Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Community Property (1) Basic Presumptions: Christin Hill Bar Review

Caricato da

MissPardisTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Community Property (1) Basic Presumptions: Christin Hill Bar Review

Caricato da

MissPardisCopyright:

Formati disponibili

Christin Hill

Bar Review

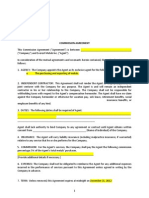

COMMUNITY PROPERTY

(1) BASIC PRESUMPTIONS

a. California is a community property state. All property acquired during the marriage is presumed

to be CP, while all property acquired before marriage or after permanent separation, or by gift or

inheritance is presumed to be SP. Property acquired in a SP state by either H or W before they

became domiciled in CA is quasi-CP. Upon death or divorce quasi-CP is treated as CP.

i. The characterization of an asset as either CP or SP depends on three factors: (1) the

source of the asset, (2) any actions by the parties that may have altered the character

of the asset, and (3) any statutory presumptions that apply to the asset.

ii. In order to determine the character of any asset, the courts will trace back to the

source of funds used to acquire the asset. A mere change in form of an asset does not

change its characterization. E.g., capital gain from the sale of SP is SP.

b. Absent a showing of the parties agreement or that title was taken in a form that overcomes the

community presumption, the burden of proof is on the party claiming SP.

c. The economic community ends when (1) there is permanent physical separation AND (2)

intent not to resume marital relation

(2) CHARACTERIZE EACH ASSET

a. Personal Injury Awards are CP if the cause of action arose during marriage. If the cause of

action arose before marriage or after permanent separation, the award is SP.

i. At divorce, CP personal injury awards will be awarded entirely to the injured spouse

ii. Personal injury liabilities are always the SP of the tortfeasor, unless tort occurred

while spouse was acting for the benefit of the community, then look to SP first, next CP.

b. Retirement Benefits are CP if earned during the course of the marriage. For retirement

pensions and other retirement benefits earned before and during marriage, courts apply the

time rule to determine how much of the pension is attributable to CP labor and how much is

attributable to SP labor: (present value) x (# years wrkd during marriage / total # years wrkd)

c. Disability pay and workers comp benefits are either CP or SP depending on the wages they

are designed to replace. To the extent disability benefits are taken in lieu of retirement benefits,

disability benefits are treated as retirement benefits, and thus are CP. For distribution CP until

parties separate, thereafter earners SP.

d. Courts are split on severance pay. May argue that its SP b/c it replaces future wages. Or CP

where it the result of labor performed during the marriage.

e. Stock options are a form of employee compensation and are treated as CP or SP depending

on when they were earned. Courts use the time rule to determine the respective CP/SP shares.

f. Business and professional good will is CP to the extent it is earned during marriage.

g. Education and training are NOT CP. But, the community may be entitled to reimbursement

when CP funds are used to pay education expenses and the education enhanced the spouses

earning capacity UNLESS the community has substantially benefited from the earnings of the

educated spouse (10 years presumption) OR other spouse also received comm. funded ed.

h. Funds borrowed during marriage, and goods purchased on credit during marriage are

presumptively CP. But, look to the primary intent of the lender. Who or what was the lender

primarily looking to for satisfaction of the debt?

i. Business owned before marriage, which greatly increased in value after marriage:

i. Rule: When community labor is used to enhance the value of a SP business, the

community is entitled to share in the increased value of the SP [e.g., here, although Hs

business is SP, the CP is entitled to a share of the appreciation because Hs labor

during the course of the marriage was used to increase the value of the business]

Pereira accounting is used when the increase in

value is primarily a result of community labor. Using

Pereira, you determine the value of the SP at the

beginning of the business and give it the fair rate of

return over the course of the marriage (usually 10%

simple interest). The remainder is CP.

Van Camp accounting is used when the increase in

value is primarily the result of the unique nature of the

SP asset. Using Van Camp, you determine what a fair

salary would be for the community labor, and multiply

that by the years of marriage, and subtract any salary

already received and any amounts paid for community

expense. The result is CP. The rest is SP.

