Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Doing Business in Bangladesh - Bangladesh Trade and Export Guide - GOV

Caricato da

Yueniese Liang SunbaeTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Doing Business in Bangladesh - Bangladesh Trade and Export Guide - GOV

Caricato da

Yueniese Liang SunbaeCopyright:

Formati disponibili

10/24/2016

Doing business in Bangladesh: Bangladesh trade and export guide - GOV.UK

GOV.UK

Department for

International Trade (https://www.gov.uk/government/organisations/department-for-international-trade)

See more information about this Guidance (https://www.gov.uk/government/publications/exporting-tobangladesh)

Guidance

Doing business in Bangladesh: Bangladesh trade and export

guide

Updated 23 July 2015

Contents

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

Bangladesh export overview

Challenges doing business in Bangladesh

Growth potential

UK and Bangladesh trade

Opportunities for UK businesses in Bangladesh

Start-up considerations

Legal considerations

Tax and customs considerations

Business behaviour

Entry requirements

Contacts

1. Bangladesh export overview

Bangladesh aims to become a middle income country by 2021.

Contact a Department for International Trade (DIT) Bangladesh export adviser

(http://www.greatbusiness.gov.uk/ukti) for a free consultation if you are interested in exporting to

Bangladesh.

Contact UK Export Finance (UKEF) about trade finance and insurance cover (http://www.gov.uk/ukexport-finance) for UK companies. You can also check the current UKEF cover position for

Bangladesh (https://www.gov.uk/guidance/country-cover-policy-and-indicators#bangladesh).

The governments strategic vision for 2021 (http://www.boi.gov.bd/index.php/about-bangladesh1/governmentand-policies/government-vision-2021) is a plan for growth through massive investment in infrastructure, skills

development and trade. Co-operation with the private sector and international donor agencies is

expected.

Almost 100 UK businesses operate in Bangladesh, including well known companies like HSBC, Unilever

and GSK.

Benefits for UK businesses exporting to Bangladesh include:

https://www.gov.uk/government/publications/exporting-to-bangladesh/doing-business-in-bangladesh-bangladesh-trade-and-export-guide

1/9

10/24/2016

Doing business in Bangladesh: Bangladesh trade and export guide - GOV.UK

English widely spoken in business

British made goods regarded as reliable among end users

strong consumer demand for products, equipment and services

concessionary duty on imported capital machinery

Strengths of the Bangladesh market include:

annual growth rate of at least 5.3% over the last 16 years

stable credit rating

close to issuing first Sovereign Bond

poverty levels cut by half in the last decade

competitive labour force

Ready Made Garment (RMG) export levels quadrupled in 5 years

2. Challenges doing business in Bangladesh

Bangladesh is 173rd in the World Banks ease of doing business ranking

(http://www.doingbusiness.org/rankings).

Procurement practices in Bangladesh:

often lack transparency

have significant bureaucratic burden

Bangladesh is ranked 145th in Transparency Internationals Corruption Perceptions Index

(https://www.transparency.org/cpi2014/results).

The Bangladesh market is extremely price sensitive with low price goods from India and China

dominating many sectors. UK companies should sell into the market on the basis of:

quality

life cycle cost

training

after sales service

2.1 Corruption

Corruption affects many aspects of daily life in Bangladesh and is often cited as a barrier to private

sector development.

One of the biggest challenges facing UK companies in Bangladesh is how to avoid paying speed

money. Speed money is unofficial, under the counter payments to minor officials to expedite business.

Politicians, bureaucrats and law enforcement officials often wield significant discretionary power and

there have been some abuses.

You should have in place regular due diligence procedures and up-to-date risk strategies when doing

business in Bangladesh.

You should ensure you take the necessary steps to comply with the requirements of the UK Bribery

Act (https://www.gov.uk/government/publications/bribery-act-2010-guidance).

3. Growth potential

https://www.gov.uk/government/publications/exporting-to-bangladesh/doing-business-in-bangladesh-bangladesh-trade-and-export-guide

2/9

10/24/2016

Doing business in Bangladesh: Bangladesh trade and export guide - GOV.UK

3.1 Economic growth

Gross Domestic Product (GDP) grew by 6% in fiscal year (FY) 2013 (fiscal year ends in June). Industry

grew by 9% with strong expansion in construction and small scale manufacturing. 6.7% growth is

forecast for 2016.

Inflation slowed to 6.41% in 2015 from 7.35% in 2014 FY.

