent advice in relation to any investment,

financial, legal, tax, accounting or regulatory issues discussed herein. Analyses and opinions contained herein may be based on assumptions that if

altered can change the analyses or opinions expressed. Nothing contained herein shall constitute any representation or warranty as to future

Performance of any financial instrument, credit, currency rate or other market or economic measure. Furthermore, past Performance is not

necessarily indicative of future results. This communication is provided for information purposes only. It is not an offer to sell, or a solicitation of an

offer to buy, any security, nor to enter into any agreement or contract with IFMR Trust or any of its subsidiaries. In addition, any subsequent offering

will be at your request and will be subject to negotiation between us. It is not intended that any public offer will be made by us at any time, in respect

of any potential transaction discussed herein. Any offering or potential transaction that may be related to the subject matter of this communication

will be made pursuant to separate and distinct documentation and in such case the information contained herein will be superseded in its entirety by

such documentation in final form. In addition, because this communication is a summary only it may not contain all material terms, and therefore this

communication in and of itself should not form the basis for any investment decision. Financial instruments that may be discussed herein may not be

suitable for all investors, and potential investors must make an independent assessment of the appropriateness of any transaction in light of their

own objectives and circumstances, including the possible risks and benefits of entering into such a transaction. By accepting receipt of this

communication the recipient will be deemed to represent that they possess, either individually or through their advisers, sufficient investment

expertise to understand the risks involved in any purchase or sale of any financial instrument discussed herein. If a financial instrument is

denominated in a currency other than an investors currency, a change in exchange rates may adversely affect the price or value of, or the income

derived from, the financial instrument, and any investor in that financial instrument effectively assumes currency risk. Prices and availability of any

financial instruments described in this communication are subject to change without notice.

Private and Confidential

Alternative Investment Funds

Contents

Categories of AIFs.................................................................................................................................................... 3

Structure Details ..................................................................................................................................................... 3

Co-investment requirement for Sponsor/Manager ........................................................................................ 3

Strong prudential guidelines ........................................................................................................................... 4

Investor Eligibility ............................................................................................................................................ 4

Investment ticket size and scheme size .......................................................................................................... 4

Listing .............................................................................................................................................................. 4

Other details of AIF scheme ............................................................................................................................ 4

Investment Conditions ............................................................................................................................................ 5

Investment conditions for Category I Social Venture AIF ............................................................................... 5

Taxation of AIFs ....................................................................................................................................................... 5

Determinate/Indeterminate Status ................................................................................................................ 6

Taxation for a determinate Trust .................................................................................................................... 7

Taxation for an indeterminate Trust ............................................................................................................... 7

Business Income/No Business Income ............................................................................................................ 7

Revocable/Irrevocable Transfer ...................................................................................................................... 8

CBDT circular on determinate/indeterminate status ..................................................................................... 8

Comparison with Mutual Funds .............................................................................................................................. 8

The New CSR Rules and Social Venture AIFs......................................................................................................... 11

Definition of Corporate Social Responsibility ............................................................................................. 11

Applicability ................................................................................................................................................... 11

Administration CSR Committee and Policy ................................................................................................ 12

Computation of Net Profits ........................................................................................................................... 13

Reporting....................................................................................................................................................... 13

Schedule VII of the Companies (Corporate Social Responsibility) Rules, 2014 ............................................ 13

Social Venture AIFs and CSR.......................................................................................................................... 14

Frequently Asked Questions on AIFs .................................................................................................................... 14

Regulatory Atlas .................................................................................................................................................... 19

Private and Confidential

Alternative Investment Funds

On 21 May 2012, Indias capital market regulator, Securities and Exchange Board of India (SEBI), notified the

Alternative Investment Funds (AIF) Regulations, 2012. This is in line with the global trend of carving out a new

set of regulations for alternative assets. For instance, in April 2009, the European Commission had proposed a

directive for alternative investment fund managers at the European level. This regulation, termed as 'Alternative

Investment Fund Manager's Directive' or AIFMD recently became operational on 22 July, 2013.

In the Indian context, AIF means any fund established in India in the form of a trust, company or limited liability

partnership which is a privately pooled investment vehicle and is not covered under the SEBIs Mutual Funds

(MFs) Regulations or Collective Investment Schemes (CIS) Regulations. Thus, AIFs offer a new way of

investing in India, separate from the MF or CIS route.

The AIF regulations have been designed keeping in mind the unique needs of both investors and investees in

alternate asset classes that are not necessarily mainstream. The funds registered as venture capital funds

under SEBIs Venture Capital Funds Regulations shall continue till their normal wind up but all new funds and

schemes will now be launched under the AIF regulations.

Categories of AIFs

An AIF can be registered under three different categories based on its investment objective and structure.

Different categories of AIF

Category I AIF

Category II AIF

Start up or early stage

ventures

Social Ventures

SME

Infrastrucure

Other sectors considered

as socially desirable

These are AIFs which do

not fall in either Category

I or Category III and

which does not

undertake leverage or

borrowing*

Category III AIF

Employes diverse or

complex trading

strategies

May employ leverage

Source: SEBI

*For Category II AIF, leverage or borrowing is only permitted to meet day-to-day operational requirements

Structure Details

Co-investment requirement for Sponsor/Manager

The AIF regulation mandatorily requires the Sponsor or Manager (both Sponsor and Manager can be the same

entity in an AIF) to always have a continuing interest in the AIF. This continuing interest has been defined as

2.5% of the fund corpus or Rs 5 crore whichever is less. Thus, under an AIF, the interests of the investors are

aligned with the interests of the Sponsor/Manager.

Private and Confidential

Alternative Investment Funds

Strong prudential guidelines

The AIF regulations contain several prudential guidelines keeping in mind the interest of the investors. These

guidelines create a strong regulatory oversight on issues relating to conflict of interest and disclosures. There

are strict requirements as to who can Sponsor an AIF and who can become a Manager. Separate reporting

requirements have been put in place so that disclosures and reporting is done in a transparent and timely

manner. The detailed prudential guidelines have been specified for the operation of an AIF under the section on

General Obligations and Responsibilities and Transparency which covers general obligations, conflict of

interest, transparency, valuation, obligation of manager, maintenance of records, etc.

Investor Eligibility

The AIF regulation places no restriction on the type of investors that can invest in AIF schemes as long as the

issuance is through private placements. As per SEBI regulations, AIF may raise funds from any investor

whether Indian, foreign or non-resident Indians by way of issue of units. Though the AIF regulations permit

foreign investors to subscribe to units, the newly issued SEBIs Foreign Portfolio Investors (FPI) Regulations

does not list AIF units as permissible investments. Accordingly, foreign investors can invest in AIFs through the

FDI route after approval from Indias Foreign Investment Promotion Board (FIBP).

As per IRDA circular IRDA/F&I/CIR/INV/172/08/2013, insurers in India are permitted to invest in Social Venture

funds, SME funds, Venture Capital fund and infrastructure fund under Category I AIFs. Life Insurance

Companies are permitted to invest upto 3% of their overall portfolio in AIFs and not more than 10% of any AIF

corpus size while for General Insurance Companies the respective exposure limits are 5% and 10%

respectively.

AIFs can invest in units of other AIFs. Funds of Category I AIF can invest in units of other Category I AIFs of

same sub-category. Funds of Category II AIF can invest in units of other Category I or Category II AIFs and

Funds of Category III AIF can invest in units of other Category I or Category II AIFs

Investment ticket size and scheme size

Each scheme of an AIF must have corpus of at least twenty crore rupees. Also, an AIF cannot accept from any

investor an investment of value less than one crore rupees. Units of AIFs can only be issued through private

placement and each scheme of an AIF cannot have more than a thousand investors.

