Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Groupe Ariel - Questions PDF

Caricato da

Debbie Rice0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

942 visualizzazioni1 paginaTitolo originale

Groupe Ariel - Questions.pdf

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

942 visualizzazioni1 paginaGroupe Ariel - Questions PDF

Caricato da

Debbie RiceCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

The following questions should support your analysis of the case and help structuring the solution.

Please formulate your solution in up to 8 pages (Times New Roman 12pt, spacing 1.5,

margins 2,5 at all sides). Also be prepared to verbally present your arguments and results in

class and discuss it with the other groups.

There is no unique correct solution. The quality of your solution depends on the depth of your

analysis and the clarity and correctness of your arguments.

Groupe Ariel S.A.: Parity Conditions and Cross-Border Valuation

Questions for Assignment

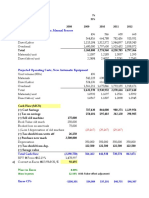

1. Compute the net present value of Ariel-Mexicos recycling equipment by discounting incremental cash flows. Apply two approaches.

a. Discount peso cash flows at a Peso discount rate and convert the NPV.

b. Translate the projects future Peso cash flows into Euros at expected future exchange rates and discount at a Euro discount rate.

Assume expected future inflation for France is 3% per year and for Mexico is 7% per

year. Explain your cash flows (do not miss the tax effects) and the choice of discount

rates. Compare the two sets of calculations and the corresponding NPVs.

2. Check (as far as possible) to what extent relative purchasing power parity and interest rate

parity is reflected in the historic data given in the case.

3. Explore the relevance and influence of assumptions regarding parity conditions. What is

your result in part 1 if you assume parity conditions to hold? What if you apply alternative

assumptions not consistent with parity? Try different assumptions regarding inflation

rates.

4. Suppose Ariel expects a significant real depreciation of the peso against the Euro. How

should Martin incorporate such an expectation into his NPV analysis? What is its effect on

the concluded NPVs?

5. Should Groupe Ariel approve the equipment purchase? Include hedging and financing

considerations into your discussion and recommendation.

Further information:

Note that Exhibit 2 is stated in pesos, not thousands of pesos!

The actual 1-year and 2-year forward rates at the date of the case were MXN 16.4331/EUR

and MXN 16.9998/EUR, respectively (mid-points between bid and ask). Longer rates were

not available.

Please find the case data in the Excel Sheet GroupeAriel.xls (available in Moodle).

Potrebbero piacerti anche

- Group Ariel CaseDocumento3 pagineGroup Ariel Casemibebradford33% (9)

- Case ArielDocumento2 pagineCase ArielBadr0% (5)

- Groupe Ariel - SolutionDocumento6 pagineGroupe Ariel - SolutiontrangngqNessuna valutazione finora

- Group ArielDocumento5 pagineGroup ArielSumit SharmaNessuna valutazione finora

- Groupe Ariele SolutionDocumento5 pagineGroupe Ariele SolutionSergio García100% (1)

- ArielDocumento3 pagineArielmemfida100% (1)

- Group Ariel S.A. Parity Conditions and Cross Border ValuationDocumento13 pagineGroup Ariel S.A. Parity Conditions and Cross Border Valuationmatt100% (1)

- Groupe Ariel SA Case AnalysisDocumento7 pagineGroupe Ariel SA Case Analysiskarthikmaddula007_66100% (1)

- Groupe Ariel Assignment Instructions and Rubric 1121Documento9 pagineGroupe Ariel Assignment Instructions and Rubric 1121gadisika0% (1)

- Groupe Ariel Project AnalysisDocumento1 paginaGroupe Ariel Project AnalysisGiorgi Kharshiladze100% (4)

- GroupeAriel S.ADocumento3 pagineGroupeAriel S.AEina GuptaNessuna valutazione finora

- Groupe Ariel CaseDocumento9 pagineGroupe Ariel CasePaco Colín86% (7)

- Projected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Documento4 pagineProjected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Cesar CameyNessuna valutazione finora

- Ariel - ICFDocumento9 pagineAriel - ICFSannya DuggalNessuna valutazione finora

- AES Case StudyDocumento12 pagineAES Case StudyTim Castorena33% (3)

- Albert Adusei BrobbeyDocumento10 pagineAlbert Adusei BrobbeyNana Quame GenzNessuna valutazione finora

- Noble GroupDocumento3 pagineNoble GroupromanaNessuna valutazione finora

- (Shared) Day5 Harmonic Hearing Co. - 4271Documento17 pagine(Shared) Day5 Harmonic Hearing Co. - 4271DamTokyo0% (2)

- Group Ariel StudentsDocumento8 pagineGroup Ariel Studentsbaashii4Nessuna valutazione finora

- Flash Memory, Inc.Documento2 pagineFlash Memory, Inc.Stella Zukhbaia0% (5)

- Flash Memory IncDocumento3 pagineFlash Memory IncAhsan IqbalNessuna valutazione finora

- New Heritage Doll CoDocumento3 pagineNew Heritage Doll Copalmis2100% (5)

- Finance - WK 4 Assignment TemplateDocumento31 pagineFinance - WK 4 Assignment TemplateIsfandyar Junaid50% (2)

