Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cenvat Credit in Easy Steps

Caricato da

NiravMakwanaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cenvat Credit in Easy Steps

Caricato da

NiravMakwanaCopyright:

Formati disponibili

27/01/2011

Cenvat

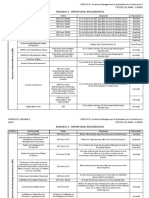

Cenvat Credit in easy steps

What is Cenvat?

Avoid cascading

effect

Destination

Principle

Credit of inputs,

input services and

capital goods

Utilisation of Cenvat

Credit

Credit only if

manufacture or

provision of service

One to one relation

not required

Basic purpose of Vat is to eliminate cascading effect of taxes

by tax credit system. This is done through mechanism of

input tax credit.

Cenvat is based on destination principle i.e. excise

duty/service tax is paid only when goods are consumed. Till

then, burden of duty gets passed on to the next

buyer/customer [In case of sales tax, as per this principle,

sales tax is payable in the State in which goods are

consumed and not in the State in which goods are produced]

Cenvat scheme allows credit of excise duty paid on inputs

goods, capital goods and service tax paid on input services

[Rule 3(1) of Cenvat Credit Rules]

This credit can be utilised for payment of excise duty on

dutiable final products and service tax on taxable output

services [Rule 3(4) of Cenvat Credit Rules]

Cenvat credit is available only if there is manufacture or

provision of taxable output service.

Cenvat Credit Rules do not require one to one relationship

[Rule 3(1) read with 3(4) of Cenvat Credit Rules] Entire Cenvat

credit is common pool which can be utilised for payment of

any eligible duty, service tax or amount.

Input (goods) eligible for Cenvat credit

Inputs which are used in or in relation to manufacture of

Inputs used in or in

taxable final product and inputs directly used for provision of

relation to

taxable output service are eligible for Cenvat credit [Rule 2(k)

manufacture

of Cenvat Credit Rules]

Consumables

eligible

Accessories,

packing material,

paint

LDO, HSD and

petrol not eligible

Cement, angles,

channels etc. not

eligible

Inputs directly used

for providing

http://www.dateyvs.com/cenex07.htm

Input may be used directly or indirectly in manufacture. Any

input integrally connected with manufacturing process is

eligible. Process loss is eligible.

Consumables are eligible for Cenvat credit.

Accessories, packing material and paints are eligible as

inputs.

LDO, HSD and petrol are not eligible for Cenvat credit

[Explanation 1 to Rule 2(k) of Cenvat Credit Rules]

Input does not include cement, angles, channels, CTD or TMT

used for construction of factory shed, building or foundation or

structures to support capital goods [Explanation 2 to Rule 2(k)

of Cenvat Credit Rules]

Definition of input is restricted for service providers. Only

inputs used directly in providing taxable service are eligible.

1/7

27/01/2011

Cenvat

service

If service provider charges separately for material supplied

while providing service, its cost is not includible.

Correspondingly, duty paid on such material is not

Cenvatable.

Instant credit

Cenvat credit on input (goods) is instant, i.e. as soon as

inputs are received in the factory.

Input Service

Input service

eligible for Cenvat

credit

Cenvat credit is available of service tax paid on input services.

Definition of input service is very wide [Rule 2(l) of Cenvat

Credit Rules]. Inclusive part of the definition expands the

scope much beyond manufacture or provision of taxable

service.

Decisions in Coca Cola (Bombay High Court) and ABB (LB of

Any service in

relation to business CESTAT) have cleared most of doubts about interpretation of

input service and it is clear that any relation with manufacture

is input service

or provision of taxable service is not required. any service in

relation to business of manufacturer or service provider is

input service

Credit of service tax on input services is available only after

Credit only after

payment is made of bill including service tax to service

payment of bill

provider for service [Rule 4(7) of Cenvat Credit Rules]

Input Service Distributor and Input Credit Distributor

Service tax paid at Head Office, Regional/Branch office can be

Utilisation of credit

utilised through mechanism of Input Service Distributor. They

of service tax paid

should be registered and pass credit through invoice [Rules

at HO, depots

2(m) and 7 of Cenvat Credit Rules]

The Input Service Distributor can distribute Cenvat credit of

Distribution of

service tax availed by it by issuing an Invoice to its

Credit through

manufacturing units or units providing output service. The

Invoice

invoice should have details as required in Rule 4A(2) of

Service Tax Rules.

