Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

400 - 817 Mutual HoldingsExmpl 63B

Caricato da

Zenni T XinTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

400 - 817 Mutual HoldingsExmpl 63B

Caricato da

Zenni T XinCopyright:

Formati disponibili

Dr. M.D.

Chase

Advanced Accounting 817-63B

Long Beach State University

MUTUAL HOLDINGS (AICPA adapted)

Page 1

I. COMPREHENSIVE EXAMPLE: CPA EXAMINATION QUESTION

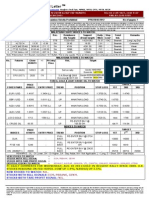

1. On January 1, 19x6, P purchased a controlling interest in S. The trial balances for P and S at 12/31/x6, are shown below:

"P" Company

S Company

Cash..........................

$

37,900

$ 29,050

Marketable securities.........

33,000

18,000

Trade accounts receivable.....

210,000

88,000

Allowance for bad debts.......

[ 6,800]

[ 2,300]

Intercompany recievables......

24,000

Inventories...................

275,000

135,000

Machinery and equipment.......

514,000

279,000

Accumulated depreciation......

[298,200]

[196,700]

Investment in A at cost.......

100,000

Patents.......................

35,000

Dividends payable.............

[ 7,500]

Trade accounts payable........

[195,500]

[174,050]

Intercompany payables.........

[8,000]

Common stock ($10 par)........

[150,000]

Common stock ($ 5 par)........

[ 22,000]

PIC in excess of par..........

[ 36,000]

[ 14,000]

Retained earnings.............

[370,500]

[102,000]

Sales and service.............

[850,000]

[530,000]

Dividend income...............

[ 3,000]

0

Other income..................

[ 9,000]

[ 3,700]

Cost of goods sold............

510,000

374,000

Depreciation expense..........

65,600

11,200

Administrative and selling exp

130,000

_ 110,500

Balance......................

0

0

The following information is also available:

(a) P purchased 1,600 shares of S's outstanding stock on 1/1/19x5, for $48,000, and on 1/1/19x6, purchased an additional 1,400 shares for

$52,000.

(b)An analysis of the stockholder's equity accounts at 12/31/19x5, and 19x4, follows:

P Company

S Company

12/31

12/31

19x5

19x4

19x5

19x5

Common stock, $10 par $150,000

$150,000

Common stock, $ 5 par..

$ 20,000 $ 20,000

PIC in excess of par...

36,000

36,000

10,000

10,000

Retained earnings......

378,000

285,000

112,000

82,000

Totals............

$564,000

$471,000

$142,000 $112,000

(c) S's marketable securities consist of 1,500 shares of "P" common stock purchased on 6/15/x6, in the open market for $18,000. The

securities were purchased as a temporary investment and were sold on 1/15/x7 for $25,000.

(d) --On 12/10/x6, "P" declared a cash dividend of $ .50 per share, payable 1/10/x7, to stockholders of record on 12/20/x6.

--S paid a cash dividend of $1 per share on 6/30/x6.

--S distributed a 10% stock dividend on 9/30/x6; S stock was selling for $15 per share ex-dividend on 9/30/x6.

--S paid no dividends in 19x5.

(e) S sold machinery, with a book value of $4,000 and a remaining life of five years to "P" for $4,800 on 12/31/x6. The gain on the sale

was credited to the other income account.

Dr. M.D. Chase

Advanced Accounting 817-63B

Long Beach State University

MUTUAL HOLDINGS (AICPA adapted)

Page 2

(f) S includes all intercompany receivable and payable accounts in the trade accounts receivable and trade accounts payable accounts.

--During 19x6 the following intercompany sales were made:

"P" to S......................

S to "P"......................

$

$

Net

Sales

78,000

104,000

182,000

Included in "P"

Inventory at

12/31/x6

$

24,300

18,000

$

42,300

"P" sells merchandise to S at cost. S sells merchandise to "P" at the regular selling price to make a normal profit margin of 30%. There

were no intercompany sales in prior years.

1.

2.

