Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Internal Reconstruction: IPCC Paper 1: Accounting Chapter V

Caricato da

Raj ShannyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Internal Reconstruction: IPCC Paper 1: Accounting Chapter V

Caricato da

Raj ShannyCopyright:

Formati disponibili

1

Internal

Reconstruction

IPCC Paper 1 : Accounting Chapter V

CA. S.S. Prathap, FCA

Learning Objectives

To understand the concept of Internal reconstruction

Learn to pass Reconstruction / Capital Reduction Journal

Entries.

Learn to do full fledged 16 marks exam sums .

Internal Reconstruction An Intro.

Internal Reconstruction - a kind of financial Re-engineering

When the company is having substantial accumulated losses it

becomes a sinking ship. Banks, Financial Institutions Sundry

Creditors will no more be willing to extend credit and there is

no way for the company to pull itself back to good health;

except through scarifies by the various stake holders

Preference and Equity Share Holders

Debenture Holders

Directors ......

Internal Reconstruction An Intro.

The sacrifices made by the stake holders are

Profits to the company and have to be credited to

a special a/c called

Reconstruction a/c ( old name is Capital Reduction a/c )

It is a nominal a/c and all gains of Internal

Reconstruction will be credited to it and all

expenses and losses will be debited to it .

If there is any credit balance in Reconstruction a/c

it has to be transferred to Capital Reserve a/c .

Steps

1

2

3

Carefully pass Journal Entries involving

reduction of capital , settlement of Liabilities and

revaluation of assets.

Note the changes in the Balance Sheet which

have to come in after reconstruction .

The Balance Sheet after reconstruction should

always have the heading (And Reduced) as per

Section 100 of Companies Act.

Methods of Internal Reconstruction

Alteration of Share Capital as per Section 94,95 and 97 of

the Companies Act.

Variation of Shareholders rights as per section 106 of the

Companies Act,1956.

Reduction of Share Capital as per Section 100 to 105 of

the Companies Act,1956

Surrender of Shares

Illustration 1

Vishnu Ltd has 20,000 Equity Shares of Rs.10/- each

=

Rs.2,00,000

The Equity Shares are to be reduced to Rs.4/- each

=

Rs.80,000

JOURNAL ENTRY :

Equity Share capital

Dr.

(Rs.10 Face Value)

To Equity share capital a/c

(Rs.4 each)

To Reconstruction a/c

2,00,000

80,000

1,20,000

Illustration 2

Adwait Ltd has 5000 Equity share of Rs.100/- each fully

paid up. They are to be divided into shares of Rs. 10/each.

JOURNAL ENTRY :

Equity Share capital a/c Dr.

(5,000 * 100)

To Equity Share capital a/c

(50,000 * 10)

(Being stock split)

5,00,000

5,00,000

Illustration 2 - Continued

50 % of new share were surrender .

JOURNAL ENTRY :

Share Capital a/c

Dr.

(25,000 * 10)

To Reconstruction a/c

2,50,000

2,50,000

10

Illustration No. 3

JSN Sum

11

JSN Ltd

The following is the Balance Sheet of JSN Ltd as on 31.03.2012.

12,000,10% Preference

share of Rs.100 each

12,00,000

Goodwill

90,000

24,000 , Equity shares of

Rs.100 each

24,00,000

Land and building

12,00,000

10% Debentures

6,00,000

Plant & Machinery

18,00,000

Bank Overdraft

6,00,000

Stock

2,60,000

Sundry Creditors

3,00,000

Debtors

2,80,000

Cash

30,000

Profit & Loss

14,00,000

Preliminary expenses

40,000

51,00,000

51,00,000

12

JSN Ltd (Contd...)

The equity Shares are to be reduced to shares of Rs.40

each fully paid and the preference shares to be reduced

to fully paid shares of Rs.75 each.

The debenture holders took over stock and debtors in full

satisfaction of their claims.

The land and Building to be appreciated by 30% and

Plant and Machinery to be depreciated by 30%.

The fictitious and intangible assets are to be eliminated.

Expenses of Reconstruction amounted to Rs.5,000

Give Journal Entries incorporating the above scheme of

Reconstruction and prepare the reconstruction Balance

Sheet .

13

JSN Ltd

Accounts to be opened :

1 . Reconstruction a/c

2 . Cash a/c

14

Steps

Record the sacrifice of Equity Share holders and

Preference Share holders . Credit Reconstruction a/c with

the gain.

Settlement of 10 % Debentures.

15

Step - 2

Revaluation of Land , Building , Plant and Machinery.

Debit Reconstruction a/c with accumulated losses (P & L

balance) , Goodwill a/c & Preliminary expenses .