Christin Hill

Bar Review

(3) ALTERING THE CHARACTER OF ASSETS

a. Parties may opt out of the community property and separate property characterizations by

agreement, either as to particular asserts or as to all acquisitions.

b. Premarital agreements must be in writing, singed by both parties.

i. Unless (1) full performance or (2) estoppel based on detrimental reliance.

ii. Defenses to enforcement:

1. It was not signed voluntarily

a. Bonds case: involuntary mean an 11th hour ultimatum.

b. 2001 statute: agreement is involuntary unless:

i. Represented by independent counsel when signed (or

waived representation in a separate writing) AND

ii. Given at least 7 days to sign between being presented w/

agreement and advised to seek legal counsel and the signing &

iii. If not represented by independent counsel, was fully informed

in writing (in a language in which the party was proficient) of

terms and basic effect.

2. It was unconscionable (question of law for the judge)

a. Generally, unconscionable if no fair, reasonable and full disclosure of

the other partys property or financial obligations

b. Waivers of spousal support are unenforceable if (1) party was not

represented by independent legal counsel at the time of signing OR (2)

the provision is unconscionable at time of enforcement.

c. Transmutations (marital agreements):

i. Before 1985, oral transmutations were permitted, whether express or implied.

ii. On or after Jan. 1, 1985: must be (1) in writing, (2) signed by the spouse whose

interest is adversely affected, AND (3) must expressly state that a change in ownership

is being made. Exception for gifts of tangible property of a personal nature.

(4) EFFECT OF HOW TITLE IS TAKEN

a. Married Womans Special Presumption

i. Where property is taken in the married womans name alone, prior to 1975, that

property is presumed to be her SP. Based on the fact that prior to 1975 the H was

given sole management and control of the community assets and thus, any property

taken in the Ws name was presumed to have been a gift to her.

ii. The presumption can be rebutted by a showing that (1) H did not indent to make a gift

to W but had some other reason for taking title in her name [e.g. creditors claims] or

(2) W took title in her name w/out Hs knowledge or consent.

iii. Arises only when:

1. Title taken in Ws name alone before 1975 (property would be Ws SP)

2. Title in name of W and H before 1975, but title is not taken in joint tenancy form,

and not as H & W or Mr. & Mrs. (would by Ws SP, CP)

3. Title in name of W and some third party before 1975 (W would be TIC w/ 3 rd P)

b. Taking Assets in Joint Title: Lucas and Anti-Lucas Rules

i. At death, Lucas applies. Under Lucas, when a married couple takes title in joint and

equal form, it is presumptively CP. Any SP used to acquire the asset is presumed to be

a gift to the community unless agreement to the contrary. So no reimbursement.

ii. At divorce, under California Family Law, when a married couple takes title to asset in

joint tenancy after 1984, the asset is presumed to be CP for purposes of divorce.

1. The CP presumption can be rebutted only by:

a. Express statement in the deed that the property is SP and not CP or

b. Written agreement by the parties that the property is SP and not CP

2. But, at divorce, spouse who made post 1984 contributions of SP to the

acquisitions or improvements of CP is entitled to reimbursement w/out interest

for contributions to downpayment, improvements, or principal payments on

the mortgage (DIP) (but not interest on the mortgage, taxes, insurance, etc.)

3. Plus, a spouse who deeds SP into jointly titled property is entitled to a right of

reimbursement for the fair market value of the property at the time it was

deeded into joint tenancy.

Christin Hill

Bar Review

c. Absent joint and equal title, apply the source rule two permissible methods:

i. Exhaustion: at the time the asset was purchased, community funds in the account had

already been exhausted by the payment of family expenses, and therefore the asset

must have been purchased with separate funds.

ii. Direct tracing: at the time the asset was purchased, there were separate funds

available, and the SP proponent intended to use SP funds to purchase an SP asset.

d. Taking Assets in Separate Title: Can argue that taking title in one spouses own name (even

where CP used to make the purchase) indicates a gift to that spouse, so that the property is her

own SP. Must argue there was an oral transmutation prior to 1985. Post 85, need a writing.

