Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

EU-Japan Free Trade Agreement

Caricato da

Alina TeodorescuCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

EU-Japan Free Trade Agreement

Caricato da

Alina TeodorescuCopyright:

Formati disponibili

Research Papers N 28

European Post Graduate School of International & Development Studies

EU-Japan Free Trade

Agreement: Factors Influencing

the Future of the Agreement

Sofia Olsson de Koning

2012

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

Table of Content

Abstract ............................................................................................................................................... 3

1.

Introduction................................................................................................................................. 4

1.1 Background ................................................................................................................................ 4

1.2 Research Question..................................................................................................................... 5

1.3 Limitations ................................................................................................................................. 5

1.4 Methodology ............................................................................................................................. 5

2.

Analysis ........................................................................................................................................ 7

2.1 EU-Japan Trade Relations .......................................................................................................... 7

2.2 EU Political & Industry Influences ........................................................................................... 14

2.3 Japan Domestic Factors ........................................................................................................... 19

3.

Conclusion ................................................................................................................................. 25

4.

References ................................................................................................................................. 27

4.1 Written sources ....................................................................................................................... 27

4.2 Presentations........................................................................................................................... 27

4.3 Official documents................................................................................................................... 28

4.4 Websources ............................................................................................................................. 29

4.5 Interviews ................................................................................................................................ 30

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

Abstract

The objective of this paper is to look at the factors influencing the EU-Japan Free Trade

Agreement and which of these factors have real influence on the future of the agreement.

The EU and Japan are two major economies, together making up 44 % of the world GDP1. A

trade agreement between the two parties would boost both economies, create economic

growth and job opportunities and increase export not only between the two parties, but also

globally. As a first step, following the process of establishing a free trade agreement

between the EU and an external partner, a scoping exercise was carried out. The purpose of

this was to list all non-tariff measures and issues to be discussed and tackled during the

negotiations and this exercise was completed in May this year. In July the Commission asked

the Council for mandate to proceed to the negotiations of the agreement.

This paper looks at the three main factors influencing the agreement. Firstly the trade

relations themselves are analyzed, including the non-tariff measures and the distrust on the

European side that the Japanese will actually dismantle these. Secondly the role of the

European institutions is considered, where the Lisbon Treaty has given the European

Parliament enhanced power to ratify any agreement and how this threat of veto gives the EP

power to influence the discussions already from the start. It also looks at the influence of the

European automotive industry and its disproportionate impact on the discussions, especially

through vocal lobbying in the EU. Thirdly the aspect of Japanese domestic politics is studied

and how the politics and business sector in Japan influence the agreement. So far, Japan has

been the demanding party, but with their unstable government and divided bureaucracy,

they could shift their attention to other FTAs that may be of greater importance to them

(TPP and ASEAN). With a strong yen and considerable FDI on the European market the tariff

reduction may have limited impact in reality and although the free trade agreement would

be beneficial for both Europe and Japan, maybe the European economy is in greater need of

the FTA than the Japanese?

E Sunesen J Francois and M Thelle, Assessment of Barriers to Trade and Investment between the EU and

Japan, Copenhagen Economics, Copenhagen, 2009

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

1. Introduction

1.1 Background

The EU and Japan are the largest and the third largest economies in the world. They account

for 33 percent and 11 percent respectively of world GDP, and 17 percent and 6 percent of

world trade2. Japan is EUs 7th most important trading partner and the EU is the third most

important trading partner for Japan after China and the US. Traditionally the trade

relationship has been dominated by strong surpluses on the Japanese side, but it has

recently become more balanced.

In July 1991 a "Joint Declaration on Relations between the European Community and its

Member States and Japan" was signed. Yearly EU-Japan summits were established and at

the 10th EU-Japan Summit held in Brussels in December 2001, a ten-year Action Plan to

reinforce EU-Japan partnership and move it from consultation to joint action, was adopted.

This was an ambitious set of actions covering most economic and political fields. Its objective

was to bring the two parties closer to each other and to work together. Four areas were

identified and actions were listed within each of these four areas: promoting peace and

security, strengthening the economic and trade partnership utilizing the dynamism of

globalization for the benefit of all, coping with global and societal changes and bringing

together people and cultures3.

In reality however, very few of the stipulated actions took place. It can be argued that the

action plan was too ambitious, too widespread and unfocused, but it is also inevitable not to

mention the economic crisis, the collapse of Lehman brothers and the economic bubble

which completely changed the political and economic agenda in both EU and Japan during

the same period, as reasons for the less successful outcome of the 2001 Action Plan.

In May 2011, at the 20th EU-Japan summit in Brussels, the 2001 Action Plan had expired and

both parties agreed to start the negotiations for:

a deep and comprehensive Free Trade Agreement (FTA)/Economic Partnership

Agreement (EPA), addressing all issues of shared interest to both sides including

tariffs, non-tariff measures, services, investment, Intellectual Property Rights,

competition and public procurement; and

a binding agreement, covering political, global and other sectorial cooperation in a

comprehensive manner, and underpinned by their shared commitment to

fundamental values and principles.4

The first step following the process for establishing any EU Free Trade Agreement is a

scoping exercise which sets out to list all issues that need to be tackled during the

negotiations. The scoping exercise prepared for the EU-Japan FTA is the most ambitious ever

2

Sunesen et al, Assessment of Barriers to Trade and Investment between the EU and Japan

European Union Japan Summit Brussels 2001 Shaping our Common Future, An Action Plan for EU-Japan

Cooperation

4

20th EU-Japan Summit, Joint Press Statement 20th EU-Japan Summit Brussels, 28 May 2011 Press

3

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

carried out in EU and together EU and Japan created and agreed roadmaps for how to tackle

identified issues and dismantle listed barriers in the various sectors.

The scoping exercise was finalized in May 2012. In June the same year, the European

Parliament, having recently been given additional power through the Lisbon treaty to ratify

any EU FTAs, passed a resolution asking the Council to delay the negotiations. On the 18th

July 2012 the Commission put forward mandate to the Council asking to start the FTA

negotiations with Japan. They considered the preparations completed and successful, that

there were substantial opportunities linked with a FTA and that EU and Japan were ready to

proceed to the next step.

Before the negotiations of the EU-Japan FTA can officially start, the 27 EU members have to

give their consensus and the Council has to approve the mandate. Currently we are in the

middle of this process.

1.2 Research Question

The objective of this study is to clarify the factors that influence the future of the free trade

agreement between EU and Japan and which of these in reality can impact the outcome.

What are the obstacles to the negotiations and the agreement at this very moment?

Which of these obstacles can be considered most influential and have real impact?

1.3 Limitations

The EU-Japan Free Trade Agreement will contain a free trade agreement and a political

agreement. The aim of the political agreement is to reinforce the values common to the two

major economies, such as democracy, human rights, rule of law, market-based economy and

sustainable development. As mentioned above, at the 20th EU-Japan summit in May 2011

the summit leaders agreed to start the process for the negotiations for a binding agreement,

covering political, global and other sectorial cooperation. They also agreed to enhance

cooperation on issues such as support for Afghanistan, assistance to the Palestinians, nuclear

safety and disaster management5.

Although there may be discussions concerning details in this agreement it is the common

understanding amongst scholars and diplomats on both sides that this agreement will not be

the blocking factor in going forward to sign a comprehensive agreement. Some say that

Japan is only interested in the FTA, but that the political agreement is the price they have to

pay for the free trade agreement and that they will not make a big issue out of this. In order

to focus my study I have therefore decided to look only at the economical part of the

agreement, the free trade agreement, as this is the part where most issues and questions

are raised.

