Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tullow October 2014 Overview Presentation

Caricato da

Diego Villagómez DíazCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Tullow October 2014 Overview Presentation

Caricato da

Diego Villagómez DíazCopyright:

Formati disponibili

October 2014 Overview Presentation

Tullow Oil plc

October 2014

October 2014 Overview Presentation

Disclaimer

This presentation contains certain forward-looking statements that are subject to the

usual risk factors and uncertainties associated with the oil and gas exploration and

production business.

Whilst Tullow believes the expectations reflected herein to be reasonable in light of

the information available to them at this time, the actual outcome may be materially

different owing to factors beyond the Groups control or within the Groups control

where, for example, the Group decides on a change of plan or strategy.

The Group undertakes no obligation to revise any such forward-looking statements to

reflect any changes in the Groups expectations or any change in circumstances,

events or the Groups plans and strategy. Accordingly no reliance may be placed on

the figures contained in such forward looking statements.

Slide 2

October 2014 Overview Presentation

OVERVIEW PRESENTATION

October 2014 Overview Presentation

Good progress made during 1H 2014

West Africa

Stable Jubilee production 103,000 bopd

TEN development on time and on budget

Onshore discovery at Igongo in Gabon

East Africa

Kenya discoveries support development plans

MoU signed with Government of Uganda

Project FID targeted for late 2015/early 2016

Corporate

European asset sales progressing well

Balance sheet further strengthened

Strong cash flow maintained

Slide 4

October 2014 Overview Presentation

Delivering on our strategy

Additional cash flow from new production

High Margin

Production

Cash flow

Exploration

and

Appraisal

Monetisation

Options &

Portfolio

Management

Selective

Development

Surplus Cash

Additional

Exploration, Cash

Distribution

Costs &

Dividends

Material cash flow generation and development upside from West Africa

New oil province potential in East Africa delivering significant future resource growth

Industry leading exploration portfolio in Africa and Atlantic Margins

Strong balance sheet provides foundations to deliver long term value to shareholders

Slide 5

October 2014 Overview Presentation

Core West African production on track to meet FY 2014 target

West African production

KENYA

South Lokichar Basin

1H 2014 actual: 63,900 boepd

FY 2014 guidance: 64-68,000 boepd

Development studies underway; single basin has

potential to produce in excess of 100,000 bopd gross.

North Sea production

1H 2014 actual: 14,500 boepd

FY 2014 guidance: 13-14,000 boepd

Basin development

targeting over 200,000

bopd gross production.

Pro rated adjustments to guidance

will be made once sales complete

Ghana Jubilee field

operated oil production

West Africa

non-operated oil production

45

45

40

40

35

35

30

30

kboepd

kboepd

UGANDA

Lake Albert Rift Basin

25

20

GHANA

TEN development

On track for first oil

in mid-2016; FPSO

gross capacity of

80,000 bopd.

25

20

15

15

Mauritania

10

10

Congo (Brazz)

Cte d'Ivoire

Eq Guinea

Gabon

0

2013

Slide 6

1H 2014

2014

2015

Future Development Projects

Countries with ongoing operations

Key oil producing countries

2013

1H 2014

2014

2015

October 2014 Overview Presentation

Industry-leading exploration acreage position

Balanced spread of E&A campaigns provides robust feedstock to sustain Tullows

average annual addition of 200mmboe mean resources

Slide 7

October 2014 Overview Presentation

OVERVIEW PRESENTATION

October 2014 Overview Presentation

Business and funding strategy

Business Strategy

Funding Strategy

Financing Initiatives

Additional cash flow from new production

High

Margin

Production

Cash flow

Exploration

and Appraisal

Fully Funded

Monetisation

Options &

Portfolio

Management

Selective

Development

Debt facilities

Costs &

Dividends

Commercial Bank

Facilities

$3.5bn RBL

$750m RCF ~$500m

EFF

LC Facility

Debt Capital

Markets

Surplus

Cash

Additional

Exploration,

Cash Distribution

2nd $650 million

Corporate Bond

issued 1H14

Operating Cash

Flow

~$0.9bn in 1H14

Portfolio

Management

$2.9bn

Uganda farmdown

Solid cash flow and well funded balance sheet to execute strategy

Slide 9

October 2014 Overview Presentation

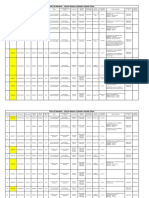

2014 Half-yearly results summary

1H 2014

1H 2013

$1,265m

$1,347m

$673m

$764m

Administrative Expenses

($120m)

($89m)

Loss on disposal

($115m)

Exploration costs written off1

($402m)

($176m)

$36m

$500m

($95m)

$313m

Basic earnings per share

(8.3c)

32.2c

Interim dividend per share

4.0p

4.0p

$1,048m

$804m

$905m

$1,016m

Unchanged as per Sales Revenue above

$2,802m

$1,729m

Headroom of $2.3 billion at end June

Sales revenue

Gross profit

Operating profit

(Loss)/profit after tax

Capital investment2

Cash generated from operations3

Net debt4

Comments

Unchanged from 1H 2013 after adjusting for Bangladesh

asset sale and Gabon production deferral

Contingent consideration & licence payment

1H activity $185m Prior years - $217m

Unchanged

In line with $2.1 billion forecast for FY 2014

Before tax refunds

2013 excludes Spring acquisition and includes Norway capex on an after tax refund basis

3 Before working capital movements

4 Net debt is cash and cash equivalents less financial liabilities

2

Continued solid generation of gross profit and operating cashflow;

loss after tax due to increased exploration write-offs and one-off items

Slide 10

October 2014 Overview Presentation

Net income 1H 2014 v 1H 2013

$m

400

300

2

84

43

27*

55

200

313

100

226

0

107

115

95

Tax

Loss on

disposal

1H 2014

53

-100

1H 2013

Slide 11

Price

Volume

Operating

costs

Other costs Exploration

(*Other cash

(*Other

cash Write-offs

Costs)

costs)

