Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accounting Assignment Abel

Caricato da

Mo DiagneCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Accounting Assignment Abel

Caricato da

Mo DiagneCopyright:

Formati disponibili

BM001-3--AS

Individual Assignment

201604

Table of Contents

Question 1: Financial account for ABC & CO...........................................................................2

Ledgers...................................................................................................................................2

Trial Balance for ABC & CO.................................................................................................7

Statement of Comprehensive Income for ABC & CO...........................................................8

Statement of Financial Position for ABC & CO....................................................................9

Question 2................................................................................................................................10

a) Definition of accounting term and discussion of the component of accounting equity10

b)

Trial Balance..............................................................................................................10

Question 3: Objectives and Importance of financial statements..............................................11

Objective and Importance of statement of financial position...............................................11

Objective and Importance of statement of cash flow...........................................................11

Objective and Importance of statement of owners equity...................................................11

Objective and Importance of statement of comprehensive income.....................................12

Question 4................................................................................................................................13

Matching concept.................................................................................................................13

Accrual Basis.......................................................................................................................13

Prudence concept.................................................................................................................13

Going Concern.....................................................................................................................13

Materiality Concept..............................................................................................................14

APU Level 1

Asia Pacific University of Technology and Innovation

Page 1 of 15

BM001-3--AS

Individual Assignment

201604

Question 1: Financial account for ABC & CO

Ledgers

Cash A/C

DATE

AMOUNT (RM)

DATE

AMOUNT (RM)

Dec 1

Capital A/C

200,000

Dec 1

Bank A/C

195,000

Dec 6

Sales A/C

60,000

Dec 8

Purchases A/C

20,000

Dec 31

Bank A/C

10,000

Dec 31

Balance c/d

35,000

260,000

260,000

Bank A/C

DATE

Dec 1

Dec 25

Dec 31

Cash A/C

Mr.

A/C

Cash A/C

AMOUNT

DAT

AMOUNT

(RM)

(RM)

195,000

Dec 2

20,000

Dec 3

10,000

Dec

21

Dec

31

Dec

31

Furniture

A/C

Vehicle A/C

50,000

Mr. A A/C

25,000

Salaries A/C

5,000

Balance c/d

130,000

225,000

APU Level 1

15,000

Asia Pacific University of Technology and Innovation

225,000

Page 2 of 15

BM001-3--AS

Individual Assignment

201604

Capital A/C

DATE

Dec 31

Balance

c/d

AMOUNT

DAT

AMOUNT

(RM)

(RM)

200,000

Dec 1

Cash

A/C

200,000

200,000

200,000

Furniture A/C

DATE

Dec 2

Bank

A/C

AMOUNT

DAT

(RM)

E

Dec

Balance

31

c/d

15,000

AMOUNT

(RM)

15,000

15,000

15,000

Vehicle A/C

DATE

Dec 3

Bank

A/C

AMOUNT (RM)

DATE

50,000

Dec 31

AMOUNT (RM)

Balance

c/d

50,000

APU Level 1

Asia Pacific University of Technology and Innovation

50,000

50,000

Page 3 of 15

BM001-3--AS

Individual Assignment

201604

Mr. A A/C

DAT

AMOUNT

DAT

AMOUNT

E

Dec

(RM)

(RM)

10,000

Dec 5

10

Dec

21

Dec

31

Purchases

Returned

A/C

Bank A/C

25,000

Balance c/d

15,000

Purchase

s

50,000

50,000

50,000

Sales A/C

DATE

Dec 18

Dec 31

Mr. B A/C

Balance

c/d

AMOUNT

DAT

AMOUNT

(RM)

(RM)

5,000

Dec 6

Cash A/C

Dec

Mr.

12

A/C

95,000

100,000

60,000

40,000

100,000

Purchases A/C

DATE

APU Level 1

AMOUNT

DAT

Asia Pacific University of Technology and Innovation

AMOUNT

Page 4 of 15

BM001-3--AS

Individual Assignment

(RM)

Dec 5

Mr. A A/C

50,000

Dec 8

Cash A/C

20,000

201604

E

Dec

10

Dec

31

(RM)

Mr. A A/C

Balance

c/d

70,000

10,000

60,000

70,000

Mr. B A/C

DAT

E

Dec

Sales

12

A/C

AMOUNT

DAT

(RM)

