Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Simple Interest and Depreciation Formulas

Caricato da

Bea AbesamisTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Simple Interest and Depreciation Formulas

Caricato da

Bea AbesamisCopyright:

Formati disponibili

Beatrice Amistoso Abesamis

Simple Interest

F=P+ I

I =Pin

F=P(1+)

Remember:

- Default interest is per year.

- Value of m if:

Semi - Annually - 2

Quarterly - 4

Monthly - 12

Daily - 360

Ordinary Simple Interest

- 1 year = 360 days

Exact Simple Interest

One year is:

- 365 days if ordinary year.

- 366 days if leap year.

It is leap year if:

- Divisible by 4

- If it is century year, it must be

divisible by 400.

Compound Interest

F=P(1+i)n

F=P(1+

r mt

)

m

F=P ern

Effective Rate

ER=(1+ i)n1

ER=er 1

Cash Flow Diagram

1. Draw the cash flow diagram.

Lender's Side - F up, P down

Borrower's Side - P up, F down

2. Set the focal point.

3. Equate up = down.

Annuity

[

[

(1+i)n 1

F=A

i

P= A

1(1+i)

i

DeferredAnnuity

P= A

1(1+i)

i

(1+i)k

Perpetuity

P=

A

i

VARIABLES

F = Future Amount

P = Present Amount

I = Interest

i = Interest Rate

n = Number of Years

m = No. of Compounding Years

t = Number of Years

ER = Effective Rate

A = Annuity

k =Number of Years Before

Beatrice Amistoso Abesamis

Depreciation

Straight Line Method

- Simplest Method

d=

C oC n

n

C

( ndismantle)

C o

n

d=

D m=d (m)

d

x 100

Co

C oC n

(1+i ) 1

i

D m=d

k=

2

n

m1

2

n

( )

d m=C o 1

2

n

Sinking Fund Method

- Annuity-like

- Fixed cost for every year

- Sinking Fund Deposit Factor (Just

multiply with Co

d=

Double Declining Balance

Method

- Exactly similar as DBM but k is

2/n.

2

Cm =C o (1 )

n

Cm =C oDm

k=

Dm=C oCm

(1+i ) 1

i

Dm=C oCm

Sum of the Year's Digit Method

ReverseYear=nm+1

Years=

2

n C

=1 n

n

Co

Cm =C oDm

d m=C o Cn

d m=C o (1k )m1 k

ReverseYear

Years

Dm=d 1+ d2

D m=

Declining Balance

Method/Matheson Formula

- Fixed percentage

n(n+1)

2

(RY 1 + RY 2 )

(C oC n )

Years

Cm =C oDm

Service-Output Method

Cm =C o (1k )

k =1

k =1

Cm

Co

Cn

Co

a. Working Hours Method

d n=

Co Cn

H year

Ht

b. Output Method

Beatrice Amistoso Abesamis

d n=

Co Cn

Q year

Qt

VARIABLES

Co = First Cost

Cn = Cost After n Years / Trade-in Value

n = Life of the Property

Dm = Total Depreciation After m Years

i = Interest Rate

k = Rate of Depreciation

Ht = Total No. of Hours

Hyear = No. of Hours for a Certain Year

Qt = Total No. of Output

Qyear = No. of Output for a Certain Year

Beatrice Amistoso Abesamis

Bonds

Decreasing

Total Periodic Expense

A=

( 1+i )n1

i

1( 1+ g ) ( 1+i )

First Price

ig

P = Present Worth of All Cash

Disbursement

I =Fr

A+I

Bond Value

1(1+i)

V n=Fr

i

+C(1+i )

