Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Caricato da

Shyam SunderTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Caricato da

Shyam SunderCopyright:

Formati disponibili

M. S.

CHOUDHARY & ASSOCIATES

Address - 98, UDAY PARK,

New Delhi 110 049

PH. 011 - 41042727

E-mail : msc@icai.org

CHARTERED ACCOUNTANTS

LIMITED REVIEW REPORT

Review Report to the Board of Directors of

Jyotirgamya Enterprises Limited

We have reviewed the accompanying statement of unaudited financial results of Jyotirgamya Enterprises Limited

for the quarter ended on 30th June, 2016. This statement is the responsibility of the Companys Management and

has been approved by the Board of Directors/ Committee of Board of Directors. Our responsibility is to issue a

report on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400, Engagements to

Review Financial Statements issued by the Institute of Chartered Accountants of India. This standard requires that

we plan and perform the review to obtain moderate assurance as to whether the financial statements are free of

material misstatement. A review is limited primarily to inquiries of company personnel and an analytical

procedure applied to financial data and thus provides less assurance than an audit. We have not performed an

audit and accordingly, we do not express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to believe that the

accompanying statement of unaudited financial results prepared in accordance with applicable accounting

standards and other recognized accounting practices and policies has not disclosed the information required to be

disclosed in terms of Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations,

2015, including the manner in which it is to be disclosed, or that it contains any material misstatement.

For M.S. CHOUDHARY & ASSOCIATES

Chartered Accountants

FRN : 025255N

Madhu Sudan Choudhary

Proprietor

Mem No.: 073229

Place : New Delhi

Date : 10th August, 2016

JYOTIRGAMYA ENTERPRISES LIMITED

Regd Off: 1101, Tolstoy House, Tolstoy Marg, New Delhi - 110 001

Statement of Standalone Unaudited Results for the quarter ended on 30th June, 2016

Amount (in Rs.)

PART I

Statement of Standalone Unaudited Results for the quarter ended on 30th June, 2016

Particulars

Three months Preceding

Corresponding

Year to date

ended

three months

three months

figure for

ended

ended in the

period ended

previous year

30-06-2016

31-03-2016

30-06-2015

30-06-2016

(Refer Notes Below)

(Unaudited)

(Audited)

(Unaudited)

(Unaudited)

Income from operations

(a) Net sales/ income from operations

3,65,000

56,500

3,65,000

(b) Other operating income

4,430

Total income from operations (net)

3,65,000

60,930

3,65,000

Expenses

(a) Cost of materials consumed

(b) Purchases of stock-in-trade

6,09,660

52,020

6,09,660

(c) Changes in inventories of finished goods, work-in-progress

and stock-in-trade

Year to date

figure for

corresponding

period ended

30-06-2015

(Unaudited)

Previous year

ended

31-03-2016

(Audited)

56,500

4,430

60,930

3,66,500

3,66,500

52,020

-

31,08,020

(27,56,000)

(d) Employee benefits expense

(e) Depreciation and amortisation expense

(f) Other expenses

Total expenses

Profit / (Loss) from operations before other income, finance costs

and exceptional items (1-2)

Other income

Profit / (Loss) from ordinary activities before finance costs and

exceptional items (3 + 4)

Finance costs

Profit / (Loss) from ordinary activities after finance costs but

before exceptional items (5 + 6)

Exceptional items

Profit / (Loss) from ordinary activities before tax (7 + 8)

2,05,500

88,891

2,43,798

11,47,849

(7,82,849)

2,74,000

4,08,840

1,29,680

8,12,520

(8,12,520)

1,40,500

57,447

4,927

2,54,894

(1,93,964)

2,05,500

88,891

2,43,798

11,47,849

(7,82,849)

1,40,500

57,447

4,927

2,54,894

(1,93,964)

8,70,500

5,81,181

8,99,369

27,03,070

(23,36,570)

1,37,210

(6,45,639)

3,70,324

(4,42,196)

1,58,624

(35,340)

1,37,210

(6,45,639)

1,58,624

(35,340)

10,76,324

(12,60,246)

(26,744)

(6,72,383)

(1,21,362)

(5,63,558)

(35,340)

(26,744)

(6,72,383)

(35,340)

(1,21,362)

(13,81,608)

(6,72,383)

(5,63,558)

(35,340)

(6,72,383)

(35,340)

(13,81,608)

11

12

Tax expense

Mat Credit Entitlement

Deferred Tax Liability

Net Profit / (Loss) from ordinary activities after tax (9 + 10)

Extraordinary items (net of tax expenes)

(6,72,383)

-

8,413

(1,02,551)

(4,69,420)