Net Finance

October 2014 Overview Presentation

Sources and uses of funds

Cash inflow $1,672m

Operating cash flow $728m*

$m

2,000

1H 2014 Net cash inflow $59m

(1H 2013:$1,030m*)

Net loan draw down $944m

(1H 2013:$901m)

$944m

1,500

$219m

$161m

Cash outflow $1,613m

Cash Capex $1,196m (1H 2013:Capex $847m)

Acquisitions nil (1H 2013: $393m)

$37m

$1,196m

1,000

Other payments $37m(1H 2013 nil)

Cash tax paid $161m (1H 2013:$291m)

Finance Costs & fees, & Dividends $219m

$728m

500

(1H 2013:$177m)

Net cash inflow $59m

Increase in cash balances

* After working capital,

Cash Inflow

Operating Cash flow

Acquisitions

Slide 12

Cash Outflow

Net loan draw down

Tax

Capex

Finance costs and dividends

October 2014 Overview Presentation

Debt capital structure has evolved in 1H14

Debt maturity profile

Key metrics

$mm

Commitment size

Maturity

$mm

RBL

3,500

Dec 2019

Cash and cash equivalents

Corporate Facility

750

Apr 2017

Debt outstanding

6% Senior Notes

650

Nov 2020

RBL Facilities

6% Senior Notes

650

Apr 2022

EFF 1

~500

Dec 2017

Corporate Facility

EFF

30 June 2014

Senior Notes

$mm

4,000

RBL 2

3,500

3,000

411

1,632

281

1,300

Total debt

3,213

Net debt

2,802

Facility headroom

2,300*

2,000

Corporate

Facility

750

1,000

EFF1

500

1,633

Senior

Notes

650

Senior

Notes

650

281

0

2017

(1)

(2)

2018

2019

2020

Norwegian Exploration Finance Facility

Final maturity; RBL amortises linearly over 2016 2019

2021

2022

RBL remains core facility (development/producing asset

based)

Corporate Facility (further capacity from resources base)

Corporate bonds provide diversification of investor base,

tenor, structure (unsecured) and pricing (fixed rate)

* LC Facility creates $300m additional headroom

Tullow has access to ~$6.0bn of committed debt facilities with current headroom of $2.3bn* and no near term maturities

Slide 13

October 2014 Overview Presentation

2014 capital expenditure

$2.1 billion capex for full year 2014

2014

$720m

2013

$220m

$910m

$2,100m

$1,160m

$209m

$681m

$1,800m

Ghana: Jubilee Phase 1A & TEN developments ($760m)

Kenya: Exploration and appraisal drilling ($310m)

Uganda: Appraisal drilling and development progress

towards FID ($200m)

Other Africa: Maintaining mature production

& high impact exploration ($580m)

ESAA: selected high impact exploration ($220m)

ESAA: Maintaining mature production ($30m)

1H 2014 capital split:

2012

$756m

$378m

$776m

35% Ghana; 90% Africa

$1,870m

$101m

Europe,

S. America

& Asia

$310m

South & East

Africa

0

500

1,000

1,500

2,000

2,500

$million

Expl

App

Notes:

i) 2013 Capital Expenditure excludes the Spring acquisition expenditure

ii) 2013 and 2014 Exploration expenditure is net of Norwegian tax refund

iii) 2011 Capital Expenditure excludes the Nuon and Ghana EO acquisition expenditure.

Slide 14

1H 2014

$1,048m

Dev

$637m

West &

North Africa

October 2014 Overview Presentation

Highlights

Financial performance

Strong Revenue and Cash Flow generation from core West African production

Strong balance sheet

Second successful $650m bond issue, re-financing of $750m corporate RCF plus new $300m LC facility

Portfolio management

Sale of non-core European and Asian assets and ongoing TEN farm-down

Investing for the long term

Solid cash flow and well funded balance sheet to execute strategy

Slide 15

October 2014 Overview Presentation

OVERVIEW PRESENTATION

October 2014 Overview Presentation

Finding oil in 2014

H1 E&A

Outcomes

Commercial

Discovery

Technical

Discovery

Dry Hole

Cost-effective feedstock for value creation

EAST AFRICA

Exploration

Ewoi-1

Emong-1

Amosing-1

Shimela-1

Gardim-1

Etom-1

Twiga-2A

Etuko-2

Agete-2E

Fregate-1

Tapendar-1

Langlitinden-1

Gotama-1

Ngamia-2

Waraga-3

Rii-2

Ngamia-3

Amosing-2A

WEST AFRICA

Exploration

Igongo-1

Appraisal

J-24 LM3

OMOC-601

NORTH ATLANTIC

Exploration

Hanssen-1

Vincent-1

Lupus-1

Heimdalsh

Appraisal

Butch East

Butch SW

Slide 17

Campaign approach hedges annual variability

E&A investment managed to maximise value

Ekunyuk-1

Appraisal

We continue to find our own oil

October 2014 Overview Presentation

2014 YTD Exploration and Appraisal activities

NORWAY - 7 wells

NETHERLANDS - 1 well

Seismic Key

Langlitinden (7222/11-2) Gotama (31/2-21)

Hanssen (7324/7-2)

Butch SW (8/10-6)

Butch East & ST (8/10-5) Lupus (31/10-1)

Heimdalsh (2/9-5)

Vincent (E11-1)