I =Fr

A = Periodic Deposit to the Sinking Fund

Vn = Value of the Bond in n Periods Before

Redemption

F = Face Value

C = Redemption Price/Selling Price

r = Bond rate

I = Interest on the Bond per Period

F = Accumulated Amount, Amount

Needed to Retire the Bond

Gradient

P= A

F=A

[[

] [

]] [[

1( 1+i )n G 1( 1+i )n

n(1+i)n

i

i

i

] ]

n

(1+i)n1

G (1+i) 1

n

i

i

i

Economic Studies

Geometric Gradient

Increasing

P=First Price

1 (1+ g )n ( 1+i )n

ig

Price+ g ( Price )=Next Price

Rate of Return Method

Net Annual Profit

Capital Invested

Beatrice Amistoso Abesamis

*Total Annual Cost

> Expenses + Owner's Salary (If given) +

Depreciation Value (Depreciation is not always

an outcome. It can also be an income.): Use

Sinking Fund and Revenue or Sales.

> When given is in %, multiply by the

investment

>If two are given like the other one is the cost

after n years, use depreciation. If ever that the

cost becomes higher after n years, it will be an

income.

* Investment is also called first cost and

project cost.

* Net Annual Profit = Revenue or Sales - Total

Annual Cost (also means earnings before

income taxes)

Annual Worth Method

Annual Net Savings

Additional Investment

* Payroll taxes are deducted from labor cost.

* Annual Savings = Annual Cost A - Annual

Cost B

* Additional Investment = First Cost A - First

Cost B

* ROR less than interest rate: NO

Annual Cost Method

* Given Percent x Investment

* Product +Total Annual Cost

* Pick the lesser one.

Present Worth Method

*Given Percent x Investment

* Product + Total Annual Cost

* Given Revenue - Sum

* If Negative (Not Justifiable)

* Two different years: Get the multiple.

* Depreciation, Final Year, and First Cost must

be aligned.

Present Worth Method

EUAC

* Inflow: Revenue (P/A,%,n) + Salvage

Value(P/A,%,n)

^ Do this if the given has salvage value.

* Outflow: Investment + Expenses (Total

Annual Cost without Depreciation) (P/A,%,n)

* Inflow - Outflow

Future Worth Method

* Refer to the Present Worth's Cash Flow

Diagram

Payback (Payout) Method

Investment Salvage Value

Net Annual Cash Flo w

*Net Annual Cash Flow = Revenue - Total

Annual Cost without Depreciation

Comparing Alternatives

Rate of Return on Additional

Investment

Annual Cost ( Without Depreciation )+

n

1( 1+ i )

i

Capitalized Cost

Co +

Cost of Renovation A

+

n

i

(1+i ) 1

Depreciation is Given

n

1(1+i)

Co + d

i

Break Even Analysis

P ( x )=FC +[ M ( x ) + L ( x ) +V ( x ) ]

Potrebbero piacerti anche

- Standard Integration FormulasDocumento5 pagineStandard Integration FormulasMika Vernadeth SingNessuna valutazione finora

- Engineering-Economy-40 PRE FINALS EXAM PDFDocumento4 pagineEngineering-Economy-40 PRE FINALS EXAM PDFroyce542Nessuna valutazione finora

- Cyber Exploration Laboratory 2.1Documento9 pagineCyber Exploration Laboratory 2.1Jemuel Vince Delfin100% (1)

- Engineering EconomyDocumento5 pagineEngineering EconomyDayLe Ferrer AbapoNessuna valutazione finora

- Quiz 2 Answers PDFDocumento5 pagineQuiz 2 Answers PDFJohn FerreNessuna valutazione finora

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocumento6 pagineFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNessuna valutazione finora

- Engineering Economy Learning ModulesDocumento20 pagineEngineering Economy Learning ModulesJan Alexis MonsaludNessuna valutazione finora

- BL3B User Manual PDFDocumento142 pagineBL3B User Manual PDFRandy VanegasNessuna valutazione finora

- Calculator Techniques OrigDocumento17 pagineCalculator Techniques OrigAngelica NoquiaoNessuna valutazione finora

- CGL Flame - Proof - MotorsDocumento15 pagineCGL Flame - Proof - MotorspriteshNessuna valutazione finora

