Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Accounting Assignment

Caricato da

Manish PandeyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Accounting Assignment

Caricato da

Manish PandeyCopyright:

Formati disponibili

Financial Accounting Assignment

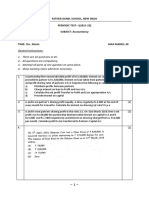

Name: Disha Nangia

Batch: 2016-2018

Assignment: Financial Accounting

Roll no.: 39

Course: PGDM Core - B

Date: 25th August, 2016

Amity Universe sells artifacts either for cash or notes receivable that earn interest. The

business uses the direct write-off method to account for bad debts. Sujan Singh, the

owner, has prepared Amitys financial statements. The most recent comparative income

statements for 2003 and 2004 are as follows:

2004

Total Revenue

Total Expenses

Net Income

2003

210,000

195,000

157,000

153,000

53,000

42,000

Based on the increase in net income, Amity seeks to expand its operations. Sujan has

asked you to invest Rs.50, 000 in the business. You have several meetings at which you

learn that notes receivable from customers were Rs.200, 000 at the end of 2002 and

Rs.400, 000 at the end of 2003. Also, total revenues for 2004 and 2003 include interest at

15 percent on the years beginning notes receivable balance. Total expenses include a

doubtful accounts expense of Rs.2, 000 each year, based on the direct write-off basis.

Amity estimates that doubtful accounts expense would be 2 percent of sales revenue if

the allowance method were used.

A. Prepare for Amity Universe a comparative single-step income statement that identifies

sales revenue, interest revenue, doubtful accounts expense, and other expenses, all

computed in accordance with generally accepted accounting principles.

B. Is Amity Universes future as promising as his income statement makes it appear? Why

or why not?

----------

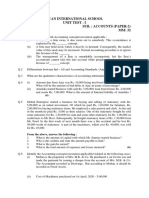

A. Income Statement:

Sales Revenue

Interest Revenue

Total Revenue

Bad Debt Expenses

Other Expenses

Total Expenses

Net Income

2004

150,00

0

60,000

210,00

0

3000

155,00

0

158,00

0

52,000

Interest Revenue:

2003: 200,000*15% = 30,000

2004: 400,000*15% = 60,000

Bad Debt Expenses

2003: 165,000*2% = 3,300

2003

165,00

0

30,000

195,00

0

3300

151,00

0

154,30

0

40,700

2004: 150,000*2% = 3,000

Other Expenses

2003: 153,000 - 2,000 = 151,000

2004: 157,000 - 2,000 = 155,000

B. It is mentioned that Amity Universe sells artifacts either for cash or notes

receivable that earn interest. It is observed that the Sales Revenue is decreasing

from 2003 to 2004 and the notes receivable has increased from 2 lakhs to 4 lakhs

in a year. This implies that the owner has sold the artifact on credit and not

collected the money yet.

Amity Universes future is not as promising as his income statement makes it

appear due to the following reasons:

a. At the end of 2003, the total revenue as per calculation is 395,000 (195,000

+ 200,000). However, at the meetings, it was learnt that the notes

receivables from customers at the end of 2003 was Rs. 400,000. This

difference of Rs. 5000 is probably because a cheque was issued but it

bounced.

Even though the owner has been selling the artifacts on credit, his revenue

is not increasing. This implies that there is less demand for his product and

the product itself is not good.

The above statements prove the company is not worthy enough to collect

the credit. Also, there is an uncertainty involved in this case and it may

happen again in the future.

b. Interest revenue accounts for approx. 29% of the total revenue. However,

Sujan Singh is in the business of selling artifacts, and not giving loans.

Without this revenue, Amity Universes is a loss making company.

c. The notes receivable at the end of the 2002 was Rs. 200,000, implying he

has not collected it for the previous year too. Hence, the prospect of getting

the money back looks bleak. Moreover, when the sales revenue is

decreasing, the cost to help make that revenue is increasing (other expenses

increased from 2003 to 2004)

Potrebbero piacerti anche

- General Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDocumento3 pagineGeneral Instructions:: Class: XII Max. Marks: 30 Date: 13-08-2021 Time: 1 HourDANESH RICHARDNessuna valutazione finora