E

Dec

40,000

18

Dec

25

Dec

31

AMOUNT

(RM)

Sales

Returned

A/C

5,000

Bank A/C

20,000

Balance c/d

15,000

40,000

40,000

Salaries A/C

DATE

Dec 31

Bank

A/C

AMOUNT

DAT

AMOUNT

(RM)

E

Dec

(RM)

Balance

31

c/d

5,000

5,000

5,000

5,000

Expenses A/C

APU Level 1

Asia Pacific University of Technology and Innovation

Page 5 of 15

BM001-3--AS

Individual Assignment

DAT

E

Dec

Accrued

31

A/C

Expenses

201604

AMOUNT

DAT

(RM)

E

Dec

Balance

31

c/d

20,000

AMOUNT

(RM)

20,000

20,000

20,000

Accrued Expenses A/C

AMOUNT

DATE

Dec 31

(RM)

Balance

c/d

20,000

AMOUNT

DATE

(RM)

Dec

Expenses

31

A/C

20,000

APU Level 1

Asia Pacific University of Technology and Innovation

20,000

20,000

Page 6 of 15

BM001-3--AS

Individual Assignment

201604

Trial Balance for ABC & CO

L.F

LIST OF ACCOUNTS

DEBIT (RM)

Cash A/C

35,000

Bank A/C

130,000

Capital A/C

Furniture A/C

15,000

Vehicle A/C

50,000

Mr.A A/C

15,000

Sales A/C

95,000

Purchases A/C

60,000

Mr.B A/C

15,000

10

Salaries A/C

5,000

11

Expenses A/C

20,000

12

Accrued Expenses A/C

200,000

20,000

330,000

APU Level 1

CREDIT (RM)

Asia Pacific University of Technology and Innovation

330,000

Page 7 of 15

BM001-3--AS

Individual Assignment

201604

Statement of Comprehensive Income for ABC & CO

Statement of Comprehensive Income For the period ended at 31st Dec

PARTICULAR

AMOUNT

AMOUNT

(RM)

(RM)

Sales

95,000

Less: Cost Of Goods Sold

Purchases

60,000

35,000

Less: Operating Expenses

Salaries

5,000

Expenses

20,000

25,000

Net Profit

APU Level 1

10,000

Asia Pacific University of Technology and Innovation

Page 8 of 15

BM001-3--AS

Individual Assignment

201604

Statement of Financial Position for ABC & CO

Statement of Financial Position as at 31st Dec

AMOUN

T (RM)

AMOUN

T

(RM)

AMOUN

AMOUN

T (RM)

T (RM)

Current

Current Assets

Liabilities

Cash

35,000

Bank

130,000

Mr. B

15,000

Mr. A

Accrued

Expenses

15,000

20,000

35,000

180,000

Owners

Fixed Assets

Equity

Furniture

15,000

Capital

200,000

Vehicle

50,000

Add: Net Profit

10,000

APU Level 1

65,000

210,000

245,000

245,000

Asia Pacific University of Technology and Innovation

Page 9 of 15

BM001-3--AS

Individual Assignment

201604

Question 2

a) Definition of accounting term and discussion of the

component of accounting equity

Accounting is the systematic and comprehensive recording of financial transactions

pertaining to a business. Accounting also refers to the process of summarizing, analysing and

reporting these transactions. The financial statements that summarize a large company's

operations, financial position and cash flows over a particular period are a concise summary

of hundreds of thousands of financial transactions it may have entered into over this period.

The accounting equation (Assets = Liabilities + Owner Equity) is a simplified breakdown of

the values entered in the balance sheet. It illustrates the relationship between a

company's assets, liabilities and shareholder or owner equity. The accounting equation shows

the balance of a companys resources (those displayed on the balance sheet as assets). The

companys assets are shown on the left side of the equation, and the liabilities and equity are

shown on the right side. The equation illustrates that all of a companys resources (assets) are

provided by their creditors or their owners (through liabilities and equity). The accounting

equation also shows that every economic event that affects the balance sheet will have a dual

effect. The accounting equation is a simple way to view the relationship of financial activities

across a business.

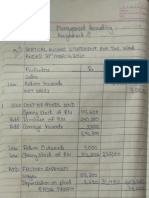

b) Trial Balance

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled

into debit and credit columns. A company prepares a trial balance periodically, usually at the

end of every reporting period. The general purpose of producing a trial balance is to ensure

the entries in a company's bookkeeping system are mathematically correct. Preparing a trial

balance for a company serves to detect any mathematical errors that have occurred in the

double-entry accounting system. Provided the total debts equal the total credits, the trial

balance is considered to be balanced, and there should be no mathematical errors in the

ledgers.