Listing

Units of close ended AIFs may be listed on stock exchange subject to a minimum tradable lot of one crore

rupees. Listing of AIF units is permitted only after final close of the fund or scheme.

Other details of AIF scheme

Private and Confidential

Alternative Investment Funds

Within an AIF, multiple close-ended schemes can be launched with a minimum maturity of at least 3 years.

Category III AIFs can be both open-ended and close-ended. The subscription to any scheme has to be through

a private placement.

Investment Conditions

The general investment conditions are applicable to all categories of AIFs and are as follows,

i)

AIFs may invest in securities of companies incorporated outside India subject to conditions or

guidelines stipulated by RBI and SEBI

ii)

Category I and II AIFs shall invest not more than twenty five percent of the corpus in one investee

company;

iii)

Category III AIFs shall invest not more than ten percent of the corpus in one Investee Company

iv)

Un-invested portion of corpus may be invested in liquid mutual funds or bank deposits or other liquid

assets as per the investment objective;

Investment conditions for Category I Social Venture AIF

Following are the investment restrictions specific to Social Venture AIFs,

i)

Category I AIFs cannot borrow funds directly or indirectly or engage in any leverage except for

meeting temporary funding requirements for not more than thirty days, on not more than four occasions in a

year and not more than ten percent of the corpus.

ii)

At least seventy five percent of the corpus shall be invested in unlisted securities or partnership

interest of social ventures. Social ventures has been defined as a trust, society, company, venture capital

undertaking or limited liability partnership formed with the purpose of promoting social welfare or solving social

problems or providing social benefits and includes microfinance.

iii)

Category I Social Venture Funds can accept grants as well as give grants to social ventures

iv)

Such funds may choose to accept muted returns for their investors

Taxation of AIFs

As per Regulation 3(4)(a) of SEBIs AIF Regulations, all Category I AIFs were to be construed as venture

capital company or venture capital fund for the purpose of Section 10 (23FB) of the Income Tax Act, 1961

(ITA). This would have ensured automatic tax-pass for all Category I AIFs. However, the Finance Bill 2013

clarified under the section Pass through Status to certain Alternative Investment Funds that only Category I

Private and Confidential

Alternative Investment Funds

AIFs registered as Venture Capital Fund are eligible for automatic tax pass-through under Section 10 (23FB),

read with Section 115U of the ITA. Since there is no specific tax provision for other types and categories of

AIFs, their taxation is based on the provisions applicable to the respective legal status under which such the AIF

is structured. For AIFs structured as Trusts, taxation is governed under the Indian Trusts Act, 1882.

Given below is a schematic representation of taxation of Trusts in India. The tax treatment depends on several

factors like determinate/indeterminate status, business income/no business income in the Trust, taxation as an

individual or Association of Persons (AOP) and the revocability of contributions in the Trust.

Taxation of Trusts in India

Trust

(Classification of Trust as Determiante

or Indeterminate is as per Explanation

1 to Section 164)

Determinate Trust

Section 161

(Classification of Income is as

per CBDT Circular no. 1827)

Business Income

Section 161 (1A)

Taxed at MMR

Indeterminate Trust

Section 164

(Classification of Income is as

per CBDT Circular no. 1827)

No Business Income

Section 161 (1)

Business Income

Tax rate applicable to each

benefeciary as RA. Alternatively, AO

can assess income in the hands of

the beneficiaries

Taxed at MMR*

No Businesss Income

Taxed at MMR*

MMR Maximum Marginal Rate ; RA Representative Assessee; AO Assessing Officer

*Taxation will be as applicable to Association of Persons (AOP) if certain conditions are met

Determinate/Indeterminate Status

Whether a Trust is classified as a determinate Trust or indeterminate Trust is based on Explanation 1 to Section

164 of ITA as per which, a determinate Trust should have identifiable beneficiaries and the their beneficial

interest in the Trust should be ascertainable. For a determinate Trust, the taxation is as per Section 161 of ITA.

If a Trust fails the determinate status test, it is taxed as per Section 164 of ITA. For guidance on the

Private and Confidential

Alternative Investment Funds

requirements for a Trust to be determinate, the fund industry relies on the AIG Ruling (1997, 224 ITR 473

AAR) which held that it is not necessary that names of beneficiaries should be mentioned in Trust Deed. The

ruling also held that the requirement for ascertainable beneficial interest is satisfied if the proportion of beneficial

interest is specified in a manner that may need some computation to find out individual shares.

Taxation for a determinate Trust

As per Section 161 (1) of the ITA, tax can be discharged by the Trustee as a Representative Assessee (RA), as

enumerated in Section 160 (iv) for a Trust Deed executed in writing. As a RA, the Trustee will discharge tax in

like manner and to the same extent as would be applicable to the beneficiaries represented by him.

Section 161 (2) of the ITA clarifies that where any person is assessed under this Section as a RA, the person

will not, in respect of that income, be assessed under any other provision of the ITA. It may also be noted that

the tax authorities can under Section 166 tax the beneficiaries directly rather than the Trust as a RA. With

regard to this, the Central Board of Direct Tax has clarified through a circular (Circular No. 157CBDT F. No.

228/8/73-IT(A-II), dated 26-12-1974) that income will be subject to tax only once, and once the tax authority has

decided to tax either the trustee or the beneficiary, it is no more open to access the same income again in the

hands of either.

Section 166 read with Rule 37BA of the Income Tax Rules, 1962 (Rules), clarifies that where tax is assessable

in the hands of a person other than the deductee, credit for tax deducted at source, will be given to the other

person and not the deductee. For this purpose, the deductee can file a declaration with the deductor, thereby

enabling the deductor to report tax deductions directly in the name of the other person. Such a declaration shall

include the following,

(i)

Name, address, permanent account number (PAN) of the person to whom credit is to be given

(ii)

Reasons for giving credit to such person directly

The above provisions lay down the guidelines for discharge for tax directly in the name of the beneficiaries of a

Trust.

Taxation for an indeterminate Trust

An indeterminate Trust is taxed under Section 164 of ITA, as per which, tax is charged at the Maximum

Marginal Rate (MMR) except under certain circumstances as listed under Section 164 (1) (i) (iv) where tax is

charged as applicable on Association of Persons (AOP).

Business Income/No Business Income

As per Section 161 (1A) of the ITA, where any income of a determinate Trust consists of business income, tax

will have to be discharged on the whole of the income at the MMR. Also as per Section 164 (1), if any income of

an indeterminate Trust consists of business income, tax will have to be discharged at the MMR. The only

exception to these rules being in case of a Trust declared by a person by will exclusively for the benefit of a

relative dependent on him.

Private and Confidential

Alternative Investment Funds

Revocable/Irrevocable Transfer

The taxation of a Trust is also dependent on the nature of transfer to the Trust by the contributors who are the

holders of beneficial interest. As per Section 61 of the ITA, in case a transfer is revocable, all income arising to

the person by virtue of such a transfer will be taxable to the transferor and included in his total income. For a

fund structured as a Trust in which the transfers of the contributions are redeemed later, Section 61 makes the

case for taxation directly in the hands of such transferors.

CBDT circular on determinate/indeterminate status

The Central Board of Direct Taxes (CBDT) circular (Circular No. 13/2014, dated 28-07-2014), clarified the

following regarding the status of taxation of Alternative Investment Funds (AIFs) structured as contributory

Trusts,

1) In the situation where the Trust deed either does not mention the investors or does not specify their beneficial

interests, then the tax rate is at maximum marginal rate (MMR) namely 33.99%.

