Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 11

Caricato da

Ram SskCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 11

Caricato da

Ram SskCopyright:

Formati disponibili

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

CHAPTER ELEVEN

ELECTRONIC DATA INTERCHANGE

PRELIMINARY

Electronic Data Interchange or EDI can be termed as computer to computer transmission of

standard data, which mainly consists of:

a)

b)

Direct application to application communication.

Use of electronic transmission medium rather than Magnetic tapes, discs or other transmission

media.

c)

Use of electronic mailboxes for store and collect/store and forward transmission delivery of

documents.

d)

Use of structured and formatted messages based on internationally accepted standard.

Computers have been around in our country for about last three decades. For quite a long time,

computer technology has been in its nascent stage, confirmed mainly to small personal computers,

r.i

n

calculators or customised computers used in specific institutions like Atomic Energy institutes, research

organisations, etc.

The earlier computers in applied use were not only voluminous in size but also limited in terms of

nc

e

their functional capabilities. In the last decade or so, there has been tremendous progress and

improvisations in the field of computer technology. The modern day computers have not only shrunk in

size but have also achieved vast dimensions in the field of storage, maneuverability, presentation and

.re

fe

re

transmission of information and data.

With the advancements in the field of technology, the modern computers have kept pace by

taking quantum leap in the direction of sophisticated hardware as well as software to pack in amazing

capabilities.

Since the time of advent of Local Area Networks, Internets and Internet, a revolution has dawned

iin the sphere of Information Technology. One of the greatest advantages of this is the fast and easier

exchange of information among the people through computers, locally as well as all over the world.

Of late, the Central Government as well as State Governments have also switched over to

computerisation of their offices on a large scale. This provides neat, faster and accurate

analysis/storage/retrieval and printing of Data and Information besides saving a lot of manpower, space,

stationery etc.

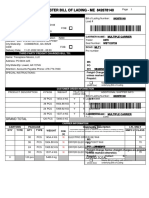

THE INDIAN CUSTOMS EDI SYSTEM

Indian Customs EDI System is a software package which accepts Customs documents

electronically from the Custom House Agents (CHAs), Importers and Exporters for processing by the

Customs Officers. The Bill of Entry (BEs) and Shipping Bills (SBs) can be submitted by EDI over NICNET,

the nation-wide computer communication network of the National Informatics Centre (NIC), using the

Remote EDI System (RES).

Those who do not have computer systems can bring their documents to the Services Centre

(SC), a facility set up by Customs for entering the BEs/SBs into the computer system and to submit them

to Customs for further processing.

Once the documents are submitted to Customs, either through EDI or through SC, there is no

paper movement in the Custom House (CH). The documents do move from one officer to another, but

only electronically within the computer system.

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

240

ICES has been designed and developed by NIC in consultation with the CBEC. It comprises two

major sub-systems, namely:

ICES/I for processing Import documents

ICES/E for processing Export documents

NIC has also designed and developed a software package Remote EDI System (RES), which

enables the CHAs to prepare the Customs declarations, submit the documents to ICES through the EDI

Services of NICNET. RES is presently operational only in Delhi. It has been specially developed to

facilitate housekeeping operations of CHAs too. It enables them to receive status information, queries, as

well as the finally processed documents, challans, Drawback payment status, etc. from ICES over

NICNET.

EDI SYSTEM IN THE CUSTOM HOUSE

Based on EDI concept, ICES (Indian Customs EDI System) has been developed, which is a

software package accepting Custom documents electronically (through Service Centre) from Custom

House Agents, Importers and Exporters for processing by Custom Officers. Bills of Entry and Shipping

r.i

n

Bills can be submitted by EDI over NICNET, the nation wide computer communication network of National

Informatics Centre (NIC), using Remote EDI System (RES), to be processed by the Custom House.

nc

e

EDI was introduced in several Air Cargo Complexes in the past few years. Few advantages of

EDI, which were observed are :

Creation of Import and Export data bank with on line data entry.

2)

On line retrieval of information to facilitate assessment, valuation, refund etc.

3)

Fast and efficient data retrieval.

4)

On line availability of CTH and CETH.

5)

Correct rate of duty applied by System automatically with regards to CTH and CETH.

6)

Removal of calculation errors.

7)

Swift analysis of Import/Export.

8)

Import data base for IGM control, licence, bond, Bank Guarantee, duty payment etc.

9)

Speedier assessment and completion of Customs formalities.

.re

fe

re

1)

After introduction of EDI System, original documents are seen only after assessment (by Group

staff), at examination stage in docks. Groups are expected to do assessment only on the basis of

documents fed electronically into the system, hence much of workload has shifted from regular Groups to

docks.

Though the exact infrastructure of computerisation in each Custom House may largely depend on

the topography, volume of work, available resources, etc., the basic procedure has to remain uniform

throughout the formations.

The broad procedures for processing the Shipping Bills and Bills of Entry through EDI, as outlined

in the two Public Notices issued by the Mumbai Custom House, are given below:-

Computerised processing of Shipping Bills under the Indian Customs EDI systems (ices)

(Exports) New Custom House, Mumbai.

It is brought to the notice of all Exporters, Importers, CHAs and members of the trade that the

computerised processing of Shipping Bills under the Indian Customs EDI Systems-Exports (ICES/E),

have commenced at New Custom House, Mumbai. The change over to computerised processing of

Shipping Bills would be in phases, as per date to be notified later :

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

241

A) White Shipping Bill.

(Except those relating to jewellery, 100% EOU, DEEC, DEPB,

EPCG, Pass Book and re-export cases)

B) Shipping bills relating to Drawback and dutiable.

C) DEEC Shipping bills.

D) DEPB Shipping bills.

There shall be several EDI centres in the Docks, for processing of Export, each headed by an

Assistant Commissioner of Customs, who will be in charge of appraising and as well as examination.

The procedure to be followed in respect of the Indian Customs EDI Systems-Exports will be as

follows:-

2. CHANGE IN PROCEDURE FOR GR-1

2.1

With the introduction of EDI, the requirement of filing a GR1 form stands abolished in respect of

documents filed through EDI. Henceforth, Exporters/CHAs would be required to file a declaration

in the form SDF (Appendix I). It would be filed at the stage of arrival of the goods in the docks

r.i

n

area. One copy of the Declaration would be attached to the original copy of the S/B generated

by the system and retained by the Customs. The second copy would be attached to the duplicate

S/B (the exchange control copy) and surrendered by the Exporter to the authorised dealer for the

2.2

nc

e

collection/negotiations.

The Exporters are required to obtain a certificate from the bank through which they would be

realising the export proceeds (Appendix 1A). If the Exporter wishes to operate through different

.re

fe

re

banks for the purpose, a certificate would have to be obtained from each of the banks. The

certificate will be submitted to Custom and registered in the system. These would have to be

submitted once a year for confirmation, or whenever the bank is changed.

2.3

In the declaration form (Annexure A or B) to be filed by the Exporters for the electronic processing

of Export documents , the Exporters would need to mention the name of the bank and branch

code as mentioned in the certificate from the bank. They will verify the details in the declaration

In the case of S/Bs processed manually , the existing arrangement of filing GR-1 forms would

continue.

2.4

with the information captured in the systems through the certificates registered earlier.

3. DATA ENTRY OF SHIPPING BILLS :3.1

The procedure for registration of IEC codes, PAN numbers, CHAs Licence numbers and/or

account numbers by Exporters and CHAs has already been notified. The S/Bs cannot be allowed

in absence of registration in the system.

3.2

For the purpose of filing the S/B the Exporters would present at the Center a declaration in form

Annexure A (for exports without claim for drawback) or Annexure B (for exports under claim for

drawback) along with copy of the Invoice. The form should be complete and signed by the

exporter or his authorised CHA. Incomplete or unsigned forms would not be accepted.

