Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Ac1 1-1 3

Caricato da

Adeirehs Eyemarket BrissettDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Ac1 1-1 3

Caricato da

Adeirehs Eyemarket BrissettCopyright:

Formati disponibili

Managing Financial Principles and Techniques

Sherieda Brissett

1.1

AC 1.1-1.3

The importance of costs in the pricing strategy of the International University of the

Caribbean (IUC):

Costs are important in the pricing strategy of the International University of the Caribbean. The

organization provides an opportunity for individuals to attain tertiary education, and this is being done

amongst numerous competitors. As this is so, the company needs to be able to deliver its educational

services at a competitive cost, and this is done by surveying the rivals for the current costs on the market

and arriving at a reasonable cost that will not only benefit the customers but the organization as well.

Without controlling costs, IUC will not be able to have a niche in the tertiary education market. Having

the right costing system helps in controlling costs. Two of the main reasons behind the poor performance

of the International University of the Caribbean over the past two years are poor cost management and the

lack of pricing strategy.

1.2

A costing system to be used by the International University of the Caribbean:

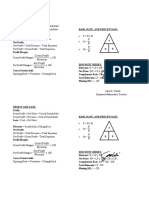

IUCs costing system is based on absorption costing system. In this costing system both the fixed and

variable costs are included in the costing to determine prices. Variable costs are those costs which vary

with the change in production level while fixed costs are those which remain unchanged with the

production levels. An absorption costing system for IUC will look like:

Direct Material Costs

Plus: Direct labor costs

Plus: Variable manufacturing overhead

------------------------------------------------Total Variable costs

Add: Fixed production costs

Add: Fixed non-production costs

-------------------------------------------------Total cost = Total fixed cost + Total variable costs

Average cost per unit = Total cost / Total output

Add: Mark-up (say 20 %)

Managing Financial Principles and Techniques

Sherieda Brissett

-------------------------------------------------

AC 1.1-1.3

Total price per unit

1.3 Recommendations on improving the costing and pricing systems used by IUC

In 2011 IUC charged a mark-up of a whopping 64.015 percent (for calculations see below) on its total

cost per unit for setting the price per unit. However, the net profit margin was only 3.04 per cent.

In 2010 IUC charged a mark-up of 63.93 per cent on its total cost per unit for setting the price per unit.

However, the net profit margin was only 3.68 per cent.

In spite of the high mark-up, the net profit margin is very low because of the very high selling and

administrative expenses. It is imperative that the company cuts down its selling and administrative

expenses.

A better pricing strategy may be one where the company charges only variable cost. On the variable costs

it may charge the same mark-up which it is currently charging (around 60 per cent). This will have the

effect of lowering the price per unit charged from customers. A lower (more competitive) price may

translate into much high revenues for IUC if the price elasticity of demand of its products is greater than

one. In such a case variable costing strategy will transfer into higher profits for the company.

Calculation of mark-up:

Mark-up charged = (Sale cost of programme) / Cost of programmes ran) * 100

Mark-up charged in 2011 = (2990 1823 ) / 1823) * 100 = 64.01 per cent

Mark-up charged in 2010 = (3500 2135)/2135) * 100 = 63.93 per cent

Net profit margin = (Net Profit / Sales) * 100

Net profit margin in 2011 = (91/2990) * 100 = 3.04 per cent.

Net profit margin in 2010 = (129/ 3500) * 100 = 3.68 per cent.

Potrebbero piacerti anche

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesDa EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNessuna valutazione finora

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageDa EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageValutazione: 5 su 5 stelle5/5 (1)

- Cost Volume Profit AnalysisDocumento12 pagineCost Volume Profit Analysisganeshiyer1467% (3)

- Marginal Costing With Decision MakingDocumento38 pagineMarginal Costing With Decision MakingHaresh Sahitya0% (1)

- Strategic Cost Management - A - STDocumento14 pagineStrategic Cost Management - A - STAnkush KriplaniNessuna valutazione finora

- Introduction To CostsDocumento7 pagineIntroduction To CostsLisaNessuna valutazione finora

- Marginal Costing - DefinitionDocumento15 pagineMarginal Costing - DefinitionShivani JainNessuna valutazione finora

- Marginal and Absorption CostingDocumento5 pagineMarginal and Absorption CostingHrutik DeshmukhNessuna valutazione finora

- Tong Hop Kien ThucDocumento13 pagineTong Hop Kien ThucCloudSpireNessuna valutazione finora

- Acc 3200 MidtermDocumento5 pagineAcc 3200 MidtermCici ZhouNessuna valutazione finora

- Topic 1: Assumptions of CVP AnalysisDocumento8 pagineTopic 1: Assumptions of CVP AnalysisZaib NawazNessuna valutazione finora

