Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

The Effect of Economic Value Added and Earning Per Share To Stocks Return (Panel Data Approachment)

Caricato da

inventionjournalsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

The Effect of Economic Value Added and Earning Per Share To Stocks Return (Panel Data Approachment)

Caricato da

inventionjournalsCopyright:

Formati disponibili

International Journal of Business and Management Invention

ISSN (Online): 2319 8028, ISSN (Print): 2319 801X

www.ijbmi.org || Volume 5 Issue 2 || February. 2016 || PP-08-15

The Effect Of Economic Value Added And Earning Per Share

To Stocks Return (Panel Data Approachment)

1

1,2

Rafrini Amyulianthy, 2Elsa K.Ritonga

Faculty of Economic and Business University of Pancasila, Indonesia

ABSTRACT : The purpose of this study is to examine the effect of Economic Value Added (EVA) and Earning

per Share (EPS) on stocks return. This study was taken because there are still differences between the research

study with each other. This research was conducted using secondary data. Population in this research was a

with time company incorporated in the index LQ 45 in Indonesian Stock Exchange period 2013-2014. Sampling

technique using was purposive sampling. There are 21 companies to analyzed. This study using multiple

regression with panel data. Results shows that Economic Value Added (EVA) have positive significant effect on

Stock Return, while Earning Per Share (EPS) also have positive significant on Stock Return. Adjusted R Square

value was 0,395091 means 39,50% can explained by the independent variable, while 60,50% are influenced by

the other variables which have not been included in the research model.

Keywords : Stocks Return, Economic Value Added, Earning Per Share, Multiple Regression, Panel Data

I. INTRODUCTION

In the era of free market economy, an increasingly competitive business world, so that requires

companies to be able to adapt in order to avoid bankruptcy and ahead of the competition. One of the important

information from the financial statements that are often used by investors as a major determinant of investment

decisions is the company's performance.

The management performance (achievement) measure can compare with the various types of different

industries and not on a similar type of industry. One technique for measuring a company's financial performance

by comparing of various kinds is through Economic Value Added (EVA). EVA first introduced by Stern

Stewart and Co. Emipirical studies concerning Economic Value Added (EVA) as an indicator of the company's

performance appraisal has been done both among colleges and among practitioners of economics, as well as an

assessment of the relationship EVA with stock prices. However, there are some studies that the results vary.

Some claimed there was no correlation between EVA with stock prices, but there is also a relationship between

the two states, whether they are positive or negative, for example, Olsen, 1996; Peterson and Peterson, 1996;

DeVilliers and Auret, 1997; Kramer and Pushner, 1997; Chen and Dodd, 1997; Turvey and Sparling, 2003;

Turvey et al., 2000.

Besides measuring performance could also use the information from Earnings Per Share (EPS), where

performance is measured by the amount of profit achieved. In principle, the more achievements (performance)

of the company to generate profits will increase demand for shares of the company with the resut the stock price

will increase. (Biddle et al, 1995).

II. LITERATURE REVIEWS & HYPOTHESIS DEVELOPMENT

EVA and Stock Returns

EVA, as a concept of economic profit, is the result of adjustments to GAAP-based accounting

advocated by Stern Stewart and Co. Moreover, the claim that EVA is the main driver for shareholder value has

been empirically tested by a number of US studies, giving rather mixed results. A number of these studies report

either poor or no statistical relation between EVA and stock return, or between EVA and market value (Olsen,

1996; Peterson and Peterson, 1996; DeVilliers and Auret, 1997; Kramer and Pushner, 1997; Chen and Dodd,

1997; Tuvey and Sparling, 2003; Tuvey et al., 2000). In contrasting findings, Lehn and Makhija (1996, 1997)

report that EVA has a slight edge as a performance measure compared to other accounting earnings measures.

OByrne (1996, 1997) shows that EVA explains more than twice as much of the variance in market/capital ratio

as NOPAT when the EVA model has positive and negative EVA coefficients. OByrne (1996) also showed that

EVA changes explain significantly more of the variation in market value changes.

www.ijbmi.org

8 | Page

The Effect Of Economic Value Added And Earning Per

EPS and Stock Returns

Earnings Per Share (EPS) is the ratio between the revenue generated (net income) and the number of

outstanding shares. Earnings Per Share (EPS) illustrates the company's profitability is reflected in shares

(Cerlienia, 2010). According Darmadji and Hendy (2005) definition of earnings per share (EPS) which is a ratio

that shows some of the gains (profits) obtained by investors or shareholders per share. Profit is a measure of the

success of a company, because that investors often focus on the magnitude of Earning Per Share (EPS) to

analyze shares. The higher the value of EPS of course encouraging shareholders because the greater the profit

provided to shareholders. And the higher the profit achieved by the company, the value of the company will

increase which in turn will be reflected in the company's stock value (Biddle et al, 1995).

Furthermore, the hypotheses in this research are:

H1 : There is an effect of EVA to stock returns

H2 : There is an effect of EPS to stock returns

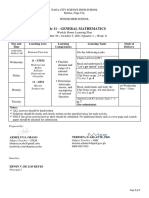

Figure 1

EVA

STOCK RETURNS

EPS

III. METHODS

The data used in this study as the source of the data is in the 2013- 2014 Annual Report, the quality of

data obtained from the internet reporting company's website and financial data from the Indonesian Capital

Market Directory (ICMD) published by the Institute for Economic and Financial Research (ECFIN). Samples

that were taken and used in this study were from companies listed as LQ 45 index within range from 2013-2014

on the Indonesia Stock Exchange (IDX). The number of samples in this study were 21 companies.The sample is

a purposive sampling to obtain a sample that can represent the specified criteria. The criteria as following:

Table 1

Samples Criteria

Companies listed in Indonesias LQ45 2013-2014

Companies are not consistently listed in Indonesias LQ

45 2013-2014

Companies who do not publish audited financial

statements 2013-2014

Companies that present financial statements are

denominated in dollars

Companies that data is incomplete financial statements

58

(27)

0

(1)

(9)

Total samples

21

Year observation (x2 years)

42

Independent Variables

The independent variables in this study is the company performance which are proxied by Economic Value

Added (EVA) and Earnings Per Share (EPS).

