Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Order Winners - Order Qualifiers PDF

Caricato da

Greenstars NguyễnTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Order Winners - Order Qualifiers PDF

Caricato da

Greenstars NguyễnCopyright:

Formati disponibili

1

Order Winners, Order Qualifiers, and Quality Perception in Service Operations

Autoria: Eliane Pereira Zamith Brito, Ricardo Luiz Beneduzzi Aguilar, Luiz Artur Ledur

Brito

Abstract

Car assemblers and their dealers have been developing strategies to avoid losing customers of

maintenance service business after the vehicle warranty period. However, the results of those

initiatives have been disappointing considering that only 25% of the car maintenance market

is served by authorized car dealers. Through the analysis of customer expectations about

service it was possible to identify means to better deal with customers and increase the

probability of their retention, adjusting operations design and variables. This study identified

the service attributes customers perceive as order qualifying and order winning factors in the

decision about the car maintenance service provider. Data were collected from a probabilistic

sample of some 400 owners of 1995 to 2002 1000cc powered engine cars in Uberlndia,

Brazil. Analysis was done integrating operations and marketing conceptual approaches using

several multivariate techniques. Authorized dealers offer proved to be strategically weak,

focused in order qualifiers rather than order winners. Directions for improvement in the

operations of both authorized dealers and independent shops could be derived.

Introduction

The automotive industry, in Brazil, is one of the major industries in the country with over 16

billion dollars of net sales in 2001 (ANFAVEA 2004, p. 50). This paper is concerned with a

closely related industry, the car maintenance business. The Brazilian fleet was 16 million cars

in 2001, while sales of new cars totaled 1.3 million units (ANFAVEA, 2004). Assuming the

standard one year warranty period, more than 14 million car users had eventually to choose

where to have his or her car repaired. Another aspect is age distribution of the Brazilian fleet

of cars. The average age was, in 2001, 9.8 years, 36.8% of the cars between one and five

years, and 25.3% between six and ten (FENABRAVE, 2003). Two types of service providers

serve this market. The service department of authorized car dealers is the first alternative

offered to the customer, at least during the warranty period, after the acquisition of a new car.

The other alternative is the independent repair shop.

The importance of maintenance service to the network of car dealers linked to the car

assemblers is increasing. According to FENABRAVE (2001) the after sales service increases

dealers productivity and profitability. Those services, which include sales of parts and

maintenance service, can diminish the dealer dependence on car sales that have heavily

fluctuated during the 90s in Brazil. Urdan (1999) studied the change in operational results

composition of authorized dealers finding that the share of parts and services department rose

from 15% in 1989 to 46% in 1996.

Although the after sales service is an important revenue source to the authorized car dealers,

most consumers use the network of independent maintenance supplier after the warranty

period. According to ABRIVE (2003), 75% of the total car maintenance services are done in

independent shops, leaving only one fourth of the business to the authorized dealers. Given

the initial lead represented by the warranty period, when the authorized dealers have the

chance to demonstrate their service quality to all customers, this situation should be quite

concerning to them. On the other hand, independent shops can face a potential challenge

should the authorized dealers improve their performance, given the lead the latter have during

the warranty period.

The present study addressed the customer choice related to this situation. It objective was to

identify the attributes that determine this choice and, consequently, how the service offers of

both providers could be improved and adjusted to customer preferences.

Marketing usually addresses this issue from the perspective of customer satisfaction

evaluation. The assumption is that satisfied customers are expected to be more loyal. A

prolific stream of literature on service quality evaluation has been developed, of which the

SERVQUAL scale (PARASUNAMAN; BERRY; ZEITHAML, 1988) is one of the most well

known scales used. Operations strategy, on the other hand, attempts to reconcile market

requirements and operations resources (SLACK; LEWIS, 2003). Hill (1993) introduced the

idea of order winning and order qualifying factors as an approach to determine the ideal

design of an operation. The market approach in isolation focuses on the perception of quality

of the current service provider, leaving in the background the weight of the alternatives

offered to the customer. It also does not develop what should be done in the operation as a

consequence of that. The operations approach, on the other hand, does not emphasize the

current relationship of the customer with his or her current supplier. This paper intends to

combine both approaches as a broader way of addressing the problem. An analysis covering

both quality service elements and other attributes related to the design of the operation was

done. A probabilistic sample of 400 subjects was investigated with a structure questionnaire.

Results were analyzed using several multivariate techniques and the main attributes leading to

customer decision could be identified and classified in order winning and order qualifying

factors. The strategic weakness of the authorized dealers offer could be identified and

indications of how the operations of both authorized dealers and independent shops could be

made more competitive were suggested.

In the next three sections, service operations are defined and a review of marketing and

operations approach to service is offered. The methodology used in the research is described

in the following section. Results and analysis are then presented and commented. A

conclusions section ends the paper and suggests path for future research.

The definition and characteristics of service operations

One of the first service definitions is a market transaction performed by an organization or an

entrepreneur without the transfer propriety rights of tangible products (JUDD, 1964 p.59;

1968, p.1). Grnross (1978, 1980) adds that service benefits are delivered through an

interactive experience between customer and people from the service provider and the

intensity of this interaction varies as a function of many factors. This early definition has been

expanded by several authors. Bateson and Hoffman (1999, p. 9-10) point that most services

combine tangible goods with the performance of a number of activities. For example, car

maintenance service is a combination of parts activities developed by people, both necessary

to the delivery the agreed outcome the repaired car. They remember that is hardy to find a

pure service or good and that, in fact, any offer is a combination of services and goods. The

same position is taken by most modern authors (CORREA; CAON, 2002; LOVELOCK;

WRIGHT, 2001).

Grnroos (1978; 1980), Zeithaml and Bitner (2000, p. 12), Zeithaml, Parasuraman and Berry

(1985) describe the main service characteristics in comparison to goods. The most basic and

cited characteristic is intangibility. Services are actions that cannot be seen, felt, tasted, or

touched. This poses some challenges to managers. They cannot inventory service in order to

meet fluctuations in demand. Besides, quality is difficult to be assessed and communicated to

consumers, and the service concept can be easily copied. A second characteristic the high

dependence on human performance, people may act differently each time they execute one

task and customers, for many reasons, can also perceive the action differently any time they

receive the service. This heterogeneity is also hard to manage. Thirdly, the production and

consumption of service usually occur simultaneously and to be convenient service has to be

produced close to customer, resulting in small-scale production process. Therefore, most

services cannot benefit from significant economies of scale. Perishability is another service

characteristic. Customer cannot have propriety rights linked to service as well as return or

resold since is not possible to inventory them. Planning and production are consequently

important activities in the management of service.

Another view is that all these differences are more an issue of grade than of nature.

Perishability, for instance, is frequently a characteristic of goods too, with similar implications

in inventory and planning. A BigMac, for instance, has only a few minutes of lifetime before

it is discarded as unfit for consumption. In this sense, it becomes quite acceptable to adapt

many of the operations approaches and techniques, initially developed for manufacturing to

services (CORREA; CAON, 2002).

Both marketing and operations fields offer approaches to analyze service performance. The

next two sections explore, in an integrative mode, these two approaches, leading up to the

approach taken by this research.

Marketing approach to service and customer satisfaction

The marketing service literature tries to understand the consumer choice for service provider

through the analysis of customer satisfaction models such as SERVQUAL. On the other hand,

operations literature addresses a closely related issue considering the matching of market

requirements and operations resources.