The distribution of credit can be in any ratio. However, total

Distribution can be

credit distributed should not be more than service tax paid on

in any ratio

input services. If some input service is exclusively used for

exempted final product/output service, its credit is not

available for distribution by Input Service Distributor [Rule 7].

Input Credit Distributor can distribute credit on duty paid on

Credit of excise

duty on input goods inputs (goods) if invoice received at HO and distributed to

other places [Rule 7A of Cenvat Credit Rules]

Since Cenvat credit can be passed through mechanism of

endorsement of invoice, this facility is not much used.

Capital goods eligible for Cenvat credit

Only capital goods as defined in Rule 2(a) of Cenvat Credit

Capital goods

Rules are eligible for Cenvat Credit. Following capital goods

eligible for Cenvat

are covered in clause (A)(i) of above definition - Tools, hand

credit

tools, knives etc. falling under chapter 82 * Machinery covered

under chapter 84 * Electrical machinery under chapter 85 *

Measuring, checking and testing machines etc. falling under

chapter 90 * Grinding wheels and the like, and parts thereof

falling under sub-heading No 6804 * Abrasive powder or grain

on a base of textile material, of paper, of paper board or other

materials, falling under chapter heading 6805

http://www.dateyvs.com/cenex07.htm

2/7

27/01/2011

Cenvat

Dumpers or tippers falling under chapter 87 are eligible as

capital goods for Cenvat credit to providers of service of Site

formation and clearance, excavation and earthmoving and

demolition [section 65(105)(zzza)] and Mining of mineral, oil or

gas services [section 65(105)(zzzy)], if these are registered in

name of service provider and zre used for providing taxable

service (amendment w.e.f. 22-6-2010). Other service providers

and manufacturers are not eligible.

Capital goods to be

used in factory

Equipment or

appliances used in

office not eligible to

manufacturer

Eligibility of Motor

vehicles

Sending out capital

goods

Partial use of

capital goods for

exempted goods

allowable

Capital goods on

hire

purchase/lease/loan

Duty paying

documents

Depreciation should

not be availed on

Cenvat portion

Credit to be availed

in two instalments

Removal of capital

goods as such, after

use or as scrap

http://www.dateyvs.com/cenex07.htm

This definition is quite different from capital goods as

understood in conventional accounting or under income tax.

Capital goods should be used in the factory of manufacturer or

for provision of output service.

Capital goods does not include equipment or appliance used

in an office of manufacturer (this restriction does not apply to

service provider)

Motor vehicle is capital goods only in respect of specified

service providers [Rule 2(a)(B) of Cenvat Credit Rules]

Capital goods should be used in factory. These can be sent

outside for job work but should be brought back within 180

days [Rule 4(5)(a) of Cenvat Credit Rules]

Moulds, dies, jigs and fixtures can be sent outside without

restriction of return within 180 days [Rule 4(5)(b) of Cenvat

Credit Rules

Capital goods used exclusively for manufacture of exempted

goods are not eligible for Cenvat credit. Thus, partial use for

exempted goods is allowable i.e. full Cenvat credit is available.

Capital goods obtained on hire purchase/lease / loan are

eligible [Rule 4(3) of Cenvat Credit Rules]

Duty paying documents eligible are same for Cenvat on

inputs.

Depreciation under section 32 of Income Tax Act should not

be claimed on the excise portion of the Capital Goods. Rule

4(4) of Cenvat Credit Rules (Otherwise, the manufacturer will

get double deduction for Income Tax - one credit as Cenvat

and another credit as depreciation) e.g. if cost of 'capital

goods' is Rs 1.16 lakhs, out of which Rs 0.15 lakh is duty

paid, assessee can claim depreciation under Income Tax only

on Rs one lakh, if he has availed Cenvat credit of Rs 0.16

lakh. The requirement gets satisfied only if the assessee

follows accounting procedure specified in guidelines issued by

Institute of Chartered Accountants of India

Cenvat credit on capital goods is required to be availed in

more than one year, i.e. upto 50% credit can be availed when

these are received and balance in any subsequent financial

year. The condition for taking balance credit is that the capital

goods should be in possession of manufacturer of final

products in subsequent years. SSI units can avail entire

100% Cenvat credit in first year itself Rule 4(2)(a) of Cenvat

Credit Rules.

Capital goods on which Cenvat credit was taken can be

removed as such on payment of amount equal to Cenvat

credit availed [Rule 3(5) of Cenvat Credit Rules]

3/7

27/01/2011

Cenvat

If capital goods on which Cenvat was availed are removed as

scrap, an amount equal to duty on scrap value is payable

[Rule 3(5A) of Cenvat Credit Rules].