3.

4.

Required:

How does "P" account for its investment in S?, how do you know?

Analyze the investment; any excess of cost over book value is to be allocated to a building with a 20-year life.

Prepare the necessary consolidated elimination and adjusting entries. Use the treasury stock method to account for mutual holdings.

Compute Consolidated Net Income; Minority Interest Net Income and Controlling Interest Net Income

Dr. M.D. Chase

Advanced Accounting 817-63B

Long Beach State University

MUTUAL HOLDINGS (AICPA adapted)

Page 3

Solution:

1. How does "P" account for its investment in S?, how do you know?

"P" uses the cost method based on the fact that the account "dividend income" appears in the trial balance, the investment is carried

at cost, unadjusted for equity interest in "S" net income and no other obvious inconsistencies exist.

2. Analyze the investment; any excess of cost over book value is to be allocated to goodwill with a 20-year life.

Investment 1: 1/1/x5

Cost (1,600 of 4,000 shares O/S)....... $

Purchased BV:C/S........

$

20,000

PIC........

10,000

RE.........

82,000

Total SHE $

112,000

% acquired:

16/40

Attributed to Building (20yr life)........... $

48,000

44,800

3,200

Investment 2: 1/1/x6

Cost (1,400 of 4,000 shares O/S).......$ 52,000

Purchased BV:C/S........$ 20,000

PIC........ 10,000

RE......... 112,000

Total SHE $142,000

% acquired:

14/40

49,700

Attributed to Building (20yr life)...........$ 2,300

3. Prepare the necessary consolidated elimination and adjusting entries. Use the treasury stock method to account for mutual holdings.

* Convert to equity method (no conversion necessary on the second investment because this is the year of acquisition; refer to Advanced

Accounting-27 "Purchase Accounting Using the Cost Method")

Investment in S ("P"%)(Change in S RE date of Acq to BOY;(.4)(112,000-82,000)........ 12,000

"P" RE..............................................................................

12,000

** Bring the Retained earnings accounts back to BOY balance: (as there are no dividends accounts, the books have been partially closed

(dividends have been closed to RE; to insure proper allocations to MI, RE should be returned to BOY balance.

Dividends "P" books (15,000)($.5)........................................................ 7,500

Dividends S books (4,000)($1).......................................................... 4,000

"P" RE..............................................................................

7,500

S RE..............................................................................

7,500

A) Eliminate intercompany dividends:

Dividend income (.75)(4,000)($1).........................................................

Dividends (S books)...............................................................

3,000

3,000

Dividends payable (.1)(15,000)($.5)......................................................

750

Dividends ("P" books) ( to correct error on S books)..............................

750

Correct entries on S books would have been:

Dividend declared: Dividend receivable............

750

Dividend income............

750

These entries were not made; therefore the adjustment is as illustrated

NOTE:The intercompany stock dividend requires no adjustment but should note the change in shares owned through a

(refer to Advanced Accounting 51-B)

Memo entry: A 10% stock dividend has increased the number of shares owned by 300 shares (.75)(4,000)(.1)

memo entry

Dr. M.D. Chase

Advanced Accounting 817-63B

Long Beach State University

MUTUAL HOLDINGS (AICPA adapted)

Page 4

B) Eliminate the pro-rata share of the investment account:

S C/S (22,000)(.75)....................................................................

S PIC (14,000)(.75)....................................................................

S RE (102,000 + 4,000)(.75)...........................................................

Investment in S...................................................................

16,500

10,500

79,500

106,500

C) Allocate the excess of cost over bookvalue per analysis of investment:

A/D Building (3,200 investment #1 + 2,300 investment #2)..........

5,500

Investment in S...................................................................

5,500

NOTE: the investment account should be eliminated at this point; if it is not an error is present

D) Amortize the excess of cost over bookvalue per analysis:

"P" RE (3,200/20)(1yr) to adjust RE for past amortizations............

Depreciation expense (3,200/20 + 2,300/20) current year deprec

A/D Building............................................................................