1.4 Methodology

This research is a Master thesis in International Politics and looks at the bilateral relations

between the supranational organization EU and the nation Japan.

5

Ministry of Foreign Affairs Japan: Japan-EU Relations 2011

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

The direction of the study can be considered partially descriptive as the aim is to describe

the current situation of the EU-Japan FTA and the factors likely to influence the outcome,

and partially explaining as I also intend to explain the connection between different factors.

As usually the case in an explaining study I have a few pre-defined, identified factors which

are of central interest for the study. In this case they are the EU political scene, Japanese

domestic politics and the trade relation between the two parties. As a benchmark I will look

at the EU-Korea FTA which was approved in 2009 and effective in 2011 and which is

comparative in the sense that Japan and Korea have similar trade structure with EU,

although the size of the markets is different.

Data gathering has been obtained through written sources, official documents and

interviews with EU and Japanese diplomats and with Japan-EU academic scholars.

After having introduced the background and the subject in the introduction, my analysis

consists of three parts. The first part sets out to describe the trade relations between the EU

and Japan, the result of the scoping exercise, the identified barriers to trade and the

opportunities related with a FTA. The purpose of this section is to establish the context, the

current status and to understand the discussions and the issues at stake.

The second chapter analyzes EUs view on the FTA and the main threats coming from EU

side. The recently adopted Lisbon Treaty has changed the political power between the EU

institutions and given the Parliament stronger influence on the FTA. The biggest opposition

against the FTA in Europe, the European automotive industry, will also be considered and

the relationship and effectiveness of these two influencing factors.

The third chapter looks at Japan as the demanding party of the EPA / FTA and the threats

linked to the Japanese domestic politics and regional market strategies.

Finally in the conclusion I will answer the research question what are the main factors

influencing the EU-Japan FTA and the realistic importance of these.

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

2. Analysis

2.1 EU-Japan Trade Relations

Trade relations between EU and Japan have been characterized by a trade deficit on the

European side and have only become more balanced in recent years. Over the period

2006/2010, EU exports to Japan fell by 0.6% per annum, compared with a rise in global EU

exports of 3.8%. Over the same period Japanese exports to the EU fell by 3.2% per annum,

while global exports from Japan rose by 3.1%.6 This is largely due to macro-economic

developments such as emerging market growth in Asia and Europe, where the markets have

grown faster than the EU and Japans economies. Rapid regional trade integration has also

played a role. Russia and Turkey have become major trading partners of the EU and in Asia,

China and Korea have become Japans most important partners.

Trade and foreign investment

Japan is EUs 7th most important trading partner. Trade in goods with Japan in 2010

accounted for 3.2% of European exports and 4% of imports. These statistics provide an

incomplete picture however as they do not reflect the increased outsourcing of industrial

production to China and other Asian countries.7

Automotive products and chemicals account for nearly a third of EU exports to Japan. Food,

machinery, pharmaceutical, medical devices and textiles account for approximately ten

percent each. The principal EU exports to Japan is medicine, motor cars and pork meat, but

as seen in the picture below EU export spreads across several sectors.

Figure 1: EU exports to Japan are more broadly distributed across sectors

European Commission Staff Working Document Executive Summary of the Impact Assessment Report on EUJapan Trade Relations' Brussels 18.07.2012 {COM(2012) 390} {SWD(2012)209}, page 2

7

Directorate-General for External Policies Policy Department Policy Briefing Trade and economic relations with

Japan: assessing the hurdles to the FTA, DG EXPO/B/PolDep/Note/2012_243

8

Sunesen et al, page 26

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

When looking at the EU imports, automotive and electronic products make up half of the

import from Japan. If including machinery the three sectors account for two thirds of total

export to the EU, with the main products being printers and parts, motor cars and digital

cameras. As can be observed in the figure below, the Japanese export is much more

concentrated to certain sectors than the European export to Japan.

Figure 2: EU imports from Japan are concentrated in a few sectors

Trade in services has expanded in recent years with the balance in favor of the EU. The EU

exports around 20 billion of services to Japan per year, and Japan exports about 14 billion

to the EU. Japans import of services is much below its potential compared to other

countries. Japans import penetration is particularly low in business services and

communications (telecommunication and post) services, where it is the lowest among the

largest economies in the world.10

As a result of the economic crisis, Japanese investment in the EU decreased between 2007

and 2009. Nevertheless, Japan is a major investor in the EU with 5% of the EUs inward FDI

stock originating from Japan. Investment in Europe represents around 22% of Japans total

outward investment.11

About 3370 Japanese companies operate in the EU Member States, of which 705 are

manufacturing companies that generate roughly 400 000 jobs in Europe12. Japanese

multinationals have become an integral part to the EUs manufacturing landscape.

Nevertheless, according to the Commission, in 2010 the EU imported about four times as

many cars as it exported to Japan, making Japan the EUs trade partner with which it has the

largest car trade deficit13. In contrast to the South Korean vehicles, which tend towards the

9

Sunesen et al, page 25

Sunesen et al

11

Directorate-General for External Policies Policy Department, page 12

12

Directorate-General for External Policies Policy Department, page 12

13

P Nelson, The Lisbon Treaty effect: toward a new EJ-Japan economic and trade partnership?, Japan Forum

24:3, 2012, page 345

10

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

low-cost end of the market, the Japanese vehicles are high value added, making them direct

competitors with the EU automotive manufacturers, particularly the German, Italian and

French vehicles. These are fiercely protected by domestic interests and industrial

associations and the European automotive industry is clearly the strongest opponent to the

EU-Japan FTA.

Over the past 20 years, the EU has also invested in Japan, especially in telecommunications,

car manufacturing, retail and insurance. Investment has declined in recent years, and

although the EU remains the second largest investor in Japan after China, foreign direct

investment in Japan is the lowest of all OECD countries and there is a huge potential for

improvement.14

Tariffs and Non-Tariff Measures

Preceding the Scoping Exercise the European Commission ordered a study on the potential

of the EU-Japan FTA and an assessment of the barriers from the consultancy firm

Copenhagen Economics. This report clearly argues that although bilateral trade has a relative

decline, this should not be equated with low economic potential in the trade relationship.

The study shows that there are still significant gains from eliminating tariffs on both sides,

but that most of the potential economic gains reside in the reduction of trade costs

associated with nontariff measures (NTMs). Nontariff measures are not necessarily barriers

to trade. They include all non-tariff and non-quota measures that affect the cost of trade,

such as the regulatory environment, technical regulations and standards and differences in

procedures for conformity assessment. Many of these measures were never intended to be

barriers for international trade, but were simply set up as part of the procedure to regulate

the industry on the domestic market. In Japan, the language is often seen as a barrier for

foreign actors, which is of course not a barrier that can, or should, be eliminated.