- Module4 CaseAssignmentDocumento1 paginaModule4 CaseAssignmentDevin Butchko0% (2)

- Caso TeuerDocumento46 pagineCaso Teuerjoaquin bullNessuna valutazione finora

- Flash Memory, IncDocumento16 pagineFlash Memory, Inckiller drama67% (3)

- Flash MemoryDocumento9 pagineFlash MemoryJeffery KaoNessuna valutazione finora

- Cases Qs MBA 6003Documento5 pagineCases Qs MBA 6003Faria CHNessuna valutazione finora

- Heritage Doll CompanyDocumento11 pagineHeritage Doll CompanyDeep Dey0% (1)

- Aspen CaseDocumento15 pagineAspen CaseWee Chuen100% (1)

- CARREFOUR S.A. Case SolutionDocumento3 pagineCARREFOUR S.A. Case SolutionShubham PalNessuna valutazione finora

- The Case Solution of AES Tiete: Expansion Plant in BrazilDocumento19 pagineThe Case Solution of AES Tiete: Expansion Plant in BrazilParbon Acharjee0% (1)

- Aes Case SolutionDocumento3 pagineAes Case SolutionXimenaLopezCifuentes100% (1)

- Tottenham Case SolutionDocumento14 pagineTottenham Case SolutionVivek SinghNessuna valutazione finora

- Flash - Memory - Inc From Website 0515Documento8 pagineFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- 2017 L 3 & L4 Mini Assignments & Summary SolutionsDocumento9 pagine2017 L 3 & L4 Mini Assignments & Summary SolutionsZhiyang Zhou67% (3)

- Online AnswerDocumento4 pagineOnline AnswerYiru Pan100% (2)

- Assignment Schumpeter Finanzberatung DEC-5-21Documento2 pagineAssignment Schumpeter Finanzberatung DEC-5-21RaphaelNessuna valutazione finora

- Case AnalysisDocumento11 pagineCase AnalysisSagar Bansal50% (2)

- Flash Memory CaseDocumento6 pagineFlash Memory Casechitu199233% (3)

- MSDI Excel SheetDocumento4 pagineMSDI Excel SheetSurya AduryNessuna valutazione finora

- Globalizing The Cost of Capital and Capital Budgeting at AESDocumento33 pagineGlobalizing The Cost of Capital and Capital Budgeting at AESK Ramesh100% (1)

- New Heritage Doll CompanyDocumento5 pagineNew Heritage Doll CompanyRahul LalwaniNessuna valutazione finora

- AirThread G015Documento6 pagineAirThread G015Kunal MaheshwariNessuna valutazione finora

- Teur CaseDocumento7 pagineTeur Casewriter topNessuna valutazione finora

- Mercuryathleticfootwera Case AnalysisDocumento8 pagineMercuryathleticfootwera Case AnalysisNATOEENessuna valutazione finora

- BurtonsDocumento6 pagineBurtonsKritika GoelNessuna valutazione finora

- Flash Memory AnalysisDocumento25 pagineFlash Memory AnalysisTheicon420Nessuna valutazione finora

- AirThread Class 2020Documento21 pagineAirThread Class 2020Son NguyenNessuna valutazione finora

- New Heritage Doll - SolutionDocumento4 pagineNew Heritage Doll - Solutionrath347775% (4)

- Valuation of AirThreadConnectionsDocumento3 pagineValuation of AirThreadConnectionsmksscribd100% (1)

- Section I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeDocumento11 pagineSection I. High-Growth Strategy of Marshall, Company Financing and Its Potential Stock Price ChangeclendeavourNessuna valutazione finora

- MercuryDocumento5 pagineMercuryமுத்துக்குமார் செNessuna valutazione finora

- Final Project Instructions SACMDocumento2 pagineFinal Project Instructions SACMJustin RuffingNessuna valutazione finora

- Research Papers On Interest Rate ParityDocumento4 pagineResearch Papers On Interest Rate Parityxmniibvkg100% (1)

- Journal of Financial Economics: Eugene F. Fama, Kenneth R. FrenchDocumento16 pagineJournal of Financial Economics: Eugene F. Fama, Kenneth R. FrenchjomanousNessuna valutazione finora

- Uncovered Interest Rate Parity Literature ReviewDocumento4 pagineUncovered Interest Rate Parity Literature Reviewfuzkxnwgf100% (1)

- Anchor en A 0811Documento45 pagineAnchor en A 0811Mara MeliNessuna valutazione finora

- Assignment 2Documento3 pagineAssignment 2François VoisardNessuna valutazione finora

- 300 AssignmentDocumento4 pagine300 AssignmentFgvvNessuna valutazione finora

- Korres Natural ProductsDocumento6 pagineKorres Natural ProductsDebbie RiceNessuna valutazione finora

- Groupe Ariel - Questions PDFDocumento1 paginaGroupe Ariel - Questions PDFDebbie RiceNessuna valutazione finora

- Suggested Questions - Baker Adhesives V2Documento10 pagineSuggested Questions - Baker Adhesives V2Debbie RiceNessuna valutazione finora

- The Seven Properties of Good Models: Please ShareDocumento14 pagineThe Seven Properties of Good Models: Please ShareDebbie RiceNessuna valutazione finora