2) In the situation where the Trust deed mentions the investors name and specifies their beneficial interests, and

when the Trust earns business income, then the tax rate is at MMR namely 33.99%. Under Section 2(13) of the

Income Tax Act, investments are not considered as business income and hence this may not be applicable.

3) Further, the circular allows exclusion under jurisdiction in case any High Court has taken a contrary view on

the same subject that what is being proposed in the circular.

Thus, in a case where the Trust deed mentions the investors name and specifies their beneficial interests and

the Trust does not earn business income, in our opinion, the Trust can then pay tax on behalf of the

beneficiaries accordingly under Section 161 of the ITA.

Though there is no mention about date of creation of the trust in the explanation part of the CBDT circular No.

13/2014, dated 28-07-2014, (point 4 and point 5), some tax counsels have taken the view that the circular

proposes that a Trust can be classified as a determinate Trust only if the name of the beneficiaries are known

on the date of the creation of the Trust.

Comparison with Mutual Funds

Definition

Alternative Investment Fund (AIF)

Mutual Fund (MF)

An AIF is:

A MF is:

Any fund that collects monies from investors

A fund established to raise monies through

(Indian/foreign), for investing in accordance

the sale of units to the public or a section of

with a defined investment policy and;

the public under one or more schemes for

which is not covered under the SEBIs Mutual investing in a wide range of securities and is

Private and Confidential

Legal Structure

Alternative Investment Funds

Alternative Investment Fund (AIF)

Mutual Fund (MF)

Funds and Collective Investment Scheme

governed under SEBIs Mutual Fund

Regulations.

Regulations.

An AIF can be a Trust/Company/Limited

A MF is set up as a trust, which has

Liability Partnership/Body Corporate which is

sponsor, trustees, asset management

established/incorporated in India.

company (AMC), and custodian.

According to AIF regulation, the manager and In case of mutual fund, a sponsor is different

Manager/Sponsor

sponsor can be the same

from manager. Sponsor has to contribute

not less than 40% to the net worth of the

AMC.

The key investment team of the investment

An AMC, which is registered under

manager of an AIF needs to have adequate

Company's Act and approved by SEBI,

experience, with at least one key personnel

manages the funds.

Eligibility for

having not less than five years experience in

Manager

advising or managing pools of capital and has An AMC is granted a certificate to manage

relevant professional qualification. Hence, the funds only if it has a net worth not less that

investment manager can be an individual or an of Rs 50 crores apart from other

entity.

requirements.

An AIF can seek registration under three

categories:

Category I - An AIF which invests in start-up

ventures/social ventures/ small and medium

enterprises (SMEs) /infrastructure/other

sectors which the government considers as

Trustees, sponsor, AMC, and custodian

complying with applicable provisions can

socially or economically desirable.

Registration

launch and register a mutual fund and can

Category II - AIFs which do not undertake

leverage other than to meet day-to-day

operational requirements and do not fall under

Category I or Category III

Category III - AIFs such as hedge funds or

funds which employ complex trading strategies

fall in Category III. Also these may employ

leverage including through investment in

manage multiple schemes across various

asset classes.

Private and Confidential

Alternative Investment Funds

Alternative Investment Fund (AIF)

Mutual Fund (MF)

listed/unlisted derivatives.

Category I and II AIFs should be Closed

Fund Types

Ended;

A Mutual Fund can be both Closed Ended

Category III AIF can be both Closed Ended

or Open Ended funds.

and Open Ended

The minimum subscription amount of debt

oriented and balanced schemes at the time

of new fund offer shall be at least Rs 20

Minimum Corpus

An AIF should have a minimum corpus of Rs

crores and that of other schemes shall be at

20 crores.

least Rs 10 crores. An average AUM of Rs

20 crore on half yearly rolling basis shall be

maintained for open ended debt oriented

schemes.

Minimum investment size for an AIF is Rs 1

Minimum

crore. However, if investors are

Depending on the mutual fund scheme,

Investment by

employees/directors of the AIF or

AMC will mention in offer document the

Investors

employees/directors of the Manager, then

minimum investment amount.

minimum investment value is reduced to Rs 25

lakh.

Manager/Sponsor shall have a continuing

Sponsor or Asset Management Company

Continuing Interest interest of not less than 2.5% of the corpus or shall invest not less than 1.0% of the corpus

Issuance of Units

Rs 5 crore (5% of corpus or Rs 10 crore in

or Rs 50 lakhs, whichever is less, in the

case of category III AIF), whichever is lower.

growth option of each scheme

AIFs can issue units only through private

MFs can issue units by way of public

placements

issuance

Listing in Exchange Listing is permitted but there is no compulsion

for AIFs to list units on an exchange.

Min. Tenure

Every closed ended scheme, other than an

equity linked savings scheme, has to be

listed on a recognized stock exchange.

No scheme of an AIF can have a tenure

No minimum tenure

shorter than 3 years.

Number of

An AIF cannot have more than 1000 investors There is no such ceiling in case of mutual

Investors

in any scheme.

funds.

10

Private and Confidential

Alternative Investment Funds

The New CSR Rules and Social Venture AIFs

The Ministry of Corporate Affairs has notified Section 135 and Schedule VII of the Companies Act 2013 as well

as the provisions of the Companies (Corporate Social Responsibility Policy) Rules, 2014 (CSR Rules) to come

into effect from April 1, 2014.

The CSR concept revolves around business corporations performing obligations that one owes as a business

enterprise towards people and society at large. CSR is an act that aims to bring positive changes to the lives of

individuals; and transcends profit-and-loss issues for companies or individuals. CSR, therefore, is an act of

moral, social and business responsibility to protect, preserve and nurture human values and promote socioeconomic welfare.

Definition of Corporate Social Responsibility

The Companies (Corporate Social Responsibility) Rules, 2014 defines Corporate Social Responsibility (CSR)

as, including but not limited to:

Projects or Programs relating to activities specified in Schedule VII of the Companies Act, 2013; or

Projects or Programs relating to activities undertaken by the Board of Directors of a Company (Board) in

pursuance of recommendations of the CSR Committee of the Board as per declared CSR Policy of the

Company subject to the condition that such policy will cover subjects enumerated in Schedule VII of the

Act

Applicability

All companies (both Private Limited and Public Limited) in India that satisfy one or more of the following

conditions are required to spend at least 2% of their average net profit for the immediately preceding three

financial years on CSR activities.

Any company that falls under the above criteria will be required to comply with the provisions every year. In

order to exit from the CSR compliance requirements, the company should complete 3 consecutive years

wherein it does not satisfy any of the above-mentioned criteria.

Foreign companies with business operations in India will be required to contribute to CSR based on the profits

of their Indian business operations. Indian branches and project offices of foreign companies are also covered

11

Private and Confidential

Alternative Investment Funds

under the CSR provisions and will be required to set up a CSR Committee and have a CSR Policy in place.

Eligible CSR Activities and Expenditure

The following are classified as eligible CSR activities under Schedule VII of the Companies Act, 2013.

CSR activities and expenditure must be with respect to any of the activities mentioned in Schedule VII

(detailed below) of the Companies Act, 2013

Any activity undertaken by the Company in its normal course of business would not qualify as a CSR

activity. The Company should clearly distinguish its CSR related activities from other routine business

activities.

Contributions to political parties, either directly or indirectly, will not be considered to be a CSR activity.

Likewise, CSR projects or programs that benefit only the employees of the Company would not be

considered as eligible CSR activities.