In general, both the EU and Japan have low tariffs on goods with an average rate of 3.8% for

both partners. Japan however has more duty-free tariff lines (47.4 % of tariff lines in Japan

compared to 25.8 % in the EU). The weighted tariff protection in Japan for EU exports is

lower than the weighted tariff protection in the EU for Japan exports (1.7 % vs. 3.4%). This is

because EU has tariffs on products with high volumes (such as vehicles), whereas Japans

tariffs are normally in sectors where EU does not export high volumes (i.e. agricultural dairy

products).15

The trade cost of NTMs is not easy to estimate and varies between measurement methods

and data used. The Copenhagen Economics report based its result on survey data from EU

firms operating in Japan and from companies exporting to EU. They conducted the survey in

seven key sectors (automotive, pharmaceuticals, medical devices, processed foods,

transport equipment, telecoms and financial services) to analyze the impact of NTMs and to

estimate the impact of their costs.

14

15

Sunesen et al

Sunesen et al

10

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

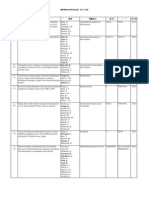

The Copenhagen Economic found a total of 99 NTMs and categorized them per sector, see

figure below. The most important impact of NTMs can be seen in the pharmaceutical

industry, followed by processed food, office and IT equipment and automotive. The

discriminatory NTMs are measures that apply only to foreign firms and these would be

discussed in a FTA and can be solved with trade policy instruments. As seen below these are

not the predominant issues in case of Japan. Most barriers apply to domestic firms as well

and are only solvable with domestic reform, or in combination with domestic reform. They

are non-discriminatory as they apply to Japanese and foreign firms alike, but considering the

nature of the Japanese market and the Japanese customers they do de facto create barriers

to trade on the Japanese market.

Figure 3: Total number of NTM issues grouped by solvability

16

If categorizing the barriers further, it could be seen that out of the 99 barriers, 67 were listed

as Technical Barriers to Trade (TBT). In Automotive, which is the most resistant industry in

the FTA discussions, the TBTs accounted for 8 out of 10 barriers17. Interestingly the most

barriers can be seen in the pharmaceutical industry. Nevertheless the European Federation

of Pharmaceutical Industries and Associations (efpia) is one of the advocators of the FTA as

they see large potential for their stakeholders with the elimination of these barriers18.

Public Procurement

Public procurement is an area which is mentioned as a difficult market to enter for foreign

companies and which will be subject to negotiation under the comprehensive FTA. The

Japanese culture of public procurement is different and the process less transparent than

16

Sunesen et al, page 38

Sunesen et al, page 39

18

European Federation of Pharmaceutical Industries and Associations (efpia) Position Paper The EU-Japan FTA

A key opportunity for the competitiveness of Europes Innovative Pharmaceutical Industry and enhanced

cooperation with Japan

17

11

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

the European. There is however significant potential in opening up the procurement market,

especially in railroad as this is a sector where European companies are market leaders.

During the scoping exercise, barriers were listed and roadmaps were established on how to

dismantle the remaining barriers should the negotiations start.

The Japanese External Trade Organization (JETRO) has already started posting some of the

public procurements in English on their webpage, but one Japanese diplomat pointed out

the fact that although the European bureaucracy has been pushing Japan to open up this

part to the international market, there has been very limited interest from the European

companies. There have been publications issued in English targeting EU companies, but only

Chinese and Korean firms have shown interest so far in the Japanese tendering process19. It

could be argued that there is a discrepancy between what the political side asks for and

what the business side wants in the EU.

Opportunities

The Copenhagen economics report concluded that EU-Japan trade liberalization would

create more trade in total for the two partners. Europes total export to all partners

(globally) would go up by 0.7% in the maximum scenario (0.3% coming from tariff removal

and 0.4% from NTM reductions). Its total import would increase by 0.6%. For Japan, trade

liberalizations would lead to much larger percentage increase due to the sheer size of the

European market. Japans total export would increase by 6.4% (2.5% from tariff removal and

3.9% from NTMs) while its total import would increase with 7.9%. The figure below shows

the total impact the FTA would have on global import and export in EU and Japan

respectively.

Figure 4: Global trade impact for EU and Japan in combined tariff and NTM scenarios

20

Another study conducted by RIETI in 2010 calculated the FTAs impact on EUs real GDP to

0.12%, to be compared to Korea and India for example where the impact would be only

0.07% and 0.09% respectively. The same study shows that the nominal GDP impact would be

5.5 (US$ trillion) compared to 1.0 with Korea and 1.7 with India.21 This study only took into

account tariff reductions and not NTMs.

These studies show that there is a clear underperformance in the bilateral trade and

investment relationship between the two economies which leads to losses in

competitiveness, productivity and welfare.

19

Interview Japanese diplomat, 17/9

Sunesen et al, page 78

21

M Nakatomi, Japans EPA policy and Japan-EU economic partnership Ministry of Economy, Trade and

Industry, March 2012

20

12

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

The European Business council (EBC), representing the interests of 3000 European

companies in Japan spreading over all sectors further stresses the untapped opportunities

on the Japanese markets, for example in medical devices, food and procurement. They point

to the market potential of 127 million homogeneous consumers, the high standard of living

and purchase power, loyal customers, accessibility to the media and well-developed

business support services.22

Different viewpoints

Trade liberalization remains the cheapest way we have to stimulate our economy said

Trade Commissioner Karel De Gucht when presenting the European Commissions proposal

for negotiations with Japan in July. The ball is now in the member states court. I would ask

them to seize this opportunity and give the commission a mandate to start negotiations

soon23. He added that battling the third year of the euro-area dept crisis, Europe cannot

afford to forego the chance for a trade pact with Japan and that a deal could create 400000

extra jobs in Europe. We need these jobs, De Gucht said. Overlooking Japan would be a

serious mistake in our trade strategy24. The Commissions view is that the automotive

industry may not gain from an agreement, but they will also not lose, and that many other

industries have a lot to gain. When looking at the big picture there is a positive outlook for

the European economy and job creation linked with the FTA.

In discussions with both EU and Japanese diplomats both sides agreed that many of the

issues and barriers listed in the Copenhagen economics report and in succeeding scoping

exercise have already been tackled by Japan and a roadmap has been created in each sector

to dismantle the remaining ones. A special task force, the revitalization unit was initiated

by the Japanese government for this purpose25. As mentioned previously in this chapter,

many of the NTMs were never intended as barriers for foreign companies, but are merely a

result of domestic trade and require change in regulations, procedure and sometimes even

culture. The EU has been pressing Japan to give up all of the NTMs first, before discussing

the tariffs, but the Japanese side argues that they cannot remove more NTMs at this point in

time, before the negotiations have even started. This would mean to give up their

negotiation power without knowing if they will get anything in return.26

There are voices of distrust on the European side to whether the Japanese are serious in

their intentions and if they will deliver. This distrust may be rooted in a history of discussions

which have not led to anything substantial. Officials and bureaucrats on EU side who have

been involved in these talks over the years remain skeptical to why Japan would be willing to

change this time when so little has happened until now. Some say that the Japanese

government submission for the scoping exercise was surprisingly poor and one

representative of an EU-Japan industrial organization expressed that the British

government was shocked by the substance in the Japanese part and then the British

government is still positive to the EU-Japan FTA27. To enforce sincerity on EU side and to

calm the worried opposition Trade Commissioner Karel de Gucht issued a statement saying

22

A Murray, Seizing the Opportunity in Japan Why the EU Needs a Trade Agreement with Japan European

Business Council in Japan, 22 September, 2011

23

Bloomberg Businessweek (18/07/2012): EU Regulators Seek Green Light for Japan Free Trade Talks

24

Bloomberg Businessweek (18/07/2012): EU Regulators Seek Green Light for Japan Free Trade Talks

25

Interview Japanese diplomat 17/9/2012

26

Interview Japanese diplomat 17/9/2012

27

Interview 18/9 2012

13

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

that the European Commissions proposal for the negotiating directives includes a provision

clearly stating that if Japan has not delivered on its non-tariff barrier roadmaps within a year

from the start of the negotiations, the negotiations will be stopped28.