Any remaining credit balance in Reconstruction a/c

transferred to Capital Reserve.

16

The Equity Shares are to be reduced

to shares of Rs.40 each fully paid

Equity share capital a/c(100)

To Equity Share capital a/c(75)

To Capital Reduction a/c

Dr. 24,00,000

9,60,000

14,40,000

(Being 24,000 equity shares of Rs.100 each reduced to Rs.40 each)

Reconstruction a/c

By Equity share holder

14,40,000

17

Preference shares to be reduced to

fully paid shares of Rs.75 each.

10% Pref. Share capital a/c(Rs.100)

Dr. 12,00,000

To 10% Pref.Share capital a/c(Rs.75)

9,00,000

To Capital Reduction a/c

3,00,000

(Being 12,000 Preference share of Rs.100 each reduced to Rs.75

each)

Reconstruction a/c

By Equity share holder

14,40,000

By 10% Pref.Share holders

3,00,000

18

The debenture holders took over stock and

debtors in full satisfaction of their claims.

10 % Debentures a/c

To Stock a/c

To Debtors a/c

To Capital Reduction a/c

Dr. 6,00,000

2,60,000

2,80,000

60,000

( Being debenture holders given stock and debtors in full settlement of

their claims )

Reconstruction a/c

By Equity share holder

14,40,000

By 10% Pref.Share holders

3,00,000

By 10% Debentures

60,000

19

Land and Building to be appreciated by 30%

Land and Building a/c

To Capital Reduction a/c

Dr. 3,60,000

3,60,000

( Being Land and Building appreciated by 30 % )

Reconstruction a/c

By Equity share holder

14,40,000

By 10% Pref.Share holders

3,00,000

By 10% Debentures

60,000

By Land & Buildings

3,60,000

20

Plant and Machinery to be

depreciated by 30%.

Capital Reduction A/c

Dr.

To Plant and Machinery A/c

(Being Plant and Machinery

depreciated by 30%)

5,40,000

5,40,000

Reconstruction A/c

To Plant and

Machinery

5,40,000

By Equity share holder

14,40,000

By 10% Pref.Share holders

3,00,000

By 10% Debentures

60,000

By Land & Buildings

3,60,000

21

Expenses of Reconstruction

amounted to Rs.5,000

Reconstruction a/c

To Cash a/c

Dr.

5,000

5,000

(Being expenses of reconstruction paid)

Cash A/c

To balance B/d

30,000

By Reconstruction

5,000

Reconstruction A/c

To Plant and

Machinery

5,40,000

By Equity share holder

14,40,000

To cash

5,000

By 10% Pref.Share holders

3,00,000

By 10% Debentures

60,000

By Land & Buildings

3,60,000

22

Cash a/c

To balance B/d 30,000 By Reconstruction

By c/s balance

30,000

5,000

25,000

30,000

23

The fictitious and intangible assets are

to be eliminated.

Capital Reduction a/c

Dr.

To Goodwill a/c

To Profit & Loss a/c

To Preliminary expenses a/c

To Capital Reserve a/c(bal. fig)

16,15,000

90,000

14,00,000

40,000

85,000

(Being various losses written off , assets written down and balances in

capital Reduction a/c transferred to Capital Reserve a/c)

24

Reconstruction a/c

To cash

5,000

By Equity share holder

14,40,000

To Plant & Mach

5,40,000

By 10% Pref.Share holders

3,00,000

To goodwill

90,000

By 10% Debentures

60,000

To Profit & Loss

14,00,000 By Land & Buildings

To Preliminary

40,000

To Capital Reserve

85,000

21,60,000

3,60,000

21,60,000

25

Reconstruction A/c

To cash

5,000

By Equity share holder

14,40,000

To Plant & Mach

5,40,000

By 10% Pref.Share holders

3,00,000

To Goodwill

90,000

By 10% Debentures

60,000

To Profit & Loss

14,00,000 By Land & Buildings

To Preliminary

40,000

To Capital Reserve

85,000

21,60,000

3,60,000

21,60,000

26

Notes to Accounts - 1

1.

Share Capital :

Equity share capital

24,000 equity shares of Rs.40

Preference share capital

12,000, 10% Preference

shares of Rs.75 each

TOTAL

9,60,000

9,00,000

18,60,000

27

Notes to Accounts - 2

2. Reserves and Surplus :

Capital Reserve

Rs.85,000

3. Tangible Assets :

Land and Building

Rs.15,60,000

Plant and Machinery Rs.12,60,000

TOTAL

Rs.28,20,000

28

Balance Sheet (And reduced)of JSN

Ltd as on 31.03.2012

I.

Note No.