There is a rich line of research in marketing on evaluation and measurement of customer

satisfaction. According to Parasuraman, Berry and Zeithaml (1991) the service quality

evaluation results from a comparison between what is expected by customers and the service

received. The expectation can be used here in two different ways. Expectations can be

understood as the way customers believe the service is going to be delivered and secondly it

can be related to the service desired by customers. Berry and Parasuraman (1991, p.59)

emphasize the evidences that expectations are dynamic and vary due to many factors. They

also explain that there is a layer bellow the desired level that can be acceptable what they

called as zone of tolerance. The minimum acceptable level of service is called adequate

service. Two factors can affect the desired service level - the enduring service intensifiers and

the personal needs. Five factors influence the perception of service as adequate: transitory

service intensifiers, perceived service alternatives, customer self-perceived service role,

situational factors, and predicted service.

Parasuraman, Berry and Zeithaml (1985) developed a model to measure quality of service

after consumption. It is called SERVQUAL and it is probably the best known model used to

measure quality of service. It focuses on measuring quality perception after customer has

received the service. The SERVQUAL evaluates customer satisfaction using five dimensions:

reliability, tangibles, responsiveness, assurance, and empathy (PARASURAMAN; BERRY;

ZEITHAML, 1991). The dimensions of service quality were well discussed by many authors,

but there seems to be no agreement among them. Harrison-Walker (2002) proposes two

dimensions, Carman (1990) poses that dimensions depends on the sector analysed. Bouman

and Wiele (1992, p.10-12) present a tri-dimensional perspective to quality measurement to

automotive services. These authors initially developed their scale using the five dimensions of

SERVQUAL. However, their research findings could not support those five dimensions. The

authors proposed then only three dimensions: courtesy to customer, tangibles, and trust.

Rodrigues (2001, p.120) developed a study on perception of service evaluation in the

Brazilian market identifying factors such as service price to the customer, service lead-time,

honesty of service provider and trust in the service provider personnel as important to

customers perception of quality. He concluded that service seems to be a tri-dimensional

construct and this number of dimensions tends not to vary. The dimensions defined by the

author are tangible elements, interaction between customer and service provider, and the

service provider responsibility. Although the names given by authors to some quality service

dimensions are different, there seems to have some convergence between Grnroos (1984, p.

42), Sureshchandar, Rajendran and Anantharaman (2002), Rodrigues (2001), and Bouman

and Wiele (1992) about the importance of customers and employees relationship. There is

also convergence about the tangible dimension. Sureshchandar, Rajendran and Anantharaman

(2002, 2001) and Sureshchandar, Rajendran and Kamalanabhan (2001) observed that aspects

related to humans are more relevant than those technical aspects to deliver quality service.

They want to emphasize the importance managers have to give to human resources, instead to

the other aspects. Maybe because of this approach, focused on the evaluation of an already

decided service supply, price rarely comes into consideration when evaluating services.

Bouman and Wiele (1992) and Rodrigues (2001) adapted the SERVQUAL dimensions in

order to have a scale adjusted to evaluate the automotive service. An important different

between the Bouman and Wiele (1992) proposed scale and SERVQUAL is that the former

use only one question to measure expectations and perception. Differently, Rodrigues (2001,

p.119) explains that he adapted the SERVQUAL scale, because he wanted to measure

something different. The idea is not to measure the perceived quality service, but what

customer expects about the service he or she is just to buy, as done in the present study.

Most of these works focus on evaluation of quality perception and not on the decision taken

by the customer to maintain or change current service supplier. There is a hidden assumption

that highly satisfied customers tend to be loyal. This relationship between loyalty and

customer satisfaction is covered by other authors (JONES; SASSER, 1995; HESKETT et al.,

1994; REICHHELD; SASSER, 1990; REICHHELD, 1996; SCHNEIDER; BOWEN).

Fitzsimmons and Fitzsimmons (2002) discuss the criteria used by customers to select a

service provider. The focus is on the phase before the buying decision. The criteria cited by

the authors are availability or accessibility, convenience or location, reliability, customization,

price, quality measure through the comparison between before and after service quality

perception, service provider reputation, guarantees, and responsiveness. This list of criteria

has a substantial overlap with the attributes analyzed by Parasuraman, Berry and Zeithaml

(1985). It is important to note, however, the inclusion of price and reputation that can be used

in the decision process of service provider.

The focus of this study is the analysis of the complex situation where a consumer is engaged

in a continuing relationship with a service provider. In this case, all the theoretical analysis of

his satisfaction with this service is thus applicable, but he or she is constantly exposed to the

offer of an alternative service provider. His satisfaction with the current supplier has clearly a

bearing to his future choices, but it interacts with the nature and characteristics of the

alternative offer. His process of choice is then more complex than simply analyzing his

satisfaction. Most of the marketing literature is then covering one aspect of this decision

situation. The operations management literature offers a complementary perspective to the

above development.

Order winning and order qualifiers

Slack and Lewis (2003) and Hill (1993) define Operations Strategy as the reconciliation of

market requirements and operations resources. The market requirements are expressed in

terms of performance objectives categorized into quality, speed, dependability, flexibility,

degree of customization, innovation, and cost. These performance objectives constitute a link

between the market determined competitive factors and the operations resources that

influence performance. One way to assess the relative importance of the competitive factors

was offered by Hill (1993) with the concept of order-winning and order-qualifying factors.

The basic approach is the concept of fit: adjusting the operations parameters as to achieve a

determined specified level of performance. Hill explains that the Operations Department is

not responsible by all order winning factors. Factors such as brand name, design leadership

have to be managed by other areas in the company.

Hill (1993, p.43) says that the idea is to define the criteria are important to customer decision.

These criteria have to be defined clearly at the business strategy level otherwise managers will

determine their own standard for the business. He also notes that most companies are in

markets characterized by differences that have to be understood in details in order to craft the

offer to the chosen market segment. This discussion refers to production of tangible goods,

but the reasoning can be used to services as well.

According to the author, order qualifiers are those criteria that the company must comply with

to be considered as a possible supplier. Having a good performance in these criteria, however,

is not enough to win the orders and exceeding the threshold limit for these factors influences

nothing or very little in the customer final decision. The order-winner criteria are those that

make up the company differentiation in comparison to the competitors and allow suppliers

that hold them to win the orders. The higher a supplier scores in these factors, the higher the

chances of winning the order. Both groups of criteria are essential to the business success.

Therefore, suppliers must guarantee meeting the qualifying criteria in order to get into and

stay in a market place, while performance in the order winning criteria is the key to win the

battle for customers preference.

The definition of criteria and their classification into qualifying or winning order categories is

a task that must be reviewed over time and Marketing and Operations have to walk hand to

hand in the process, otherwise unrealistic requirements can emerge. Hence, there is a clear

need of connecting marketing and operations approaches especially when dealing with a

practical and competitive situation.

The situation this research intends to explore can be better understood by integrating both

approaches previously described. Customers, in this case, car owners, are more or less

involved in a sequential stream of service encounters with one or both types of service

providers (authorized dealers and independent repair shops). Their satisfaction with previous

service deliveries has certainly an influence on future decisions and may even lead to loyalty

to a particular service provider. When they make a new decision, however, they consider

additionally the different attributes of the possible offers (the order qualifiers and order

winners) and make a new choice, continuing the process. The next section describes this

approach in detail.