The question why it would be different this time is interesting. Japan and EU have been

discussing for decades, there have been white papers issued by industrial associations and

governments, business round-table discussions, regulatory reform dialogue, the Hague

declaration and the EU-Japan Action plan. In summary, there have been endless meetings

between all levels of EU and Japanese players with no major change in the game plan. The

difference this time, argues EBC, is that all these discussions have depended on dialogue and

not negotiation.29 And this is what is imperative in the current discussions. This time it is

about a legally binding, comprehensive agreement which will force all parties to negotiate

with a clear goal, knowing that whatever the outcome is, they will have to stick to it. With

the one condition that the negotiations must be allowed to start, first.

28

29

Tax News (14/06/2012) MEPs Voice Concerns on Possible EU-Japan FTA

A Murray, Seizing the Opportunity in Japan Why the EU Needs a Trade Agreement with Japan

14

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

2.2 EU Political & Industry Influences

Within EU, the severe economic crisis of countries such as Ireland, Portugal and Greece are

affecting other countries as well. The euro crisis of 2011-2012 has meant that EU has

become more pre-occupied with its own affairs and the political agenda has shifted to

domestic issues rather than external affairs. This poses a threat to the FTA discussions with

3rd party in general and to the ongoing EU-Japan discussions in particular.

Another issue affecting European politics is the power shift between the institutions,

following the Lisbon Treaty of 2009. Prior to the entry into force of Lisbon, EU trade policy

was limited to two actors: the European Commission and the Council of Ministers. The

Treaty of Lisbon elevates the powers of the European Parliament (EP) which has been

granted a power of consent in the negotiation process of international trade agreements.

The Commission is now under a legal obligation to report regularly on the progress of

negotiations to the International Trade Committee of the EP (INTA Committee) and must

ensure that the European Parliament shall be immediately and fully informed at all stages

of the procedure.30 The EP now has the hard power of consent in the ratification phase of

the Free Trade Agreements, which in itself is a sufficient threat to give them soft power to

influence the negotiations.

EP as a new influencer in the FTAs with 3rd party has opened up a new point of access for

trade policy lobbyists. The EP represents the interests of the European citizens and

industries and is a force that cannot be neglected.

In the 2006 EU strategy Global Europe Competing in the World; A Contribution to the EUs

Growth and Job Strategy EU states its objective for new generation FTAs which should be

comprehensive and ambitious in coverage31. The FTA between EU and the Republic of Korea

was the first to be concluded between the EU and an Asian strategic partner. Negotiations

were launched in May 2007, installed in October 2009 and closed prior to the entry of force

of the Lisbon Treaty in December 2009. The agreement was signed by the Council in October

2010, when the Lisbon legal framework applied. This meant that the EPs role in the

negotiation phase of the EU-Korea FTA was limited, but the agreement could only be

approved subject to EP ratification. This was the first time the European Parliament

exercised its right to consent a bilateral agreement and the FTA proved to be a test case

where the Parliament wanted to demonstrate its new veto power. The EP influenced by

lobbyist in especially the automotive sector delayed the process significantly and managed

to add safeguard clauses before it gave its final consent to the agreement.32

In the case of the EU-Japan FTA the whole process takes place in a post-Lisbon framework.

The figure below shows the different stages the FTA will go through, starting with a scoping

30

L Richardson, The post-Lisbon Role of the European Parliament in the EUs Common Commercial Policy:

Implications for Bilateral Trade Negotiations, College of Europe Department of EU International Relations and

Diplomacy Studies, EU Diplomacy Paper 05/2012, page 4

31

European Commission External Trade (2006): Global Europe Competing in the World A contribution to the

EUs Growth and Job Strategy

32

L Richardson

15

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

exercise, followed by the mandate which is asked for by the Commission to the Council, and

which is where we currently are in the EU-Japan process. When the mandate has been

approved, the negotiations can start. When the negotiations are completed and a proposal

is drafted, this has to be ratified and finally implemented.

Figure 5: EU FTA process

Whereas the European Parliament legally only has the right to consent or veto the proposal

after the negotiations are completed, the risk of veto remains a threat throughout the

process. With the new directive that the EP should be informed at all stages it further

enforces their power in all steps of the process. Everybody I have spoken to has mentioned

this as a potential delay factor and a risk for the final outcome of the FTA.

The European Parliament is creating its own studies and engaging in meetings and

discussions with its Japanese counterparts. They are continuously asking the Commission for

information sessions and in June this year they passed a resolution asking the Council to

consider their view before accepting to start the negotiations33. It is clear that their strategy

is to become more involved in EU trade policies and to be a major actor within this. This

means that the Commission has lost a degree of autonomy as chief negotiator and must

engage effectively with the EP in order to avoid dissent at the ratification stage. Also the

Council, which has been reluctant to share its powers with the EP, has realized that it cannot

advance without cooperation between both institutions.

The European Parliament is elected by the European people and represents the citizens of

Europe. As such they cannot be neglected. There is criticism within EU however that the

INTA committee still has weak connections with DG Trade and the member states and that

the INTA relays on expertise from DG Trade and concerned industries and industry

representatives instead of their own knowledge34. As such they are vulnerable for lobbying

and not always equipped to make the correct judgments. As elected officials they are further

susceptible to public opinion and to concerns and voices in their member states, especially

when it concerns labor and traditional industries with high emotional effect. There is a risk

that they act in favor of the loudest voices, without considering all interest groups in society

and the best outcome for the European economy.

Automotive

In Europe, the automotive industry with the European Automotive Manufacturers

Association (ACEA) in lead is one of the loudest voices, and the hardest lobbyist against the

FTA. Some member states are also opposing the FTA, and these are in general countries with

considerable automotive production; France, Italy, Spain and Germany. Germany seems to

33

34

Tax News (14/06/2012) MEPs Voice Concerns on Possible EU-Japan FTA

Interview 21/9/2012

16

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

be divided however in the discussions. There is a fear in the automotive industry that

Japanese vehicles would flood the European market steeling market share from European

manufacturers, should the current tariffs of 10% on imported vehicles be removed.

This fear may be exaggerated. Japan has in fact lost a lot its competitive edge because of the

strong yen and the risk of overwhelming import from Japan (with products produced in

Japan) is limited in reality. This issue was raised by both EU and Japanese diplomats during

my interviews. 85% of the cars sold on the EU market are produced in Europe and the single

largest exporter to the EU, Japan, has only 5% of the market35. Japanese auto manufacturers

such as Toyota, Nissan & Honda are already present on the European market and the reason

for this is not purely cost related, there are also benefits in terms of design and products

which are adapted to fit the regional needs. Japanese brands in Europe source 80% of their

parts from local suppliers36 (or Japanese suppliers having localized in Europe) and since

production and local sale in Europe will not be impacted by the free trade agreement the

real impact of the Japanese export would be limited compared to current situation.