(5) EFFECT OF PARTIES ACTIONS ON CHARACTERIZATION OF ASSETS

a. Pro Rata Rule: The community estate takes a pro rata portion of the property measured by the

percentage of principal debt reduction attributable to the expenditure of community funds.

i. Formula: CP = principal debt reduction attributable to CP / purchase price

ii. Applies where:

1. An installment purchase is made before marriage, and subsequent payments

are made w/ CP after marriage.

2. During marriage W inherits land subject to mortgage and pays it off w/ CP

3. H purchases a whole life insurance policy (cash value) before marriage, and

subsequent premiums are paid w/ CP after marriage. But, not term life

insurance policy (no cash value, last premium pay. determines character).

b. Reimbursement Rules:

i. CP used to improve SP:

1. Where spouse uses CP to improve own SP improvements become part of

the SP. The community can seek reimbursement for the greater of the cost of

improvements or the enhanced value of the SP attributable to the CP.

2. Where spouse uses CP to improve the other spouses SP split in authority

a. Some courts presume gift.

b. Other courts reject the presumption of gift and grant reimbursement.

ii. SP used to improve CP:

1. In divorce: Community may seek reimbursement w/out interest for DIP

2. In death: NO reimbursement unless proof of agreement (Lucas). SP is deemed

a gift and becomes part of the CP.

c. Commingled bank accounts:

i. The mere fact that SP funds are commingled with CP funds does not transform or

transmute the SP into CP. However, the burden of proof is on H to show that each

asset was acquired w/ separate funds (through tracing or exhaustion).

ii. It is presumed that expenditures for family expenses were made w/ CP funds (to the

extent available), even though it was known that SP funds was also available.

However, b/c of commingling and inadequate records, where some expenses may have

been paid by SP, it is presumed a gift to the community (absent contrary agreement).

(6) MANAGEMENT & CONVEYANCES OF CP

a. During the marriage each spouse has equal management and control over all community

assets, and thus has full power to buy or sell CP and contract debts w/out the other spouses

joinder or consent. Except:

i. Spouse managing a business is given primary management and control.

ii. One spouse cannot sell or encumber personal property used in family dwelling or

clothing w/out written consent of the other spouse. Trx is voidable at any time.

iii. Conveyances of community real property requires joinder by both spouses.

(If to a BFP, 1 year SoL. If not to a BFP, no SoL, viodable at any time.)

b. Neither spouse can make an inter vivos gift of CP w/out the other spouses written consent.

i. Non-gifting spouse may take back the gift, and thus restore the community.

ii. But, if non-gifting spouse does not discover the gift until after the death of the gifting

spouse, the non-gifter may set aside the gift only as to her CP, not the entirety.

Recovery will be from either the donee or the gifting-spouses estate.

iii. Same rule where one spouse purchases a life insurance policy and names a 3 rd party

as beneficiary. But, federal preemption prevents recovery of gifts of US savings bonds.

Christin Hill

Bar Review

c. CP & Creditors:

i. Neither spouse can transfer or encumber her interest in CP except one spouse

can unilaterally encumber her CP interest to pay a family law atty in divorce action.

ii. CP can be reached to pay debts incurred before and during marriage except earnings

of nondebtor spouse cannot be reached for premarital debts if held in a separate

account and no commingled w/ CP funds.

iii. Each spouse has a duty to support the other spouse and minor children of the

marriage, so each spouse is personally liable for the other spouses Ks for necessities.

Therefore, one spouses SP can be reached in satisfaction of necessary debt of

the other (e.g. medical bills).

iv. At divorce, a creditor cannot reach CP awarded to a spouse unless that spouse (1)

incurred the debt or (2) was assigned the debt by the court.

(7) DISTRIBUTION

a. At divorce, all CP will be divided 50-50 unless the court finds that the interest of justice

require an unequal division.

i. Generally, each and every asset must be divided 50-50 unless economic circumstances

warrant awarding certain assets wholly to one spouse (and each spouse ends up with

50% of all CP in terms of total economic value).

ii. Exceptions to the general rule: (1) misappropriation by one spouse, (2) liabilities

exceed assets, (3) education debts assigned to the educated spouse, (4) tort liabilities

assigned to the tortfeasor, (5) family home may be awarded to the person who is given

custody of the minor children.

