Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Top NCD Picks for September 2013

Caricato da

vivekrajbhilai5850Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Top NCD Picks for September 2013

Caricato da

vivekrajbhilai5850Copyright:

Formati disponibili

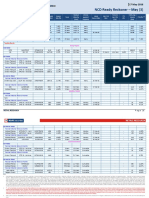

Top NCD Picks September (2)

September 10, 2013

Series

HSL Scrip code

Last

traded

Price

(Rs)

Coupon

Rate (%)

Tenor

Residual

Maturity

(Year)

Interest

payment

frequency

Latest

Record

Date

Call / Put

Date

Tenor

to Call /

Put

(Yrs)

YTC

(%)

Daily

Average

Volume

(Nos)

YTM

(%)

793REC22

820PFC2022

REC793NBNR

PFC820N5NR

972

1065

7.93%

8.20%

10 Yrs

10 Yrs

8.55

8.40

Annual

Annual

15-Jun-13

28-Sep-12

NA

NA

NA

NA

NA

NA

646

1279

8.66%

8.35%

751HUDCO28

HUDCO050327

HUD751N5NR

HUD820N2NR

952

1018

7.51%

8.20%

15 Yrs

15 Yrs

14.45

13.49

Annual

Annual

Nil

18-Feb-13

NA

NA

NA

NA

NA

NA

921

1925

8.61%

8.49%

N1

N5

STABANN1NR

STABANN5NR

10150

10646

9.25%

9.95%

10 years

15 years

7.16

12.52

Annual

Annual

16-Mar-13

16-Mar-13

5-Nov-15

17-Mar-21

2.16

7.52

11.23%

9.52%

42

363

9.76%

9.62%

AA+ Rated

Residual Maturity- Below 24 months

Shriram Transport Finance

STFC NR - Indi

Shriram Transport Finance

STFC ND

SRTRANNRNR

SRTRANNDNR

1015

605

11.15%

10.25%

3 Years

5 Years

1.92

1.73

Annual

Annual

15-Mar-13

15-Mar-13

NA

NA

NA

NA

NA

NA

101

137

13.27%

11.87%

Residual Maturity- Above 24 months

Shriram Transport Finance

STFC NU - Indivi

Shriram Transport Finance

STFC NS - Indivi

SRTRANNUNR

SRTRANNSNR

1068

1018

0.00%

11.40%

5 Years

5 Years

3.92

3.92

Cumulative

Annual

Nil

15-Mar-13

NA

NA

NA

NA

NA

NA

108

229

12.87%

12.47%

AA- Rated

Residual Maturity- Below 24 months

Religare Finvest Limited

O2C3

Muthoot Finance

MFINNCD1D / N4

RFL2C3N6NR

MUTFINN4NR

1024

984

12.25%

12.25%

3 Years

3 Years

1.04

1.01

Annual

Annual

22-Mar-13

30-Aug-13

NA

NA

NA

NA

NA

NA

306

237

15.50%

13.87%

Residual Maturity- Above 24 months

Muthoot Finance

MFINNCD2D

India Infoline Finance

IIFLFIN N7

MUTFIN2DNR

INDINFN7NR

1172

1020

NA

NA

5.5 Yrs

6 Years

3.36

5.02

Cumulative

Cumulative

Nil

Nil

NA

NA

NA

NA

NA

NA

253

179

17.23%

14.95%

Issuer

Tax Free Bonds

AAA Rated

REC

Power Finance Co

AA+ Rated

HUDCO

HUDCO

Taxable Bonds

AAA Rated

SBI

SBI

Note:

Credit Rating (as per latest data): For STFC NCDs CARE AA+ / Crisil AA (Stable). For TATA Cap NCDs CARE AA+ / ICRA LAA+. For L&T Fin NCDs CARE AA+ / ICRA LAA+. For SBI Bonds

CARE AAA / AAA/ Stable by CRISIL. For IndiaInfoline NCDs - CARE AA-' by CARE & ICRA AA- by ICRA. For SHRIRAMCITI NCDs - Crisil AA-/Stable Care AA'. For Muthoot NCDs - CRISIL

AA-/Stable by CRISIL and [ICRA] AA-(stable) by ICRA. For Manappuram NCDs - CARE AA- from CARE and BWR AA- from Brickwork. For Religare Finvest NCDs - [ICRA] AA (Stable) from