Only expenditure incurred on projects and programs in India would qualify as CSR expenditure

CSR capacity building costs of own personnel either directly or through any implementation agency

shall be considered as CSR expenditure. However, such capacity building costs shall not exceed 5% of

the overall CSR expenditure for the year.

Companies belonging to the same group can set up a registered Trust, Society or a Company to

undertake their CSR activities. In such cases, each company should clearly specify the activities to be

undertaken, the modalities for fund utilisation and the reporting and monitoring mechanisms. If the entity

through which the CSR activities are being undertaken is not established by the company or its holding,

subsidiary or associate company, such entity should have an established track record of three years

undertaking similar activities.

Companies can also collaborate with each other for jointly undertaking CSR activities, provided that

each of the companies is able to individually report on such projects.

Preference would need to be given to local areas and the areas around which the company operates

while deciding on the CSR activities to be undertaken.

The vehicle which is used to discharge the CSR expenditure should have an established track record of

three years in undertaking similar programs or projects, unless the vehicle has been established by the

company (or its holdings, or associates or subsidiary companies).

Administration CSR Committee and Policy

The Board would be required to appoint a three-member CSR Committee, including one independent

director.

Private Limited Companies and Foreign Companies are exempt from having an independent director on

the CSR Committee and can constitute their Committees with only two members. Private Limited

Companies with only two Directors on their Boards shall constitute the CSR Committee with both the

Directors.

12

Private and Confidential

Alternative Investment Funds

The CSR Committee would be responsible to frame the CSR Policy, the proposed initiatives and a

transparent mechanism to monitor the CSR activities of the Company.

The CSR Policy should explicitly state that any surplus arising from the CSR activities should not be

considered as business profits of the Company.

Computation of Net Profits

Net Profit means the net profit calculated as per the financial statements of the Company, excluding the

following:

o

Profits from any overseas branch of the company.

Dividends received from other companies in India which are complying with the CSR obligations

Reporting

The Companys Board is required to mandatorily report on the CSR activities in its Report. In case the

prescribed amount is not spent during the year, reasons for not doing so should also be clearly

disclosed in the Boards report.

Companies will be required to display their CSR Policy and activities, including amount spent on each,

on their websites.

Schedule VII of the Companies (Corporate Social Responsibility) Rules, 2014

Eradicating hunger, poverty and malnutrition; promoting preventive healthcare and sanitation; making

available safe drinking water;

Promoting education, including special education and employment enhancing vocational skills

especially among children, women, elderly and the differently abled and livelihood enhancement

projects;

Promoting gender equality, empowering women, setting up homes and hostels for women and orphans;

setting up old age homes, day care centres and such other facilities for senior citizens and measures for

reducing inequalities faced by socially and economically backward groups;

Ensuring environmental sustainability, ecological balance, protection of flora and fauna, animal welfare,

agroforestry, conservation of natural resources and maintaining quality of soil, air and water;

Protection of national heritage, art and culture including restoration of buildings and sites of historical

importance and works of art; setting up of public libraries; promotion and development of traditional arts

and handicrafts;

Measures for the benefit of armed forces veterans, war widows and their dependents;

Training to promote rural, nationally recognized sports, Paralympic sports and Olympic sports,

Contribution to the Prime Minister's National Relief Fund or any other fund set up by the Central

Government for socio-economic development and relief and welfare of the Scheduled Castes,

Scheduled Tribes, other backward classes, minorities and women;

13

Private and Confidential

Alternative Investment Funds

Contributions or funds provided to technology incubators located within academic institutions which are

approved by the Central Government; and

Rural development projects.

Social Venture AIFs and CSR

As per section 2(u) of SEBIs AIF Regulations, a Social Venture Fund is an AIF which invests primarily in

securities or units of social ventures and which satisfies social performance norms laid down by the fund.

Social venture in turn have been defined as trust, society or company or venture capital undertaking or limited

liability partnership formed with the purpose of promoting social welfare or solving social problems or providing

social benefits.

According to the CII-PWC Handbook on Corporate Social Responsibility in India, a minimum of 6000 Indian

Companies will be required to undertake CSR projects in order to comply with the legislation and many of these

companies would be first-timers. Further, the handbook estimates that the total CSR commitments could

amount to approximately INR 20,000 crores. Implementation of the new legislation is expected to bring in huge

funds into the development sector and it is critical to ensure these funds are optimally utilised for the specified

activities.

SEBI's AIF Regulations allows Category I Social Venture Funds to accept grants. The minimum amount that a

Social Venture Fund can accept as a grant is Rs. 2.50 million. Given that Social Venture AIFs are deemed by

SEBI to have positive social benefits on the overall economy, such AIFs structured as Trusts and who meet the

vintage requirements, will be eligible for receiving CSR grants. Social Venture AIF funds can serve as a platform

for channelizing CSR expenditure into productive activities that benefit the society at large.

Frequently Asked Questions on AIFs

1. Who can invest in an AIF?

As per SEBI regulations, AIFs may raise funds from any investor whether Indian, foreign or non-resident Indians

by way of issue of units.

IRDA vide its Circular No. IRDA/F&I/INV/CIR/054/03/2013 dated March 18, 2013 permitted insurers to invest in

Category I Alternative Investment Funds (AIF) and clarified that such investments would be restricted to

Infrastructure and SME sectors.

In a follow up circular, IRDA/F&I/CIR/INV/172/08/2013 dated August 23, 2013, insurers in India are permitted to

invest in Category I & II AIFs under the extant SEBI Regulations. The permitted Funds in Category I are

Infrastructure Fund, SME Fund, Venture Capital Fund and Social Venture Fund as defined in Alternate Fund

Regulations. Whereas, in Category II, at least 51% of the funds of such AIF shall be invested in either of the

Infrastructure entities or SME entities or Venture Capital undertakings or Social Venture entities.

Type of Insurer

Overall Exposure to Venture

Funds and AIFs put together

14

Exposure to single

AIF/Venture Fund

Private and Confidential

Alternative Investment Funds

(a)

(b)

(c)

10% of AIF` /Venture Fund size

or 20% of Overall Exposure as

per (b), whichever is lower.

Life Insurance Company

3% of respective Fund

The above 10%Limit shall be

read as 20% in case of

Infrastructure Fund

10% of AIF` /Venture Fund size

or 20% of Overall Exposure as

per (b), whichever is lower.

General Insurance Company

5% of Investment Assets

The above 10% Limit shall be

read as 20% in case of

Infrastructure Fund

AIFs can invest in units of other AIFs if their constituting documents so permit. Funds of Category I AIF can

invest in units of other Category I AIFs of same sub-category. Funds of Category II and Category III AIF can

invest in units of other Category I or Category II AIFs.

2. Can the investments in a Social Venture Alternative Investment Fund (AIF) be classified as

Priority Sector Lending (PSL)?

The investments in an AIF cannot currently be classified as PSL even though the underlying assets may qualify

as PSL assets. However, investments in a Social Venture AIF can act as platform for familiarity with the Bottom

of the Pyramid (BoP) sector which can then facilitate direct investments in PSL assets.

3. In which category will the proposed IFMR Investments AIF fall?

IFMR Investments proposed AIF is proposed to be registered as a Category I Social Venture AIF. As per

SEBIs AIF Regulation, 2012, there are three categories of AIFCategory I AIF which invests in start-up or early stage ventures, social ventures, SMEs, Infrastructure or

other sectors or areas which the government or regulators consider as socially or economically desirable

Category II AIF which does not fall in Category I and III and which does not undertake leverage or borrowing

other than to meet day-today operational requirements

Category III AIF which employs diverse or complex trading strategies and may employ leverage including

through investment in listed or unlisted derivatives

4. Will the pass through benefit be applicable to the AIF launched by IFMR Investments?

As per regulations, only Category I Venture Capital AIFs are eligible for tax pass through benefit. However,

through various structuring options, AIFs can be constructed to be tax-neutral independent of the regulatory tax

pass through status. Accordingly, the proposed AIF to be launched by IFMR Investments will also achieve taxneutrality through the appropriate structuring option.