Acquisition

Processing/

Re-processing

MAURITANIA - 2 wells

Multi client survey

Fregate-1 Tapendar-1

Drilling Key

8,666 sq km 3D

3,520 sq km 3D PSTM

4,000 sq km

3D PSTM

950 km 2D PSTM

1,950 km 2D

Offshore

950 km 2D

2,500 sq km 3D PSDM

Onshore

2,000 sq km 3D PSDM

UGANDA - 2 wells

150 km 2D PSTM

Waraga-3 Rii-2

106 sq km 3D

GUYANA

ETHIOPIA - 2 wells

Shimela-1 Gardim-1

200 sq km 3D PSTM

951 km 2D PSTM

KENYA - 11 wells

1,920 sq km 3D PSTM

Amosing-1

Ewoi-1

Etom-1

Ngamia-3

SURINAME

1,285 sq km

3D PSTM

GHANA - 1 well

J-24 LM3

1,730 sq km 3D

1,730 sq km

3D PSTM

Twiga-2 & ST

Ngamia-2

Ekunyuk

Amosing-2A

Emong-1

Agete-2E

Etuko-2 & DST

822 km 2D

416 sq km 3D

822 km

2D PSTM

225 sq km

3D PSTM

NAMIBIA

1,036 km 2D

URUGUAY

1,822 sq km

3D PSTM

GABON - 2 wells

OMOC-601 Igongo-1

3,779 sq km 3D

1,500 sq km 3D PSTM

500 km 2D PSTM

Slide 18

October 2014 Overview Presentation

Campaign approach to finding oil in Africa & the Atlantic

We find oil in Africa & the Atlantic

Value added through

finding our own New Oil

Drilling Out Successful Core Plays & Basins

Exploration Business

Development

Campaigns focus delivery

High success rates in drill out

Feedback to New Ventures

Monetise our finds

Testing Frontier Plays & Basins

Campaigns hedge & phase risks

Adapt to geoscience outcomes

Adapt to business environment

Success every 2-3 years

Some tests will fail

Africa & Atlantic New Frontiers

Big Picture New Concepts

Geological databases

Expertise & knowledge

Business networks

Slide 19

Retired campaigns - for refocus

Overly complex / costly

Sub-economic

Or simply, no oil there

October 2014 Overview Presentation

Balancing investment across the portfolio

We find oil in Africa & the Atlantic

Frontier

1

South Atlantic Margins

Low cost options give exposure to upside

Older turbidites beneath shelf (low cost)

Exploration Business

Development

6

1

Africa & Atlantic New Frontiers

>100 opportunities reviewed p.a.

97% rejected on value basis

Guyanas Margin

New oil basin opened in 2011

Strong portfolio enables value refocus

Central Atlantic Margin

New oil play opened in 2014

Shift to lower-cost material oil plays

Core

4

East African Rift Basins

10 Bbo STOIIP found in 40 Bbo potential

2 new oil rift basins opened 2006 & 2012

Oil province potential in 12+ basin portfolio

North Atlantic Continental Shelf

Hoop oil basin opened in Barents Sea

Near infrastructure exploration

Fiscal incentives encourage exploration

West African Margin

Discovered 4.6 Bboe in place

Near infrastructure exploration

Selective wildcats for elusive next Jubilee

2015 E&A Capex Split

10%

Slide 20

25%

65%

October 2014 Overview Presentation

Shifts of emphasis within exploration portfolio for value

Uruguay

Ghana

Liberia, Sierra Leone

Guyana

Suriname

Gabon

Namibia

Guinea

Netherlands

Uganda

Norway

Ethiopia

Mauritania

Kenya

Madagascar

Higher cost / Lower non-technical risk

Lower cost / Higher non-technical risk

Past Present

Less complex

Planned Wells in 2014/15

Slide 21

October 2014 Overview Presentation

Exploring for high value oil

Higher profitability associated with

higher oil reserve mix

Oil finding principles

100%

Focus on finding high value producible light oil

80%

Oil is multiples more valuable than gas

Oil finding approach

Oil finding focus applied across business

Geophysically, oil harder to find than gas

Proprietary technologies & know-how

Scientific method: idea - test - feedback

Return on net cumulative capital costs, %

Oil is easier to commercialise

High Value Oil

60%

40%

20%

0%

-20%

-40%

Low Value Gas

-60%

Top quartile returns

from oil discoveries

-80%

-100%

0%

20%

40%

60%

80%

100%

Oil as a % of total production

Source: IHS Herold Global Upstream Performance Review: Worldwide (August 2013)

Slide 22

October 2014 Overview Presentation

How we explore: our process works

$600M

Risked upside* Monte Carlo simulation of

Prospect & Lead Inventory (P10 = 4.3 Bbo)

within full potential of plays & basins (6.6 Bbo)

Slide 23

$1,000M

October 2014 Overview Presentation

Cost efficient exploration $3.3/boe (2007-2013)

900

Net Contingent Resources Additions from E&A (mmboe)

800

700

3 core campaigns < $3.3/boe

East African Rift Basins

Potential Kick in

Creaming Curve

East African Rift Basins $1.95/boe

- Investing in a major winner

West African Margin $3.2/boe

- Pioneering done, return to Jubilee NFE

3 core campaigns

< $3.3/boe

600

North Atlantic Margin $2.25/boe

- Capital efficient commercial plays

West African Margin

500

3 frontier campaigns > $3.3/boe

400

300

Guyanas Margin

- Flat-lined at Zaedyus. Suriname kick?

North

Atlantic

Margin

Central Atlantic Margin

- Proven oil basin, shift to low cost plays

200

3 frontier campaigns

> $3.3/boe

100

South Atlantic Margin

- Entry positions near Angola/Brazil

Guyanas Margin

$0 -10

South

Atlantic

Margin

Slide 24

$200

Central

Atlantic

Margin

$400

$600

Retired

Campaigns

$800

$1,000

E&A Investment

$1,200

$1,400

$1,600

October 2014 Overview Presentation

Net contingent resource additions from E&A

900

800

Tullow Net MMboe

700

600

Ekales-1 & Agete-1

200mmboe / year, steady average performance

Strong run of success in Uganda & Ghana

New basins campaigns deliver continuity

Low cost Kenya & Norway extend the trends

60% from onshore, 40% from offshore

Finding cycles; short onshore, long offshore

Twiga-1 & Etuko-1

Ngamia-1

Jobi East-1,

Gunya-A

Jobi-3/4/5

Wisting-1

Nigiri-2

500

400

Enyenra-2A, 3A

Jobi-1, Rii-1

300

Tweneboa-1, 2

Owo-1

200

Mahogany-1,

Hyedua-1

100

East Africa

Atlantic Margins

Mahogany-2 & 3

2007

2008

2009

2010

2011

2012

2013

Success in new basin opening exploration strategy has led to

good prospects for lower finding costs

Uganda at original equities, no uplift from Heritage acquisition

Slide 25

October 2014 Overview Presentation

E&A Highlights

Good progress year to date

Successful Exploration & Appraisal outcomes in first half of 2014, continuing to add value to portfolio

