Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Trading - Forex Trading Strategies - Cashing in On Short Term Currency Trends

Caricato da

petefaderTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Trading - Forex Trading Strategies - Cashing in On Short Term Currency Trends

Caricato da

petefaderCopyright:

Formati disponibili

Click HERE to Learn How I Make $1000 Per Day!

TRADING Strategies

Cashing in on short-term

CURRENCY TRENDS

Trends may be rarer than trading ranges, but that

doesnt mean they cant be traded. This strategy

uses two time frames to identify the trend, an

overbought-oversold indicator to pinpoint entry and

a trailing stop to protect gains on profitable trades.

BY TIMOTHY OSULLIVAN

any technical trading

market involve the majors.

ent time periods (10-minute and hourly),

strategies revolve around

along with two technical indicators: a

the assumption that mar200-bar moving average and a 14-bar

kets will hover within a

The strategy uses two charts with differslow stochastic study (see Stochastic

given range and with good reason. Seventy percent of the time

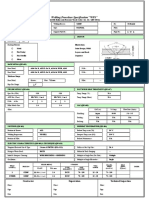

FIGURE 1 LONG TRADE, HOURLY TREND

markets will bounce back and forth

With price consistently above the 200-bar moving average, the hourly chart reflects

between support and resistance levthe prevailing uptrend.

els, or fluctuate randomly. The rest

of the time, market behavior is charEuro/U.S. Dollar (EUR/USD), hourly

acterized by persistent price moves

1.002

trends that shatter support and

0.996

resistance levels.

Although these basic probabilities

0.990

work against traders who try to

0.984

exploit trends, the potential rewards

0.978

can be worth the risk. It is possible to

increase your ability to capitalize on

0.972

trends by locating trend signals,

0.966

identifying specific entry points

0.960

within the trend and using risk management techniques to limit losses.

0.954

200-hour moving average

The following sections will

0.949

explain how a trading system based

on these concepts works especially

0.942

well in the foreign exchange (Forex),

or currency, market, particularly

Stochastics (14, 3, 3)

90

with the major currencies the

60

U.S. dollar, Euro, Japanese yen,

30

British

pound,

Swiss

franc,

Canadian dollar and Australian dol12:00 3:00 18:00 9:00 0:00 15:00 6:00 21:00 12:00 3:00 18:00 9:00 0:00 15:00 6:00

18

19

20

21

23 24

25

26

27

28

lar. More than 85 percent of transacSource: Gain Capital

tions in the $1 trillion per day Forex

2

www.activetradermag.com October 2002 ACTIVE TRADER

Click HERE to Learn How I Make $1000 Per Day!

Stochastic refresher

refresher, right).

Step 1: Identify a trend. Compare the

moving averages on the 10-minute and

hourly charts. A trend is in effect when

price is consistently above/below the

moving averages on both charts.

Step 2: Pinpoint entry. Once youve

identified a trend, look for the following

two conditions at the same time on the

10-minute chart: 1) the market is no

more than 20 points above (to buy) or 20

points below (to sell) the moving average; and 2) the fast stochastic line crosses above the slow stochastic line below

20 (to buy) or crosses below the slow

stochastic line above 80 (to sell).

These conditions indicate: 1) the currency is currently in a short-term

uptrend or downtrend; and 2) the currency has paused or pulled back (reflected by the higher low stochastic reading

and the fact that price is within 20 points

of the moving average) and is poised to

turn (because the fast stochastic line is

crossing back above or below the slow

line).

Step 3: Ride the trend. Set a trailing

stop after the initial trade entry. On a

long position, enter a stop-loss order 10

points below the 200-period moving

average on the 10-minute chart. In the

case of a short position, place the initial

stop 10 points above this moving average. As the trade goes in your favor, raise

(for a long trade) or lower (for a short

trade) the stop to protect profits. For

simplicitys sake, the following examples use a trailing stop 25 points from

each new top or bottom. The charts in

the next section illustrate the application

of this strategy in two currency pairs.

The first example took place in the

Eurocurrency-dollar (EUR/USD) currency pair during the fourth week of

June 2002. (For those unfamiliar with

currency quoting and charting conventions, see Quoting currencies, p. xx.)

First, compare the hourly and 10-

The stochastic oscillator consists of two lines: %K and a moving average of

%K called %D.