Economic Value Added (EVA)

Is measurement of companys value added by reducing the burden of the cost of capital arising from the

investments that has been made.

where :

EVA = Net Operating Profit after Tax (NOPAT) - Cost of Capital

Earnings Per Share (EPS)

Is the net income after tax. The amount of revenue earned for each share of total income for common shares

divided with number of outstanding shares.

www.ijbmi.org

9 | Page

The Effect Of Economic Value Added And Earning Per

where :

EPS =

Dependent Variables

The dependent variable in this study is stock returns which the difference between income (loss) suffered by

shareholders as the share price is now relatively higher (lower) than the previous stock price.

where :

Ri =

Control Variables

Size

In this study, measured by the size variable ln (natural log) total assets in 2013&2014. Data were obtained from

BEI and ICMD site. Total assets illustrates the size of the company. This size is expected to be an effect on the

company's stock returns.

Research Model

To test the hypothesis that has been designed, this study uses one main models. This model is used to

investigate the hypothesis H1 & H2 to test the effect of EVA and EPS to stock returns. Here is the research

model:

Stock Returns = + 1EVA + 2EPS + 3Size + e

where:

Stock Returns = difference in income (loss) suffered by shareholders as the share price is now relatively higher

(lower) than the previous share price.

EVA

= the value added produced of company from reducing the burden of the cost of capital arising

in investment that has been made

EPS

= net income after tax divided by the number of outstanding share

Size

= ln total assets

Data Analysis

Procedures used in the multiple regression analyzes were conducted to see the effect of Economic

Value Added (EVA) and Earning Per Share (EPS) to stock returns with Ordinary Least Square (OLS) using

panel data approchement. In the use of panel data, there are three types of approaches that can be used are:

Common Effect, Fixed Effect, and Random Effects.

1. Common Effects Model

Is the simplest model in panel data processing is to perform regression by the method of ordinary least

squares (OLS) on a joint data (Pooled). Where N is the number of unit cross section and T is the

number of periods of time. By assuming the component error in the processing of ordinary least

squares, we can make the estimation process separately for each unit cross section. Thus obtained the

same number of T equation. Likewise, we will obtain the equation of time series as much as N

equations for each observation. To get the parameters and are constant and efficient, shall be in the

larger regression by involving as much as NT observation.

2. Random Effect Model

This model is also called the Error Component Model. Just like the fixed effects model, the model also

allows the difference in the value of the intercept parameters and coefficients differ between regions

and across time, but expressed in error. The disruption of this model is assumed to be random for the

entire population. This model also result in that individual errors are not correlated with each other, as

well as error combination. By using a random effects model, we can save the use of degrees of freedom

and does not diminish in number as the fixed effect model. This has implications for parameter

estimation result will be more efficient.

3. Fixed Effect Model

This model is also called Least Square Dummy Variable Model. This model approach by inserting a

dummy variable to allow for the difference intercept parameter values and coefficients vary between

regions and over time. Changes in the dummy variable fixed effect can reduce the number of degree of

freedom that ultimately affect the efficiency of parameter estimates.

www.ijbmi.org

10 | Page

The Effect Of Economic Value Added And Earning Per

How to choose one of the three existing approaches above are as follows:

a.

b.

c.

Choose between Common Effects Model vs Fixed Effects Model

To choose which model is more suitable between Common Effects Model or Fixed Effects Model, can

be used Chow Test (Restricted F-Test).

Choose between Common Effects Model vs Random Effects Model

To choose which model is more suitable between Common Effects Model or Random Effects Model,

can be used Lagrange Multiplier Test (LM Test).

Choose between Fixed Effects Model vs Random Effects Model

To choose which model is more suitable between Fixed Effects or Random Effects, can be used

Hausmans Test.

IV. RESULTS

Descriptive Statistics

The object of this study consisted of the variables studied, namely EVA, EPS and stocks return on the

company listed on the Indonesia Stock Exchange (IDX) since 2013-2014 as LQ 45 companies. The test results

showed descriptive statistics in this study had an average of 0,047803, with a maximum value of 0,492063 for

stock returns. The value of EVA has an average of 11,26336 and a maximum value of 326,0182. Meanwhile,

EPS has an average of 0,548858 and a maximum value of 2,790190 (see Apendix Table 1 shows the

descriptive statistics of all variables in this research.).

Selection Model

To choose the most suitable model that will be used in research can be carried out by the three tests, as follows:

1. Chow Test: Chows Test results calculate that Fvalue probability is greater than = 0.05. Conclude

that Fixed Effect model was not significant in the data panel. The results of test calculations are

performed decision: accept H0 and conclude that Pooled/Common Effect Model is better than the Fixed

Effect Model for the probability value 0.3456> (0.05).

2. LM test: From LMs Test were performed conclude that accept H0 and Pooled/Common Effect Model

is better than Random Effect Models with probability values 0.0710> (0.05).

3. Hausmans test: From Hausmans Test were performed conclude that accept H0 and Random Effect

Model is better than Fixed Effect Models with probability values 0,1660> (0,05).