5. Is foreign investment allowed in AIFs?

15

Private and Confidential

Alternative Investment Funds

The AIF regulations specify that AIFs may raise funds from any investor whether Indian, foreign or non-resident

Indians by way of issue of units. However, RBIs FEMA and other relevant guidelines needs to be amended to

ensure automatic foreign invest in AIFs. Thus, currently, foreign investments in AIF are permissible under the

approval route.

6. How is the interest of the Manager/Sponsor aligned with the investor in an AIF?

The Manager or Sponsor are required to have a continuing interest in the AIF of not less than 2.5 percent of the

corpus or Rs 5 crore, whichever is lower, in the form of investment in the AIF and such interest cannot be

through the waiver of management fees. For Category III AIF, the continuing interest shall be not less than 5

percent of the corpus or Rs 10 crore, whichever is lower.

7. What are the general guidelines for investment in an AIF?

Investment in all categories of AIFs shall be subject to the following conditions:(a) each scheme of the AIF shall have corpus of at least Rs 20 crore;

(b) the AIF shall not accept from an investor, an investment of value less than Rs 1 crore:

(c) the Manager or Sponsor shall disclose their investment in the AIF to the investors of the AIF;

(d) no scheme of the AIF shall have more than one thousand investors;

(e) the fund shall not solicit or collect funds except by way of private placement.

8. What are the general investment restrictions that an AIF has to follow?

Investments by all categories of AIFs are subject to the following conditions:(a) AIF may invest in securities of companies incorporated outside India subject to such conditions or guidelines

that may be stipulated or issued by the Reserve Bank of India and the Board from time to time;

(b) Co-investment in an investee company by a Manager or Sponsor shall not be on terms more favourable than

those offered to the AIF;

(c) Category I and II AIFs shall invest not more than twenty five percent of the corpus in one Investee Company;

(d) Category III AIF shall invest not more than ten percent of the corpus in one Investee Company

(e) AIF shall not invest in associates except with the approval of seventy five percent of investors by value of

their investment in the AIF;

(f) Un-invested portion of the corpus may be invested in liquid mutual funds or bank deposits or other liquid

assets of higher quality such as Treasury bills, CBLOs, Commercial Papers, Certificates of Deposits, etc. till

deployment of funds as per the investment objective;

9. What are the investment restrictions for a Category 1 AIFs?

(a) Category I AIF shall invest in investee companies or venture capital undertaking or in special purpose

vehicles or in limited liability partnerships or in units of other AIFs as specified in these regulations;

(b) Category I AIFs shall not borrow funds directly or indirectly or engage in any leverage except for meeting

temporary funding requirements for not more than thirty days, on not more than four occasions in a year and not

more than ten percent of the corpus.

10. What are the investment restrictions for a Category 1 Social Venture AIF?

16

Private and Confidential

Alternative Investment Funds

AIF Regulations specify that for a Category 1 AIF Social Venture Fund, at least seventy five percent of the

corpus shall be invested in unlisted securities or partnership interest of social ventures.

11. Who is a Sponsor and Manager in an AIF?

The AIF Regulations define Sponsor and Manager as follows,

- sponsor means any person or persons who set up the AIF and includes promoter in case of a company and

designated partner in case of a limited liability partnership;

- manager means any person or entity who is appointed by the AIF to manage its investments by whatever

name called and may also be same as the sponsor of the Fund;

For being a Manager, the following condition has to be met,

the key investment team of the Manager of AIF has adequate experience, with at least one key personnel

having not less than five years experience in advising or managing pools of capital or in fund or asset or wealth

or portfolio management or in the business of buying, selling and dealing of securities or other financial assets

and has relevant professional qualification

12. Does a Category 1 Social Venture Fund mandatorily need to target muted returns?

AIF Regulations specify that Category 1 AIF Social Venture Fund, may accept muted returns for their

investors i.e. they may accept returns on their investments which may be lower than prevailing returns for

similar investments.

As clearly specified, the requirement for muted returns is optional and not mandatory.

13. What are the minimum eligibility criteria for launching an AIF?

For the purpose of the grant of certificate to an applicant, the following minimum conditions for eligibility have

been specified(a) the applicant is prohibited from making an invitation to the public to subscribe to its securities;

(b) the applicant, Sponsor and Manager are fit and proper persons based on the criteria specified in Schedule II

of the Securities and Exchange Board of India (Intermediaries) Regulations, 2008;

(c) the key investment team of the Manager of AIF has adequate experience

(d) the Manager or Sponsor has the necessary infrastructure and manpower to effectively discharge its

activities;

(e) the applicant has clearly described at the time of registration the investment objective, the targeted investors,

proposed corpus, investment style or strategy and proposed tenure of the fund or scheme;

14. What are the tenure requirements general guidelines for investment in an AIF?

Category I AIF and Category II AIF are required to be close ended and the tenure of fund or scheme should

meet the below guidelines,

- Category I and II AIF or schemes launched by such funds should have a minimum tenure of three years.

- Category III AIF may be open ended or close ended.

Extension of the tenure of the close ended AIF may be permitted up to two years subject to approval of twothirds of the unit holders by value of their investment in the AIF. In the absence of consent of unit holders, the

AIF will have to fully liquidate within one year following expiration of the fund tenure or extended tenure.\

17

Private and Confidential

Alternative Investment Funds

15. Can units of AIF be listed?

Units of close ended AIF may be listed on stock exchange subject to a minimum tradable lot of Rs 1 crores.

Listing of AIF units is permitted only after final close of the fund or scheme.

16. Can AIFs accept grants?

Category 1 AIFs may accept grants, provided that utilization of such grants shall be restricted to invested in

unlisted securities or partnership interest of social ventures.

17. What are the general obligations of the Manager of an AIF?

The Manager is obliged to:

(a) address all investor complaints;

(b) provide to the Board any information sought by Board;

(c) maintain all records as may be specified by the Board;

(d) take all steps to address conflict of interest as specified in these regulations;

(e) ensure transparency and disclosure as specified in the regulations.

18

Private and Confidential

Alternative Investment Funds

Regulatory Atlas

Date

Topic

Master Circular

Securities and Exchange Board of

India (Alternative Investment Funds)