160

275

435

E) Eliminate mutual investment of S in "P" as T/S at cost; short-term so not retired

Treasury stock...........................................................................

18,000

MES (the investment was carried as MES and not as investment in "P")...

18,000

F) Eliminate gain on intercompany sale of depreciable PP&E:

Other income (was not recorded as gain on sale) (4,800 - 4,000)...........

800

Machinery (must be carried at basis of selling affiliate less current deprec 800

G) Eliminate intercompany receivables and payables:

Trade accounts payable ..................................................................

24,000

Intercompany payables (per trial balance)................................................

8,000

Trade accounts receivable...........................................................

Intercompany receivables (per trial balance)........................................

8,000

24,000

H) Eliminate sales of intercompany merchandise at gross:

Sales....................................................................................

Cost of goods sold..................................................................

182,000

I) Eliminate profit in ending inventory:

Cost of goods sold (18,000)(.3)..........................................................

Inventory...........................................................................

182,000

5,400

5,400

4. Compute Consolidated Net Income; Minority Interest Net Income and Controlling Interest Net Income

Per trial balance

[850,000]

[530,000]

[ 3,000]

0

[ 9,000]

[ 3,700]

510,000

374,000

65,600

11,200

130,000

110,500

[153,400]*

[ 38,000]

Adjustments/Eliminations

H 182,000

Sales and service.............

Dividend income...............

Other income..................

F

800

Cost of goods sold............

I

5,400

H [182,000]

Depreciation expense..........

Administrative and selling exp

D

275

Internally generated income.

*

(excludes dividend income)

Consolidated net income..................................................................

To MI (.25)[(38,000 +0 -(800+5,400)]................................................

To Controlling interest: 153,400 +0 -275 +(.75)(38,000 +0 -(800+5,400)..............

Consolidated

Net Income

[ 1,198,000]

[

11,900]

707,400

76,800

240,775

184,925]

7,950

176,975

Potrebbero piacerti anche

- Mini Case 8 and 9 FixDocumento6 pagineMini Case 8 and 9 FixAnisah Nur Imani100% (1)

- Economic Analysis of Indian Construction IndustryDocumento23 pagineEconomic Analysis of Indian Construction Industryaishuroc100% (2)

- Fix Asset&Intangible AssetDocumento7 pagineFix Asset&Intangible AssetAdinda0% (1)

- Intermediate Accounting - MidtermsDocumento9 pagineIntermediate Accounting - MidtermsKim Cristian MaañoNessuna valutazione finora

- 02 - Problem Solutions PDFDocumento20 pagine02 - Problem Solutions PDFadfad15780% (10)

- Jawaban Chapter 16 KeisoDocumento9 pagineJawaban Chapter 16 Keisovica100% (1)

- Practice Question 2Documento2 paginePractice Question 2Prerna AroraNessuna valutazione finora

- Chapter 17 AnswersDocumento5 pagineChapter 17 AnswersJennifer Cooper100% (1)

- Rika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02Documento5 pagineRika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02MARCHO AGUSTANessuna valutazione finora

- PIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsDa EverandPIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsNessuna valutazione finora

- 400 - 515 Lease Review44BDocumento6 pagine400 - 515 Lease Review44BZenni T XinNessuna valutazione finora

- Dr. M.D. Chase Long Beach State University Advanced Accounting-305-16B Purchase: Analysis/Eliminations Page 1Documento4 pagineDr. M.D. Chase Long Beach State University Advanced Accounting-305-16B Purchase: Analysis/Eliminations Page 1Zenni T XinNessuna valutazione finora

- Dr. M.D. Chase Long Beach State University Advanced Accounting 405-32B Interco Transactions-Upstream Sale: Depreciable Asset Page 1Documento2 pagineDr. M.D. Chase Long Beach State University Advanced Accounting 405-32B Interco Transactions-Upstream Sale: Depreciable Asset Page 1Zenni T XinNessuna valutazione finora

- 400 - 221 AVANZADA15Purchase Pooling Comparison Date of Acq 9CDocumento3 pagine400 - 221 AVANZADA15Purchase Pooling Comparison Date of Acq 9Ckarenxiomara7Nessuna valutazione finora