Methodological approach

The population analyzed can be described as owners of 1995 to 2002 1000cc powered engine

cars of Uberlndia City (state of Minas Gerais in Brazil). A probabilistic sample consisting of

400 car users was drawn, so research results can be said to represent the population analyzed,

ensuring external validity. The selection used data on city population held by the research

institute that conducted the interviews. Data were collected in November, 2003.

A structured questionnaire was used to evaluate 30 service attributes. The field research used

as starting point the scale developed by Rodrigues (2001). This author built a 27-variables

scale to analyze consumer expectation of automotive service before the buying decision.

Other three variables were included to compose the actual scale used in this research

following our discussion on marketing and operations approaches. Those variables were

organizational image (GRNROOS, 1984; FITZSIMMONS; FITZSIMMONS, 2002), trust

(MAYER; DAVIS; SCHOORMAN, 1995) and price (FITZSIMMONS; FITZSIMMONS,

2002). This list of 30 attributes is thus a comprehensive list of all factors the customer could

consider when renewing his choice of service supplier. The scale was then submitted to a

series of qualitative pre-tests until a clear understanding was achieved among respondents.

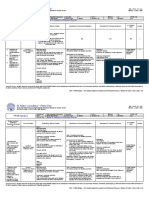

The affirmatives proposed related to the variables listed in Exhibit 1.

Equipments general condition

Site general condition

Employees appearance

Keep the established schedule

Capabilities to absorb not estimated costs generated

by internal problems or fails

Stick to the forecast and prices

Receipt correction and precision

Do right at first time

Keep promises

Pay attention to modifications demanded by the

customer

Disposition to solve customers problems

Disposition to explain de service development

Attendants disposition and quick response

Dedication to the service details

Disposition to communicate price changes

Attendants ability to be trusted

Employees knowledge and experience

Employees courtesy and politeness

Organization climate and environment

Organization capability to anticipate possible

problems

Employees discretion

Adequate opening hours

Disposition to adapt to customer schedule

Company openness to negotiate

Employees disposition to know customers

Company disposition to adopt specific solutions

Individual and personal attention

Trustful mechanics

Image of being reliable

Value for money service

Exhibit 1 Research variables list

Source: The authors

Personal interviews were conducted to gather the research data. First, respondents had to

inform their options for car maintenance after the warranty period (independent shop or

authorized dealers) and several demographic and car characteristics. Then they were asked to

evaluate how they expected both authorized dealers and independent shops to perform in each

one of the 30 selected attributes. Finally, respondents had to identify and rank, among the 30

variables, the six attributes they judged most relevant for their choice process.

The data were analyzed using descriptive statistics and several multivariate techniques. A

logistic regression was developed using as a dependent variable the choice for one type or

another of service provider as informed by respondents. The results highlighted which factors

led to this choice and their relative importance. Factor analysis was used to judge the scale in

comparison to previous studies testing scale validity and reliability. Other multivariate

techniques offered further understanding of customer decision process.

Results and research findings

Two thirds of respondents were customers of independent shops, coinciding closely with the

data declared by FENABRAVE (2003a), the official speaker for the sector. Respondents were

predominantly from the male gender (75%). One possible explanation for this could be that

the car maintenance role in most families is still taken by men. One of the filters used in the

research was the requirement that the respondent was responsible for the car maintenance.

The first stage of the analysis was to conduct a factor analysis on the 30 attributes

investigated. Analysis was done separately for the evaluations of independent shops and for

the authorized dealers evaluations. The factors extracted were compared to and matched the

dimensions examined in previous studies as in Rodrigues (2001). Construct validity could then

be assured.

Initially each group of variables was subjected to the Bartletts sphericity test and KaiserMeyer-Olkin (KMO) check for sample adequacy and no problems were identified, ensuring

the sample and data were adequate for the factor analysis procedure. Factor analysis was done

using the principal components method and Varimax rotation of the resulting factors. Results

indicated three factors corresponding to the dimensions identified by Rodrigues (2001) for the

same service context (car maintenance). Tables 1 and 2 shows the factor loadings and the

values of Cronbachs Alpha for the independent repair shops and authorized dealers

respectively. Results indicate consistency of the identified dimensions ensuring construct

validity and reliability. This was an expected result since most the selected attributes were

based on the tested and validated instrument developed by Rodrigues (2001) which also had

its origins in the validated SERVQUAL developed by Parasunaman, Berry and Zeithaml

(1988).

The first extracted factor can be related to the Customer Relationship factor identified by

Rodrigues (2001) and captures the elements related to the process of service delivery. The

second factor can be associated to the Supplier Responsibility factor of the same research that

covers the content of the service. The third factor refers clearly to the Tangible Elements

dimension, also identified by Rodrigues (2001).

Table 1 Evaluation of independent shops factor analysis

Source: Authors

Components

Disposition to adapt to customer schedule

Employees discretion

Value for money service

Employees disposition to know customers

Adequate opening hours

Individual and personal attention

Trustful mechanics

Employees courtesy and politeness

Company disposition to adopt specific solutions

Attendants disposition and quick response

Attendants ability to be trusted

Company openness to negotiate

Image of being reliable

Organization climate and environment

Disposition to communicate price changes

Capabilities to absorb not estimated costs generated by internal problems or fails

Pay attention to modifications demanded by the customer

Keep promises

Disposition to explain de service development

Disposition to solve customers problems

Do right at first time

Receipt correction and precision

Stick to the forecast and prices

Organization capability to anticipate possible problems

Dedication to the service details

Employees knowledge and experience

Site general condition

Equipments general condition

Employees appearance

Keep the established schedule

Cronbach -

1

.744

.678

.661

.654

.653

.625

.615

.589

.584

.576

.573

.543

.542

.537

.507

.432

.145

.238

.406

.387

.305

.260

.210

.471

.491

.445

.133

.171

.235

.325

0.932

2

.114

.340

.222

.121

.167

.312

.300

.488

.330

.493

.473

.248

.321

.480

.319

.261

.767

.744

.678

.631

.630

.592

.583

.552

.532

.496

.286

.230

.247

.396

0.917

3

.197

.116

.058

.296

.062

.271

.239

.176

.119

.213

.189

.336

.378

.184

.212

.363

.300

.346

.050

.307

.382

.266

.270

.147

.174

.346

.815

.814

.680

.479

0.808

Table 2 Evaluation of Authorized Dealers factor analysis

Source: Authors

Components

Disposition to adapt to customer schedule

Adequate opening hours

Individual and personal attention

Employees disposition to know customers

Employees discretion

Company openness to negotiate

Company disposition to adopt specific solutions

Value for money service

Disposition to explain de service development

Keep promises

Do right at first time

Pay attention to modifications demanded by the customer

1

.763

.688

.659

.655

.653

.641

.634

.533

.500

.154

.112

.145

2

.135

.097

.251

.232

.171

.266

.260

.453

.464

.766

.718

.713

3

.120

.161

.089

.090

.315

.205

.118

.153

.141

.211

.226

.282

Attendants ability to be trusted

Keep the established schedule

Trustful mechanics

Disposition to solve customers problems

Organization capability to anticipate possible problems

Attendants disposition and quick response

Employees knowledge and experience

Dedication to the service details

Employees courtesy and politeness

Disposition to communicate price changes

Image of being reliable

Organization climate and environment

Site general condition

Equipments general condition

Employees appearance

Stick to the forecast and prices

Receipt correction and precision

Capabilities to absorb not estimated costs generated by internal problems or fails

Cronbach -

.318

.154

.390

.387

.234

.519

.242

.505

.459

.165

.183

.309

.027

.067

.225

.285

.394

.279

0.879

.685

.611

.598

.573

.567

.563

.539

.524

.507

.501

.499

.420

.167

.189

.330

.209

.147

.251

0.922

.172

.239

.189

.192

.207

.138

.388

.176

.295

.004

.339

.407

.824

.790

.586

.548

.467

.384

0.752

Having established construct validity, the analysis now focuses on the decision factors. The

responders at the end of the interview indicated the importance of each factor, by selecting and

ranking the six most important factors they considered when making a decision. The ten most

important factors presented in Exhibit 2 for both groups. For the selection of this list, the

factor ranked first received a weigh of six, the second five, the third four and so on. This way

of ranking followed the study of Carvalho and Leite (1997). Results are very similar for both

groups.