Regulations, 2012

16-Sep-13

(as amended up to September 16, 2013)

http://www.sebi.gov.in/cms/sebi_data/co

mmondocs/AIFRegulations2012.pdf

Operational guidelines

Operational, Prudential and Reporting

Norms for Alternative Investment

29-Jul-13 Funds (AIFs)

http://www.sebi.gov.in/cms/sebi_data/atta

chdocs/1375094611151.pdf

Application for change in category of

the Alternative Investment Fund

07-Aug-13

http://www.sebi.gov.in/cms/sebi_data/atta

chdocs/1375870851852.pdf

Guidelines on disclosures, reporting

and clarifications under AIF

19-Jun-14 Regulations

http://www.sebi.gov.in/cms/sebi_data/atta

chdocs/1403173065618.pdf

19-Jun-14

18-Jul-14

18-Mar-13

23-Aug-13

07-Apr-14

Information to be filled by

unregistered funds

http://www.sebi.gov.in/cms/sebi_data/atta

chdocs/1403173979338.xls

Description

This broad set of guidelines regulates

Alternative Investment Funds in India, the

regulation for which was introduced on May

21, 2012

These guidelines lay down the operational

and reporting norms that are to be followed

by all AIFs in India

These guidelines describe the rules and

procedure regarding changes form one

category of AIF registration to another

In light of the first guidelines for operational,

prudential and reporting norms for AIFs

issued on July 29, 2013, this next set of

guidelines provide further operational

requirements/norms for AIFs along with

issuing certain clarifications to amendments

introduced on September 16, 2013

This link provides the information to be

filled by funds which are exempt from

registration under sub-regulation (1) of

Regulation (3) of the AIF Regulations

Clarification and extension of deadline

with respect to circular on Guidelines

This circular provides clarifications on the

on disclosures, reporting and

circular issued on 19-Jun-14 and extends

clarifications under AIF Regulations

the deadline for compliance for previously

http://www.sebi.gov.in/cms/sebi_data/atta issued guidelines

chdocs/1405675574305.pdf

Guidelines pertaining to investment in AIFs

Permission of Insurers to invest in

Category I Alternative Investment

IRDA vide this circular permitted insurance

Funds

companies to invest in Category I AIFs

https://www.irda.gov.in/admincms/cms/w restricted to Infrastructure Funds and SME

hatsNew_Layout.aspx?page=PageNo19

Funds

25&flag=1

Permission to Insurers to Invest in

IRDA vide this circular extended permission

Category I & II Alternative Investment

for investment in AIFs by insurance

Funds (AIFs)

companies to more sub-categories in

https://www.irda.gov.in/ADMINCMS/cms/

Category I AIFs as well as certain Category

whatsNew_Layout.aspx?page=PageNo2

II AIFs

047&flag=1

Investment through Alternative

This circular by RBI provides for the

Investment Funds Clarification on

treatment of investment in AIFs for

19

Private and Confidential

Alternative Investment Funds

Date

Topic

Calculation of NOF of an NBFC

http://rbi.org.in/Scripts/NotificationUser.as

px?Id=8826&Mode=0

Taxation of AIFs

Clarification regarding taxation of

Alternate Investment Funds having

status of non-charitable trusts under

28-Jul-14

the Income-tax Act, 1961

http://www.incometaxindia.gov.in/commu

nications/circular/circular13_2014.pdf

Others

List of Registered AIFs (May 2014)

31-May-14 http://www.sebi.gov.in/cms/sebi_data/atta

chdocs/1381741901306.pdf

How to get registered as an

Alternative Investment Fund

http://www.sebi.gov.in/cms/sebi_data/atta

chdocs/1339489217797.pdf

Processing Application Status

http://www.sebi.gov.in/sebiweb/home/list/

5/35/0/0/Processing-Application-Status

Data relating to activities of

Alternative Investment Funds (AIFs)

30-Jun-14

http://www.sebi.gov.in/cms/sebi_data/atta

chdocs/1392982252002.html

20

Description

computation of Net Owned Funds (NOF) of

an NBFC for AIFs sponsored by such

NBFCs for investment in group companies

This circular by CBDT provides certain

clarification on the taxation of AIFs

structured as non-charitable trusts

This link provides the list of all registered

AIFs in India with SEBI as of May 31, 2014

This link provides step by step instruction

on the process of getting registered as an

AIF

For applications made to SEBI for

registration as AIFs, this link provides the

status update on pending applications

This link provides the data relating to the

cumulative figures of commitment received

and investments made by different

categories of AIFs in India

10th

CORPORATE OFFICE

Floor, IITM Research Park, Kanagam Village, Taramani, Chennai 600113, India

Tel: +91 44 66687000; Fax: +91 44 66687010

Email: contact.investments@ifmr.co.in, Website: investments.ifmr.co.in

Copyright, 2014 IFMR Investments. All Rights Reserved. Contents may be used freely with due acknowledgement to IFMR Investments. All of

the information contained herein is based on information obtained from companies, experts, and other sources which IFMR Investments believes

to be reliable. IFMR Investments does not audit or verify the truth or accuracy of any such information. Although reasonable care has been taken

to ensure that the information herein is true, such information is provided 'as is' without any warranty of any kind, and IFMR Investments makes

no representation or warranty, express or implied, as to the accuracy, timeliness or completeness of any such information. All information

contained herein must be construed solely as statements of opinion, and IFMR Investments shall not be liable for any losses incurred by users

from any use of this publication or its contents.

21

Potrebbero piacerti anche

- Ninepoint Tec Private Credit Fund OmDocumento86 pagineNinepoint Tec Private Credit Fund OmleminhptnkNessuna valutazione finora

- Active Alpha: A Portfolio Approach to Selecting and Managing Alternative InvestmentsDa EverandActive Alpha: A Portfolio Approach to Selecting and Managing Alternative InvestmentsNessuna valutazione finora

- Accounting for Derivatives: Advanced Hedging under IFRSDa EverandAccounting for Derivatives: Advanced Hedging under IFRSNessuna valutazione finora

- Alternative Investment Strategies A Complete Guide - 2020 EditionDa EverandAlternative Investment Strategies A Complete Guide - 2020 EditionNessuna valutazione finora

- CLO Investing: With an Emphasis on CLO Equity & BB NotesDa EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesNessuna valutazione finora

- Alternative Investments Complete Self-Assessment GuideDa EverandAlternative Investments Complete Self-Assessment GuideNessuna valutazione finora

- Alternative Investment FundsDocumento10 pagineAlternative Investment Fundskrishna sharmaNessuna valutazione finora

- Hedge Fund Due Diligence: Professional Tools to Investigate Hedge Fund ManagersDa EverandHedge Fund Due Diligence: Professional Tools to Investigate Hedge Fund ManagersNessuna valutazione finora

- Alternative Investment FundsDocumento10 pagineAlternative Investment Fundskrishna sharmaNessuna valutazione finora

- Investment Fund Leagle DocumentsDocumento6 pagineInvestment Fund Leagle Documentspradeebha100% (1)

- Private Equity Unchained: Strategy Insights for the Institutional InvestorDa EverandPrivate Equity Unchained: Strategy Insights for the Institutional InvestorNessuna valutazione finora

- Fund ManagementDocumento12 pagineFund ManagementstabrezhassanNessuna valutazione finora

- Private Equity Fund Of Funds A Complete Guide - 2020 EditionDa EverandPrivate Equity Fund Of Funds A Complete Guide - 2020 EditionNessuna valutazione finora

- Shubham Hedge FundDocumento71 pagineShubham Hedge FundfgersgtesrtgeNessuna valutazione finora

- Loan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesDa EverandLoan Workouts and Debt for Equity Swaps: A Framework for Successful Corporate RescuesValutazione: 5 su 5 stelle5/5 (1)

- The Handbook for Investment Committee Members: How to Make Prudent Investments for Your OrganizationDa EverandThe Handbook for Investment Committee Members: How to Make Prudent Investments for Your OrganizationNessuna valutazione finora

- Buyouts: Success for Owners, Management, PEGs, ESOPs and Mergers and AcquisitionsDa EverandBuyouts: Success for Owners, Management, PEGs, ESOPs and Mergers and AcquisitionsNessuna valutazione finora

- Funds: Private Equity, Hedge and All Core StructuresDa EverandFunds: Private Equity, Hedge and All Core StructuresNessuna valutazione finora

- Behind the Curve: An Analysis of the Investment Behavior of Private Equity FundsDa EverandBehind the Curve: An Analysis of the Investment Behavior of Private Equity FundsNessuna valutazione finora