If capital goods are cleared after use as second hand capital

goods, amount is payable at reduced rate by reducing credit

taken @ 2.5% per quarter.

Availment of Cenvat credit

Cenvat Credit is a pool of duties and taxes paid on inputs,

What is Cenvat

capital goods and input services as specified in Rule 3(1) of

Credit

Cenvat Credit Rules.

In respect of inputs / capital goods procured from EOU unit,

Procurement of

Cenvat credit is available equal to CVD and special CVD paid

goods from EOU

and education cess and SAH education cess w.e.f. 7-9-2009

(earlier, it was allowable as per a complicated formula) Rule

3(7)(a) of Cenvat Credit Rules.

Utilisation of Cenvat credit

Cenvat credit is a pool. The credit in this pool can be utilised

Utilisation for any

for payment of any excide duty on excisable final product and

eligible purpose

service tax on taxable output service. The credit can also be

used for payment of certain amounts [Rule 3(4) of Cenvat

Credit Rules]

Credit only of inputs Credit can be utilised only of inputs and input services

received upto end of the month [First proviso to Rule 3(4) of

and services

Cenvat Credit Rules] (even if excise duty/service tax is

received upto end

payable at a later date)

of month

Credit of Basic excise duty, CVD, Special CVD and service

Inter-changeability

tax can be utilised for payment of any duty on final product or

of credit of various

service tax on output services, except duty payable u/s 85 of

duties

Finance Act on pan masala and certain tobacco products

[provisos to Rule 3(4) of Cenvat Credit Rules]

Cenvat Credit of education cess, NCCD and additional excise

Restrictions on

duty paid on inputs under section 85 of Finance Act (and

interchangeability

corresponding CVD on imported inputs) can be utilised only

for payment of corresponding duty on final product i.e. the

credit is not inter-changeable.

Credit of special CVD (present rate is @ 4%) u/s 3(5) of

Credit of special

Customs Tariff Act can be utilised by manufacturer but not by

CVD

service providers [third proviso to Rule 3(4) of Cenvat Credit

Rules]

Credit of education cess paid on input goods and paid on

Credit of education

cess and SAHE cess input services is inter-changeable. Similarly, credit of SAH

Education cess paid on input goods and paid on input

services is inter-changeable.

Duty paying document for availing Cenvat credit

Eligible duty/tax

paying document

Cenvat credit can be availed on basis of eligible duty

documents as specified in Rule 9(1).

Invoice of Manufacturer, Bill of Entry, Supplementary Invoice,

Dealers Invoice and GAR-7 challan when service receiver is

liable to pay service tax are major eligible documents.

Transit Invoice

Credit can be availed on basis of transit invoice i.e. on basis of

invoice of manufacturer when goods purchased through dealer

and name of ultimate buyer is shown as consignee.

No time limit for

availing Cenvat

There is no time limit for availing Cenvat credit can be taken

even after 3/4 years

http://www.dateyvs.com/cenex07.htm

4/7

27/01/2011

Cenvat

credit

Credit cannot be

denied on account

of minor defects

There is ample case law that Cenvat credit cannot be denied

for minor defects in duty paying document.

Endorsement of

duty paying

document

Duty/tax paying document need not be in name of the

manufacturer using the input/input services for

manufacture/provision of taxable output service. It is sufficient

if these are endorsed in his name with certificate that endorser

has not availed Cenvat credit.

Burden of proof

Person taking credit must take reasonable steps while

availing Credit. Burden of proof of admissibility of Cenvat credit

is on him [Rule 9(5) of Cenvat Credit Rules]

Dealers Invoice for Cenvat

Cenvat credit can be availed on basis of Invoice issued by

First stage and

second stage dealer dealer registered with Central Excise [Rule 9(1) of Cenvat

Credit Rules]

can issue

Cenvatable Invoice

First stage and second stage dealer registered with Central

Excise can issue Cenvatable Invoice. First stage dealer

means dealer purchasing goods from manufacturer or his

depot or consignment agent. They have to submit quarterly

return to department within 15 days from close of quarter

[Rule 9(8) of Cenvat Credit Rules]

If the first stage dealer claims refund of special CVD of 4%,

Optional refund of

the buyer cannot avail Cenvat credit. (This is not compulsory

4% special CVD

on dealer. It is optional).

Transit Invoice is also permissible. In such case, dealer need

Transit Invoice

not be registered, if name of ultimate buyer is shown as

consignee in the invoice issued by manufacturer.