Current users of independent repair shops

Stick to the forecast and prices

Value for money service

Do right at first time

Trustful mechanics

Keep promises

Disposition to solve customer's problems

Keep the established schedule

Current users of authorized dealers

Do right at first time

Value for money service

Trustful mechanics

Stick to the forecast and prices

Employees knowledge and experience

Keep the established schedule

Keep promises

Pay attention to modifications demanded by the

customer

Employees knowledge and experience

Pay attention to modifications demanded by the

customer

Disposition to solve customer's problems

Equipments general condition

Equipments general condition

Exhibit 2 Most important decision factors indicated by consumers groups

Source: Authors

These are the factors the consumers say they consider when making a choice. The related

question is whether service providers should design their operations accordingly. This type of

analysis has several limitations. First, the consumers may not be telling the whole truth, they

may say they value these aspects, but their actions may not support this. The fact that both

groups identify the same aspects is an indication of this since they make different choices.

Second, some aspects may be deemed important, but if all alternative providers have a similar

offers they will not influence the decision. In the operations management jargon, they will be

order qualifiers, but not order winners. A further analysis is necessary.

10

The next step in the analysis was to perform a logistic regression with the choice of service

provider as the dependent variable and the consumer evaluation of his/her current supplier in

each of the attributes as independent variables. The logistic regression suits itself perfectly for

this application. The interpretation of the coefficients of the logistic regression indicates which

attributes are associated to an increase or decrease of the probability that a customer will chose

one or another service supplier.

The dependent variable was coded 0 choice for an independent supplier and 1 choice for a

authorized supplier. The sign of the coefficients of the logistic regression for each attribute

indicate its association with one or another service provider. Coefficients with negative sign

contribute to the regression leading to zero. These attributes are associated to the choice of an

independent supplier. On the other hand, positive B coefficients show attributes are associated

to the choice for an authorized dealer as a supplier.

Table 1 presents the results of the logistic regression. It includes the B coefficients resulting

from each variable, its respective standard deviation, the statistics Wald (ratio between the

coefficient and its standard deviation, squared) and the calculated statistics significance. Only

the attributes p-values less than 0.05 were included in Table 3.

Table 3 Main attributes influencing customer choice

Source: The authors

Employees appearance

Image of being reliable

Equipments general condition

Site general condition

Attendants disposition and quick response

Company openness to negotiate

Value for money service

Disposition to solve customers problems

Constant

Coeficient B

Std error

Wald

Sig.

0,792

0,585

0,521

0,368

0,352

-0,362

-0,468

-0,475

-11,365

0,154

0,130

0,188

0,164

0,137

0,112

0,097

0,128

1,423

26,400

20,317

7,691

5,025

6,637

10,476

23,438

13,679

63,798

0,000

0,000

0,006

0,025

0,010

0,001

0,000

0,000

0,000

The attributes that are associated to customers choice for an authorized supplier are related to

visual and appearance attributes, with emphasis on the personal presentation of the contact

attendants (B= 0,792), the general state of the equipment (B= 0,521) and the general state of

the facilities (B= 0,368). The image of reliability of the company in the market (B= 0,585) and

the availability and support of the contact attendants (B= 0,352) also characterize the

evaluation of those that opt for an authorized supplier.

Disposition to solve customers problems, company openness to negotiate and value for

money service are attributes that regular customers of independent shops tend to value higher.

This can be interpreted as the perceived ability that independent shops have to adapt itself to

customers demand. The value for money attribute (B= -0,468) is the one that contributes most

to the choice of an independent supplier, followed closely by the attribute disposition to solve

the customers problem (B= -0,475).

The logistic regression showed that these are the attributes where differences in performance

evaluation do exist. It does not imply in causation. One attribute may be valued differently

simply because the two suppliers have different characteristics. For example, employees

appearance is clearly better evaluated by customers of authorized dealers, but this may be

11

simply a consequence of a common practice by all authorized dealers. Since all have

employees with better appearance, the factor showed up as differentiation factor. The

additional question of relevance is which of these factors (where the differences are perceived)

is truly important for customers decision? The solution is to cross check this list of factors

with the factors deemed important for the decision by customers (Exhibit 2). The intersection

of these two sets of attributes constitutes the attributes that are important and where the

customers perceive a difference in performance.

Only value for money service, disposition to solve customers problems, and site general

condition meet both these criteria. Most of the attributes where the current consumers evaluate

the authorized dealers better are not in the list of important attributes. This indicates a serious

flaw in the strategy of authorized dealers. They are being different (better) in attributes, the

customer does not use as an important decision criteria. An exception to this is the general site

condition. Independent shops are performing differently better in two highly valued attributes:

value for money and disposition to solve customers problems. These are the two order

winners for the independent shops.

These results are based on the expected evaluation of attributes of the customer current

supplier. We also explored the evaluation of the expectations that these customers have for the

alternative supplier. The attributes evaluated are the same as the ones used to evaluate the

service supplier chosen. The same logistic regression was carried out for the not chosen

supplier and the result is a group of attributes that indicate why a type of supplier was not

chosen. Table 4 presents the results of this regression.

The coefficients of the regression is identify the attributes valued (expectation) differently by

consumers not choosing a certain supplier type. Since the valuation of the attributes referred

now to the supplier not chosen, the more negative the coefficient, the more the attribute is

contributing for the service of the independent supplier not to be chosen. In the same way, the

more positive the coefficient of an attribute, the more this attribute is contributing for the

service of the authorized supplier not to be chosen.

Table 4 Main attributes leading to lost of customers

Source: The authors

B Coefficient

Image of being reliable

Site general condition

Equipments general condition

Employees discretion

Disposition to communicate price changes

Capabilities to absorb not estimated costs generated by internal

problems or fails

Trustful mechanics

Stick to the forecast and prices

Employees disposition to know customers

Employees courtesy and politeness

Value for money service

Constant

Std

Wald

Error Statics

Sig.

-0,941

-0,828

-0,442

-0,283

-0,223

0,148

0,165

0,167

0,130

0,097

40,493

25,162

7,003

4,741

5,240

0,000

0,000

0,008

0,029

0,022

-0,221

0,092

5,792

0,016

0,275

0,358

0,394

0,403

0,537

7,469

0,112

0,107

0,111

0,151

0,118

1,076

6,015

11,109

12,641

7,112

20,690

48,220

0,014

0,001

0,000

0,008

0,000

0,000

12

The main factors where authorized dealers are better evaluated, now by their non-customers

are quite similar to the evaluation made by their own customers, indicating no communication

problem. Image of being reliable, site general condition and equipments general condition

appear in both regressions. Consumers that chose independent shops expect the authorized

dealers to perform better in these dimensions, but despite this, choose otherwise. This is

understandable since only the equipments general condition attribute was included in the list

of most important attributes, and in the last position. Attributes where the independent dealers

are better evaluated are the value for money service, the employees courtesy and politeness,

employees disposition to know the customer, stick to forecast prices and trustful mechanics. It

is important to note that these are performance perceptions by customers currently patronizing

authorized dealers, and so represent their evaluation of a possible supply alternative.