APU Level 1

Asia Pacific University of Technology and Innovation

Page 10 of 15

BM001-3--AS

Individual Assignment

201604

Question 3: Objectives and Importance of financial

statements

Objective and Importance of statement of financial position

Statement of financial position helps users of financial statements to assess the financial

health of an entity. When analysed over several accounting periods, balance sheets may assist

in identifying underlying trends in the financial position of the entity. It is particularly helpful

in determining the state of the entity's liquidity risk, financial risk, credit risk and business

risk. When used in conjunction with other financial statements of the entity and the financial

statements of its competitors, balance sheet may help to identify relationships and trends

which are indicative of potential problems or areas for further improvement. Analysis of the

statement of financial position could therefore assist the users of financial statements to

predict the amount, timing and volatility of entity's future earnings.

Objective and Importance of statement of cash flow

Statement of cash flows provides important insights about the liquidity and solvency of a

company which are vital for survival and growth of any organization. It also enables analysts

to use the information about historic cash flows to form projections of future cash flows of an

entity (e.g. in NPV analysis) on which to base their economic decisions. By summarizing key

changes in financial position during a period, cash flow statement serves to highlight

priorities of management. For example, increase in capital expenditure and development

costs may indicate a higher increase in future revenue streams whereas a trend of excessive

investment in short term investments may suggest lack of viable long term investment

opportunities. Furthermore, comparison of the cash flows of different entities may better

reveal the relative quality of their earnings since cash flow information is more objective as

opposed to the financial performance reflected in income statement which is susceptible to

significant variations caused by the adoption of different accounting policies.

Objective and Importance of statement of owners equity

Statement of owners equity helps users of financial statement to identify the factors that

cause a change in the owners' equity over the accounting periods. Whereas movement in

shareholder reserves can be observed from the balance sheet, statement of owners equity

APU Level 1

Asia Pacific University of Technology and Innovation

Page 11 of 15

BM001-3--AS

Individual Assignment

201604

discloses significant information about equity reserves that is not presented separately

elsewhere in the financial statements which may be useful in understanding the nature of

change in equity reserves. Examples of such information include share capital issue and

redemption during the period, the effects of changes in accounting policies and correction of

prior period errors, gains and losses recognized outside income statement, dividends declared

and bonus shares issued during the period.

Objective and Importance of statement of comprehensive

income

Comprehensive income is the sum of net income and other items that must bypass the income

statement because they have not been realized, including items like an unrealized holding

gain or loss from available for sale securities and foreign currency translation gains or losses.

Understanding the drivers of a company's daily operations is going to be the most important

consideration for a financial analyst, but looking at the statement of comprehensive income

can uncover other potentially major items. Insurance companies, banks and other financial

institutions have large investment portfolios that they manage. Realized gains and losses are

going to run through reported net income for the most part, but looking at the unrealized side

of the equation can demonstrate how it is managing its investments and if there is the

potential for big losses down the road. In this respect, statement of comprehensive income

can help an analyst get to a more accurate measure of the fair value of a company's

investments.

APU Level 1

Asia Pacific University of Technology and Innovation

Page 12 of 15

BM001-3--AS

Individual Assignment

201604

Question 4

Matching concept

Matching concept is one of the basic underlying guidelines in accounting. The matching

principle directs a company to report an expense on its income statement in the same period

as the related revenues. A significant relationship exists between revenue and expenses.

Expenses are incurred for the for the purpose of producing revenue. In measuring net income

for a period, revenue should be offset by all the expenses incurred in producing that revenue.

This concept of offsetting expenses against revenue on the basis of "causes and effect" is

called the Matching Concept.

Accrual Basis

Accrual accounting is an accounting method that measures the performance and position of a

company by recognizing economic events regardless of when cash transactions occur. The

general idea is that economic events are recognized by matching revenues to expenses (the

matching principle) at the time in which the transaction occurs rather than when payment is

made (or received). This method allows the current cash inflows/outflows to be combined

with future expected cash inflows/outflows to give a more accurate picture of a company's

current financial condition.