Campaign approach

Campaign approach hedges annual variability, phases risk & focuses delivery

Shift of emphasis

Investment in successful onshore campaigns and lower complexity offshore wells to maximise value

More to come in 2014+

Three basin opening wildcats in Kenya & multiple wells in Norway

Slide 26

October 2014 Overview Presentation

OVERVIEW PRESENTATION

October 2014 Overview Presentation

Core West African production on track to meet FY 2014 target

2014 West African production

1H 2014 actual: 63,900 boepd

FY 2014 guidance: 64-68,000 boepd

TEN development on track

First oil mid-2016

Gross capacity of 80,000 bopd

West Africa

non-operated oil production

45

45

40

40

35

35

30

30

kboepd

kboepd

Ghana Jubilee field

operated oil production

25

20

25

20

15

15

Mauritania

10

10

Congo (Brazz)

Cte d'Ivoire

Eq Guinea

Gabon

0

2013

Slide 28

1H 2014

2014

2015

Future Development Projects

Countries with ongoing operations

Key oil producing countries

2013

1H 2014

2014

2015

October 2014 Overview Presentation

West African production generating strong cash flows

Significant incremental investment activity across

non-operated assets

Strong pre-tax operating cash flow generation across

West African portfolio in 1H 2014

- Pre tax operating cash flow: $916m

2H 2014 ANNUALISED

2,000

1,600

1,400

1,200

$m

1,000

Okume Complex infill drilling; 4 wells

completed with 6-8 further in 2014-16

100% success rate with 4D seismic at

Okume to date resulting in new 4D

survey over Ceiba/Okume planned 1Q

2015.

West & North Africa pre-tax operating cash flow

1,800

Equatorial Guinea

Mauritania

Cte d'Ivoire

Congo (Brazz)

Eq Guinea

Gabon

Ghana

800

600

400

Cte dIvoire

200

Espoir infill drilling commencing 4Q 2014

FY 2011

FY 2012

FY 2013

1H 2014

Regional business with potential to

deliver net 100,000 bopd and generate

~$2.5bn pre-tax operating cashflow

Slide 29

12+ wells to be drilled continuously in 2014-16; 8+

producers and 4 water injectors .

Strong 2014 Gas Sales

Gabon

Tchatamba - Marin and South infill; 4 of 6 wells remaining.

Onal - Maroc Nord Development drilling: in progress with three rigs.

Echira infill; Infill well program consisting of 2 wells completed Q2 2014.

Key producing

areas

October 2014 Overview Presentation

Ghana projects on track to enhance production and cash flow

Ghana gross production profile

Jubilee production on track to meet 2014 FY

250

TEN being developed (80:20 oil:gas)

TEN Upside (45:55 oil:gas)

kboepd *

200

production guidance of 100,000 boepd

- Jubilee 1H 2014 gross production 103,000 bopd

- Onshore gas processing facility expected online

150

in Q4 2014

- Production to be increased to FPSO capacity in

100

2015, subject to gas disposal

Jubilee to be developed

Jubilee Upside

MTA

50

TEN development project on budget and on

track to deliver first oil mid-2016

0

2010

2014

2018

2022

2026

2030

2034 2036

* Excludes Jubilee associated gas; includes TEN gas

JUBILEE OIL

TEN OIL

- $4.9bn budget

- c.30% project completed; c.50% by year end

GAS

- 8 of 10 wells required at startup already drilled

- Facility oil production capacity of 80k bopd

Developing over 2 billion boe of

reserves and resources

Jubilee

Slide 30

TEN

October 2014 Overview Presentation

Potential to increase Jubilee FPSO capacity

FPSO capacity improvements

Oil optimisation

Gas compression

Work

completed

Work

in progress

Work

outstanding

Run down

improvements

Cooling

optimisation

Run down

improvements

Cooling

modifications

Pumps and

exchangers

Debottlenecking

Slide 31

- Constrained by gas export infrastructure

- On track to deliver 100,000 bopd in 2014

FPSO capacity is being upgraded

- FPSO tested at maximum 126,000 bopd

- On completion of FPSO debottlenecking, oil

capacity of c.140,000 bopd

Upgrading

power

capacity

- Gas capacity being increased from 160 mmscfd

to c.180 mmscfd

Good reservoir management will

determine long term production

potential

Scale unit

by-pass

Water injection

CAPACITY

POTENTIAL

Rewheeling

Dehydration

optimisation

Current oil capacity

Oil

125 kbopd

135 kbopd

140 kbopd

Gas

160 mmscfd

170 mmscd

180 mmscfd

Near term opportunities to

increase long-term FPSO capacity

October 2014 Overview Presentation

Visible future growth TEN development overview

Base development case

300 mmboe reserves being developed

24 well development

Gross development capex of $4.9 billion

Leased FPSO, capacity of 80,000 bopd

Mid-2016 start up

10 wells on stream at start up; 7 drilled to date

Plateau production reached by end 2016

c.$4 billion capex spent by First Oil

Post start up

Drill and complete remaining 14 wells by 2018

Initiate export of gas by mid-2017

Focus on delivering upside resources

TEN Gross Development Capex

US$bn

1.6

1.4

1.2

1.0

0.8

0.6

0.4

0.2

-

Well results to date underpin

confidence in resource estimates

2013

Slide 32

2014

2015

2016

2017

2018

October 2014 Overview Presentation

Visible future growth - TEN Project on track

Execution schedule with strategic milestones

2013

ACTIVITY

Q2

General Milestones

Q3

2014

Q4

Q1

Q2

Q3

2015

Q4

Q1

Q2

Q3

2016

Q4

Q1

Q3

Q4

Mobilise 1st URF Vessel to Ghana

All Major Contracts Awarded

Commence In Country Fabrication

EIA Approval (for drilling)

FPSO Ready for Sail-Away

EHS-DSC

EHS-OSC

1st SSXT Available

Drilling & Completion

Q2

10 Wells Complete

Tullow delivery teams staffed

and in place

Final 3D Model Review

All Major POs & Sub-Contracts Awarded

1st Dry Docking Complete

All Modules Complete

Turret Complete/Rotational Test

FPSO Construction

All permits in place for

installation works, beginning

in 2015

Subsea Engineering

All Major POs Placed - URF

URF SPS Connectors Complete

Subsea Procurement

Umbilicals Loaded Out

Subsea Fabrication

Umbilicals / Risers Complete

Subsea Installation

FPSO Installation

FPSO On Station

First Oil

Hook-up & Commission.