Consumers of authorized dealers expect independent shops to perform better in these

dimensions which implies they perceive to be paying a higher price (value for money

attribute), prices change more often than the competitor does (stick to forecast price), and the

mechanics handling the issue are less trustful. These three attributes were included in the list

of most important attributes influencing the decision. It highlights the weakness of the

authorized dealers offers and the risk that their customers will defect to independent shops.

A summary of the above analysis is presented in Exhibit 3. It shows the attributes where the

evaluation made by the consumers is different. The highlighted attributes are the ones

included in the list of most important attributes the consumers consider when making their

choices. These are the attributes where performance is different and important, the true order

winners.

The chosen type of supplier

Authorized

Independent

Employees appearance

Image of being reliable

Image of being reliable

Site general condition

Authorized

Equipments general condition

Equipments general condition

Site general condition

Employees discretion

Attendants disposition and quick

Disposition to communicate price

Evaluated

response

changes

Supplier

Capabilities to absorb not estimated

costs generated by internal problems

or fails

Value for money service

Disposition to solve customers

Employees courtesy and politeness problems

Independent

Employees disposition to know

Value for money service

customers

Company openness to negotiate

Stick to the forecast and prices

Trustful mechanics

Exhibit 3 Explaining the choice or the no choice of a type of supplier

Source: The authors

Analyzing first column of attributes in Exhibit 3 represents the evaluation of current customers

of authorized dealers regarding their current service provider and the alternative, the

independent shops. Although the authorized dealers are better evaluated in several attributes,

these are not the ones used by consumers to choose. They are probably exceeding in

performance in order qualifier attributes and have only one order winner working in their

favor: the equipments general condition. The independent shops have three order winners: the

value for money service, the stick to forecast and prices and trustful mechanics. These results

indicate the weakness of the authorized dealer supply offer and the need to reconceive their

operations. Their customers are likely to defect at first opportunity.

13

The second column of attributes of Exhibit 3 depicts the evaluation of independent shops by

customers. Their own customers (the lower right quadrant) recognize they perform better in

the value for money service and in the disposition to solve customers problems. These are

rightful order winners and justify their choices. They are also aware that the alternative

suppliers, authorized dealers, perform better in a number of attributes they do not deem so

important. The only aspect they judge important and the authorized dealers do better is the

equipments general condition.

The first logistic regression model was able to predict customer choice in more than 88.4% of

the cases. Omnibus and Hosmer & Lemeshow tests indicated good model performance. The

results of the Omnibus test indicate an adequate performance for the model, in which all

variables included in the analysis picture a significance level above 95%. The calculations of

R-squared of Cox and Snell, which is usually below 1, were also performed. The statistical Rsquared of Nagelkerke is a correction of the statistical value of Cox and Snell, yet its

maximum value is 1. The analysis of these results shows a sound adequacy of the model, in

which the values of R-squared of Cox & Snell and the R-squared of Nagelkerke were 0.498

and 0.692 respectively. Another test to verify the adherence of the model is the zerohypothesis test that the model does not adhere to the results (Hosmer and Lemeshow Test).

The study of the variables resulting from the logistic regression showed positive results, since

the significance value was above 55,3%, well below the 95% necessary to validate the zerohypothesis, therefore rejecting the zero-hypothesis of non-adherence of the model.

The second logistic regression, relating the performance expectation of the alternative supplier

showed also a good model performance. In the results of the Omnibus test all the variables of

not choice showed significance above 95%. The analysis of R-squared of Nagelkerke was

above 0.74, with the inclusion step by step of the 11 variables resulting from the logistic

regression for the evaluation of choice, also showing a good adherence of the model. The

model also showed that the zero-hypothesis, that the model does not adhere to the results, is

not valid, and its calculated significance value was only 10.9%. At last, the predictive capacity

was analyzed. The model showed 89.9% of correct prediction, showing great coherence in the

results and its capacity to predict by measuring the expectations of the services, which supplier

has a greater chance of not being chosen by the client for a service of corrective or preventive

maintenance.

Conclusion

This paper had the intention to study the decision situation faced by a customer in choosing

the service provider for car maintenance. In the Brazilian setting, this choice has two basic

options: using an authorized dealer as a continuation of the service provided during the

warranty period, or using independent repair shops.

An integrative approach combining marketing and operations perspectives was used. Car

maintenance is a service used repetitively by the consumer and each consumer had a current

service provider at the time the research was done. The evaluation of performance of this

service provider had an influence on his subsequent choices. High satisfaction with current

service can lead to loyalty (REICHHELD; SASSER, 1990; REICHHELD, 1996; JONES;

SASSER, 1995). The marketing approach to quality service evaluation covers this aspect. The

customer is also influenced by his perception of the relative value represented by the

alternative offers open to him. Suppliers constantly adjust their operations to have a better fit

14

between the market needs and the operations resources (SLACK; LEWIS, 2003). One useful

approach to do this is to identify the order winning and order qualifying factors and adjust

ones operations to satisfy in the order qualifying factors and perform as well as possible in the

order winning factors (HILL, 1993).

The analysis of the sample chosen has shown a clear weakness in the position of the

authorized dealers in this market. This helps to understand the current market share of these

suppliers that is only 25% when they have the opportunity, during the warranty period, to

demonstrate to all future customers the quality of their offer. The current authorized dealers

customers evaluate them with a better performance in only one order-winning factor, the

equipments better condition. No other attributes, where they were better evaluated, seem to be

order-winning factors. On the other hand, these same very customers expect the competitor to

perform better in three order-winning factors: value for money service, stick to forecast prices,

and trustful mechanics. In other words, they see the competitor (independent shops) offering a

lower cost same value service, more likely to maintain the prices they initially promise, and

trust more the mechanics that will do the job. Additionally, they say these are important

factors for their choice decision. The most likely outcome is future customer defections to

independent shops.

An additional point is that the only attribute where the authorized dealers perform better, the

better condition of the equipments, is not so difficult to imitate. Using the resource-based

approach (BARNEY, 1991), resources that are easily imitable cannot be a source of sustained

competitive advantage, they lead at most to a temporary advantage and with time to

competitive parity. In fact, some independent service providers, mostly part of repair chains

are following exactly this approach.

The model can also be used as a managerial tool to identify initiatives that influence customer

expectations and a strategic guide for rethinking the service operations. Managers can then

work on aspects of the operation related to the qualifying and order winning factors,

considering the two groups of customers. Authorized dealers need to change their approach, or

they will continue to lose customers to independent repair shops. The analysis done indicates a

road map of how it could be done. First they need to neutralize the disadvantage they have in

some order winning attributes. One of the main problems is the perception of a better value for

money of the service offered by the independent shop. The lack of economies of scale in

service is a difficulty, but a joint work with car manufacturers integrating the supply chain and

capturing the benefits from such an integration could be a promising area, since it would be

difficult to imitate. Other important attributes are more easily improved. Guaranteeing prices

and estimates and promoting a direct contact of the customer with a mechanic rather than with

a good looking attendant, but with limited technical knowledge could be possible initiatives.

