Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Partnership Questions

Caricato da

Con Pu0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

545 visualizzazioni3 paginepartnerships bar questions

Copyright

© © All Rights Reserved

Formati disponibili

DOC, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentopartnerships bar questions

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

545 visualizzazioni3 paginePartnership Questions

Caricato da

Con Pupartnerships bar questions

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOC, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 3

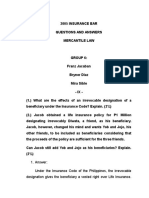

Question # 29: (2014 BAR Exam-Civil Law)

Timothy executed a Memorandum of Agreement (MOA) with

Kristopher setting up a business venture covering three (3) fastfood

stores known as "Hungry Toppings" that will be established at Mall

Uno, Mall Dos, and Mall Tres.

The pertinent provisions of the MOA provides:

1. Timothy shall be considered a partner with thirty percent

(30%) share in all of the stores to be set up by Kristopher;

2. The proceeds of the business, after deducting expenses,

shall be used to pay the principal amount of P500,000.00

and the interest therein which is to be computed based on

the bank rate, representing the bank loan secured by

Timothy;

3. The net profits, if any, after deducting the expenses and

payments of the principal and interest shall be divided as

follows: seventy percent (70%) for Kristopher and thirty

percent (30%) for Timothy;

4. Kristopher shall have a free hand in running the business

without any interference from Timothy, his agents,

representatives, or assigns , and should such interference

happen, Kristopher has the right to buy back the share of

Timothy less the amounts already paid on the principal and

to dissolve the MOA; and

5. Kristopher shall submit his monthly sales report in

connection with the business to Timothy.

What is the contractual relationship between Timothy

and Kristopher?

SUGGESTED ANSWER:

The contractual relation between Timothy and Kristopher is a

contract of partnership specifically limited partnership.

Under Article 1767 of the Civil Code, by the contract of

partnership two or more persons bind themselves to contribute

money, property, or industry to a common fund, with the intention of

dividing the profits among themselves. Furthermore, Article 1843

defines a limited partnership is one formed by two or more persons

under the provisions of the following article, having as members one

or more general partners and one or more limited partners. The

limited partners as such shall not be bound by the obligations of the

partnership. In relation to Article 1843, Article 1848 states that a

limited partner shall not become liable as a general partner unless, in

addition to the exercise of his rights and powers as a limited partner,

he takes part in the control of the business. Article 1851 (2) also

provides that a limited partner shall have the same rights as a general

partner to have on demand true and full information of all things

affecting the partnership, and a formal account of partnership affairs

whenever circumstances render it just and reasonable.

In the case given, Timothy obtained loan as principal amount of

500,000.00 and they have agreed to divide the profits, 70% for

Kristopher and 30% for Timothy which constitutes partnership.

Moreover, the partnership is a limited partnership as stated in Article

184 because Timothy does not take part in the control of the business

and Kristopher shall have the free hand in running the business

without the interference of Timothy (Article 1848, Civil Code).

Nevertheless, Timothy is entitled to monthly sales reports in

connection with the business, a right enshrines in Article 1851 cited

above.

Hence, the contractual relation between Timothy and Kristopher

is a contract of partnership specifically limited partnership.

PARTNERSHIP

GROUP 3:

Karen Faith A. Caliso

Romero B. Batulan, Jr.

Jorim C. Gerodias

Aguinaldo D. Mendez

Potrebbero piacerti anche

- 6th Central Pay Commission Salary CalculatorDocumento15 pagine6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 2007-2013 REMEDIAL Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Documento198 pagine2007-2013 REMEDIAL Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Jay-Arh93% (123)

- Corpo ReviewerDocumento62 pagineCorpo ReviewerLorelie Sakiwat VargasNessuna valutazione finora

- Partnership Agency and TrustDocumento23 paginePartnership Agency and Trustnbragas100% (2)

- Corporation Law ReviewerDocumento41 pagineCorporation Law ReviewerRik GarciaNessuna valutazione finora

- Transpo DigestDocumento4 pagineTranspo DigestAndrew GallardoNessuna valutazione finora