3.3

In respect of items subject to cess , the corresponding serial number of the Cess Schedule

should be mentioned. A printed challan generated by the system would be handed over to the

Exporter . The Cess amount indicated should be paid in the Cash section of the Custom House,

under a receipt.

3.4.1

In the beginning, data entry of Shipping Bills will be allowed to be made only at the Service

Center located at New Custom House, Mumbai.

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

242

3.5.

After the Exporters/CHAs have become conversant with the EDI procedures, the option of

Remote EDI system would also be made available. In the Remote EDI system (RES)

Exporters/CHAs can electronically file their Shipping Bills from their offices through Dial-up

modems using telephone line. However commencement of that system will be notified at a later

date.

3.6.

The schedule of charges to be levied for data entry at the Service Center would be as determined

by the Custom House from time to time.

3.7.

The Service Center operators shall carefully enter the data on the basis of declarations (duly filled

forms of Annex. `A or `B) made by the Exporter/CHAs. After completion of data entry, the

Check List will be printed by the Data Entry Operator and shall be handed over to the

Exporters/CHAs for confirmation of the correctness. After the CHAs/Exporter makes corrections,

if any, in the check list and returns the same to the operator duly signed, the operator shall make

the corresponding corrections in the data and shall submit the Shipping Bill to the Indian Customs

EDI Systems (ICES)-Export.

The operator shall not make any amendment after generation of

the check list against the respective fields and duly authenticated by CHA/Exporters signature.

The system automatically generates the Shipping Bill number, the operator shall endorse the

r.i

n

3.8.

same on the Check list in clear and bold figures. It should be noted that no copy of the Shipping

Bill would be made available at this stage. However, the TR-6 challan for payment of Cess will

nc

e

be generated at this stage. Noting Stage will not apply to Shipping Bills submitted through the

Indian Customs EDI System.

3.9.

The declarations would be accepted at the Service Center from 10.00 A.M. to 4.30 P.M.

.re

fe

re

Declarations received upto 4.30 P.M. will be entered in the computer system by the Service

Center on the same day. The examination of cargo and Let Export will be completed the same

day for the goods brought in the Docks and registered before 3 P.M.

3.10.

The validity of the Shipping Bill in EDI system is 15 days only. After expiry of fifteen days from

the date of Shipping Bill, the Exporter has to again file the declaration afresh.

GOODS.

The processing of Shipping Bills involving allocation of ready made garments quota by Apparel

4.1

PROCEDURE, QUOTA ALLOCATION AND OTHER CERTIFICATION FOR EXPORT

4. OCTROI

Export Promotion Council will also change with the introduction of the new system. Under EDI

system the quota allocation label will be pasted on the export invoice instead of the Shipping Bill.

The allocation number of AEPC should be entered in the system at the time of Shipping Bill data

entry. The quota certification of export invoice should be submitted to Customs along with other

original documents at the time of examination of the export cargo. As a transitional measure,

Customs will accept AEPC certification of the manual Shipping Bill format also. However, in

these cases the Shipping Bill be treated on par with invoice and will not be subjected to any

processing. The shipping bill no. should also be indicated on the invoice when goods are

presented for examination. Initially, during the transition period pasting of quota labels on the

shipping bills will be allowed. For determining the validity date of the quota the relevant date

would be the date on which the full consignment is presented to the Customs for examination and

duly recorded in the Computer system.

4.2

Certification of other agencies involved in export clearance such as Cotton Textiles Export

Promotion Council, Wildlife Inspection Agency under the Convention on International Trade in

Endangered Species (CITES).

Engineering Export Promotion Council, Agricultural Produce

Export Development Agency (APEDA), Central Silk board. All India Handicraft Board, Assistant

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

243

Drug Controller, Archaeological Survey of India should also be obtained on the Export invoice

since the Shipping Bill will no longer be available for such pre-shipment certification.

The

transitional arrangements for certification by these agencies would continue as in the case of

AEPC certification. The No Objection of Assistant Drug Controller will also be obtained on the

Export Invoice itself.

4.3

The Exporters may make use of export invoice or such other document as required by the Octroi

authorities for the purpose of Octroi exemption, since the Shipping Bill is generated only after the

let export order is given by Customs.

5. ARRIVAL OF GOODS AT DOCKS :

5.1

The goods brought for the purpose of examination and subsequent let export will be allowed

entry into the Docks on the strength of the checklist and other declarations filed by the Exporter in

the Service Center. The Custodian (Mumbai Port Trust) will not insist for production of Shipping

Bill to allow entry of the goods to the docks area. The Custodian (Mumbai Port Trust) will

endorse the quantity of goods actually received on the reverse of the Check List.

The Check list, copies of the other Declarations as aforesaid and additional data entry form as

r.i

n

5.2

per Annexure C should be submitted to the Examining Officer (Docks) designated for record of

arrival of the goods.

The Examining Officer

shall verify the quantity of the goods actually

nc

e

received, and will enter the particulars of arrival into the system and thereafter enter the additional

details as per Annexure C. If at any stage subsequent to the entry of goods in the Docks, it is

found that the Shipping Bill has not been filed, the exporter and his Custom House Agent will be

.re

fe

re

solely responsible for the delay in processing the documents for export and any consequent

damage / deterioration / pilferage in respect of the Export goods.

5.2

The Customs will record arrival of goods only after the full consignment, with duly numbered

packages, is received inside the Dock. As already stated, the export goods should be brought for

the purpose of examination and let export within 15 days of filing of the Declaration in the Export

Service Center. In case of delay, a fresh declaration would need to be filed in the Export Service

Center in the Custom House.

6.1

6. PROCESSING OF SHIPPING BILLS :

The Shipping Bills shall be processed by the system on the basis of declarations made by the

Exporters. However, the following Shipping Bills shall automatically appear on the screen of the

Assistant Commissioner of Customs, who shall confirm the processing :(i)

Shipping Bills where the FOB value of the goods is more than rupees ten lakhs.

(ii)

Shipping Bills relating to free trade samples whose value is more than Rupees Twenty

Thousand.

(iii)

6.2

Drawback Shipping Bills where drawback amount is more than Rupees One Lakh.

Apart from verifying the value and other particulars for assessment, the Assistant Commissioner

may call for the samples, if required for confirming the declared value or for checking

classification under the Drawback Schedule. The Assistant Commissioner may also give any

special instruction for examination of goods, if felt necessary.

6.3

The Exporter/CHAs can check up with the query counter at the Service Center whether the

Shipping Bill submitted by them in the system has been cleared by the Assistant Commissioner

or not, before the goods are brought into the Docks for examination and export. In case any

query has been raised by the Assistant Commissioner the same is required to be replied through

the service Center or in case of CHAs having EDI connectivity through their respective terminals.

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

244

The Shipping Bill be passed by the Assistant Commissioner after all the queries have been

satisfactorily replied to.

7. CUSTOMS EXAMINATION OF EXPORT CARGO :7.1

After the receipt of the goods in the Docks, the Exporter/ CHA will contact the Examining Officer

designated for the purpose and present the check list with the endorsement of Custodian, other

declarations as aforesaid along with all original documents such as, Invoice and Packing list, AR4, etc. He will also present the details of additional particulars, if any, listed in Public Notice as

Annexure-C. As already stated the Examining Officer will verify the quantity of the goods actually

received and enter into the system. The aforesaid officer will also enter the additional particulars

in Annexure-C and thereafter mark the Electronic Shipping Bill and also hand over all original

documents to the Shed Appraiser who will assign an Examining Officer for the examination and

intimate the officers name and the packages to be examined, if any, on the Check list and return

it to the Exporter or his agent. No such examination order shall be given unless the goods have

the packages / goods in case of any discrepancy.