Performance Test

Operations

Major contracts awarded to

world-class contractors with

West Africa experience

Early Drilling

FPSO Engineering

FPSO Procurement

Over 2 million man-hours

worked to date

Commissioning

Project progress to date on

track; expect progress to be

c.50% by end of 2014

Project remains on schedule

and within budget

Slide 33

October 2014 Overview Presentation

Non-operated sustaining high margin production

Good technical work has delivered investment opportunities

High return investments compete strongly for capital within

Tullows portfolio

Medium term investment plans sanctioned and under way

High value incremental

investments can sustain

net production around

30,000 boepd to 2020+

Non-operated West Africa net production profile

45,000

Profile at 2006

Production Add

Current Plans

Future Opportunities

40,000

35,000

boepd

30,000

21 production licences

Over 800 active wells

25,000

20,000

15,000

10,000

5,000

0

2006

Slide 34

2010

2014

2018

2022

2025

October 2014 Overview Presentation

Non-operated case study: Gabon

Gabon net production profile

16,000

High value infill drilling has offset decline

14,000

boepd

12,000

Tullow technical influence impacting

10,000

Operator decisions

8,000

6,000

Sputnik, pre-salt exploration opportunity,

4,000

offers material upside potential in 2014

2,000

0

2006

2010

Profile at 2006

2014

Production Add

2018

Current Plans

2022

2025

Future Opportunities

Gabon net capex profile

2006

0

-20,000

2010

2014

2018

2022

2025

c.55

161%

0.57

Wells

per Year

Reserve

Replacement

Average payback

per well

(last 4 years)

(years)

US$ 000

-40,000

-60,000

-80,000

-100,000

-120,000

Slide 35

Strong reserves replacement can

sustain net production >13,000 boepd,

with exploration upside

October 2014 Overview Presentation

Non-operated case study: Equatorial Guinea

Use of 4D seismic data to optimise infill drilling

- First iteration in 2010 (learning ahead of use at

Jubilee & TEN)

- Next campaign planned for late 2014/15 (Ceiba)

Outstanding results achieved on Ceiba

- Initial 20,000 bopd gross flow rate from recent

infill wells

Ongoing drilling activity on Okume Complex

- 10 well programme under way

- 4 future wells on Elon, dependent on 4D data

processing

4D seismic enabling previously unseen

oil to be developed

Slide 36

October 2014 Overview Presentation

Guinea phase of West African Margin Campaign

Targeting the elusive upside of the Jubilee play

Regional geology points to turbidite sands deposited by an ancient delta of the Niger River

Potential scale of opportunity on a par with Ghana

Fatala selected for drilling; 373 mmbo (gross unrisked mean), 974 mmbo (P10), CoS 20%

Further prospects & leads identified; total gross mean risked resources > 350mmbo

Slide 37

October 2014 Overview Presentation

Central Atlantic Margin Campaign

Mauritania Outboard Plays

Mauritania deepwater turbidites (1st phase)

Fregate-1 discovers over 30m light oil & condensate

Commercialisation options under review (high costs)

Follow-up potential of new oil play being high-graded

Campaign break to integrate data

Mauritania Inboard Plays

Mauritania shelf plays (2nd phase)

Cost effective exploration shifts inboard

Rifted margin & carbonate plays

Kibaro prospect; 67 mmbo (gross unrisked mean),

150 mmbo (P10), CoS 24%

Further prospects & leads identified with gross

mean risked resources > 1 Bbo

Slide 38

October 2014 Overview Presentation

OVERVIEW PRESENTATION

October 2014 Overview Presentation

Progressing oil resources towards development in East Africa

Full life cycle regional scale E&P business

Two basins discovered; over 300,000 bopd gross potential

Large yet-to-find from basin opening campaigns

GoU, GoK & partners aligned for earliest possible first oil

Significant progress on Uganda and Kenya upstream

developments and export pipeline

World class asset base early in value cycle

Slide 40

October 2014 Overview Presentation

East Africa Business highlights

Full life cycle regional scale E&P business

Two basins discovered with over 300,000 bopd potential

Large yet-to-find upside from basin opening exploration campaign

Governments and partners aligned for earliest possible first oil

400

Countries

Slide 41

Licences

10+

Years experience

Kenya - Lokichar

Kenya - Additional Basin 1

Kenya - Additional Basin 2

90,000

2.3 Bbo

1 to 5 Bbo

Sq Km

Acreage

Discovered

Resources (Gross)

Risked Yet to Find

Resources (gross)

2043

2042

2041

2040

2040

2039

2038

2037

2036

2035

2034

2033

2032

2031

2030

2030

2029

2028

2027

2026

2025

2024

Uganda - Lake Albert

East Africa Business

2023

2020

2022

2019

2018

2021

200

2020

Gross Production (kbopd)