- Algebra 1: Multiple ChoiceDocumento1 paginaAlgebra 1: Multiple ChoiceTrina Ritchell AquinoNessuna valutazione finora

- CEERS REVIEW CENTER CALCULATOR TECHNIQUESDocumento17 pagineCEERS REVIEW CENTER CALCULATOR TECHNIQUESCARYL ANN COMPAÑERONessuna valutazione finora

- 021SAACK Burner Operating Instructions PDFDocumento136 pagine021SAACK Burner Operating Instructions PDFmekidmu tadesse100% (1)

- Differential Equations Part 1 ECE Board ExamDocumento8 pagineDifferential Equations Part 1 ECE Board ExamMark M.Nessuna valutazione finora

- A. What Is Balanced/objective Review or Criticism?Documento11 pagineA. What Is Balanced/objective Review or Criticism?Risha Ann CortesNessuna valutazione finora

- Money Time LowDocumento41 pagineMoney Time LowChristian Sunga0% (2)

- Solution of Introduction To Many-Body Quantum Theory in Condensed Matter Physics (H.Bruus & K. Flensberg)Documento54 pagineSolution of Introduction To Many-Body Quantum Theory in Condensed Matter Physics (H.Bruus & K. Flensberg)Calamanciuc Mihai MadalinNessuna valutazione finora

- Gepsuct PDFDocumento16 pagineGepsuct PDFMario RanceNessuna valutazione finora

- Engineering EconomyDocumento266 pagineEngineering EconomyGlaiza Lacson0% (1)

- Calculator Techniques: That Works For CASIO 991 and 570 ES/PLUSDocumento35 pagineCalculator Techniques: That Works For CASIO 991 and 570 ES/PLUSMark Anthony RamosNessuna valutazione finora

- MENSURATION FORMULASDocumento31 pagineMENSURATION FORMULASHanley Keith DiamsinNessuna valutazione finora

- Module 00 Engineering Economics PDFDocumento330 pagineModule 00 Engineering Economics PDFJON EDWARD ABAYANessuna valutazione finora

- Asm Master Oral Notes - As Per New SyllabusDocumento262 pagineAsm Master Oral Notes - As Per New Syllabusshanti prakhar100% (1)

- Engineering Economics Chapter 2Documento41 pagineEngineering Economics Chapter 2Jenalyn MacarilayNessuna valutazione finora

- Dwarf Boas of The Caribbean PDFDocumento5 pagineDwarf Boas of The Caribbean PDFJohn GamesbyNessuna valutazione finora

- Engineering Economy ReviewerDocumento5 pagineEngineering Economy ReviewerBea Abesamis100% (1)

- Engineering Economy Lecture6Documento40 pagineEngineering Economy Lecture6Jaed CaraigNessuna valutazione finora

- Econ 4Documento27 pagineEcon 4Trebob GardayaNessuna valutazione finora

- Engineering EconomyDocumento131 pagineEngineering EconomyAlfredo ManansalaNessuna valutazione finora

- MULTIPLE CHOICE QUESTIONS in ENGINEERING MATHEMATICS by Venancio I. Besavilla, Jr. VOL2Documento31 pagineMULTIPLE CHOICE QUESTIONS in ENGINEERING MATHEMATICS by Venancio I. Besavilla, Jr. VOL2MikmikJojiNessuna valutazione finora

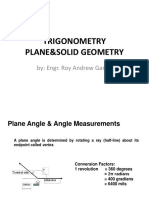

- Trigonometry Plane&Solid Geometry: By: Engr. Roy Andrew GarciaDocumento50 pagineTrigonometry Plane&Solid Geometry: By: Engr. Roy Andrew GarciaEraAlmen100% (1)

- Differential EquationsDocumento19 pagineDifferential EquationsDinah Jane MartinezNessuna valutazione finora

- Engineering Economy Course Student 4Documento27 pagineEngineering Economy Course Student 4Baesl 2000Nessuna valutazione finora

