Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Formulas - Math For PMP

Caricato da

abhi10augDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Formulas - Math For PMP

Caricato da

abhi10augCopyright:

Formati disponibili

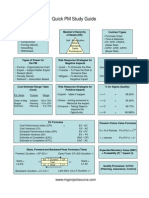

Formulas / Math for PMP

If you think a formula is missing here but required in PMP exam. Post a comment and we will add to this table.

1. PERT

2. Standard Deviation

3. Variance

4. Float or Slack

5. Cost Variance

6. Schedule Variance

7. Cost Perf. Index

8. Sched. Perf. Index

9. Est. At Completion (EAC)

(P + 4M + O )/ 6 Pessimistic, Most Likely,

Optimistic

(P - O) / 6

[(P - O)/6 ]squared

LS-ES and LF-EF

EV - AC

EV - PV

EV / AC

EV / PV

BAC / CPI,

AC + ETC -- Initial Estimates are flawed

AC + BAC - EV -- Future variance are Atypical

10. Est. To Complete

AC + (BAC - EV) / CPI -- Future Variance would

be typical

EAC - AC

Percentage complete

EV/ BAC

11. Var. At Completion

BAC - EAC

12. To Complete Performance Index TCPI Values for the TCPI index of less then 1.0 is good

because it indicates the efficiency to complete is

less than planned. How efficient must the

project team be to complete the remaining

work with the remaining money?

13. Net Present Value

14. Present Value PV

15. Internal Rate of Return

16. Benefit Cost Ratio

( BAC - EV ) / ( BAC - AC )

Bigger is better (NPV)

FV / (1 + r)^n

Bigger is better (IRR)

Bigger is better ((BCR or Benefit / Cost) revenue

or payback VS. cost)

17. Payback Period

Or PV or Revenue / PV of Cost

Less is better

18. BCWS

19. BCWP

20. ACWP

21. Order of Magnitude Estimate

22. Budget Estimate

Net Investment / Avg. Annual cash flow.

PV

EV

AC

-25% - +75% (-50 to +100% PMBOK)

-10% - +25%

23. Definitive Estimate

24. Comm. Channels

25. Expected Monetary Value

26. Point of Total Assumption (PTA)

Sigma

Return on Sales ( ROS )

Return on Assets( ROA )

-5% - +10%

N(N -1)/2

Probability * Impact

((Ceiling Price - Target Price)/buyer's Share

Ratio) + Target Cost

1 = 68.27%

2 = 95.45%

3 = 99.73%

6 = 99.99985%

Net Income Before Taxes (NEBT) / Total Sales OR

Net Income After Taxes ( NEAT ) / Total Sales

NEBT / Total Assets OR

NEAT / Total Assets

NEBT / Total Investment OR

Return on Investment ( ROI )

Working Capital

Discounted Cash Flow

NEAT / Total Investment

Current Assets - Current Liabilities

Cash Flow X Discount Factor

Savings = Target Cost Actual Cost

Bonus = Savings x Percentage

Contract related formulas

Contract Cost = Bonus + Fees

Total Cost = Actual Cost + Contract Cost

Critical Path formulas

Forward Pass: (Add 1 day to Early Start)

Backward Pass: (Minus 1 day to Late Finish)

LS = (LF - Duration + 1)

ES = Early Start; EF = Early Finish;

LS = Late Start; LF = Late Finish

EF = (ES + Duration - 1)

EVA = Net Operating Profit After Tax - Cost of Capital (Revenue - Op. Exp - Taxes) - (Investment Capital X % Cost of

Capital) EVA - Economic Value Add Benefit Measurement - Bigger is better

Source Selection = (Weightage X Price) + (Weightage X Quality)

Potrebbero piacerti anche

- Earned Value Management for the PMP Certification ExamDa EverandEarned Value Management for the PMP Certification ExamValutazione: 4.5 su 5 stelle4.5/5 (15)

- 17 PMP Formulas Mentioned in The PMBOK GuideDocumento14 pagine17 PMP Formulas Mentioned in The PMBOK GuideStéphane SmetsNessuna valutazione finora