The basic stochastic calculation compares the most recent close to the price

range (high of the range - low of the range) over a particular period. A basic

five-bar stochastic calculation is the difference between the most recent bars

close and the lowest low of the last five days divided by the difference

between the highest high and the lowest low of the last five days. The result

is multiplied by 100. The formula for this calculation, which is %K, is:

%K = 100*{(C t-Ln)/(Hn-Ln)}

where

Ct = the most recent bars closing price

Ln = the lowest price of the most recent n bars

Hn = the highest price of the most recent n bars

(for a stochastic calculated on daily bars, the default is five days)

The second line, %D, is simply a three-period moving average of %K:

average(%K,3)

Because this basic fast stochastic calculation is very volatile, an additionally smoothed version of the indicator, where the original %D line becomes a

new slow %K line and a three-period average of this line becomes the slow

%D line, is more commonly used.

The stochastic can be made to reflect longer- or shorter-term price movement and to be less or more sensitive to small price fluctuations by increasing

or decreasing the number of bars used to calculate %K and/or increasing or

decreasing the length of the moving average used to calculate %D. For example, a stochastic using a 10-bar %K and a three-bar moving average for %D [stochastic(10,3)] would be shorter-term and more sensitive than a stochastic

using a 20-bar %K and a five-bar moving average for %D [stochastic(20,5)].

Seventy percent of the time markets

will bounce back and forth between

support and resistance levels,

or fluctuate randomly.

minute EUR/USD charts. Look for a

time when price is above the 200-period

moving averages on both charts. On the

hourly chart (Figure 1, opposite page),

the fact that price is almost exclusively

ACTIVE TRADER October 2002 www.activetradermag.com

above the 200-hour moving average

indicates a persistent uptrend. On the

10-minute chart (Figure 2, top left), price

moves (and remains above) the moving

continued on p. x

3

Click HERE to Learn How I Make $1000 Per Day!

FIGURE 2 LONG TRADE, 10-MINUTE TREND

Price is also above the 200-bar moving average in the final third of the 10-minute

chart. The market moves within 20 points of the moving average between 1 p.m.

and midnight on June 27. The entry is finally signaled when the fast stochastic

line crosses above the slow line (a sign of renewed upside momentum) when the

indicator is below 20 near 8 p.m.

Euro/U.S. Dollar (EUR/USD), 10-minute

1.0000

0.9975

Stop out @ 0.9967

Market stays within 20 points

of moving average

0.9950

0.9925

0.9900

Buy entry @ 0.9883

0.9875

0.9850

Stochastic crosses below 20

0.9825

0.9800

0.9775

Stochastics (14, 3, 3) 72.5152, 77.0424

80

Although

the basic

probabilities

work against

traders who try

to exploit

trends, the

potential

rewards can be

worth the risk.

40

5:40 9:10 13:10 17:10 20:30 23:50 3:10 6:30 9:50 13:10 17:00 20:20 23:40 3:00 6:20

6/26

6/27

6/28

Source: Gain Capital

FIGURE 3 SHORT TRADE, HOURLY TREND

On June 27, the down trending USD/JPY traded consistently below the 200-hour

moving average.

U.S. Dollar/Japanese Yen (USD/JPY), hourly

126.4

125.6

200-hour moving average

124.8

124.0

123.2

122.4

121.6

120.8

120.0

119.2

118.4

Stochastics (14, 3, 3) 11.6808, 8.8996

117.6

60

30

14:00 10:00 6:00 2:00 22:00 18:00 14:00 10:00

12

13

14

16 17

18

19

20

Source: Gain Capital

6:00 2:00 22:00 18:00 14:00 10:00 6:00

21

23 24

25

26

27

28

average in the last third of the

chart. The next step is to pinpoint the entry zone when the

market is within 20 points of the

moving average on the 10minute chart and the stochastic

lines cross.

The range between 1 p.m. and

midnight on June 27 meets these

requirements. The entry point

occurs when the fast stochastic

crosses above the slow stochastic

when the indicator is below 20. A

long position is entered at .9883

around 8 p.m., with an accompanying stop-loss at .9858 (10

points below the 200-bar moving

average value of .9868). The stop

is then trailed upward as the

market makes new peaks. The

EUR/USD tops out at .9992, so

the stop scaled up to .9967,

where the position was closed

for an 84-point ($840) gain.