Equity and Liabilities

(1) Shareholders Funds

(a) Share capital

(b) Reserves and Surplus

1

2

(2)Current Liabilities

Short term borrowings

Trade Payables

18,60,000

85,000

6,00,000

3,00,000

TOTAL

28,45,000

29

Balance Sheet (And reduced)of JSN

Ltd as on 31.03.2012

Note No.

II. Assets

(1) Non-Current assets

(a) Fixed Assets

Tangible Assets

(2) Current Assets

Cash and cash equivalents

(30,000 5,000)

TOTAL

28,20,000

25,000

28,45,000

30

Illustration No.4

Rocky Sum

May 2002 (20 marks)

31

Rocky Sum

The following is the Balance Sheet of Rocky Ltd. As at March

31,2002 :

Rs. In lacs

Liabilities :

Fully paid equity shares of Rs.10 each

500

Capital Reserve

6

12% Debentures

400

Debenture Interest Outstanding

48

Trade Creditors

165

Directors Remuneration Outstanding

10

Other Outstanding Expenses

11

Provisions

33

1,173

32

Rocky Sum (contd...)

Assets

Goodwill

Land and Building

Plant and Machinery

Furniture and Fixture

Stock

Debtors

Cash at bank

Discount on issue of Debentures

Profits and Loss Account

Rs. In lacs

15

184

286

41

142

80

27

8

390

1,173

33

Rocky Sum (Contd....)

The following scheme of Internal Reconstruction was

framed & approved by the Court & all the concerned

parties:

(i) All the equity shares be converted into the same

number of fully paid equity shares of Rs.2.50 each.

(ii) Directors agree to forego their outstanding

remuneration.

(iii) The debentureholders also agree to forego outstanding

interest in return of their 12% debentures being converted

into 13% debentures.

(iv) The existing shareholders agree to subscribe for cash,

fully paid equity shares of Rs.2.50 each for Rs.125 lacs.

34

Rocky Sum (Contd....)

(v) Trade creditors are given the option of either to accept fullypaid equity shares of Rs.2.50 each for the amount due to them

or to accept 80% of the amount due in cash. Creditors for

Rs.65 lacs accept equity shares whereas those for Rs.100 lacs

accept Rs.80 lacs in cash in full settlement.

(iv) The Assets are revalued as under:

Rs. in lacs

Land and building

230

Plant and Machinery

220

Stock

120

Debtors

76

Pass journal entries for all the above mentioned transactions

and draft the companys Balance Sheet immediately after the

reconstruction.

35

Rocky

Accounts to be opened :

1 . Reconstruction a/c

2 . Bank a/c

36

Steps

1

2

3

Open Reconstruction a/c and to its credit record the sacrifices of

Equity Share holders , Directors , 12 % Debenture holders and

trade creditors .

The Revaluation of assets should be passed through Reconstruction

a/c

The balance left in Reconstruction a/c should be used to write off

Goodwill

Discount on issue of Debentures and

Accumulated Losses (P&L a/c)

37

Journal Entries

38

All the equity shares be converted into the same

number of fully paid equity shares of Rs.2.50

each.

Rs. In lacs

Equity Share Capital

(Rs.10 each) a/c

Dr.

500

To Equity Share Capital

(Rs.2.50 each) a/c

125

To Reconstruction a/c

375

(Conversion of all the equity shares into the same number

of fully paid equity shares of Rs.2.50 each as per scheme

of reconstruction)

Reconstruction A/c

By Equity Share Capital A/c

375

39

Directors agree to forego their

outstanding remuneration. Rs. In lacs

Directors Remuneration

Out Standing a/c Dr.

10

To Reconstruction a/c

10

(Out Standing remuneration foregone by the directions as

per scheme of reconstruction)

Reconstruction A/c

By Equity Share Capital A/c

375

By Directors Remuneration O/s

10

40

The debentureholders also agree to forego outstanding

interest in return of their 12% debentures being converted

into 13% debentures.

Rs. In lacs

12% Debentures a/c

Dr.

400

Debenture Interest

Out Standing a/c

Dr.

48

To 13% Debentures a/c

400

To Reconstruction a/c

48

(Conversion of 12% debentures into 13% debentures ,

Debenture holders forgoing outstanding debenture

interest)

Reconstruction By

A/c

Equity Share Capital A/c

By Directors Remuneration O/s

375

10

By Debenture Interest Outstanding 48

41

The existing shareholders agree to subscribe for

cash, fully paid equity shares of Rs.2.50 each for

Rs. In lacs

Rs.125 lacs.

Bank

Dr.

125

To Equity Share

Application a/c

(Application money received for equity shares)

125

42

Trade creditors are given the option of either to

accept fully-paid equity shares of Rs.2.50 each

Rs. In lacs

Equity Share Application a/c Dr.