- PMstudyprocesschart Formula V5Documento2 paginePMstudyprocesschart Formula V5786tip786Nessuna valutazione finora

- Project Portfolio Management: A View from the Management TrenchesDa EverandProject Portfolio Management: A View from the Management TrenchesValutazione: 2 su 5 stelle2/5 (1)

- PMP Formulas - Cheat Sheet v0.6Documento2 paginePMP Formulas - Cheat Sheet v0.6Mohamed LabbeneNessuna valutazione finora

- PMP Certification: A Beginner's Guide, Fourth EditionDa EverandPMP Certification: A Beginner's Guide, Fourth EditionNessuna valutazione finora

- PMBOK Formulas GuideDocumento4 paginePMBOK Formulas GuideWilliam Rojas MoralesNessuna valutazione finora

- A Glimpse Into Your Project Management Future: 8 Certifications That Can Work For YouDa EverandA Glimpse Into Your Project Management Future: 8 Certifications That Can Work For YouNessuna valutazione finora

- PMP Formulas - Cheat Sheet v0.6Documento2 paginePMP Formulas - Cheat Sheet v0.6Don GiovzNessuna valutazione finora

- Exam Cram Essentials Last-Minute Guide to Ace the PMP Exam: First EditionDa EverandExam Cram Essentials Last-Minute Guide to Ace the PMP Exam: First EditionNessuna valutazione finora

- VI VI - PMP Formula Pocket GuideDocumento1 paginaVI VI - PMP Formula Pocket GuideSMAKNessuna valutazione finora

- Process Management Knowledge AreasDocumento9 pagineProcess Management Knowledge AreasRobincrusoe100% (1)

- PMP Itto ChartDocumento25 paginePMP Itto ChartMuhammad Amir JamilNessuna valutazione finora

- Project Control Stages A Complete Guide - 2019 EditionDa EverandProject Control Stages A Complete Guide - 2019 EditionNessuna valutazione finora

- Outwitting The PMP© Exam: Released 2012Documento100 pagineOutwitting The PMP© Exam: Released 2012Outwitting The PMP ExamNessuna valutazione finora

- PMP Tips and ResourcesDocumento3 paginePMP Tips and ResourcessachinzguptaNessuna valutazione finora

- Develop Project Management Plan: Initiating & Planning Processes GroupsDocumento2 pagineDevelop Project Management Plan: Initiating & Planning Processes GroupsMarcelo Melo100% (1)

- Itto Pmbok 5Documento19 pagineItto Pmbok 5imronNessuna valutazione finora

- Crosswind PDF Application GuideDocumento34 pagineCrosswind PDF Application GuideChristian ChineduNessuna valutazione finora

- PMP PreparationDocumento17 paginePMP Preparationsherifelshammaa100% (2)

- PMP ITTO Process Chart PMBOK Guide 6th Edition-1aDocumento14 paginePMP ITTO Process Chart PMBOK Guide 6th Edition-1aSyed SadiqNessuna valutazione finora

- PMP Exam Prep: (What It Really Takes To Prepare and Pass)Documento26 paginePMP Exam Prep: (What It Really Takes To Prepare and Pass)meetvisu118100% (1)

- PMP Exam Cheat SheetDocumento10 paginePMP Exam Cheat Sheethema_cse4Nessuna valutazione finora

- PMP Formulas: 1. Number of Communication ChannelsDocumento5 paginePMP Formulas: 1. Number of Communication ChannelsramaiahNessuna valutazione finora

- PMP Prep Notes Project LifecycleDocumento3 paginePMP Prep Notes Project LifecycletrudiddleNessuna valutazione finora

- Memorize ITTOs with Pneumonics and MnemonicsDocumento4 pagineMemorize ITTOs with Pneumonics and MnemonicsRobincrusoe100% (3)

- PMP Cheat SheetDocumento2 paginePMP Cheat SheetLukinho De SouzaNessuna valutazione finora

- Quick PMP Study Guide - 1Documento1 paginaQuick PMP Study Guide - 1Raja Mukherjee100% (3)

