Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

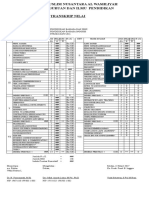

Berita 1 Desember 2016 (Asli)

Caricato da

PuputCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Berita 1 Desember 2016 (Asli)

Caricato da

PuputCopyright:

Formati disponibili

UK consumer morale edges up, but households worry about

finances - survey

LONDON, Nov. 29 (Reuters)

British consumer morale edged up this month, bolstered by a strong labour market, despite

rising concern about household finances, a survey showed on Tuesday.

Pollster YouGov and consultancy Cebr said their barometer of consumer confidence edged

up to 109.4 in November from 109.1 in October, reflecting an increase in measures of job

security and workplace activity.

However, the survey's gauges of household finances edged lower for a second month in a

row, chiming with a report from data company Markit that suggested Britons are becoming

increasingly worried about inflation.

Britain's economy has performed much better than most economists had expected in the

immediate aftermath of June's vote to leave the European Union. But a much bigger test awaits

next year.

Rising inflation caused by the pound's post-referendum plunge looks set to squeeze

household spending and economists said they still expected business investment to slow.

"We shouldn't ignore the clouds on the horizon: both backward and forward-looking

household finance measures dropped for the second successive month," said Stephen Harmston,

head of YouGov reports.

"While the declines are relatively small at the moment, they are ongoing and will be

monitored closely over the coming months."

The World Is Feeling the Might of Chinas Commodity

Traders

SHANGHAI, Nov. 29 (Bloomberg)

The Chinese speculators shaking up global commodity markets are switched-on, flush with

cash and probably not getting enough sleep.

For the second time this year, trading has exploded on the nations exchanges, pushing prices

of everything from zinc to coal to multi-year highs and sending authorities scrambling to deflate

the bubble before it bursts. Metals brokers described panic earlier this month as the frenzy spread

to markets in London and New York, prompting wild swings in prices that show no signs of

abating.

While billions of yuan have poured in from herd-like Chinese retail investors who show little

regard for market fundamentals, brokers and traders say even more is coming from an expanding

army of deep-pocketed hedge funds. Theyre chasing better returns in commodities as stocks and

real estate fade, often using algorithms and trading late into the night, when markets in London

and New York are most active.

There is no doubt that the price moves and the bigger volumes worldwide are being driven

by the Chinese, and by professional speculators and financial players, said Tiger Shi, managing

partner at brokerage BANDS Financial Ltd., which counts several of those funds as clients. The

western hedge funds and institutional investors dont really know whats going on. Often they

were used to trading macro factors or Fed policy, but now they find they have fewer advantages.

Shi, previously head of metals in Asia at Jefferies Group LLC and Newedge Financial Inc.,

estimates that China may have more than 5,000 hedge funds active in commodities. At least 10

manage assets of more than 10 billion yuan ($1.4 billion).

The use of algorithmic trading, in which computers execute multiple orders in milliseconds,

is turbo-charging volume and volatility, according to Fu Peng, a portfolio manager at Lianzhan

Global Macro Fund Management Co. About a third of activity on Chinese exchanges is executed

by automated commands, which generates more volume and greater momentum on global

markets, Shi estimates.

A recent example was on Nov. 11. Copper in Shanghai jumped by the most since trading

began in 2004 amid a surge in volume. On the London Metal Exchange, it gained as much as 7.6

percent, before sinking 1.7 percent in the Asian evening. The gap between the days high and low

was more than $500, the widest in five years, and the intensity of the swing was just as big in

New York futures.

Potrebbero piacerti anche

- Global Investor: Highlights of The International Arena: Executive SummaryDocumento7 pagineGlobal Investor: Highlights of The International Arena: Executive SummarySulakshana De AlwisNessuna valutazione finora

- News SummaryDocumento17 pagineNews Summaryapi-290371470Nessuna valutazione finora

- Readings 1Documento10 pagineReadings 1s rineNessuna valutazione finora

- According To Reuters China Recent Survey Another Survey Borrowed Money On FaithDocumento3 pagineAccording To Reuters China Recent Survey Another Survey Borrowed Money On FaithPratikAgarwalNessuna valutazione finora

- Markets Recover On Irish Bailout Talks: Stock Market Analysis: Weekly Market WrapDocumento18 pagineMarkets Recover On Irish Bailout Talks: Stock Market Analysis: Weekly Market WrapnishantpuriNessuna valutazione finora