Figures 3 and 4 illustrate a

similar example in the dollar-yen

rate (USD/JPY). The hourly

chart (Figure 3, bottom left)

shows price was trading well

below the 200-bar moving average after June 21. On the 10continued on p. x

www.activetradermag.com October 2002 ACTIVE TRADER

minute chart (Figure 4, below), price fell

below the moving average after 10 a.m.

on June 27, indicating a sell opportunity.

Also, price was within 20 points of the

moving average at this point. A short

trade was opened around 5 p.m. at

119.57 when the fast stochastic line

crossed below the slow stochastic line

when the indicator was above 80.

The trade was protected with a

FIGURE 4 SHORT TRADE, 10-MINUTE TREND

stop-loss order at 119.86. In this

case, the stop remained intact until

On the 10-minute USD/JPY chart, a stochastic crossover (above 80) occurred around

the following day, when USD/JPY

5 p.m. while price was below (but within 20 points of) the 200-bar moving average

began to decline. After trailing the

signaling a short trade.

stop down as the market continU.S. Dollar/Japanese Yen (USD/JPY), 10-minute

ued to decline, profits were taken

at 118.58 (25 points off the 118.33

120.75

low), for a gain of 99 points.

120.50

Market stays within 20 points

of moving average

120.25

120.00

119.75

Sell entry @ 119.57

119.50

119.25

Stochastic crosses above 80

Stop out @ 118.58

Stochastics (14, 3, 3) 28.9156, 30.0101

119.00

118.75

90

60

30

6:30 10:00 13:20 17:20 20:40

6/26

Source: Gain Capital

0:003:20 6:40 10:00 13:20 17:10 20:30 23:50 3:10 6:30

6/27

6/28

This short-term trading method

works well in the Forex market,

but it is also applicable to others.

Each step of the system helps identify areas where effective trades

can be made. If at any point one of

the criteria is not met, youll

instantly know not to make a

trade. This model also gives you

the freedom to experiment with

different chart intervals. When

youre equipped with a system

that can help you catch the trend

early, you can wait for the rest of

the market to follow.

For information on the author see p.

xx.

Quoting currencies

ecause currencies are quoted in a different manner than equities, reading a

foreign exchange quote may seem a bit confusing at first. However, its really quite simple if you remember two things: 1) The first currency listed first

is the base currency and 2) the value of the base currency is always 1.

For example, if you see a quote of USD/CAD 1.54825, that means that one U.S.

dollar is equal to 1.54825 Canadian dollars. Likewise, USD/JPY 122.01 shows that one

U.S. dollar is equal to 122.01 Japanese yen.

In every trade involving the U.S. dollar, the dollar will be the base currency, with

three exceptions the British pound (GBP), the Australian dollar (AUS) and the

European currency unit, or Euro (EUR). In these cases, you might see a quote such

as GBP/USD 1.4366, meaning that one British pound equals 1.4366 U.S. dollars.

Whenever the U.S. dollar is the base unit and a currency quote goes up, it means

the dollar has appreciated in value and the other currency has weakened. If the

USD/JPY quote we previously mentioned increases to 123.01, the dollar is stronger

because it will now buy more yen than before.

However, in the three instances where the U.S. dollar is not the base rate, a rising quote means a weakening dollar, as

it now takes more U.S. dollars to equal one pound, Euro or Australian dollar.

In other words, if a currency quote goes higher, that increases the value of the base currency. A lower quote means the

base currency is weakening.

Trades that do not involve the U.S. dollar are called cross rates, but the premise is the same. A quote of GBP/CHF 2.4577

signifies that one British pound is equal to 2.4577 Swiss francs.

www.activetradermag.com October 2002 ACTIVE TRADER

Potrebbero piacerti anche

- (Trading) TILKIN MACD Divergences Com (PDF)Documento3 pagine(Trading) TILKIN MACD Divergences Com (PDF)diavolulNessuna valutazione finora

- THE SECRET MEANING OF JAPANESE CANDLESTICKS PART 1 (tsmjcp1)Documento16 pagineTHE SECRET MEANING OF JAPANESE CANDLESTICKS PART 1 (tsmjcp1)Lenx PaulNessuna valutazione finora

- The Easy Forex Breakout Trend Trading Simple System Basic Manual VersionDocumento30 pagineThe Easy Forex Breakout Trend Trading Simple System Basic Manual VersionChakrey LeaderNessuna valutazione finora

- Ebook Mmist09 v02Documento52 pagineEbook Mmist09 v02abcplot123100% (1)

- Forex Ghost Scalper StrategyDocumento6 pagineForex Ghost Scalper StrategyPakkiri RNessuna valutazione finora