- Process Groups: PMP® Process Chart Based On PMBOK® 6th EditionDocumento15 pagineProcess Groups: PMP® Process Chart Based On PMBOK® 6th EditionGaurav100% (2)

- PMP Exam Brain Dump Sheet - PM Lessons Learned GroupDocumento15 paginePMP Exam Brain Dump Sheet - PM Lessons Learned Groupanssrinivas100% (3)

- Velopi PMP Cheat Sheet PDFDocumento1 paginaVelopi PMP Cheat Sheet PDFtrudiddleNessuna valutazione finora

- Walla Walla Army Airfield - 02/16/1945Documento8 pagineWalla Walla Army Airfield - 02/16/1945CAP History LibraryNessuna valutazione finora

- PMP Application Excel FormDocumento5 paginePMP Application Excel FormkgvenkateshNessuna valutazione finora

- PMP Sample Questions PDFDocumento106 paginePMP Sample Questions PDFmp272Nessuna valutazione finora

- PMP NotesDocumento49 paginePMP NotesgirishkrisNessuna valutazione finora

- PMP AddendumDocumento88 paginePMP AddendummeneghelsNessuna valutazione finora

- PMP NotesDocumento4 paginePMP Notesmukesh697Nessuna valutazione finora

- PMP Notes - Rajesh NairDocumento42 paginePMP Notes - Rajesh Nairanurag_0967% (3)

- RMP - Integration and Very Important QuestionsDocumento89 pagineRMP - Integration and Very Important QuestionsAhmed EL-desokeyNessuna valutazione finora

- Memorizing Earned Value Formulas Through Pattern RecognitionDocumento9 pagineMemorizing Earned Value Formulas Through Pattern Recognitiongirishkris100% (2)

- PMP Exam QuestionsDocumento31 paginePMP Exam QuestionsAsuelimen tito100% (1)

- PMP Strategy Guide v6.1.1 PDFDocumento64 paginePMP Strategy Guide v6.1.1 PDFJohn Treff100% (4)

- PMI-ACP Exam Prep: Glossary of Agile TermsDocumento17 paginePMI-ACP Exam Prep: Glossary of Agile Termspromethuschow100% (1)

- Brain Dump For PMP PreparationDocumento8 pagineBrain Dump For PMP PreparationFitrio Makarov NugrahaNessuna valutazione finora

- Mock Exam WileyDocumento43 pagineMock Exam WileyAshief AhmedNessuna valutazione finora

- PMO Charter Template ExampleDocumento35 paginePMO Charter Template Exampleidelin.molinasNessuna valutazione finora

- PMP Exam Success SecretsDocumento22 paginePMP Exam Success SecretsSheik Mohamed Ali100% (2)

- 60 Days - PMP Study PlanDocumento3 pagine60 Days - PMP Study PlanShahram Karimi100% (7)

- Formulas For PMP ExamDocumento5 pagineFormulas For PMP ExamppnaranattNessuna valutazione finora

- PMBOK Guide - PmbokDocumento224 paginePMBOK Guide - PmbokAhmed Hamdy Hussein0% (3)

- Pass On The First Try: ProjectDocumento2 paginePass On The First Try: ProjectPuneet Pal SinghNessuna valutazione finora

- Slides and Practice Exams PMP Exam Power PrepDocumento978 pagineSlides and Practice Exams PMP Exam Power PrepHasz Vilicus Operis100% (9)

- Very Important Notes PMP 6th - Issued by Wagdy Azzam Ver.1Documento7 pagineVery Important Notes PMP 6th - Issued by Wagdy Azzam Ver.1Mahmoud NmiesNessuna valutazione finora

- Project Selection Methods WBS Facts: Net Present Value Scoring ModelsDocumento7 pagineProject Selection Methods WBS Facts: Net Present Value Scoring ModelsShehzad Ahmed100% (5)

- 150 Important Points For PMPDocumento4 pagine150 Important Points For PMPsrini.eticala2614100% (3)

- PMBOK6 EnglishDocumento1 paginaPMBOK6 Englishbigprice100% (3)

