Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Caricato da

Shyam SunderTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)

Caricato da

Shyam SunderCopyright:

Formati disponibili

@ffi

EcARtrAITolt INDUSTRIES LTD

lSO900l:2008

222, ACHARYA JAGADISH CHANDRA BOSE ROAD, KOLKATA.TOO OI7, INDIA

(D : (+9t-33) 2280 3127, 22902236, 2287 8229, Fax : (+91-33) 2287 9938

E-mail : info@carnationindustries.com. Web: www.carnationindustries.com.

CIN

: L27 209W

B I 983PLCO35920

Dt:11.11.2016

The Asst. General Manager

Listing Department

BSE Ltd.

P.J. Towers, Dalal Street

Mumbai - 400 001 .

The General Manager

The Calcutta Stock Exchange

Ltd.

6, Lyons Range

Kolkata - 7A0 001.

Dear Sir,

Sub: Un Audited Financial Results for the quarter

September. 2016 and Limited Review Report

ended 30th

We are enclosing herewith the Unaudited Financial Results and

the Limited Review Report for the quarter ended 30th September,

2016.The results were taken on record by the Board of Directors at

its meeting held on 11th November, 2016.

Kindly acknowledge.

Thanking you

Yours faithfully

For Carnati'on lndustries Ltd

Ja

Com

ganrual

y Secretary

Encl: as above

Registered Office

2El1, JHEEL ROAD, P.O.SALK|A,

LILUAH, HOWRAH - 7lt t06

Phone

JAIN & BACARIA

CHARTERED ACCOUNTANTS

.

27 ISA,WATERLOO STHEET, KOLKATA 7OO 069

REVIEW REPORT

We have reviewed the accompanying statement of unaudited financial results of

CARNATION INDUSTRIES LIMITED for the quarter ended 30s September, 2016.

This statement is the responsibility of the Company's management and has been

approved by the Board of Directors. Our responsibility is to issue a report on these

financial statements based on our review.

We sonducted our review in accordance with the Standard on Review Engagement

(SRE) 2410," Review of Interim Financial Information Performed by the Independent

Auditors of the Entity" issued by the Institute of Chartered Accountants of India. This

standard requires that we plan and perform the review to obtain moderate assurance as

to whether the financial

statements are free

of material misstatement. A review

is

limited primarily to inquiries of Company personnel and analytical procedures applied

to financial data and thus provides less assurance than an audit. We have not performed

an audit and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes

us to believe that the accompanying statement

of unaudited financial results prepared in

accordance with applicable accounting standards and other recognised accounting

practices and policies has not disclosed the information required to be disclosed in

of Regulation 33 SEBI (Listing Obligations and Disclosures Requirements)

Regulations, 2015, including the manner in which it is to be disclosed, or that it

terms

contains any material misstatement.

FoT

JAIN & BAGARIA

Chartered Accountants

27 l8A, Waterloo Street,

Kolkata

Dated:

700 069

I IN0V lcl6

(B.K.AGARWAL)

Partner

Mem. No. 065361

FRN:310045E

t 2243 561 I

rlzZqg562l

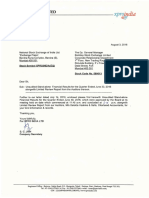

CARNATION INDUSTRIES LIMITED

1 1 06'

Regd. Offlce : 2811,JHEEL ROAD'LILUAH'P'O''SALKIA'HOWRAH-71

Fax : (+91-33) 2287 9938

8229'

9284,2287

3127,2290

2280

(+91-33)

Ph.No.:

Email: sanjay@carnationindustries'com'

l'AK I

CIN

:www.carnationindustries'com'

Website :www

L27209WBl 983PLC035920

(Rs. in laKns

r ',

,tt :=,::::i:i;i:l:

rllrarrvrqr No\

Statemenl OI Unauol(eq

I

.t.^

,^,

+h^

.!

n,

lTa Siv mbnth ended 30tn

rad.