Cenvat credit can be availed in respect of imported goods

Cenvat credit of

purchased through dealer, by either issuing dealers invoice

CVD and special

or by endorsement of Bill of Entry.

CVD on imported

goods

Manufacture of Exempted as well as taxable goods and provider of both

exempted and taxable services

Cenvat credit is available only if final product is dutiable or

No credit if final

service tax is payable on output service [Rule 6(1) of Cenvat

product/output

Credit Rules]

service exempted

Options available to If assessee is manufacturing exempted as well as dutiable

goods and/or providing taxable as well as exempt services,

manufacturer of

and availing Cenvat credit, he has three options (a) maintain

exempted as well

separate records of inputs and input services used for exempt

as taxable goods

final products/services (b) If common inputs/input services are

and provider of

utilised for exempted as well as taxable final product,

exempted and

assessee is required to pay 5% amount on exempted final

taxable services

product or 6% amount on exempt output services (b) Pay

amount proportionate to credit on exempted final

product/output service [Rule 6(2) and 6(3) of Cenvat Credit

Rules]

Option once availed cannot be changed in the financial year.

Option cannot be

The option is to all exempted goods/services [Explanation I to

changed during the

Rule 6(3) of Cenvat Credit Rules]

year

Entire credit without In case of 16 services covered under Rule 6(5) of Cenvat

Credit Rules, entire Cenvat credit is available without

proportionate

proportionate reversal.

reversal

In case of supplies covered under Rule 6(6) of Cenvat Credit

Supplies to SEZ,

http://www.dateyvs.com/cenex07.htm

5/7

27/01/2011

Supplies to SEZ,

EOU, exports,

Cenvat

In case of supplies

covered under Rule 6(6) of Cenvat Credit

Rules [exports, supplies to SEZ/EOU, specified projects],

entire credit is available without proportionate reversal.

Removal of inputs for sale or job work

Inputs on which Cenvat credit was taken can be removed as

Removal of inputs

such on payment of amount equal to Cenvat credit availed

as such

[Rule 3(5) of Cenvat Credit Rules]

Inputs on which Cenvat credit was availed can be sent outside

Sending inputs for

for job work. These should come back within 180 days [Rule

job work

4(5)(a) of Cenvat Credit Rules]

Direct despatch of final product from place of job worker can

Direct despatch

be done with permission of AC/DC for one financial year [Rule

from place of job

4(6) of Cenvat Credit Rules]

worker

Removal of waste

Waste is final product for excise purposes and duty is

Waste is final

payable as if final product is being cleared. This applies only if

product

waste is produced or manufactured and is excisable goods.

If a particular waste is not mentioned in Central Excise tariff,

Waste not

neither any amount nor duty is payable at the time of

mentioned in Tariff

clearance.

Records and returns under Cenvat

Manufacturer/service provider is required to maintain records

Records of Cenvat

of inputs and capital goods, records of credit received and

credit

utilised. [Rule 9(5) of Cenvat Credit Rules]

Returns of details of Cenvat credit availed, Principal Inputs and

Return of Cenvat

utilization of Principal Inputs in forms ER-1 to ER-7 is to be

credit availed and

submitted [Rule 9A of Cenvat Credit Rules]

utilised

Revised return of Cenvat credit can be submitted within 60

Revised return

days [Rule 9(11) of Cenvat Credit Rules]

Dealer/service provider/input service distributor is also required

Returns by dealers,

to submit returns [Rule 9(6) and 9(10) of Cenvat Credit Rules]

input service

distributor

Other provisions relating to Cenvat

SSI unit can opt out of Cenvat at end of the year. He has to

SSI to reverse

reverse Cenvat credit on inputs in stock as on 31st March

Cenvat at end of

[Rule 11(2) of Cenvat Credit Rules]

year

SSI can take Cenvat When he starts payment of duty during financial year after

exemption is over, he can avail Cenvat credit of duty paid on

of duty on inputs in

inputs in stock

stock

Simultaneous exemption and availment of Cenvat is

Simultaneous

permissible by SSI only in specified cases.

exemption

Exporter of final product or taxable services can avail Cenvat

Cenvat credit to

credit on inputs and input services. He can claim refund of

exporter

Cenvat credit if he cannot utilise the Cenvat credit for payment

of duty on sale made within India on payment of duty [Rule 5

of Cenvat Credit Rules]

Merchant exporter can claim refund of specified input services

Refund of credit of

used while exporting final product.

input services

If undertaking is transferred, merged or shifted, Cenvat credit

Transfer,

can be transferred [Rule 10 of Cenvat Credit Rules] .

amalgamation of

undertaking

Penalty can be imposed for wrongfully taking or utilising

Penalty for

Cenvat credit [Rules 15 and 15A of Cenvat Credit Rules]

improper Cenvat

credit

Accounting for Cenvat should be as per guidance note issued

Accounting for

http://www.dateyvs.com/cenex07.htm

6/7

27/01/2011

Cenvat

Cenvat and stock

valuation

by ICAI.