- Banasthali Vidhyapith Faculty of Management Studies MBA II Semester Financial Management Take-Home AssignmentDocumento7 pagineBanasthali Vidhyapith Faculty of Management Studies MBA II Semester Financial Management Take-Home AssignmentAtulit AgarwalNessuna valutazione finora

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Documento4 pagineFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNessuna valutazione finora

- Segment Sales Net Profit: Sample Questions For Written Test in ProjectsDocumento3 pagineSegment Sales Net Profit: Sample Questions For Written Test in ProjectsvasantNessuna valutazione finora

- Good Will Tuition QuestionsDocumento3 pagineGood Will Tuition QuestionsKunika DubeyNessuna valutazione finora

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Documento5 pagineSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaNessuna valutazione finora

- Ryan International School Unit Test - I Class-Xi Sub.: Accounts (Paper-2) Time: 1 Hrs. MM: 32Documento2 pagineRyan International School Unit Test - I Class-Xi Sub.: Accounts (Paper-2) Time: 1 Hrs. MM: 32RGN 11E 20 KHUSHI NAGARNessuna valutazione finora

- 12 Accountancy ch01 Test Paper 04 Past Adjestments PDFDocumento3 pagine12 Accountancy ch01 Test Paper 04 Past Adjestments PDFRicha SharmaNessuna valutazione finora

- 12 Accountancy ch01 Test Paper 10 Capitalisation Method PDFDocumento2 pagine12 Accountancy ch01 Test Paper 10 Capitalisation Method PDFRicha SharmaNessuna valutazione finora

- 4 - BF - For STUDENTSDocumento47 pagine4 - BF - For STUDENTSPhill SamonteNessuna valutazione finora

- GROUP5 Biggerisntalwaysbetter Case StudyDocumento27 pagineGROUP5 Biggerisntalwaysbetter Case StudyJasmine Cate JumillaNessuna valutazione finora

- Acc FInal QBDocumento54 pagineAcc FInal QBnewalliance commerceNessuna valutazione finora

- AccountsDocumento5 pagineAccountsVinoth Kannan RameshbabuNessuna valutazione finora

- Paper 1: AccountingDocumento30 paginePaper 1: Accountingsuperdole83Nessuna valutazione finora

- Fundamentals of Accounting mgt-205Documento2 pagineFundamentals of Accounting mgt-205Kuch BNessuna valutazione finora

- XII ACC Holiday HomeworkDocumento3 pagineXII ACC Holiday HomeworkGaurav SainNessuna valutazione finora

- CBSE Class 11 Accountancy Unit Test Problems and SolutionsDocumento1 paginaCBSE Class 11 Accountancy Unit Test Problems and SolutionsDinesh Bothra Res-commerce AccountancyNessuna valutazione finora

- Cases Karkraft & Valley TransportersDocumento2 pagineCases Karkraft & Valley TransportersAvirup ChatterjeeNessuna valutazione finora

- Accounts and Business Studies Question BankDocumento5 pagineAccounts and Business Studies Question BankAkshat TiwariNessuna valutazione finora

- Accounting Papers of Ibp Part TwoDocumento64 pagineAccounting Papers of Ibp Part TwoTehreem Ali50% (2)

- Sample Midterm ExamDocumento14 pagineSample Midterm ExamAnyone SomeoneNessuna valutazione finora

- CASHFLOWDocumento16 pagineCASHFLOWAnkit AgarwalNessuna valutazione finora

- Long Question of Financial AcDocumento20 pagineLong Question of Financial AcQasim AliNessuna valutazione finora

- Class 12 - Quarterly Examination Q FINALDocumento11 pagineClass 12 - Quarterly Examination Q FINALsubbuNessuna valutazione finora

- Work 2 Joshi ClassDocumento6 pagineWork 2 Joshi ClassSatyajeet RananavareNessuna valutazione finora

- TSB CFAP 6 Mock 1 - April 27 2019Documento3 pagineTSB CFAP 6 Mock 1 - April 27 2019KAMRAN BAIG0% (1)

- Accounting Test Paper 1: Key ConceptsDocumento30 pagineAccounting Test Paper 1: Key ConceptsSatyajit PandaNessuna valutazione finora

- 11Documento4 pagine11William LanzuelaNessuna valutazione finora

- Mba025 Set1 Set2 520929319Documento16 pagineMba025 Set1 Set2 520929319tejas2111Nessuna valutazione finora