ICRA Ltd. &[CARE] AA- from CARE. For NHAI NCDs - CRISIL AAA/Stable by CRISIL CARE AAA by CARE and "Fitch AAA(ind) with Stable Outlook by FITCH. For PFC NCDs - "CRISIL

AAA/Stable by CRISIL and ICRA AAA by ICRA. For IRFC - CRISIL AAA/Stable by CRISIL, [ICRA] AAA by ICRA and CARE AAA by CARE ", For REC - CRISIL AAA/Stable by CRISIL,CARE

AAA by CARE, Fitch AAA(ind)by FITCH and [ICRA]AAA by ICRA. For Tata Capital Financial Service Ltd - AA+/Stable from ICRA Limited and CARE AA from CARE. For IIFCL, ICRA

AAA/Stable by ICRA,BWR AAA by Brickworks and CARE AAA by CARE.

Unexpected cut in credit rating could result in bond prices going down and resultant MTM loss.

YTM is yield to maturity - Annualized yield that would be realized on a bond if the bond is held until the maturity date.

Yield to call (YTC) is the annualized rate of return that an investor would earn if he bought a callable bond at its current market price and held until the call is first exercisable by the issuer.

Religare, PFC, REC, DCI, Ennore Port, IIFCL NCDs are listed only on BSE, while the rest are listed on NSE and (in some cases - Muthoot finance, IIFL, HUDCO and some series of Shriram Citi,

Muthoot Fin & Religare Fin) also on BSE. In case where the NCD are listed on both the exchanges, the price on the exchange where it is traded more (average daily volumes) is considered.

FV of NCDs in all cases is Rs.1000, except Rs.10,000 for SBI, Rs.1,00,000 for TATA Cap N1 and Rs. 200 for STFC N1 and STFC N2.

Last traded date means date of last trade (not beyond the previous month). Further freak trades are not considered for YTM calculations.

While short listing the top picks, enough weightage is given to frequency of trade and average volumes.

RETAIL RESEARCH

Fax: (022) 3075 3435

Corporate Office: HDFC Securities Limited, I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg

(East), Mumbai 400 042 Fax: (022) 30753435 Website: www.hdfcsec.com

Disclaimer: Debt investments are subject to risk. Past performance is no guarantee for future performance. This document has been prepared by HDFC Securities Limited

and is meant for sole use by the recipient and not for circulation. This document is not to be reported or copied or made available to others. It should not be considered to be

taken as an offer to sell or a solicitation to buy any security. The information contained herein is from sources believed reliable. We do not represent that it is accurate or

complete and it should not be relied upon as such. We may have from time to time positions or options on, and buy and sell securities referred to herein. We may from time

to time solicit from, or perform investment banking, or other services for, any company mentioned in this document. This report is intended for non-Institutional Clients.

Retail Research

Potrebbero piacerti anche

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKDa EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2023 + TEST BANKNessuna valutazione finora

- Procedure - Management ReviewDocumento2 pagineProcedure - Management Reviewiresendiz50% (2)

- Deliverance From Debt and Financial FreedomDocumento9 pagineDeliverance From Debt and Financial FreedomApostle Paul Amadi93% (14)

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKDa EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNessuna valutazione finora

- Tactical Asset AllocationDocumento70 pagineTactical Asset AllocationPattabiraman MurariNessuna valutazione finora

- Tactical Asset AllocationDocumento70 pagineTactical Asset AllocationPattabiraman MurariNessuna valutazione finora

- 33899Documento6 pagine33899shoaibNessuna valutazione finora

- Capital Market Management - Avadhani IncompleteDocumento11 pagineCapital Market Management - Avadhani Incompletemidnight graphiteNessuna valutazione finora

- Vision 2050: Time TotransformDocumento118 pagineVision 2050: Time TotransformComunicarSe-ArchivoNessuna valutazione finora

- Performance Improvement PlanDocumento3 paginePerformance Improvement PlanLuis Carlos Sandoval Jr.100% (1)

- Safety ManualDocumento33 pagineSafety ManualOUYANGXU111Nessuna valutazione finora