If we look at the EU-Korea agreement, where similar fears were raised, it is evident that

Korean import of vehicles has increased, but this increase started already before the FTA

was implemented. The tariff on import from Korea will be reduced over 5-7 years, which

means that the tariff one year after the implementation of the agreement only has been

reduced by maximum 2% and the impact of this is very limited37. The argument of Korean

vehicles flooding the European market is therefore weak, and as in the case of Japan the

main Korean automotive companies, Hyundai and Kia, have their own production sites in

Europe. Two differences can be noted however when comparing with Korea, the first one

being the sheer size of the market and the industry, where Japan has a much bigger impact

than Korea. Secondly Japanese automotive makers have a larger range of products with

more high value models and therefore compete more directly with the European

manufacturers.

Another argument against the FTA raised by the European automotive side is the closeness

and unattractiveness of the Japanese market. Japan has an aging and decreasing population

and according to the Mitsubishi Research Institute, between 2010 and 2020 Japans

domestic market is set to decline by 660,000 units.38 Japanese further tend to buy Japanese,

and although EU car brands are associated with luxury and quality and there is high potential

for future growth, high investments, demanding character of the Japanese customer and

complicated distribution networks make export to the Japanese market challenging.

EU exporters of motor vehicle pay an extra trade cost of 10% according to the Copenhagen

economics survey39, which means that they have a serious disadvantage compared with

Japanese producers. The tariff on Japanese import to EU is 10% and although the relative

gain would be the same on both sides should the tariffs and non-tariffs be eliminated, there

is a distrust on EU side that the non-tariff barriers in Japan will actually disappear.

35

H Makiyama, FTA and the crisis in the European car industry, European Centre for International Political

Economy (ECIPE) Policy Briefs No. 02/2012, page 8

36

H Makiyama, page 8

37

Interview 21/9/2012

38

ACEA (19/07/2012): Auto industry skeptical about benefits of EU/Japan Free Trade Agreement

39

Sunesen et al

17

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

According to the Japanese Automotive Manufacturers Association (JAMA) this issue is top

priority however, and they say they are working in cooperation with ACEA to find potential

solutions for the six auto-related non-tariff issues in Japan identified by ACEA:

1)

2)

3)

4)

5)

6)

Harmonization of standards and certification requirements

Fiscal incentives for eco-friendly vehicles

Kei cars (light vehicles where EU is excluded from the market)

Zoning (procedures for opening service shops)

Pyrotechnic safety devices

High pressure tanks40

JAMA is also working with the government of Japan toward the adoption of the remaining

UN regulations and they maintain that they have already adopted 31 items from the 45

passenger-related items that were listed. In parallel, the government of Japan has submitted

a proposal on the establishment of a common international system for mutual recognition of

whole vehicle type approval (IWVTA)41.

Hosuk Lee Makiyama argues that the crisis in the car industry is not linked to the FTA neither

with Korea nor Japan, but has its root in long-term decline in innovation, competitiveness

and focus on low-profit segments. The crisis was neither caused nor worsened by foreign

imports, whose drop in sales was disproportionate to cars made in the EU writes Makiyama

in a policy brief issued by the European Center for International Political Economy (ECIPE).42

He continues by pointing out that state intervention and subsidies have been

counterproductive and that part of the industry is affected by permanent overcapacities.

Todays crisis in the European automotive industry is not due to a temporary slump in sales

but the result of long-term structural problems. Sales in Europe are still not recovering and

have declined by more than 15% since 2007 and even if consumer demand recovers in the

EU, the income elasticity for the car market is remarkably low (0.4) meaning that car sales

will recover at less than half the rate of the EU economy on average.43 The main problems in

the European car industry argues Makiyama, are lack of demand at home, market

interventions by governments destroying profits, overcapacities in Europe concentrated in

France, Italy and Spain and the variation amongst EU member states in production, valueadded and innovation. Producer subsidies and consumer incentives may artificially uphold

consumer demand for a period of time, and save unemployment from plummeting in

election times, but trying to save all of the jobs in the short term diminishes the chances of

saving them in the long term, as bailouts make them even less efficient. Such efforts steal

resources and market shares from healthy parts of the European industry and spills over into

40

Y Yano, Achieving New Momentum for Enhanced Economic Partnership through and EU-Japan Economic

Integration Agreement Perspective of the Japanese Auto Industry Japan Automobile Manufacturers

th

Association Inc. (JAMA) EU-Japan Seminar in Brussels, 8 March 2012

41

Y Yano

42

H Makiyama, page 1

43

H Makiyama, page 3

18

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

isolationist sentiments in EU trade policy and threatens Europes growth writes

Makiyama.44

Looking at the factors above it is understandable that the European car industry is

concerned and less enthusiastic about a free trade agreement with Japan, but the problems

are not linked to the FTA with Japan and it can be argued that the resistance is

disproportionate to the effects a FTA would have on the European automotive industry. In

view of the whole discussion around the FTA it must also be considered that automotive

export makes out 4% of total export and although it is a sector that employs millions in EU,

the economic relevance in value-added compared with other industries is limited45. In

addition, the European car producers make up over 90% of Japans import and Copenhagen

Economics estimates that European export can increase by 84% with the removal of NTMs

through a FTA. As the EU runs a considerable trade surplus on passenger cars and exports

3.5 times more than it imports46; it should be clear that the only way forward for the

European car market is to open up and tap into overseas markets.

44

H Makiyama, page 7

H Makiyama, page 9

46

H Makiyama, page 10

45

19

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

2.3 Japan Domestic Factors

Japanese trade has always been characterized by strong surplus, and the imbalance in trade

has over the years caused diplomatic issues with trade partners all over the world. With

some crisis-related exceptions, Japan ran trade surpluses for 30 years until 2011, when the

combined deficit of goods and services was -0.8% of GDP (52.3 billion USD).47 This decline

can be attributed to a number of factors, including a sharp appreciation in the yen in 2011

and a disruption in electronics and automobile production as a result of the earthquake in

Japan and floods in Thailand. Exports are expected to recover as a result of slightly weaker

yen and a strong demand from Asia and North America. However, the import bill will also

increase given the considerably increased energy imports, as nuclear power generators

remain halted. The deficit on goods trade balance is expected to diminish in the coming few

years, but the balance in the services sector will remain negative.48

The Japanese industries recovered from the earthquake more quickly than expected. In

2012, industrial output rose, boosted by recovery measures and demand from Asia and

North America. The automotive industry was hit the hardest, but output and new vehicle

sales are rising.

Japanese industries continue to face challenges however, posed by the strong yen,

competition with emerging economies, delays in concluding trade agreements and increased

difficulty in accessing resources, especially rare earths which are of vital importance for its

electronics industry. High corporate taxes, elevated energy prices and the increasing

competitiveness of regional rivals have motivated corporations to move overseas, which

raises concerns about delocalization. There is fear for a massive outflow of key industries

and technologies which normally support growth and employment in the country.

The effort to stem this migration includes improving the business environment, cutting

corporate tax and pushing forward with trade economic partnership agreements, as well as

with public and private initiatives that support innovation and strengthen Japanese

industries.49

Japans FTA Strategy

Pending the conclusion of the multilateral Doha Round, Japan has in the last years engaged

in a number of Economic Partnership Agreements (EPAs) with countries and regions. It has

been a clear strategy of the Japanese government and since the beginning of the previous

decade 13 EPAs have been signed, as can be seen in the figure below. All are secondgeneration free trade agreements (FTAs) that go beyond traditional tariff concessions and

include matters such as trade in services, intellectual property and in certain cases,

investments50. Discussions have been stalled in the case of Australia and Korea and yet a few

47

Directorate-General for External Policies Policy Department, page 6

Directorate-General for External Policies Policy Department page 6

49

Directorate-General for External Policies Policy Department, page 7

50

Directorate-General for External Policies Policy Department, page 9

48

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

are in discussion, among these the most influential once being the Trans Pacific Partnership,

TPP, (including US), ASEAN +3/+6 and the EU-Japan FTA.