Thus, after used three test between the Chow Test, LM Test and Hausmans Test, the most appropriate

use for panel data test method is Pooled/Common Effect Model as the best model. (see Apendix Table

2, 3 and 4)

Hypothesis Testing

For futher, hypothesis testing with data panel, this research use pooled/ common effect model to

examine the effect of independent and dependend variables of the research model. (see Apendix Table 7). But

before the hypotheses testing was conducted, there were BLUE test that has been done. (see Apendix Table 5

and 6 for Multicolinearity Test, Heteroscedasticity Test and Autocorellation Test)

From the test results as the table 3 shown that:

Hypotheses 1 is accepted, the results indicate that the economic value added (EVA) has a significant

influence on stock returns. Between EVA and stock returns there is positive relationship (1=

0,029042). This means that EVA significantly affected stock returns.

Hypotheses 2 is accepted, the results indicate that the earnings per share (EPS) has a significant

influence on stock returns. Between EPS and stock returns there is positive relationship (2=0,031813).

This means that EPS significantly affected stock returns significant.

Discussion

Based on the test results as described, the discussion will explore the influence of EVA and EPS to

stock returns. The two hypotheses of this study is that EVA & EPS affect stock returns. From the test results

obtained that EVA and EPS significantly affected to stock returns. So therefore it means that all hypotheses is

accepted. The results are consistent with research from Olsen, 1996; Peterson and Peterson, 1996; DeVilliers

and Auret, 1997; Kramer and Pushner, 1997; Chen and Dodd, 1997; Tuvey and Sparling, 2003; Tuvey et al.,

2000); Lehn and Makhija (1996, 1997). Also inline with research from Biddle et al, 1995 where's the higher

profit achieved by the company, the value of the company will increase which in turn will be reflected in the

value of shares of the company.

www.ijbmi.org

11 | Page

The Effect Of Economic Value Added And Earning Per

V. CONCLUSION

Based on the results of statistical testing and analysis has been discussed in the previous chapter, it can be

concluded as follows:

1.

2.

There is a positive significant relationship EVA and stock returns. This proves the first hypothesis is

accepted. That there is significant effect between EVA to stock returns for the company. These results

suggest that EVA is one of the important variables that determine the returns of companies in

Indonesia.

There is a positive significant relationship EPS and stock returns. This proves the second hypothesis of

this study is accepted. That there is significant effect between EPS to stock returns for the company.

These results suggest that EPS also an important variables that determine the returns of companies in

Indonesia.

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

Biddle, G.C., R. Bowen, and J.S. Wallace (1997), Does EVA Beat Earnings? Evidence on Associations with Stock Returns and

Firm Values, Journal of Accounting and Economics, Vol.24 No.3

Cerlienia. 2010. The Effect of ROA, ROE, DER, EPS dan PER terhadapto Return Saham. Journal Of Accounting. Hal: 5-7.

Chen, S. and Dodd, J.L. (1997), Economic Value Added (EVA): an empirical examination of a new corporate performance

measure, Journal of Managerial Issues, Vol. IX, Fall, pp. 318-33

Darmadji, Tjiptono and Hendy, M. Fakhruddin. 2011. Pasar Modal di Indonesia. Jakarta: Salemba Empat.

DeVilliers, J.U. and Auret, C.J. (1997), A comparison of EPS and EVA as explanatory variables for share price, Journal for

Studies in Economics and Econometrics, Vol. 22, August, pp. 47-63.

Kramer, J.K. and Pushner, G. (1997), An empirical analysis of economic value added as a proxy for market value added,

Financial Practice and Education, Spring/Summer

Lehn, K. and Makhija, A.K. (1996), EVA and MVA: as performance measures and signals for strategic change, Strategy &

Leadership, Vol. 24, May/June, pp. 34-8.

Lehn, K. and Makhija, A.K. (1997), EVA, accounting profits, and CEO turnover: an empirical examination 1985-1994, Journal

of Applied Corporate Finance, Vol. 10 No. 2, pp. 90-7.

OByrne, S.F. (1996), EVA and market value, Journal of Applied Corporate Finance, Vol. 9 No. 1.

OByrne, S.F. (1997), EVA and shareholder return, Financial Practice and Education, Spring/Summer, pp. 50-4.

Olsen, E.E. (1996), Economic Value Added: Perspectives, Boston Consulting Group, Boston, MA.

Peterson, P.P. and Peterson, D.R. (1996), Company Performance and Measures of Value Added, The Research Foundation of the

Institute of Chartered Financial Analysts, Charlottesville, VA.

Tuvey, C. and Sparling, D. (2003), Further thoughts on the relationship between economic value added and stock market

performance, Agribusiness, Vol. 19 No. 2, pp. 255-67.

Tuvey, C.L., Van Duren, E. and Sparling, D. (2000), The relationship between economic value added and the stock market

performance of agribusiness firms, Agribusiness, Vol. 16 No. 4, pp. 399-416.

APENDIX

Table 1

Descriptive Statistic

(n = 42)

Mean

Median

Maximum

Minimum

EVA

EPS

11,26336

1,265346

326,0182

-38,05021

0,548858

0,207090

2,790190

-0,104410

Stocks

Return

0,047803

0,011364

0,492063

-0,714233

SIZE

0,7805

0,7882

0,8926

0,6555

Table 2

Chow Test

(n=42)

Effects Test

Cross-section F

Cross-section Chi-square

Period F

Period Chi-square

Cross-Section/Period F

Cross-Section/Period Chi-Square

Statistic

Prob.