- DANON v. BRIMODocumento1 paginaDANON v. BRIMOk santos50% (2)

- Report PDFDocumento2 pagineReport PDFGauriGanNessuna valutazione finora

- Top Tax-Free and Taxable NCD Picks for May 2014Documento1 paginaTop Tax-Free and Taxable NCD Picks for May 2014arun_algoNessuna valutazione finora

- Top NCD Picks and Analysis for May 2014Documento1 paginaTop NCD Picks and Analysis for May 2014shobhaNessuna valutazione finora

- ReportDocumento2 pagineReportumaganNessuna valutazione finora

- ReportDocumento1 paginaReportumaganNessuna valutazione finora

- Top NCD Picks - April (4) : Retail ResearchDocumento1 paginaTop NCD Picks - April (4) : Retail Researcharun_algoNessuna valutazione finora

- ReportDocumento3 pagineReportshobhaNessuna valutazione finora

- 3013618Documento2 pagine3013618GauriGanNessuna valutazione finora

- 3013734Documento2 pagine3013734GauriGanNessuna valutazione finora

- TAX-FREE AND TAXABLE BONDS RESEARCHDocumento3 pagineTAX-FREE AND TAXABLE BONDS RESEARCHumaganNessuna valutazione finora

- ReportDocumento3 pagineReportumaganNessuna valutazione finora

- Top AA+ rated tax-free bonds under 15 yearsDocumento3 pagineTop AA+ rated tax-free bonds under 15 yearsumaganNessuna valutazione finora

- Head and Shoulders Broken: Punter's CallDocumento5 pagineHead and Shoulders Broken: Punter's CallRajasekhar Reddy AnekalluNessuna valutazione finora

- City Developments Downgraded to Sell on Residential Uncertainties; Hotel Segment Remains FirmDocumento6 pagineCity Developments Downgraded to Sell on Residential Uncertainties; Hotel Segment Remains FirmJay NgNessuna valutazione finora

- Bulls Say Happy Weekend: Punter's CallDocumento5 pagineBulls Say Happy Weekend: Punter's CallGauriGanNessuna valutazione finora

- Module1-Investments & Risk & DerivativesDocumento169 pagineModule1-Investments & Risk & DerivativesLMT indiaNessuna valutazione finora

- CMT Ar 2014Documento224 pagineCMT Ar 2014Sassy TanNessuna valutazione finora

- Investment Analysis & Portfolio MGTDocumento104 pagineInvestment Analysis & Portfolio MGTkhusbuNessuna valutazione finora

- Telecom Sector Update and Key Operator AnalysisDocumento3 pagineTelecom Sector Update and Key Operator AnalysisSoodamany Ponnu PandianNessuna valutazione finora

- Fiem Industries (Fieind) : Leds To Light Up FutureDocumento3 pagineFiem Industries (Fieind) : Leds To Light Up FuturehridaybikashdasNessuna valutazione finora

- India Info Line ICICI DirectDocumento6 pagineIndia Info Line ICICI DirectSharad DhariwalNessuna valutazione finora

- ReportDocumento3 pagineReportumaganNessuna valutazione finora

- Daily Technical Report, 10.05.2013Documento4 pagineDaily Technical Report, 10.05.2013Angel BrokingNessuna valutazione finora

- Daily Option Daily Option News Letter News LetterDocumento7 pagineDaily Option Daily Option News Letter News Letterapi-256777091Nessuna valutazione finora

- Market Outlook 9th January 2012Documento3 pagineMarket Outlook 9th January 2012Angel BrokingNessuna valutazione finora

- Starhill Global REIT Ending 1Q14 On High NoteDocumento6 pagineStarhill Global REIT Ending 1Q14 On High NoteventriaNessuna valutazione finora

- Market Outlook 23rd August 2011Documento3 pagineMarket Outlook 23rd August 2011angelbrokingNessuna valutazione finora

- Daily Technical Report, 21.05.2013Documento4 pagineDaily Technical Report, 21.05.2013Angel BrokingNessuna valutazione finora

- td140220 2Documento7 paginetd140220 2Joyce SampoernaNessuna valutazione finora

- Singapore Container Firm Goodpack Research ReportDocumento3 pagineSingapore Container Firm Goodpack Research ReportventriaNessuna valutazione finora