- Trade Details: Half-Position of GBPDocumento4 pagineTrade Details: Half-Position of GBPImre GamsNessuna valutazione finora

- 10pips PDFDocumento13 pagine10pips PDFAnonymous 4gamBfNessuna valutazione finora

- 100 Pips FX GainerDocumento16 pagine100 Pips FX GainerJefri SoniNessuna valutazione finora

- Tri Pips NotesDocumento3 pagineTri Pips NotesRob BookerNessuna valutazione finora

- What Is Scalping?: The Lazy River Scalping StrategyDocumento10 pagineWhat Is Scalping?: The Lazy River Scalping StrategyTheGod LinesNessuna valutazione finora

- Entry Rules 30 Pip MethodDocumento9 pagineEntry Rules 30 Pip MethodAgus Cucuk100% (1)

- Forex. EnglishDocumento44 pagineForex. Englishramesh.kNessuna valutazione finora

- Power Pin Reversal Stochastic Forex Trading StrategyDocumento7 paginePower Pin Reversal Stochastic Forex Trading StrategyjoseluisvazquezNessuna valutazione finora

- Fx5m Forex Trading SystemDocumento21 pagineFx5m Forex Trading Systemkent503Nessuna valutazione finora

- How To Trade Against The HerdDocumento46 pagineHow To Trade Against The HerdstowfankNessuna valutazione finora

- Top 7 Reasons Why Forex Traders Fail and Lose MoneyDocumento9 pagineTop 7 Reasons Why Forex Traders Fail and Lose Moneyrobert.d.lopezNessuna valutazione finora

- Trend Trading Buy Sell Signals With The T3 Bands MT4 IndicatorDocumento4 pagineTrend Trading Buy Sell Signals With The T3 Bands MT4 Indicatordonald trumpNessuna valutazione finora

- PipCollector v.02 User ManualDocumento6 paginePipCollector v.02 User ManualBudi MulyonoNessuna valutazione finora

- FX Taurus Pro - ManualDocumento6 pagineFX Taurus Pro - ManualDaniel Zavala100% (3)

- 4 5863814219530505354Documento31 pagine4 5863814219530505354DansnipesNessuna valutazione finora

- Basic Candlestick Pattern A Graphical Re PDFDocumento23 pagineBasic Candlestick Pattern A Graphical Re PDFenghoss77Nessuna valutazione finora

- BOW Indicator V4.0 Trading GuideDocumento2 pagineBOW Indicator V4.0 Trading GuideBruno VicenteNessuna valutazione finora

- Rapid Trade FinderDocumento13 pagineRapid Trade FinderintanNessuna valutazione finora

- Ichimoku Forever at Forex Factory PDFDocumento13 pagineIchimoku Forever at Forex Factory PDFhenrykayode4Nessuna valutazione finora

- Support Gap Up: Bullish ConfirmationDocumento6 pagineSupport Gap Up: Bullish ConfirmationScott LuNessuna valutazione finora

- PPG Trading Strategy ReportDocumento24 paginePPG Trading Strategy ReportPauline ChazaNessuna valutazione finora

- Sum of Little Book of Currency TradingDocumento8 pagineSum of Little Book of Currency TradingTrung LêNessuna valutazione finora

- Continuation Patterns For Breakout TradingDocumento2 pagineContinuation Patterns For Breakout TradingNakul GuptaNessuna valutazione finora

- Firststrike 1 PDFDocumento8 pagineFirststrike 1 PDFgrigoreceliluminatNessuna valutazione finora

- Big Ben Trading StrategyDocumento4 pagineBig Ben Trading StrategyMario CruzNessuna valutazione finora

- From WoodiesDocumento12 pagineFrom WoodiesalexandremorenoasuarNessuna valutazione finora

- A Simple Forex Trading System That Works: I Trade The Daily Chart, But I Am A Day TraderDocumento37 pagineA Simple Forex Trading System That Works: I Trade The Daily Chart, But I Am A Day TraderHabi Angga TNessuna valutazione finora

- 4X Pip Snager Trading Systems New VersionDocumento69 pagine4X Pip Snager Trading Systems New VersionRene ZeestratenNessuna valutazione finora

- System Sync Highly Profitable Trading System PDFDocumento5 pagineSystem Sync Highly Profitable Trading System PDFAchmad HidayatNessuna valutazione finora