1. Spouses are subject to fiduciary duties that arise from their confidential

relationship, imposing a duty of the highest good faith in dealing with each

other. Thus, a crossly negligent and reckless investment of community funds is

a breach of the spouses fiduciary duty.

b. At death:

i. If the spouse dies w/ a will, she/he is entitled to dispose of all SP and of the CP.

1. Survivors Duty to Elect: The surviving spouse must elect between the will

and her CP rights when the decedents will attempts to pass the survivors

interest in CP.

ii. If the spouse dies w/out a will, the CP is awarded entirely to the surviving spouse.

Between one third an all of the decedents SP will be awarded to the surviving spouse

depending on whether there are issue or parents surviving.

c. Quasi-Community Property: property acquired by the couple while living in another jx. which

would have been classified as CP had the parties been domiciled in CA

i. At divorce quasi-CP is treated exactly like CP. If the property is out-of-state, the court

will divide all CP and quasi-CP in such a way that it is not necessary to alter the nature

of the interests held in the out-of-state realty,

ii. At death, the survivor has a interest in decedents quasi-CP. But, non-acquiring

spouse who predeceases has no ownership interest in devise.

d. Putative Spouse (one who reasonably believed she was lawfully married).

i. Treat quasi-marital property the same as community property

ii. But, H who falsely tells W that marriage is valid has no putative spouse rights.

(8) PREEMPTION

a. Under the Supremacy Clause, federal law preempts inconsistent state laws. In some instances,

federal law preempts CA from applying community property concepts to certain assets.

b. Applies to: (1) fed. homestead claims, (2) military life insurance benefits, (3) US savings bonds

c. Not: (1) R.R. retirement benefits, (2) military retirement benefits, (3) copyrights.

Potrebbero piacerti anche

- CA community property basicsDocumento6 pagineCA community property basicsalexoganesyanNessuna valutazione finora

- Community Property OutlineDocumento19 pagineCommunity Property OutlineNeel VakhariaNessuna valutazione finora

- Community Property - Checklist (1) Basic Presumptions (You MUST Put This at The Top of EVERY Community Property Essay)Documento3 pagineCommunity Property - Checklist (1) Basic Presumptions (You MUST Put This at The Top of EVERY Community Property Essay)Kat-Jean FisherNessuna valutazione finora

- Comm Prop Outline SandyDocumento46 pagineComm Prop Outline SandyBill LundNessuna valutazione finora

- Community PropertyDocumento2 pagineCommunity Propertyjm9887Nessuna valutazione finora

- Community Property TemplateDocumento3 pagineCommunity Property TemplateHaifa NeshNessuna valutazione finora

- CP Mentor OutlineDocumento10 pagineCP Mentor OutlineLALANessuna valutazione finora

- Characterization of Property in Divorce ProceedingsDocumento18 pagineCharacterization of Property in Divorce ProceedingsAndrea FagundesNessuna valutazione finora

- Ca Bar - Community PropertyDocumento8 pagineCa Bar - Community PropertyAlexandra DelatorreNessuna valutazione finora

- Corporations - OutlineDocumento5 pagineCorporations - OutlineMissPardisNessuna valutazione finora

- Evidence I Mentor OutlineDocumento8 pagineEvidence I Mentor OutlineLALANessuna valutazione finora

- CA Bar: Performance Test Tips 1 (2009)Documento3 pagineCA Bar: Performance Test Tips 1 (2009)The Lawbrary100% (1)

- Remedies OutlineDocumento40 pagineRemedies OutlineLALANessuna valutazione finora

- BNR-CrimLaw-Excerpt-pg1-3 Writing TemplateDocumento4 pagineBNR-CrimLaw-Excerpt-pg1-3 Writing TemplateMissPardisNessuna valutazione finora