- Engineering Economy 1stDocumento1 paginaEngineering Economy 1stMatthew DavidNessuna valutazione finora

- ANNUITYDocumento27 pagineANNUITYAPPIAH DENNIS OFORINessuna valutazione finora

- Compound Interest FormulaDocumento21 pagineCompound Interest FormulaFrancis De GuzmanNessuna valutazione finora

- Geometric Gradient Series, Finishing Chapter 2Documento17 pagineGeometric Gradient Series, Finishing Chapter 2Shaka Shalahuddin Shantika PutraNessuna valutazione finora

- Chapter 3Documento25 pagineChapter 3abdullah 3mar abou reashaNessuna valutazione finora

- CEE CpE CEE109 Wata UpdateDocumento84 pagineCEE CpE CEE109 Wata UpdateJOYNessuna valutazione finora

- Continuous vs Discrete CompoundingDocumento3 pagineContinuous vs Discrete CompoundingJohnlloyd BarretoNessuna valutazione finora

- MULTIPLE CHOICE QUESTIONS in ENGINEERING MATHEMATICS Besavilla, Jr. VOL1 PDFDocumento122 pagineMULTIPLE CHOICE QUESTIONS in ENGINEERING MATHEMATICS Besavilla, Jr. VOL1 PDFRed RelozaNessuna valutazione finora

- D.C. Machin BaidaDocumento53 pagineD.C. Machin BaidaLeonard ValdezNessuna valutazione finora

- 8 - DepreciationDocumento3 pagine8 - Depreciationjoyce san joseNessuna valutazione finora

- Engineering Economy AccountingDocumento198 pagineEngineering Economy AccountingJericho Dizon TorresNessuna valutazione finora

- Engineering Economy Review: Annuities, Interest, PerpetuitiesDocumento3 pagineEngineering Economy Review: Annuities, Interest, PerpetuitiesTatingJainar0% (1)

- Module 2 - Equilibrium of Rigid BodiesDocumento21 pagineModule 2 - Equilibrium of Rigid BodiesJoyce AsisNessuna valutazione finora

- Engineering Economics - SolutionsDocumento11 pagineEngineering Economics - SolutionsIssacus Youssouf100% (1)

- AnnuityDocumento23 pagineAnnuityCathleen Ann TorrijosNessuna valutazione finora

- ES 10 - Lec 2Documento47 pagineES 10 - Lec 2ebrahim maicomNessuna valutazione finora

- Engineering Economy 2Documento1 paginaEngineering Economy 2Matthew DavidNessuna valutazione finora

- ENGINEERING ECONOMY With ANSWER KEYDocumento14 pagineENGINEERING ECONOMY With ANSWER KEYKAMIKAZINessuna valutazione finora

- First Order Differential Equations ApplicationsDocumento41 pagineFirst Order Differential Equations ApplicationsBob BlohNessuna valutazione finora

- Engineering Economy BP2 Set B With SolutionsDocumento8 pagineEngineering Economy BP2 Set B With SolutionsZach LavineNessuna valutazione finora

- Maxima and Minima Chapter SummaryDocumento6 pagineMaxima and Minima Chapter SummaryAbdul Halil Abdullah100% (1)

- Integration TechniqueDocumento125 pagineIntegration TechniqueShafi NibrajNessuna valutazione finora

- Class X: Chapter - 7 Some Applications To Trigonometry Important Formulas & ConceptsDocumento11 pagineClass X: Chapter - 7 Some Applications To Trigonometry Important Formulas & Conceptsanon_959831687Nessuna valutazione finora

- Students Engineering Economy 2 PDFDocumento9 pagineStudents Engineering Economy 2 PDFMark Jake RodriguezNessuna valutazione finora

- Equation of Value For Ceit-04-501aDocumento9 pagineEquation of Value For Ceit-04-501aAngeli Mae SantosNessuna valutazione finora