- FIX ASSET&INTANGIBLE ASSET Kel. 10 AKM 1Documento7 pagineFIX ASSET&INTANGIBLE ASSET Kel. 10 AKM 1AdindaNessuna valutazione finora

- Fix Asset Intangible AssetDocumento7 pagineFix Asset Intangible AssetMichelleNessuna valutazione finora

- Prepare in Good Form The 20X9 GAAP Based Statement of RevenuesDocumento1 paginaPrepare in Good Form The 20X9 GAAP Based Statement of Revenuestrilocksp SinghNessuna valutazione finora

- Homework Solutions Chapter 1Documento9 pagineHomework Solutions Chapter 1Evan BruendermanNessuna valutazione finora

- 400 - 812 IntercoTransSubsInvBondsPs 56BDocumento5 pagine400 - 812 IntercoTransSubsInvBondsPs 56BZenni T XinNessuna valutazione finora

- Solution Manual For Financial Accounting in An Economic Context 10th Edition Pratt PetersDocumento37 pagineSolution Manual For Financial Accounting in An Economic Context 10th Edition Pratt PetersLauraEllisrkgp100% (43)

- CH 12Documento8 pagineCH 12Sree Mathi SuntheriNessuna valutazione finora

- Balance Sheet and Statement of Cash FlowsDocumento8 pagineBalance Sheet and Statement of Cash FlowsAntonios FahedNessuna valutazione finora

- Property Plant Equipment: Sukhpreet KaurDocumento79 pagineProperty Plant Equipment: Sukhpreet KaurJeryl AlfantaNessuna valutazione finora

- Dr. M.D. Chase Long Beach State University Advanced Accounting 807-54B Sale of Ownership Interest Page 1Documento5 pagineDr. M.D. Chase Long Beach State University Advanced Accounting 807-54B Sale of Ownership Interest Page 1Zenni T XinNessuna valutazione finora

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocumento1 paginaThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNessuna valutazione finora

- Financial Accounting Canadian 6Th Edition Harrison Solutions Manual Full Chapter PDFDocumento78 pagineFinancial Accounting Canadian 6Th Edition Harrison Solutions Manual Full Chapter PDFlucnathanvuz6hq100% (12)

- Financial Intelligence TrainingDocumento56 pagineFinancial Intelligence Trainingbe_kind4allNessuna valutazione finora

- Selected Transactions Completed by Equinox Products Inc During The FiscalDocumento2 pagineSelected Transactions Completed by Equinox Products Inc During The FiscalAmit PandeyNessuna valutazione finora

- Debt Investments TutorialDocumento4 pagineDebt Investments TutorialRawan YasserNessuna valutazione finora

- Financial Accounting Canadian 6th Edition Harrison Solutions ManualDocumento79 pagineFinancial Accounting Canadian 6th Edition Harrison Solutions Manualpatrickbyrdgxeiwokcnt100% (21)

- Multiple Choice On Cash Flow StatementDocumento7 pagineMultiple Choice On Cash Flow StatementLongtan JingNessuna valutazione finora

- ACCT336 Chapter23 SolutionsDocumento7 pagineACCT336 Chapter23 SolutionskareemrawwadNessuna valutazione finora

- 111Documento7 pagine111haerudinsaniNessuna valutazione finora

- Solutiondone 2-207Documento1 paginaSolutiondone 2-207trilocksp SinghNessuna valutazione finora

- 1 To 111 Thories 1 57Documento34 pagine1 To 111 Thories 1 57Jyasmine Aura V. AgustinNessuna valutazione finora

- Financial Statement AnalysisDocumento18 pagineFinancial Statement AnalysisAprile Margareth HidalgoNessuna valutazione finora

- Additional Solutions - Chapter 15Documento24 pagineAdditional Solutions - Chapter 15maxima0078Nessuna valutazione finora