5 )temDer. ZUlo

Particulars

30.09.2016

(Unaudited)

ncome from Ooerations

O) Other Operating lncornq . ..

i;CiTcodffioPerations (ne0

-- -

al uosr ol

hl Purcnase

or st()u(-IlFuass

goods,work-in-progress

@hed

and stock-in-trade

at Emolovee benefits expense

Et oeoreciation and amortisation

0 Other expenses

e)Qense-

and exceptional items (1-2)

Other lncome

\udited)

9,428.00

414.13

9.842.13

2,813.15

99.81

2,912.99

3,996.31

152.84

4.149.15

s.138.88

1.089.08

,t aza )1

2,139.57

10.28

2.805.37

0.62

4,782.96

1,050.49

6.37

58.19

275.66

662.61

71,83

1.335.89

4,934.51

1,262.11

138.15

2,796.72

e.257.17

584.96

3.91

200.21

5,339.09

before exceotional ltems (5t6)

xceotional ltems

Profiv(Loss) Ifom Urolnary acrlvltles eelert ta^ 1' r e'

10 Tax Expense

nctivitieg atter tax (9 tto)

11

12 ExtraorOinary ltems (Net of tax expense)

13 Net Protlv(Loss) Ior Ine perloq ( t t!. tz)

-(Face value Rs.1o/-Per

14

Reserves as per balance sheet

9

ffiinarv

ffi

(22s.6e)

146.31

al1'r aa

341.77

(278.25)

633.48

60.54

1,285.39

1.57

30.37

30.1 7

646.61

? no7 50

638.78

1.843.51

2,645.11

166.57

131.57

267.88

298,14

404.58

54.94

2.06

27.75

57.79

108.73

5.OC l.U

186.51

269.94

325,89

462.37

693.69

112.64

178.59

205.79

306.23

392.61

46.23

73.87

91.35

20.1 0

156.14

301.0E

91,35

16.73

74.62

20.1 0

56.1 4

39.44

80.66

25.80

130.34

301.08

67.30

233.78

80.66

345.72

130.34

345.72

233.78

345.72

ffi

31.03.2016

76.29

1.975.0E

ffi

exceotional items (3t4)

30.09.2015

(Unaudited)

1.89E.79

139.38

JUnaudited)

30.09.2016

(Unaudited)

2,097.52

76.55

2.174.07

(52.56)

osts

3

30.09.2015

gxoens6

30.06.2016

(Unaudited)

Year - Ended

Half Ybar Ended

c tuarter -Ended

SL.

No.

46,23.

73.87

21.67

24,56

17.77

56.10

24.56

345.72

345.72

56.1 0

74.62

345.72

1,485.86

@luation

15

of orevious accountino vear

16

tjEatnrndper S,",aAbefo;e extraordinary items) (of Rs 10/'

each)

o.71

0.71

1.62

1.62

2.16

2.16

2.33

2.33

3.77

3.77

6.76

6.76

o.71

0.71

1.62

1.62

2.16

2.16

2.33

2,33

3.77

6.76

6,76

ii)Earnings per Share (after extraordinary items) (of Rs. 1O/'each)

b) Diluted

3.77

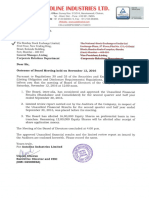

TO REGULATION 33 OF THE SEBI

SEGMENT REPORTING FOR THE QUARTER ENDED 3OTH SEPTEMBER,2OI6 PURSUANT

(LtsTtNG OBLTGATTONS AND DTSCLOSURE REQUIREMENTS) REGULATIONS'2o15'

( Rs. in lakhs)

SL.

No.

a.

Particulars

30 09 2016

(Unaudited)

Exoorts

North America

b.

Errope

d. Australia

2

Quarter - Ended

30 06.20',16

(Unaudited)

Domestic

Net Sales / !ncome From OPerations

1,072.46

609.06

385.87

9.56

921.80

467.47

506.22

20.57

3.30

2,097,52

1,898.79

30 09.2015

(Unaudited)

Half Year Endeo

30.09.2015

30.09.2016

(Unaudited)

(Unaudited)

Year - Ended

31.03.2016

(Audited)

3,754.84

2.824.71

1,994.26

1.076.53

892.09

9.56

2.074.33

1.494.60

1.525.04

3.26

16.59

23.87

41.65

44.62

2.813.18

3,996.31

5,'t38.88

9,428.00

1,241.13

938.84

616.61

2,768.05

35.78

\

u--

,ff-:-I I NOV ?316

CARNATION I NDUSTRI ES LIM ITED

Regd. office : 28/1 ,JHEEL ROAD,LILUAH,P.O.-SALKIA,HOWRAH'71 1106'

(+91.33) 2280 9127,2290 2256,2287 8229, Fax : (+91 -33) 2287 9938

sanjay@carnationindustries.com, Website :www.carnationindustries.com, CIN:127209W81983PLCO35920

'

Statement of Assets and

Ph' No. :

Liabilities

(Rs. in lakhs)

SL.