0,978485

30,904691

3,316388

7,102384

1,207704

36,926675

0,5219

0,0565

0,0853

0,0077

0,3456

0,0172

www.ijbmi.org

12 | Page

The Effect Of Economic Value Added And Earning Per

Null (no.rand.effect) Alternative

Breusch-Pagan

Test Summary

Table 3

LM Test

(n=42)

Cross-section

One-sided

0,229057

Period

One_sided

3,030510

Both

3,259567

(0,6322)

(0,0817)

(0,0710)

Table 4

Hausmans Test

(n=42)

Chi-Sq.Statistic

Prob.

3,591746

0,1660

Cross-section random

Table 5

Multicolinearity Test

EVA

Correlation

EVA

EPS

1,000000

-0,051867

Variabel

Table 6

Heteroscedasticity and Autocorellation Test

Coefficient

Std.Error

t-Statistic

C

EPS

EVA

R-squared

Adjusted

Rsquared

S.E.of regression

Sum squared resid

Log likelihood

F-statistic

Prob (F-statistic)

Variabel

C

EPS

EVA

Size

R-squared

Adjusted R-squared

S.E.of regression

Sum squared resid

Log likelihood

F-statistic

Prob (F-statistic)

EPS

1,000000

Prob.

0,144942

0,026266

-0,000129

0,033668

-0,015887

0,021236

6,825197

0,024719

1,062611

0,000304

-0,423478

Mean dependent var

S.D.dependent var

0,0000

0,2945

0,6743

0,157908

0,101739

0,102544

0,410098

37,61417

0,679405

0,512817

Akaike info criterion

Schwarz criterion

Hannan-Quinn criter.

Durbin-Watson stat

-1,648294

-1,524174

-1,602799

1,887584

Table 7

Hypoteses Testing

Coefficient

Std.Error

t-Statistic

0,060558

0,040229

1,505342

0,031813

0,046825

5,058439

0,029042

0,000576

4,602861

0.070507

0,013598

6,048566

0,366194

Mean dependent var

0,395091

S.D.dependent var

0,194254

Akaike info criterion

1,471655

Schwarz criterion

10,78150

Hannan-Quinn criter.

11,26650

Durbin-Watson stat

0,000137

www.ijbmi.org

Prob.

0,1403

0,0009

0,0000

0.0002

0,047803

0,237976

-0,370548

-0,246428

-0,325053

2,080404

13 | Page

The Effect Of Economic Value Added And Earning Per

No

1

2

3

4

5

6

7

8

Kode

Efek

AALI

ADRO

AKRA

ANTM

ASII

ASRI

BBCA

BBNI

BBRI

10

BBTN

11

12

13

14

15

16

17

18

19

BDMN

BHIT

BKSL

BMRI

BMTR

BSDE

BUMI

BWPT

CPIN

20

21

22

23

24

EXCL

GGRM

GIAA

HRUM

ICBP

25

IMAS

26

27

28

29

30

31

32

33

34

INCO

INDF

INDY

INTP

ITMG

JSMR

KLBF

LPKR

LSIP

35

36

37

38

39

MAIN

MAPI

MNCN

PGAS

PTBA

40

41

42

43

SMCB

SMGR

SSIA

TLKM

44

UNTR

Tabel 8

Company Lists

Nama

Feb

Agt

Perusahaan

2013

2013

Astra Agro Lestari Tbk

Adaro Energy Tbk.

AKR Corporindo Tbk.

Aneka Tambang (Persero) Tbk.

Astra Internasional Tbk.

Alam Sutera Realty Tbk.

Bank Central Asia Tbk.

Bank Negara Indonesia (Persero)

Tbk.

Bank Rakyat Indonesia (Persero)

Tbk

Bank Tabungan Negara (Persero)

Tbk.

Bank Danamon Indonesia Tbk.

Bhakti Investama Tbk.

Sentul City Tbk.

Bank Mandiri (Persero) Tbk.

Global Mediacom Tbk.

Bumi Serpong Damai Tbk.

Bumi Resources Tbk.

BW Plantation Tbk.

Charoen Pokphand Indonesia

Tbk.

XL Axiata Tbk.

Gudang Garam Tbk.

Garuda Indonesia Tbk.

Harum Energy Tbk.

Indofood CBP Sukses Makmur

Tbk.

Indomobil Sukses International

Tbk.

Vale Indonesia Tbk.

Indofood Sukses Makmur Tbk.

Indika Energy Tbk.

Indocement Tunggal Prakasa Tbk.

Indo Tambangraya Megah Tbk.

Jasa Marga (Persero) Tbk.

Kalbe Farma Tbk.

Lippo Karawaci Tbk.

PP London Sumatra Indonesia

Tbk.

Malindo Feedmiil Tbk.

Mitra Adiperkasa Tbk.

Media Nusantara Citra Tbk.

Perusahaan Gas Negara Tbk.

Tambang Batubara Bukit Asam

(Persero) Tbk.

Holcim Indonesia Tbk.

Semen Indonesia (Persero) Tbk.

Surya Semesta Internusa Tbk.

Telekomunikasi Indonesia

(Persero) Tbk.

United Tractors Tbk.

www.ijbmi.org

Feb

2014

Agt

2014

Sampling

Complete

Not Complete

Complete

Complete

Complete

Not Complete

Not Complete

Not Complete

Not Complete

Not Complete

Complete

Not Complete

-

Complete

Complete

Complete

Not Complete

Complete

-

Complete

Complete

Not Complete

Complete

Complete

Complete

Complete

Complete

Not Complete

Complete

Complete

-

Complete

Complete

14 | Page

The Effect Of Economic Value Added And Earning Per

45

46

47

48

49

50

51

52

53

54

UNVR

MLPL

PWON

WIKA

ADHI

CTRA

PTPP

SMRA

TAXI

TBIG

55

56

57

58

VIVA

WSKT

LPPF

SCMA

Unilever Indonesia Tbk.