- How To Answer Bar Questions or Any Other Legal QuestionsDocumento7 pagineHow To Answer Bar Questions or Any Other Legal QuestionsKitem Kadatuan Jr.Nessuna valutazione finora

- Land PDFDocumento127 pagineLand PDFacheron_pNessuna valutazione finora

- Land PDFDocumento127 pagineLand PDFacheron_pNessuna valutazione finora

- Land PDFDocumento127 pagineLand PDFacheron_pNessuna valutazione finora

- G.R. No. 169757 CESAR C. LIRIO, Doing Business Under The Name and Style of CELKOR AD SONICMIX, Petitioner, Vs - WILMER D. GENOVIA, RespondentDocumento3 pagineG.R. No. 169757 CESAR C. LIRIO, Doing Business Under The Name and Style of CELKOR AD SONICMIX, Petitioner, Vs - WILMER D. GENOVIA, RespondentCarie LawyerrNessuna valutazione finora

- Hizon Notes - Land Titles & DeedsDocumento62 pagineHizon Notes - Land Titles & Deedsjusang16100% (4)

- Partnership Bar Qs 1975-2016Documento7 paginePartnership Bar Qs 1975-2016Mary Therese Gabrielle EstiokoNessuna valutazione finora

- Investment Slide 1Documento17 pagineInvestment Slide 1ashoggg0% (1)

- Grandfather Rule: When The 60-40 Filipino - Foreign Equity Is in DoubtDocumento5 pagineGrandfather Rule: When The 60-40 Filipino - Foreign Equity Is in DoubtJeth Vigilla NangcaNessuna valutazione finora

- Notes in Business Organization Ii Remedial RightsDocumento4 pagineNotes in Business Organization Ii Remedial RightsshelNessuna valutazione finora

- Partnership and Trust BarDocumento12 paginePartnership and Trust BarColee StiflerNessuna valutazione finora

- Syndicate 6 - Gainesboro Machine Tools CorporationDocumento12 pagineSyndicate 6 - Gainesboro Machine Tools CorporationSimon ErickNessuna valutazione finora

- Suggested Answer:: Information Amendment Supervening Events (1997)Documento3 pagineSuggested Answer:: Information Amendment Supervening Events (1997)Samuel WalshNessuna valutazione finora

- 07 IFRS 16 LeasesDocumento45 pagine07 IFRS 16 LeasesAung Zaw Htwe50% (2)

- Assignment No. 10 Civil LawDocumento39 pagineAssignment No. 10 Civil LawLaarni Gee83% (6)

- Bar Qna - Partnership & AgencyDocumento15 pagineBar Qna - Partnership & AgencyRound Round100% (2)

- Answer: Under The Insurance Code of The Philippines, The Irrevocable Designation Gives The Beneficiary A Vested Right Over Life InsuranceDocumento7 pagineAnswer: Under The Insurance Code of The Philippines, The Irrevocable Designation Gives The Beneficiary A Vested Right Over Life InsuranceCon PuNessuna valutazione finora

- Commercial Law FaqsDocumento30 pagineCommercial Law FaqsDiane UyNessuna valutazione finora

- Civil Law Review II Quizzes CompilationDocumento56 pagineCivil Law Review II Quizzes CompilationMadona Grate100% (1)

- Corpo Jah MidtermsDocumento34 pagineCorpo Jah MidtermsJah JoseNessuna valutazione finora

- Mercantile Law Mock Bar AnswersDocumento7 pagineMercantile Law Mock Bar AnswersNeil Antipala100% (2)

- Arrogante vs. DeliarteDocumento13 pagineArrogante vs. DeliarteDexter CircaNessuna valutazione finora

- Digested Nego CasesDocumento9 pagineDigested Nego CasesBonna De RuedaNessuna valutazione finora

- Bar Exam Q&A ObligationsDocumento18 pagineBar Exam Q&A ObligationsRoxanne PeñaNessuna valutazione finora

- San Beda College of Law: Insurance CodeDocumento24 pagineSan Beda College of Law: Insurance CodeCon PuNessuna valutazione finora

- Case 28: Estates and Trusts (Employees Trusts)Documento1 paginaCase 28: Estates and Trusts (Employees Trusts)NikkiNessuna valutazione finora