- Worksheet 2 AccountsDocumento3 pagineWorksheet 2 Accountshanu kesharwaniNessuna valutazione finora

- Xii Comm Holiday Homework 2020 23Documento44 pagineXii Comm Holiday Homework 2020 23Mohit SuryavanshiNessuna valutazione finora

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocumento8 pagineSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3Nessuna valutazione finora

- Paper 01Documento12 paginePaper 01sathini sanvidithaNessuna valutazione finora

- GoodwillDocumento19 pagineGoodwillmenekyakiaNessuna valutazione finora

- Accounts Paper Ii PDFDocumento6 pagineAccounts Paper Ii PDFAMIN BUHARI ABDUL KHADERNessuna valutazione finora

- Quiz 1Documento4 pagineQuiz 1ankit coolNessuna valutazione finora

- Accounting Final Sendup 2013Documento3 pagineAccounting Final Sendup 2013Mozam MushtaqNessuna valutazione finora

- Valuation of GoodwillDocumento5 pagineValuation of GoodwillChaaru VarshiniNessuna valutazione finora

- Choose The Best Answer From The Given Alternatives and Provide Your Answer On The Answer Sheet Provided!Documento3 pagineChoose The Best Answer From The Given Alternatives and Provide Your Answer On The Answer Sheet Provided!FantayNessuna valutazione finora

- Accountancy - Paper-I - 2012Documento3 pagineAccountancy - Paper-I - 2012MaryamQaaziNessuna valutazione finora

- Assignments +2 2022 2023 A1 CHAPTR 3Documento3 pagineAssignments +2 2022 2023 A1 CHAPTR 3Lester WilliamsNessuna valutazione finora

- Accounting For Managers MB003 QuestionDocumento34 pagineAccounting For Managers MB003 QuestionAiDLo0% (1)

- Kota FibresDocumento10 pagineKota FibresShishirNessuna valutazione finora

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Documento5 pagineAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNessuna valutazione finora

- Class 12th Accounts Unsolved Sample Paper 1Documento9 pagineClass 12th Accounts Unsolved Sample Paper 1Vikrant NainNessuna valutazione finora

- Practice Assignment For Student (Project 1)Documento4 paginePractice Assignment For Student (Project 1)Saibal Dutta75% (4)

- CA INTER Paper 5 Expected Questions May 2022Documento138 pagineCA INTER Paper 5 Expected Questions May 2022gimNessuna valutazione finora

- Institutional AssessementDocumento4 pagineInstitutional Assessementmagarsa hirphaNessuna valutazione finora

- Xii Acc WS 3Documento4 pagineXii Acc WS 3Gaytri ThaparNessuna valutazione finora

- Fundamental Test PDFDocumento2 pagineFundamental Test PDFHarshit AgarwalNessuna valutazione finora

- Audit QuestionsDocumento7 pagineAudit QuestionsTanya TanyaNessuna valutazione finora

- Kota Fiber Case StudyDocumento17 pagineKota Fiber Case StudyNirajGhimireNessuna valutazione finora

- Ratio Analysis of Airtel FinalDocumento9 pagineRatio Analysis of Airtel FinalRiya PandeyNessuna valutazione finora

- Financial Accounting and Reporting I: Additional Practice QuestionsDocumento34 pagineFinancial Accounting and Reporting I: Additional Practice Questionsalia khanNessuna valutazione finora

- 2013 Accounting Part 1 Support SeminarDocumento11 pagine2013 Accounting Part 1 Support SeminaraashaadhiNessuna valutazione finora

- RKG Imp Q (CH 1 & 2) DoneDocumento3 pagineRKG Imp Q (CH 1 & 2) Donepriyanshi.bansal25Nessuna valutazione finora

- Finc512 PaperDocumento14 pagineFinc512 PaperSHREYANSH RAINessuna valutazione finora

- Accounting-Based Management Principles (Made Easy)Da EverandAccounting-Based Management Principles (Made Easy)Nessuna valutazione finora

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- Policy Brief: What Works?Documento8 paginePolicy Brief: What Works?hemalathaNessuna valutazione finora

- Events Management Proposal Lilydocx RevisedDocumento18 pagineEvents Management Proposal Lilydocx RevisedDvy D. Vargas100% (1)