- Bond Portfolio Management StrategiesDocumento32 pagineBond Portfolio Management StrategiesSwati VermaNessuna valutazione finora

- Social Impact Bond CaseDocumento21 pagineSocial Impact Bond CaseTest123Nessuna valutazione finora

- Structured Finance and Insurance: The ART of Managing Capital and RiskDa EverandStructured Finance and Insurance: The ART of Managing Capital and RiskValutazione: 3 su 5 stelle3/5 (1)

- Risk Finance and Asset Pricing: Value, Measurements, and MarketsDa EverandRisk Finance and Asset Pricing: Value, Measurements, and MarketsNessuna valutazione finora

- Public Private Equity Partnerships and Climate ChangeDocumento52 paginePublic Private Equity Partnerships and Climate ChangeInternational Finance Corporation (IFC)Nessuna valutazione finora

- Reading 45-Private Equity Valuation-QuestionDocumento20 pagineReading 45-Private Equity Valuation-QuestionThekkla Zena100% (1)

- SS 01 Quiz 2 PDFDocumento60 pagineSS 01 Quiz 2 PDFYellow CarterNessuna valutazione finora

- Foreign Exchange Operations: Master Trading Agreements, Settlement, and CollateralDa EverandForeign Exchange Operations: Master Trading Agreements, Settlement, and CollateralNessuna valutazione finora

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresDa EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresNessuna valutazione finora

- Modern Investment Management: An Equilibrium ApproachDa EverandModern Investment Management: An Equilibrium ApproachValutazione: 3.5 su 5 stelle3.5/5 (4)

- Inside Private Equity: The Professional Investor's HandbookDa EverandInside Private Equity: The Professional Investor's HandbookNessuna valutazione finora

- Fund AccountingDocumento7 pagineFund AccountingMayuresh Shirsat100% (1)

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondDa EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNessuna valutazione finora

- Private Equity Funds Performance EvaluationDocumento5 paginePrivate Equity Funds Performance Evaluationgnachev_4100% (1)

- Fund PerformanceDocumento13 pagineFund PerformanceHilal MilmoNessuna valutazione finora

- Kickstart Your Corporation: The Incorporated Professional's Financial Planning CoachDa EverandKickstart Your Corporation: The Incorporated Professional's Financial Planning CoachNessuna valutazione finora

- Investment Leadership and Portfolio Management: The Path to Successful Stewardship for Investment FirmsDa EverandInvestment Leadership and Portfolio Management: The Path to Successful Stewardship for Investment FirmsNessuna valutazione finora

- Alternative Invesmtents For Pension FundsDocumento35 pagineAlternative Invesmtents For Pension FundsQuantmetrixNessuna valutazione finora

- Leadership Risk: A Guide for Private Equity and Strategic InvestorsDa EverandLeadership Risk: A Guide for Private Equity and Strategic InvestorsNessuna valutazione finora

- 2 Real Options in Theory and PracticeDocumento50 pagine2 Real Options in Theory and Practicedxc12670Nessuna valutazione finora

- Process and Asset Valuation A Complete Guide - 2019 EditionDa EverandProcess and Asset Valuation A Complete Guide - 2019 EditionNessuna valutazione finora

- CAIA Candidate HandbookDocumento12 pagineCAIA Candidate HandbookAshlesh SonjeNessuna valutazione finora

- Career Guides - Leveraged Finance & Credit Risk Management Free GuideDocumento9 pagineCareer Guides - Leveraged Finance & Credit Risk Management Free GuideRublesNessuna valutazione finora

- Lecture 5 - A Note On Valuation in Private EquityDocumento85 pagineLecture 5 - A Note On Valuation in Private EquitySinan DenizNessuna valutazione finora

- Investment Management: Meeting the Noble Challenges of Funding Pensions, Deficits, and GrowthDa EverandInvestment Management: Meeting the Noble Challenges of Funding Pensions, Deficits, and GrowthWayne H. WagnerNessuna valutazione finora

- M&A Disputes: A Professional Guide to Accounting ArbitrationsDa EverandM&A Disputes: A Professional Guide to Accounting ArbitrationsNessuna valutazione finora

- Investment Leadership: Building a Winning Culture for Long-Term SuccessDa EverandInvestment Leadership: Building a Winning Culture for Long-Term SuccessNessuna valutazione finora

- Capital Structure A Complete Guide - 2020 EditionDa EverandCapital Structure A Complete Guide - 2020 EditionNessuna valutazione finora

- Punching Above Your Weight: Minority Investments in PE: Portfolio Media. Inc. - 111 West 19Documento4 paginePunching Above Your Weight: Minority Investments in PE: Portfolio Media. Inc. - 111 West 19Jon Van TuinNessuna valutazione finora

- Investment and Portfolio ManageemntDocumento2 pagineInvestment and Portfolio Manageemntumair aliNessuna valutazione finora

- Private Equity and Pricing Value CreationDocumento12 paginePrivate Equity and Pricing Value CreationANUSHKA GOYALNessuna valutazione finora

- The New Science of Asset Allocation: Risk Management in a Multi-Asset WorldDa EverandThe New Science of Asset Allocation: Risk Management in a Multi-Asset WorldNessuna valutazione finora

- PIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsDa EverandPIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsNessuna valutazione finora

- Investment Decision and Portfolio Management (ACFN 632)Documento23 pagineInvestment Decision and Portfolio Management (ACFN 632)Hussen AbdulkadirNessuna valutazione finora

- B Pension Risk TransferDocumento7 pagineB Pension Risk TransferMikhail FrancisNessuna valutazione finora

- 2017-11-01 Builders Line English EditionDocumento56 pagine2017-11-01 Builders Line English EditionBhaskar ShanmugamNessuna valutazione finora

- EY-RAI Pulse of Indian Retail Market FinalDocumento16 pagineEY-RAI Pulse of Indian Retail Market Finalnehal vaghelaNessuna valutazione finora

- The God's Destiny (Final)Documento179 pagineThe God's Destiny (Final)Bhaskar ShanmugamNessuna valutazione finora

- PMLAnnualReport 2014Documento224 paginePMLAnnualReport 2014Bhaskar ShanmugamNessuna valutazione finora

- Retail Realty in India Vs Asian CountriesDocumento28 pagineRetail Realty in India Vs Asian Countriesashimasehgal0112Nessuna valutazione finora

- Mumbai PremiumsDocumento1 paginaMumbai PremiumsBhaskar ShanmugamNessuna valutazione finora

- BLR Hyd 5893962462708 BSDocumento1 paginaBLR Hyd 5893962462708 BSBhaskar ShanmugamNessuna valutazione finora

- Annual Survey of Industries Vol I 2009-10Documento879 pagineAnnual Survey of Industries Vol I 2009-10Bhaskar Shanmugam0% (1)

- Office Traction@Glance - Dec 2012 - Bangalore PDFDocumento3 pagineOffice Traction@Glance - Dec 2012 - Bangalore PDFBhaskar ShanmugamNessuna valutazione finora

- Office Traction@Glance - Dec 2012 - Bangalore PDFDocumento3 pagineOffice Traction@Glance - Dec 2012 - Bangalore PDFBhaskar ShanmugamNessuna valutazione finora

- Annual Survey of Industries 2008-09 Vol. IDocumento671 pagineAnnual Survey of Industries 2008-09 Vol. IBhaskar ShanmugamNessuna valutazione finora

- 936 - III - BAngalore RuralDocumento221 pagine936 - III - BAngalore RuralBhaskar ShanmugamNessuna valutazione finora