- Con Law I Mentor OutlineDocumento7 pagineCon Law I Mentor OutlineLALANessuna valutazione finora

- Community Property Math For Lawyers: The Moore FormulaDocumento6 pagineCommunity Property Math For Lawyers: The Moore FormulaDenise NicoleNessuna valutazione finora

- Torts remedies outline summaryDocumento10 pagineTorts remedies outline summaryLALA100% (1)

- CheatSheetSamples PDFDocumento17 pagineCheatSheetSamples PDFJackMorganNessuna valutazione finora

- CAL Criminal Law Outline PDFDocumento8 pagineCAL Criminal Law Outline PDFTonyNessuna valutazione finora

- Business Associations OutlineDocumento4 pagineBusiness Associations OutlineJenna AliaNessuna valutazione finora

- California Bar Exam Lecture Notes - RemediesDocumento16 pagineCalifornia Bar Exam Lecture Notes - RemediesLal Legal100% (1)

- Examples and ExplanationsDocumento4 pagineExamples and Explanationsapi-257776438Nessuna valutazione finora

- Wills MnemonicsDocumento6 pagineWills MnemonicsSemsudNessuna valutazione finora

- Rigos Bar Review Series "Uniform" Multistate Essay Exam (Mee) Review Federal Civil Procedure Magic Memory OutlinesDocumento8 pagineRigos Bar Review Series "Uniform" Multistate Essay Exam (Mee) Review Federal Civil Procedure Magic Memory Outlinessomeguy813Nessuna valutazione finora

- Contracts Outline BurtonDocumento28 pagineContracts Outline BurtonAnna DeWallNessuna valutazione finora

- Bar Outline 2012 RemediesDocumento3 pagineBar Outline 2012 RemediesJohn Carelli100% (2)

- Family Law Factors and Marriage Termination OptionsDocumento15 pagineFamily Law Factors and Marriage Termination Optionsjsara1180Nessuna valutazione finora

- CONTRACTS EXAM WRITING FORMULADocumento6 pagineCONTRACTS EXAM WRITING FORMULAsratzkinNessuna valutazione finora

- ScrutiniesDocumento2 pagineScrutiniesmkreese0100% (1)

- Mbe® Contracts: Learning ObjectivesDocumento19 pagineMbe® Contracts: Learning ObjectivesZviagin & CoNessuna valutazione finora

- Summer 2012 Illinois Bar Review ScheduleDocumento1 paginaSummer 2012 Illinois Bar Review ScheduleKristen LunnyNessuna valutazione finora

- Scott Pearce's Master Essay Method Constitutional LawDocumento32 pagineScott Pearce's Master Essay Method Constitutional LawStacy OliveiraNessuna valutazione finora

- MBE Subject Matter OutlineDocumento8 pagineMBE Subject Matter OutlineSalam TekbaliNessuna valutazione finora

- Pieper Bar Review - MPT Info (Feb 2019)Documento7 paginePieper Bar Review - MPT Info (Feb 2019)AnthonyNessuna valutazione finora

- Remedies FlowDocumento44 pagineRemedies Flowzeebeelo100% (1)

- CA Bar: Contracts (2009)Documento20 pagineCA Bar: Contracts (2009)The LawbraryNessuna valutazione finora

- 2011 Wills JohansonDocumento26 pagine2011 Wills JohansonNino GambiniNessuna valutazione finora

- Lawyers' Duties To The Public & The Legal System (2-4%)Documento1 paginaLawyers' Duties To The Public & The Legal System (2-4%)TestMaxIncNessuna valutazione finora

- PR Mentor OutlineDocumento15 paginePR Mentor OutlineLALANessuna valutazione finora

- 10-Week Study Schedule - Part-Time For 8 Weeks and Full Time 2 WeeksDocumento10 pagine10-Week Study Schedule - Part-Time For 8 Weeks and Full Time 2 WeeksMcApeG3100% (1)

- Topics Covered on the Multistate Bar Exam (MBEDocumento2 pagineTopics Covered on the Multistate Bar Exam (MBEzzsquadronNessuna valutazione finora