125

To Equity Share capital

(Rs.2.50 each) a/c

125

(Application money transferred to share capital)

43

Trade creditors are given the option of either to

accept fully-paid equity shares of Rs.2.50 each

Rs. In lacs

Trade Creditors

Dr.

165

To Equity Share Capital a/c

65

To Bank a/c

80

To Reconstruction a/c

20

(Trade creditors for Rs.65 lakhs accepting shares for full

amount and those for Rs.100 lakhs accepting cash equal

to 80% of claim in full settlement)

Reconstruction A/c

By Equity Share Capital A/c

375

By Directors Remuneration O/s

10

By Debenture Interest Outstanding 48

By Trade Creditors

20

44

Use of old Capital Reserve

Rs. In lacs

Capital Reserve

Dr.

6

To Reconstruction a/c

6

(Capital Reserve being used for purpose of reconstruction)

Reconstruction A/c

By Equity Share Capital A/c

375

By Directors Remuneration O/s

10

By Debenture Interest Outstanding 48

By Trade Creditors

20

By Capital Reserve

45

Revaluation of Land & Building

Rs. In lacs

Land and Building

Dr.

46

To Reconstruction a/c

46

(Appreciation made in the value of land and building as per

scheme of reconstruction)

Reconstruction A/c

By Equity Share Capital A/c

375

By Directors Remuneration O/s

10

By Debenture Interest Outstanding 48

By Trade Creditors

20

By Capital Reserve

By Land & Building

46

46

Writing off accumulated losses &

fictitious assets etc.

Rs. In lacs

Reconstruction a/c

Dr. 505

To Goodwill a/c

15

To Plant and Machinery a/c

66

To Stocks a/c

22

To Debtors a/c

4

To Discount on issue of

Debentures a/c

8

To Profit and Loss Account

390

(Writing off losses and reduction in the value of asset)

47

Reconstruction a/c

To Goodwill

15

By Equity Share Capital A/c

375

To Plant & Machinery

66

By Directors Remuneration O/s

10

To Stock

22

By Debenture Interest Outstanding 48

To Debtors

By Trade Creditors

20

To Discount on issue of debentures

By Capital Reserve

To Profit & Loss

390

By Land & Building

46

505

505

48

Note 1

Rs. In lacs

Equity Share capital as on 31.03.2002 (after

reconstruction)

Equity Share Capital(Rs.2.50 each)

(+) Fresh issue

(+) Equity shares issued to creditors

125

125

65

315

49

Note 2

Rs. In lacs

Cash at Bank as on 31.03.2002(after reconstruction)

Cash at Bank(before reconstruction)

27

(+)Proceeds from issue of equity shares

125

152

80

(-)Payment made to creditors

TOTAL

72

50

Balance Sheet (And reduced)of Rocky

Ltd as at 31.03.2012

Rs. Lakhs

I.

Equity and Liabilities

(1) Shareholders Funds

Share capital

Note No.

1

315

(2) Non - Current Liabilities

Long term borrowings

400

(3)Current Liabilities

Outstanding expenses

Provisions

11

33

TOTAL

759

51

Balance Sheet

II. Assets

(1) Non-Current assets

(a) Fixed Assets

Tangible Assets

Note No. Rs. In Lakhs

491

(2) Current Assets

Stock

Trade Receivables

Cash and cash equivalents

TOTAL

120

76

72

759

52

Ice sum

(16 Marks, Nov 2011)

53

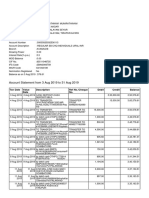

Ice Sum

The Balance Sheet of M/s Ice Ltd as on 31-03-2011 is given below:

Liabilities

Amount

Assets

1,00,000 equity shares

Freehold Property

Rs 10 each fully paidup 10,00,000

4,000,8% Pref. shares

Rs 100 each fully paid

4,00,000

Plant and machinery

6% Debenture Secured

by freehold property

4,00,000

Trade Investments (atCost)

Arrear Interest

24,000 4,24,000

Sundry Debtors

Sundry Creditors

1,01,000

Stock-In-Trade

Directors Loan

3,00,000

Deferred Advertisement

Expenses

Profit & Loss Account

Total

22,25,000

Total

Amount

5,50,000

2,00,000

2,00,000

4,50,000

4,50,000

50,000

4,75,000

22,25,000

54

Ice Sum (Contd....)

The Board of Directors of the company decided upon the

following scheme of reconstruction with the consent of

respective stakeholders:

Preference shares are to be written down to Rs 80 each and

equity shares to Rs 2 each.