-

(35,340)

-

(6,72,383)

-

(35,340)

-

8,413

(1,02,551)

(12,87,470)

-

13

14

Net Profit / (Loss) After Tax for the period (11 + 12)

Paid-up equity share capital (Face Value of Rs. 10/- each)

(6,72,383)

1,00,00,000

(4,69,420)

1,00,00,000

(35,340)

1,00,00,000

(6,72,383)

1,00,00,000

(35,340)

1,00,00,000

(12,87,470)

1,00,00,000

15

Reserve excluding Revaluation Reserves as per balance sheet of

previous accounting year

Earning Per Share before extraordinary items (Face Value Rs. 10/-)

(not annualised) :

1,85,07,757

1,91,80,140

2,04,19,318

1,85,07,757

2,04,19,318

1,91,80,140

Basic Earning Per Share

Diluted Earning Per Share

Earning Per Share after extraordinary items (Face Value Rs. 10/-)

(not annualised) :

(0.67)

(0.67)

(0.47)

(0.47)

(0.04)

(0.04)

(0.67)

(0.67)

(0.04)

(0.04)

(1.29)

(1.29)

Basic Earning Per Share

(a)

Diluted Earning Per Share

(b)

PART II

A

PARTICULARS OF SHAREHOLDING

Public shareholding

1

- Number of shares

- Percentage of shareholding

Promoters and Promoter Group Shareholding**

2

a) Pledged / Encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding of

promoter and promoter group)

(0.67)

(0.67)

(0.47)

(0.47)

(0.04)

(0.04)

(0.67)

(0.67)

(0.04)

(0.04)

(1.29)

(1.29)

7,54,410

75.44%

7,53,400

75.34%

7,54,410

75.44%

7,53,400

75.34%

7,53,400

75.34%

7,53,400

75.34%

3

4

5

6

7

8

9

10

16(i)

(a)

(b)

16(ii)

- Percentage of shares (as a % of the total share capital of

the company)

b) Non - encumbered

- Number of shares

- Percentage of shares (as a % of the total shareholding of

the Promoter and Promoter group)

- Percentage of shares (as a % of the total share capital of

the company)

Particulars

B

Notes :

1

2

INVESTOR COMPLAINTS

Pending at the beginning of the quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end of the quarter

2,45,590

100.00%

2,46,600

100.00%

2,45,590

100.00%

2,46,600

100.00%

2,46,600

100.00%

2,46,600

100.00%

24.56%

24.66%

24.56%

24.66%

24.66%

24.66%

3 months

ended

30-06-2016

0

0

N.A.

0

The aforesaid financial result have been approved by the Board of Directors in its Board meeting held on 10.08.2016

Figures for the prior period have been regrouped and / or rearranged wherever considered necessary.

By Order of the Board

Place:

Date:

New Delhi

10.08.2016

Ashok Kumar Chordia

(Director)

Din:- 01511622

Potrebbero piacerti anche

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento7 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For June 30, 2013 (Result)Documento3 pagineFinancial Results & Limited Review For June 30, 2013 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2013 (Result)Documento3 pagineFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results For December 31, 2015 (Result)Documento3 pagineFinancial Results For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento8 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For June 30, 2014 (Result)Documento4 pagineFinancial Results & Limited Review For June 30, 2014 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento8 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNessuna valutazione finora

- Mastering Tally PRIME: Training, Certification & JobDa EverandMastering Tally PRIME: Training, Certification & JobNessuna valutazione finora

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 paginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderNessuna valutazione finora

- Financial Results For Dec 31, 2013 (Result)Documento4 pagineFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Mutual Fund Holdings in DHFLDocumento7 pagineMutual Fund Holdings in DHFLShyam SunderNessuna valutazione finora

- JUSTDIAL Mutual Fund HoldingsDocumento2 pagineJUSTDIAL Mutual Fund HoldingsShyam SunderNessuna valutazione finora

- Financial Results For September 30, 2013 (Result)Documento2 pagineFinancial Results For September 30, 2013 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 pagineSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNessuna valutazione finora

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 pagineOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNessuna valutazione finora

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 paginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 pagineSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNessuna valutazione finora

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 pagineFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNessuna valutazione finora

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 pagineExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 pagineFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento11 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results For Mar 31, 2014 (Result)Documento2 pagineFinancial Results For Mar 31, 2014 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento3 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- PDF Processed With Cutepdf Evaluation EditionDocumento3 paginePDF Processed With Cutepdf Evaluation EditionShyam SunderNessuna valutazione finora