Multipolar Tbk.

Pakuwon Jati Tbk.

Wijaya Karya Tbk.

Adhi Karya (Persero) Tbk.

Ciputra Development Tbk.

PP (Persero) Tbk

Summarecon Agung Tbk.

Express Trasindo Utama Tbk.

Tower Bersama Infrastructure

Tbk.

Visi Media Karya Tbk.

Waskita Karya (Persero) Tbk.

Matahari Departement Store Tbk.

Surya Citra Media Tbk.

TOTAL SAMPLE

www.ijbmi.org

Complete

-

21

15 | Page

Potrebbero piacerti anche

- International PDFDocumento8 pagineInternational PDFDeni Lukman FirmansyahNessuna valutazione finora

- Analysis of Factors Affecting Stock ReturnsDocumento11 pagineAnalysis of Factors Affecting Stock ReturnsMelisa SuyandiNessuna valutazione finora

- Analisis Perbedaan Kandungan Informasi Komponen LabaDocumento27 pagineAnalisis Perbedaan Kandungan Informasi Komponen LabadownloadreferensiNessuna valutazione finora

- This Is The Author-Manuscript Version of This Paper. First Published inDocumento21 pagineThis Is The Author-Manuscript Version of This Paper. First Published inSatish KumarNessuna valutazione finora

- Firm Size Impact on ProfitabilityDocumento21 pagineFirm Size Impact on ProfitabilityJohn HarrisNessuna valutazione finora

- Returns-Earnings Regressions: An Integrated Approach: Ebartov@stern - Nyu.eduDocumento58 pagineReturns-Earnings Regressions: An Integrated Approach: Ebartov@stern - Nyu.eduwirodihardjoNessuna valutazione finora

- Impact of Intellectual Capital On The Financial Performance of Listed Companies in Tehran Stock ExchangeDocumento4 pagineImpact of Intellectual Capital On The Financial Performance of Listed Companies in Tehran Stock ExchangekumardattNessuna valutazione finora

- EVA As A Financial Metric: The Relationship Between EVA and Stock Market PerformanceDocumento11 pagineEVA As A Financial Metric: The Relationship Between EVA and Stock Market Performancenadya ratnasariNessuna valutazione finora

- 1 PB PDFDocumento11 pagine1 PB PDFnadya ratnasariNessuna valutazione finora

- Sahara (2018) - MVADocumento10 pagineSahara (2018) - MVASyefirabellaNessuna valutazione finora

- Chapter Three Final 1Documento8 pagineChapter Three Final 1Syiera Fella'sNessuna valutazione finora

- Jurnal ReviewDocumento2 pagineJurnal ReviewAdelia YolandaNessuna valutazione finora

- An ExaminationDocumento28 pagineAn ExaminationZulfadly UrufiNessuna valutazione finora

- Determinants of Firm Performance: A Comparison of European CountriesDocumento7 pagineDeterminants of Firm Performance: A Comparison of European CountriesSanti WuNessuna valutazione finora

- Factors Affecting Changes in Profits of Manufacturing Companies Listed on the Indonesia Stock Exchange 2005-2009Documento13 pagineFactors Affecting Changes in Profits of Manufacturing Companies Listed on the Indonesia Stock Exchange 2005-2009Rinaldi Sinaga100% (1)

- EPS-bank profit linkDocumento10 pagineEPS-bank profit linkchudamaniNessuna valutazione finora

- Analysis of Financial RatiosDocumento9 pagineAnalysis of Financial RatiosIRINA ALEXANDRA GeorgescuNessuna valutazione finora

- bmd110189 1 5Documento5 paginebmd110189 1 5Nadya RatnasariNessuna valutazione finora

- Pengaruh Profitabilitas Terhadap Dividend Payout Ratio Pada Perusahaan Manufaktur Di IndonesiaDocumento6 paginePengaruh Profitabilitas Terhadap Dividend Payout Ratio Pada Perusahaan Manufaktur Di IndonesiateguhyulionoNessuna valutazione finora

- J41 BF DWL 51 OGe Sa 1238Documento13 pagineJ41 BF DWL 51 OGe Sa 1238AfraNessuna valutazione finora

- Dupont Model and Product Profitability Analysis Based On Activity-Based Costing and Economic Value AddedDocumento12 pagineDupont Model and Product Profitability Analysis Based On Activity-Based Costing and Economic Value AddedGaurav SonkeshariyaNessuna valutazione finora

- Eva PDFDocumento26 pagineEva PDFVeenesha MuralidharanNessuna valutazione finora

- E PSSH Price Vast M 2013Documento9 pagineE PSSH Price Vast M 2013IsnaynisabilaNessuna valutazione finora

- Research Article On Capital Structure and Firm PerformanceDocumento13 pagineResearch Article On Capital Structure and Firm PerformanceTariq ArmanNessuna valutazione finora

- Chapter 4: Findings and DiscussionDocumento14 pagineChapter 4: Findings and DiscussionQuratulain Altaf HusainNessuna valutazione finora

- Research Paper - EVA Indian Banking SectorDocumento14 pagineResearch Paper - EVA Indian Banking SectorAnonymous rkZNo8Nessuna valutazione finora

- Pengaruh Cash Ratio, Debt To Equity Ratio, Profitability Dan Sales Growth Terhadap Dividend Payout Ratio Dan Dampaknya Pada Nilai PerusahaanDocumento20 paginePengaruh Cash Ratio, Debt To Equity Ratio, Profitability Dan Sales Growth Terhadap Dividend Payout Ratio Dan Dampaknya Pada Nilai PerusahaanDian SusilawatiNessuna valutazione finora