- Evidence Rules and ConceptsDocumento86 pagineEvidence Rules and ConceptsDoug Helfman100% (1)

- Introduction to Family Law and its DefinitionsDocumento93 pagineIntroduction to Family Law and its Definitionsbiglank99Nessuna valutazione finora

- MPRE Info BookDocumento52 pagineMPRE Info BookKate GarrisNessuna valutazione finora

- MBE BN ContractsDocumento64 pagineMBE BN ContractsZviagin & CoNessuna valutazione finora

- Constitutional Law OutlineDocumento48 pagineConstitutional Law Outlinehammurabi11100% (1)

- Barmax Mpre Study Guide: Ii. The Client-Lawyer Relationship (10% To 16%)Documento6 pagineBarmax Mpre Study Guide: Ii. The Client-Lawyer Relationship (10% To 16%)TestMaxIncNessuna valutazione finora

- California Winter 2015 AM & PM Bar ScheduleDocumento1 paginaCalifornia Winter 2015 AM & PM Bar Scheduled_zhang84Nessuna valutazione finora

- California Bar Exam Lecture Notes - Community PropertyDocumento28 pagineCalifornia Bar Exam Lecture Notes - Community PropertyLal LegalNessuna valutazione finora

- Hoyos Property Outline Southwestern Law SchoolDocumento43 pagineHoyos Property Outline Southwestern Law SchoolAnton YatsenkoNessuna valutazione finora

- California Bar Exam Real Property OutlineDocumento15 pagineCalifornia Bar Exam Real Property OutlineStacy OliveiraNessuna valutazione finora

- Habit Describes Specific Conduct and Makes No Moral JudgmentDocumento4 pagineHabit Describes Specific Conduct and Makes No Moral JudgmentJohn CarelliNessuna valutazione finora

- Barbri Corp OutlineDocumento12 pagineBarbri Corp Outlineshaharhr1100% (3)

- Judicial Review: Marbury v. MadisonDocumento35 pagineJudicial Review: Marbury v. MadisonXi ZhaoNessuna valutazione finora

- Torts CA BAR Exam OutlineDocumento17 pagineTorts CA BAR Exam OutlinechrisngoxNessuna valutazione finora

- Property Law - Dukeminier Chap2A - Finderslaw - PropDocumento6 pagineProperty Law - Dukeminier Chap2A - Finderslaw - PropRuchika BenganiNessuna valutazione finora

- ElizabethWarrenBankruptcy PDFDocumento41 pagineElizabethWarrenBankruptcy PDFGustavo Lacerda FrancoNessuna valutazione finora

- PR Rule ChartsDocumento22 paginePR Rule Chartseric bernsNessuna valutazione finora

- Rigos Bar Review Series "Uniform" Multistate Essay Exam (Mee) Review Family Law Magic Memory OutlinesDocumento4 pagineRigos Bar Review Series "Uniform" Multistate Essay Exam (Mee) Review Family Law Magic Memory Outlinessomeguy813Nessuna valutazione finora

- MBE & MEE Essentials: Governing Law for UBE Bar Exam ReviewDa EverandMBE & MEE Essentials: Governing Law for UBE Bar Exam ReviewNessuna valutazione finora

- Crim Pro Essay 2Documento3 pagineCrim Pro Essay 2MissPardisNessuna valutazione finora

- Barbri Mbe AnswersDocumento16 pagineBarbri Mbe AnswersMissPardisNessuna valutazione finora

- Civil ProcedureDocumento6 pagineCivil ProcedureMissPardisNessuna valutazione finora

- PropertyOutline S11Documento21 paginePropertyOutline S11MissPardisNessuna valutazione finora

- Van Valkenburgh v. Lutz: Adverse Possession Requires Enclosure and CultivationDocumento1 paginaVan Valkenburgh v. Lutz: Adverse Possession Requires Enclosure and CultivationMissPardisNessuna valutazione finora

- Community PropertyDocumento7 pagineCommunity PropertyMissPardisNessuna valutazione finora

