Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financing Trends in The Solar Sector PDF

Caricato da

rajuanthatiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financing Trends in The Solar Sector PDF

Caricato da

rajuanthatiCopyright:

Formati disponibili

Financing Trends in the Solar Sector

1 of 7

http://ecmweb.com/print/green-building/financing-trends-solar-sector

print | close

Electrical Construction and Maintenance

Tom Zind

By Tom Zind, Freelance Writer

Fri, 2012-11-09 11:26

For an energy source thats so consistent and measured in its 93-million-mile trek to Earths atmosphere, solar

power rides a roller coaster of heady promise and stark reality as its factored into the market for electrical

energy.

From a technical standpoint, snatching energy from the sun has never been easier. Technologies for accessing,

converting, and distributing solar energy chiefly via photovoltaic (PV) panels are proven and established.

Meanwhile, progress on the next game-changing technical front to refine methods of capturing and storing it in

batteries is picking up steam.

Its in the

mechanics of

integrating

itself into the

existing

electrical

energy

framework

where solar

is still

searching for

its footing.

Competing

against wind

and other

renewables,

as well as

established

fossil fuels,

on a playing

field thats

buckling under forces that swing between tilting and levelizing it, solar seems to be running in place. On one

level, its raring to go; on another, its stymied by seemingly intractable market realities.

After a flurry of activity, some publicly funded financial incentives that helped solar take off around 2005 are

ebbing. Thats left it more exposed to the mercy of fundamental energy market forces that are proving

stubbornly resistant to renewables. But at the same time, prices and supplies of fossil fuels notably natural gas

are gyrating. The result amounts to more questions than answers about long-term prospects for traditional

07-03-15 2:00 PM

Financing Trends in the Solar Sector

2 of 7

http://ecmweb.com/print/green-building/financing-trends-solar-sector

energy sources and, by extension, renewables like solar.

Big picture entices investors

The bigger financial picture for solar is anything but bleak, however, especially in light of the emergence of

creative funding concepts. Taking a long view of the energy market through an environmental prism, solar

industry players cant help but see a bright future. But for as far as the eye can see, solars economic viability will

be a central concern one that financiers, developers, installers, and power producers are working hard to

address.

Convinced that its core attributes as a clean and abundant source of power make it a cant-miss technical

proposition, the solar delivery industry is shifting more of its attention to rationalizing solar as a sound

investment. Exploring everything from new twists on leases, third-party ownership, and power purchase

agreements on the consumer side to vehicles such as project bonds, asset securitization, and master limited

partnership arrangements on the developer side, solar proponents are turning over every stone for answers (see

SIDEBAR: Funding Options).

While it is indeed more challenging to make solar projects work financially, investor interest in projects remains

fundamentally strong, contends Mark Crowdis, president of Reznick Think Energy, LLC, a renewable energy

consultancy with headquarters in Bethesda, Md. Yes, expirations and retrenchments of incentives put solar on

shakier investment ground. It was easier to develop investor-grade projects before expiration of the Treasury

Departments 1603 grant program, which doled out 30% of a projects cost in direct cash, and the Energy

Departments 1705 loan guarantee program for riskier utility-scale projects. Many investors were more

enthusiastic about solar projects and willing to take more risks before the near-collapse of the New Jersey solar

renewable energy credit (SREC) market. Add in plummeting natural gas prices and entrenched fossil fuel

subsidies, and the picture worsens.

But this situation is being partially offset, he notes, by falling prices on PV components. Plus, requirements that

utilities boost the renewables component of their energy mix in some cases with specific solar carve outs

and efforts to broaden their corporate investment portfolios to include funding of distributed solar project

investments act as counterweights to the incentive reductions and decreased electricity prices.

Theres capital in this market, says Crowdis. Investors used to lack an understanding of how solar

technologies and systems worked. Now investors are much savvier. Theres more understanding of solar

enough so that more investors are now willing to provide capital for projects. Banks, pension funds, and even

individuals want to invest in renewable energy in North America. Its seen as an attractive, stable, and potentially

high-return investment.

Topping out or taking a break?

Between 2004 and 2011, it seems, investors increasingly bought that argument. During that time, according to a

May 2012 white paper published by Bloomberg New Energy Finance, Re-Imagining U.S. Solar Financing,

asset financing of U.S. solar PV projects grew 58%. Such funding peaked in 2011, Bloomberg says, spurred

partly by looming year-end incentives expirations, when $21.1 billion was secured to help build out some 1.8 GW

of new solar PV capacity.