- Top Forex Indicators To Use: Your Solution For Financial CongestionDocumento60 pagineTop Forex Indicators To Use: Your Solution For Financial CongestionKamoheloNessuna valutazione finora

- 1 Minute Scalping StrategyDocumento6 pagine1 Minute Scalping Strategyayub khanNessuna valutazione finora

- Forex Intelligence Guide)Documento61 pagineForex Intelligence Guide)Romeo RofhiwaNessuna valutazione finora

- Mega DroidDocumento89 pagineMega DroidLeoMonicaRaresChiricaNessuna valutazione finora

- Introduction To The Ichimoku Indicator and How To Trade It - Forex Trading - MetaTrader Indicators and Expert AdvisorsDocumento5 pagineIntroduction To The Ichimoku Indicator and How To Trade It - Forex Trading - MetaTrader Indicators and Expert AdvisorsPapy RysNessuna valutazione finora

- Scientificscalper Com PDFDocumento13 pagineScientificscalper Com PDFDinesh MishraNessuna valutazione finora

- Blessed FX BasicsDocumento54 pagineBlessed FX Basicsjoshuasage160Nessuna valutazione finora

- Forex GrailDocumento17 pagineForex GrailVeeraesh MSNessuna valutazione finora

- Moda Trendus ManualDocumento9 pagineModa Trendus ManualCapitanu IulianNessuna valutazione finora

- Forex NewDocumento20 pagineForex NewHariyanto ChowNessuna valutazione finora

- Manual THV V3Documento12 pagineManual THV V3fishbone_freaksNessuna valutazione finora

- TMS V19 ManualDocumento17 pagineTMS V19 ManualTawhid AnamNessuna valutazione finora

- Break Out Trading SystemDocumento26 pagineBreak Out Trading Systemmanlimbang100% (1)

- The Simplest For Ex PipsDocumento18 pagineThe Simplest For Ex PipsManojkumar NairNessuna valutazione finora

- Schaff Trend Cycle Indicator - Forex Indicators GuideDocumento3 pagineSchaff Trend Cycle Indicator - Forex Indicators Guideenghoss77100% (1)

- Double Trend ProfitDocumento14 pagineDouble Trend Profitarvin4d100% (1)

- 2.3 - Average Directional Movement Index Rating (ADXR) - Forex Indicators GuideDocumento2 pagine2.3 - Average Directional Movement Index Rating (ADXR) - Forex Indicators Guideenghoss77Nessuna valutazione finora

- Forex For Beginners: "Rapid Quick Start Manual" by Brian CampbellDocumento10 pagineForex For Beginners: "Rapid Quick Start Manual" by Brian CampbellBudi MulyonoNessuna valutazione finora

- Extreme TMA System ENGLISH PDFDocumento5 pagineExtreme TMA System ENGLISH PDFWawan PangkasepnaNessuna valutazione finora

- Jacko Trading StyleDocumento25 pagineJacko Trading StyleMohammed NizamNessuna valutazione finora

- Money ManagementDocumento7 pagineMoney ManagementAubie Maope100% (1)

- NIK - 20pip EbookDocumento12 pagineNIK - 20pip EbookSandro Pinna100% (1)

- DDS Scalping System - ForexobrokerDocumento10 pagineDDS Scalping System - ForexobrokermysticsoulNessuna valutazione finora

- Simple Forex StrategiesDocumento4 pagineSimple Forex Strategieszeina32Nessuna valutazione finora

- Manifesto UnlockedDocumento18 pagineManifesto Unlockedpetefader100% (1)

- Volatility: Markets Markets, Which Move Quickly, Are High Volatility MarketsDocumento4 pagineVolatility: Markets Markets, Which Move Quickly, Are High Volatility MarketspetefaderNessuna valutazione finora

- Van-Tharp - Trading SystemsDocumento9 pagineVan-Tharp - Trading Systemspetefader67% (3)

- VanessaFX Advanced SystemsDocumento25 pagineVanessaFX Advanced SystemspetefaderNessuna valutazione finora

- Venkataraman-Automated Versus Floor Trading An Analysis of Execution Costs On The Paris and New York ExchangesDocumento41 pagineVenkataraman-Automated Versus Floor Trading An Analysis of Execution Costs On The Paris and New York ExchangespetefaderNessuna valutazione finora

- Gimmees: Click To Learn How I Make $1000 Per Day!Documento5 pagineGimmees: Click To Learn How I Make $1000 Per Day!petefaderNessuna valutazione finora