- Value Relevance of Accounting InformationDocumento10 pagineValue Relevance of Accounting InformationmimriyathNessuna valutazione finora

- What determines residual incomeDocumento44 pagineWhat determines residual incomeandiniaprilianiputri84Nessuna valutazione finora

- Artikel 2 - Adorasi Reinha (46117057)Documento8 pagineArtikel 2 - Adorasi Reinha (46117057)Adorasi ReinhaNessuna valutazione finora

- Economic Value Added and Market Value Ad PDFDocumento7 pagineEconomic Value Added and Market Value Ad PDFShiva Durga Nageswararao CHNessuna valutazione finora

- Jurnal Pendukung 14 (LN)Documento8 pagineJurnal Pendukung 14 (LN)Natanael PranataNessuna valutazione finora

- Evaluation of Financial Performance Using Value Addition Metrics - A Select Study of 'It' Companies in IndiaDocumento6 pagineEvaluation of Financial Performance Using Value Addition Metrics - A Select Study of 'It' Companies in IndiaAnonymous CwJeBCAXpNessuna valutazione finora

- Eco Nomic Value Added (Eva) As A Per For Mance Mea Sure Ment For Glcs Vs Non-Glcs: Ev I Dence From Bursa Ma Lay SiaDocumento12 pagineEco Nomic Value Added (Eva) As A Per For Mance Mea Sure Ment For Glcs Vs Non-Glcs: Ev I Dence From Bursa Ma Lay SiaprashanttutuNessuna valutazione finora

- Impact of Discounted Cash Flow Method and PriceDocumento5 pagineImpact of Discounted Cash Flow Method and PriceShraddhaNessuna valutazione finora

- Economic Value Added Performance of Bse - Sensex Companies Against Its Equity CapitalDocumento16 pagineEconomic Value Added Performance of Bse - Sensex Companies Against Its Equity CapitalIAEME PublicationNessuna valutazione finora

- ROE and EVA: Could They Explain Concurrently in Stock Return Association Model?Documento23 pagineROE and EVA: Could They Explain Concurrently in Stock Return Association Model?downloadreferensiNessuna valutazione finora

- An Interim Report-DeekshaDocumento16 pagineAn Interim Report-DeekshaJoy K SahooNessuna valutazione finora

- Analysis of The Impact of Governance On Bank Performance: Case of Commercial Tunisian BanksDocumento25 pagineAnalysis of The Impact of Governance On Bank Performance: Case of Commercial Tunisian BanksRubel SahaNessuna valutazione finora

- RRESEARCH PROPOSALDocumento8 pagineRRESEARCH PROPOSALSandeepani T.A.INessuna valutazione finora

- Effect of Investment Opportunity Set (Ios), Level of Leverage and Return To Return Stock Market Company in Indonesia Stock ExchangeDocumento20 pagineEffect of Investment Opportunity Set (Ios), Level of Leverage and Return To Return Stock Market Company in Indonesia Stock ExchangeAnonymous XIwe3KKNessuna valutazione finora

- 1565 7600 1 PBDocumento15 pagine1565 7600 1 PBKhoirul HudaNessuna valutazione finora

- What Affects The Implied Cost of Equity Capital?: Dgode@stern - Nyu.eduDocumento32 pagineWhat Affects The Implied Cost of Equity Capital?: Dgode@stern - Nyu.edueko triyantoNessuna valutazione finora

- EVA As Superior Performance Measurement ToolDocumento9 pagineEVA As Superior Performance Measurement ToolDiogo Oliveira SantosNessuna valutazione finora

- Comprehensive Income Pada Perusahaan ManufakturDocumento15 pagineComprehensive Income Pada Perusahaan ManufakturheraNessuna valutazione finora

- 324-Article Text-544-1-10-20210628Documento7 pagine324-Article Text-544-1-10-20210628TurtleSnackNessuna valutazione finora

- Research Method ChapterDocumento11 pagineResearch Method ChapterHafizhHermawanNessuna valutazione finora

- The Market Reaction To ROCE and ROCE Components: Eli Amir and Itay KamaDocumento53 pagineThe Market Reaction To ROCE and ROCE Components: Eli Amir and Itay KamaJameel KhanNessuna valutazione finora

- Journal AnalysisDocumento21 pagineJournal AnalysisLa AnggaNessuna valutazione finora

- Profit Margin and Capital Structure: An Empirical RelationshipDocumento4 pagineProfit Margin and Capital Structure: An Empirical Relationshiprizki taxNessuna valutazione finora

- Synopsis For MphilDocumento7 pagineSynopsis For MphilBilal SattarNessuna valutazione finora

- Abo Chapter Three UsefulDocumento8 pagineAbo Chapter Three UsefulAkanni Lateef ONessuna valutazione finora

- Journal of Business Venturing Insights: Ond Řej DvouletýDocumento8 pagineJournal of Business Venturing Insights: Ond Řej Dvouletýpir bilalNessuna valutazione finora

- The Impact of Firm Growth On Stock Returns of Nonfinancial Firms Listed On Egyptian Stock ExchangeDocumento17 pagineThe Impact of Firm Growth On Stock Returns of Nonfinancial Firms Listed On Egyptian Stock Exchangealma kalyaNessuna valutazione finora

- NPM, Roe, Der (2022) FarmasiDocumento10 pagineNPM, Roe, Der (2022) FarmasiRaihan bagjaNessuna valutazione finora

- The Effect of Return On Assets, Return On Equity and Earning Per Share On Stock PriceDocumento10 pagineThe Effect of Return On Assets, Return On Equity and Earning Per Share On Stock PriceIsnaynisabilaNessuna valutazione finora