Looking ahead, the white paper projects that U.S. PV deployment will demand an average of $6.9 billion per

year through 2020. Between 2012 and 2020, residential and commercial capacity alone not counting

utility-scale installations will grow at a compounded annual rate of 22%, resulting in almost 16 GW of

cumulative capacity at the close of that period.

07-03-15 2:00 PM

Financing Trends in the Solar Sector

3 of 7

http://ecmweb.com/print/green-building/financing-trends-solar-sector

Meanwhile,

utilityinstalled PV

continued to

grow at a

faster clip

into 2012. In

the years

second

quarter

alone, utility

PV installs

numbered

more than

20 for a

combined

447MW,

according to a report from GTM Research and the Solar Energy Industries Association. According to this report,

it was the busiest quarter ever for utility-scale PV.

Overall, PV installs of 742MW were up 116% in the quarter over the same period in 2011, the report said. The

residential market experienced little growth in the quarter, while the commercial market contracted 33%

quarter-over-quarter. Still, the residential and commercial markets could be the near-term growth engines for

PV. If utilities are reluctant to disrupt the profitable status quo with big capital outlays on solar, more electric

customers are increasingly eager to get out ahead of the steepening energy cost curve. PV systems either

purchased outright or leased while still generally requiring a substantial investment thats lashed to an

extended payback period offer an opportunity to lay a foundation for lower net energy costs down the road.

Thats leading more companies, among them specialized electrical contractors, to get into the business of

formulating, designing, and installing PV solutions for this market a market thats likely to grow as solar

capital equipment and installation costs come down amidst a growing supply glut and a consolidating industry.

Shift to utility projects

Eying solar and other alternative energy sources from a short-term hedging and long-term positioning

perspective, utilities and independent power producers certainly have begun to integrate more solar into their

generation mix. However, theres little evidence theyre in any particular hurry to allocate large slugs of capital

and capacity to new technologies. With systems built for abundant coal and now, more recently, cheap natural

gas power producers still have little incentive to embark on wholesale replacements of fully depreciated

generation and transmission assets that can deliver power efficiently, if not at a price far from certain to remain

stable.

That utility market, however, has been where the action is for some companies that have sought to stake out

positions on the leading edge of the solar installation market. Having plunged into the commercial market in the

busy early-adopter phase, some solar systems contractors have been shifting their attention to utility market

niches that offer more immediate potential.

In the quest for more opportunities to keep its hand in the evolving solar space, Rosendin Electric has delved

deeper into markets where solars economic advantage is stark. Having installed large renewable distributed

energy generation (RDEG) PV projects in municipalities and school districts in California, as well as

07-03-15 2:00 PM

Financing Trends in the Solar Sector

4 of 7

http://ecmweb.com/print/green-building/financing-trends-solar-sector

utility-grade solar farm projects, the San Jose, Calif., electrical contractor turned its attention to utility projects

in markets where sunlight factors and exceedingly high incumbent energy costs make a near slam-dunk case for

PV.

Rosendin Electric is in the midst of building a 75MW PV solar farm project for the state-owned utility in Puerto

Rico. Because end-user energy costs are 25 to 32 cents per kWh and rising, this arrangement is an ideal

candidate for an alternative energy approach. Seeing a window of opportunity to address high energy costs and

an aging fuel oil-based electric supply, the islands governor pushed through renewable portfolio standards for

the utility, paving the way for this and many other PV projects, says Duncan Frederick, the companys director of

solar operations.

Beyond these utility-scale opportunities, theres a high concentration of industrial and commercial users in

Puerto Rico, especially in the pharmaceutical sector there, who are paying a lot for power, creating a demand for

local RDEG renewable power solutions, he says. Were [solar contractors] all chasing markets like this that

have a fundamental higher cost of power, because without that its tough to make these projects work. Larger

EPC players like us saw a great ride with local incentivized RDEG projects, but we needed to switch gears to

focus on new markets as state and local incentives have dried up.

Signs of life in commercial

In a clear demonstration of the PV markets protractedly unsettled nature, Frederick is now looking for new

signs of life in the commercial RDEG space. With the utility sector generally looking tougher to crack because of

low natural gas prices, that market may present new opportunities for the company to partner with developers

and independent power producers on commercial PV projects wherein financial returns for equity investment

are becoming competitive, he says.

Were in a holding pattern to see how that shakes out the idea being that we want to have a good presence in

both markets, knowing that each one will have its ups and downs, he says.