Preference dividend in arrear for 3 years to be waived by 2/3rd

and for balance 1/3rd, equity shares of Rs 2 each to be allotted.

Debenture holder agreed to take one freehold property at its

book value of Rs 3,00,000 in part payment of the holdings.

Balance debentures to remain as liability of the company.

Arrear debenture interest to be paid in cash.

Remaining free hold property to be valued Rs 4,00,000

55

Ice Sum(Contd....)

Investment sold out for Rs 2,50,000

75% of Directors loan to be waived and for the balance,

equity share of Rs 2 each to be allotted.

40% of sundry debtors, 80% of stock and 100% of

deferred advertisement expenses to be written off.

Companys contractual commitments amounting to Rs

6,00,000 have been settled by paying 5% penalty of

contract value.

Show the journal entries for giving effect to the internal

reconstruction and drawn the Balance Sheet of the

company after effecting the scheme.

56

Approach to the sum

The sacrifices of Preference

share holders , Directors have to be recorded and

credited to Reconstruction a/c .

For all other movements Journal

Entries to be passed .

The credit balance in

Reconstruction a/c to be used to write off Profit and loss

debit balance.

57

Journal Entries

58

Preference shares are to be written down to Rs 80

each and equity shares to Rs 2 each.

8% Preference share

capital a/c(Rs.100 each)

Dr.

To 8% Preference share

capital a/c (Rs.80 each)

To Capital Reduction a/c

(Being the preference shares of Rs.100

each reduced to Rs.80 each as per the

approved scheme)

Equity Share

capital a/c (Rs.10 each) Dr.

To Equity Share

capital a/c (Rs.2 each)

To Capital Reduction a/c

(Being the Equity shares of Rs.10 each

reduced to Rs.2 each)

4,00,000

3,20,000

80,000

10,00,000

2,00,000

8,00,000

59

Preference dividend in arrear for 3 years to be

waived by 2/3rd and for balance 1/3rd, equity

shares of Rs 2 each to be allotted.

Capital reduction a/c

Dr.

To Equity share capital a/c

32,000

32,000

(Being arrears of preference share

dividend of one year to be satisfied

by issue of 16,000equity shares of Rs.2 each)

60

Debenture holder agreed to take one freehold

property at its book value of Rs 3,00,000 in part

payment of the holdings.

6% Debentures a/c

Dr.

To Freehold property a/c

(Being claim settled in part by

transfer of freehold property)

3,00,000

3,00,000

61

Arrear debenture interest to be paid in

cash.

Accrued debenture interest a/c

To Bank a/c

(Being accrued debenture interest paid)

Dr.

24,000

24,000

62

Remaining free hold property to be valued

Rs 4,00,000.

The opening Freehold property was Rs.5,50,000 . Of this

3,00,000 was taken over by Debenture holders.

The balance remaining property of Rs.2,50,000 has been

valued upwards at Rs.4,00,000.

Freehold property a/c

Dr.

1,50,000

To Capital reduction a/c

1,50,000

(Being appreciation in the value of freehold property)

63

Investment sold out for Rs 2,50,000.

Bank a/c

Dr. 2,50,000

To Trade investment a/c

To Capital Reduction a/c

(Being trade investment sold on profit)

2,00,000

50,000

64

75% of Directors loan to be waived and for the

balance, equity share of Rs 2 each to be allotted.

Directors Loan a/c

Dr. 3,00,000

To Equity share capital a/c

To Capital Reduction a/c

(Being Directors loan waived by

75% and balance discharged by

issue of 37,500 equity shares of

Rs. 2 each)

75,000

2,25,000

65

40% of sundry debtors, 80% of stock and 100% of

deferred advertisement expenses to be written

off.

Reconstruction a/c

To Sundry Debtors a/c

To Stock in hand a/c

To Deferred

advertisement expenses a/c

Dr. 4,70,000

1,80,000

2,40,000

50,000

66

Companys contractual commitments amounting to Rs

6,00,000 have been settled by paying 5% penalty of

contract value.

Reconstruction a/c

To Bank a/c

(Being penalty paid)

Dr. 30,000

30,000

67

Write off of accumulated losses

Reconstruction a/c

Dr.

7,73,000

To P & L a/c

4,75,000

To Capital Reserve a/c

2,98,000

(Being Profit and loss account debit balance written off and

balance transferred to capital reserve account )

68

Notes to accounts

1 . Share Capital :

1,53,500 Equity shares of Rs.2 each

4,000 , 8% Preference shares of Rs.80

3,07,000

3,20,000

TOTAL

6,27,000

2 . Reserves and Surplus :

Capital Reserve

2,98,000

69

Notes to accounts

3 . Long Term Borrowings :

6% Debentures

1,00,000

4 . Tangible Assets :

Freehold Property

Plant & Machinery

TOTAL

5 . Cash and Cash Equivalents :

`

Cash at Bank

(2,50,000-24,000-30,000)

4,00,000

2,00,000

6,00,000

1,96,000

70

Balance Sheet (As reduced)of Ice Ltd

I.