Second, authorized car dealers could try to leverage those attributes were they are recognized

to perform well. They could try to increase the importance given to these attributes by the

consumer. The close relationship with the car manufacturer implying a more updated

technology background, and the brand image can than turn into decisive resources that cannot

be imitated by the independent shops.

The results of the research can also be used to guide the actions of independent repair shops.

Here the focus point is clearly identified. They need to improve the equipments and site

general condition. This move was already taken by some repair shop chains like Precision

Tune Auto Care, a global chain of repair shops with more than 650 shops worldwide, active in

Brazil since 1999.

15

This research has also several limitations. The sample included only cars with engines of

1000cc. Although these represented 66.7% of the sales of new cars in 2002 (ANFAVEA,

2004), the decision drivers for other types of cars may be quite different. The sample was also

filtered by year of manufacturing of the car and cars manufactured before 1995 were not

included. Research was done in Uberlndia with a probabilistic sample, so results can be

considered to have external validity only for this city. Other regions of the country may have

specificities that lead to different results. The impact of convenience, represented by

proximity of location to customer residence or work can be explored. Two areas for future

studies could broaden the understanding of this situation. One would be to focus the decision

moment that occurs at the end of the warranty period when the consumer has to make a

decision to change of maintain its current service supplier. Another would be to investigate

specifically the customers that do decide for a change and investigate the reasons behind this

decision.

The study of customer evaluation of service operations and his or her decision to choose

among different service providers is indeed a fertile ground for future studies. The problem is

complex and its analysis is better understood by combining different approaches offered by

several fields as this research attempted combining operations and marketing approaches.

References

ABRIVE (Associao Brasileira das Reparadoras Independentes de Veculos). Notcias.

Pesquisa aponta as melhores and piores seguradoras do pas. 2003. Available at

www.ruv.com.br/notcias.htm. access made in April 26th, 2004.

ANFAVEA (Associao Nacional dos Fabricantes de Veculos Automotores) Anurio

Estatstico. 2003. Available at http://www.anfavea.com.br/Index.html, access made in April

26th, 2004.

BARNEY, Jay. Firm resources and sustained competitive advantage. Journal of Management,

Vol. 17, n.1, p. 99-120, 1991.

BATESON, John E. G.; HOFFMAN, K. Douglas. Managing services marketing, text and

readings. Orlando, The Dryden Press, 1999.

BERRY, Leonard L.; PARASURAMAN, A. Marketing services, competing through quality.

New York, The Free Press, 1991.

BOUMAN, Marcel; WIELE, Ton Van der. Measuring service quality in the car service

industry, building and testing an instrument. International Journal of Service Industry

Management, Vol. 3, n. 4, p.4-16, 1992.

BURTON, Dawn. Consumer education and service quality, a conceptual issues and practical

implications. Journal of Service Marketing, Vol. 16, n. 2, p. 125-142, 2002.

CARMAN, James M., Consumer Perceptions of service quality, an assessment of the

SERVQUAL dimensions. Journal of Retailing, Vol. 66, n. 1, p.33, 1990.

CARVALHO, Frederico A.; LEITE, Valdecy F. A ordem dos atributos afeta a avaliao de

qualidade? Uma investigao emprica a partir da verso mais recente do modelo

SERVQUAL. Revista de Administrao Contempornea, Vol. 1, No.1, p. 35-53, 1997.

CORRA, H.L.; CAON, M. Gesto de servios. So Paulo: Atlas, 2002.

FENABRAVE (Federao Nacional da Distribuio de Veculos Automotores). Ps vendas:

um

canal

para

aumentar

a

rentabilidade.

2001.

Available

at

www2.fenabrave.org.br/notcias/1045.htm. access made in April 26th, 2004.

FENABRAVE (Federao Nacional da Distribuio de Veculos Automotores). Frota

Circulante. 2003. Available at <www.tela.com.br/html/pesquisas/ access made in April 26th,

2004.

16

FITZSIMMONS, James A.; FITZSIMMONS, Mona J. Administrao de servios.

Operaes, estratgia e tecnologia de informao. Porto Alegre, Bookman, 2002.

frota/int_pesq_frota_auto.asp>, (2003).

GRNROOS, Christian. A Service-orientated approach to marketing of services. European

Journal of Marketing, Vol.12, n. 8, p.588-601, 1978.

GRNROOS, Christian. Designing a long range marketing strategy for service. Long Range

Planning, Vol,13., 1980.

HARRISON-WALKER, L. Jean. Examination of the factorial structure of service quality, a

multi-firm analysis. The Service Industries Journal. Vol. 22, n. 2, p. 59-72, 2002.

HESKETT, James H. et al. Putting the service-profit chain to work. Harvard Business

Review, p. 164-174, March-April, 1994.

HILL, T., Manufacturing strategy. Basingstoke, UK: MacMillan, 1993.

JONES, Thomas O.; SASSER Jr., W. Earl. Why satisfied customers defect. Harvard Business

Review, p. 88-99, November-December, 1995.

JUDD, Robert. The case for redefining service. Journal of Marketing, Vol.28, p.58-59, 1964.

LOVELOCK, Christopher; WRIGHT, Lauren. Servios, marketing e gesto. So Paulo:

Saraiva, 2001.

MAYER, Roger C.; DAVIS, James H., An integrative model of organizational trust. Academy

of Management Review, Vol. 20, n. 3, p. 709-735, 1995.

PARASURAMAN, A.; BERRY, Leonard; ZEITHAML, Valarie. A conceptual model of

service quality and its implications for future research. Journal of Marketing, Vol49, p.4450,

1985.

PARASURAMAN, A.; BERRY, Leonard; ZEITHAML, Valarie. Refinement and

reassessment of SERVQUAL scale. Journal of Retailing, Vol. 67, issue 4, p.421-452, 1991.

PARASURAMAN, A.; BERRY, Leonard; ZEITHAML, Valarie. SERVQUAL, a multipleitem scale for measuring consumer perceptions of service quality. Journal of Retailing,

Vol.64, N.1, p.12-40, 1988.

PARASURAMAN, A.; BERRY, Leonard; ZEITHAML, Valarie. Understanding customer

expectations of service. Sloan Management Review, Vol. 32, issue 3, p.39-48, 1991.

REICHHELD, Frederick F. The loyalty effect. 1996.

REICHHELD, Frederick F.; SASSER Jr., W. Earl. Zero defections: quality comes to services.

Harvard Business Review, p. 105-111, September-October, 1990.

RODRIGUES, Alziro Csar M. Uma escala de mensurao da zona de tolerncia de

consumidores de servio. Revista de Administrao Contempornea, Vol 5, N.2, p. 113-134,

2001.

SCHNEIDER, Benjamin; BOWEN, David E. Understanding customer delight and outrage.

Sloan Management Review,p 35-35, Fall 1999.

SLACK, N.; LEWIS, M. Operations Strategy. Upper Saddle River, NJ: Prentice-Hall, 2003.

SURESHCHANDAR, G. S.; RAJENDRAN, C.; ANANTHARAMAN, R. N. The

relationship between service quality and customer satisfaction, a factor specific approach.

Journal of Services Marketing. Vol 16, n.4, p. 363-379, 2002.

SURESHCHANDAR, G. S.; RAJENDRAN, C.; ANANTHARAMAN, R. N., A conceptual

model for TQM in service organizations. Total Quality Management, Vol. 12, n.3, p.343-363,

2001.