7.2

r.i

n

been physically received in the Docks. It may however be clarified that Customs may examine all

The Examining Officer will inspect / examine the shipment along with the Shed Appraiser. The

Examining Officer will enter the examination report in the system. There will be no need for a

nc

e

written examination report. He will then mark the Electronic Bill along with all original documents

and check list to the Shed Appraiser. If the Shed Appraiser is satisfied that the particulars

entered in the system conform to the description given in the original documents and the physical

.re

fe

re

examination, he will proceed to allow let export for the shipment and inform the Exporter or his

agent.

7.3

Procedure for clearance of export consignments received in parts in Docks.

In respect of cases where the exporter is unable to bring the entire consignment into the Docks

for examination and Let Export and brings the consignment in parts and seeks examination and

The part consignment will be allowed entry into the Docks on the strength of the Check

1)

the Dock.

Let export on that basis the following procedure will be followed for processing of Shipping Bill in

List and the Exporter/CHA will obtain the endorsement of MbPT certifying the quantity of

the goods entered.

2)

The Exporter , CHA will then present the part consignment to the Appraiser and

Examining Officer/P.O. who will examine the goods and give Let Export for the part

consignment if the goods are as per the declaration given in the check list and are

otherwise in order.

3)

The Examination report in respect of part consignment will be written on the reverse of

the checklist and Let Export also will be given on the reverse side of the Checklist.

4)

The goods then will be presented to the Preventive Officer(Docks) for allowing shipment.

Preventive Officer will allow shipment for the quantity of goods for which LEO is given on

the reverse of the checklist.

5)

The goods will then be allowed loading under Preventive Supervision.

6)

The above procedure will be followed for each part consignment and for each such part

Shipment clear-cut Let Export Order and allow shipment order will be endorsed, till the

entire consignment is examined and loaded on to the Vessel.

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

245

7)

After the entire consignment is shipped in the Vessel, the Exporter will obtain the

signature of the Master of the Vessel acknowledging the receipt of the goods on board on

the reverse of the checklist. Then the P.O. will also endorse the shipment details and

date of shipment on the checklist after verifying the mate receipt.

8)

The Exporter/CHA will then report to the Dock examining officer (P.O.) for the processing

of the Shipping Bill in the System.

9)

The Exporter will submit the Checklist with all the endorsements with ANNEXURE-C and

other documents as specified in this Public Notice,

to the Examining Officer in the

Docks.

10)

The Examining Officer as per the Procedure stipulated in this Public Notice will register

the particulars of ANNEXURE-C in the Computer and mark the Shipping Bill to the

Appraiser who will complete all the formalities of assessment before giving LET

EXPORT in the system.

After the LET EXPORT is given by the Appraiser, the

Customs copy and Exporters copy of the Shipping Bill will be generated. After obtaining

the print out the Appraiser shall obtain the signature of Examining Officer

on the

r.i

n

examination report and the signature of the Exporter/CHA on both the Shipping Bills.

Thereafter, the Shed Appraiser will sign both the Shipping Bills at the specified place and

authenticate the SDF Declaration (original & duplicate) and return the Exporter copy of

nc

e

the Shipping Bill along with duplicate copy of SDF to the exporter/CHA. The Appraiser

will retain the Checklist and other declarations in the Docks along with the Customs copy

of the Shipping Bills and original copy of SDF.

The Exporter copy of the Shipping Bill will be submitted by the Exporter/CHA to the

.re

fe

re

11)

Preventive Superintendent for entry of the loading stuffing details in to the system, relying

on the container loading plan Cargo Loading Plan, the mate receipt and the checklist

available with the Shed Appraiser.

12)

If the Vessel has not sailed by the time the Shipping Bill is generated in the system, the

Exporter will get the exporter copy of the Shipping Bill endorsed by the master of the

Vessel, and will submit the same to the Preventive Officer for signature in the appropriate

place in the Shipping Bill endorsing shipment details after verifying mate receipt and

check list. If the Vessel has already sailed, the Preventive Officer can endorse the actual

shipment particulars at the appropriate place in the Shipping Bill based on mate receipt

and check list.

7.4

In order to provide the procedure for stuffing of containerised Cargo in the Docks area under

P.O.s Supervision and loading of bulk and containerised cargo two Annexures K & L are

provided. The same should be submitted in triplicate to Supdt. / P.O. at the time seeking

supervision for stuffing / loading.

7.5 Procedure in case of factory stuffed containers :

7.5.1

Factory stuffed containers are received in the Docks area, the Customs Preventive Officer at the

gate will verify the Central Excise seal on the container and will give the seal check

endorsement on the Invoice.

Thereafter, the Exporter or his agent should present the said

invoice, check list and declaration along with all other original documents such as packing list AR4 etc., to the Examining Officer posted for this purpose. He will also present the details of

additional particulars if any listed in Annexure-C to this Public Notice. The Examining Officer will

enter the additional particulars and mark the Shipping Bill and original documents to the Shed

Appraiser, for consideration of let export. The system may require re-examination of the factory

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

246

stuffed container on a random basis.

If the container is selected for re-examination by the

system, the procedure as given in Para 7.2 above will be required to be followed. In other cases,

if the Shed

Appraiser (Export) is satisfied with the particulars entered in the system and

description given in the original documents, Central Excise examination report, and there is no

need to examine the factory stuffed goods, he will proceed to allow let export for the shipments

and inform the Exporter.

7.5.2

In case the Shed Appraiser (Export) feels that the goods require re-examination, he will mark the

electronic copy of the shipping bill and other documents to the Assistant Commissioner (Exports)

and instruct the exporter or his agent to meet the Assistant Commissioner(Exports).

If the

Assistant Commissioner of Customs (Exports), approves the re-examination of the goods, then

container will be brought to the Docks and the procedure specified in para 7.2 above will be

followed.

7.6 Variation between the Declaration & Physical Examination :

The check list and the declaration along with all original documents will be retained by the

r.i

n

Appraiser concerned. In case of any variation between the declaration in the Shipping Bill and

physical documents / Examination report, the Appraiser will mark the Electronic Shipping Bill to

the Assistant Commissioner of Customs (Exports). He will also forward the physical documents

nc

e

to Assistant Commissioner of Customs (Exports) and instruct the Exporter or his agent to meet

the Assistant Commissioner of Customs (Exports) for settlement of dispute. In case the exporter

agrees with the views of the Department, the Shipping Bill would be processed accordingly.

.re

fe

re

Where however, the exporter disputes the view of the Department, principles of natural justice

would need to be followed before finalisation of the issue.

8. GENERATION OF SHIPPING BILLS :8.1

After the let export order is given on the system by the Appraiser, the Shipping Bill shall be

generated by the system in two copies, i.e., one Customs copy, one Exporters copy (E.P. copy

will be generated only after vessel has sailed). After obtaining the print out the Appraiser shall

obtain the signatures of the Examining Officer on the Examination report and the representative

The CHAs

of the CHA on both copies of the Shipping Bill and Examination report.

representatives name and identity card number should be clearly mentioned below his signature.

The Appraiser shall thereafter sign & stamp both the copies of the Shipping Bill at the specified

place.

8.2

The Appraiser should also sign and stamp the original & duplicate copy of SDF form (already

submitted by the Exporters with other documents) for value only. Customs copy of Shipping Bill

and original copy of the SDF will be retained along with the original declarations by the Appraiser

and forwarded to Export Department of the Custom House. He will return the exporter copy and

the second copy of the SDF form to the Exporter or his agent. The E.P. copy of the Shipping Bill

will be printed and shipment details MR NO. along with date of sailing will be endorsed by the

Preventive Officer, only after sailing of the Vessel and verification of mate receipt by the proper

officer (Preventive Officer).