- PARTNERSHIP Bar Q&AsDocumento2 paginePARTNERSHIP Bar Q&Asaldenamell100% (1)

- L6M5 Tutor Notes 1.0 AUG19Documento22 pagineL6M5 Tutor Notes 1.0 AUG19Timothy Manyungwa IsraelNessuna valutazione finora

- Criminal Law 1 Reviewer (St. Paul College of Criminal Justice)Documento88 pagineCriminal Law 1 Reviewer (St. Paul College of Criminal Justice)Con PuNessuna valutazione finora

- Marcelo Labor 1 Reviewer PDFDocumento37 pagineMarcelo Labor 1 Reviewer PDF8LYN LAW100% (1)

- Labor Relations Digest Atty CDocumento2 pagineLabor Relations Digest Atty Ccedric vanguardNessuna valutazione finora

- What Is A Contract of Partnership?: Midterm ExamDocumento4 pagineWhat Is A Contract of Partnership?: Midterm ExamAllen KateNessuna valutazione finora

- Enriquez v. AbadiaDocumento3 pagineEnriquez v. AbadiaCon PuNessuna valutazione finora

- BAR QsDocumento2 pagineBAR QseverydaylaraeNessuna valutazione finora

- Bar Qs DEPOSITDocumento2 pagineBar Qs DEPOSITHemsley Battikin Gup-ayNessuna valutazione finora

- Civ Mock Bar (LE)Documento12 pagineCiv Mock Bar (LE)cybele longcobNessuna valutazione finora

- x02 Midterm - BarQDocumento4 paginex02 Midterm - BarQezmailer75Nessuna valutazione finora

- Appraisal RightDocumento4 pagineAppraisal RightMike E Dm100% (1)

- 1987 Remedial Law Bar QuestionsDocumento6 pagine1987 Remedial Law Bar QuestionsJc GalamgamNessuna valutazione finora

- Answers To Quiz No 14Documento6 pagineAnswers To Quiz No 14Your Public ProfileNessuna valutazione finora

- Corpo Law Midterms Coverage BarQsDocumento12 pagineCorpo Law Midterms Coverage BarQsFaye Jennifer Pascua PerezNessuna valutazione finora

- Civil Law: Sales and LeaseDocumento31 pagineCivil Law: Sales and LeaseJezen Esther Pati100% (1)

- Credit Notes GuarantyDocumento3 pagineCredit Notes GuarantyRyan Suaverdez100% (1)

- Q & A LaborDocumento5 pagineQ & A Labormamp05100% (1)

- Partnership QuestionsDocumento2 paginePartnership QuestionsVillar John Ezra100% (1)

- Privacy of Communications and Correspondence Case DigestDocumento50 paginePrivacy of Communications and Correspondence Case DigestJennilyn Tugelida75% (4)

- Cases - Shares and ShareholdersDocumento5 pagineCases - Shares and ShareholdersAling KinaiNessuna valutazione finora

- Lifeblood TheoryDocumento2 pagineLifeblood TheoryCon Pu0% (1)

- ActionsDocumento3 pagineActionsmennaldzNessuna valutazione finora

- Corporation ExamDocumento5 pagineCorporation ExamVincent John DalaotaNessuna valutazione finora

- Module 10 (Sales, Part 7)Documento25 pagineModule 10 (Sales, Part 7)Nah HamzaNessuna valutazione finora

- Pasig Revenue Code PDFDocumento295 paginePasig Revenue Code PDFJela Oasin33% (9)

- Tax Invoice: ALWAR GAS SERVICE (000010176)Documento1 paginaTax Invoice: ALWAR GAS SERVICE (000010176)VijendraNessuna valutazione finora

- Supreme Court Case DigestDocumento119 pagineSupreme Court Case DigestCon Pu50% (2)

- Civil Code and Criminal Code Provisions On LaborDocumento3 pagineCivil Code and Criminal Code Provisions On LaborJaneen ZamudioNessuna valutazione finora

- MidtermDocumento18 pagineMidtermCloieRjNessuna valutazione finora

- Civ Chair - S DigestsDocumento82 pagineCiv Chair - S Digestsruth sab-itNessuna valutazione finora

- Non-Delegation of Taxation PowerDocumento4 pagineNon-Delegation of Taxation PowerCon PuNessuna valutazione finora