Good progress on Uganda and Kenya developments including pipeline

October 2014 Overview Presentation

East Africa regional crude oil export pipelines

Regional pipeline agreed

- Governments across region supportive

600 km

Significant progress on technical design

860 km

- Routing and environmental screening completed

- Conceptual design studies completed

- Buried pipeline

- Flow assurance heating technology identified

- Offshore loading system concept designs complete

- Pre-FEED substantially progressed

- Current costs estimated at c.$4.5 bn

Structuring of pipeline companies being addressed

- Tariffs and commercial structures being progressed

Export pipelines will unlock value of regions oil

Slide 42

October 2014 Overview Presentation

Kenya Ethiopia: World-class oil province potential

E&A campaign delivery parallel approach

1. South Lokichar Basin drill-out, appraisal & testing

Discovery of over 600 mmbo Pmean gross resources

Flow tests confirm good productivity

8/9 wildcat wells discover producible oil

Emong-1 discovers oil in tight sands

Etom-1 extends known oil play northwards

Ekosowan-1 to spud Sept 2014

2. Basin testing wildcats

Volcanics encountered in Chew Bahir lacustrine basin

Kodos-1 to test Kerio Central sub-basin in Sept 2014

Epir-1 to test Kerio North sub-basin in Q4 2014

Engomo-1 to test Turkana NW sub-basin in Q4 2014

2015 activity: five more sub-basins to be tested

Eight new sub-basins to be tested in 18 months

Slide 43

October 2014 Overview Presentation

Kenya development plans rapidly advancing

Explore, appraise and develop simultaneously

Exploration and appraisal drill out by end 2015

- 600 mmbo Pmean gross resources discovered to date

Appraisal Area of Interest (AOI) established

Extended well tests being planned

Development plan for discovered resources by end 2015

-

Targeting c.100,000 bopd gross

Social & environmental baseline surveys under way

Parallel basin opening exploration campaign

-

Potential for subsequent development phases

Shortening timeline to first oil

Government aligned on early first oil ambitions

Leveraging Uganda experience to accelerate activities

Targeting end 2015/early 2016 FID

Rapid progress being made towards commercialisation

Slide 44

October 2014 Overview Presentation

Exploring Kenya & Ethiopias significant resource potential

The following basins will be tested in 2014/2015

Spud date

North Kerio Basin: Kodos

Sept 2014

Turkana Central Basin: Epir

4Q 2014

Turkana North Basin: Engomo

4Q 2014

North Lokichar Basin

1H 2015

Kerio Valley Basin

1H 2015

Nyanza Trough

2H 2015

Kerio South Basin

2H 2015

South Omo Basin

2H 2015

Eight basin opening wells to be

drilled by end of 2015

Slide 45

October 2014 Overview Presentation

Focus on driving down Kenya well costs

Kenya well costs

Since 2004

50

Significant savings based on experience

Transferring learnings on well design

and execution across region

Driving down exploration drilling costs

& further reductions targeted

Reducing rig move time and cost

40

Total well costs (US$ million)*

104 exploration and appraisal wells &

sidetracks - 77 as operator

40 wells tested both production & injection

57,700 sq km of FTG surveys all as operator

12,362 km 2D seismic & 2,152 sq km 3D seismic

30

20

10

Ngamia-1

2342m

Paipai

4255m

Twiga-1

3250m

Etuko-1

3100m

Ekales-1

2554m

Agete-1

1930m

Amosing-1

2351m

*Total well cost (excl. Rig move and site preparation)

Tullow most experienced explorer of Tertiary Rift Basins in Africa

Slide 46

Ewoi-1

1911m

Twiga-2

2101m

Emong-1

1394m

October 2014 Overview Presentation

Kenya overview: volumes, maps & cross-sections

Slide 47

October 2014 Overview Presentation

Three basin opening Kenya wells in 2H 2014

Slide 48

North Kerio Basin: Kodos

Drilling

Turkana Central Basin: Epir

4Q 2014

Turkana North Basin: Engomo

4Q 2014

October 2014 Overview Presentation

Shortening appraisal timelines in Kenya

ASSET

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

EA2 Buliisa

Kingfisher

2014

2015

2016

EA1 Buliisa

Kaiso Tonya

Kaiso Tonya

Buliisa

Kingfisher

FID

Uganda

Energy Africa

purchase

Kenya

3D Seismic

Tullow Farm-in

Appraisal, Drilling & Testing

FEED

FDP

Discoveries

Sth. Lokichar

AOI Signed

Milestones

Kenya and Uganda FID can be delivered together by mid-2016

Slide 49

FID

South Lokichar

October 2014 Overview Presentation

Uganda development status

Project definition being finalised

250

Appraisal programme completed

Development costs reduced by 30%

Development plans submitted to GoU ,

remaining EA1 plans to be submitted

between June and December 2014.

Enhanced oil recovery (EOR) being

worked

MoU underpins basis of

development

Gross Production (kbopd)

Kingfisher PL awarded, all EA2 Field

200

200

150

100

50

MoU provides agreement on export

Regional export pipeline being progressed.

Area 1

Area 2

Kingfisher

2043

2042

2041

2040

2039

2038

2037

2040

EOR Additional Recovery

Focus on enhancing project value and regional synergies

Slide 50

2036

2035

2034

2033

2032

2030

2031

2030

2029

2028

2027

2026

2025

2024

2023

2022

2020

2021

2020

2019

2018

pipeline and local refinery initially

30,000 bopd

October 2014 Overview Presentation

Uganda development optimisation and Capex savings

4%

$3bn Capex cost reduction

Reduction in

Facilities Capex

9%

Reduction in

Well & Pad

Costs

16%

c.$8bn

Reduction in

Well & Pad

Numbers

Development optimisation and Capex reduction

programme in 2013/14

Capex reduced from c.$11bn to c.$8bn

- Tullows c.$6/bbl competitive with benchmarks

Further Capex reductions targeted

60% of life of project Capex pre first oil

- Tullows share $1.6 bn at current equity

Current Capex

Estimate

45

40

Wells executed to standardised repeatable designs

35

Well designs minimise pad numbers

30

Purpose built rigs and pads minimise drilling,

completion and rig move times

Facilities costs reduced by redesign of process,

reduction in flowline lengths & sharing of facilities

Further Capex reductions targeted

US$ real/boe

Capex reductions

Onshore Capex per boe benchmark study

25

20

Lake Albert Jan 2013

15

Lake Albert Jun 2014

10

5

0

Other onshore African basins

Slide 51

Source Woodmac

October 2014 Overview Presentation

Next growth frontier exploration examples 2015+

Namibia reachable turbidites

Older turbidites beneath shelf

(low cost)

Oil system established by

Wingat-1 (HRT)