- PMP Project Hours WorksheetDocumento3 paginePMP Project Hours WorksheetJanell Parkhurst, PMPNessuna valutazione finora

- The 10 Knowledge Areas & Ittos: Based On PMBOK® Guide 5th EditionDocumento25 pagineThe 10 Knowledge Areas & Ittos: Based On PMBOK® Guide 5th EditionAchintya KumarNessuna valutazione finora

- V 1 I 1 A 4Documento2 pagineV 1 I 1 A 4abhi10augNessuna valutazione finora

- 1 - 111nvision Manual For OnlineusersDocumento31 pagine1 - 111nvision Manual For Onlineusersabhi10augNessuna valutazione finora

- CS-Cobol For PeoplesoftDocumento1 paginaCS-Cobol For PeoplesoftPriyesh AshishNessuna valutazione finora

- V 1 I 1 A 2Documento2 pagineV 1 I 1 A 2abhi10augNessuna valutazione finora

- PS User Security SetupDocumento30 paginePS User Security Setupabhi10augNessuna valutazione finora

- Related Content and WorkCentersDocumento47 pagineRelated Content and WorkCentersabhi10aug100% (1)

- 04 Integration Management - Updated PDFDocumento6 pagine04 Integration Management - Updated PDFabhi10augNessuna valutazione finora

- Compensation DataDocumento10 pagineCompensation Dataabhi10augNessuna valutazione finora

- Implementing People Soft SecurityDocumento14 pagineImplementing People Soft SecuritysshelkeNessuna valutazione finora

- V 1 I 3 A 1Documento2 pagineV 1 I 3 A 1abhi10augNessuna valutazione finora

- Converting Classic PIA Components To PeopleSoft Fluid User InterfaceDocumento28 pagineConverting Classic PIA Components To PeopleSoft Fluid User Interfacepeterlasking100% (1)

- Related Content Configuration ExampleDocumento2 pagineRelated Content Configuration Exampleabhi10augNessuna valutazione finora

- PS 9.1 Re-Implementation - Employee Data Security Prototype v1.0Documento31 paginePS 9.1 Re-Implementation - Employee Data Security Prototype v1.0abhi10augNessuna valutazione finora

- Using Scripts: BrowserDocumento2 pagineUsing Scripts: Browserabhi10augNessuna valutazione finora

- Save hours with Meta SQL commandsDocumento2 pagineSave hours with Meta SQL commandsabhi10augNessuna valutazione finora

- SQR FAQ's - CDocumento24 pagineSQR FAQ's - Cabhi10augNessuna valutazione finora

- ERecruit-Realizing The Paperless Recruiting FunctionDocumento29 pagineERecruit-Realizing The Paperless Recruiting Functionabhi10augNessuna valutazione finora

- Itto 5thedDocumento77 pagineItto 5thedShaikh Mohammed Waliul HaqueNessuna valutazione finora

- Ci JavaDocumento11 pagineCi Javansunilkumar100% (2)

- Changing DatabasesDocumento2 pagineChanging Databasesabhi10augNessuna valutazione finora

- Forms and Approval BuilderDocumento9 pagineForms and Approval Builderabhi10augNessuna valutazione finora

- SQR Performance & EfficiencyDocumento10 pagineSQR Performance & EfficiencyKalicharan ReddyNessuna valutazione finora

- PeopleSoft Performance TuningDocumento9 paginePeopleSoft Performance Tuningrmalhotra86Nessuna valutazione finora

- Configuration Request For IB CommonDocumento8 pagineConfiguration Request For IB Commonabhi10augNessuna valutazione finora

- Itto 5thedDocumento77 pagineItto 5thedShaikh Mohammed Waliul HaqueNessuna valutazione finora

- Job Tree BuilderDocumento2 pagineJob Tree Builderabhi10augNessuna valutazione finora

- Crystal Reports AllDocumento173 pagineCrystal Reports Allabhi10augNessuna valutazione finora

- How To Set Values in Component InterfaceDocumento4 pagineHow To Set Values in Component Interfaceabhi10augNessuna valutazione finora