- Learning ObjectivesDocumento10 pagineLearning ObjectivesShraddha MalandkarNessuna valutazione finora

- What Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsDocumento10 pagineWhat Is The Difference Between Marginal Costing and Absorption Costing Only HeadingsLucky ChaudhryNessuna valutazione finora

- ADVANCED COST ACCOUNTING ACC 310 Marginal Absoption Lecture 12Documento30 pagineADVANCED COST ACCOUNTING ACC 310 Marginal Absoption Lecture 12okeowoNessuna valutazione finora

- Acct 2321 Essay Q&A Exam - 2Documento3 pagineAcct 2321 Essay Q&A Exam - 2Sayyaf NayefNessuna valutazione finora

- Full Cost AccountingDocumento27 pagineFull Cost AccountingMarjorie OndevillaNessuna valutazione finora

- UGB253 Management Accounting Business FinalDocumento15 pagineUGB253 Management Accounting Business FinalMohamed AzmalNessuna valutazione finora

- Final JOBDocumento9 pagineFinal JOBHenok SamuelNessuna valutazione finora

- IntroDocumento37 pagineIntrowfd52muni100% (1)

- Chapter Six Pricing Decisions: Major Influences On Pricing DecisionDocumento6 pagineChapter Six Pricing Decisions: Major Influences On Pricing DecisionTESFAY GEBRECHERKOSNessuna valutazione finora

- Budgeting, Costing & EstimatingDocumento32 pagineBudgeting, Costing & Estimatingmastermind_asia9389Nessuna valutazione finora

- Standard CostingDocumento12 pagineStandard CostingPîyûsh KôltêNessuna valutazione finora

- MarginalCosting Unit 5Documento13 pagineMarginalCosting Unit 5sourabhdangarhNessuna valutazione finora

- Ca - Ii CH-5Documento5 pagineCa - Ii CH-5Moti BekeleNessuna valutazione finora

- Marginal CostingDocumento37 pagineMarginal Costingbhavinpoldiya100% (1)

- Classification of CostingDocumento22 pagineClassification of CostingMohamaad SihatthNessuna valutazione finora

- Managing Financial Principlemns and TechniquesDocumento23 pagineManaging Financial Principlemns and Techniquesamersown100% (1)

- Cost Behavior Patterns and CPV Analysis: Chapter SixDocumento20 pagineCost Behavior Patterns and CPV Analysis: Chapter Sixabraha gebruNessuna valutazione finora

- Cost Accounting ConceptsDocumento18 pagineCost Accounting Concepts18arshiNessuna valutazione finora

- East Africa University (Eau) Cost AccountingDocumento27 pagineEast Africa University (Eau) Cost AccountingJohn HassanNessuna valutazione finora

- Management Information Class: Prepared By: A.K.M Mesbahul Karim FCADocumento33 pagineManagement Information Class: Prepared By: A.K.M Mesbahul Karim FCAFarjana AkterNessuna valutazione finora

- Distinguish Between Marginal Costing and Absorption CostingDocumento10 pagineDistinguish Between Marginal Costing and Absorption Costingmohamed Suhuraab50% (2)

- Cost Accounting AssignmentDocumento12 pagineCost Accounting Assignmentridhim khandelwalNessuna valutazione finora

- MB0041 AccountsDocumento10 pagineMB0041 AccountsvermaksatishNessuna valutazione finora

- Ca - Ipcc: Cost & Management AccountingDocumento33 pagineCa - Ipcc: Cost & Management AccountingsaikiranNessuna valutazione finora

- Unit 1 Introduction To Cost AccountingDocumento10 pagineUnit 1 Introduction To Cost AccountingPRINCE THAKURNessuna valutazione finora

- Cost ConceptDocumento6 pagineCost ConceptDeepti KumariNessuna valutazione finora

- Decision Making Through Marginal CostingDocumento33 pagineDecision Making Through Marginal CostingKanika Chhabra100% (2)

- Break Even Analysis: Costing Systems and Techniques For Engineering CompaniesDocumento6 pagineBreak Even Analysis: Costing Systems and Techniques For Engineering Companiesasimrafiq12Nessuna valutazione finora

- CostingDocumento32 pagineCostingnidhiNessuna valutazione finora

- Vendmart - TheDocumento6 pagineVendmart - TheSagarrajaNessuna valutazione finora

- Standard Cost DefinitionDocumento45 pagineStandard Cost DefinitionSandeep ShahNessuna valutazione finora

- Objectives:: Semester Cost and Management AccountingDocumento87 pagineObjectives:: Semester Cost and Management AccountingJon MemeNessuna valutazione finora

- Cost & Management AccountantDocumento7 pagineCost & Management AccountantLavina AgarwalNessuna valutazione finora