SURESHCHANDAR, G. S.; RAJENDRAN, C.; KAMALANABHAN, T.J. Customer

perceptions of service quality, a critique. Total Quality Management, Vol. 12, n.1, p.111-124,

2001.

URDAN, Flvio Torres. Relacionamento entre orientao para o mercado e desempenho:

estudo longitudinal de um grupo de concessionrias de veculos. Tese de doutorado pela

17

Faculdade de Economia, Administrao e Contabilidade da Universidade de So Paulo. So

Paulo, 1999.

ZEITHAML, Valarie, BITNER, Mary Jo., Services marketing, integrating customer focus

across the firm. Boston, Irwin McGraw-Hill, 2000.

ZEITHAML, Valarie; PARASURAMAN, A.; BERRY, Leonard L. Problems and strategies

in services marketing. Journal of Marketing. Vol 49, p. 33-45, 1985.

Potrebbero piacerti anche

- Zubi Kakeesh IJBMDocumento14 pagineZubi Kakeesh IJBMgraciaNessuna valutazione finora

- Franchisee EffortDocumento32 pagineFranchisee Effortho.hienthaoNessuna valutazione finora

- 08 Chapter1Documento33 pagine08 Chapter1vehiclesalesbeaekaNessuna valutazione finora

- Research On The Influence of After-Sales Service Quality Factors On Customer SatisfactionDocumento11 pagineResearch On The Influence of After-Sales Service Quality Factors On Customer SatisfactionsitirizkyNessuna valutazione finora

- Managing Service Quality: A Differentiating Factor For Business FirmDocumento5 pagineManaging Service Quality: A Differentiating Factor For Business FirmthesijNessuna valutazione finora

- 1.1 Customer Relationship Management (CRM)Documento8 pagine1.1 Customer Relationship Management (CRM)Anonymous mWaQv9oyNessuna valutazione finora

- Consumer Evaluation and Competitive Advantage in Retail Financial Services - A Research AgendaDocumento22 pagineConsumer Evaluation and Competitive Advantage in Retail Financial Services - A Research Agendajjle100% (2)

- 2008 02 MKT PDFDocumento30 pagine2008 02 MKT PDFVincent CarrollNessuna valutazione finora

- Stratcost ReportingDocumento2 pagineStratcost ReportingRohainamae aliNessuna valutazione finora

- Idic ModelDocumento12 pagineIdic ModelBhosx KimNessuna valutazione finora

- 7p Marketi̇ng StrategyDocumento6 pagine7p Marketi̇ng StrategyIsmail SemerciNessuna valutazione finora

- MBA 4th Sem Marketing ManagmentDocumento36 pagineMBA 4th Sem Marketing ManagmentRahul BankapurNessuna valutazione finora

- Customer Service DimensionDocumento3 pagineCustomer Service Dimensionaashi100% (1)

- Evaluation of Customer Service QualDocumento6 pagineEvaluation of Customer Service Qualcstubborn10Nessuna valutazione finora

- Service Marketing and The Critical Distribution Issue: Old Challenges and New SolutionsDocumento22 pagineService Marketing and The Critical Distribution Issue: Old Challenges and New SolutionsEdd G BarretoNessuna valutazione finora

- A Study of Service Quality of Stockbrokers in Mauritius UsingDocumento12 pagineA Study of Service Quality of Stockbrokers in Mauritius Usingpoison jenNessuna valutazione finora

- Service QualityDocumento24 pagineService QualityCristina BalcanNessuna valutazione finora

- Benchmarking for Businesses: Measure and improve your company's performanceDa EverandBenchmarking for Businesses: Measure and improve your company's performanceNessuna valutazione finora

- Topic 1 Foundations For Services MarketingDocumento7 pagineTopic 1 Foundations For Services MarketingHesanRajaraniNessuna valutazione finora

- Customer Switching Behavior in Service Industries: An Exploratory StudyDocumento15 pagineCustomer Switching Behavior in Service Industries: An Exploratory StudySudana HaryantoNessuna valutazione finora

- 10 - Chapter 3Documento27 pagine10 - Chapter 3MJ ZayadNessuna valutazione finora

- Literature Review of CRMDocumento5 pagineLiterature Review of CRMJoney DeepNessuna valutazione finora

- CRM Implementation in Indian Telecom Industry - Evaluating The Effectiveness of Mobile Service Providers Using Data Envelopment AnalysisDocumento18 pagineCRM Implementation in Indian Telecom Industry - Evaluating The Effectiveness of Mobile Service Providers Using Data Envelopment Analysisshreeshail_mp6009Nessuna valutazione finora

- Quality Services of Manufacturing of Automobiles IDocumento2 pagineQuality Services of Manufacturing of Automobiles ITanzeel HassanNessuna valutazione finora

- The Impact of Customer Relationship ManaDocumento110 pagineThe Impact of Customer Relationship ManaJayagokul SaravananNessuna valutazione finora

- 20 - Measuring Customer Relationship Management Performance A Consumer-Centric ApproachDocumento27 pagine20 - Measuring Customer Relationship Management Performance A Consumer-Centric ApproachkynthaNessuna valutazione finora

- Factors Behind The Brand Switching in Telecom IndustryDocumento20 pagineFactors Behind The Brand Switching in Telecom IndustryRasheeq Rayhan0% (1)

- Discussions: 5.1 Discussion About The FindingsDocumento4 pagineDiscussions: 5.1 Discussion About The FindingsCijo VargheseNessuna valutazione finora

- Services Marketing: Unit - 1 MaterialDocumento37 pagineServices Marketing: Unit - 1 Materiallaxmy4uNessuna valutazione finora

- Business-To-Business Marketing: Service Recovery and Customer Satisfaction Issues With Ocean Shipping LinesDocumento20 pagineBusiness-To-Business Marketing: Service Recovery and Customer Satisfaction Issues With Ocean Shipping LinesYenu EthioNessuna valutazione finora

- Five Steps To Effective ProcurementDocumento7 pagineFive Steps To Effective ProcurementtkurasaNessuna valutazione finora

- Service Gaps and Customer Retention: Srilanka Institute of MarketingDocumento14 pagineService Gaps and Customer Retention: Srilanka Institute of Marketingiresha rathnayakeNessuna valutazione finora

- 184 Sayendra SharmaDocumento6 pagine184 Sayendra Sharmagowtham rajaNessuna valutazione finora

- 3 More PS, Differentiating ServicesDocumento16 pagine3 More PS, Differentiating Servicesसागर मोहन पाटीलNessuna valutazione finora

- SQ Concepts and ModelsDocumento24 pagineSQ Concepts and ModelsWinahyuNessuna valutazione finora

- ML0006 FALL 2010 SolutionsDocumento16 pagineML0006 FALL 2010 Solutionssastrylanka_1980Nessuna valutazione finora

- India Petroleum Industry Case StudyDocumento5 pagineIndia Petroleum Industry Case Studynedcisa114Nessuna valutazione finora

- A Study On Benchmarking: Importance of Benchmarking Process in Service MarketingDocumento3 pagineA Study On Benchmarking: Importance of Benchmarking Process in Service Marketingnzayisenga adrienNessuna valutazione finora

- Background: Rem Project ReportDocumento17 pagineBackground: Rem Project ReportSachin KumarNessuna valutazione finora

- Tangible ExplainationDocumento10 pagineTangible ExplainationAnath Rau KrishnanNessuna valutazione finora