The

commercial

PV market

could be

poised for

growth if only

because the

prospect of

uncertain and

likely rising

energy costs

is so

menacing.

For especially

large

commercial

users

positioned to

leverage

economies of

scale, PV

07-03-15 2:00 PM

Financing Trends in the Solar Sector

5 of 7

http://ecmweb.com/print/green-building/financing-trends-solar-sector

installations

can represent

an investment

in a key

component of

competitiveness. Combine that with the ability to possibly offset costs with incentives for the use of alternative

energy and the ability to use power purchase agreements (PPAs) to sell power produced on-site back into the

grid, and big commercial energy users may begin to see the advantages.

If youre a large business like a Wal-mart-type operation that has a lot of buildings that allows you to do an

aggregated bid on a system, the numbers can be made to work, Crowdis says. But I think its still going to be

harder to make the financial case without any incentives in place, with the exception of spots where electric rates

are very high.

The bar for financial feasibility in the non-residential market may not be as high, though, if creative funding

schemes and payback scenarios can be brought into play. Third-party finance, for instance, can bring in outside

entities to build, operate, maintain, and attempt to turn a profit from a PV system. The commercial entity, in

turn, gets to tap into some of the power generated, presumably at competitive rates. The owner, meanwhile,

juices its return via tax-equity financing that takes advantage of investment tax credits for funding renewable

energy projects.

Cupertino Electric, Inc., a San Jose electrical contractor, is hopeful that creative financing and other forms of

outside investment will help fuel an uptick over time in commercial PV in California. Saurabh Samdani, who

oversees forecasting and modeling for the company, sees commercial PV prospects still being uncomfortable

with the idea of outright system ownership.

We can tell everyone that solar systems are easy to operate and maintain, but many companies dont have the

processes or people in place to do it, Samdani says. They may not be interested in taking the risk of owning and

operating a system. The common perception is that these activities are best left to the entities who understand

this risk. Therefore, these companies are more comfortable with a third-party owning and maintaining the

system.

Still, from a financial resources standpoint, many companies willing to consider aggressive steps to get a handle

on their own energy costs may be better positioned than ever, says John Curcio, who started Cupertinos

renewables division in 2007 and now serves as its chief commercial officer.

Theres a tremendous amount of cash on company balance sheets today, so the resources might be there to

directly fund a PV system, he says.

Factoring solar into the grid

Growth in the commercial and residential PV market could also come courtesy of evolving regulations governing

how solar energy system owners can offset the costs of power obtained from the grid. Curcio noted recent

progress in California on advantageous changes to net metering that would allow commercial PV users to

consolidate meters from multiple properties for the purpose of calculating net energy cost savings on utilityfurnished power.

Net metering and other techniques that can effectively lower electric consumption and costs will be an important

driver of PVs growth in the residential market. With systems still costly enough to generally preclude outright

ownership, homeowners will need more certainty that their power costs come in low enough to pay for leases,

07-03-15 2:00 PM

Financing Trends in the Solar Sector

6 of 7

http://ecmweb.com/print/green-building/financing-trends-solar-sector

system maintenance, and, when applicable, financing costs.

Now averaging about $4 per watt installed, about 40% of which covers equipment, according to the Solar

Electric Power Association (SEPA), PV systems remain significant investments demanding assurances of

reduced power costs. Those costs have come down from more than $8 just five years ago, says Eran Mahrer,

SEPAs vice president of utility strategy, but they still present a high enough bar to give homeowners pause. The

keys to expanding residential PV will be further declines in costs, especially those tied to installation, mixed with

programs that can help monetize solars inherent efficiencies as an energy source.

Utility incentives through programs like the California Solar Initiative that provide cash rebates are one of the

most important drivers of residential solar, Mahrer says. But most incentives like this were designed to ratchet

down on some predictable path, and thats been happening. Whats left in addition to the Federal Investment

Tax Credit is another mechanism for driving solar, which is net metering, and being able to export energy

produced to the utility and getting a retail credit.

Gauging residential prospects

Until costs come down further, its likely that homeowners interested in installing PV will look to third-party

ownership arrangements such as PPAs or leases where ownership can be secured after the lease period ends.

Companies specializing in structuring and delivering such deals have been proliferating, but a shakeout may be

underway, given the persistent challenges of stable or declining costs of traditional sources of electricity and not

enough business to go around. But PV module manufacturers, pressured by declining equipment costs, could

begin to move into the system development space in a bid to weather the reduced-return environment.