New 3D survey highlights 2015

prospect

Albatross prospect; 422 mmbo

(gross unrisked mean), 1093

mmbo (P10), CoS 17%

Further prospects & leads

identified with gross mean

risked resources > 150 mmbo

Slide 52

October 2014 Overview Presentation

OVERVIEW PRESENTATION

October 2014 Overview Presentation

Near infrastructure & Frontier opportunities in North Atlantic

Barents Sea - Frontier

Major oil finds continue at Wisting prospect cluster

Hassel & Bjaaland target cluster potential up to 500 mmbo

Norwegian Sea - Near Infrastructure

Zumba - Upper Jurassic exciting new syn-rift play

Hagar - Upper Jurassic structural play

North Sea - Near Infrastructure

Heimdalsh - unsuccessfully drilled Upper Jurassic structural play

Rovarkula - Middle & Upper Jurassic structural play

Slide 54

October 2014 Overview Presentation

OVERVIEW PRESENTATION

October 2014 Overview Presentation

Guyanas: extensive Jubilee play potential plus upside plays

Non-operated E&A lacks success after Zaedyus-1, turns to de-risked oil plays and new

attractive lower geo-pressured prospects on Eastern Slope

Regional campaign shifts to operated Suriname venture & to lower-cost shallower plays in

proven oil basin

Slide 56

October 2014 Overview Presentation

Next growth frontier exploration examples 2015

Guyanas Margin

Significant oil charge proven by

Zaedyus-1 (72 m pay)

Industry interest continues to

ramp-up

Commanding acreage spread

with play diversity

Equity being managed to mitigate

exposures

Goliathberg operated prospect in

Suriname; 287 mmbo (gross

unrisked mean), 788 mmbo

(P10), CoS 20%

Further prospects & leads

identified with gross mean risked

resources > 716 mmbo

Slide 57

October 2014 Overview Presentation

OVERVIEW PRESENTATION

October 2014 Overview Presentation

18 month Exploration and Appraisal programme

mmboe

Country

Block

Prospect/Well

Interest

Gross Mean

Net Mean

Spud Date

Arouwe

Sputnik-1

35%

206

72

Imminent

WEST & NORTH AFRICA

Gabon

In addition to our planned exploration wells, Tullows exploratory appraisal drilling in Gabon has a very good track record of replacing reserves and sustaining production.

We expect these exploration wells to add to the success of the 2013 appraisal programme.

Mauritania

C-10

Kibaro/Lamina

59.15% (op)

67 / 85

39 / 52

2H 2015

The Mauritania exploration programme continues with the drilling of Kibaro or Lamina on the shelf area of Block C-10 in 2015.

Ghana

DW Tano

Wawa-2A

49.95% (op)

28

13

2H 2015

Guinea

Guinea Offshore

Fatala

40% (op)

373

149

1H 2015

3D seismic acquired, processed & interpreted over deep water turbiditic Fatala and Sylli prospects. Fatala is estimated to spud between late 2014 and mid 2015, with significant followup prospectivity identified. Once the current issues regarding the licence that were detailed in March 2014 have been resolved a more specific spud date will be confirmed.

Slide 59

October 2014 Overview Presentation

18 month Exploration and Appraisal programme

mmboe

Country

Block

Prospect/Well

Interest

Gross Mean

Net Mean

Spud Date

21

11

Completed

53

26

Q4 2014-2015

35

17

1H 2015

50

25

Q4 2014

North Turkana Basin well

53

26

1H 2015

Amosing-2/2A

13

Completed

Kodos

74

37

In progress

Epir (formally Aze)

55

27

Q4 2014

40

20

In progress

South Kerio Basin well

118

59

1H 2015

Dyepa

54

27

1H 2015

Ngamia appraisal

70

35

On-going

Amosing appraisal

30

15

Q4 2014 - Q1 2015

SOUTH & EAST AFRICA

Etom

13T

Ekales appraisal

50% (op)

Tausi

Engomo (formally Kiboko)

10BA

Kenya

50% (op)

Ekosowan

10BB

50% (op)

12A

Lead 12A-1

65% (op)

41

21

1H 2015

12B

Ahero Lead A

50% (op)

44

22

2H 2015

With over 120 leads and prospects across multiple basins there is significant prospectivity and follow-up potential in this pioneering campaign that has the potential to open up a

significant new oil province in East Africa.

Madagascar

Block 3111

Berenty

100%* (op)

84

2D seismic acquired, processed & interpreted - further seismic being shot in 2014 with Berenty well planned to spud 1H 2015.

*- Tullow has agreed to farm-out 35% to OMV, subject to various approvals being obtained.

Slide 60

84

1H 2015

October 2014 Overview Presentation

18 month Exploration and Appraisal programme

mmboe

Country

Block

Prospect/Well

Interest

Gross Mean

Net Mean

Spud Date

PL 494

Heimdalsh

15%

140

21

Completed

PL 591

Zumba

80% (op)

254

203

1H 2015

PL 642

Hagar

20%

491

98

1H 2015

PL537

Hassel (Wisting East N)

20%

97

19

1H 2015

PL537

Bjaaland (Wisting East South)

20%

147

29

1H 2015

PL626

Rovarkula

30%

36

11

1H 2015

EUROPE, SOUTH AMERICA & ASIA

Norway

Our exploration inventory and campaigns in Norway will continue to be built up through the years ahead, far beyond this current 18 month programme. Tullows exciting Barents Sea

frontier acreage provides transformational new exploration opportunities for opening and extending new plays particularly after the Wisting light oil discovery in 2013. Our Norwegian

Sea and northern North Sea acreage has multiple proven and new plays and prospects close to existing infrastructure for quick monetisation.

Block 31

Spari

30%

246

74

1H 2015

Block 47

Goliathberg-Voltzberg South

100% (op)

287

287

2H 2015

Suriname

3D seismic acquired, processed & interpreted over deep water turbiditic Goliathberg and other prospects in Block 47 with farm-down ongoing, and shallow water turbiditic leads and

prospects in Block 31.