Figure 6: Overview of FTAs signed by Japan since 2002 and the content of the agreements

51

The TPP, if achieved, will be a second generation trade agreement also including provisions

on regulatory issues, public procurement, competitiveness and business facilitation,

environment protection and development. It would constitute one of the most advanced

and complete trade agreements ever negotiated.52

Prime Minister Yoshihiko Noda spoke about the FTA strategy in his speech to the Diet in

January 2012 The first and most important strategic activity for this will be our efforts to

take the lead in realizing a free-trade area in the Asia-Pacific region, what is known as the

FTAAP concept, and to create rules for free trade and investment through high-level

economic partnerships. Moving forward with Japan-Republic of Korea (ROK) and JapanAustralia negotiations, and aiming toward the early start of negotiations for wide-area

economic partnerships centering on the Japan-China-ROK relationship or ASEAN, we will

continue to advance consultations with relevant countries toward participating in

negotiations for the Trans-Pacific Partnership agreement, or TPP. At the same time, we will

aim for the early start of negotiations on a Japan-European Union (EU) economic partnership

agreement (EPA) as well53

Japan is engaging in several levels of trade agreement in parallel. There is a risk however that

the negotiations will be challenging. Previously, Japans interest groups (i.e. agricultural and

51

Y Watanabe, Strengthening and Institutionalizing Japan EU Relations: Japans Trade Policy in the Aftermath

of the Disaster Faculty of Policy Management Keio University, Stockholm June 14-15 2012, page 10

52

Directorate-General for External Policies Policy Department page 10

53

M Nakatomi, page 9

21

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

pharmaceutical) have blocked the concessions needed for far reaching trade agreements

and some scholars believe that Japan needs to decide on their strategy, rather than trying to

move forward in all directions at the same time.

Figure 7: Advancing on four levels

54

Domestic Challenges

Japanese domestic politics have been extremely complex over the last two decades. Marie

Sderberg writes in the introduction of the last issue of the Japan Forum that with the

exception of Prime Minister Koizumi Junichiro (2001-2006) there has been a revolving door

for Japans prime ministers: thirteen different people have held the post over the last twenty

years (as of May 2012)55. The Liberal Democratic Party (LDP) which has been in power in

Japan since the mid 1950s with the exception of two non-LDP coalition governments in the

mid 1990s was voted out of power in 2009. The party currently in power, the Democratic

Party of Japan (DPJ), is in the process of learning the difference between being in opposition

and being in government where political promises should be fulfilled. The DPJ does not have

majority in the upper house of the Diet and is therefore further facing difficulties enforcing

its policies.

The difficulty to conclude the negotiations of comprehensive and more strategic agreements

on Japan side lays to a large extent in the fragility of the domestic politics and in the rivalry

and infighting in the bureaucracy. In contrast to the long term planning of the Japanese

corporate world, it can be argued that the Japanese government has a short time view of the

future. Due to the limited term the officials tend to stay in their positions, the government

often acts in order to achieve result on a short term, neglecting the affects the decisions (or

non-decisions) may have in the long run. The short life span of Japanese politicians also gives

more power to the bureaucracy where a constant rivalry between ministries and officials

influence the decision making process.

54

55

Directorate-General for External Policies Policy Department, page 10

M Sderberg, Introduction: where is the EU-Japan relationship heading?, Japan Forum, 24:3 2012, page 251

22

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

The continuous shift in staff and persons in charge further causes problem when discussing

FTAs with 3rd party. The knowledge acquired by one official cannot be 100% passed to the

successor and there is a constant lack of relationship building and continuity between Japan

officials and its counterparts. This was mentioned by both EU and Japan diplomats during my

interviews as a difficulty in the relationship building between EU and Japan56.

The instability of the Japanese government can also be regarded as a difference when

comparing the EU-Japan discussions with the EU-Korea negotiations. The Korean

government was very strongly in favor of an agreement and very unified on all fronts. The

decision making in Korea was clear and straight forward, whereas Japanese politics is

characterized by complex networks involving the government, the bureaucracy and the

industry57. This complexity slows down the decision making process, but it is a process that is

too integrated in the Japanese politics to be likely to change in the near future.

Keidanren & the Japanese Industry

While the political side of Japan is turbulent and changing, the business sector remains more

stable and the two sectors are closely interlinked. The Japanese government has a huge

budget deficit to tackle, but there are many strong businesses and companies in Japan and

through the main network Keidanren they have considerable impact on Japanese politics,

especially in the economic policy making.

Keidanren represents the big industry in Japan, but also SMEs, and it can be considered as

the main voice of Japanese companies. Established in 1946, it is Japans peak employers

association under which industry associations from sector specific (e.g. electronics) to

product specific (e.g. computers) associations are organized. Japans zaikai, or top business

associations, consisting of Keidanren together with three others, represents the interests of

the economy as a whole58. Keidanren has been closely tied to particularly the Liberal

Democratic Party (LDP). Despite appearing to be one party, the LDP was riddled with

factional alliances with the head of each faction striving to become the head of the party and

thus prime minister. The competitiveness within the LDP and the long term in power allowed

for patterns of communication and accepted practices among interest groups to develop.

These networks and ties cut across the bureaucracy and the private/semi-private

organizations, including Keidanren.59

Patricia Nelson highlights the fact that Japan has a tendency to place business policy before

political and social policy, while the EU tends to place political and social policy before

business policy. These different approaches are grounded in the evolution of each system,

including the notion of Japan, Inc. and, in the EU case, the Lisbon Treaty, she writes in the

56

Interview

Interview

58

P Nelson: Anachronistic Icons? Business Institutions in the Japanese Variant of Capitalism,

http://hhs.academia.edu/PatriciaNelson/Papers/1794602/Anachronistic_Icons_Business_Institutions_in_the_J

apanese_Variant_of_Capitalism

59

P Nelson, Anachronistic Icons? Business Institutions in the Japanese Variant of Capitalism, page 6

57

23

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

latest issue of Japan Forum60 and this may explain why the business sector is the loudest

voice in the FTA discussion in Japan.

Keidanren has been the strongest advocator for an EU-Japan FTA as its stakeholders see

substantial benefits with an agreement. With the EU-Korea agreement coming into effect in

July 2011 the pressure from Keidanren increased. The EU-Korea FTA gives the Korean

companies an advantage in tariff reduction. Over 5-7 years the tariffs on personal vehicles

will be reduced from 10% to zero and in the small car segment where Korea and Japan are

direct competitors this gives Korea an important advantage. Also the electronic sector is in a

similar situation.