- Tutorial Test 4 AnswerDocumento5 pagineTutorial Test 4 AnswerHoang Bich Kha NgoNessuna valutazione finora

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Documento5 pagineSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberNessuna valutazione finora

- ch05 ExercisesDocumento13 paginech05 ExercisesTowkirNessuna valutazione finora

- 06 Fischer10e SM Ch06 Final PDFDocumento50 pagine06 Fischer10e SM Ch06 Final PDFvivi anggiNessuna valutazione finora

- Buscom - Module 3Documento10 pagineBuscom - Module 3naddieNessuna valutazione finora

- Cash Flow Statement1Documento2 pagineCash Flow Statement1Mila Mercado0% (1)

- Final Exam AnswerDocumento5 pagineFinal Exam AnswerPham Ngoc AnhNessuna valutazione finora

- Using The Information Provided Here For The Airport Enterprise FundDocumento1 paginaUsing The Information Provided Here For The Airport Enterprise Fundtrilocksp SinghNessuna valutazione finora

- Depa 206Documento7 pagineDepa 206MARISA SYLVIA CAALIMNessuna valutazione finora

- Solutions Chapter 16Documento7 pagineSolutions Chapter 16Kakin WanNessuna valutazione finora

- ABC Manufacturing Entity Sole Trader Has Provided You With TheDocumento1 paginaABC Manufacturing Entity Sole Trader Has Provided You With TheMiroslav GegoskiNessuna valutazione finora

- Quiz 2 - 09.10.18 Set A BDocumento4 pagineQuiz 2 - 09.10.18 Set A BRey Joyce AbuelNessuna valutazione finora

- Lakeland Corporation Year 5 Year 4 Assets: Chapter One - Overview of Financial Statement AnalysisDocumento4 pagineLakeland Corporation Year 5 Year 4 Assets: Chapter One - Overview of Financial Statement AnalysisKHOO TAT SHERN DEXTONNessuna valutazione finora

- Ch23 StudentSolutionsDocumento14 pagineCh23 StudentSolutionsMegan Collins100% (4)

- Financial ManagementDocumento10 pagineFinancial ManagementVratish AryagNessuna valutazione finora

- Chapter 04 SMDocumento86 pagineChapter 04 SMAthena LauNessuna valutazione finora

- Reviewer Acctg 7Documento6 pagineReviewer Acctg 7ezraelydanNessuna valutazione finora

- Ccfylv: Ch. 2 Practice QuizDocumento11 pagineCcfylv: Ch. 2 Practice QuizFrank LovettNessuna valutazione finora

- Ashley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouDocumento1 paginaAshley LTD Is A Manufacturing Firm The Bookkeeper Supplies YouMiroslav GegoskiNessuna valutazione finora

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocumento9 pagineSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your Ownkswb12Nessuna valutazione finora

- At 7Documento9 pagineAt 7Leah Jane Tablante Esguerra100% (1)

- This Study Resource Was: SolutionDocumento5 pagineThis Study Resource Was: SolutionTien NguyenNessuna valutazione finora

- Ch03 SolutionsDocumento8 pagineCh03 SolutionsSeviana VyanaNessuna valutazione finora

- Brief Exercises - Cash FlowDocumento4 pagineBrief Exercises - Cash FlowHannah JoyNessuna valutazione finora

- ACC 410 Exam 2 Spring 2011KEYDocumento8 pagineACC 410 Exam 2 Spring 2011KEYusa4meNessuna valutazione finora

- 400 - 1315 PartnershipLiquidations 89BDocumento5 pagine400 - 1315 PartnershipLiquidations 89BZenni T XinNessuna valutazione finora

- Dr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingDocumento15 pagineDr. M. D. Chase Long Beach State University Advanced Accounting 1510-96B Government and Nonprofit AccountingZenni T XinNessuna valutazione finora

- These Instructions May Result in A Failing GradeDocumento18 pagineThese Instructions May Result in A Failing GradeZenni T XinNessuna valutazione finora