- Using Options To Buy Stocks - Build Wealth With Little Risk and No CapitalDocumento534 pagineUsing Options To Buy Stocks - Build Wealth With Little Risk and No CapitalpetefaderNessuna valutazione finora

- Van Tharp - Stop Worrying Yourself Out of ProfitsDocumento5 pagineVan Tharp - Stop Worrying Yourself Out of Profitspetefader100% (1)

- U.S. Key Economic IndicaDocumento24 pagineU.S. Key Economic IndicapetefaderNessuna valutazione finora

- Triangle Trading MethodDocumento14 pagineTriangle Trading Methodxagus100% (1)

- Using Neural Networks and Genetic Algorithms To Predict Stock Market ReturnsDocumento166 pagineUsing Neural Networks and Genetic Algorithms To Predict Stock Market ReturnspetefaderNessuna valutazione finora

- Trend Vs No TrendDocumento3 pagineTrend Vs No TrendpetefaderNessuna valutazione finora

- Understanding Forex CandlestickDocumento14 pagineUnderstanding Forex CandlestickpetefaderNessuna valutazione finora

- Vejay Gupta - Financial Analysis Using Excel Brealey MyersDocumento254 pagineVejay Gupta - Financial Analysis Using Excel Brealey MyerspetefaderNessuna valutazione finora

- Trading Ebook - Trading ForexDocumento4 pagineTrading Ebook - Trading ForexpetefaderNessuna valutazione finora

- VSA System ExplainedDocumento182 pagineVSA System Explainedpetefader100% (2)

- Tradings 3R SDocumento4 pagineTradings 3R Spetefader100% (1)

- Trading FunctionsDocumento21 pagineTrading FunctionspetefaderNessuna valutazione finora

- Tradetables 1 6 2003Documento7 pagineTradetables 1 6 2003petefaderNessuna valutazione finora

- Walker, Myles Wilson - How To Indentify High-Profit Elliott Wave Trades in Real TimeDocumento203 pagineWalker, Myles Wilson - How To Indentify High-Profit Elliott Wave Trades in Real TimepetefaderNessuna valutazione finora

- Trading ForexOne More Zero. How To Trade The Forex Like A Pro in One HourDocumento58 pagineTrading ForexOne More Zero. How To Trade The Forex Like A Pro in One HourpetefaderNessuna valutazione finora

- Trading As A BusinessDocumento169 pagineTrading As A Businesspetefader100% (1)

- Trading - Forex - Predicting Price MovementDocumento25 pagineTrading - Forex - Predicting Price MovementpetefaderNessuna valutazione finora

- Trading - Forex - Predicting Price MovementDocumento25 pagineTrading - Forex - Predicting Price MovementpetefaderNessuna valutazione finora

- Tom Peters - 100waysDocumento65 pagineTom Peters - 100wayspetefaderNessuna valutazione finora

- The Pocketbook of Economic IndicatorsDocumento39 pagineThe Pocketbook of Economic IndicatorspetefaderNessuna valutazione finora

- Trade BookDocumento36 pagineTrade BookpetefaderNessuna valutazione finora

- Trade BreakoutsDocumento7 pagineTrade Breakoutspetefader100% (1)

- The Magic of Forex TradingDocumento10 pagineThe Magic of Forex TradingpetefaderNessuna valutazione finora

- The Chulalongkorn Centenary ParkDocumento6 pagineThe Chulalongkorn Centenary ParkJack FooNessuna valutazione finora

- Text Extraction From Image: Team Members CH - Suneetha (19mcmb22) Mohit Sharma (19mcmb13)Documento20 pagineText Extraction From Image: Team Members CH - Suneetha (19mcmb22) Mohit Sharma (19mcmb13)suneethaNessuna valutazione finora

- Case Study in Architectural Structures: A-7E Avionics System - ADocumento36 pagineCase Study in Architectural Structures: A-7E Avionics System - Ajckz8Nessuna valutazione finora

- CIGRE Operational Evaluation of RTV Coating Performance Over 17 Years On The Coastal Area at Jubail-SADocumento9 pagineCIGRE Operational Evaluation of RTV Coating Performance Over 17 Years On The Coastal Area at Jubail-SAMalik Shoaib khalidNessuna valutazione finora

- State Farm Claims: PO Box 52250 Phoenix AZ 85072-2250Documento2 pagineState Farm Claims: PO Box 52250 Phoenix AZ 85072-2250georgia ann polley-yatesNessuna valutazione finora