- 56 SEIAA Meeting (3.10.2012) PDFDocumento91 pagine56 SEIAA Meeting (3.10.2012) PDFBhaskar ShanmugamNessuna valutazione finora

- 53rd SEIAA Meeting (06.07.2012) - 1Documento84 pagine53rd SEIAA Meeting (06.07.2012) - 1Bhaskar ShanmugamNessuna valutazione finora

- Is Real Estate in India in A BubbleDocumento3 pagineIs Real Estate in India in A BubbleBhaskar ShanmugamNessuna valutazione finora

- 53rd SEIAA Meeting (06.07.2012) - 1Documento84 pagine53rd SEIAA Meeting (06.07.2012) - 1Bhaskar ShanmugamNessuna valutazione finora

- 55th SEIAA Meeting - 03.09.2012Documento64 pagine55th SEIAA Meeting - 03.09.2012Bhaskar ShanmugamNessuna valutazione finora

- Bangalore Residential Report May 2012Documento44 pagineBangalore Residential Report May 2012Bhaskar ShanmugamNessuna valutazione finora

- Private Equity Buy Side Financial Model and ValuationDocumento19 paginePrivate Equity Buy Side Financial Model and ValuationBhaskar Shanmugam100% (3)

- E&R at Glance: JANUARY 2013Documento3 pagineE&R at Glance: JANUARY 2013Bhaskar ShanmugamNessuna valutazione finora

- Keys PreDocumento79 pagineKeys PreBhaskar ShanmugamNessuna valutazione finora

- IT Policy-Draft 2011Documento18 pagineIT Policy-Draft 2011Bhaskar ShanmugamNessuna valutazione finora

- Karnataka: An Overview: C Max. 40 CDocumento17 pagineKarnataka: An Overview: C Max. 40 CBhaskar Shanmugam100% (1)

- MOU's Bangalore UrbanDocumento5 pagineMOU's Bangalore UrbanBhaskar ShanmugamNessuna valutazione finora

- HybridDocumento22 pagineHybridBhaskar ShanmugamNessuna valutazione finora

- PRR Can Dry Up TG Halli Catchment AreaDocumento2 paginePRR Can Dry Up TG Halli Catchment AreaBhaskar ShanmugamNessuna valutazione finora

- L'Occitane Enters Indian Spa MarketDocumento1 paginaL'Occitane Enters Indian Spa MarketBhaskar ShanmugamNessuna valutazione finora

- MITOCW - 10. Financial System Challenges & OpportunitiesDocumento32 pagineMITOCW - 10. Financial System Challenges & OpportunitiesAnjali AhujaNessuna valutazione finora

- Fs SP Pan Arab CompositeDocumento6 pagineFs SP Pan Arab CompositeMarNessuna valutazione finora

- Old Bridge Mutual Fund - Factsheet March 2024Documento8 pagineOld Bridge Mutual Fund - Factsheet March 2024Bharathi 3280Nessuna valutazione finora

- Digital Marketing Channel and Celebrity Endorsement Analysis of Online Mutual Fund Purchase Decisions With Mutual Fund Performance MediationDocumento12 pagineDigital Marketing Channel and Celebrity Endorsement Analysis of Online Mutual Fund Purchase Decisions With Mutual Fund Performance MediationInternational Journal of Innovative Science and Research TechnologyNessuna valutazione finora

- Monthly Portfolio As On 30th June 2021Documento367 pagineMonthly Portfolio As On 30th June 2021muhsinNessuna valutazione finora

- Petition Against Starcomms PP and Chapel Hill Denham - 180512 - Morgan CapitalDocumento10 paginePetition Against Starcomms PP and Chapel Hill Denham - 180512 - Morgan CapitalProshareNessuna valutazione finora

- Islamic Financial Planner - Module One (Revision) Financial Planning Industry in MalaysiaDocumento16 pagineIslamic Financial Planner - Module One (Revision) Financial Planning Industry in MalaysiaShahizan Md Noh100% (1)

- Project Report On Tata Aia Life InsuranceDocumento52 pagineProject Report On Tata Aia Life Insurancevipinkathpal25% (4)

- 1Documento11 pagine1PHƯƠNG ĐẶNG DƯƠNG XUÂNNessuna valutazione finora

- Accelerating Capital Markets Development in Emerging EconomiesDocumento26 pagineAccelerating Capital Markets Development in Emerging EconomiesIchbin BinNessuna valutazione finora

- Investment Option Through BajajDocumento57 pagineInvestment Option Through BajajSiddiqua AnsariNessuna valutazione finora

- Mutual Fund: Mutual Funds in IndiaDocumento12 pagineMutual Fund: Mutual Funds in IndiaNirali AntaniNessuna valutazione finora

- Aequitas InvestmentsDocumento5 pagineAequitas InvestmentsSantosh RoutNessuna valutazione finora

- Sriram Insight Financial ProjectDocumento99 pagineSriram Insight Financial ProjectVinay Bhandari100% (1)

- DMS-IIT Delhi Compendium 2019-21Documento55 pagineDMS-IIT Delhi Compendium 2019-21Sounak Chatterjee100% (1)

- Key Investor Information: Vanguard Lifestrategy® 20% Equity Fund (The "Fund")Documento2 pagineKey Investor Information: Vanguard Lifestrategy® 20% Equity Fund (The "Fund")Cristian GherghiţăNessuna valutazione finora

- Project Mutual Funds Awareness 47Documento24 pagineProject Mutual Funds Awareness 47m.com22shiudkarsudarshanNessuna valutazione finora

- Security Bank - UITF Investment ReportDocumento2 pagineSecurity Bank - UITF Investment ReportgwapongkabayoNessuna valutazione finora

- Mutual Fund Investor Attitude Towards RiskDocumento67 pagineMutual Fund Investor Attitude Towards RiskBinoyNessuna valutazione finora

- Description of Securities and Risks Related To Securities EngDocumento7 pagineDescription of Securities and Risks Related To Securities EngNikhilparakhNessuna valutazione finora

- Project Report: Mutual FundDocumento32 pagineProject Report: Mutual FundArian HaqueNessuna valutazione finora

- HSBC Amfi Mock Test-1Documento10 pagineHSBC Amfi Mock Test-1Ankit Sharma100% (1)

- Analysis On Axis BankDocumento99 pagineAnalysis On Axis BankNiket_Verma_8763Nessuna valutazione finora

- Biitm-IFSS-Mutual Funds - ZoomDocumento55 pagineBiitm-IFSS-Mutual Funds - ZoomBikash Kumar DashNessuna valutazione finora

- Sudipta Shib-21bsp1265-Group 3 (Ibs-Mumbai)Documento9 pagineSudipta Shib-21bsp1265-Group 3 (Ibs-Mumbai)Joy OfficialNessuna valutazione finora

- IC VAR LIFE - Reviewer With Answer KeyDocumento15 pagineIC VAR LIFE - Reviewer With Answer KeyDalton Jay LuzaNessuna valutazione finora

- International FinanceDocumento47 pagineInternational Financedohongvinh40Nessuna valutazione finora

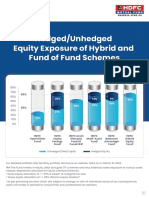

- Leaflet - Hedged and Unhedged Exposure of Hybrid FundsDocumento2 pagineLeaflet - Hedged and Unhedged Exposure of Hybrid FundsDeepakNessuna valutazione finora

- Self Attempt Questions - SolutionsDocumento5 pagineSelf Attempt Questions - SolutionsShermaine WanNessuna valutazione finora

- Research ProjectDocumento64 pagineResearch ProjectSaurabh RautNessuna valutazione finora