Equity and Liabilities

Note No.

(1) Shareholders Funds

(a) Share capital

1

(b) Reserves and Surplus

2

6,27,000

2,98,000

(2)Non- Current Liabilities

Long term borrowings

1,00,000

(3)Current Liabilities

Trade Payables

1,01,000

TOTAL

Rs. Lacks

11,26,000

71

Balance Sheet (As reduced)of Ice Ltd

II. Assets

(1) Non-Current assets

(a) Fixed Assets

Tangible Assets

Note No.

(2) Current Assets

(a) Inventories

(b) Trade Receivables

(c)Cash and cash equivalents

TOTAL

Rs. In Lakhs

6,00,000

60,000

2,70,000

1,96,000

11,26,000

72

Lesson Summary

So we learnt how to handle an Internal Reconstruction

sum .

The first step is to pass Journal Entries , Credting

Reconstruction A/c with all gains and Debiting the various

stake holders who are sacrificing

The Assets and Liabilities should simultaneously be taken

at their revised valuation

The remaining credit balance in Reconstruction A/c

should be transferred to Capital Reserve A/c.

73

Thank You

Potrebbero piacerti anche

- PM Ipcc Acc Vol2 Chapter5Documento26 paginePM Ipcc Acc Vol2 Chapter5ShambuReddyNessuna valutazione finora

- Internal ReconstructionDocumento8 pagineInternal Reconstructionsmit9993Nessuna valutazione finora

- Chapter Internal ReconstructionDocumento4 pagineChapter Internal ReconstructionAnonymous mTZsMOjNessuna valutazione finora

- Corporate Accounting QUESTIONSDocumento4 pagineCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Internal Reconstruction Part-IIDocumento13 pagineInternal Reconstruction Part-IIINTER SMARTIANSNessuna valutazione finora

- Advanced AccountingDocumento13 pagineAdvanced AccountingprateekfreezerNessuna valutazione finora

- 202 FM Home AssignmentDocumento2 pagine202 FM Home Assignmentyepim44096Nessuna valutazione finora

- Marking Scheme Sample Question Paper Accountancy, Class XII Board Examination, March, 2015Documento13 pagineMarking Scheme Sample Question Paper Accountancy, Class XII Board Examination, March, 2015kamalNessuna valutazione finora

- Internal ReconsrtuctionDocumento33 pagineInternal ReconsrtuctionRenuNessuna valutazione finora

- Funds Flow AnalysisDocumento16 pagineFunds Flow AnalysisPravin CumarNessuna valutazione finora

- Funds Flow AnalysisDocumento16 pagineFunds Flow AnalysisGyan PrakashNessuna valutazione finora

- AK ImpairmentDocumento3 pagineAK ImpairmentClaire Labiste IINessuna valutazione finora

- Accountancy EngDocumento8 pagineAccountancy EngBettappa Patil100% (1)

- AmalDocumento7 pagineAmalAkki GalaNessuna valutazione finora

- Revisionary Test Paper - Final - Syllabus 2012 - Dec2013: Paper 18 - Business Valuation ManagementDocumento114 pagineRevisionary Test Paper - Final - Syllabus 2012 - Dec2013: Paper 18 - Business Valuation ManagementNagendra KrishnamurthyNessuna valutazione finora

- Question SheetDocumento2 pagineQuestion SheetHarsh DubeNessuna valutazione finora

- 19696ipcc Acc Vol2 Chapter14Documento41 pagine19696ipcc Acc Vol2 Chapter14Shivam TripathiNessuna valutazione finora

- Finance Question Papers Pune UniversityDocumento12 pagineFinance Question Papers Pune UniversityJincy GeevargheseNessuna valutazione finora

- 19684ipcc Acc Vol2 Chapter2Documento0 pagine19684ipcc Acc Vol2 Chapter2kevalcharlaNessuna valutazione finora

- 3246accounting - CA IPCCDocumento116 pagine3246accounting - CA IPCCPrashant Pandey100% (1)

- Advanced Corporate AccountingDocumento6 pagineAdvanced Corporate Accountingamensinkai3133Nessuna valutazione finora

- Presentation On Internal ReconstructionDocumento23 paginePresentation On Internal Reconstructionneeru79200040% (5)

- Corrporate ModelDocumento10 pagineCorrporate Modelnithinjoseph562005Nessuna valutazione finora