- Master Data FileDocumento58 pagineMaster Data Fileinfo.glcom5161Nessuna valutazione finora

- Science Grade 10 (Exam Prep)Documento6 pagineScience Grade 10 (Exam Prep)Venice Solver100% (3)

- Routine Maintenance For External Water Tank Pump and Circulation Pump On FID Tower and Rack 2017-014Documento5 pagineRoutine Maintenance For External Water Tank Pump and Circulation Pump On FID Tower and Rack 2017-014CONVIERTE PDF JPG WORDNessuna valutazione finora

- LET-English-Structure of English-ExamDocumento57 pagineLET-English-Structure of English-ExamMarian Paz E Callo80% (5)

- Nuttall Gear CatalogDocumento275 pagineNuttall Gear Catalogjose huertasNessuna valutazione finora

- Previous Papers GPSC Veterinary Officer AHI Advt. No. 33 2016 17 Date of Preliminary Test 08 01 2017 Subject Concerned Subject Que 101 To 300 Provisional Key PDFDocumento18 paginePrevious Papers GPSC Veterinary Officer AHI Advt. No. 33 2016 17 Date of Preliminary Test 08 01 2017 Subject Concerned Subject Que 101 To 300 Provisional Key PDFDrRameem Bloch100% (1)

- One and Half SindromeDocumento4 pagineOne and Half SindromeYulia DamayantiNessuna valutazione finora

- Adsorption ExperimentDocumento5 pagineAdsorption ExperimentNauman KhalidNessuna valutazione finora

- BS 215-2-1970-Aluminium Conductors and Aluminium Conductors Steel-Reinforced For Overhead Power TransmissionDocumento16 pagineBS 215-2-1970-Aluminium Conductors and Aluminium Conductors Steel-Reinforced For Overhead Power TransmissionDayan Yasaranga100% (2)

- Tutorial 6Documento3 pagineTutorial 6Lai Qing YaoNessuna valutazione finora

- 04 Membrane Structure NotesDocumento22 pagine04 Membrane Structure NotesWesley ChinNessuna valutazione finora

- AWS Compete CustomerDocumento33 pagineAWS Compete CustomerSergeyNessuna valutazione finora

- Alto Hotel Melbourne GreenDocumento2 pagineAlto Hotel Melbourne GreenShubham GuptaNessuna valutazione finora

- Categories of Cargo and Types of ShipsDocumento14 pagineCategories of Cargo and Types of ShipsVibhav Kumar100% (1)

- NZ2016SH (32k) - e - NSC5026D 3.3V +100ppmDocumento2 pagineNZ2016SH (32k) - e - NSC5026D 3.3V +100ppmDumarronNessuna valutazione finora

- Salwico CS4000 Fire Detection System: Consilium Marine ABDocumento38 pagineSalwico CS4000 Fire Detection System: Consilium Marine ABJexean SañoNessuna valutazione finora

- Quiz 2 I - Prefix and Suffix TestDocumento10 pagineQuiz 2 I - Prefix and Suffix Testguait9Nessuna valutazione finora

- Distillation ColumnDocumento22 pagineDistillation Columndiyar cheNessuna valutazione finora

- 2021-01-01 - Project (Construction) - One TemplateDocumento1.699 pagine2021-01-01 - Project (Construction) - One TemplatemayalogamNessuna valutazione finora

- Wps For Carbon Steel THK 7.11 GtawDocumento1 paginaWps For Carbon Steel THK 7.11 GtawAli MoosaviNessuna valutazione finora

- USTH Algorithm RecursionDocumento73 pagineUSTH Algorithm Recursionnhng2421Nessuna valutazione finora

- A Tall Order - Cooling Dubai's Burj Khalifa: FeatureDocumento2 pagineA Tall Order - Cooling Dubai's Burj Khalifa: FeatureMohsin KhanNessuna valutazione finora

- ADMT Guide: Migrating and Restructuring Active Directory DomainsDocumento263 pagineADMT Guide: Migrating and Restructuring Active Directory DomainshtoomaweNessuna valutazione finora

- Dash8 200 300 Electrical PDFDocumento35 pagineDash8 200 300 Electrical PDFCarina Ramo LakaNessuna valutazione finora

- Market EquilibriumDocumento36 pagineMarket EquilibriumLiraOhNessuna valutazione finora