- Standalone Financial Results For June 30, 2016 (Result)Documento2 pagineStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Investor Presentation For December 31, 2016 (Company Update)Documento27 pagineInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 pagineTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Review: Midterm I Financial Accounting (2) Multiple Choice QuestionsDocumento40 pagineReview: Midterm I Financial Accounting (2) Multiple Choice QuestionsC14041159王莫堯Nessuna valutazione finora

- FAR.2913 - Government Grants.Documento4 pagineFAR.2913 - Government Grants.Edmark LuspeNessuna valutazione finora

- Adjusting The Accounts: Learning ObjectivesDocumento83 pagineAdjusting The Accounts: Learning Objectivesorstyd100% (1)

- AFAR H01 Cost Accounting PDFDocumento7 pagineAFAR H01 Cost Accounting PDFhellokittysaranghaeNessuna valutazione finora

- Inventories: Learning OutcomesDocumento28 pagineInventories: Learning OutcomesCA Kranthi KiranNessuna valutazione finora

- Problems: Problem 12 - 2Documento9 pagineProblems: Problem 12 - 2Jein PNessuna valutazione finora

- 2 Financial AnalysisDocumento22 pagine2 Financial AnalysisAB11A4-Condor, Joana MieNessuna valutazione finora

- L5 - ABFA1173 POA (Lecturer)Documento6 pagineL5 - ABFA1173 POA (Lecturer)Tan SiewsiewNessuna valutazione finora

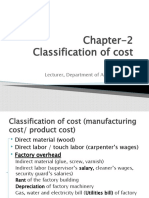

- Chapter 2 (Cost Classification)Documento13 pagineChapter 2 (Cost Classification)Najia MuktaNessuna valutazione finora

- Intermediate Accounting I: Financial AssetsDocumento20 pagineIntermediate Accounting I: Financial AssetsdeeznutsNessuna valutazione finora

- UntitledDocumento4 pagineUntitledRima WahyuNessuna valutazione finora

- 01 Ipptchap001 - Changing Role of Managerial Accounting (Edited)Documento12 pagine01 Ipptchap001 - Changing Role of Managerial Accounting (Edited)Alok Raj0% (1)

- CH 10Documento74 pagineCH 10Satria WijayaNessuna valutazione finora

- Final AccountsDocumento20 pagineFinal Accountsabhimanbehera0% (1)

- This Study Resource WasDocumento7 pagineThis Study Resource WasFarhana GuiandalNessuna valutazione finora

- Capital Structure + International WACCDocumento34 pagineCapital Structure + International WACCSiobhainNessuna valutazione finora

- Beams11 ppt09Documento19 pagineBeams11 ppt09Mario RosaNessuna valutazione finora

- PT Barito Pacific TBK - Fy 2020Documento210 paginePT Barito Pacific TBK - Fy 2020Muhammad MuhammadNessuna valutazione finora

- Loan ImpairmentDocumento22 pagineLoan ImpairmentJEFFERSON CUTENessuna valutazione finora

- EC1 - Module 2 3Documento6 pagineEC1 - Module 2 3Vincent Anthony SandoyNessuna valutazione finora

- Financial analysis of Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCLDocumento13 pagineFinancial analysis of Deepak Fertilizers and Petrochemicals Corporation Limited (DFPCLSiddharth Rohilla (M22MS074)Nessuna valutazione finora

- Asset Utilization AnalysisDocumento41 pagineAsset Utilization AnalysisMohamedHibahMhibahNessuna valutazione finora

- MGT 201 All Solved Quiz 2 in One FileDocumento77 pagineMGT 201 All Solved Quiz 2 in One FilenargisNessuna valutazione finora

- Financial Statement FraudDocumento6 pagineFinancial Statement FraudPranay DubeyNessuna valutazione finora

- Module 10 PAS 33Documento4 pagineModule 10 PAS 33Jan JanNessuna valutazione finora

- Cfas - Journal EntriesDocumento3 pagineCfas - Journal EntriesJefferson SarmientoNessuna valutazione finora

- Ummary of Study Objectives: 198 Financial StatementsDocumento5 pagineUmmary of Study Objectives: 198 Financial StatementsYun ChandoraNessuna valutazione finora

- ACC - Nguyen Thanh Tung - Indi 2Documento4 pagineACC - Nguyen Thanh Tung - Indi 2Nguyen Thanh Tung (K15 HL)Nessuna valutazione finora

- Questions From SM 2020-SfmDocumento85 pagineQuestions From SM 2020-Sfmvishnu tejaNessuna valutazione finora

- PGFAP-Brochure v2Documento15 paginePGFAP-Brochure v2Art EuphoriaNessuna valutazione finora