8.3

As regards the AEPC quota and other certifications, these will be retained along with the Shipping

Bill in the Dock export, after the Shipping Bill is generated by the system.

At the time of

examination, apart from checking that the goods are covered by the quota certifications, the

details of the quota entered into the system would be checked.

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

247

9. EXAMINATION / STUFFING / LOADING OF GOODS AND CONTAINERS :9.1

The Exporter or his agent should hand over the Exporter copy of the Shipping Bill duly signed by

the Appraiser permitting Let Export, to the steamer agent who will then approach the proper

officer (Preventive Officer) for allowing the shipment. In case of containerised cargo the stuffing of

container at Docks will be done under Preventive Supervision. Loading of both containerised and

bulk cargo will be done under Preventive Supervision. The Customs Preventive Superintendent

(Docks) will enter the particulars of packages actually stuffed in to the container, the bottle seal

no., particulars of loading of cargo container on board in to the system and endorse the same

details on the exporter copy of the Shipping Bill presented to him by the steamer agent. To

facilitate the process of entry of cargo loading report in the system the Exporter / CHA / Steamer

Agent will prepare a Cargo Loading Plan (CLP) / container stuffing sheet. If there is a difference

in the quantity number of packages stuffed in the containers / goods loaded on vessel the Supdt.

(Docks) will put a remark on the Shipping Bill in the system and that Shipping Bill requires

amendment or changed quantity. Those Shipping Bills also will not be taken up for the purpose

of sanction of Drawback /

DEEC logging, till the Shipping Bill is suitably amended for the

9.2

r.i

n

changed quantity.

The Customs Preventive Officer supervising the loading of container and general cargo in to the

10. PAYMENT OF MERCHANT OVERTIME (M.O.T.)

nc

e

vessel will give Shipped on Board endorsement on the Exporters copy of the Shipping Bill.

For the time being the present manual system in respect of payment of Merchant Overtime

11. DRAWAL OF SAMPLES :11.1

.re

fe

re

(MOT) charges will continue.

Where the Appraiser Docks (Export) orders for samples to be drawn and tested, the Examining

Officer will proceed to draw two samples from the consignment and enter the particulars thereof

along with details of the testing agency in the ICES/E system. There will be no separate register

for recording dates of samples drawn. Three copies of the test memo will be prepared by the

Examining Officer and will be signed by the Examining Officer and Appraising Officer on behalf

of Customs and the Exporter or his agent. The disposal of the three copies of the test memo are

as follows :-

11.2

i)

Original- to be sent along with the sample to the test agency.

ii)

Duplicate Customs copy to be retained with the 2nd sample.

iii)

Triplicate Exporters copy.

The Assistant Commissioner if he considers necessary, may also order for sample to be drawn

for purpose other than testing such as visual inspection and verification of description, market

value inquiry etc.

12. QUERIES :With the discontinuance of the assessment in the Export Department, it is anticipated that there

will not be any queries since any doubt can be clarified by the Exporter or his agent during

examination. However, in a rare case, where the need arises for a detailed answer from the

Exporters, a query can be raised by the Examining Officer or the Appraising Officer on the system

which should be confirmed by the Assistant Commissioner of Customs (Exports). The Shipping

Bill will remain pending and can not be printed till the Exporters reply is seen and accepted by

the Customs Department.

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

248

13. AMENDMENTS: 13.1

Any correction / amendments in the checklist generated after the submission of declaration can

be made at the Service Center provided the documents have not yet been submitted in the

system and the Shipping Bill number has not been generated. Where corrections are required to

be made after the generation of the Shipping Bill No. or after the goods have been brought into

the Export Dock, amendments will be carried out in the following manners : i)

If the goods have not yet been allowed let export amendments may be permitted by the

Assistant Commissioner(Exports)

ii)

Where the Let Export order has already been given, amendments may be permitted only

by the Additional / Deputy Commissioner, New Custom House, Mumbai, in charge of

Export section.

13.2

In both the cases, after the permission for amendments has been granted, the Assistant

Commissioner (Export) will approve the amendments on the system on behalf of the Additional /

Deputy Commissioner. Where the print out of the Shipping Bill has already been generated, the

Exporter will first surrender all copies of the Shipping Bill to the Dock Appraiser for cancellation

r.i

n

before amendment is approved on the system.

14. SHORT SHIPMENTS, SHUT-OUT, CANCELLATION AND BACK TO TOWN PERMISSIONS :

All permissions for short shipment certificate, shut-out, cancellation of Shipping Bill and back to

nc

e

14.1

town permission shall be given by the Assistant Commissioner (Export) on the basis of an

application made by the Exporter/CHA in this behalf. The application shall be accompanied by a

.re

fe

re

no objection from the concerned shipping lines.

The Shipping Bill particulars need to be

modified / cancelled in the system before granting such permission. The Assistant Commissioner

should check the status of the Export General Manifest (E.G.M.) corresponding to that Shipping

Bill before allowing modification/cancellation. In case the EGM has been filed but drawback

against the Shipping Bill is not sanctioned, the concerned Shipping Bill should be cancelled so

that drawback is disallowed. Where however the drawback has been sanctioned against the

Shipping Bill consequent to the filing of EGM, the party should be asked to pay back the amount

of drawback sanctioned before granting the permission.

15. CHANGE OF VESSEL NAME :15.1

It will be mandatory for the Exporter or his agent to indicate Vessel name in Annexure C. Any

request for change in vessel name after let export and before stuffing loading shall be in writing

by the CHA/Exporter or the steamer agent depending upon who is the in-charge of the goods and

such change shall be carried out by the Preventive Officer in-charge of loading / stuffing after

obtaining permission from Superintendent (Docks). After stuffing / loading, the Custom Officer

designated for the purpose shall carry out changes in vessel name and the officer permitting the

change in vessel name will enter the particulars of the new vessel name into the system. The

System will generate amendment number, which will be endorsed on the application for the

amendment by the Preventive Officer. It is clarified that for change in vessel name the

cancellation of let export order or reprint of Shipping Bill is not required.

15.2

The Exporter has to file a declaration with regard to freight (whenever CIF and C&F terms are

applicable) in Annexure-C. At the time of submission of shipping bill or when the goods are

presented for examination before the officer, the declaration as to freight should reflect the freight

charges borne by the Exporter irrespective of the amount received by the Shipping lines and the

consolidating Agent or any other person engaged in the entire operation of shipping and

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

249

movement. In the unlikely event of the Exporter not being aware of the actual freight, payment by

him at the time of filing of Annexure-C, the Exporters should, to facilitate early payment of

drawback, file a declaration of the freight on the basis of the standard published schedule of

freight rates. Where however the actual freight is higher than the freight declared in the Shipping

bill, it would be the responsibility of the steamer agent to report to customs every case where

declared freight is less than those charged for transaction.

The Exporter/CHAs should also

review each case after shipment has taken place and if the freight borne by them is higher than

the one declared in the shipping bill, they should pay back to the Customs, the excess drawback

claimed / received or duty concession claimed thereon. The Exporter should bear in mind that

any mis declaration resulting in loss of revenue is liable to be proceeded against under the

Customs Act, 1962 or under any other law for the time being in force.

16. RECONSTRUCTION OF LOST DOCUMENTS:

No duplicate print out of EDI Shipping Bill will be generated if Shipping Bill is lost, since extra

copy of Shipping Bills are liable to be misused. A certificate will be issued by the Customs stating

r.i

n

that let export order has been allowed on the system to enable the goods to be accepted by the

steamer agents. Drawback will be sanctioned on the basis of the let export order already

still available with the department.