- Perceived Financial KnowledgeDocumento36 paginePerceived Financial KnowledgeAnkh64Nessuna valutazione finora

- Job Vacancy - Rusumo - Power - CompanyDocumento3 pagineJob Vacancy - Rusumo - Power - CompanyRashid BumarwaNessuna valutazione finora

- House Designs, QHC, 1950Documento50 pagineHouse Designs, QHC, 1950House Histories100% (8)

- Contoh Soal UN Bahasa Inggris SMAaaaaa N 1 NELLYDocumento49 pagineContoh Soal UN Bahasa Inggris SMAaaaaa N 1 NELLYsuherpanNessuna valutazione finora

- Enhanced housing loan policy circularDocumento3 pagineEnhanced housing loan policy circularantcbeNessuna valutazione finora

- Differences Between Angel Investors and Venture CapitalistsDocumento14 pagineDifferences Between Angel Investors and Venture CapitalistsTanvir KhanNessuna valutazione finora

- R.A 8367 PDFDocumento6 pagineR.A 8367 PDFreshell100% (1)

- Assignment On Technical AnalysisDocumento18 pagineAssignment On Technical AnalysisHappie SynghNessuna valutazione finora

- Substance Over FormDocumento2 pagineSubstance Over Formsimson singawahNessuna valutazione finora

- A Project Report On Budgetary Control at Ranna SugarsDocumento69 pagineA Project Report On Budgetary Control at Ranna Sugarsanshul5410Nessuna valutazione finora

- Manufacturing of Agricultural Submersible Pump SetsDocumento6 pagineManufacturing of Agricultural Submersible Pump Setsmohamed shufiyanNessuna valutazione finora

- Indirect TaxDocumento10 pagineIndirect TaxAishwarya TiwariNessuna valutazione finora

- Analysis of Working Capital For Bharti... by Charu Kejriwal... EDITEDDocumento81 pagineAnalysis of Working Capital For Bharti... by Charu Kejriwal... EDITEDmr.avdheshsharma67% (3)

- UBL Internship ReportDocumento68 pagineUBL Internship ReportAisha rashidNessuna valutazione finora

- Exam 3 Review 1Documento31 pagineExam 3 Review 1DamariMoscosoNessuna valutazione finora

- Final Full Thesis TextDocumento79 pagineFinal Full Thesis TextLemlem TesfayeNessuna valutazione finora

- Aquintey V TibongDocumento1 paginaAquintey V TibongEarl Ian DebalucosNessuna valutazione finora

- Time Value - ADocumento22 pagineTime Value - ANAVNIT CHOUDHARYNessuna valutazione finora

- Make $1000 per month with money making tipsDocumento7 pagineMake $1000 per month with money making tipsMuhammad Zia ShahidNessuna valutazione finora

- InfralinePlus June 2016Documento76 pagineInfralinePlus June 2016SurendranathNessuna valutazione finora

- Form W-4 (2008) : Employee's Withholding Allowance CertificateDocumento3 pagineForm W-4 (2008) : Employee's Withholding Allowance CertificatetarisadNessuna valutazione finora

- EMPLOYEE MOTIVATION at Syndicate Bank - Anuj TiwariDocumento71 pagineEMPLOYEE MOTIVATION at Syndicate Bank - Anuj TiwariTahir Hussain50% (6)

- CV Popovici Ana-Maria en PDFDocumento2 pagineCV Popovici Ana-Maria en PDFAna Maria PopoviciNessuna valutazione finora

- Foreign Exchange Department - Punjab National BankDocumento23 pagineForeign Exchange Department - Punjab National BankHusein RangwalaNessuna valutazione finora

- Fixed Income AssignmentDocumento4 pagineFixed Income Assignmentswapnil swadhinataNessuna valutazione finora

- IB Final NotesDocumento29 pagineIB Final NotesfarooqsalimNessuna valutazione finora

- Final Exam Cases on Fallacies and Labor DisputesDocumento1 paginaFinal Exam Cases on Fallacies and Labor DisputesGene AbotNessuna valutazione finora

- Taxation (United Kingdom) : Tuesday 12 June 2012Documento12 pagineTaxation (United Kingdom) : Tuesday 12 June 2012Iftekhar IfteNessuna valutazione finora