- Financial Statement Analysis: Business Strategy & Competitive AdvantageDa EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageValutazione: 5 su 5 stelle5/5 (1)

- Financial Performance Measures and Value Creation: the State of the ArtDa EverandFinancial Performance Measures and Value Creation: the State of the ArtNessuna valutazione finora

- EIB Working Papers 2019/02 - How energy audits promote SMEs' energy efficiency investmentDa EverandEIB Working Papers 2019/02 - How energy audits promote SMEs' energy efficiency investmentNessuna valutazione finora

- Event Studies for Financial Research: A Comprehensive GuideDa EverandEvent Studies for Financial Research: A Comprehensive GuideNessuna valutazione finora

- The Effect of Transformational Leadership, Organizational Commitment and Empowerment On Managerial Performance Through Organizational Citizenship Behavior at PT. Cobra Direct Sale IndonesiaDocumento9 pagineThe Effect of Transformational Leadership, Organizational Commitment and Empowerment On Managerial Performance Through Organizational Citizenship Behavior at PT. Cobra Direct Sale Indonesiainventionjournals100% (1)

- Islamic Insurance in The Global EconomyDocumento3 pagineIslamic Insurance in The Global EconomyinventionjournalsNessuna valutazione finora

- Effects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - NigeriaDocumento12 pagineEffects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeriainventionjournals100% (1)

- Negotiated Masculinities in Contemporary American FictionDocumento5 pagineNegotiated Masculinities in Contemporary American FictioninventionjournalsNessuna valutazione finora

- A Discourse On Modern Civilization: The Cinema of Hayao Miyazaki and GandhiDocumento6 pagineA Discourse On Modern Civilization: The Cinema of Hayao Miyazaki and GandhiinventionjournalsNessuna valutazione finora

- Effects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeria.Documento12 pagineEffects of Online Marketing On The Behaviour of Consumers in Selected Online Companies in Owerri, Imo State - Nigeria.inventionjournalsNessuna valutazione finora

- The Network Governance in Kasongan Industrial ClusterDocumento7 pagineThe Network Governance in Kasongan Industrial ClusterinventionjournalsNessuna valutazione finora

- An Appraisal of The Current State of Affairs in Nigerian Party PoliticsDocumento7 pagineAn Appraisal of The Current State of Affairs in Nigerian Party PoliticsinventionjournalsNessuna valutazione finora

- A Critical Survey of The MahabhartaDocumento2 pagineA Critical Survey of The MahabhartainventionjournalsNessuna valutazione finora

- The Social Composition of Megaliths in Telangana and Andhra: An Artefactual AnalysisDocumento7 pagineThe Social Composition of Megaliths in Telangana and Andhra: An Artefactual AnalysisinventionjournalsNessuna valutazione finora

- Inter-Caste or Inter-Religious Marriages and Honour Related Violence in IndiaDocumento5 pagineInter-Caste or Inter-Religious Marriages and Honour Related Violence in IndiainventionjournalsNessuna valutazione finora

- Literary Conviviality and Aesthetic Appreciation of Qasa'id Ashriyyah (Decaodes)Documento5 pagineLiterary Conviviality and Aesthetic Appreciation of Qasa'id Ashriyyah (Decaodes)inventionjournalsNessuna valutazione finora

- Student Engagement: A Comparative Analysis of Traditional and Nontradional Students Attending Historically Black Colleges and UniversitiesDocumento12 pagineStudent Engagement: A Comparative Analysis of Traditional and Nontradional Students Attending Historically Black Colleges and Universitiesinventionjournals100% (1)

- The Impact of Leadership On Creativity and InnovationDocumento8 pagineThe Impact of Leadership On Creativity and InnovationinventionjournalsNessuna valutazione finora

- The Usage and Understanding of Information and Communication Technology On Housewife in Family Welfare Empowerment Organization in Manado CityDocumento10 pagineThe Usage and Understanding of Information and Communication Technology On Housewife in Family Welfare Empowerment Organization in Manado CityinventionjournalsNessuna valutazione finora

- H0606016570 PDFDocumento6 pagineH0606016570 PDFinventionjournalsNessuna valutazione finora

- Muslims On The Margin: A Study of Muslims OBCs in West BengalDocumento6 pagineMuslims On The Margin: A Study of Muslims OBCs in West BengalinventionjournalsNessuna valutazione finora

- E0606012850 PDFDocumento23 pagineE0606012850 PDFinventionjournalsNessuna valutazione finora

- H0606016570 PDFDocumento6 pagineH0606016570 PDFinventionjournalsNessuna valutazione finora

- Non-Linear Analysis of Steel Frames Subjected To Seismic ForceDocumento12 pagineNon-Linear Analysis of Steel Frames Subjected To Seismic ForceinventionjournalsNessuna valutazione finora

- Effect of P-Delta Due To Different Eccentricities in Tall StructuresDocumento8 pagineEffect of P-Delta Due To Different Eccentricities in Tall StructuresinventionjournalsNessuna valutazione finora

- C0606011419 PDFDocumento6 pagineC0606011419 PDFinventionjournalsNessuna valutazione finora

- E0606012850 PDFDocumento23 pagineE0606012850 PDFinventionjournalsNessuna valutazione finora

- F0606015153 PDFDocumento3 pagineF0606015153 PDFinventionjournalsNessuna valutazione finora

- C0606011419 PDFDocumento6 pagineC0606011419 PDFinventionjournalsNessuna valutazione finora

- D0606012027 PDFDocumento8 pagineD0606012027 PDFinventionjournalsNessuna valutazione finora