- BNR-CrimLaw-Excerpt-pg1-3 Writing TemplateDocumento4 pagineBNR-CrimLaw-Excerpt-pg1-3 Writing TemplateMissPardisNessuna valutazione finora

- Property Outline: Property Is Composed of A Multiplicity of Rights (Doctrine of Property)Documento5 pagineProperty Outline: Property Is Composed of A Multiplicity of Rights (Doctrine of Property)MissPardisNessuna valutazione finora

- Constitutional LawDocumento19 pagineConstitutional LawMissPardis100% (1)

- Group OutlineDocumento11 pagineGroup OutlineMissPardisNessuna valutazione finora

- Future Interests OutlineDocumento3 pagineFuture Interests OutlineMissPardisNessuna valutazione finora

- PerpetuitiesDocumento3 paginePerpetuitiesMissPardisNessuna valutazione finora

- Symphony Space V Pergola PropertiesDocumento3 pagineSymphony Space V Pergola PropertiesMissPardisNessuna valutazione finora

- Van Valkenburgh v. Lutz: Adverse Possession Requires Enclosure and CultivationDocumento1 paginaVan Valkenburgh v. Lutz: Adverse Possession Requires Enclosure and CultivationMissPardisNessuna valutazione finora

- Life Estate Holder May Destroy StructureDocumento1 paginaLife Estate Holder May Destroy StructureMissPardisNessuna valutazione finora

- CorporationsDocumento4 pagineCorporationsMissPardisNessuna valutazione finora

- Mystery of Property Rights A U.S. PerspectiveDocumento46 pagineMystery of Property Rights A U.S. PerspectiveMissPardisNessuna valutazione finora

- Integrating SpacesDocumento1 paginaIntegrating SpacesMissPardisNessuna valutazione finora

- Ludwig V Farm Bureau Mutual InsuranceDocumento2 pagineLudwig V Farm Bureau Mutual InsuranceMissPardisNessuna valutazione finora

- Okeefe V SnyderDocumento2 pagineOkeefe V SnyderMissPardisNessuna valutazione finora

- Property Rules and Slavery: The Emancipation CaseDocumento1 paginaProperty Rules and Slavery: The Emancipation CaseMissPardisNessuna valutazione finora

- Mann V BradleyDocumento1 paginaMann V BradleyMissPardisNessuna valutazione finora

- King's Bench, 1722. 1 Strange 505 Pages 98-101 Case BookDocumento1 paginaKing's Bench, 1722. 1 Strange 505 Pages 98-101 Case BookMissPardisNessuna valutazione finora

- Insurance OutlineDocumento29 pagineInsurance OutlineMissPardisNessuna valutazione finora

- Character EvidenceDocumento2 pagineCharacter EvidenceMissPardisNessuna valutazione finora

- Par Crim Pro ApproachDocumento6 paginePar Crim Pro ApproachMissPardisNessuna valutazione finora

- Williams V GolubDocumento2 pagineWilliams V GolubMissPardisNessuna valutazione finora

- Barbri Mbe AnswersDocumento3 pagineBarbri Mbe AnswersMissPardisNessuna valutazione finora

- A Crime Is Different From A TortDocumento22 pagineA Crime Is Different From A TortMissPardisNessuna valutazione finora

- Constitutional Law - OutlineDocumento3 pagineConstitutional Law - OutlineMissPardisNessuna valutazione finora

- TAX UPDATE ON SALARY IN PAKISTAN FOR TAX YEAR 2020Documento1 paginaTAX UPDATE ON SALARY IN PAKISTAN FOR TAX YEAR 2020Malik Muhammad MuzamilNessuna valutazione finora

- Gaisano vs Development Insurance Premium DisputeDocumento2 pagineGaisano vs Development Insurance Premium DisputeMicaela Dela PeñaNessuna valutazione finora

- Optima Restore Brochure 1Documento8 pagineOptima Restore Brochure 1abhi_1mehrotaNessuna valutazione finora

- A Study On Customer Awareness Towards Health Insurance With Special Reference To Coimbatore CityDocumento5 pagineA Study On Customer Awareness Towards Health Insurance With Special Reference To Coimbatore CityIOSRjournalNessuna valutazione finora