Prudence concept

Prudence is a key accounting principle which makes sure that assets and income are not

overstated and liabilities and expenses are not understated. Prudence concept will recognize

all probable losses as they are discovered and most expenditure as they are incurred. Revenue

will be deferred until it is verified. Having strict revenue-recognition criteria is one of the

most common forms of accounting conservatism. For example Periodic evaluations of assets

are made to make sure their carrying value does not exceed the benefits expected to be

derived from the asset, and if it does exceed, the impairment of fixed asset is recorded by

reducing its carrying amount.

APU Level 1

Asia Pacific University of Technology and Innovation

Page 13 of 15

BM001-3--AS

Individual Assignment

201604

Going Concern

Going Concern is one the fundamental assumptions in accounting on the basis of which

financial statements are prepared. Financial statements are prepared assuming that a business

entity will continue to operate in the foreseeable future without the need or intention on the

part of management to liquidate the entity or to significantly curtail its operational activities.

Therefore, it is assumed that the entity will realize its assets and settle its obligations in the

normal course of the business. For example, if we expected a company to go out of business

a few months from now, it would make no sense to record any long-term liabilities for that

firm, because we wouldn't expect the business to still be there to pay them.

Materiality Concept

Information is material if its omission or misstatement could influence the economic

decisions of users taken on the basis of the financial statements. Materiality therefore relates

to the significance of transactions, balances and errors contained in the financial statements.

Materiality defines the threshold after which financial information becomes relevant to the

decision making needs of the users. Information contained in the financial statements must

therefore be complete in all material respects in order for them to present a true and fair view

of the affairs of the entity. Materiality is relative to the size and particular circumstances of

individual companies. As an example of a clearly immaterial item, you may have prepaid

$100 of rent on a post office box that covers the next six months; under the matching

principle, you should charge the rent to expense over six months. However, the amount of the

expense is so small that no reader of the financial statements will be misled if you charge the

entire $100 to expense in the current period, rather than spreading it over the usage period. In

fact, if the financial statements are rounded to the nearest thousand or million dollars, this

transaction would not alter the financial statements at all.

APU Level 1

Asia Pacific University of Technology and Innovation

Page 14 of 15

BM001-3--AS

Individual Assignment

201604

References

"Accounting Definition | Investopedia". Investopedia. N.p., 2003. Web. 23 May 2016.

"Accounting Equation - Accountingtools". Accountingtools.com. N.p., 2016. Web. 23 May

2016.

"Prudence Concept | Definition And Examples". Accountingexplained.com. N.p., 2016. Web.

23 May 2016.

"Relevance Of Accounting Information And Its Examples". Accounting-simplified.com. N.p.,

2016. Web. 23 May 2016.

"Trial Balance Definition | Investopedia". Investopedia. N.p., 2007. Web. 23 May 2016.

"What Is The Accounting Equation? | Debitoor Accounting Glossary". Debitoor.com. N.p.,

2016. Web. 23 May 2016.

APU Level 1

Asia Pacific University of Technology and Innovation

Page 15 of 15

Potrebbero piacerti anche

- Statement of Cash Flows: Preparation, Presentation, and UseDa EverandStatement of Cash Flows: Preparation, Presentation, and UseNessuna valutazione finora

- BUSM 1276 - Assessment 1 Brief - Sem1 2018Documento10 pagineBUSM 1276 - Assessment 1 Brief - Sem1 2018Utkarsh VibhuteNessuna valutazione finora

- Accounting Assignments ListDocumento8 pagineAccounting Assignments Listumar0% (1)

- Financial Accounting I Assignment #2Documento3 pagineFinancial Accounting I Assignment #2Sherisse' Danielle WoodleyNessuna valutazione finora

- Financial Accounting Assignment TurnitinDocumento13 pagineFinancial Accounting Assignment TurnitinWeslyn LeeNessuna valutazione finora

- Integration of Renewable Energy Sources and Electric Vehicles in V2G Network PDFDocumento28 pagineIntegration of Renewable Energy Sources and Electric Vehicles in V2G Network PDFALEX AGUSTO TORRE HUAMANNessuna valutazione finora

- Turner PDFDocumento271 pagineTurner PDFNour ShaffouniNessuna valutazione finora

- Managerial Accounting Assignment 1Documento11 pagineManagerial Accounting Assignment 1AhnifsajidNessuna valutazione finora