In April this year, the chairman of Keidanren Hiromasa Yonekura wrote a letter to the

European political and business leaders, calling for negotiations on an EU-Japan FTA/EPA to

start as soon as possible. In the letter he addresses harmonization and mutual recognition of

regulations, standards and conformity assessment procedures that could be applied to third

country markets as the top challenges. As the center of gravity of the global economy shifts

to the east, it is imperative for the EU and Japan, which share such basic values as

democracy, rule of law and a commitment to the market economy to take the lead in making

business rules and setting standards for goods and services, and to join forces to have

emerging economies on board with us61, says Yonekura in the letter, pointing out the

importance of a comprehensive and ambitious EU-Japan FTA. He further emphasizes Japan

as the third largest economy in the world and a strategic partner in Asia for Europe.

The EU market is important to Japan, but with the current crisis and decline of the European

economy, there are other regions which have greater attraction for the Japanese industry.

The graph below shows the increase in trade over 10 years (from 1998-2008) with EU and

Asia respectively and it is clear that Asia has become a more important trade partner. The

risk if the EU-Japan negotiations stall for too long is that Keidanren will lose interest and

focus its effort on TPP and Asian agreements instead, such as ASEAN +3 and ASEAN +6. China

and the US are already the largest trade partners for Japan and their markets have more

potential for future growth than the European market.

Figure 8: Rapid increase in Japans trade with East Asian partners

60

62

P Nelson, The Lisbon Treaty effect: toward a new EU-Japan economic and trade partnership?, page 362

http://www.keidanren.or.jp/en/policy/2012/026.html(2012)

62

Sunesen et al, page 24

61

24

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

There are also divisions in the bureaucracy in Japan and while Keidanren and the ministry of

Trade remain supportive of the FTA, other ministries are more reluctant. The ministry of

agriculture has strongly opposed the TPP and the Australian FTA63. It has been less vocal in

the EU-Japan FTA discussions, but it also has not spoken out in favor of the agreement.

Agricultural issues, especially Japanese rice, remain sensitive in Japan and strongly affects

the public opinion, and in its turn the elected politicians. Also the pharmaceutical industry

has been expressing doubts about the benefits of an EU-Japan agreement for its sector.

Having said this, a Japanese diplomat meant that there is still a strong argument for Japan

and the Japanese industry to support and push for negotiations between EU and Japan and

this is the issue of standards and regulations, which was also raised by Keidanren as a main

incentive for the EU-Japan FTA. EU and Japan have similar outlook on global standards both

in the economic and political field and by creating a strong EU-Japan alliance, with defined

standards and regulations, this would force China and other emerging markets to adopt

these standards, especially if US would also abide to the common practices. China poses a

big threat to Japan and therefore this is an important factor in the discussions.

The gap between seeing the strategic incentive in agreeing and implementing common

standards and regulations and actually practically agree on the detailed issue in each

industry is however large. Each party has its own industry standard and is reluctant to

change. In newer industries this has proven much easier however and Japan and EU have for

example been able to set common standards for ecological food. Going forward with the

agreement would require strong leadership and commitment from Keidanren and the

Japanese External Trade Office (JETRO) to put theory into practice in opening up the market,

dismantling barriers and agree standards and regulations.

63

Interview

25

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

3. Conclusion

EU and Japan are the first and third largest markets in the world and together they make up

44% of the world GDP.64 A trade agreement between these two major economies is likely to

bring substantial economic growth on both sides and be beneficial for both economies. The

EU and Japan are both suffering from challenging economic situations and a trade

agreement that could boost economy and create more jobs should be a welcome message in

times of crisis. Reality is different however, and with different interest groups raising their

voices pro and con the agreement it will be a challenge for the Commission to get the

mandate they have asked the Council to approve, and proceed to negotiations.

Pharmaceutical and public procurement may be sectors with the biggest potential for

European companies on the Japanese market, whereas automotive and electronics remain

the sectors of most interest for the Japanese industry in Europe. Japan is perceived as a very

closed and protected market, but reality shows that most of the so called barriers are

technical barriers or linked to cultural factors and not targeted foreign companies

specifically. EU and Japan have listed all remaining barriers and created roadmaps on how to

tackle and dismantle these once the negotiations have started. There is distrust however,

among EU member states and officials that these barriers will actually be dismantle and this

distrust is rooted in a history of negotiations and discussions which have not led anywhere.

This time though, for the first time, the EU and Japan are going to negotiate a binding

agreement, Japan seems to make a serious effort to dismantle the NTMs listed in the

scoping exercise and the EU has been clear in its message that if the barriers are not tackled,

the negotiations will stop.

I would argue that the perception of Japan as a closed and difficult market, together with the

de facto identified barriers and the distrust in the Japanese government to actually

dismantle these barriers, are factors that risk having a real influence in going forward with

the agreement. The perception may have to do with the limited knowledge of the market as

European companies already present in Japan are clearly in favor of an agreement, but it is

clear that Japan has to show serious commitment and results in order to convince Europe

that they are ready to open up the market.

The power shift between the European Institutions, where the European Parliament through

the Lisbon Treaty has been given the legal right to veto any external trade agreement, is also

changing the political arena in the European Union. The parliament, being elected by the

citizens of Europe, is more sensitive to public opinion and more vulnerable for lobbying;

especially from the automotive industry which has a high emotional impact in Europe, as a

traditional industry with historical roots and as an employer of millions of Europeans.

Following the analysis in previous chapters I would argue that the automotive industry in

Europe has a disproportionate influence in the discussions, compared to the impact it has in

general and compared to the impact a FTA between the EU and Japan would have on the

European automotive industry in particular. The reason for decline in the European

64

Sunesen et al

26

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

automotive industry is rather linked to structural problems within the sector than from

import threats from countries like Korea and Japan. In addition, Japan already has a strong

presence in Europe with high FDI and many production sites here. With the strong yen the

situation is not likely to change and the threat of Japanese vehicles flooding the European

market due to reduction of tariffs is limited in reality. The risk in my view however, is that

the automotive succeeds in convincing member states and MEPs and that the negotiations

will be delayed or stalled, because of this.

Another factor of influence is Japanese domestic politics. Japan has a clear strategy to

engage in FTAs but the willpower to push for an EU-Japan FTA may be challenged by

domestic politics and bureaucratic rivalry. The decision making in Japan is not as straight

forward as in the case of Korea for example, and although the influence of the EU-Korea

agreement remains important in the discussions, especially within automotive and

electronics, with substantial foreign investments already in Europe and the strong yen, the

real impact of the tariff reductions may, as previously argued, be limited. Keidanren is the

strongest advocator of the trade agreement and they will most likely remain in favor as their

stakeholders do not have much to lose, but a lot to gain. In fact, I would argue that Japan

does not have much to lose with an agreement, but for Japan it is more a matter of

prioritization. The delay and distrust on EU side may cause the Japanese to lose interest and

focus on other regions, such as TPP and ASEAN, which could offer more attractive conditions

and growth potential. Japan has until now been the demanding party, but the risk is that the

dynamics will change.

With a Europe in crisis and in need of an economic boost the question is, can Europe afford

to lose this opportunity? And, is it right of the EU, an institution based on the principles of

free market and free trade to let protectionism of certain industries forego the very

principles it is based on, as well as the pursuit of benefits of all?