- Banco Filipino Savings and Mortgage Bank V CADocumento1 paginaBanco Filipino Savings and Mortgage Bank V CACon Pu100% (1)

- Civil Law Exam Part 1 Q&aDocumento4 pagineCivil Law Exam Part 1 Q&aGeorge PandaNessuna valutazione finora

- Law On Evidence PointersDocumento6 pagineLaw On Evidence PointersKenneth Bryan Tegerero TegioNessuna valutazione finora

- Coleman Vs Hotel de France DigestDocumento1 paginaColeman Vs Hotel de France DigestRyan SuaverdezNessuna valutazione finora

- Arts. 1193 1998 PRACTICE PROBLEMSDocumento4 pagineArts. 1193 1998 PRACTICE PROBLEMSHEHE100% (1)

- The Heirs of The Vendee A Retro With Respect Only To Their Respective Shares, Whether The Thing Be Undivided or It HasDocumento1 paginaThe Heirs of The Vendee A Retro With Respect Only To Their Respective Shares, Whether The Thing Be Undivided or It HasCMLNessuna valutazione finora

- CredTrans 2 FinalDocumento7 pagineCredTrans 2 FinaltheamorerosaNessuna valutazione finora

- Quiz 6Documento4 pagineQuiz 6Jan NiñoNessuna valutazione finora

- Ra 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create) Prepared By: Dr. Virginia Jeannie P. Lim Salient Changes Introduced AreDocumento9 pagineRa 11534 - Corporate Recovery & Tax Incentives For Enterprises Act (Create) Prepared By: Dr. Virginia Jeannie P. Lim Salient Changes Introduced AreAlicia Jane NavarroNessuna valutazione finora

- G.R. No. 97212Documento4 pagineG.R. No. 97212shezeharadeyahoocomNessuna valutazione finora

- Answers 7Documento3 pagineAnswers 7Xiv NixNessuna valutazione finora

- 2019 Bar ExaminationsDocumento62 pagine2019 Bar ExaminationsAllana Erica CortesNessuna valutazione finora

- Module 2 Capacity To Buy or SellDocumento5 pagineModule 2 Capacity To Buy or Sellcha11Nessuna valutazione finora

- Corpo RecapDocumento8 pagineCorpo RecapErwin April MidsapakNessuna valutazione finora

- CHAPTER 2 - Nature and Effect of Obligations (Arts. 1163-1178)Documento35 pagineCHAPTER 2 - Nature and Effect of Obligations (Arts. 1163-1178)abigael severino100% (1)

- UST Central Student Council Central Board v. UST Central Commission On ElectionsDocumento6 pagineUST Central Student Council Central Board v. UST Central Commission On ElectionsTomasinoWebNessuna valutazione finora

- SitusDocumento1 paginaSitusCon PuNessuna valutazione finora

- Set OffcompensationDocumento2 pagineSet OffcompensationCon PuNessuna valutazione finora

- Exemption of GovernmentDocumento1 paginaExemption of GovernmentCon PuNessuna valutazione finora

- Regulatory TaxesDocumento2 pagineRegulatory TaxesCon PuNessuna valutazione finora

- Antonio P Tan Vs Court of Appeals Et AlDocumento5 pagineAntonio P Tan Vs Court of Appeals Et AlCon PuNessuna valutazione finora

- RemediesDocumento5 pagineRemediesCon PuNessuna valutazione finora

- Neyra v. NeyraDocumento8 pagineNeyra v. NeyraCon PuNessuna valutazione finora

- Annie Tan Vs CA Et AlDocumento7 pagineAnnie Tan Vs CA Et AlCon PuNessuna valutazione finora

- Antonio P Tan Vs Court of Appeals Et AlDocumento5 pagineAntonio P Tan Vs Court of Appeals Et AlCon PuNessuna valutazione finora

- Aznar VsDocumento18 pagineAznar VsCon PuNessuna valutazione finora

- Digest CasesDocumento8 pagineDigest CasesCon PuNessuna valutazione finora

- Corroborative Evidence Is An Additional Evidence of Different Kind and Character Tending To Prove The Same PointDocumento1 paginaCorroborative Evidence Is An Additional Evidence of Different Kind and Character Tending To Prove The Same PointCon PuNessuna valutazione finora