- Value Research: FundcardDocumento4 pagineValue Research: FundcardYogi173Nessuna valutazione finora

- Market Outlook 25th August 2011Documento3 pagineMarket Outlook 25th August 2011Angel BrokingNessuna valutazione finora

- Stock Stock Analysis: Stock To Watch Stock To WatchDocumento8 pagineStock Stock Analysis: Stock To Watch Stock To Watchapi-240625149Nessuna valutazione finora

- Daily Technical Report, 18.07.2013Documento4 pagineDaily Technical Report, 18.07.2013Angel BrokingNessuna valutazione finora

- Technical Report 2nd March 2012Documento5 pagineTechnical Report 2nd March 2012Angel BrokingNessuna valutazione finora

- Technical Format With Stock 14.12.2012Documento4 pagineTechnical Format With Stock 14.12.2012Angel BrokingNessuna valutazione finora

- Stock Stock Analysis: Stock To Watch Stock To WatchDocumento8 pagineStock Stock Analysis: Stock To Watch Stock To Watchapi-234732356Nessuna valutazione finora

- Daily Option News LetterDocumento7 pagineDaily Option News Letterapi-256777091Nessuna valutazione finora

- Sundaram Select MidcapDocumento2 pagineSundaram Select Midcapredchillies7Nessuna valutazione finora

- Market Outlook: Dealer's DiaryDocumento4 pagineMarket Outlook: Dealer's DiaryAngel BrokingNessuna valutazione finora

- Daily Derivatives: December 23, 2016Documento3 pagineDaily Derivatives: December 23, 2016choni singhNessuna valutazione finora

- Importance of Equity Research in Today's Equity Markets by CapitalHeight.Documento4 pagineImportance of Equity Research in Today's Equity Markets by CapitalHeight.Damini CapitalNessuna valutazione finora

- Market Outlook 29th September 2011Documento3 pagineMarket Outlook 29th September 2011Angel BrokingNessuna valutazione finora

- Stock Stock Analysis: Stock To Watch Stock To WatchDocumento8 pagineStock Stock Analysis: Stock To Watch Stock To Watchapi-240625149Nessuna valutazione finora

- Kotak Nifty ETF PDFDocumento4 pagineKotak Nifty ETF PDFkayNessuna valutazione finora

- Top SIP fund picks for disciplined long-term investingDocumento4 pagineTop SIP fund picks for disciplined long-term investingLaharii MerugumallaNessuna valutazione finora

- Positive Momentum Continues: Punter's CallDocumento3 paginePositive Momentum Continues: Punter's CallDivakar MamidiNessuna valutazione finora

- Deliverable Swap Futures - CMEDocumento2 pagineDeliverable Swap Futures - CMEjitenparekhNessuna valutazione finora

- SingTel Maintains Hold RatingDocumento4 pagineSingTel Maintains Hold Ratingscrib07Nessuna valutazione finora

- Market Outlook 20th September 2011Documento4 pagineMarket Outlook 20th September 2011Angel BrokingNessuna valutazione finora

- Daily Option News LetterDocumento7 pagineDaily Option News Letterapi-234732356Nessuna valutazione finora

- Daily Option News LetterDocumento7 pagineDaily Option News Letterapi-256777091Nessuna valutazione finora

- PC Jeweller LTD IER InitiationReport 2Documento28 paginePC Jeweller LTD IER InitiationReport 2Himanshu JainNessuna valutazione finora

- Daily Option News LetterDocumento7 pagineDaily Option News Letterapi-256777091Nessuna valutazione finora

- Schroder Dana Istimewa: Fund FactsheetDocumento1 paginaSchroder Dana Istimewa: Fund FactsheetWacadd OfcaipiNessuna valutazione finora

- Chapter 11 Bond Prices and YieldsDocumento36 pagineChapter 11 Bond Prices and Yieldssharktale2828Nessuna valutazione finora

- MTAG - Research Hive - 27 Aug 2020Documento2 pagineMTAG - Research Hive - 27 Aug 2020JazzyNessuna valutazione finora

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryDa EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Non-Ergodicity Explained: Why Individual Results May Differ from AveragesDocumento72 pagineNon-Ergodicity Explained: Why Individual Results May Differ from AveragesAtul Divya SodhiNessuna valutazione finora