- Bba311 Project Template-5.1 Telly - ZavalaDocumento11 pagineBba311 Project Template-5.1 Telly - ZavalaJoselito CorazonNessuna valutazione finora

- Discussion Question Chapter 10Documento6 pagineDiscussion Question Chapter 10Fathia RofifahNessuna valutazione finora

- Assignment Financial Accounting Jan YasminDocumento3 pagineAssignment Financial Accounting Jan Yasminbarukautahu0% (1)

- Swot Analysis of Aarong BangladeshDocumento11 pagineSwot Analysis of Aarong BangladeshFarzana Khan0% (2)

- Order Fulfillment and Logistics Considerations For Multichannel RetailersDocumento14 pagineOrder Fulfillment and Logistics Considerations For Multichannel RetailerspedrocaballeropedroNessuna valutazione finora

- Accounting 102 Assignment 10Documento3 pagineAccounting 102 Assignment 10Cindy YinNessuna valutazione finora

- Accounting AssignmentDocumento6 pagineAccounting AssignmentSyed Sheraz Ahmed ShahNessuna valutazione finora

- MAA716 Assignment Part 3 T1 2015Documento2 pagineMAA716 Assignment Part 3 T1 2015ashibhallauNessuna valutazione finora

- Five Types of WebpagesDocumento5 pagineFive Types of WebpagesMalik Ghulam ShabirNessuna valutazione finora

- Entrepreneur Interview InstructionsDocumento11 pagineEntrepreneur Interview InstructionsjoeNessuna valutazione finora

- BUSM 1139 Elizabeth Health: BUSM1139 - SUSINDRA - NICHOLASHUGO - S3417647 1Documento10 pagineBUSM 1139 Elizabeth Health: BUSM1139 - SUSINDRA - NICHOLASHUGO - S3417647 1Nicholas HugoNessuna valutazione finora

- Latest Syllabus For Google AppsDocumento4 pagineLatest Syllabus For Google AppsJaya MalathyNessuna valutazione finora

- 1HRD EssayfinalDocumento10 pagine1HRD EssayfinalkhaizamanNessuna valutazione finora

- Assignment - Doc - GE-01-Fundamentals of Financial Accounting - 16022016120900Documento10 pagineAssignment - Doc - GE-01-Fundamentals of Financial Accounting - 16022016120900Bulbul Ahamed100% (2)

- Extract Pages From Marketing-Strategy - WM P3Documento40 pagineExtract Pages From Marketing-Strategy - WM P3Phuong PhamNessuna valutazione finora

- MANAGEMENT ACCOUNTING ASSIGNMENT NimeelithaDocumento11 pagineMANAGEMENT ACCOUNTING ASSIGNMENT NimeelithaNimeelitha GelliNessuna valutazione finora

- Southeast University Assignment AccountingDocumento10 pagineSoutheast University Assignment AccountingOzairNessuna valutazione finora

- CO Account Assignment LogicDocumento4 pagineCO Account Assignment LogicvenkatNessuna valutazione finora

- Assignment FrontsheetDocumento16 pagineAssignment FrontsheetKhoa NguyễnNessuna valutazione finora

- Assignment 1Documento5 pagineAssignment 1Sumedh KakdeNessuna valutazione finora

- Benefits and Detrimental Effects of Internet On StudentsDocumento10 pagineBenefits and Detrimental Effects of Internet On Studentscheryl limNessuna valutazione finora

- Internet AssignmentDocumento13 pagineInternet AssignmentSangeeth100% (1)

- Revised DIT Course 2011Documento23 pagineRevised DIT Course 2011Mubashir MahmoodNessuna valutazione finora

- E-Commerce in Nigeria: How To Move Forward: Legal Framework For The Introduction of E-CommerceDocumento5 pagineE-Commerce in Nigeria: How To Move Forward: Legal Framework For The Introduction of E-CommerceOnwuka OnyemaechiNessuna valutazione finora

- Supply Chain ManagementDocumento2 pagineSupply Chain ManagementlogicballiaNessuna valutazione finora

- Web-Development ToC PDFDocumento4 pagineWeb-Development ToC PDFNikhilNessuna valutazione finora

- Gitam Assignment QuestionsDocumento2 pagineGitam Assignment QuestionsRaj Nd0% (1)

- Writing A Good Essay For E&GDocumento1 paginaWriting A Good Essay For E&Gsabishi2312Nessuna valutazione finora