- Nuguid v. NuguidDocumento7 pagineNuguid v. NuguidCon PuNessuna valutazione finora

- Case Digest: Guerrero V. Bihis (521 Scra 394) : FactsDocumento2 pagineCase Digest: Guerrero V. Bihis (521 Scra 394) : FactsCon PuNessuna valutazione finora

- Azuela v. CaDocumento5 pagineAzuela v. CaCon PuNessuna valutazione finora

- Cpa Questions Part XDocumento10 pagineCpa Questions Part XAngelo MendezNessuna valutazione finora

- Tutorial 6 AnswersDocumento5 pagineTutorial 6 AnswersMaria MazurinaNessuna valutazione finora

- Management Report On Reckitt Benckiser Bangladesh LTDDocumento13 pagineManagement Report On Reckitt Benckiser Bangladesh LTDOld PagesNessuna valutazione finora

- Doing Business in UAEDocumento16 pagineDoing Business in UAEHani SaadeNessuna valutazione finora

- 19696ipcc Acc Vol2 Chapter14Documento41 pagine19696ipcc Acc Vol2 Chapter14Shivam TripathiNessuna valutazione finora

- A - Updated GYC Commercial Aerocity Yamuna Price List 19 11 2020-1Documento1 paginaA - Updated GYC Commercial Aerocity Yamuna Price List 19 11 2020-1Zama KazmiNessuna valutazione finora

- Foundation Broad Cost LeaderDocumento6 pagineFoundation Broad Cost LeaderGuisse MariamNessuna valutazione finora

- Container Market PDFDocumento3 pagineContainer Market PDFDhruv AgarwalNessuna valutazione finora

- Acct. Ch. 9 H.W.Documento7 pagineAcct. Ch. 9 H.W.j8noelNessuna valutazione finora

- Iesco Online Billl PDFDocumento2 pagineIesco Online Billl PDFAsad AliNessuna valutazione finora

- (C501) (Team Nexus) Assignment 1Documento14 pagine(C501) (Team Nexus) Assignment 1Mohsin Md. Abdul KarimNessuna valutazione finora

- Direct Deposit Authorization Form - Controlled PDFDocumento2 pagineDirect Deposit Authorization Form - Controlled PDFNatilee CampbellNessuna valutazione finora

- CAEmploymentGuide2014 PDF 23april2014Documento156 pagineCAEmploymentGuide2014 PDF 23april2014Jessica100% (1)

- Ambit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFDocumento15 pagineAmbit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFRobert StanleyNessuna valutazione finora

- Management Letter Mattsenkumar Services PVT LTD 2021-22Documento12 pagineManagement Letter Mattsenkumar Services PVT LTD 2021-22Sudhir Kumar DashNessuna valutazione finora

- AccountingDocumento5 pagineAccountingMaitet CarandangNessuna valutazione finora

- ECON 2 Module CHAP 7 ORGANIZATIONAL STRUCTUREDocumento10 pagineECON 2 Module CHAP 7 ORGANIZATIONAL STRUCTUREAngelica MayNessuna valutazione finora

- Sip Project Template Final RevisedDocumento21 pagineSip Project Template Final RevisedMonnu montoNessuna valutazione finora

- Meaning of Financial StatementsDocumento2 pagineMeaning of Financial StatementsDaily LifeNessuna valutazione finora

- Business Studies Paper 1 June 2011 PDFDocumento5 pagineBusiness Studies Paper 1 June 2011 PDFPanashe MusengiNessuna valutazione finora

- Fundamental of Oil and Gas IndustryDocumento23 pagineFundamental of Oil and Gas IndustryWaqas ShaikhNessuna valutazione finora

- Activity Questions 6.1 Suggested SolutionsDocumento6 pagineActivity Questions 6.1 Suggested SolutionsSuziNessuna valutazione finora

- AHL - Annual Report 2019 PDFDocumento111 pagineAHL - Annual Report 2019 PDFShin TanNessuna valutazione finora

- FR Assignment 4Documento4 pagineFR Assignment 4shashalalaxiangNessuna valutazione finora