- Purchase Goi ProceduresDocumento69 paginePurchase Goi Proceduresvivekrajbhilai5850Nessuna valutazione finora

- Mut Fin ProspDocumento504 pagineMut Fin Prospvivekrajbhilai5850Nessuna valutazione finora

- Step by Step Corporate EmailDocumento4 pagineStep by Step Corporate Emailvivekrajbhilai5850Nessuna valutazione finora

- Len User ManualDocumento34 pagineLen User Manualvivekrajbhilai5850Nessuna valutazione finora

- IT Infrastructure ProformaDocumento3 pagineIT Infrastructure Proformavivekrajbhilai5850Nessuna valutazione finora

- Ses MB 4900028276 DJ0161000003Documento1 paginaSes MB 4900028276 DJ0161000003vivekrajbhilai5850Nessuna valutazione finora

- SSA GazetteDocumento1 paginaSSA Gazettevivekrajbhilai5850Nessuna valutazione finora

- EVEREADY LED Compact Area Light Evcal41bpDocumento1 paginaEVEREADY LED Compact Area Light Evcal41bpvivekrajbhilai5850Nessuna valutazione finora

- Amd Po4190001987Documento1 paginaAmd Po4190001987vivekrajbhilai5850Nessuna valutazione finora

- R3 Forms To USeDocumento16 pagineR3 Forms To USevivekrajbhilai5850Nessuna valutazione finora

- Delivery Challan Format For Sending MaterialsDocumento1 paginaDelivery Challan Format For Sending Materialsvivekrajbhilai5850Nessuna valutazione finora

- MC Donals West LifeDocumento1 paginaMC Donals West Lifevivekrajbhilai5850Nessuna valutazione finora

- Guidelines For Placement of Purchase Orders On Manufacturer Authorized DealersDocumento1 paginaGuidelines For Placement of Purchase Orders On Manufacturer Authorized Dealersvivekrajbhilai5850Nessuna valutazione finora

- Shankara RaipurDocumento5 pagineShankara Raipurvivekrajbhilai5850Nessuna valutazione finora

- Transperency PDFDocumento3 pagineTransperency PDFvivekrajbhilai5850Nessuna valutazione finora

- Constitution Amendment Act, 2016 On GST - Amendments Effective 16-9-2016Documento7 pagineConstitution Amendment Act, 2016 On GST - Amendments Effective 16-9-2016vivekrajbhilai5850Nessuna valutazione finora

- MM Dashboard RearrangementDocumento4 pagineMM Dashboard Rearrangementvivekrajbhilai5850Nessuna valutazione finora

- Dda Public Notice For Changing of Timinf For Public Dealing in Vikas Sadan (English - 300915 PDFDocumento1 paginaDda Public Notice For Changing of Timinf For Public Dealing in Vikas Sadan (English - 300915 PDFvivekrajbhilai5850Nessuna valutazione finora

- ShriramCity DEBT CRISIL RATINGDocumento14 pagineShriramCity DEBT CRISIL RATINGvivekrajbhilai5850Nessuna valutazione finora

- Transfer Order 367-2016Documento3 pagineTransfer Order 367-2016vivekrajbhilai5850Nessuna valutazione finora

- GST Council Approves Draft CGST Bill and Draft IGST BillDocumento5 pagineGST Council Approves Draft CGST Bill and Draft IGST Billvivekrajbhilai5850Nessuna valutazione finora

- Laptop Purchase for Newly Promoted GMsDocumento4 pagineLaptop Purchase for Newly Promoted GMsvivekrajbhilai5850Nessuna valutazione finora

- LOKPAL CIRCULAR 2ND April 16 PDFDocumento2 pagineLOKPAL CIRCULAR 2ND April 16 PDFvivekrajbhilai5850Nessuna valutazione finora

- Exe - 11 Declaration of TourDocumento1 paginaExe - 11 Declaration of Tourvivekrajbhilai5850Nessuna valutazione finora

- ST Finance C Product NoteDocumento3 pagineST Finance C Product Notevivekrajbhilai5850Nessuna valutazione finora