- Assignment On Management AccountingDocumento17 pagineAssignment On Management AccountingMarysun Tlengr100% (2)

- AIMA AssignmentDocumento7 pagineAIMA AssignmentMinhaz AlamNessuna valutazione finora

- Doll Museum Case StudyDocumento9 pagineDoll Museum Case StudySRIRAMA CHANDRANessuna valutazione finora

- Connectors: 2. Introducing Sub-TopicsDocumento3 pagineConnectors: 2. Introducing Sub-TopicsManuel Moreno SánchezNessuna valutazione finora

- Financial Accounting S - B A - I: Assets (RS.) Owners' Equity (RS.)Documento1 paginaFinancial Accounting S - B A - I: Assets (RS.) Owners' Equity (RS.)Fahad MushtaqNessuna valutazione finora

- Financial AccountingDocumento5 pagineFinancial AccountingHafiz WaqasNessuna valutazione finora

- AssignmentDocumento34 pagineAssignmentSuryanarayana Murthy Mangipudi100% (2)

- Ecommerce: Sir Sohaib IrfanDocumento5 pagineEcommerce: Sir Sohaib IrfanChaudhary Sohail ShafiqNessuna valutazione finora

- New Enterprise and Innovation Management NeimDocumento5 pagineNew Enterprise and Innovation Management NeimlavishNessuna valutazione finora

- Introduction To International Business (BAP64) : Course Name: Course Code: Course Load: Term: Coordinator: Teaching StaffDocumento6 pagineIntroduction To International Business (BAP64) : Course Name: Course Code: Course Load: Term: Coordinator: Teaching StaffLuxi JiangNessuna valutazione finora

- Assignment 1Documento1 paginaAssignment 1Faez FeakryNessuna valutazione finora

- Assignment On Government AccountingDocumento8 pagineAssignment On Government AccountingMohammad SaadmanNessuna valutazione finora

- Assignment 1Documento20 pagineAssignment 1SarthakAryaNessuna valutazione finora

- Individual Task - Practical Work & Pitching - Guideline & Rubric 20%Documento4 pagineIndividual Task - Practical Work & Pitching - Guideline & Rubric 20%Amilin HatiaraNessuna valutazione finora

- Accounting 2Documento35 pagineAccounting 2Yousaf JamalNessuna valutazione finora

- Balkar - Phrasal Verbs FinalDocumento19 pagineBalkar - Phrasal Verbs FinalPunjabi MundaNessuna valutazione finora

- Resume of Kountinya SaiDocumento3 pagineResume of Kountinya Saiapi-78374761Nessuna valutazione finora

- Financial Accounting AssignmentDocumento11 pagineFinancial Accounting AssignmentMadhawa RanawakeNessuna valutazione finora

- Assignment 1 - QuestionsDocumento10 pagineAssignment 1 - QuestionsShinza Jabeen0% (3)

- Partner Marketing Manager in Greater New York City NY Resume Pamela SclafaniDocumento2 paginePartner Marketing Manager in Greater New York City NY Resume Pamela SclafaniPamela SclafaniNessuna valutazione finora

- Assign 2Documento3 pagineAssign 2Abdul Moqeet100% (1)

- Digital Business Management - Assignment 1 V1Documento3 pagineDigital Business Management - Assignment 1 V1khozema1Nessuna valutazione finora

- Imforme de Ingles (Financial Anlisis) en InglesDocumento7 pagineImforme de Ingles (Financial Anlisis) en InglesKristhian SilvaNessuna valutazione finora

- Oracle R12 Multi Period AccountingDocumento37 pagineOracle R12 Multi Period AccountingSiva KumarNessuna valutazione finora

- HSBC IMT AssignmentDocumento13 pagineHSBC IMT AssignmentMo Diagne100% (1)

- Baidy-Kelera Assignment2Documento9 pagineBaidy-Kelera Assignment2Mo DiagneNessuna valutazione finora

- Operational Management Assignment McDonaldDocumento11 pagineOperational Management Assignment McDonaldMo Diagne0% (1)

- Dyer Chapter04Documento20 pagineDyer Chapter04Mo DiagneNessuna valutazione finora

- Excel Solutions - CasesDocumento33 pagineExcel Solutions - CasesChris DeconcilusNessuna valutazione finora