17. RE - PRINT OF SHIPPING BILLS;

nc

e

recorded on the system. Only SDF Declaration will be allowed to be reconstructed if the original is

.re

fe

re

Re-print of shipping bills are not ordinarily allowed since the extra copies of the shipping bills can

be misused. However, where there is a system failure and as a result of which the print out after

let export order has not been generated or there is misprint, re-print of the same will be allowed

only after permission is granted by Assistant Commissioner (Export). The misprint copy shall be

cancelled before any such permission is granted.

The scheme of computerized processing of drawback claims under the Indian Customs EDI

18.1

18. EXPORT OF GOODS UNDER CLAIM FOR DRAWBACK

System Exports will be applicable for all exports through Custom House except excluded

categories. In respect of excluded categories the export documents will be filed manually and the

DBK claim shall also be filed separately with Assistant Commissioner, Drawback, as hitherto.

18.2

In respect of goods to be exported under claim for drawback, the Exporters will file declaration in

the form annexed as Annexure-B of this Public Notice. The declaration in the Annexure-C of this

Public notice would also be required to be filed when the export goods are presented at the

Export Docks for examination & let export.

18.3

The Exporters are also required to give their current account number along with the name of the

bank through which the export proceeds are to be realised.

18.4

Export declaration involving a drawback amount of more than Rupee one lakh will be processed

on screen by the Assistant Commissioner, Customs before the goods can be brought for

examination and for allowing Let Export.

18.5

The drawback claims are sanctioned subject to the provisions of the Customs Act, 1962, the

Customs & Central Excise Duties Drawback Rules, 1995 and conditions prescribed below

different sub-headings of all industry rates (as per notification No. 67/98 Customs dated

01.09.1998 as amended). In order to sanction the drawback through EDI system, the exporters

are required to submit declarations as per Appendix III and appropriate declarations, if any along

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

250

with the shipping bills as per applicable Appendices to this public notice. The details of the

declarations being submitted shall be mentioned in the appropriate column of proforma at

Annexure B. The rates of drawback under some S.S. Nos. are dependent upon certain

conditions as mentioned in the Drawback Schedule. In order that the EDI system processes the

claims correctly, exporters are advised to give the correct S.No. of the relevant Appendix

applicable to their case on the declaration as well as in column condition No. in the table given

in proforma at Annexure B. The S.S. Nos. of the relevant declarations which are not applicable for

the exporter may be deleted.

If the relevant declarations are not filed along with the shipping bills, the EDI system will

not process the drawback claims. The Exporters and CHAs are advised to file the required

declarations along with the shipping bills for immediate processing of their drawback claims and

properly fill the table in ANNEXURE-B.

18.6

( Not reproduced here )

18.7

( Not reproduced here )

18.8

After actual export of the goods, the Drawback claims will be processed through EDI system by

r.i

n

the officers of Drawback Branch on first come first served basis. There is no need for filing

separate drawback claims. The status of the Shipping Bills and sanction of DBK claim can be

ascertained from the query counter set up at the Service Center. If any query has been raised or

nc

e

deficiency notice, the same will be shown on the terminal. A printout of the query/deficiency may

be obtained by the authorised person of the Exporter from the Service Center. The Exporters are

advised to reply to such queries expeditiously and such replies shall be entered in the EDI system

.re

fe

re

at the Service Center. The claim will come in queue of the EDI system only after reply to

queries/deficiencies are entered by the Service Center.

18,9

Shipping Bills in respect of goods under claim for drawback against brand rates would also be

processed similarly, except that drawback would be sanctioned only after the original brand rate

letter is produced before the designated Customs officer in the Office of Assistant Commissioner

(Export) and is entered in the system. The Exporter should specify the S.S No. of drawback as

All the claims sanctioned on a particular day will be enumerated in a scroll and transferred to the

18.10

98.01 for provisional drawback in the AnnexureB.

Designated Bank through the system. The bank will credit the drawback amount in the respective

accounts of the Exporters on the next working day. Bank will send a fortnightly statement to the

Exporters of such credits made in their accounts.

18.11

The Steamer Agent/Shipping Line will transfer electronically the EGM to the Customs EDI system

so that the physical export of the goods is confirmed, to enable the Customs to sanction the

drawback claims. Such Shipping Bills will be cleared electronically on a first come first served

basis.

19. EXPORT OF GOODS UNDER THE DEEC SCHEME:

19.1

Only Shipping Bills relating to DEEC wherein the DEEC book was issued on or after 01.04.95 will

be processed on the EDI system. This would cover all DEEC books issued in terms of the

following notifications.

1) 079/95-Cus dt.31.03.95

2) 080/95-Cus dt.31.03.95

3) 106/95-Cus dt,02.06.95

4)107/95-Cus dt.02.06.95

5) 148/95-Cys dt,19.09.95

6) 149/95-Cus dt.19.09.95

7) 030/97-Cus dt.01.04.97

8) 031/97-Cus dt.01.04.97

9) 36/97-Cus dt. 11.4.97

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

251

19.2

All the Exporters intending to file Shipping Bills under the DEEC scheme

whether under claim for Drawback or otherwise should first get their DEEC Book registered with

the New Custom House, Mumbai. The registration will be done in the Service Center. The

original DEEC book would need to be produced at the Service Center for data entry. A print out

of the relevant particulars entered will be given to the Exporter/CHA for his confirmation. After the

confirmation by the Exporter/CHA by way of signing the printout alongwith the Identity Card

Number of the CHA, the DEEC book would need to be presented to the Appraiser (DEEC Cell) in

the Export department, who would verify the particulars entered in the computer with the original

DEEC book and register the same in the EDI system. The Registration no. of the DEEC book

would be furnished to the Exporter/CHA which would need to be mentioned on the declaration

forms Annexure A/B filed for export of goods.

It would not be necessary thereafter for the

exporter/CHA to produce the original DEEC Book for processing of the Export declarations.

19.3

Each Book will be allotted a Registration No. which should be indicated on the Shipping

bills in the relevant columns of Annexure A/B. Besides, the declarations at Appendix II (in all

filled by the Exporters and signed by them (Not by CHA).

19.4

r.i

n

cases) and III (where drawback is also claimed in addition to DEEC benefits) are also to be

Exporters who will be filing shipping bills for export of goods under the DEEC scheme would

be required to file additional declarations regarding availment / non-availment of MODVAT or

nc

e

regarding observance/non-observance of specified procedures prescribed in the Central Excise

Rules, 1944 in the form given in Appendix II. The declaration should be supported by the

necessary certificates (A.R.-4 or any other evidence of non-availment of MODVAT ) issued by

Let

.re

fe

re

the jurisdictional Central Excise Authorities.

Export would

be

allowed

only

after

verification of all these certificates at the time of examination of the goods. The fact that

the prescribed DEEC Declaration is being made should be clearly stated at the

appropriate

place in the declaration being filed in the Service Center or through RES Mode.

19.5

All the Export declarations for DEEC would be processed on screen by the Appraiser and the

Assistant Commissioner. After the declarations have been so processed and accepted, the

goods can be presented at the Docks for examination and Let Export as in the case of other

export goods. All Exporters availing of the DEEC facilities are requested

to immediately

get their DEEC Books registered in the EDI system so that the export declarations are

processed expeditiously.

19.6

Further requirements in regard to computerised processing of DEEC shipping bills are as

follows:

a)

Where benefits under both the DEEC and the Drawback schemes are sought to be

availed of, Exporters should file both the declarations as at Appendices II & III.

b)

The options set out in the Appendices II & III should be read carefully and

whatever is not applicable should be struck out.

c)

Exporters availing DEEC benefits in terms of Notifications No.148/95, 149/95 both dated

19.09.95

or

30/97

dated 01.04.97

should

subscribe

to

the declaration at S.