- July 252010 PostsDocumento141 pagineJuly 252010 PostsAlbert L. PeiaNessuna valutazione finora

- The Monarch Report 4/29/2013Documento3 pagineThe Monarch Report 4/29/2013monarchadvisorygroupNessuna valutazione finora

- Vol 2 No. 29 October 3, 2011Documento1 paginaVol 2 No. 29 October 3, 2011twinkjNessuna valutazione finora

- Commercial Awareness NotesDocumento5 pagineCommercial Awareness Notespancakes101bimboNessuna valutazione finora

- China stock trading halted after 7% plunge amid growth concernsDocumento4 pagineChina stock trading halted after 7% plunge amid growth concernsAndres1984Nessuna valutazione finora

- Berita 3 November 2016 (Asli)Documento2 pagineBerita 3 November 2016 (Asli)PuputNessuna valutazione finora

- Aug-01-Dj Forex Week AheadDocumento2 pagineAug-01-Dj Forex Week AheadMiir ViirNessuna valutazione finora

- 5oceans Is China Blowing BubblesDocumento10 pagine5oceans Is China Blowing BubblesrguyNessuna valutazione finora

- 8-15-11 Steady As She GoesDocumento3 pagine8-15-11 Steady As She GoesThe Gold SpeculatorNessuna valutazione finora

- Special Report On Gold and SilverDocumento12 pagineSpecial Report On Gold and SilverDeepakNessuna valutazione finora

- LINC Week 9Documento9 pagineLINC Week 9TomasNessuna valutazione finora

- After The Selloff, Investors Eye Cyclicals Switch: Jenny Cosgrave @jenny - CosgraveDocumento2 pagineAfter The Selloff, Investors Eye Cyclicals Switch: Jenny Cosgrave @jenny - CosgraveTheng RogerNessuna valutazione finora

- Factiva 20180604 1444Documento131 pagineFactiva 20180604 1444Lucas GodeiroNessuna valutazione finora

- Market Slide Continues On Emerging Economy WoesDocumento3 pagineMarket Slide Continues On Emerging Economy WoesyhunnieleeNessuna valutazione finora

- Influencing On Worldwide Financial Markets, Recommendation and ConclusionDocumento7 pagineInfluencing On Worldwide Financial Markets, Recommendation and Conclusionrahul_dipaniNessuna valutazione finora

- China's Property Market - End of The Golden Era - The EconomistDocumento2 pagineChina's Property Market - End of The Golden Era - The EconomistMarsh WritesNessuna valutazione finora

- China Lets Currency Weaken, Risking New Trade Tensions Hong KongDocumento2 pagineChina Lets Currency Weaken, Risking New Trade Tensions Hong KongRahmatullah MardanviNessuna valutazione finora

- China Quietly Relaxes Controls On Foreign CapitalDocumento4 pagineChina Quietly Relaxes Controls On Foreign CapitalNancy Alejandra Alvear MarambioNessuna valutazione finora

- CNH Tracker Aug 12 2011Documento2 pagineCNH Tracker Aug 12 2011Kevin PlumbergNessuna valutazione finora

- Foreign Exchange: Currency Trading Soars Amid StressDocumento5 pagineForeign Exchange: Currency Trading Soars Amid StressSoubhik ChatterjeeNessuna valutazione finora

- Chinese Market Crash 2015: Behind the Dramatic Rise and FallDocumento3 pagineChinese Market Crash 2015: Behind the Dramatic Rise and FallRonak KamdarNessuna valutazione finora

- 3 NOV, 2010, World Bank Warns China at Risk From Global Trade ImbalancesDocumento15 pagine3 NOV, 2010, World Bank Warns China at Risk From Global Trade ImbalancesKomalpreet KaurNessuna valutazione finora

- Frontier News Summary 20th JuneDocumento4 pagineFrontier News Summary 20th JuneAmal SanderatneNessuna valutazione finora

- Ici Research: PerspectiveDocumento32 pagineIci Research: PerspectiveDavid LimNessuna valutazione finora

- Mining Stocks: Basic Resources Sector Rio Tinto BHP BillitonDocumento2 pagineMining Stocks: Basic Resources Sector Rio Tinto BHP BillitonTheng RogerNessuna valutazione finora

- EM currencies tumble as Argentina's peso slumpsDocumento2 pagineEM currencies tumble as Argentina's peso slumpsluckyboy77Nessuna valutazione finora