However the acquisition is structured, homeowners who fit the optimal PV user profile can probably secure a

guarantee of cheaper power over time, Mahrer says. On a households cash flow basis, payments on a PV

system versus present utility power, a customer can benefit from a fixed cost of energy and hedge themselves

against future price changes at least under todays net metering arrangements.

That, of course, may be the biggest wild card in trying to forecast whether PV and other renewables will grow to

become more than fringe sources of power. If traditional sources of power become easier and cheaper to access

and use in a cleaner fashion and they remain heavily subsidized to boot solar and other alternatives will

surely struggle to gain a foothold. Combine that with declining economic incentives, notably the scheduled

reduction in the federal investment tax credit for solar from 30% to 10% in 2016, and the hill becomes even

steeper.

Yet creative and aggressive financing coming from a bigger pool of investors eager to grab a piece of the new

frontier in arguably the worlds most important economic sector energy could well keep solar and other

renewables in the game. Ditto for the companies deploying the technology, including electrical contractors and

engineers engaged in everything from securing financing to designing and installing systems to performing

operations and maintenance.

The prospects for solar energy and for us in that space look good, Rosendin Electrics Frederick says. If

theres a shakeout in the industry, the players remaining are those that have a strong financial foundation and

are diversified enough to be a player in the residential, commercial, and utility-grade sectors.

Zind is a freelance writer based in Lees Summit, Mo. He can be reached at tomzind@att.net.

As much work as went into refining solar PV technology, theres been no shortage of effort into finding ways to

07-03-15 2:00 PM

Financing Trends in the Solar Sector

7 of 7

http://ecmweb.com/print/green-building/financing-trends-solar-sector

make it financially practical to install. Financing solar PV has almost become an industry unto itself, as all

parties look for creative ways to factor up-front costs, payback periods, prevailing electric rates, subsidies, and a

host of other variables into a favorable equation.

While every financing deal can come with its own unique structure and nuances, most come down to a choice

between system ownership of some sort or reaping the cost benefits of solar-produced electricity.

Outright ownership: Residential or commercial power users with deep pockets or willing lenders can buy a

system, reaping both the potential benefits of lower cost power and the intrinsic value of a PV system. Tax

credits, net metering, and depreciation can effectively lower the costs of ownership over the systems life and

potentially raise a propertys value, but system maintenance and financing costs are offsets. Users without the

ability to pay cash for a system can access a variety of lending schemes, including bank and subsidized loans, as

well as those secured by the solar equipment or property, or unsecured commercial or guaranty loans like those

through the Small Business Administration.

Leasing: Significant up-front costs can be eliminated under leases where a third party owns the system. The user

makes lease payments on the hardware, but those costs are offset by cheaper power. Under a typical lease, the

user can extend the lease at terms end or purchase the system for residual value.

Power Purchase Agreements (PPA): Users simply interested in cleaner, cheaper power can purchase the solar

power generated from a hosted system. Installation, ownership, and maintenance is handled by a third party,

which contracts to offer the user power at a set rate for a period of time. Power cost savings are typically reduced

in this scenario, but up-front costs are eliminated.

Source URL: http://ecmweb.com/green-building/financing-trends-solar-sector

07-03-15 2:00 PM

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- LNG For Non Technical PeopleDocumento3 pagineLNG For Non Technical Peoplesandeep lalNessuna valutazione finora

- Ahu 01 (STD)Documento5 pagineAhu 01 (STD)onspsnonsNessuna valutazione finora

- Ihs Que$tor CFDocumento44 pagineIhs Que$tor CFsegunoyes100% (1)

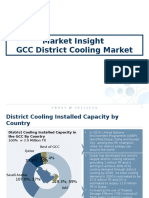

- Market Insight - District Cooling Market in GCCDocumento8 pagineMarket Insight - District Cooling Market in GCCAnonymous VovdmoI1y100% (1)

- Carrier chiller-30XADocumento12 pagineCarrier chiller-30XAamitbslpawar100% (1)

- Surge Arrester PDFDocumento16 pagineSurge Arrester PDFChristian Vasquez MedranoNessuna valutazione finora

- A Project Report On Training & Development at Century PapersDocumento8 pagineA Project Report On Training & Development at Century PapersNaval KishorNessuna valutazione finora

- LT Shipbuilding BrochureDocumento13 pagineLT Shipbuilding BrochureSrinivasan RajenderanNessuna valutazione finora