- Dr. M.D. Chase Long Beach State University Advanced Accounting 810-51Cd Special Issues: Changes in Ownership InterestDocumento3 pagineDr. M.D. Chase Long Beach State University Advanced Accounting 810-51Cd Special Issues: Changes in Ownership InterestZenni T XinNessuna valutazione finora

- 400 - 812 IntercoTransSubsInvBondsPs 56BDocumento5 pagine400 - 812 IntercoTransSubsInvBondsPs 56BZenni T XinNessuna valutazione finora

- 400 1005 ForeignCurncyTranslation Transactions 83BDocumento13 pagine400 1005 ForeignCurncyTranslation Transactions 83BZenni T XinNessuna valutazione finora

- 400 - 1305 PartnershipAcctConcepts 87BDocumento9 pagine400 - 1305 PartnershipAcctConcepts 87BZenni T XinNessuna valutazione finora

- 400 705 Special Issues DirectAcq51CaDocumento1 pagina400 705 Special Issues DirectAcq51CaZenni T XinNessuna valutazione finora

- 400 - 815 IndirectMutualHold 61BDocumento1 pagina400 - 815 IndirectMutualHold 61BZenni T XinNessuna valutazione finora

- 400 710 InterCoPS 51CbDocumento3 pagine400 710 InterCoPS 51CbZenni T XinNessuna valutazione finora

- 400 - 610 ConsEPS 72BDocumento6 pagine400 - 610 ConsEPS 72BZenni T XinNessuna valutazione finora

- 400 - 805 ChangesInOwnershipIntrst51cDocumento5 pagine400 - 805 ChangesInOwnershipIntrst51cZenni T XinNessuna valutazione finora

- Dr. M.D. Chase Long Beach State University Advanced Accounting 807-54B Sale of Ownership Interest Page 1Documento5 pagineDr. M.D. Chase Long Beach State University Advanced Accounting 807-54B Sale of Ownership Interest Page 1Zenni T XinNessuna valutazione finora

- Dr. M.D. Chase Long Beach State University Advanced Accounting 510-42B Review Problem With Intercompany Bonds Page 1Documento5 pagineDr. M.D. Chase Long Beach State University Advanced Accounting 510-42B Review Problem With Intercompany Bonds Page 1Zenni T XinNessuna valutazione finora

- Dr. M.D. Chase Long Beach State University Advanced Accounting 520-45B Intercompany Leases:Adjumstments & Eliminations Page 1Documento3 pagineDr. M.D. Chase Long Beach State University Advanced Accounting 520-45B Intercompany Leases:Adjumstments & Eliminations Page 1Zenni T XinNessuna valutazione finora

- 400 - 605 CashFlowReview84Documento9 pagine400 - 605 CashFlowReview84Zenni T XinNessuna valutazione finora

- Dr. M.D. Chase Long Beach State University Advanced Accounting 525-46B Intercompany Leases-Illustrative Examples Page 1Documento8 pagineDr. M.D. Chase Long Beach State University Advanced Accounting 525-46B Intercompany Leases-Illustrative Examples Page 1Zenni T XinNessuna valutazione finora

- 400 - 218 Pooling 90 Percent Test - Equvalant Shares 8CDocumento3 pagine400 - 218 Pooling 90 Percent Test - Equvalant Shares 8CZenni T XinNessuna valutazione finora

- 400 - 310 PurchaseSimpleFullEquity22BDocumento9 pagine400 - 310 PurchaseSimpleFullEquity22BZenni T XinNessuna valutazione finora

- Dr. M.D. Chase Long Beach State University Advanced Accounting-230-15B Recording/Analyzing A Purchase Consolidation Page 1Documento5 pagineDr. M.D. Chase Long Beach State University Advanced Accounting-230-15B Recording/Analyzing A Purchase Consolidation Page 1Zenni T XinNessuna valutazione finora

- Business Valuation Approaches - FULLDocumento12 pagineBusiness Valuation Approaches - FULLGrigoras Alexandru NicolaeNessuna valutazione finora