- Consolidation Techniques and ProceduresDocumento48 pagineConsolidation Techniques and ProceduresSausan SaniaNessuna valutazione finora

- Desco Final Account AnalysisDocumento26 pagineDesco Final Account AnalysiskmsakibNessuna valutazione finora

- Horizintal and Vertical Analysis of Jollibee Foods CorpDocumento9 pagineHorizintal and Vertical Analysis of Jollibee Foods CorpAlfraim Sheine Sandulan Gomez100% (1)

- Unit II Consolidated Financial Statements Date of AcquisitionDocumento17 pagineUnit II Consolidated Financial Statements Date of AcquisitionDaisy TañoteNessuna valutazione finora

- 105a - Financial Accounting IDocumento23 pagine105a - Financial Accounting IBhatt MusairNessuna valutazione finora

- IFRS Separate Fincancial Statements Up DateDocumento264 pagineIFRS Separate Fincancial Statements Up DatestiljanNessuna valutazione finora

- Accounting Assignment PDFDocumento18 pagineAccounting Assignment PDFMohammed SafwatNessuna valutazione finora

- Adjusting EntryDocumento13 pagineAdjusting Entrymichaella maglinteNessuna valutazione finora

- BAW 4614 Advanced Financial Accounting ReportingDocumento52 pagineBAW 4614 Advanced Financial Accounting ReportingTEE YAN YING UnknownNessuna valutazione finora

- ACT 2100 Worksheet IVDocumento7 pagineACT 2100 Worksheet IVAshmini PershadNessuna valutazione finora

- Analysis of Financial StatementsDocumento39 pagineAnalysis of Financial StatementsA. Saeed KhawajaNessuna valutazione finora

- Ans Mini Case 2 - A171 - LecturerDocumento14 pagineAns Mini Case 2 - A171 - LecturerXue Yin Lew100% (1)

- BADVAC1X - MOD 2 Conso FS Date of AcqDocumento6 pagineBADVAC1X - MOD 2 Conso FS Date of AcqJopnerth Carl CortezNessuna valutazione finora

- CA01 VariableCostingFDocumento114 pagineCA01 VariableCostingFSadile May KayeNessuna valutazione finora

- Polar SportsDocumento9 paginePolar SportsAbhishek RawatNessuna valutazione finora

- Coactg1 Common Exam ReviewerDocumento7 pagineCoactg1 Common Exam ReviewerIvy Rose BorasNessuna valutazione finora

- QUIZ 2 Partnership Liquidation Installment PerezDocumento6 pagineQUIZ 2 Partnership Liquidation Installment PerezChelit LadylieGirl FernandezNessuna valutazione finora

- Lecture - 5 - CFI-3-statement-model-completeDocumento37 pagineLecture - 5 - CFI-3-statement-model-completeshreyasNessuna valutazione finora

- 3310-Ch 10-End of Chapter solutions-STDocumento30 pagine3310-Ch 10-End of Chapter solutions-STArvind ManoNessuna valutazione finora

- Interim Financial ReportingDocumento119 pagineInterim Financial ReportingXander Clock100% (1)

- LabChapt P3-34 P3-35Documento5 pagineLabChapt P3-34 P3-35Meisya VianqaNessuna valutazione finora

- Level 3 Accounting Update Text 2022Documento105 pagineLevel 3 Accounting Update Text 2022KhinMgLwin100% (1)

- Unit: IV Final Accounts of Sole TradersDocumento16 pagineUnit: IV Final Accounts of Sole TradersAnbe SivamNessuna valutazione finora

- Profitability AnalysisDocumento6 pagineProfitability AnalysisawaischeemaNessuna valutazione finora

- Management Accounting Assignment - 1Documento4 pagineManagement Accounting Assignment - 1anvesha khillarNessuna valutazione finora

- PT ESS1217 - Mapping Report Break LinkDocumento392 paginePT ESS1217 - Mapping Report Break Linkricho naiborhuNessuna valutazione finora

- BACCTG1 ExercisesDocumento52 pagineBACCTG1 Exercisesmoon heiz100% (2)

- Exercise 1: Tugas 12 Oktober 2020Documento2 pagineExercise 1: Tugas 12 Oktober 2020melvina siregarNessuna valutazione finora

- LaporanKeuanganWIKA30September2018Documento164 pagineLaporanKeuanganWIKA30September2018arrizal firdausNessuna valutazione finora