- Commodities-Mostly Up On European Optimism, US DataDocumento5 pagineCommodities-Mostly Up On European Optimism, US DataUmesh ShanmugamNessuna valutazione finora

- DN 10page (18-18)Documento1 paginaDN 10page (18-18)Robert OkandaNessuna valutazione finora

- Pound Plunges 6% in 2 Minutes: Financial Times (7 of October 2016 Online)Documento4 paginePound Plunges 6% in 2 Minutes: Financial Times (7 of October 2016 Online)luckyboy77Nessuna valutazione finora

- Learn From Yesterday - Live For Today - Hope For Tomorrow: Today's Market HeadlineDocumento6 pagineLearn From Yesterday - Live For Today - Hope For Tomorrow: Today's Market Headlineapi-148748282Nessuna valutazione finora

- Elliot Wave Theorist June 10Documento10 pagineElliot Wave Theorist June 10Mk S Kumar0% (1)

- Where to Go if You 'Sell in May and Go AwayDocumento4 pagineWhere to Go if You 'Sell in May and Go AwayTheng RogerNessuna valutazione finora

- Beijing Permits Renminbi To Hit Record Despite Export FallDocumento2 pagineBeijing Permits Renminbi To Hit Record Despite Export FallWei ZhangNessuna valutazione finora

- Interview Brief StuffDocumento5 pagineInterview Brief StuffdarylchanNessuna valutazione finora

- Asian Markets Roiled by Recession FearsDocumento1 paginaAsian Markets Roiled by Recession FearsAsia EnriquezNessuna valutazione finora

- Slide in Rupee Has Everyone Worried With Few Solutions in SightDocumento1 paginaSlide in Rupee Has Everyone Worried With Few Solutions in SightvinayvpalekarNessuna valutazione finora

- Turkish Lira Plunges After Erdogan Fires Central-Bank ChiefDocumento2 pagineTurkish Lira Plunges After Erdogan Fires Central-Bank Chiefakash bathamNessuna valutazione finora

- Special liquidity issues arise in stressed capital marketsDocumento5 pagineSpecial liquidity issues arise in stressed capital marketsDL SantosNessuna valutazione finora

- Outlook 2011: Three Dominant Factors Will Impact Gold, Silver and Platinum in 2011Documento16 pagineOutlook 2011: Three Dominant Factors Will Impact Gold, Silver and Platinum in 2011Khalid S. AlyahmadiNessuna valutazione finora

- Pound remains under pressure as negative sentiment persists despite heavy short positioningDocumento2 paginePound remains under pressure as negative sentiment persists despite heavy short positioningluckyboy77Nessuna valutazione finora

- Fear Index Explodes As World Careens Toward Global Market MeltdownDocumento12 pagineFear Index Explodes As World Careens Toward Global Market Meltdownwaqar2010Nessuna valutazione finora

- Chasing The DragonDocumento2 pagineChasing The Dragonkeithxiaoxiao096Nessuna valutazione finora

- A Crisis of Beliefs: Investor Psychology and Financial FragilityDa EverandA Crisis of Beliefs: Investor Psychology and Financial FragilityValutazione: 3 su 5 stelle3/5 (1)

- SSRN Id1121734Documento39 pagineSSRN Id1121734Muhammad UllahNessuna valutazione finora

- Trumps Siege of China Hits Hong KongDocumento4 pagineTrumps Siege of China Hits Hong KongJustinTangNessuna valutazione finora

- METALS-Aluminium Hits 13-Year Peak On China and Guinea Supply Fears - Reuters NewsDocumento3 pagineMETALS-Aluminium Hits 13-Year Peak On China and Guinea Supply Fears - Reuters NewsLucas JangNessuna valutazione finora

- FT Special Report Currncy Mar'11Documento5 pagineFT Special Report Currncy Mar'11jian101Nessuna valutazione finora

- 1-23-12 More QE On The WayDocumento3 pagine1-23-12 More QE On The WayThe Gold SpeculatorNessuna valutazione finora

- LINC Newsletter Week 44Documento7 pagineLINC Newsletter Week 44David SundströmNessuna valutazione finora

- Global Demand For US AssetDocumento2 pagineGlobal Demand For US AssetSyed Mohd FaizalNessuna valutazione finora

- These Are The Five Biggest Threats To UK Financial Stability Right NowDocumento8 pagineThese Are The Five Biggest Threats To UK Financial Stability Right NowakellaskNessuna valutazione finora

- U.S. Probes Currency CartelDocumento6 pagineU.S. Probes Currency CartelSubha RengarajanNessuna valutazione finora