- 148 Surajit Roy PDFDocumento5 pagine148 Surajit Roy PDFAsefjamilNessuna valutazione finora

- Enhancing Customer Satisfaction in Terms of Service Quality in Supermarket - The Case Study of Big C Supermaket in HCMCDocumento12 pagineEnhancing Customer Satisfaction in Terms of Service Quality in Supermarket - The Case Study of Big C Supermaket in HCMCAmanda ReyesNessuna valutazione finora

- Journal of Services Marketing: Emerald Article: An Investigation of Marketing Problems Across Service TypologiesDocumento23 pagineJournal of Services Marketing: Emerald Article: An Investigation of Marketing Problems Across Service TypologiesI Putu Eka Arya Wedhana TemajaNessuna valutazione finora

- Art204 PDFDocumento15 pagineArt204 PDFPrashant KumbarNessuna valutazione finora

- Customer Relationship Management ConceptDocumento4 pagineCustomer Relationship Management Conceptabhishek35492Nessuna valutazione finora

- Car Market and Buying Behavior A Study of Consumer PerceptionDocumento69 pagineCar Market and Buying Behavior A Study of Consumer Perceptionrahulmandalsingh67% (3)

- Service Quality of Maruti Vs HyundaiDocumento16 pagineService Quality of Maruti Vs HyundaiJaved Shaikh100% (1)

- 5 Servqual and ServperfDocumento13 pagine5 Servqual and ServperfDidin Dimas Ponco AdiNessuna valutazione finora

- Adding Value To Retail Financial ServicesDocumento11 pagineAdding Value To Retail Financial ServiceslengocthangNessuna valutazione finora

- 08876040610679918Documento13 pagine08876040610679918Annisaa RasyidaNessuna valutazione finora

- Araghi Baron 2016 Acquisition Retention Service QualityDocumento39 pagineAraghi Baron 2016 Acquisition Retention Service Qualitynabajyoti baruahNessuna valutazione finora

- Influential Barriers of Customer Relationship Management ImplementationDocumento10 pagineInfluential Barriers of Customer Relationship Management Implementationxaxif8265Nessuna valutazione finora

- Service Quality Management in The Insurance Industry On The Basis of Service Gap ModelDocumento6 pagineService Quality Management in The Insurance Industry On The Basis of Service Gap Modeljigneshhpatel287Nessuna valutazione finora

- Aricle Review: Expanded Marketing Mix For ServicesDocumento9 pagineAricle Review: Expanded Marketing Mix For ServicesChhavi SainiNessuna valutazione finora

- Best Customer Experience-Entering The Age of The CustomerDocumento5 pagineBest Customer Experience-Entering The Age of The Customerdatarian rianNessuna valutazione finora

- Listening To Customer THR Research 17 JulDocumento65 pagineListening To Customer THR Research 17 JulKazi Rabbi Al AzizNessuna valutazione finora

- EAPP - Session 1 To 4Documento5 pagineEAPP - Session 1 To 4Eleanor GabalesNessuna valutazione finora

- Ies (Ese) - 2012 Answers:: General Ability TestDocumento3 pagineIes (Ese) - 2012 Answers:: General Ability TestSujendra NarayanaNessuna valutazione finora

- Water Safety PlanDocumento244 pagineWater Safety Planafauzan81100% (1)

- HSM 2 Project Management Presentation#2-2Documento61 pagineHSM 2 Project Management Presentation#2-2Waltas Kariuki100% (1)

- 1 - NDT - Regulation For Qualification NDT PersonnelDocumento29 pagine1 - NDT - Regulation For Qualification NDT Personnelsaenal100% (2)

- Informational Training MethodsDocumento6 pagineInformational Training MethodskmnowinskaNessuna valutazione finora

- Evaluating Learning and Teaching Technologies in Further EducationDocumento11 pagineEvaluating Learning and Teaching Technologies in Further EducationNader ElbokleNessuna valutazione finora

- Chapter 01Documento14 pagineChapter 01flaviamarottaNessuna valutazione finora

- Audit Question List For ISO 9001Documento21 pagineAudit Question List For ISO 9001David Phoa100% (2)

- EPMS Sample FormDocumento3 pagineEPMS Sample FormKdan ChanNessuna valutazione finora

- Educational Taxonomies With Examples, Example Questions and Example Activities Cognitive, Psychomotor, and AffectiveDocumento9 pagineEducational Taxonomies With Examples, Example Questions and Example Activities Cognitive, Psychomotor, and AffectiveJesús Eduardo Carbonó Niebles100% (1)

- Chapter 7: Evaluating & Terminating The Project: Azzah Nazihah Binti Che Abdul RahimDocumento24 pagineChapter 7: Evaluating & Terminating The Project: Azzah Nazihah Binti Che Abdul RahimMuhammad Hidayat Bin MazlanNessuna valutazione finora

- Curriculum ChangeDocumento11 pagineCurriculum ChangeMOHIB100% (2)

- Training Evaluation: 6 Edition Raymond A. NoeDocumento42 pagineTraining Evaluation: 6 Edition Raymond A. NoeMhd ZainNessuna valutazione finora

- Strategy 4 TH UnitDocumento21 pagineStrategy 4 TH UnitElango VSNessuna valutazione finora

- Arch Dam Design and Analysis: Howard Boggs Glenn TarboxDocumento2 pagineArch Dam Design and Analysis: Howard Boggs Glenn TarboxyadavniranjanNessuna valutazione finora

- AnusDocumento3 pagineAnusbellaarno100% (1)

- Nasa GB A301Documento18 pagineNasa GB A301watziznehmNessuna valutazione finora

- Pradip Chaudhary Gt05614 (Diploma of Leadershipand Management)Documento11 paginePradip Chaudhary Gt05614 (Diploma of Leadershipand Management)prajNessuna valutazione finora

- 12 Management Modules BookletDocumento164 pagine12 Management Modules BookletDanish SayedNessuna valutazione finora

- Assignment Overview - Uap DDocumento2 pagineAssignment Overview - Uap Dapi-560689359Nessuna valutazione finora

- Week 2 Career Lesson PlanDocumento8 pagineWeek 2 Career Lesson Planapi-300530206Nessuna valutazione finora

- CoE All Mock Test Planners - 230730 - 095207Documento3 pagineCoE All Mock Test Planners - 230730 - 095207darling deanNessuna valutazione finora

- QA/QS Organization Chart of JMA: (Member of VAG-Group)Documento3 pagineQA/QS Organization Chart of JMA: (Member of VAG-Group)ManibalanNessuna valutazione finora

- Business Case TemplateDocumento20 pagineBusiness Case TemplateMichaelNessuna valutazione finora

- Training of The School StakeholdersDocumento7 pagineTraining of The School StakeholdersBayan CornelynNessuna valutazione finora

- Human ErrorDocumento167 pagineHuman ErrorRoy ShahzadNessuna valutazione finora

- Cambridge IGCSE ™: First Language English (Oral Endorsement) 0500/13Documento22 pagineCambridge IGCSE ™: First Language English (Oral Endorsement) 0500/13WordnerdNessuna valutazione finora

- A Guide To The Project Management Body of Knowledge PMBOKDocumento211 pagineA Guide To The Project Management Body of Knowledge PMBOKAnonymous Z5wCELpNessuna valutazione finora

- CS 2017 1 PDFDocumento27 pagineCS 2017 1 PDFNishant KumarNessuna valutazione finora