30.09.2016

(Unaudited)

Particulars

NO.

(Audited)

EQUITY AND LIABILITIES

A

1

31.03,2016

Qharahalrlarc

\ Qhara

Er

nrle

345.72

1,566.49

1.912.21

345.72

1,485.86

1,831.58

71.36

151.52

74.01

145.21

Sub-total - Non-Current liabilities

222.88

219.22

3.626.07

2,901.24

Sub-total - Cuirent liabilities

3.680.88

2.729.22

5.75

25.54

6,441.39

8,576.48

8,679.13

Sub-total - Non-Current Assets

.199.44

0.22

57.39

1,257.05

1,228.99

0.22

58.97

1 ,288,18

Subtotal - Current Assets

984.43

5,271,33

163.96

86.93

812.78

7,319.43

Canilal

h\ Pocaruo & Snmkrs

Sub-total - Shareholders Funds

2

a\l ono-term borrowinos

b)Deferred Tax Liabilities (net)

c\l ono-term orovisions

d)Creditor for Capital Goods

Current Liabilities

a)Short-term borrowinos

b)Trade oavables

c) Other current liabilities

d)Shortterm provisions

TOTAL - EQUITY AND LIABILITIES

Non-current assets

a) Fixed Assets

b) Non-cunent investments

c) Lono-term loans and advances

6,628.33

ASSETS

B

1

24,87

76.1 5

Gurrent assets

a) Current lnvestments

b) lnventories

c) Trade Receivables

d) Cash and Bank Balances

e) Short-term loans and advances

f) Other current assets

TOTAL . ASSETS

784.71

5,427.73

195.28

114.13

869,10

7,390.95

8.679.13

8,576.48

Notes:

results were reviewed by the Audit Committee, and approved by the Board of Directors in its meeting held

on I lth November, 2016 and also the Statutory Auditors have carried out the limited review of the same.

2. Figures for the previous periods are re-classified / re-arranged / re-grouped , wherever necessary, to correspond with

the current period's classification / disclosure.

3. Other operating income representing mainly export incentiyes

4. The Company is engaged in the manufacture of Castings & M.S. Products(Fabricated Steel) which are subject to the same

risk & retums and hence constitute one primary segment. The analysis of geographical segments is based on the areas in

l. The above

which the Company operates.

(Managing Director)

Place: Kolkata

Date :11,11.2016

I I NI]V ?3}6

lrv*@

I

( A.K.Bose)

(Whole time Director)

Potrebbero piacerti anche

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Announces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Documento7 pagineAnnounces Q2 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento6 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 pagineStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento5 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Announces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Documento4 pagineAnnounces Q1 (Standalone) Results, Limited Review Report (Standalone) & Results Press Release For The Quarter Ended June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Documento5 pagineAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento7 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNessuna valutazione finora

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 pagineSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNessuna valutazione finora

- Mutual Fund Holdings in DHFLDocumento7 pagineMutual Fund Holdings in DHFLShyam SunderNessuna valutazione finora

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 pagineOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNessuna valutazione finora

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 paginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderNessuna valutazione finora

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 paginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNessuna valutazione finora

- JUSTDIAL Mutual Fund HoldingsDocumento2 pagineJUSTDIAL Mutual Fund HoldingsShyam SunderNessuna valutazione finora

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 pagineFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 pagineExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 pagineSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento11 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results For Dec 31, 2013 (Result)Documento4 pagineFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For Mar 31, 2014 (Result)Documento2 pagineFinancial Results For Mar 31, 2014 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento3 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- PDF Processed With Cutepdf Evaluation EditionDocumento3 paginePDF Processed With Cutepdf Evaluation EditionShyam SunderNessuna valutazione finora

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 pagineFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results For September 30, 2013 (Result)Documento2 pagineFinancial Results For September 30, 2013 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For June 30, 2016 (Result)Documento2 pagineStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 pagineTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNessuna valutazione finora

- Investor Presentation For December 31, 2016 (Company Update)Documento27 pagineInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Beams10e Ch11Documento27 pagineBeams10e Ch11Leo Joko PurnomoNessuna valutazione finora