The balance of payments was USD 5.4 billion in surplus in FY2014 after 10.7% growth in exports and

only 0.8% growth in imports.

Bangladeshs RMG sector is now worth almost USD 25 billion. It is the third largest apparel exporter to

the European Union (EU) and fourth largest to the US.

Bangladesh, with a population of 158 million, has the highest density population in the world. Per capita

income is USD 1,190, so more than 25.6% of people live below the poverty line.

4. UK and Bangladesh trade

There has been over 119% growth in bilateral trade in goods and services between 2007 and 2012.

The UK exported 450 million of goods and services to Bangladesh in 2013. 71% of this was services.

Exports of goods were 131 million in 2014.

The UKs main exports to Bangladesh in 2013 were:

nuclear reactors, boilers, machinery and mechanical appliances / parts

electrical machinery and equipment / parts; sound recorders and reproducers, television image and

sound recorders and reproducers, and parts / accessories

iron and steel

residues and waste from the food industries; prepared animal fodder

5. Opportunities for UK businesses in Bangladesh

Department for International Trade (DIT) provides free international export sales leads from its

worldwide network. Search for export opportunities (http://www.exportingisgreat.gov.uk).

Access tenders for all major public projects in Bangladesh via the Central Procurement Technical Unit

(http://www.cptu.gov.bd/).

The international aid agencies fund projects to improve prosperity in developing countries.

Identify opportunities to supply products and services to the international aid agencies. Contact

Department for International Trade (DIT)s Aid Funded Business Service (https://www.gov.uk/aidfunded-business) for more information.

5.1 Education and training

Bangladesh relies more than most developing countries on its human resources. About 20% of the total

population (around 29 million people) are students.

https://www.gov.uk/government/publications/exporting-to-bangladesh/doing-business-in-bangladesh-bangladesh-trade-and-export-guide

3/9

10/24/2016

Doing business in Bangladesh: Bangladesh trade and export guide - GOV.UK

The international aid agencies strongly supports the education sector in Bangladesh. Education sector

programs have been defined and funded by institutions such as:

EU

Asian Development Bank (http://www.adb.org/) (ADB)

World Bank (http://www.worldbank.org)

UNICEF (http://www.unicef.org/)

A Cross Border Higher Education (CBHE) regulation has been introduced making it part of Bangladesh

national education policy. This regulation recognises foreign qualifications. Foreign

Universities/education providers can now offer their programmes and open campuses or study centres

in Bangladesh.

The new CBHE policy opens up opportunities for UK educaiton organisations in higher and vocational

education:

English Language and IT training centres

content and curriculum development according to industry need

e-learning programmes

qualification assessment and quality assurance programmes

teaching and leadership training programmes

education facility management and consultancy

capacity building of the Technical Training Institute

introduction of Level 3 and above for vocational curriculum so that vocational students can go for

higher education.

international standard laboratory

publication house

Contact Dhaka.Commercial@fco.gov.uk for more information on opportunities in the education and

training sector.

5.2 Energy

Natural gas is currently the only local non-renewable energy resource being produced and consumed in

large quantities. Around 85% of the power generated is gas based.

The Bangladesh Power Development Board (http://www.bpdb.gov.bd/bpdb/) forecasts that total electricity

demand will be more than 12,000 Megawatts (MW) by 2016. Current generation capacity is about

10,000 MW.

Fertiliser production is also fuelling demand for gas production.

Opportunities for UK companies include:

supply of machinery and equipment

consultancy services

construction of power projects

Contact Dhaka.Commercial@fco.gov.uk for more information on opportunities in the energy sector.

5.3 Environment and water

https://www.gov.uk/government/publications/exporting-to-bangladesh/doing-business-in-bangladesh-bangladesh-trade-and-export-guide

4/9

10/24/2016

Doing business in Bangladesh: Bangladesh trade and export guide - GOV.UK

The government published the Bangladesh Climate Change Strategy and Action Plan

(http://www.sdnbd.org/moef.pdf) (BCCSAP) in 2009. BCCSAP has identified 44 different programmes within

5 areas including:

food security

social protection

health

comprehensive disaster management

infrastructure

There are opportunities for UK companies in:

supply of machinery and equipment

consultancy services

Contact Dhaka.Commercial@fco.gov.uk for more information on opportunities in the environment

and water sector.