No. IA of the Appendix II, where the export goods have not been manufactured by

availing of the procedure under Rule 12(1) (b) or 13 (1) (b) of the Central Excise

Rules, 1944.

d)

Exporters possessing DEEC Book in terms of notification No.149/95 dated 19.09.95 and

desirous of availing of the benefit under notification no.49/94-CE(NT) dated 22.09.94

should subscribe to the declaration at Sl.No.I(B) of Appendix II.

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

252

e)

Similarly, Exporters availing of benefits in terms of Notification Nos.79/95 or 80/95 both

dated 31-3-95, 106/95 or 107/95 dated 02-06-95 or 31/97 dt.01.04.97 shall subscribe to

the declaration at S.No.I(A) or I(C) of APPENDIX II as the case may be.

f)

Exporters who wish to avail of DEEC benefits but do not propose to claim any drawback

need file only he declaration as per APPENDIX II.

19.7

It is also clarified that those Exporters who propose to fulfil export obligations themselves have to

sign declaration at S.No.2A of Appendix II. However, if the export obligations are being fulfilled

by exports through a third party, the exporter is required to strike out S.No,2B or Appendix II. In

such case, the name of the DEEC licence holder as well as that of the exporter shall be given and

both have to sign the said declaration.

19.8

As regards the declaration at Appendix III, the options are set out in S.No.4 & 5.The Exporters

are required to subscribe to the correct option and delete the other(s). The Exporters who are

exporting goods under DEEC scheme shall delete the declaration at Sl.No.5A of Appendix III and

shall subscribe to the S.No. applicable to them.

19.9

Those Exporters who possess a DEEC Book under Notification No.79/95 or 80/95 or 31/97 and

r.i

n

intend to claim the Central Excise portion of drawback shall subscribe to declarations at S.No.V of

Appendix III. Those exporters who are exporting goods under DEEC but intend to avail brand

rate of drawback shall subscribe to the declaration S.S. No.V. Such Exporters are, required to file

nc

e

their shipping bills as per APPENDIX B. The Exporters who are having DEEC Books under

notifications other than 79/95, 80/95, 30/97 and 31/97 are not entitled to All Industry Rates of

19.10

.re

fe

re

Drawback.

It is further clarified as follows:

a)

While giving details relating to DEEC operations in the forms at Annexures A-B, the

exporters/CHAs should indicate the S.No. of the goods being exported in the column

titled ITEM SL.NO IN DEEC BOOK PART E of Annexure A/B.

b)

If inputs mentioned in DEEC Import Book only have been used in the manufacture of the

goods under export, in column titled ITEM SR.NO.IN DEEC BOOK PART C OF

ANNEXURE-A/B the exporters/CHAs are required to give Sl.No. of Inputs in part-C of

the DEEC Book and Exporters need not fill up column titled DESCRIPTION OF RAW

MATERIALS

c)

If some inputs not mentioned in part-C of the DEEC book have been used in the

manufacture of the goods under export and the exporter wants to declare such inputs, he

shall give the description of such inputs in column titled DESCRIPTION OF RAW

MATERIALS.

d)

In the column IND/IMP, the Exporters are required to write N if the inputs used are

indigenous and M if the inputs used are imported.

e)

In the column titled Cess schedule Sl.No. the serial number of the schedule relating to

cess should be mentioned.

20. EXPORT GENERAL MANIFEST:

20.1

All the shipping lines/agents shall furnish the Export General Manifests, Shipping Bill wise, to the

Customs electronically within 7 days from the date of sailing of the vessel. In the beginning, the

shipping lines are required to enter the manifest in the Customs Computer System through the

Service Center on payment of the prescribed fee. (In due course, an EDI server shall be installed

for the electronic delivery of EGM through EDI service providers. Till such time, all the EGMs will

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

253

have to be entered through the service center only). After the entry of EGMs a checklist will be

generated which has to be signed by Shipping Line certifying the correctness of data. Shipping

Lines are also requested to give the details of shipping bill and Bills of Lading in the EGMs

submitted by them. The Shipping lines shall be liable for penal action, if incorrect or incomplete

EGMs are submitted. Service Center would be charging a flat fee of Rs.60/- per EGM irrespective

of the number of entries.

The Service Center would be receiving the EGMs for data entry

between 10.00 A.M to 5.00 P.M. The Service Center will return the Export General Manifest after

getting it entered in the system.

20.2

Apart from lodging the EGM electronically the shipping lines would continue to file manual EGMs

along with the Exporter copy of the shipping bills as per the present practice in the Export

department. Since the disbursement of Drawback to the exporters would be dependent on the

filing of EGMs by the Shipping Lines, all Shipping Lines are advised to file the EGMs soon after

the vessel has departed. The manual EGMs would be entered in the register at the Export

Department and the Shipping lines are advised to obtain acknowledgements indicating the date

21. CREATION OF DATABASE OF EXPORTERS / CHA :

r.i

n

and time at which the EGMs were received by the Export Department.

To implement EDI based clearances it is felt necessary to create Database of all the Exporters

nc

e

and CHAs. Therefore they are requested to give the information as prescribed at Appendix XVI &

XVII to Assitt. Commissioner (EDI), New Custom House, Mumbai, under an acknowledgement.

Non submission / inaccurate submission of information may cause delay in clearances of goods

.re

fe

re

when the system goes on line.

Let Export Order

@@@@@@@@

Please refer to the Public Notice No. 42 / 99 dated 22/03/99. In para 7.5.1 of this notice it is interalia stated that in the case of Factory Stuffed Containers, the Docks Appraiser shall give the 'let export

order'.

In partial modification of the procedure mentioned therein, it has been decided that in all cases of

Factory stuffed or Customs Warehouse stuffed containers, Customs out of charge ( let export order )

should be given by the Superintendent ( Preventive ) posted at the relevant Gate.

For export cargo stuffed in the Docks area, let export order shall continue to be given by the

concerned Appraising Officer.

{ Standing Order No. 7453 dtd. 17.05.1999 issued by Commissioner of Customs, ( E.P. ), Mumbai,

in file no. S / 6 B 2138 / 99 EXP. ]

ANNEXURE A

DECLARATION FORM FOR EXPORT OF GOODS WITHOUT CLAIM FOR DRAWBACK

To be filled in by the Service Center

Date of Presentation:

Job No.

Shipping Bill No.:

Date

Signature:

Date

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

254

___________________________________________________________________________________

To be filled in by Exporters/CHAs

1. Type of Shipping Bill:

[W] Duty Free-Commercial

[F] NFEI-No foreign exchange involved

Category of goods under NFEI Shipping Bill:Free trade sample

01.

Diplomatic

02.

Warranty replacement

03.

Currency chest

04.

Tourist purchases

05.

Re-export of goods (except under Section 74)

06.

Gift parcel

07.

Others

3. CHA Licence No.:

Name:

r.i

n

2.

4.(a) IE code No.:

(c) Export Type:

nc

e

(b) Name & Address of Exporter:

(i) : [P] Private / [G] Government

(ii) : [R] Merchant / [F] Manufacturer

.re

fe

re

5. (a) Type of export house (if applicable):

[EH] Export House

[TH] Trading House

[SH] Star Trading House

[SS] Super Star Trading House

Validity up to:

(b) Certificate No.:

6. State of Origin of Export goods:

(Gujarat / Maharastra / Rajasthan / Delhi /

Haryana / Punjab / U.P. etc.)