- Coa MyobDocumento4 pagineCoa Myobalthaf alfadliNessuna valutazione finora

- Multiple Choice Problems 2Documento14 pagineMultiple Choice Problems 2Akira Marantal ValdezNessuna valutazione finora

- Risk in The BoardroomDocumento2 pagineRisk in The BoardroomDwayne BranchNessuna valutazione finora

- Chapter 6 - Accounting For SalesDocumento4 pagineChapter 6 - Accounting For SalesArmanNessuna valutazione finora

- Advanced Finance, Banking and Insurance SamenvattingDocumento50 pagineAdvanced Finance, Banking and Insurance SamenvattingLisa TielemanNessuna valutazione finora

- Investments: Analysis and Behavior: Chapter 18-Options Markets and StrategiesDocumento31 pagineInvestments: Analysis and Behavior: Chapter 18-Options Markets and Strategieshgosai30Nessuna valutazione finora

- PFF226 ModifiedPagIBIGIIEnrollmentForm V03Documento2 paginePFF226 ModifiedPagIBIGIIEnrollmentForm V03Eran LopezNessuna valutazione finora

- Fred Tam News LetterDocumento7 pagineFred Tam News LetterTan Lip SeongNessuna valutazione finora

- The Boston MatrixDocumento13 pagineThe Boston MatrixKeyur BhojakNessuna valutazione finora

- Financial Analysis and ManagementDocumento19 pagineFinancial Analysis and ManagementMohammad AnisuzzamanNessuna valutazione finora

- Info Edge (India) Limited India's Internet Classifieds CompanyDocumento23 pagineInfo Edge (India) Limited India's Internet Classifieds CompanyAbhilashaNessuna valutazione finora

- International MarketingDocumento35 pagineInternational MarketingPinkAlert100% (7)

- OXM Oxford Industries ICR 2017 Investor PresentationDocumento24 pagineOXM Oxford Industries ICR 2017 Investor PresentationAla BasterNessuna valutazione finora

- Hull RMFI3 RD Ed CH 23Documento24 pagineHull RMFI3 RD Ed CH 23gs_waiting_4_uNessuna valutazione finora

- Sudden Death of A Ceo: Death and Succession PlanningDocumento5 pagineSudden Death of A Ceo: Death and Succession PlanningJohn doeNessuna valutazione finora

- Acroynms Capital MarketsDocumento37 pagineAcroynms Capital MarketsAnuj Sharma100% (1)

- Assignment 2Documento4 pagineAssignment 2Muhammad BilalNessuna valutazione finora

- Solved Perry Chandler A Broker With Caveat Emptor LTD Offers FreeDocumento1 paginaSolved Perry Chandler A Broker With Caveat Emptor LTD Offers FreeM Bilal SaleemNessuna valutazione finora

- FM09-CH 27Documento6 pagineFM09-CH 27Kritika SwaminathanNessuna valutazione finora

- Working Capital ManagementDocumento14 pagineWorking Capital ManagementRujuta ShahNessuna valutazione finora

- Indian MFTrackerDocumento1.597 pagineIndian MFTrackerAnkur Mittal100% (1)

- Iron and Steel Industry: Economics AssignmentDocumento10 pagineIron and Steel Industry: Economics Assignmentsamikshya choudhuryNessuna valutazione finora

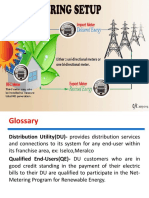

- Solar Net-Metering and Grid Tie SystemDocumento30 pagineSolar Net-Metering and Grid Tie SystemBilly Twaine Palma Fuerte100% (1)

- Unpacking Sourcing Business ModelsDocumento37 pagineUnpacking Sourcing Business ModelsAlan Veeck100% (3)

- Allianz - Behavioral Finance in ActionDocumento36 pagineAllianz - Behavioral Finance in Actionfreemind3682Nessuna valutazione finora

- 05) Money MarketDocumento56 pagine05) Money MarketNaina GoyalNessuna valutazione finora

- Tech EntrepreneurDocumento7 pagineTech EntrepreneurMark Romeo GalvezNessuna valutazione finora