- Dda Public Notice For Changing of Timing For Public Dealing in Vikas Sadan (English - 300915Documento1 paginaDda Public Notice For Changing of Timing For Public Dealing in Vikas Sadan (English - 300915vivekrajbhilai5850Nessuna valutazione finora

- An Improvement of Three Leg Signalized Intersections in Duhok City, Kurdistan-Iraq (Baran 2018)Documento6 pagineAn Improvement of Three Leg Signalized Intersections in Duhok City, Kurdistan-Iraq (Baran 2018)Baran BaranyNessuna valutazione finora

- PY Vs PWCDocumento2 paginePY Vs PWCJeric VendiolaNessuna valutazione finora

- Discharge of parties from liability on negotiable instrumentsDocumento2 pagineDischarge of parties from liability on negotiable instrumentsHarini BNessuna valutazione finora

- EWU MBA BC Course OutlinesDocumento4 pagineEWU MBA BC Course OutlineskhantabassumanikaNessuna valutazione finora

- Wesleyan University - Philippines MAS AreasDocumento5 pagineWesleyan University - Philippines MAS AreasPrinces S. RoqueNessuna valutazione finora

- Causes of Business Failure and Possible Solutions (A Case Study of Uju Printing Press, Kaduna) - ProjectclueDocumento1 paginaCauses of Business Failure and Possible Solutions (A Case Study of Uju Printing Press, Kaduna) - Projectcluemathias lakiNessuna valutazione finora

- Samsung Electronics: S StrengthDocumento34 pagineSamsung Electronics: S Strengthmariyha PalangganaNessuna valutazione finora

- QP002-F001 - Training Assessment Report for ChemistDocumento2 pagineQP002-F001 - Training Assessment Report for Chemisthghghg3Nessuna valutazione finora

- NATIONAL BUDGET CIRCULAR NO 590 A DATED SEPTEMBER 29 2023 Amending Item 3.3 of NBC 590 Validity of UnproDocumento4 pagineNATIONAL BUDGET CIRCULAR NO 590 A DATED SEPTEMBER 29 2023 Amending Item 3.3 of NBC 590 Validity of UnproChristian RuizNessuna valutazione finora

- VCE SUMMER INTERNSHIP FINANCIAL RISK ASSESSMENTDocumento12 pagineVCE SUMMER INTERNSHIP FINANCIAL RISK ASSESSMENTAnnu KashyapNessuna valutazione finora

- Types of Electronic MediaDocumento5 pagineTypes of Electronic Mediaeeqanabeella0% (1)

- Project Alfred - CIMDocumento52 pagineProject Alfred - CIMHimanshu MalikNessuna valutazione finora

- JBL. Internship ReportDocumento33 pagineJBL. Internship ReportShuvo HoqueNessuna valutazione finora

- What Is A Cryptocurrency ?Documento13 pagineWhat Is A Cryptocurrency ?Э. Цэнд-АюушNessuna valutazione finora

- SOP For Sale of Assets - FinalDocumento7 pagineSOP For Sale of Assets - FinalTejas JoshiNessuna valutazione finora

- Business Forecasting - Term VI - R - Will Be ModifiedDocumento5 pagineBusiness Forecasting - Term VI - R - Will Be ModifiedAayoush GuptaNessuna valutazione finora

- (Event Ticket) Road To Bitcoin Halving - Road To Bitcoin Halving - 1 40086-B2664-187Documento3 pagine(Event Ticket) Road To Bitcoin Halving - Road To Bitcoin Halving - 1 40086-B2664-187ghaniysultan100% (1)

- A Survey of Taxation Law Bar Questions 2009 To 2019Documento142 pagineA Survey of Taxation Law Bar Questions 2009 To 2019Jessy FrancisNessuna valutazione finora

- Independent ConsultantDocumento8 pagineIndependent ConsultantNaveen GowdaNessuna valutazione finora

- Labour Index Base Year-2016 100Documento6 pagineLabour Index Base Year-2016 100Vikrant DeshmukhNessuna valutazione finora

- Financial Accounting Reviewer - Chapter 65Documento11 pagineFinancial Accounting Reviewer - Chapter 65Coursehero PremiumNessuna valutazione finora

- Vinayak Resume 2022Documento5 pagineVinayak Resume 2022Maitry VasaNessuna valutazione finora