7. Consignee Name & Address:

8. Consignee Country:

9. Port of Destination:

10. Final Destination Country:

11. (a) Name & Address of the Bank through which export proceeds are to be realised:

(b) Account No.:

( c )Authorised Dealer Code:

Invoice Details

12. Invoice Number:

www.referencer.in

Date:

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

255

13. (a) Whether Consignee and Buyer are same:

(Yes/No)

(b) If No, Buyers Name and

address:

14. Currency of invoice:

15. Export Contract No.:

16. Nature of Payment:

[LC] Letter of Credit

[DA] Delivery against acceptance

[DP] Direct payment

[AP] Advance payment

[OT] Others

17. Period of payment as per the contract (No. of days):

r.i

n

18. (a) Nature of Contract: [1] FOB [2] CIF [3] C&F [4] C&I

(b) Whether unit price includes

[F] Freight [I] Insurance

(c)

Rate

Currency

Amount

.re

fe

re

Discount

nc

e

[B] Freight & Insurance [N] None

Commission (FAC or LAC)

Other Deductions

Packing & Misc. Charges

Insurance

Freight

(d) Name & Address of the person to whom the commission is paid/payable:

19. Item wise details.

Gener

Item ITC

Sl.

(HS)

No.

-ic &

Item

A/C

Qty

Unit

DEEC Particulars where ever applicable

Unit Price

Descri

www.referencer.in

SL No

Cess schedule

Ind./ Imported

A/C Unit

QTY

Raw Material

Part C

Description of

DEEC book

Item Sl.No. in

Part E

DEEC book

Item Sl.No.in

No.& date

DEEC Regn.

-ption

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

Agency Name

Date

(AEPC/

20. QUOTA RELATED INFORMATION

Sr. No

Invoice

Item No.

No.

Quota

Export

Certifica

Licence

te No.

No.

CTEPC/

APEDA

DECLARATION

I/We declare that the particulars given above are true and correct.

nc

e

I/We enclose the copies of the following documents: (To be submitted with the export goods in the Docks)

SDF form

ii.

DEEC Declaration

iii.

Invoice

iv.

Quota/Inspection etc. Certificates

v.

Packing List with Package wise Contents

vi.

Others (specify)

.re

fe

re

i.

Note : At the initial stage , obligatory on the part of exporter.

Name of Exporter:

Designation:

Signature:

Name of CHA:

Designation:

ID Card No.:

Signature:

Dated:

Notes:

1. All entries should be made in capital letters, typed or neatly hand written.

2. Photocopy of invoice has to be attached with the declaration form for Data entry.

3. All entries should be completed in all respects. Otherwise, it may be rejected.

www.referencer.in

r.i

n

(14)

(13)

(12)

(10)

Expiry

(11)

(9)

Quantity

(8)

(7)

(6)

(5)

(4)

(3)

(2)

(1)

256

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

257

ANNEXURE B

DECLARATION FORM FOR EXPORT OF GOODS UNDER CLAIM FOR DRAWBACK

To be filled in by the Service Center

Date of Presentation:

Job No.:

Shipping Bill No.:

Date:

Signature:

Date:

To be filled in by Exporters/C.H.A.

1. CHA Licence No.:

Name:

2. (a) IE code No.:

(b) Name & Address of the Exporter:

[i]:

[P] Private

[G] Government

[ii]: [R] Merchant

[F]Manufacturer

r.i

n

(c) Exporter Type:

.

4. (a) Type of export house (if applicable):

[TH] Trading House

[SH] Star Trading House

.re

fe

re

[EH] Export House

nc

e

3. Exporters Accounts No. in the Bank ..

[SS] Super Star Trading House

Valid upto :

(b) Certificate No.:

5. State of Origin of Export goods

(Gujarat / Maharastra / Rajasthan / Delhi /

Haryana / Punjab / UP etc.):

6. Consignee Name & Address:

7. Consignee Country:

8. Port of Destination:

9. Final Destination Country:

10. (a) Name & Address of the Bank through which export proceeds to be realised:

(b) Account No.:

(c) Authorised Dealer Code:

11. (a) SDF Declaration :

(b) RBI Waiver No. :

Date :

Invoice Details

12. Invoice Number:

www.referencer.in

Date :

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

258

13. (a) Whether Consignee and Buyer are same:

(Yes/No)

(b) If No, Buyers Name and address:

14. Currency of invoice:

15. Export Contract No.:

16. Nature of Payment:

[LC] Letter of Credit

[DA] Delivery against acceptance

[DP] Direct payment

[AP] Advance payment

17. Period of payment as per the contract (No. of days):

18. (a) Nature of Contract: [1] FOB [2] CIF [3] C&F [4] C&I

(b) Whether unit price includes:

[F] Freight

r.i

n

[ I ] Insurance

[B] Freight & Insurance

(c)

Currency

Amount

.re

fe

re

Rate

nc

e

[N] None

Discount

Commission

Other Deductions

Packing & Misc. Charges

Insurance

Freight

(d) Name & Address of the person

to whom the commission is paid:

ITC

Sl

(HS)

No.

QTY

Description

Item

Geniric & Item

19. Item wise Details :

A/C

Unit

Unit

Price

Duty Drawback Details

SS No. Apdx . Cond.

Qty

A/C

of DBK

For

Unit Rate

No

No. in

Sched. Of PN Appdx. DBK

DBK

claimed

Brand

Rate

Regd.

No.

(1)

(2)

www.referencer.in

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10) (11) (12)

(13)

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

259

Cess Sched

D E E C PARTICULARS WHEREVER APPLICABLE

Regd. Item Sl.

Item Sl. Details of Raw

No. &

No. in

No. in

Date

DEEC

DEEC

Book

Book

Part E

Part C

(15)

(16)

(14)

Quantity

A/C Unit

Ind. / Imp.

Sl. No.

(18)

(19)

(20)

(21)

Materials

(17)

20. INFORMATION OF RAW MATERIALS

Inovice No..

Item No.

Raw

MaterialSl.

Description

Qty

A/C

Rate at which DBK

Unit

Claimed

.re

fe

re

nc

e

No.

r.i

n

(To be given where Drawback is claimed on the basis of Raw Material used)

Item No.

Invoice No.

Sr. No

21. QUOTA RELATED INFORMATION

Quota

Export

Certificate

Licence

No.

No.

Quantity

Expiry

Agency

Date

Name

(AEPC/

CTEPC/

APEDA

DECLARATION

I/We declare that the particulars given above are true and correct.

I/We enclose the copies of the following documents: (To be submitted with the export goods in the Docks)

www.referencer.in

i.

SDF form

ii.

DEEC Declaration

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

260

iii.

Invoice

iv.

Quota/Inspection etc. Certificates

v.

Packing List with Package wise Contents

vi.

Others (specify)

Name of Exporter:

Designation:

Signature:

Name of CHA:

Designation:

ID Card No.:

Signature:

r.i

n

Dated:

Notes:

nc

e

1. All entries should be made in capital letters, typed or neatly hand written.

2. Photocopy of invoice has to be attached with the declaration form for Data entry.

.re

fe

re

3. All entries should be completed in all respects. Otherwise, it may be rejected.

ANNEXURE C

DATA TO BE ENTERED BY EXAMINING OFFICERS / P.O. WHEN EXPORT GOODS ARE BROUGHT

FOR EXAMINATION.

1. Shipping Bill No.:

Date:

(b) Shipping Line

2. (a) Vessel Name

(c) Steamer Agent Name

3. Freight and Insurance charges:

(i) Freight Value:

Currency:

(ii) Insurance Value:

Currency:

4. Total No. of Packages:

5. Types of packages (Boxes, Cartons, Bags etc.):

6. Numbers marked on the packages (1-25 etc.):

7. Gross weight (in Kgs):

8. Net weight (in Kgs):

9. Container particulars:

Container No.

www.referencer.in

Size

Place of Sealing

Seal No.

Date of Sealing

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

261

10. Name of the sealing agency

11. Whether factory stuffed: (Yes/No)

(i) If yes, whether sample accompanies: (Yes/No)

(ii) Factory name and address:

12. Details of AR-4 (or any other document containing examination details

by Central Excise Officer)

Sl. No.