- AcctsDocumento63 pagineAcctskanchanthebest100% (1)

- Paper12 Solution RevisedDocumento17 paginePaper12 Solution Revised15Nabil ImtiazNessuna valutazione finora

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Documento7 pagineCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNessuna valutazione finora

- Sy Bcom Oct2011Documento83 pagineSy Bcom Oct2011Anonymous l0j1IwcPDNessuna valutazione finora

- © The Institute of Chartered Accountants of IndiaDocumento56 pagine© The Institute of Chartered Accountants of IndiaTejaNessuna valutazione finora

- Problems On Internal ReconstructionDocumento24 pagineProblems On Internal ReconstructionYashodhan Mithare100% (4)

- Ca-Ii May 2022Documento6 pagineCa-Ii May 2022Gayathri V GNessuna valutazione finora

- No.............................. MAY'2011: Ipco Group-I Paper-1 AccountingDocumento12 pagineNo.............................. MAY'2011: Ipco Group-I Paper-1 AccountingSamson KoshyNessuna valutazione finora

- Analysis of Financial StatementsDocumento16 pagineAnalysis of Financial StatementsAlok ThakurNessuna valutazione finora

- 4 CO4CRT11 - Corporate Accounting II (T)Documento5 pagine4 CO4CRT11 - Corporate Accounting II (T)emildaraisonNessuna valutazione finora

- Ca QP ModelDocumento3 pagineCa QP Modelmahabalu123456789Nessuna valutazione finora

- AccountancyDocumento21 pagineAccountancyAriz AliNessuna valutazione finora

- Fund Flow StatementDocumento7 pagineFund Flow StatementvipulNessuna valutazione finora

- MCSDocumento20 pagineMCSMilind KaleNessuna valutazione finora

- Accountancy 12 SapnleDocumento21 pagineAccountancy 12 Sapnlemohit pandeyNessuna valutazione finora

- Paper - 1: Advanced AccountingDocumento19 paginePaper - 1: Advanced AccountingZamda HarounNessuna valutazione finora

- What Is Forfeiture of ShareDocumento3 pagineWhat Is Forfeiture of ShareSathish SmartNessuna valutazione finora

- AccontsDocumento7 pagineAccontsAmith MNessuna valutazione finora

- Sample PaperDocumento28 pagineSample PaperSantanu KararNessuna valutazione finora

- MBAC1003Documento7 pagineMBAC1003SwaathiNessuna valutazione finora

- Paper 33Documento6 paginePaper 33AVS InfraNessuna valutazione finora

- CCP402Documento13 pagineCCP402api-3849444Nessuna valutazione finora

- Unit IIIDocumento9 pagineUnit IIIkuselvNessuna valutazione finora

- Internal ReconstructionDocumento5 pagineInternal ReconstructionJoshua StarkNessuna valutazione finora

- 29713mtpipcc Ans May13sr2 p5Documento16 pagine29713mtpipcc Ans May13sr2 p5guptafamily1992Nessuna valutazione finora

- Model Question Set 1Documento2 pagineModel Question Set 1Destiny Tuition CentreNessuna valutazione finora

- Adv Acc - 3 CHDocumento21 pagineAdv Acc - 3 CHhassan nassereddineNessuna valutazione finora

- CBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Documento5 pagineCBSE Class 12 Accountancy Sample Paper With Marking Scheme 2013Manish SahuNessuna valutazione finora

- CH18601 FM - II Model PaperDocumento5 pagineCH18601 FM - II Model PaperKarthikNessuna valutazione finora

- Accountancy March 2008 EngDocumento8 pagineAccountancy March 2008 EngPrasad C M100% (2)

- Accountancy SQP PDFDocumento21 pagineAccountancy SQP PDFSuyash YaduNessuna valutazione finora

- CA-3, ACC-204 Cost Accounting-Code:B M.M 30 Times: 45 MinutesDocumento7 pagineCA-3, ACC-204 Cost Accounting-Code:B M.M 30 Times: 45 MinutespriyaNessuna valutazione finora

- Accounts Mock Test May 2019Documento18 pagineAccounts Mock Test May 2019poojitha reddyNessuna valutazione finora

- Part IIDocumento58 paginePart IIhaaasaaNessuna valutazione finora

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsDa EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNessuna valutazione finora

- Supply Chain Management and Business Performance: The VASC ModelDa EverandSupply Chain Management and Business Performance: The VASC ModelNessuna valutazione finora

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsDa EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNessuna valutazione finora

- A Primer On Us Bankruptcy - StroockDocumento247 pagineA Primer On Us Bankruptcy - Stroock83jjmack100% (1)