Inventory valuation should be as per AS-2 which requires

exclusion of Cenvat credit. However, for income tax purposes,

Cenvat credit has to be added in valuation in view of section

145A of Income Tax Act.

http://www.dateyvs.com/cenex07.htm

7/7

Potrebbero piacerti anche

- Cenvat Credit PDFDocumento38 pagineCenvat Credit PDFsaumitra_mNessuna valutazione finora

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Da EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Nessuna valutazione finora

- Ca Final Exam Capsule Practical Questions May 14Documento98 pagineCa Final Exam Capsule Practical Questions May 14Suhag PatelNessuna valutazione finora

- Cenvat - Overview: V S DateyDocumento33 pagineCenvat - Overview: V S Dateygsanjay84Nessuna valutazione finora

- E2 E3 Financee2 E3 If Capital Goods On Which Cenvat Credit Has Been TakenDocumento32 pagineE2 E3 Financee2 E3 If Capital Goods On Which Cenvat Credit Has Been Takenpintu_dyNessuna valutazione finora

- Notes - Mr. Rajiv Luthia - Intensuve Course Course - 30th August, 2013Documento21 pagineNotes - Mr. Rajiv Luthia - Intensuve Course Course - 30th August, 2013Aayushi AroraNessuna valutazione finora

- Cenvat: Presented To: Namit Sir Presented By: Jasmine 4270Documento23 pagineCenvat: Presented To: Namit Sir Presented By: Jasmine 4270JatinderNessuna valutazione finora

- Modvat Re-Christened As Cenvat - Modvat Has Been Renamed As 'Cenvat' W.E.F. 1-4-2000Documento9 pagineModvat Re-Christened As Cenvat - Modvat Has Been Renamed As 'Cenvat' W.E.F. 1-4-2000sangramdeyNessuna valutazione finora

- Input Service Distributor & Input Credit Distributor: Roll No-47Documento15 pagineInput Service Distributor & Input Credit Distributor: Roll No-47renuka03Nessuna valutazione finora

- Central Value Added Tax PPT at Bec Doms Bagalkot MbaDocumento16 pagineCentral Value Added Tax PPT at Bec Doms Bagalkot MbaBabasab Patil (Karrisatte)Nessuna valutazione finora

- Cenvat Credit: V S DateyDocumento44 pagineCenvat Credit: V S Dateyశ్రీనివాసకిరణ్కుమార్చతుర్వేదులNessuna valutazione finora

- 1.cenvat CreditDocumento18 pagine1.cenvat CreditGhanshyam KhandayathNessuna valutazione finora

- 2 of 2008 8 % To 10 % Duty ChangeDocumento3 pagine2 of 2008 8 % To 10 % Duty Changephani raja kumarNessuna valutazione finora

- Supplementary Notes On Service Tax Service Tax (Determination of Value) Rules, 2006Documento4 pagineSupplementary Notes On Service Tax Service Tax (Determination of Value) Rules, 2006Mohit BhansaliNessuna valutazione finora

- Custom & Excise DutyDocumento177 pagineCustom & Excise DutysnehapargheeNessuna valutazione finora

- Cenvat Credit Rules, 2004 An Overview: Gopi Donthireddy Deputy CommissionerDocumento39 pagineCenvat Credit Rules, 2004 An Overview: Gopi Donthireddy Deputy CommissionerAnuragNessuna valutazione finora

- Understanding GST Part 14 CG Input Input ServicesDocumento4 pagineUnderstanding GST Part 14 CG Input Input ServicesrgramachandranNessuna valutazione finora

- Liability of Service TaxDocumento7 pagineLiability of Service TaxkasiriverNessuna valutazione finora

- Small Scale Exemption SchemeDocumento8 pagineSmall Scale Exemption SchemebakulhariaNessuna valutazione finora

- Amendment TaxDocumento3 pagineAmendment TaxRaman SapraNessuna valutazione finora

- Indirect Tax AmendmentsDocumento46 pagineIndirect Tax AmendmentsCeciro LodhamNessuna valutazione finora