- AM TutorDocumento73 pagineAM TutorSebastian FernandoNessuna valutazione finora

- Costing For A Spinning MillDocumento9 pagineCosting For A Spinning MillNajmus SalihinNessuna valutazione finora

- Target and Kaizen CostingDocumento7 pagineTarget and Kaizen CostingFridRachmanNessuna valutazione finora

- Costing For A Spinning MillDocumento14 pagineCosting For A Spinning Millvijay100% (1)

- Break Even AnalysisDocumento14 pagineBreak Even AnalysisChitrank KaushikNessuna valutazione finora

- 5 Marginal CostingDocumento31 pagine5 Marginal CostingAkash GuptaNessuna valutazione finora

- CosmanDocumento7 pagineCosmanShanen MacansantosNessuna valutazione finora

- Costing For A Spinning Mill PDFDocumento13 pagineCosting For A Spinning Mill PDFyogesh kumawatNessuna valutazione finora

- Target Costing Presentation FinalDocumento57 pagineTarget Costing Presentation FinalMr Dampha100% (1)

- Acca Paper 1.2Documento25 pagineAcca Paper 1.2anon-280248Nessuna valutazione finora

- 11th Sem - Cost ACT 1st NoteDocumento5 pagine11th Sem - Cost ACT 1st NoteRobin420420Nessuna valutazione finora

- Strategic Cost ManagementDocumento24 pagineStrategic Cost Managementsai500Nessuna valutazione finora

- Cost Management: A Case for Business Process Re-engineeringDa EverandCost Management: A Case for Business Process Re-engineeringNessuna valutazione finora

- Engineering Economics & Accountancy :Managerial EconomicsDa EverandEngineering Economics & Accountancy :Managerial EconomicsNessuna valutazione finora

- Mapping Strategic Management ResearchDocumento16 pagineMapping Strategic Management ResearchAdeirehs Eyemarket BrissettNessuna valutazione finora

- L5-Unit 15 - 2.4Documento19 pagineL5-Unit 15 - 2.4Adeirehs Eyemarket BrissettNessuna valutazione finora

- Contribution of Business Intelligence To Strategic Mgmt-ResearchDocumento78 pagineContribution of Business Intelligence To Strategic Mgmt-ResearchAdeirehs Eyemarket BrissettNessuna valutazione finora

- Managing Financial Principles and Techniques: Sherieda BrissettDocumento5 pagineManaging Financial Principles and Techniques: Sherieda BrissettAdeirehs Eyemarket BrissettNessuna valutazione finora

- MFP - Lo3-4Documento18 pagineMFP - Lo3-4Adeirehs Eyemarket BrissettNessuna valutazione finora

- Unit 13 - Target SettingDocumento11 pagineUnit 13 - Target SettingAdeirehs Eyemarket BrissettNessuna valutazione finora

- Unit 13 - Cost and PricesDocumento16 pagineUnit 13 - Cost and PricesAdeirehs Eyemarket BrissettNessuna valutazione finora

- Unit 5 Full Assignment E StrategyDocumento27 pagineUnit 5 Full Assignment E StrategyAdeirehs Eyemarket Brissett67% (3)

- Assignment: Managing Financial Principles and TechniquesDocumento11 pagineAssignment: Managing Financial Principles and TechniquesAdeirehs Eyemarket BrissettNessuna valutazione finora

- Unit 13 - BudgetsDocumento20 pagineUnit 13 - BudgetsAdeirehs Eyemarket BrissettNessuna valutazione finora

- Unit 13 - Cost SystemsDocumento27 pagineUnit 13 - Cost SystemsAdeirehs Eyemarket BrissettNessuna valutazione finora

- MFPAT Accounting EssayDocumento9 pagineMFPAT Accounting EssayAdeirehs Eyemarket BrissettNessuna valutazione finora

- Unit 13 - Target SettingDocumento11 pagineUnit 13 - Target SettingAdeirehs Eyemarket BrissettNessuna valutazione finora

- Unit 13 - ProcessDocumento22 pagineUnit 13 - ProcessAdeirehs Eyemarket BrissettNessuna valutazione finora

- UNIT 13 - Responsibility and Control of SystemsDocumento17 pagineUNIT 13 - Responsibility and Control of SystemsAdeirehs Eyemarket BrissettNessuna valutazione finora

- Unit 13 - Activity - Based CostingDocumento25 pagineUnit 13 - Activity - Based CostingAdeirehs Eyemarket BrissettNessuna valutazione finora

- Unit 13 - Forecasting TechniquesDocumento35 pagineUnit 13 - Forecasting TechniquesAdeirehs Eyemarket BrissettNessuna valutazione finora

- Tire City - WorksheetDocumento3 pagineTire City - WorksheetBach CaoNessuna valutazione finora

