Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ratio Analysis Part I

Caricato da

Trilok KhanalTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ratio Analysis Part I

Caricato da

Trilok KhanalCopyright:

Formati disponibili

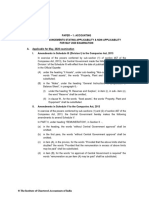

Ratio Analysis Part 1 - Overview

Paper 3B: Financial Management Chapter 3 Unit I

CA B. Hari Gopal B.com, PGDBA, FCA, FCMA, DISA(ICAI), PMP (PMI, USA),

EPBM (IIMC), MCT

Learning Objectives

1. Concept of Ratio Analysis

2. Classification of Ratios

3. Application of Ratio Analysis

4. Limitations of Financial Ratios

Introduction to Ratio Analysis

Introduction

Basis

Objective

Purpose

Ratio Analysis - Introduction

1. Basis for financial analysis, planning and

decision making is financial statements - that is

Balance Sheet and Profit and Loss account

2. However, the above statement does not

disclose all the necessary and relevant

information required for planning and decision

making

3. Ratio analysis is an analytical tool in the hands

of the Finance Manager to analyze the data

depicted in the financial statement

Ratio Analysis - Basis

1. A relationship expressed in mathematical terms

2. Between two individual figures or group of figures

3. Connected with each other in some logical manner

4. And selected from financial statements of the concern

Ratio Analysis - Objective

Objective of financial ratios is that all

stakeholders can draw conclusions about the

1. Performance

2. Strengths and

weaknesses of the firm

3. And take decisions

in relation to the firm

Ratio Analysis - Purpose

To identify aspects of a businesss performance to aid

decision making

Quantitative process may need to be supplemented

by qualitative factors to get a complete picture

Classification of ratios

Statement based classification

Functional Classification

Ratio - Classification

Statement Based

Functional

10

Statement Based Classification

Balance Sheet Current Ratio

Debt Equity Ratio

Ratios

Profit and Loss Gross Profit Ratio

account Ratios Net Profit Ratio

Combined

Ratios

Debtors Turnover Ratio

Inventory Turnover Ratio

11

Functional Classification

Liquidity Ratios

Current Ratio

Quick Ratio

Capital Structure

Ratios

Equity Ratio

Debt Equity Ratio

Coverage Ratios

Debt Service Coverage Ratio

Interest Coverage Ratio

Activity Ratios

Profitability Ratios

Capital Turnover Ratio

Inventory Turnover Ratio

Return on Equity Ratio

Price Earning Ratio

12

Liquidity Ratios

13

Liquidity Ratios

Current Ratio

Quick Ratio

Cash Ratio / Absolute Liquidity Ratio

Basic Defense Interval

Net Working Capital Ratio

14

Capital Structure Ratios

15

Capital Structure Ratios

Equity Ratio

Debt Ratio

Debt Equity Ratio

16

Coverage Ratios

17

Coverage Ratios

Debt Service Coverage Ratio

Interest Coverage Ratio

Preference Dividend Coverage Ratio

Capital Gearing Ratio

Fixed Assets Long Term Funds Ratio

Proprietary Ratio

18

Activity Ratios

19

Activity Ratios

Capital Turnover Ratio

Fixed Assets Turnover Ratio

Working Capital Turnover Ratio

20

Activity Ratios Working Capital

Ratios

Inventory Turnover Ratio

Debtors Turnover Ratio

Creditors Turnover Ratio

21

Profitability Ratios

22

Profitability ratios

From Owners point of view

Based on assets / investments

Based on sales

Based on Capital Market information

23

Profitability ratios from Owners

point of view

Return on Equity

Earnings Per Share

Dividend Per Share

Price Earning Ratio

24

Return on Equity DuPont Model

Dupont Model

Net Profit Margin

Asset Turnover

Equity Multiplier

25

Profitability ratios based on

Assets / Investment

Return on Capital Employed (ROCE) /

Return on Investment (ROI)

Return on Assets

2

26

Profitability ratios based on Sales

Gross Profit Ratio

Operating Profit Ratio

Net Profit Ratio

27

Profitability ratios based on

Capital Market Info

Price Earning Ratio

Yield Ratio

Market Value / Book Value per share

28

Performance Evaluation

29

Financial ratios for Performance Evaluation

1. Liquidity Position

2. Long Term Solvency

3. Operating Efficiency

4. Overall Profitability

5. Inter-firm comparison

6. Financial Ratios for Budgeting

30

Limitations of Ratios

31

Limitations of Financial ratios

Diversified product lines

Financial data are badly distorted by

Inflation

Seasonal factors

32

Lesson Summary

1. We have learnt the meaning, objective and purpose of

ratio analysis

2. We had seen the classification of ratios and discussed

the ratios under various groupings

3. We had reviewed how the financial ratios helps in

performance analysis

4. Finally we went through the limitations of ratio analysis

33

What Next

34

Follow the below Presentations

Ratio Analysis Part 2 - Liquidity Ratios

Ratio Analysis Part 3 Leverage Ratios

Ratio Analysis Part 4 - Activity Ratios

Ratio Analysis Part 5 - Profitability Ratios

35

Thank You

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Shankar Khanal RunningDocumento1 paginaShankar Khanal RunningTrilok KhanalNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- To MananiyaDocumento4 pagineTo MananiyaTrilok KhanalNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- प्रदेशमा हसत्न्तरण भएका ठेक्का विवरणDocumento5 pagineप्रदेशमा हसत्न्तरण भएका ठेक्का विवरणTrilok KhanalNessuna valutazione finora