- Quiz 1Documento9 pagineQuiz 1Vincent WanNessuna valutazione finora

- Power Plant Machinery Breakdown Insurance QuotationDocumento7 paginePower Plant Machinery Breakdown Insurance QuotationNaufal MuljonoNessuna valutazione finora

- TBF Superintendent of Insurance Annual Report 2020Documento36 pagineTBF Superintendent of Insurance Annual Report 2020CTV CalgaryNessuna valutazione finora

- Predictably Irrational Chapter 3 - The Cost of Zero Cost - Whistling in The WindDocumento10 paginePredictably Irrational Chapter 3 - The Cost of Zero Cost - Whistling in The WindPerry LauNessuna valutazione finora

- NYS Dept. of Health: NY State of Health PresentationDocumento39 pagineNYS Dept. of Health: NY State of Health PresentationState Senator Liz KruegerNessuna valutazione finora

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21Documento7 pagineItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21asmit somNessuna valutazione finora

- Elite Prime Saver BrochureDocumento21 pagineElite Prime Saver Brochuresunlife zeoilenNessuna valutazione finora

- 04 - Violeta Lalican vs. Insular Life Assurance Company, LTDDocumento1 pagina04 - Violeta Lalican vs. Insular Life Assurance Company, LTDperlitainocencio100% (1)

- IT Declaration Form Revised SalaryDocumento1 paginaIT Declaration Form Revised SalaryMANUBHOPALNessuna valutazione finora

- Stay Motion - Our ReplyDocumento11 pagineStay Motion - Our ReplyTrue News-usaNessuna valutazione finora

- CM2A September23 EXAM Clean ProofDocumento7 pagineCM2A September23 EXAM Clean ProofVishva ThombareNessuna valutazione finora

- SCSLA Loan Form GuideDocumento3 pagineSCSLA Loan Form GuideElden Cunanan Bonilla88% (8)

- IT Calculation for FY 2020-2021Documento3 pagineIT Calculation for FY 2020-2021Sampath SanguNessuna valutazione finora

- Tp. Insurance. 2019 - Golden - Notes - Mercantile - LawDocumento22 pagineTp. Insurance. 2019 - Golden - Notes - Mercantile - LawBanna SplitNessuna valutazione finora

- App Form Apna Office IndividualDocumento6 pagineApp Form Apna Office IndividualKadhar AnwarNessuna valutazione finora

- Zurich Motor Flexible Condiciones Generales Inglés Zurich Tenerife La Palma Gran Canaria Lanzarote Fuerteventura GomeraDocumento54 pagineZurich Motor Flexible Condiciones Generales Inglés Zurich Tenerife La Palma Gran Canaria Lanzarote Fuerteventura GomeraRogerfvNessuna valutazione finora

- Kudankulam Nuclear Power ProjectDocumento30 pagineKudankulam Nuclear Power ProjectRadhe MohanNessuna valutazione finora

- Cumballa Hill Management Contract 27 July 18Documento20 pagineCumballa Hill Management Contract 27 July 18naina vyasNessuna valutazione finora

- Country of GuyanaDocumento3 pagineCountry of Guyanasaeed_r2000422Nessuna valutazione finora

- Beyond Walls:: Business Ethics ABM-12Documento2 pagineBeyond Walls:: Business Ethics ABM-12Cassandra De SenaNessuna valutazione finora

- Insurance Awareness Video 6 To 8 PDFDocumento23 pagineInsurance Awareness Video 6 To 8 PDFrr04121999Nessuna valutazione finora

- Final TPADocumento40 pagineFinal TPAkushal87100% (1)

- Elderly SeminarDocumento20 pagineElderly SeminarPriyanka NilewarNessuna valutazione finora

- Project On Shriram Finance (STFC)Documento43 pagineProject On Shriram Finance (STFC)Jaswinder Singh83% (36)

- Travel Guard BrochureDocumento2 pagineTravel Guard BrochureAnjali GuptaNessuna valutazione finora