- Non-Linear Analysis of Steel Frames Subjected To Seismic ForceDocumento12 pagineNon-Linear Analysis of Steel Frames Subjected To Seismic ForceinventionjournalsNessuna valutazione finora

- D0606012027 PDFDocumento8 pagineD0606012027 PDFinventionjournalsNessuna valutazione finora

- F0606015153 PDFDocumento3 pagineF0606015153 PDFinventionjournalsNessuna valutazione finora

- Development of Nighttime Visibility Assessment System For Road Using A Low Light CameraDocumento5 pagineDevelopment of Nighttime Visibility Assessment System For Road Using A Low Light CamerainventionjournalsNessuna valutazione finora

- General Mathematics - Module #3Documento7 pagineGeneral Mathematics - Module #3Archie Artemis NoblezaNessuna valutazione finora

- Level-Ii: Sample PaperDocumento5 pagineLevel-Ii: Sample PaperSeng SoonNessuna valutazione finora

- Binary Search TreeDocumento177 pagineBinary Search TreeAyesha FidaNessuna valutazione finora

- Applications of MATLAB To Problems in Quantum Mechanics For Research and Education (1995) : Dirac Notation InterpreterDocumento42 pagineApplications of MATLAB To Problems in Quantum Mechanics For Research and Education (1995) : Dirac Notation InterpreterSuleman AwanNessuna valutazione finora

- HARDER Developing The Formula 0.5 Ab SIN C For The Area of A TriangleDocumento1 paginaHARDER Developing The Formula 0.5 Ab SIN C For The Area of A TrianglejulucesNessuna valutazione finora

- Thermodynamics IntroductionDocumento255 pagineThermodynamics IntroductionPrashant KulkarniNessuna valutazione finora

- Pubali Bank Limited: Post NameDocumento6 paginePubali Bank Limited: Post NametitoNessuna valutazione finora

- Atomic Physics ExamDocumento3 pagineAtomic Physics Examvasudevan m.vNessuna valutazione finora

- DLL - Mathematics 2 - Q2 - W3Documento13 pagineDLL - Mathematics 2 - Q2 - W3Maricar SilvaNessuna valutazione finora

- Unit 1 Practice QuestionsDocumento5 pagineUnit 1 Practice QuestionsKristen JimenezNessuna valutazione finora

- Python Lab Cycle - ITDocumento4 paginePython Lab Cycle - ITeswar jrNessuna valutazione finora

- Online Passive-Aggressive Algorithms On A BudgetDocumento8 pagineOnline Passive-Aggressive Algorithms On A BudgetP6E7P7Nessuna valutazione finora

- ShearDocumento84 pagineShearRifqi FauziNessuna valutazione finora

- Schering BridgeDocumento11 pagineSchering BridgePunithan RavichandranNessuna valutazione finora

- Joint Tutorial Analyzes Circular Opening Near WeaknessDocumento12 pagineJoint Tutorial Analyzes Circular Opening Near WeaknessTeofilo Augusto Huaranccay HuamaniNessuna valutazione finora

- Question Bank Unit-I Mechatronics, Sensor and Transducers (2 Mark Questions)Documento11 pagineQuestion Bank Unit-I Mechatronics, Sensor and Transducers (2 Mark Questions)ChippyVijayanNessuna valutazione finora

- Schroedindiger Eqn and Applications3Documento4 pagineSchroedindiger Eqn and Applications3kanchankonwarNessuna valutazione finora

- ACT Prep Syllabus (Fall 2019)Documento7 pagineACT Prep Syllabus (Fall 2019)Fallon HoweNessuna valutazione finora

- Quarter 2 Grade 4 Math Week 6Documento4 pagineQuarter 2 Grade 4 Math Week 6PETER JHARIELLE ANGELESNessuna valutazione finora

- Software Effort EstimationDocumento25 pagineSoftware Effort EstimationnirnikaNessuna valutazione finora

- PS1Documento2 paginePS1Nitesh Kumar DubeyNessuna valutazione finora

- CPR Notes - Chapter 02 Decision Making and BranchingDocumento24 pagineCPR Notes - Chapter 02 Decision Making and Branchingapi-37281360% (1)

- Measure of Dispersion and LocationDocumento51 pagineMeasure of Dispersion and LocationTokyo TokyoNessuna valutazione finora

- PREDICTION OF TEMPERATURE PROFILE IN OIL WELLS, A. Laderian, 1999, 14 PGDocumento14 paginePREDICTION OF TEMPERATURE PROFILE IN OIL WELLS, A. Laderian, 1999, 14 PGjoselosse desantosNessuna valutazione finora

- Maths Ans Sol - JEEMain 2023 - PH 2 - 06 04 2023 - Shift 1Documento5 pagineMaths Ans Sol - JEEMain 2023 - PH 2 - 06 04 2023 - Shift 1jayanthsaimuppirisettiNessuna valutazione finora

- Assignment Usol 2016-2017 PGDSTDocumento20 pagineAssignment Usol 2016-2017 PGDSTpromilaNessuna valutazione finora

- Frequency DNA and The Human BodypdfDocumento6 pagineFrequency DNA and The Human BodypdfRegaldna Felix100% (1)

- Notification For Joint Dakshana Selection Test (JDST) 2022Documento3 pagineNotification For Joint Dakshana Selection Test (JDST) 2022LOHIT TRADING100% (1)

- Static Structural Analysis: Chapter FourDocumento54 pagineStatic Structural Analysis: Chapter FourSoumen MondalNessuna valutazione finora

- 2011 BDMS 4E Prelims 2 AM Paper 2Documento25 pagine2011 BDMS 4E Prelims 2 AM Paper 2Hui XiuNessuna valutazione finora