- Additional Budget Required: TotalDocumento2 pagineAdditional Budget Required: TotalTrilok KhanalNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- E-Ticket: Thank You For Using Esewa Service. Wish For Your Pleasant FlightDocumento2 pagineE-Ticket: Thank You For Using Esewa Service. Wish For Your Pleasant FlightTrilok KhanalNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Pappu Construction Details PDFDocumento1 paginaPappu Construction Details PDFTrilok KhanalNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Fineness Modulus 3.2 and Surface Index 0.782. Also, Compressive Strength of MixtureDocumento1 paginaFineness Modulus 3.2 and Surface Index 0.782. Also, Compressive Strength of MixtureTrilok KhanalNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Sieve Analysis (River Bed Sand) : Fineness Modulus 494.5/100 4.9Documento3 pagineSieve Analysis (River Bed Sand) : Fineness Modulus 494.5/100 4.9Trilok KhanalNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Result and ConclusionDocumento7 pagineResult and ConclusionTrilok KhanalNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Terms of Reference For Hotel BuildingDocumento13 pagineTerms of Reference For Hotel BuildingTrilok Khanal100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Credit Enhancement Research-99Documento106 pagineCredit Enhancement Research-99carmo-netoNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Presentation 08 Mishkin - Econ12eGE - CH07 To TeacherDocumento25 paginePresentation 08 Mishkin - Econ12eGE - CH07 To TeacherKutman PamirovNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Orporations: Share Capital, Retained Earnings, and Financial ReportingDocumento10 pagineOrporations: Share Capital, Retained Earnings, and Financial ReportingkakaoNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- (WWW - Entrance-Exam - Net) - RBI ASS QuanAptitudde SolvedDocumento8 pagine(WWW - Entrance-Exam - Net) - RBI ASS QuanAptitudde SolvedAjay SharmaNessuna valutazione finora

- Group Assignment Questions GB30703 - Set 1Documento2 pagineGroup Assignment Questions GB30703 - Set 1March ClaNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Dissertation Report On Cash Management of Standard Chartered BankDocumento92 pagineDissertation Report On Cash Management of Standard Chartered BankSunil Kumar100% (15)

- Zee Entertainment SELL (Recommendation Downgrade) 20240122Documento13 pagineZee Entertainment SELL (Recommendation Downgrade) 20240122Rohan KhannaNessuna valutazione finora

- Astra Account September 2021Documento119 pagineAstra Account September 2021Risyep HidayatullahNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Rajiv Project On Study On Effectiveness of Employee Role in Service DeliveryDocumento68 pagineRajiv Project On Study On Effectiveness of Employee Role in Service Deliveryrajivranjan1988Nessuna valutazione finora

- DetailsDocumento28 pagineDetailsNeerajNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- C11 HedgingDocumento5 pagineC11 HedgingMary Joy CabilNessuna valutazione finora

- Intermediate Accounting RTP May 20Documento44 pagineIntermediate Accounting RTP May 20Durgadevi BaskaranNessuna valutazione finora

- Monnet Ispat: Performance HighlightsDocumento13 pagineMonnet Ispat: Performance HighlightsAngel BrokingNessuna valutazione finora

- Currency and Interest Rate Swaps: Chapter TenDocumento22 pagineCurrency and Interest Rate Swaps: Chapter TenEvan SwagerNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- RTP June 2018 QnsDocumento14 pagineRTP June 2018 QnsbinuNessuna valutazione finora

- Unit 1Documento16 pagineUnit 1Hari ThapaNessuna valutazione finora

- 2022 - Strategic Management 731 - CA Test 2 Review QuestionsDocumento19 pagine2022 - Strategic Management 731 - CA Test 2 Review QuestionsMaria LettaNessuna valutazione finora

- IDR Equity Fund - FFSDocumento1 paginaIDR Equity Fund - FFSIrene AzaliaNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- EquityDocumento247 pagineEquitySumit GuptaNessuna valutazione finora

- Module 1 FMGT 80Documento41 pagineModule 1 FMGT 80Novel LampitocNessuna valutazione finora

- Module Fs AnalysisDocumento12 pagineModule Fs AnalysisCeejay RoblesNessuna valutazione finora

- Assignment 3Documento2 pagineAssignment 3Lili GuloNessuna valutazione finora

- Aa BcprelimsDocumento4 pagineAa BcprelimsJamie RamosNessuna valutazione finora

- OMWealth OldMutualWealthInvestmentVehiclesOverviewDocumento5 pagineOMWealth OldMutualWealthInvestmentVehiclesOverviewJohn SmithNessuna valutazione finora

- Revised Direct Tax CodeDocumento37 pagineRevised Direct Tax Codepankaj_adv5314Nessuna valutazione finora

- 2016 Bar ExaminationsDocumento37 pagine2016 Bar ExaminationsPingotMagangaNessuna valutazione finora

- Capital Asset Pricing ModelDocumento10 pagineCapital Asset Pricing Modeljackie555Nessuna valutazione finora

- Attachment Summary Sheet - Balance of Payments - FormattedDocumento11 pagineAttachment Summary Sheet - Balance of Payments - FormattedAnshulNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Vilander Carecenters Inc Provides Financing and Capital To The Health CareDocumento1 paginaVilander Carecenters Inc Provides Financing and Capital To The Health CareAmit PandeyNessuna valutazione finora

- 2,950.000 5,554,000,000 Main Board: Industry Sector: Consumer Goods Industry (5) : Industry Sub Sector: Pharmaceuticals (53) Market CapitalizationDocumento10 pagine2,950.000 5,554,000,000 Main Board: Industry Sector: Consumer Goods Industry (5) : Industry Sub Sector: Pharmaceuticals (53) Market CapitalizationMaLiYaaNessuna valutazione finora