- Weekly OverviewDocumento3 pagineWeekly Overviewapi-150779697Nessuna valutazione finora

- SNL Metals & Mining - State of The Market Mining and Finance ReportDocumento46 pagineSNL Metals & Mining - State of The Market Mining and Finance ReportInvestor Relations Vancouver100% (1)

- Practice Oral & Listening Comprehention 2Documento10 paginePractice Oral & Listening Comprehention 2PuputNessuna valutazione finora

- Grammar and Punctuation RulesDocumento2 pagineGrammar and Punctuation RulesPuputNessuna valutazione finora

- Over 100 Questions English 3 in 1 (Primary 1)Documento8 pagineOver 100 Questions English 3 in 1 (Primary 1)PuputNessuna valutazione finora

- Kunci Gitar Chord Lirik Ed Sheeran - PerfectDocumento2 pagineKunci Gitar Chord Lirik Ed Sheeran - PerfectPuputNessuna valutazione finora

- Little MixDocumento15 pagineLittle MixPuputNessuna valutazione finora

- Translate of News PaperDocumento2 pagineTranslate of News PaperPuputNessuna valutazione finora

- MODULE 1INTRODUCING LITERATURE Kak HalimahDocumento76 pagineMODULE 1INTRODUCING LITERATURE Kak HalimahPuputNessuna valutazione finora

- Mexico To File WTO Complaint Over US Tariffs: MinistryDocumento1 paginaMexico To File WTO Complaint Over US Tariffs: MinistryPuputNessuna valutazione finora

- Full CaseDocumento6 pagineFull CasePuputNessuna valutazione finora

- EPB Comprehension Revision 1Documento7 pagineEPB Comprehension Revision 1PuputNessuna valutazione finora

- B. InggrisDocumento3 pagineB. InggrisPuputNessuna valutazione finora

- FisikDocumento1 paginaFisikPuputNessuna valutazione finora

- Formal Informal EnglishDocumento8 pagineFormal Informal EnglishTeofilo AlvarezNessuna valutazione finora

- Bahan Berita 6 OktoberDocumento2 pagineBahan Berita 6 OktoberPuputNessuna valutazione finora

- QuizzesDocumento8 pagineQuizzesgojianNessuna valutazione finora

- Lang MediaDocumento12 pagineLang MediaLoredana ȚicleteNessuna valutazione finora

- Translate of News PaperDocumento2 pagineTranslate of News PaperPuputNessuna valutazione finora

- BBC - Learning English - Vocabulary NotebookDocumento12 pagineBBC - Learning English - Vocabulary NotebookLauraRosanoNessuna valutazione finora

- Bahan Berita 12 OktoberDocumento2 pagineBahan Berita 12 OktoberPuputNessuna valutazione finora

- Euro Zone Sentiment Rises in October, Inflation Expectations DropDocumento2 pagineEuro Zone Sentiment Rises in October, Inflation Expectations DropPuputNessuna valutazione finora

- Bahan Berita 12 OktoberDocumento2 pagineBahan Berita 12 OktoberPuputNessuna valutazione finora

- Fed awaited evidence global slowdown not derailing US economyDocumento2 pagineFed awaited evidence global slowdown not derailing US economyPuputNessuna valutazione finora

- Full CaseDocumento6 pagineFull CasePuputNessuna valutazione finora

- Bahan Berita 15 OktoberDocumento2 pagineBahan Berita 15 OktoberPuputNessuna valutazione finora

- ECB Stimulus Pressure Rises as Euro Area Inflation Turns NegativeDocumento2 pagineECB Stimulus Pressure Rises as Euro Area Inflation Turns NegativePuputNessuna valutazione finora

- Bahan Berita 5 OktoberDocumento2 pagineBahan Berita 5 OktoberPuputNessuna valutazione finora

- Stocks Rally With Crude Before Payrolls As China Nerves SubsideDocumento2 pagineStocks Rally With Crude Before Payrolls As China Nerves SubsidePuputNessuna valutazione finora

- d-494 - Wed - 20 DEC 2017Documento8 pagined-494 - Wed - 20 DEC 2017PuputNessuna valutazione finora

- Improving Vocabulary Using Word Games TechniqueDocumento9 pagineImproving Vocabulary Using Word Games TechniquePuputNessuna valutazione finora

- HL 3 November 2017 (Asli)Documento2 pagineHL 3 November 2017 (Asli)PuputNessuna valutazione finora