- Sameer Salim ResumeDocumento1 paginaSameer Salim ResumeFaiq TariqNessuna valutazione finora

- Chapter 18 - Evaluating Investment PerformanceDocumento62 pagineChapter 18 - Evaluating Investment PerformanceRavi PatelNessuna valutazione finora

- Itulip - Fire Economy in Crisis Part IDocumento16 pagineItulip - Fire Economy in Crisis Part Idonnal47Nessuna valutazione finora

- 233 Printing Flashcards of Accounting I Basics)Documento11 pagine233 Printing Flashcards of Accounting I Basics)cpears56Nessuna valutazione finora

- 2018 12 31 Adhi Final Audit Report PDFDocumento190 pagine2018 12 31 Adhi Final Audit Report PDFrofi mulikhaNessuna valutazione finora

- Corporate Finance 5E 2020-356-394Documento39 pagineCorporate Finance 5E 2020-356-394Emanuele GennarelliNessuna valutazione finora

- G.R. No. 173297 Stronghold Insurance Co Vs CuencaDocumento6 pagineG.R. No. 173297 Stronghold Insurance Co Vs CuencaJoovs JoovhoNessuna valutazione finora

- Audit Legal LiabilitiesDocumento40 pagineAudit Legal LiabilitiesUmmu Aiman AyubNessuna valutazione finora

- Investment Incentives Code1Documento24 pagineInvestment Incentives Code1jethrojosephNessuna valutazione finora

- Determinantsof Capital Structure Evidencefrom JordanDocumento14 pagineDeterminantsof Capital Structure Evidencefrom JordanFaycal BenhalimaNessuna valutazione finora

- Internship Report: NOON Business School University of SargodhaDocumento25 pagineInternship Report: NOON Business School University of Sargodhaanees razaNessuna valutazione finora

- FINS5530 Lecture 1 IntroductionDocumento42 pagineFINS5530 Lecture 1 IntroductionMaiNguyenNessuna valutazione finora

- Math Problems For Future UseDocumento103 pagineMath Problems For Future UseHoneyjo NetteNessuna valutazione finora

- FinLiab QuizDocumento8 pagineFinLiab QuizAeris StrongNessuna valutazione finora

- Qwest Communication: By: Keyrane. KDocumento14 pagineQwest Communication: By: Keyrane. KKEYRANE KOUAMENessuna valutazione finora

- WM Retirment SumsDocumento8 pagineWM Retirment SumsTarun SukhijaNessuna valutazione finora

- IRR Revisions 2016 (25 Aug 2016)Documento32 pagineIRR Revisions 2016 (25 Aug 2016)rina100% (1)

- DCF Valuation Financial ModelingDocumento10 pagineDCF Valuation Financial ModelingHilal MilmoNessuna valutazione finora

- HP Compaq Merger Full ReportDocumento31 pagineHP Compaq Merger Full ReportMuhammad Mubasher Rafique86% (7)

- Letter of Intent To Purchase LandDocumento4 pagineLetter of Intent To Purchase LandDomshell Cahiles100% (4)

- 412201518458Documento2 pagine412201518458Govinda Patra100% (2)

- Amul: One of The India's Strongest BrandsDocumento7 pagineAmul: One of The India's Strongest BrandsUdayKiranRajuNessuna valutazione finora

- Shell Dividend PolicyDocumento4 pagineShell Dividend PolicyAdrian SaputraNessuna valutazione finora

- Taking Over The Mantle A STAX Report With SLID 2Documento24 pagineTaking Over The Mantle A STAX Report With SLID 2shakeelNessuna valutazione finora

- Special Commercial Laws Complete and Updated Course SyllabusDocumento8 pagineSpecial Commercial Laws Complete and Updated Course SyllabuslazylawstudentNessuna valutazione finora

- Wall Street Self Defense Manual PreviewDocumento18 pagineWall Street Self Defense Manual PreviewCharlene Dabon100% (1)

- Lone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Documento142 pagineLone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Texas WatchdogNessuna valutazione finora

- Irc CRMDocumento43 pagineIrc CRMsureshv23Nessuna valutazione finora

- Delpher Traders vs. IacDocumento3 pagineDelpher Traders vs. IacKent A. AlonzoNessuna valutazione finora