- Feasibility Study SAMPLEDocumento106 pagineFeasibility Study SAMPLERia Dumapias60% (5)

- Illustrated Code Catastrophes - Sections 314.22, 314.29, 410.6, 410.56 (B), 410.42 and 410Documento3 pagineIllustrated Code Catastrophes - Sections 314.22, 314.29, 410.6, 410.56 (B), 410.42 and 410rajuanthatiNessuna valutazione finora

- The Truth Behind Energy Project EconomicsDocumento4 pagineThe Truth Behind Energy Project EconomicsrajuanthatiNessuna valutazione finora

- Special Occupancies and The NECDocumento4 pagineSpecial Occupancies and The NECrajuanthatiNessuna valutazione finora

- Illustrated Code Catastrophes - Sections 314.15, 300.5 (B), 300.6 (B), and 240Documento3 pagineIllustrated Code Catastrophes - Sections 314.15, 300.5 (B), 300.6 (B), and 240rajuanthatiNessuna valutazione finora

- Brochure - LMS Imagine - Lab AMESim Vehicle Thermal ManagementDocumento10 pagineBrochure - LMS Imagine - Lab AMESim Vehicle Thermal ManagementrozzillaNessuna valutazione finora

- Foundation Basis Bearing Simulation Report201906 PDFDocumento5 pagineFoundation Basis Bearing Simulation Report201906 PDFNedyHortetlNessuna valutazione finora

- New Age Facilities Management (November 2010)Documento4 pagineNew Age Facilities Management (November 2010)Microcorp TechnologyNessuna valutazione finora

- SMM Ca001 0805NDocumento28 pagineSMM Ca001 0805NcarlosorizabaNessuna valutazione finora

- Unit 3 Grammar Short Test 2 A+bDocumento2 pagineUnit 3 Grammar Short Test 2 A+bvanessaNessuna valutazione finora

- Abcr 2103 AssignmentDocumento15 pagineAbcr 2103 AssignmentMadhu SudhanNessuna valutazione finora

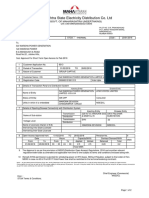

- Maharashtra State Electricity Distribution Co. LTD: (A Govt. of Maharashtra Undertaking)Documento2 pagineMaharashtra State Electricity Distribution Co. LTD: (A Govt. of Maharashtra Undertaking)chief engineer CommercialNessuna valutazione finora

- LaminateDocumento68 pagineLaminatedesignNessuna valutazione finora

- AssignmentDocumento1 paginaAssignmentSheryar NaeemNessuna valutazione finora

- QG BPP ICT F001 03 Item Modification Form Rev 05Documento7 pagineQG BPP ICT F001 03 Item Modification Form Rev 05goran abbasNessuna valutazione finora

- De Electric Circuits EeDocumento16 pagineDe Electric Circuits EeLilet P. DalisayNessuna valutazione finora

- HVAC ReportDocumento5 pagineHVAC ReportrazahNessuna valutazione finora

- Energy Conversion ES 832a: Eric SavoryDocumento30 pagineEnergy Conversion ES 832a: Eric SavoryMohamed Al-OdatNessuna valutazione finora

- Gulfpub Wo 201009Documento128 pagineGulfpub Wo 201009MnesNessuna valutazione finora

- Oct2014 EirDocumento162 pagineOct2014 EirSOUMYA PillaiNessuna valutazione finora

- C LineDocumento16 pagineC LineSunil Kumar VishwakarmaNessuna valutazione finora

- Company Profile KIMBRATAS 2019-MinDocumento40 pagineCompany Profile KIMBRATAS 2019-MinDimas awang santosoNessuna valutazione finora

- Market Situation of Bio-Briquette in Kathmandu, Nepal: The InitiationDocumento8 pagineMarket Situation of Bio-Briquette in Kathmandu, Nepal: The InitiationPralav KcNessuna valutazione finora

- Thesis Proposal Lani BalanonDocumento8 pagineThesis Proposal Lani BalanonKenneth GoNessuna valutazione finora

- Press Release New Delhi - 19 August 2019 Power Producers Receive Relief Under Supervisory Powers of APTELDocumento1 paginaPress Release New Delhi - 19 August 2019 Power Producers Receive Relief Under Supervisory Powers of APTELxanblakeNessuna valutazione finora

- TCLT100. Series: Vishay SemiconductorsDocumento6 pagineTCLT100. Series: Vishay Semiconductorsmarcos aragaoNessuna valutazione finora