- CHAPTER 2 - Presentation - For - TeachersDocumento125 pagineCHAPTER 2 - Presentation - For - TeachersReffisa JiruNessuna valutazione finora

- Basics of Engineering EconomyDocumento26 pagineBasics of Engineering EconomyHady MagedNessuna valutazione finora

- Notes by RK SirDocumento80 pagineNotes by RK SirMriduNessuna valutazione finora

- Lec 8Documento3 pagineLec 8Ahmed ShabanNessuna valutazione finora

- Corporate Finance Chapter 6Documento7 pagineCorporate Finance Chapter 6Razan EidNessuna valutazione finora

- Unit - IiiDocumento45 pagineUnit - IiiAnonymous DQGLUZxHNessuna valutazione finora

- Drawing Sheets, Dimensions, Scale, Line Diagram, Orthographic Projection, Isometric Projection/view, Pictorial Views, and Sectional DrawingDocumento11 pagineDrawing Sheets, Dimensions, Scale, Line Diagram, Orthographic Projection, Isometric Projection/view, Pictorial Views, and Sectional Drawinggyanimahato.4345Nessuna valutazione finora

- Methods of Comparison of Alternatives:: Unit - 3-Engineering Economics and Finance Cash FlowDocumento16 pagineMethods of Comparison of Alternatives:: Unit - 3-Engineering Economics and Finance Cash FlowPoovizhi RajaNessuna valutazione finora

- 3.1.2 Compounding InterestDocumento23 pagine3.1.2 Compounding InterestShaun EdNessuna valutazione finora

- Abesamis and CastilloDocumento2 pagineAbesamis and CastilloBea AbesamisNessuna valutazione finora

- SF AFDocumento1 paginaSF AFBea AbesamisNessuna valutazione finora

- BICTHESDocumento2 pagineBICTHESBea AbesamisNessuna valutazione finora

- Thyristors Are A Broad Classification of Bipolar-Conducting Semiconductor Devices HavingDocumento2 pagineThyristors Are A Broad Classification of Bipolar-Conducting Semiconductor Devices HavingBea AbesamisNessuna valutazione finora

- ConclusionDocumento2 pagineConclusionEdith CastilloNessuna valutazione finora

- Types of SphygmomanometerDocumento2 pagineTypes of SphygmomanometerBea AbesamisNessuna valutazione finora

- InterpretationDocumento3 pagineInterpretationEdith CastilloNessuna valutazione finora

- Eqn - For MergeDocumento1 paginaEqn - For MergeBea AbesamisNessuna valutazione finora

- Antenna Experiment Front Page 2Documento1 paginaAntenna Experiment Front Page 2Bea AbesamisNessuna valutazione finora

- Dsgms DGKJ AbdjDocumento1 paginaDsgms DGKJ AbdjBea AbesamisNessuna valutazione finora

- Eqn - For MergeDocumento1 paginaEqn - For MergeBea AbesamisNessuna valutazione finora

- Ec32fb1 Eval 1410588Documento2 pagineEc32fb1 Eval 1410588Bea AbesamisNessuna valutazione finora

- SongDocumento28 pagineSongBea AbesamisNessuna valutazione finora

- Statics ScreenDocumento1 paginaStatics ScreenBea AbesamisNessuna valutazione finora

- Vector Analysis ReviewerDocumento8 pagineVector Analysis ReviewerBea Abesamis100% (1)

- Earth Day, Amazon Rainforest, Biology Father & MoreDocumento1 paginaEarth Day, Amazon Rainforest, Biology Father & MoreBea AbesamisNessuna valutazione finora

- Safety Management IE 002 (TIP Reviewer)Documento5 pagineSafety Management IE 002 (TIP Reviewer)James LindoNessuna valutazione finora

- Deep Learning Based Eye Gaze Tracking For Automotive Applications An Auto-Keras ApproachDocumento4 pagineDeep Learning Based Eye Gaze Tracking For Automotive Applications An Auto-Keras ApproachVibhor ChaubeyNessuna valutazione finora