AR4 No. or any other

Date

Commissionerate

Division

Range

Document No.

I/we declare that the particulars given above are true and correct.

r.i

n

Name of the Exporter/CHA:

I D No. of authorised signatory of CHA:

nc

e

Date:

Goods arrived. Verified the number of packages and marks and numbers there on and found to

be as declared.

.re

fe

re

Name of the Examining Officer :

Signature of the Examining Officer :

Notes:

1. For factory /CFS stuffed containers, gross weight given in Sl. No. 9 should be exclusive of the

weight of the container.

2. Extra sheets may be attached, if necessary.

ANNEXURE K

LOADING PLAN / CARGO LOADING PLAN

Date :

Shipping Agent :

Shipping line :

Godown/Bay No. :

Voyage :

www.referencer.in

etc., if any

Remarks, details variations

loaded

Quantity of the goods

Customs Rotation No.

Value as per Shipping Bill

Gross Weight

Marking

Nature of Goods

Consignee

Shipping Agent / Line Seal No.:

Exporter

Shipping Bill No. & Date

Destination :

Date of Carting of Cargo

Sr. No.

Vessel :

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

262

TOTAL:

Signature & Designation

The cargo is loaded under Preventive Supervision

With date & Seal

Representative / Surveyor

Dock Asstt.

Dock I/C

Rep. & Surveyor

Preventive

Of Shipping Agent /Line

K.P.T.

K.P.T.

of handling and

Officer

ANNEXURE L

r.i

n

Transport Contractor

CONTAINER STUFFING SHEET

.:

Godown/Bay No.:

Shipping line :

Customs Seal No.:

variations etc., if any

Remarks, details

Shipping Bill

Value as per

Gross Weight in

Quintals

Packages stuffed

No. of

Nature of Goods

Shipping Agent / Line Seal No.:

Consignee

Exporter

& Date

Shipping Bill No.

Voyage :

Of Cargo

Port of Discharge :

Date of Carting

Sr. No.

Vessel :

VIA No. :

.re

fe

re

Shipping Agent :

Marking

Container No.:

nc

e

Date :

TOTAL:

Signature & Designation

The cargo is loaded under Preventive Supervision

With date & Seal

Representative / Surveyor

Dock Asstt.

Dock I/C

Rep. & Surveyor

Preventive

Of Shipping Agent /Line

K.P.T.

K.P.T.

of handling and

Officer

Transport Contractor

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

263

APPENDIX I

FORM

SDF

(Declaration under the Foreign Exchange Regulation Act, 1973)

Shipping Bill No.:

Date:

I/We, ____________________________________ (name of the Exporter) do

hereby declare that: 1. I/We am/are the seller/consignor of the goods in respect of which this declaration is

being made and that the particulars given in the Shipping Bill No.____________

Dated__________ are true and that: a) The value as contracted with the buyer is the same as the full export value declared in

r.i

n

the above Shipping Bill or

b) The full export value of the goods is not ascertainable at the time of export and that the

value declared is that which I/We, having regard to the prevailing market conditions,

nc

e

expect to receive on the sale of goods in the overseas market.

2. That I/We undertake that I/We will deliver to the bank named ___________________

the foreign exchange representing the full export value of the goods on or before @

.re

fe

re

_________________ in the manner prescribed in Rule 9 of the Foreign Exchange

Regulation Rules, 1974.

3. That I/We am/are resident(s) in India and I/We have a place of business in India.

That I/We am/are not in the caution list of the Reserve Bank of India.

(Signature of the Exporter)

4.

Name of Exporter:

Address:

Date:

Note:

1.

State appropriate date of delivery which must be the due date for payment or

within six months from the date of shipment, whichever is earlier, but for exports to

warehouses established outside India with permission of the Reserve Bank of India, the

date of delivery must be within fifteen months.

2. Strike out whichever is not applicable.

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

264

APPENDIX IA

Form of Certificate required to be obtained from the Bank through which the foreign exchange is

proposed to be realised.

From,

(Name and address of the Bank)

To,

The Commissioner of Customs (Export Promotion)

..Custom House,

Dear Sirs,

This is to certify that

(a) M/s.__________________________________________________ (Name of the exporter)

having Importer Exporter Code No.__________________________ (IEC No. issued by the DGFT) is

r.i

n

having an account (A/c No._______________ Nature of A/c_________________) in this branch of the

bank and

nc

e

(b) the branch Code of this branch is ____________________

Authorised Signatory

.re

fe

re

(Name and Designation)

Date :

Bank Stamp :

APPENDIX II

DEEC DECLARATION

Date:

Shipping Bill No.

(To be filed for export of goods under DEEC Scheme)

I/We, ________________________________ (Name of the Exporter) do hereby declare that: (1) The export goods have not been manufactured by availing of the procedure under Rule

12(1)(b)/13(1)(b) of the Central Excise Rules, 1944.

OR

The export goods have not been manufactured by availing the procedure under Rule

12(1)(b)/13(1)(b) of the Central Excise Rules, 1994, in respect of material permitted to be

imported duty free under an advance licence, except availing benefit under Notification No. 49/94CE (NT) dated 22.9.94.

OR

The export goods have been manufactured by availing the procedure under Rule

12(1)(b)/13(1)(b) of the Central Excise Rules, 1944; and,

(2) The exports under this Shipping Bill are being made directly by the Advance Licence holder.

OR

The exports against this Shipping Bill are being made by third party(s) and a contractual

agreement in this regard exists between the Advance Licence holder and third party, both have signed all

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

265

the export documents. In the event of a fraud, both will be severally and jointly responsible for the fraud

and liable for penal action.

(Signature of the Exporter)

Name of Exporter:

Address:

Date:

Note: Please strike out whichever is inapplicable.

APPENDIX - III

DRAWBACK/DEEC DECLARATION

r.i

n

(To be filed for export goods under claim for Drawback)

Shipping Bill No.

Date:

i.

nc

e

I/We, ____________________________ (Name of the Exporter) do hereby declare that: The quality and specification of the goods as stated in this Shipping Bill are in

accordance with the terms of the export contract entered into with the buyer/consignee in

ii.

.re

fe

re

pursuance of which the goods are being exported.

I/We are not claiming benefit under the Engineering Products Export (Replenishment of

Iron and steel Intermediates) Scheme, notified by the Ministry of Commerce in

Notification No. 539 RE/92-97 dated 1.3.95.

iii.

There is no change in the manufacturing formula and in the quantum per unit of the

imported material or components, if any utilised in the manufacture of export goods and

the material or components declared in the application under Rule 6 or 7 of the Drawback

Rules, 1995 to have been imported, continue to be so imported and are not obtained

iv.

from indigenous sources.

The export have not been manufactured by availing the procedure under Rule

12(1)(b)/13(1)(b) of the Central Excise Rules, 1944.

OR

The export goods have been manufactured by availing the procedure under Rule

12(1)(b)/13(1)(b) of the Central Excise rules, 1944, but we have claimed/shall be claiming

drawback on the basis of special brand rate in terms of Rule 6 of the Drawback Rules,

1995.

v.

The goods have not been manufactured and/or exported in discharge of export obligation

against an Advance License issued under the Duty Exemption Entitlement Scheme

(DEEC) declared under the Import and Export Policy.

OR

Goods have been manufactured and are being exported in discharge of export obligation

under the Duty Exemption Entitlement Scheme (DEEC), in terms of Notification No. 79/95

www.referencer.in

CUSTOMS PREVENTIVE MANUAL (CENTRAL)

VOLUME I (GENERAL)

266

or 80/95, both dated 31.3.95 or 31/97 dated 1.4.97. However, Drawback has been

claimed only in respect of the Central Excise duties leviable on inputs specified in the

Drawback Schedule.

OR