- Feasibility StudyDocumento5 pagineFeasibility StudyInza NsaNessuna valutazione finora

- Final Assignment No 3 Acctg 121Documento4 pagineFinal Assignment No 3 Acctg 121Pler WiezNessuna valutazione finora

- 215 Units Rs. 6,529.38: Mrs Zubaida Hajyani - N/ADocumento2 pagine215 Units Rs. 6,529.38: Mrs Zubaida Hajyani - N/ASensationNessuna valutazione finora

- Sun Pharma Ind Annuals Report (Final) 707Documento151 pagineSun Pharma Ind Annuals Report (Final) 707ÄbhíñävJäíñNessuna valutazione finora

- AbbotDocumento2 pagineAbbotRex RegioNessuna valutazione finora

- Marketing Trends 2024Documento1 paginaMarketing Trends 2024nblfuxinrqjjbtnjcs100% (1)

- Topic 3 International Convergence of Financial Reporting 2022Documento17 pagineTopic 3 International Convergence of Financial Reporting 2022Nguyễn Minh ĐứcNessuna valutazione finora

- Assignment 1 (2) Sale Force ManagementDocumento9 pagineAssignment 1 (2) Sale Force ManagementHira NadeemNessuna valutazione finora

- IRC Section 707 Transactions Between Partnerships and Their MembersDocumento113 pagineIRC Section 707 Transactions Between Partnerships and Their MembersDavid BriggsNessuna valutazione finora

- DẠNG BÀI TẬP TỪ VỰNG SỐ 02Documento5 pagineDẠNG BÀI TẬP TỪ VỰNG SỐ 02Nguyễn HươngNessuna valutazione finora

- 13 Month Pay - Central Azucarera Vs Central Azucarera UnionDocumento2 pagine13 Month Pay - Central Azucarera Vs Central Azucarera UnionJolet Paulo Dela CruzNessuna valutazione finora

- Electricity Bill Sep2021Documento1 paginaElectricity Bill Sep2021Jai BajajNessuna valutazione finora

- CC Stat222Documento2 pagineCC Stat222darshil thakkerNessuna valutazione finora

- Working Capital Analysis of Reliance IndustriesDocumento33 pagineWorking Capital Analysis of Reliance IndustriesDeepak kumar KamatNessuna valutazione finora

- Value Creation OikuusDocumento68 pagineValue Creation OikuusJefferson CuNessuna valutazione finora

- Funds Application Form GuidanceDocumento6 pagineFunds Application Form GuidanceEmpereur GeorgesNessuna valutazione finora

- Micro Economics I NoteDocumento161 pagineMicro Economics I NoteBinyam Regasa100% (1)

- 2018 TranscriptsDocumento316 pagine2018 TranscriptsOnePunchManNessuna valutazione finora

- Incatema Agribusiness CapabilitiesDocumento14 pagineIncatema Agribusiness CapabilitiesJaimeNessuna valutazione finora

- PLI Premium Calculator NewDocumento63 paginePLI Premium Calculator NewvivekNessuna valutazione finora

- Charity Marathon ProjectDocumento13 pagineCharity Marathon ProjectMei Yin HoNessuna valutazione finora

- Consumer Protection Act summarized in 35 charactersDocumento34 pagineConsumer Protection Act summarized in 35 charactersyogesh shakyaNessuna valutazione finora

- Bài tập writtingDocumento7 pagineBài tập writtingDuc Anh TruongNessuna valutazione finora

- Final MarketingDocumento47 pagineFinal MarketingRalp ManglicmotNessuna valutazione finora

- Business Studies - Objective Part - Section 1Documento64 pagineBusiness Studies - Objective Part - Section 1Edu TainmentNessuna valutazione finora

- Intermediate Financial Management 11th Edition Brigham Solutions ManualDocumento26 pagineIntermediate Financial Management 11th Edition Brigham Solutions ManualSabrinaFloresmxzie100% (46)

- Presentation On Capital BudgetingDocumento15 paginePresentation On Capital BudgetingNahidul Islam IUNessuna valutazione finora

- Group Discussion Topics Covering Education, History, GlobalizationDocumento8 pagineGroup Discussion Topics Covering Education, History, Globalizationshrek_bitsNessuna valutazione finora

- Business PlanDocumento31 pagineBusiness PlanJobNessuna valutazione finora

- Marine Assignment 2 - Article ReviewDocumento4 pagineMarine Assignment 2 - Article ReviewTerrie JohnnyNessuna valutazione finora