- Branch AccountingDocumento38 pagineBranch AccountingAshutosh shriwasNessuna valutazione finora

- PM BECKER Mock 1 Ans.Documento15 paginePM BECKER Mock 1 Ans.SHIVAM BARANWALNessuna valutazione finora

- Entrep Q4 - Module 6Documento13 pagineEntrep Q4 - Module 6Paula DT Pelito100% (1)

- Key Performance Indicators Sample ChapterDocumento48 pagineKey Performance Indicators Sample ChapterMihaela Dobre100% (1)

- Liquidity and Profitability RatioDocumento5 pagineLiquidity and Profitability RatioRituraj RanjanNessuna valutazione finora

- Introduction of The Selected CompaniesDocumento8 pagineIntroduction of The Selected CompaniesAbdullah NorainNessuna valutazione finora

- Project On Financial Modeling of The Coca Cola Company: Information Technology Training Centre-Charni RoadDocumento14 pagineProject On Financial Modeling of The Coca Cola Company: Information Technology Training Centre-Charni RoadVishal AhujaNessuna valutazione finora

- Role of The Investment Corporation of Bangladesh ICB in Development of Capital Market in BangladeshDocumento45 pagineRole of The Investment Corporation of Bangladesh ICB in Development of Capital Market in BangladeshAuishee BaruaNessuna valutazione finora

- A212 - Topic 2 - Slides (Part Ii)Documento26 pagineA212 - Topic 2 - Slides (Part Ii)Teo ShengNessuna valutazione finora

- Feasibility Study Final Na Ba To Haha 1Documento132 pagineFeasibility Study Final Na Ba To Haha 1Neil Frank A. LorenzoNessuna valutazione finora

- Financial Statement Analysis ToolsDocumento33 pagineFinancial Statement Analysis Toolsmarjannaseri77Nessuna valutazione finora

- 22th July 2013 (A Case Analysis Os S.alam Group of Company)Documento25 pagine22th July 2013 (A Case Analysis Os S.alam Group of Company)Nazrul IslamNessuna valutazione finora

- Mod8 Computation of Gross Profit v2Documento16 pagineMod8 Computation of Gross Profit v2MARY JOY RUSTIANessuna valutazione finora

- Beximco Pharmaceuticals Ltd.Documento19 pagineBeximco Pharmaceuticals Ltd.Mahfuj RahmanNessuna valutazione finora

- Formula CardDocumento2 pagineFormula CardAlisa GandoNessuna valutazione finora

- Group07 PA01 Financial Statement Analysis With Case StudyDocumento82 pagineGroup07 PA01 Financial Statement Analysis With Case StudyHuỳnh Mai PhươngNessuna valutazione finora

- Cambridge International AS & A Level: Business 9609/22 May/June 2021Documento22 pagineCambridge International AS & A Level: Business 9609/22 May/June 2021Daliya chaudhariNessuna valutazione finora

- Financial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTDocumento69 pagineFinancial Ratios at B.D.K. Ltd. Hubli PROJECT REPORTBabasab Patil (Karrisatte)100% (1)

- Analysis Sums-1Documento10 pagineAnalysis Sums-1Jessy NairNessuna valutazione finora

- Profitability & Liquidity Ratio AnalysisDocumento19 pagineProfitability & Liquidity Ratio AnalysisananditaNessuna valutazione finora

- DissertationDocumento24 pagineDissertationSaima NishatNessuna valutazione finora

- FIN201 Final Term PaperDocumento26 pagineFIN201 Final Term PaperAsh ShafiNessuna valutazione finora

- Ceylon Hospitals PLC and Nawaloka Hospitals PLC (1194)Documento22 pagineCeylon Hospitals PLC and Nawaloka Hospitals PLC (1194)Bajalock Virus0% (1)

- Presentation On Key Performance Indicators (KPI) and CAMEL Analysis of andDocumento44 paginePresentation On Key Performance Indicators (KPI) and CAMEL Analysis of andPravin MehtaNessuna valutazione finora

- Research Paper On Ratio AnalysisDocumento8 pagineResearch Paper On Ratio Analysislekotopizow2100% (1)

- Corporate Finance North South University ReportDocumento44 pagineCorporate Finance North South University ReportTahsin UddinNessuna valutazione finora

- Ast Lesson Plan Financial Ratios Year11Documento13 pagineAst Lesson Plan Financial Ratios Year11Ankita kumariNessuna valutazione finora

- Profitability Ratios With AnalysisDocumento4 pagineProfitability Ratios With AnalysisElla JoyceNessuna valutazione finora

- BUS 5111 - Financial Management - Written Assignment Unit 1Documento4 pagineBUS 5111 - Financial Management - Written Assignment Unit 1LaVida LocaNessuna valutazione finora