- Input Tax Credit-1Documento74 pagineInput Tax Credit-1Shaikh HumeraNessuna valutazione finora

- Administration of Central ExciseDocumento22 pagineAdministration of Central ExciseSubhasish ChatterjeeNessuna valutazione finora

- Input TAX Credit: Learning OutcomesDocumento73 pagineInput TAX Credit: Learning OutcomesRavi kanthNessuna valutazione finora

- File Final YearDocumento18 pagineFile Final YearSaurabh SinghNessuna valutazione finora

- CENVAT: A Fresh Perspective: Vivek Kohli, Ashwani Sharma, Anuj KakkarDocumento8 pagineCENVAT: A Fresh Perspective: Vivek Kohli, Ashwani Sharma, Anuj Kakkarraju7971Nessuna valutazione finora

- Indirect Taxes Budget HighlightsDocumento4 pagineIndirect Taxes Budget HighlightsAnil SharmaNessuna valutazione finora

- What Is CENVAT Credit?Documento8 pagineWhat Is CENVAT Credit?Sameer HusainNessuna valutazione finora

- Service Tax Changes Process Amounting To Manufacture or Production of Goods Excluding Alcoholic Beverages For Human ConsumptionDocumento5 pagineService Tax Changes Process Amounting To Manufacture or Production of Goods Excluding Alcoholic Beverages For Human ConsumptionYesBroker InNessuna valutazione finora

- Approved Toll Manufacturer SchemeDocumento16 pagineApproved Toll Manufacturer SchemetenglumlowNessuna valutazione finora

- Re: Service Tax-Change in CENVAT Credit Rules 2004Documento7 pagineRe: Service Tax-Change in CENVAT Credit Rules 2004Prakash BatwalNessuna valutazione finora

- Cenvat: (Central Value Added Tax)Documento12 pagineCenvat: (Central Value Added Tax)Laxmi PriyaNessuna valutazione finora

- Modvat and CenvatDocumento3 pagineModvat and CenvatpravinsankalpNessuna valutazione finora

- Excise Law PDFDocumento54 pagineExcise Law PDFJay BudhdhabhattiNessuna valutazione finora

- SBD Version 3Documento419 pagineSBD Version 3mahfuz020594Nessuna valutazione finora

- Decisions in Coca Cola and ABB Clears Mist Over Definition of Input Service'Documento29 pagineDecisions in Coca Cola and ABB Clears Mist Over Definition of Input Service'Prashant KumarNessuna valutazione finora

- Siam Indian Auto IndustryDocumento40 pagineSiam Indian Auto IndustryAtul BansalNessuna valutazione finora

- Icai Bhavan Cenvat Credit Rules Final 03102015Documento128 pagineIcai Bhavan Cenvat Credit Rules Final 03102015Aks SomvanshiNessuna valutazione finora

- Regional Training Institute, Kolkata: - Revenue Audit Examination-2018Documento17 pagineRegional Training Institute, Kolkata: - Revenue Audit Examination-2018Vikash KumarNessuna valutazione finora

- Servicetaxonworkscontract 110821054842 Phpapp01Documento81 pagineServicetaxonworkscontract 110821054842 Phpapp01Rajesh BhanushaliNessuna valutazione finora

- Cenvat Credit IssuesDocumento69 pagineCenvat Credit IssuesAayushi AroraNessuna valutazione finora

- Cenvat Credit ConceptsDocumento6 pagineCenvat Credit ConceptsVibhor BhatnagarNessuna valutazione finora

- Direct Tax: Judicial UpdateDocumento11 pagineDirect Tax: Judicial UpdateRAJARAJESHWARI M GNessuna valutazione finora

- Input Tax Credit-Cp8Documento118 pagineInput Tax Credit-Cp8Shipra SonaliNessuna valutazione finora

- What Is Service Tax ?Documento15 pagineWhat Is Service Tax ?Nawab SahabNessuna valutazione finora

- Indian Taxation and Corporate Laws: Home Service TaxDocumento8 pagineIndian Taxation and Corporate Laws: Home Service TaxRahul TankNessuna valutazione finora

- 66519bos53752 cp6Documento100 pagine66519bos53752 cp6Aditya ThesiaNessuna valutazione finora

- Foreign Trade Policy 2015-20Documento9 pagineForeign Trade Policy 2015-20manjulaNessuna valutazione finora

- Duty DrawbackDocumento4 pagineDuty DrawbackShaji KuttyNessuna valutazione finora