Slide 61

October 2014 Overview Presentation

Download the Tullow Investor Relations and

Media App from the Apple and Android stores:

Follow Tullow on:

Tullow Oil plc

9 Chiswick Park

566 Chiswick High Road

London, W4 5XT

United Kingdom

Tel: +44 (0)20 3249 9000

Fax: +44 (0)20 3249 8801

Email: ir@tullowoil.com

Web: www.tullowoil.com

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Tullow Oil Overview Presentation Sept 2016Documento37 pagineTullow Oil Overview Presentation Sept 2016Diego Villagómez DíazNessuna valutazione finora

- Carta Estratigrfica IUGS - ICS2008Documento1 paginaCarta Estratigrfica IUGS - ICS2008Murilo SantiagoNessuna valutazione finora

- EnergyNewsPremium Nov 2006Documento2 pagineEnergyNewsPremium Nov 2006Diego Villagómez DíazNessuna valutazione finora

- Swing Original Monks Press Kit (English)Documento10 pagineSwing Original Monks Press Kit (English)Diego Villagómez DíazNessuna valutazione finora

- Arculus Et Al 1999 Geochemical Window Into Sub Duct Ion and Accretion Processes Raspas Metamorphic Complex, EcuadorDocumento4 pagineArculus Et Al 1999 Geochemical Window Into Sub Duct Ion and Accretion Processes Raspas Metamorphic Complex, EcuadorDiego Villagómez DíazNessuna valutazione finora

- Colombian Minning Statistical YearbookDocumento76 pagineColombian Minning Statistical YearbookDiego Villagómez DíazNessuna valutazione finora

- Z. Ben-Avraham Nur D. Jones Cox: Continental Accretion: From Oceanic Plateaus To Allochthonous TerranesDocumento9 pagineZ. Ben-Avraham Nur D. Jones Cox: Continental Accretion: From Oceanic Plateaus To Allochthonous TerranesDiego Villagómez DíazNessuna valutazione finora

- Tips On TalksDocumento4 pagineTips On TalksDiego Villagómez DíazNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Orc & Goblins VII - 2000pts - New ABDocumento1 paginaOrc & Goblins VII - 2000pts - New ABDave KnattNessuna valutazione finora

- Kami Export - BuildingtheTranscontinentalRailroadWEBQUESTUsesQRCodes-1Documento3 pagineKami Export - BuildingtheTranscontinentalRailroadWEBQUESTUsesQRCodes-1Anna HattenNessuna valutazione finora

- Reflection Homophone 2Documento3 pagineReflection Homophone 2api-356065858Nessuna valutazione finora

- Propiedades Grado 50 A572Documento2 paginePropiedades Grado 50 A572daniel moreno jassoNessuna valutazione finora

- ConductorsDocumento4 pagineConductorsJohn Carlo BautistaNessuna valutazione finora

- Motor Master 20000 SeriesDocumento56 pagineMotor Master 20000 SeriesArnulfo Lavares100% (1)

- PESO Online Explosives-Returns SystemDocumento1 paginaPESO Online Explosives-Returns Systemgirinandini0% (1)

- Honda Wave Parts Manual enDocumento61 pagineHonda Wave Parts Manual enMurat Kaykun86% (94)

- TheEconomist 2023 04 01Documento297 pagineTheEconomist 2023 04 01Sh FNessuna valutazione finora

- Lifespan Development Canadian 6th Edition Boyd Test BankDocumento57 pagineLifespan Development Canadian 6th Edition Boyd Test Bankshamekascoles2528zNessuna valutazione finora

- CMC Ready ReckonerxlsxDocumento3 pagineCMC Ready ReckonerxlsxShalaniNessuna valutazione finora

- Insider Threat ManagementDocumento48 pagineInsider Threat ManagementPatricia LehmanNessuna valutazione finora

- QueriesDocumento50 pagineQueriesBajji RajinishNessuna valutazione finora

- Evaluating Sources IB Style: Social 20ib Opvl NotesDocumento7 pagineEvaluating Sources IB Style: Social 20ib Opvl NotesRobert ZhangNessuna valutazione finora

- Chem 102 Week 5Documento65 pagineChem 102 Week 5CAILA CACHERONessuna valutazione finora

- Column Array Loudspeaker: Product HighlightsDocumento2 pagineColumn Array Loudspeaker: Product HighlightsTricolor GameplayNessuna valutazione finora

- Resume Template & Cover Letter Bu YoDocumento4 pagineResume Template & Cover Letter Bu YoRifqi MuttaqinNessuna valutazione finora

- Reader's Digest (November 2021)Documento172 pagineReader's Digest (November 2021)Sha MohebNessuna valutazione finora

- GLF550 Normal ChecklistDocumento5 pagineGLF550 Normal ChecklistPetar RadovićNessuna valutazione finora

- Clark DietrichDocumento110 pagineClark Dietrichikirby77Nessuna valutazione finora

- Artist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheDocumento2 pagineArtist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheUy YuiNessuna valutazione finora

- AATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsDocumento3 pagineAATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsAdrian CNessuna valutazione finora

- Rishte ki baat SMS messages collectionDocumento108 pagineRishte ki baat SMS messages collectionTushar AggarwalNessuna valutazione finora

- Casting Procedures and Defects GuideDocumento91 pagineCasting Procedures and Defects GuideJitender Reddy0% (1)

- Guiding Childrens Social Development and Learning 8th Edition Kostelnik Test BankDocumento16 pagineGuiding Childrens Social Development and Learning 8th Edition Kostelnik Test Bankoglepogy5kobgk100% (27)

- Books of AccountsDocumento18 pagineBooks of AccountsFrances Marie TemporalNessuna valutazione finora

- Federal Complaint of Molotov Cocktail Construction at Austin ProtestDocumento8 pagineFederal Complaint of Molotov Cocktail Construction at Austin ProtestAnonymous Pb39klJNessuna valutazione finora

- Analytical Approach To Estimate Feeder AccommodatiDocumento16 pagineAnalytical Approach To Estimate Feeder AccommodatiCleberton ReizNessuna valutazione finora

- Merchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaDocumento29 pagineMerchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaSanghamitra KalitaNessuna valutazione finora