5.4 Information and Communication Technology (ICT)

Growth in Bangladeshs software and ICT industry has resulted from:

export demand

increasing ICT automation in domestic market

Local demand has come from large automation projects by the:

telecom industry

banking sector

garments/textile industry

There are opportunities for UK companies in:

upgrading the telecommunication infrastructure

joint venture projects with local companies for Business Process Outsourcing (BPO)

consultancy services

Contact Dhaka.Commercial@fco.gov.uk for more information on opportunities in the ICT sector.

5.5 Biotechnology and pharmaceuticals

Life sciences is one of the fastest growing sectors in Bangladesh. In 2013 the domestic market grew by

24.3% to USD 1.136 billion.

Many companies are looking to partner foreign investors.

There are 260 registered pharmaceutical companies with 191 in operation. These companies meet 97%

of domestic demand.

Products still being imported include:

vaccines

anticancer products

https://www.gov.uk/government/publications/exporting-to-bangladesh/doing-business-in-bangladesh-bangladesh-trade-and-export-guide

5/9

10/24/2016

Doing business in Bangladesh: Bangladesh trade and export guide - GOV.UK

haematological products

biotech products

Contact Dhaka.Commercial@fco.gov.uk for more information on opportunities in the life sciences

sector.

6. Start-up considerations

British companies can approach the Bangladesh market in several ways including:

export direct

set up an office

appoint a distributor

You can set up a business in Bangladesh within 11 days.

6.1 Agents

You should have a local representative either on a commission basis or as an agent if you intend to

export directly. A local partner can deal with Bangladeshi bureaucracy and advise on the best type of

advertising. An agent is allowed to participate in international tenders on behalf of their foreign principle.

Dhaka based agents should be able to cover all of Bangladesh.

The 1972 Contract Act details the rights and liabilities of an agent and also of the principal.

Most agency agreements have a clause permitting either party to give due notice of termination. It is

prudent to include a contract clause which agrees to allow an independent arbitrator outside of

Bangladesh to settle any disputes between parties.

The Bangladesh International Arbitration Centre (http://biac.org.bd/) (BIAC) was launched in 2011. This is

Bangladeshs first arbitration centre for the settlement of commercial disputes.

6.2 Setting up an office

You can establish an office to sell products and equipment direct to the end user or consumer. Offices

can also be set up on a registered joint venture basis with a Bangladeshi trading company.

You should register with the Board of Investment (http://www.boi.gov.bd/) and the Registrar of Joint Stock

Companies (http://www.roc.gov.bd/) before setting up an office.

6.3 Appointing a distributor

You should be aware of the risks of marketing your goods through distributors in Bangladesh. If you

choose this route into the market be careful about providing exclusive distribution rights.

7. Legal considerations

Local law is based on English Common Law system.

You should seek professional legal/taxation advice before entering into a joint venture or similar type of

agreement.

https://www.gov.uk/government/publications/exporting-to-bangladesh/doing-business-in-bangladesh-bangladesh-trade-and-export-guide

6/9

10/24/2016

Doing business in Bangladesh: Bangladesh trade and export guide - GOV.UK

Contact the Department for International Trade (DIT) team in Bangladesh

(https://www.gov.uk/government/world/organisations/uk-trade-investment-bangladesh#contact-us) to help find

tax and legal advisers before entering into agreements.

7.1 Standards and technical regulations

The Bangladesh Standards and Testing Institution (http://www.bsti.gov.bd/) has regulatory authority for

standards. International standards are followed.

Imported goods and their containers must not incorporate any words, pictures or inscriptions with any

religious or obscene connotations.

Milk food containers must indicate the ingredients in Bangla. They should also show date of production

and expiry in Bangla or English.

7.2 Intellectual property (IP)

Bangladesh signed the agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS) on

1 January 1995. TRIPS sets minimum standards for IP regulation as applied to nationals of other WTO

members.

The Department of Patents, Design and Trade Marks (http://www.dpdt.gov.bd/) is responsible for IP in

Bangladesh.

8. Tax and customs considerations

Bangladesh has a Double Taxation Convention (https://www.gov.uk/government/publications/bangladesh-taxtreaties-in-force) with the UK.

8.1 Value Added Tax (VAT)

The National Board of Revenue (http://www.nbr-bd.org/valueaddedtax.html) provides information on VAT.

8.2 Corporate tax

The corporate tax rates are:

37% for companies whose shares are publicly traded

40% for those whose shares are not publicly traded

40% minimum for foreign companies

45% for foreign banks

8.3 Income tax

The National Board of Revenue provides information on income tax (http://www.nbrbd.org/IncomeTax/Income_Tax_at-a-Glance_2013-14.pdf).