27

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

4. References

4.1 Written sources

Fredrik Erixon and Hosuk Lee-Makiyama (2010): Stepping into Asias Growth Markets: Dispelling

Myths about the EU-Korea Free Trade Agreement, European Centre for International Political

Economy (ECIPE) Policy Briefs No. 03/2010

Glenn D. Hook, Julie Gilson, Christopher W. Hughes, Hugo Dobson, Japans International Relations,

Politics, economics and security,Routledge, Oxon UK, 2012

Hosuk Lee Makiyama (2012): FTAs and the crisis in the European Car Industry, A free trade position

on the car crisis and the Economic Integration Agreement (EU-Japan FTA), European Centre for

International Political Economy (ECIPE) Policy Briefs No. 02/2012

Olena Mykal, The EU-Japan Security Dialogue, Invisible but Comprehensive, Amsterdam University

Press, Amsterdam 2011

Patricia A. Nelson (2012): The Lisbon Treaty effect: toward a new EU-Japan economic and trade

partnership?, Japan Forum, 24:3, 339-368

Patricia A. Nelson (2012): Anachronistic Icons? Business Institutions in the Japanese Variant of

Capitalismhttp://hhs.academia.edu/PatriciaNelson/Papers/1794602/Anachronistic_Icons_Business_

Institutions_in_the_Japanese_Variant_of_Capitalism

Sofia Olsson (2004), Evaluation of the Japanese market of protective device a case study of three

niche-products Master Thesis Department of Management & Economics Linkping Institute of

Technology LiTH-EKI-EX-2004:68-SE

Laura Richardson (2012): The post-Lisbon Role of the European Parliament in the EUs Common

Commercial Policy: Implications for Bilateral Trade Negotiations, College of Europe Department of

EU International Relations and Diplomacy Studies, EU Diplomacy Paper 05/2012

Eva R. Sunesen, Joseph F. Francois and Martin H. Thelle Assessment of Barriers to Trade and

Investment between the EU and Japan Copenhagen Economics, Copenhagen, 2009

Marie Sderberg (2012): Introduction: where is the EU-Japan relationship heading?, Japan Forum

24:3, 249-263

Alex Warleigh-Lack: European Union the basics, Routledge Oxon, UK, 2009

Stephen Woolcock (2007): European Union Policy towards Free Trade Agreements European

Centre for International Political Economy (ECIPE) Working Paper No 03/2007

4.2 Presentations

Ministry of Foreign Affairs, Japan (2011): Japan-EU Relations

Alison Murray (2011): Seizing the Opportunity in Japan Why the EU Needs a Trade Agreement

with Japan European Business Council in Japan, Alison Murray Executive Director, EBC, 22

September, 2011

28

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

Michitaka Nakatomi (2012): Japans EPA policy and Japan-EU economic partnership Principal Trade

Negotiator Japan Ministry of Economy, Trade and Industry, Senior Fellow research Institute of

Economy, Trade and Industry, March 2012

Patricia A. Nelson (2009): EU-Japan Economic and Trade Relations: What Impact of EU-Korea FTA on

Japan? Faculty of Economics, Seijo University, December 2, 2009

Patricia A. Nelson (2010): Change and EU-Japan Relations: Spotlighting Economic & Business

Organization Prepared for the Keio Jean Monnet COE Research Center for EU Studies 4th

International Symposium Implications of European Integration for the State and Sovereignty in a

Transnational World 26 June 2010

Patricia A. Nelson (2012): The EU-Japan Free Trade Agreement: Will it Ever Happen? 28th Stockholm

Seminar on Japan, 18 January 2012

Yorizumi Watanabe (2012): Strengthening and Institutionalizing Japan EU Relations: Japans Trade

Policy in the Aftermath of the Disaster Faculty of Policy Management Keio University, Stockholm

June 14-15 2012

Yoshihiro Yano (2012): Achieving New Momentum for Enhanced Economic Partnership through and

EU-Japan Economic Integration Agreement Perspective of the Japanese Auto Industry Director

General, International Dept. Japan Automobile Manufacturers Association Inc. (JAMA) EU-Japan

Seminar in Brussels, 8th March 2012

4.3 Official documents

Directorate-General for External Policies Policy Department Policy Briefing Trade and economic

relations with Japan: assessing the hurdles to the FTA, DG EXPO/B/PolDep/Note/2012_243

European Commission Commission Staff Working Document Executive Summary of the Impact

Assessment Report on EU-Japan Trade Relations Brussels 18.07.2012 {COM(2012) 390}

{SWD(2012)209}

European Commission Commission Staff Working Document Impact Assessment Report on EUJapan Trade Relations Brussels 18.07.2012

European Commission External Trade Global Europe Competing in the World A contribution to the

EUs Growth and Job Strategy 2006

European Federation of Pharmaceutical Industries and Associations (efpia) Position Paper The EUJapan FTA A key opportunity for the competitiveness of Europes Innovative Pharmaceutical

Industry and enhanced cooperation with Japan

http://www.efpia.eu:8081/sites/www.efpia.eu/files/EFPIA-PositionPaper-JapanFTA-201208.pdf

20th EU-Japan Summit Brussels, 28 May 2011 Joint Press Statement, Press www.consilium.europa.eu

European Parliament Delegation for relations with Japan Minutes of the preparatory meeting in

view of the 33rd EU-Japan Interparliamentary meeting 26th October 2011, from 15.00-18.30

Strasbourg D-JP_PV(2011)1026

29

EU-Japan Free Trade Agreement - Factors influencing the Future of the Agreement

European Union Japan Summit Brussels 2001 Shaping our Common Future, An Action Plan for

EU-Japan Cooperation www.euinjapan.jp

Foreign Trade Association (FTA) Position Paper FTA Position Paper on EU-Japan Trade Relations EUJapan Trade Relations 31 July 2012 www.fta-intl.org

4.4 Websources

Bloomberg Businessweek

EU Regulators Seek Green Light for Japan Free Trade Talks 18 July 2012

http://www.businessweek.com/news/2012-07-18/eu-regulators-seek-green-light-for-free-tradetalks-with-japan

Delegation of the European Union to Japan

The 1991 the Hague Joint Declaration

http://www.euinjapan.jp/en/relation/agreement/hague/

EU-Japan impact on the World 14 Feb 2011

http://www.euinjapan.jp/en/relation/impact/

Digital Headlines

EU-Japan Free Trade Agreement Can we see any progress?

http://www.digitaleurope.org/headlines/story.aspx?ID=74

EU-Asiacentre

European Parliament cautions on Japan FTA 14 June 2012

http://www.eu-asiacentre.eu/news_details.php?news_id=38

The European Automotive Manufacturers Association (ACEA)

Auto industry skeptical about benefits of EU/Japan Free Trade Agreement 19 July 2012

http://www.acea.be//news/news_detail/auto_industry_sceptical_about_benefits_of_eu_japan_free

_trade_agreement

EU-Japan FTA/EPA: Tentative beginnings, uncertain gains 19 July 2012

http://www.acea.be//news/news_detail/eu_japan_fta

European Commission Directorate General for Trade

Commission proposes to open negotiations for a Free Trade deal with Japan 18 July 2012

http://trade.ec.europa.eu/doclib/press/index.cfm?id=823

Japan 19 July 2012

http://ec.europa.eu/trade/creating-opportunities/bilateral-relations/countries/japan/

Ford

EU-Japan Free Trade Agreement18 July 2012

http://corporate.ford.com/news-center/press-releases-detail/pr-eujapan-free-trade-agreement36815

JETRO

White Paper Japans Market is Open to the World, April 2012

http://www.jetro.go.jp/en/eu-japan/pdf/EN120713.pdf

Keidanren

Policy Proposals Trade, Investment EPA/FTA, Chairman Calls on European Leaders to Start