- Depletion PDFDocumento3 pagineDepletion PDFAlexly Gift UntalanNessuna valutazione finora

- Provisions: B22 Major Changes in TaxDocumento9 pagineProvisions: B22 Major Changes in TaxasdjkfnasdbifbadNessuna valutazione finora

- ايميلات شركات كتير فى الكويتDocumento40 pagineايميلات شركات كتير فى الكويتahmed HOSNYNessuna valutazione finora

- International Business 7th Edition Griffin Solutions ManualDocumento17 pagineInternational Business 7th Edition Griffin Solutions Manuallendablefloordpq7r100% (31)

- 1569974603267g4SdkiBXnw22cLKZ PDFDocumento4 pagine1569974603267g4SdkiBXnw22cLKZ PDFSelvarathnam MuniratnamNessuna valutazione finora

- Discounts: Trade and Cash: Mcgraw-Hill/Irwin ©2008 The Mcgraw-Hill Companies, All Rights ReservedDocumento23 pagineDiscounts: Trade and Cash: Mcgraw-Hill/Irwin ©2008 The Mcgraw-Hill Companies, All Rights Reservedmohamed atlamNessuna valutazione finora

- Session 7 Valuation of ITC Using DDMDocumento24 pagineSession 7 Valuation of ITC Using DDMSnehil BajpaiNessuna valutazione finora

- Chap 14 - Bret Company (Case Study)Documento5 pagineChap 14 - Bret Company (Case Study)Al HiponiaNessuna valutazione finora

- 1.B.Com.Documento49 pagine1.B.Com.deepakNessuna valutazione finora

- Class Work & Home Work Question of Final Account of Banking Conpany 22-23Documento23 pagineClass Work & Home Work Question of Final Account of Banking Conpany 22-23DARK KING GamersNessuna valutazione finora

- Institutions and Corporate Capital Structure in The MENA RegionDocumento32 pagineInstitutions and Corporate Capital Structure in The MENA RegionMissaoui IbtissemNessuna valutazione finora

- CSDocumento26 pagineCSAnjuElsaNessuna valutazione finora

- Pakistan Stock Exchange Named Best Performing in AsiaDocumento2 paginePakistan Stock Exchange Named Best Performing in AsiaAqib SheikhNessuna valutazione finora

- WWW Edccblockchain IdDocumento9 pagineWWW Edccblockchain IdFathan IbraNessuna valutazione finora

- Ey Ctools Good Group 2020Documento159 pagineEy Ctools Good Group 2020Cristhian HuaytaNessuna valutazione finora

- Accounting Policy Memo - Cash Equivalents & ST InvestmentsDocumento2 pagineAccounting Policy Memo - Cash Equivalents & ST Investmentsdalebowen100% (1)

- Acct Statement - XX6419 - 08112022Documento26 pagineAcct Statement - XX6419 - 08112022AartiNessuna valutazione finora

- Particulars: Report FinalDocumento12 pagineParticulars: Report FinaldananjNessuna valutazione finora

- 2 Financial Markets and Interest RatesDocumento21 pagine2 Financial Markets and Interest Ratesadib nassarNessuna valutazione finora

- CMA Prospectus Syl 2016Documento68 pagineCMA Prospectus Syl 2016Niraj AgarwalNessuna valutazione finora

- Shareholding Pattern As On June 30, 2020Documento9 pagineShareholding Pattern As On June 30, 2020Mit AdhvaryuNessuna valutazione finora

- Executive Summary: About InvestosureDocumento2 pagineExecutive Summary: About InvestosureISHPREET KAUR50% (2)

- 8 Powerpoint Guided NotesDocumento79 pagine8 Powerpoint Guided Notesapi-173610472Nessuna valutazione finora

- Applied Soft Computing: Donghyun Cheong, Young Min Kim, Hyun Woo Byun, Kyong Joo Oh, Tae Yoon KimDocumento10 pagineApplied Soft Computing: Donghyun Cheong, Young Min Kim, Hyun Woo Byun, Kyong Joo Oh, Tae Yoon KimChris RichmanNessuna valutazione finora

- DT NotesDocumento95 pagineDT NotesDharshini AravamudhanNessuna valutazione finora

- Stock Market - A Complete Guide BookDocumento43 pagineStock Market - A Complete Guide BookParag Saxena100% (1)

- Questions AFARDocumento12 pagineQuestions AFARKatrina youngNessuna valutazione finora

- Partnership Agreement Template-WPS OfficeDocumento8 paginePartnership Agreement Template-WPS OfficeArnel AlmenarioNessuna valutazione finora

- Lecture5-Equal Payment SeriesDocumento25 pagineLecture5-Equal Payment SeriesGanda GandaNessuna valutazione finora