8.4 Customs

Find more information on customs procedures at Custom House Chittagong (http://chc.gov.bd/imp/).

https://www.gov.uk/government/publications/exporting-to-bangladesh/doing-business-in-bangladesh-bangladesh-trade-and-export-guide

7/9

10/24/2016

Doing business in Bangladesh: Bangladesh trade and export guide - GOV.UK

No import duty is applicable for an export oriented industry. For other industries it is 5% ad valorem. The

National Board of Revenue (http://www.nbr-bd.org/customs.html) provides a listing of customs duty

exemptions.

You can find more about import tariffs in the Market Access Database (http://madb.europa.eu).

8.5 Documentation

UK exporters to Bangladesh should be precise when preparing export documentation. Invoices should

clearly state the goods being supplied including specification, packing and country of origin. The invoice

should match the Letter of Credit.

Pre-shipment inspection is the norm for Bangladesh.

9. Business behaviour

Bangla is the main language. Written business correspondence and trade literature should be in

English.

Women visitors should cover their arms and legs including ankles to avoid giving offence. Women

should not wear tight clothing.

Meetings can be subject to interruptions, such as phone calls or staff members walking in to have

documents signed. This is an accepted practice as its considered rude not to immediately respond to

phone calls.

Bangladeshi businesses are generally hierarchically structured. Decisions will not be made unless the

owner, company director or senior manager are present at a meeting.

10. Entry requirements

British nationals need a visa to visit Bangladesh.

You should get a visa from the Bangladesh High Commission (http://www.bhclondon.org.uk/Visa.html) in the

UK prior to travelling.

You must have a work permit to work in Bangladesh. The employer must apply in advance to the

Bangladesh Board of Investment (http://www.boi.gov.bd/).

10.1 Travel advice

If you are travelling to Bangladesh for business, check the Foreign & Commonwealth Office (FCO)

travel advice (https://www.gov.uk/foreign-travel-advice/bangladesh) beforehand.

11. Contacts

https://www.gov.uk/government/publications/exporting-to-bangladesh/doing-business-in-bangladesh-bangladesh-trade-and-export-guide

8/9

10/24/2016

Doing business in Bangladesh: Bangladesh trade and export guide - GOV.UK

Contact the Department for International Trade (DIT) Team in Bangladesh

(https://www.gov.uk/government/world/organisations/uk-trade-investment-bangladesh#contact-us) for more

information and advice on your opportunities for doing business in Bangladesh.

https://www.gov.uk/government/publications/exporting-to-bangladesh/doing-business-in-bangladesh-bangladesh-trade-and-export-guide

9/9

Potrebbero piacerti anche

- Transformational Leadership Practices An PDFDocumento10 pagineTransformational Leadership Practices An PDFYueniese Liang SunbaeNessuna valutazione finora

- Yukl Organizational EffectivenessDocumento15 pagineYukl Organizational EffectivenessYueniese Liang SunbaeNessuna valutazione finora

- Nando's Spices Up Its Leadership Style - Personnel TodayDocumento4 pagineNando's Spices Up Its Leadership Style - Personnel TodayYueniese Liang SunbaeNessuna valutazione finora

- Week 2 IB Internationlisation ProcessDocumento39 pagineWeek 2 IB Internationlisation ProcessYueniese Liang SunbaeNessuna valutazione finora

- Week 2 IB Internationlisation ProcessDocumento39 pagineWeek 2 IB Internationlisation ProcessYueniese Liang SunbaeNessuna valutazione finora

- Search Databases - PRVDocumento5 pagineSearch Databases - PRVYueniese Liang SunbaeNessuna valutazione finora

- Acne Studios Social Report 2012Documento10 pagineAcne Studios Social Report 2012Yueniese Liang SunbaeNessuna valutazione finora

- Koh-Doh: (Thinking and Working) For Value MaximizationDocumento5 pagineKoh-Doh: (Thinking and Working) For Value MaximizationYueniese Liang SunbaeNessuna valutazione finora

- Research Paradigm 2Documento1 paginaResearch Paradigm 2Yueniese Liang SunbaeNessuna valutazione finora

- 15-Influence of Human Resource Management Practices On Employee Retention in Maldives Retail Industry PDFDocumento28 pagine15-Influence of Human Resource Management Practices On Employee Retention in Maldives Retail Industry PDFYueniese Liang SunbaeNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Grass Rink Summer Final 2019Documento9 pagineThe Grass Rink Summer Final 2019api-241553699Nessuna valutazione finora

- ISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)Documento9 pagineISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)duraisingh.me6602Nessuna valutazione finora

- Bushcraft Knife AnatomyDocumento2 pagineBushcraft Knife AnatomyCristian BotozisNessuna valutazione finora

- Grade 9 WorkbookDocumento44 pagineGrade 9 WorkbookMaria Russeneth Joy NaloNessuna valutazione finora

- Homework 1Documento8 pagineHomework 1Yooncheul JeungNessuna valutazione finora

- Laboratorio 1Documento6 pagineLaboratorio 1Marlon DiazNessuna valutazione finora

- Cad Data Exchange StandardsDocumento16 pagineCad Data Exchange StandardskannanvikneshNessuna valutazione finora

- CSEC SocStud CoverSheetForESBA Fillable Dec2019Documento1 paginaCSEC SocStud CoverSheetForESBA Fillable Dec2019chrissaineNessuna valutazione finora

- 01 - A Note On Introduction To E-Commerce - 9march2011Documento12 pagine01 - A Note On Introduction To E-Commerce - 9march2011engr_amirNessuna valutazione finora

- BRAND AWARENESS Proposal DocumentDocumento11 pagineBRAND AWARENESS Proposal DocumentBuchi MadukaNessuna valutazione finora

- Vernacular ArchitectureDocumento4 pagineVernacular ArchitectureSakthiPriya NacchinarkiniyanNessuna valutazione finora

- Standard nfx15-211Documento2 pagineStandard nfx15-211Luis Enrique Cóndor PorrasNessuna valutazione finora

- III.A.1. University of Hawaii at Manoa Cancer Center Report and Business PlanDocumento35 pagineIII.A.1. University of Hawaii at Manoa Cancer Center Report and Business Planurindo mars29Nessuna valutazione finora

- Innovativ and Liabl :: Professional Electronic Control Unit Diagnosis From BoschDocumento28 pagineInnovativ and Liabl :: Professional Electronic Control Unit Diagnosis From BoschacairalexNessuna valutazione finora

- Lec. 2Documento22 pagineLec. 2محمدNessuna valutazione finora

- T-Tess Six Educator StandardsDocumento1 paginaT-Tess Six Educator Standardsapi-351054075100% (1)

- Nestlé CASEDocumento3 pagineNestlé CASEAli Iqbal CheemaNessuna valutazione finora

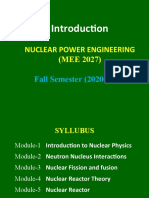

- Nuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)Documento13 pagineNuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)AllNessuna valutazione finora

- Unit 1 and 2Documento4 pagineUnit 1 and 2Aim Rubia100% (1)

- Blake 2013Documento337 pagineBlake 2013Tushar AmetaNessuna valutazione finora

- Fire Technical Examples DIFT No 30Documento27 pagineFire Technical Examples DIFT No 30Daniela HanekováNessuna valutazione finora

- ULANGAN HARIAN Mapel Bahasa InggrisDocumento14 pagineULANGAN HARIAN Mapel Bahasa Inggrisfatima zahraNessuna valutazione finora

- Baxter - Heraeus Megafuge 1,2 - User ManualDocumento13 pagineBaxter - Heraeus Megafuge 1,2 - User ManualMarcos ZanelliNessuna valutazione finora

- Tetra IntroductionDocumento65 pagineTetra Introductionuniversidaddistrital100% (2)

- How To Present A Paper at An Academic Conference: Steve WallaceDocumento122 pagineHow To Present A Paper at An Academic Conference: Steve WallaceJessicaAF2009gmtNessuna valutazione finora

- Chapter Three: Tools For Exploring The World: Physical, Perceptual, and Motor DevelopmentDocumento43 pagineChapter Three: Tools For Exploring The World: Physical, Perceptual, and Motor DevelopmentHsieh Yun JuNessuna valutazione finora

- Journal of Atmospheric Science Research - Vol.5, Iss.4 October 2022Documento54 pagineJournal of Atmospheric Science Research - Vol.5, Iss.4 October 2022Bilingual PublishingNessuna valutazione finora

- MECANISMOS de Metais de TransicaoDocumento36 pagineMECANISMOS de Metais de TransicaoJoão BarbosaNessuna valutazione finora

- Dissertation 7 HeraldDocumento3 pagineDissertation 7 HeraldNaison Shingirai PfavayiNessuna valutazione finora

- Resume NetezaDocumento5 pagineResume Netezahi4149Nessuna valutazione finora