Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

61716rmo 48-2011

Caricato da

HarryTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

61716rmo 48-2011

Caricato da

HarryCopyright:

Formati disponibili

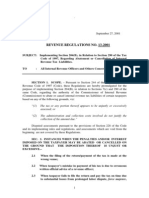

REPUBLIC OF THE PHILIPPINES

DEPARTME OFINANCE

BUREAU OF INTERNAL REVENUE

Quezon City

December 26, 2011

REVENUE MEMORANDUM ORDER NO.

48-2011_

SUBJECT

Creation of Alphanumeric Tax Code (ATC) of Selected Revenue Source

per Revenue Regulations No. 13-2011

TO

All Collection Agents, Revenue District Officers and Other Internal Revenue

Officers Concerned

I.

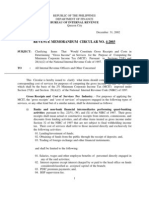

Objective:

To facilitate the proper identification and monitoring of certain income payments subject to

Expanded Withholding Tax pursuant to Revenue Regulations No. 13-2011 (Implementing the Tax

Provisions of Republic Act No. 9856 Otherwise Known as The Real Estate Investment Trust Act of

2009), the following ATCs are hereby created:

ATC

WC 690

Description

Legal Basis

Income payments subject

to Withholding Tax

received by Real Estate

Investment Trust (REIT)

RR No. 13-2011

i) Corporate

Cash or property

dividends paid by a REIT

subject to Final Tax

II.

Tax Rate

BIR Form

No.

1%

1601-E/

2307

1601-F/

2306

1601-F/

2306

RR No. 13-2011

WI 700

i) Individual

10%

WC 700

ii) Corporate

10%

Repealing Clause:

This Revenue Memorandum Order (RMO) revises portions of all other issuances inconsistent herewith.

III.

Effectivity:

This RMO shall take effect immediately.

(Original Signed)

KIM S. JACINTO-HENARES

Commissioner of Internal Revenue

B-3/tbm

Potrebbero piacerti anche

- RR 13-01Documento5 pagineRR 13-01Peggy SalazarNessuna valutazione finora

- BIR Cuts Requirements For Brokers and Importers' ClearancesDocumento4 pagineBIR Cuts Requirements For Brokers and Importers' ClearancesPortCallsNessuna valutazione finora

- rr12 01Documento12 paginerr12 01Bryant R. CanasaNessuna valutazione finora

- rr15 01Documento5 paginerr15 01HarryNessuna valutazione finora

- rr16 01Documento3 paginerr16 01HarryNessuna valutazione finora

- RR 14-01Documento9 pagineRR 14-01matinikkiNessuna valutazione finora

- 2001 RR 17 HousingDocumento7 pagine2001 RR 17 HousingCherry MaeNessuna valutazione finora

- 1903rmc09 03 PDFDocumento3 pagine1903rmc09 03 PDFHarryNessuna valutazione finora

- RMC 04-2003 - Gross Income On Services For MCIT PurposesDocumento7 pagineRMC 04-2003 - Gross Income On Services For MCIT PurposesjtilloNessuna valutazione finora

- RR 18-01Documento7 pagineRR 18-01JvsticeNickNessuna valutazione finora

- rr21 01Documento1 paginarr21 01HarryNessuna valutazione finora

- rr01 01 PDFDocumento1 paginarr01 01 PDFHarryNessuna valutazione finora

- RR 20-01Documento5 pagineRR 20-01matinikkiNessuna valutazione finora

- rr19 01Documento17 paginerr19 01HarryNessuna valutazione finora

- BIR RMC 17 2006Documento2 pagineBIR RMC 17 2006Mary Anne BantogNessuna valutazione finora

- 1873rmc07 - 03 (Annex A)Documento1 pagina1873rmc07 - 03 (Annex A)HarryNessuna valutazione finora

- BIR RMC 17 2006Documento2 pagineBIR RMC 17 2006Mary Anne BantogNessuna valutazione finora

- 1845rmc05 03 PDFDocumento1 pagina1845rmc05 03 PDFHarryNessuna valutazione finora

- Tax Guide Value Added TaxDocumento18 pagineTax Guide Value Added TaxBuenaventura RiveraNessuna valutazione finora

- 02-2003 Staggered Filing of ReturnDocumento4 pagine02-2003 Staggered Filing of Returnapi-247793055Nessuna valutazione finora

- 1845rmc05 - 03 (Annex A)Documento1 pagina1845rmc05 - 03 (Annex A)HarryNessuna valutazione finora

- 1859rmc06 - 03 (Annex A)Documento2 pagine1859rmc06 - 03 (Annex A)HarryNessuna valutazione finora

- 1689rmc03 03 PDFDocumento1 pagina1689rmc03 03 PDFHarryNessuna valutazione finora

- Collection Goal, by Implementing Office and Major Tax Type, Cy 2004Documento1 paginaCollection Goal, by Implementing Office and Major Tax Type, Cy 2004HarryNessuna valutazione finora

- Total Collection Goal by Major Tax Type, Cy 2004 (In Thousand Pesos) LegislativeDocumento1 paginaTotal Collection Goal by Major Tax Type, Cy 2004 (In Thousand Pesos) LegislativeHarryNessuna valutazione finora

- 02-2003 Staggered Filing of ReturnDocumento4 pagine02-2003 Staggered Filing of Returnapi-247793055Nessuna valutazione finora

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocumento6 pagineRepublic of The Philippines Department of Finance Bureau of Internal RevenueJess FernandezNessuna valutazione finora

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocumento6 pagineRepublic of The Philippines Department of Finance Bureau of Internal RevenueJess FernandezNessuna valutazione finora

- 1798rmo04 06tab3Documento1 pagina1798rmo04 06tab3HarryNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)