- Appendix B, Profitability AnalysisDocumento97 pagineAppendix B, Profitability AnalysisIlya Yasnorina IlyasNessuna valutazione finora

- Sceduling and Maintenance MTP ShutdownDocumento18 pagineSceduling and Maintenance MTP ShutdownAnonymous yODS5VNessuna valutazione finora

- Thinking and Acting Outside The BoxDocumento36 pagineThinking and Acting Outside The BoxMariecris GatlabayanNessuna valutazione finora

- The Quantum Gravity LagrangianDocumento3 pagineThe Quantum Gravity LagrangianNige Cook100% (2)

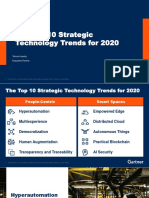

- The Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerDocumento31 pagineThe Top 10 Strategic Technology Trends For 2020: Tomas Huseby Executive PartnerCarlos Stuars Echeandia CastilloNessuna valutazione finora

- Case 1 1 Starbucks Going Global FastDocumento2 pagineCase 1 1 Starbucks Going Global FastBoycie TarcaNessuna valutazione finora

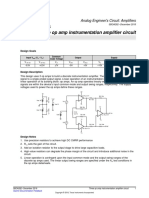

- Opamp TIDocumento5 pagineOpamp TIAmogh Gajaré100% (1)

- Mono - Probiotics - English MONOGRAFIA HEALTH CANADA - 0Documento25 pagineMono - Probiotics - English MONOGRAFIA HEALTH CANADA - 0Farhan aliNessuna valutazione finora

- Lignan & NeolignanDocumento12 pagineLignan & NeolignanUle UleNessuna valutazione finora

- Lay Out New PL Press QltyDocumento68 pagineLay Out New PL Press QltyDadan Hendra KurniawanNessuna valutazione finora

- Cats - CopioniDocumento64 pagineCats - CopioniINES ALIPRANDINessuna valutazione finora

- Evolution BrochureDocumento4 pagineEvolution Brochurelucas28031978Nessuna valutazione finora

- © 2020 Lippincott Advisor Nursing Care Plans For Medical Diagnoses - Coronavirus Disease 2019 (COVID 19) PDFDocumento7 pagine© 2020 Lippincott Advisor Nursing Care Plans For Medical Diagnoses - Coronavirus Disease 2019 (COVID 19) PDFVette Angelikka Dela CruzNessuna valutazione finora

- Priming An Airplane EngineDocumento6 paginePriming An Airplane Enginejmoore4678Nessuna valutazione finora

- Paygilant - Frictionless Fraud PreventionDocumento17 paginePaygilant - Frictionless Fraud PreventionGlobalys LtdNessuna valutazione finora

- 8086 Microprocessor: J Srinivasa Rao Govt Polytechnic Kothagudem KhammamDocumento129 pagine8086 Microprocessor: J Srinivasa Rao Govt Polytechnic Kothagudem KhammamAnonymous J32rzNf6ONessuna valutazione finora

- Working With Session ParametersDocumento10 pagineWorking With Session ParametersyprajuNessuna valutazione finora

- Past Paper Booklet - QPDocumento506 paginePast Paper Booklet - QPMukeshNessuna valutazione finora

- 1 20《经济学家》读译参考Documento62 pagine1 20《经济学家》读译参考xinying94Nessuna valutazione finora

- EGMM - Training Partner MOUDocumento32 pagineEGMM - Training Partner MOUShaik HussainNessuna valutazione finora

- Product Data: T T 13 SEER Single - Packaged Heat Pump R (R - 410A) RefrigerantDocumento36 pagineProduct Data: T T 13 SEER Single - Packaged Heat Pump R (R - 410A) RefrigerantJesus CantuNessuna valutazione finora

- Value Chain AnalysisDocumento4 pagineValue Chain AnalysisnidamahNessuna valutazione finora