- Valuation - : Concepts and CasesDocumento3 pagineValuation - : Concepts and Casesjonnajon92Nessuna valutazione finora

- Input Tax Credit (Itc) SystemDocumento17 pagineInput Tax Credit (Itc) SystemJasmin BidNessuna valutazione finora

- Guide AppDocumento43 pagineGuide AppjonbelzaNessuna valutazione finora

- Itpp U-3Documento3 pagineItpp U-3MOHAMMAD ZUBERNessuna valutazione finora

- Controversies in Input Tax Credit: Adv. Rohan Shah Rohan@shahchambers - in February 19, 2022Documento33 pagineControversies in Input Tax Credit: Adv. Rohan Shah Rohan@shahchambers - in February 19, 2022ajitNessuna valutazione finora

- Itc GSTDocumento112 pagineItc GSTSONICK THUKKANINessuna valutazione finora

- Tax HDocumento15 pagineTax HDeepesh SinghNessuna valutazione finora

- SET 23 24 Detail Guide EDocumento20 pagineSET 23 24 Detail Guide ENishan MahanamaNessuna valutazione finora

- CA CS CMA Final Statutory Updates For Nov Dec 2020Documento43 pagineCA CS CMA Final Statutory Updates For Nov Dec 2020Anu GraphicsNessuna valutazione finora

- Micro Small & Medium EnterprisesDocumento33 pagineMicro Small & Medium EnterprisesTejaswi KarriNessuna valutazione finora

- Morning InsightDocumento4 pagineMorning InsightNiravMakwanaNessuna valutazione finora

- Bank of Baroda Recruitment 2024 For BC SupervisoreDocumento21 pagineBank of Baroda Recruitment 2024 For BC SupervisoreNiravMakwanaNessuna valutazione finora

- Yes Osho - Oct 21Documento63 pagineYes Osho - Oct 21NiravMakwanaNessuna valutazione finora

- Sai Charitra Gujrathi Page 511 To 549Documento39 pagineSai Charitra Gujrathi Page 511 To 549NiravMakwanaNessuna valutazione finora

- Sai Charitra Gujrathi Page 205 To 307Documento103 pagineSai Charitra Gujrathi Page 205 To 307NiravMakwanaNessuna valutazione finora

- Sai Charitra Gujrathi Page 308 To 408Documento101 pagineSai Charitra Gujrathi Page 308 To 408NiravMakwanaNessuna valutazione finora

- Entry Guidelines 2015Documento6 pagineEntry Guidelines 2015NiravMakwanaNessuna valutazione finora

- Consumer Demand - Demand Curve, Demand Function & Law of DemandDocumento14 pagineConsumer Demand - Demand Curve, Demand Function & Law of DemandNiravMakwanaNessuna valutazione finora

- Ethics Asnmnt AnsrsDocumento30 pagineEthics Asnmnt AnsrsNiravMakwanaNessuna valutazione finora

- Samsung Galaxy S® III (T-Mobile) Software UpdateDocumento13 pagineSamsung Galaxy S® III (T-Mobile) Software UpdateNiravMakwanaNessuna valutazione finora

- Chanakya VVS 070309Documento21 pagineChanakya VVS 070309akkisantosh7444Nessuna valutazione finora

- 11th AccountancyDocumento628 pagine11th AccountancySundarRamaRaju75% (4)

- ELASTOMERICDocumento1 paginaELASTOMERICNiravMakwanaNessuna valutazione finora

- Colgat Palmolive Company OverviewDocumento9 pagineColgat Palmolive Company OverviewNiravMakwanaNessuna valutazione finora

- About Reliance CommunicationDocumento30 pagineAbout Reliance CommunicationNiravMakwanaNessuna valutazione finora

- Kendrick Basten 1Documento4 pagineKendrick Basten 1nghia leNessuna valutazione finora

- Reportorial RequirementsDocumento5 pagineReportorial RequirementsMelaine A. FranciscoNessuna valutazione finora

- Cir V Eastern Telecommunication Philippines FactsDocumento3 pagineCir V Eastern Telecommunication Philippines FactsSallen DaisonNessuna valutazione finora

- Maharashtra State Board Class 11 Economics Notes Chapter 2 MoneyDocumento3 pagineMaharashtra State Board Class 11 Economics Notes Chapter 2 MoneyMJ PHOTOGRAPHYNessuna valutazione finora

- RTGS FormDocumento2 pagineRTGS FormravilotusNessuna valutazione finora

- 1701 Jan 2018 Final With RatesDocumento4 pagine1701 Jan 2018 Final With RatesexquisiteNessuna valutazione finora

- Assesable ValueDocumento3 pagineAssesable Valuevishnu0072009Nessuna valutazione finora

- Hilado vs. CIRDocumento2 pagineHilado vs. CIRAlan Gultia100% (2)

- Sales Quotation: Jl. Nias 3 No. 33 Lingk. Tegalboto Kidul, Kel. Sumbersari, Kec. Sumbersari Kab. Jember, Jawa TimurDocumento1 paginaSales Quotation: Jl. Nias 3 No. 33 Lingk. Tegalboto Kidul, Kel. Sumbersari, Kec. Sumbersari Kab. Jember, Jawa TimurAde HerdiansyahNessuna valutazione finora

- Wilkins (Inspector of Taxes) V Rogerson: HeadnoteDocumento3 pagineWilkins (Inspector of Taxes) V Rogerson: HeadnoteShivanjani KumarNessuna valutazione finora

- Negotiable Instruments (3) - ChavezDocumento22 pagineNegotiable Instruments (3) - ChavezGian Reynold C. ParinaNessuna valutazione finora

- F 5452Documento4 pagineF 5452IRSNessuna valutazione finora

- Chapter 8: Tax Management: Planning, Avoidance and EvasionDocumento16 pagineChapter 8: Tax Management: Planning, Avoidance and EvasionCharlesNessuna valutazione finora

- PDF - ChallanList - 10 - 7 - 2021 12 - 00 - 00 AMDocumento1 paginaPDF - ChallanList - 10 - 7 - 2021 12 - 00 - 00 AM11 R N Roshikha 9 CNessuna valutazione finora

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Documento1 paginaTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)R.S.Nessuna valutazione finora

- Ce Block NCF RC - 815 and RC-642 Haider Saleh Al-HaiderDocumento3 pagineCe Block NCF RC - 815 and RC-642 Haider Saleh Al-Haidersudeep karunNessuna valutazione finora

- TATA DOCOMO E-Bill Statement For MAR 15 PDFDocumento2 pagineTATA DOCOMO E-Bill Statement For MAR 15 PDFHafeezulla KhanNessuna valutazione finora

- Income Tax Calulator With Functions and Robus Validation: PFC - Assignment - Part 1Documento4 pagineIncome Tax Calulator With Functions and Robus Validation: PFC - Assignment - Part 1tran nguyenNessuna valutazione finora

- Solution Manual For Corporate Partnership Estate and Gift Taxation 2013 7th Edition by PrattDocumento15 pagineSolution Manual For Corporate Partnership Estate and Gift Taxation 2013 7th Edition by PrattMariaMasontwfj100% (40)

- Vat Zero Rated SuppliesDocumento2 pagineVat Zero Rated SuppliesPrecy B BinwagNessuna valutazione finora

- Chapter 16 Problem SolutionsDocumento6 pagineChapter 16 Problem SolutionsAnila ANessuna valutazione finora

- Definition of TaxDocumento3 pagineDefinition of TaxAbdullah Al Asem0% (1)

- Certificate of Final Tax Withheld at Source: Faye and Sam General MerchandiseDocumento4 pagineCertificate of Final Tax Withheld at Source: Faye and Sam General MerchandiseMay MayNessuna valutazione finora

- Airtel Broadband Bill Apr To Jun 22Documento2 pagineAirtel Broadband Bill Apr To Jun 22Megha ChughNessuna valutazione finora

- Thesis On Electronic PaymentDocumento6 pagineThesis On Electronic Paymentgbvhhgpj100% (2)

- Singapore Appendix 8B For YA2021Documento1 paginaSingapore Appendix 8B For YA2021DavidNessuna valutazione finora

- Salary-Slip FormatDocumento6 pagineSalary-Slip FormatArjunAtwal100% (1)

- MATERI KASUS Mengisi REGISTRATION FORM-GUEST CARD-BREAKFAST COUPONDocumento2 pagineMATERI KASUS Mengisi REGISTRATION FORM-GUEST CARD-BREAKFAST COUPON15Dwi CiptayasaNessuna valutazione finora

- AITPN6389G - Issue Letter - 1053923881 (1) - 23062023Documento2 pagineAITPN6389G - Issue Letter - 1053923881 (1) - 23062023Peddaiah KarthiNessuna valutazione finora

- Illustration - 2022-11-03T115112.732Documento3 pagineIllustration - 2022-11-03T115112.732BLOODY ASHHERNessuna valutazione finora