Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Measure B1 Arguments and Rebuttals

Caricato da

Action Alameda News0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

802 visualizzazioni4 pagineBallot arguments and rebuttals for and against Measure B1, AUSD parcel tax renewal.

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoBallot arguments and rebuttals for and against Measure B1, AUSD parcel tax renewal.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

802 visualizzazioni4 pagineMeasure B1 Arguments and Rebuttals

Caricato da

Action Alameda NewsBallot arguments and rebuttals for and against Measure B1, AUSD parcel tax renewal.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 4

Arguments For and Against AUSD Parcel Tax Measure B1

via Action Alameda News

Rebuttal to Argument in Favor of Measure B1

B1 is unfair, violates state law, lowers corporate taxes and replaces a tax that does not expire

until 2019.

B1 taxes home and small businesses 32 times greater than big corporations.

B1 decreases taxes on corporations which takes money out of our schools.

B1 is not needed until the current tax expires in 2019. There are 2 regular elections

before then to get it right.

32 to 1 is unfair. B1 has a maximum tax, a cap, which only large corporations reach making

their effective tax rate 1 per square foot. Small businesses, homes, condos, and rentals pay

32 per square foot.

B1 violates state law which requires a uniform tax. The cap effectively creates different

rates. Courts have ruled different rates illegal. Square footage taxes on buildings must be the

same for everybody.

B1 takes money away from our schools. B1 supporters accurately claim it does not raise

taxes. However, B1 lowers taxes on corporations by eliminating the tax on vacant

lots. Corporate developers own most vacant lots. This change is a gift to corporations.

B1 proponents claim the current tax is set to expire. Yes, but not until 2019. There are 2

regular elections before then for the District to get it right. Eliminate the cap and we will

support it.

A fair tax means more money for our schools or lower rates for everybody. We support fair

taxes.

Dont support corporate tax breaks. No caps for corporations.

NO on B1.

32 to 1 is wrong.

--

The five signatures are:

Patricia Spencer Mayor, City of Alameda

Leland Traiman High School

Felicia Simon Small Business Owner

Stewart Blandon Health Information Technologist

David Howard www.SaveOurCityAlameda.org

Argument Against Measure B1

Measure B1 is unfair. You and I, the 99%, pay 32 per square foot. Because there is a cap,

large corporations like our shopping centers pay 1 per square foot. Residential properties and

small businesses are stuck paying 32 times more than big corporations.

The current tax on vacant parcels is $299. Measure B1 eliminates the tax for vacant parcels

costing our schools nearly $100,000 every year. Most vacant lots are owned by corporate

developers. Measure B1 allows these corporate developers to completely avoid paying their

fair share.

The current tax does not expire for another 2 years. Measure B1 should be rejected and the

school board should come up with a replacement which is fair for all.

A previous school tax with a similar unfair design was found to violate state law and our school

district spent millions in legal fees and refund to taxpayers. Why has the school board not

learned from their own mistakes?

Vote No on B1 and demand our school board come up with a fair tax we all can support and

one that makes corporations pay their fair share. Our school board has 2 years to get it right

because Measure B1 is wrong!

32 to 1 is wrong.

No on B1

Potrebbero piacerti anche

- Alameda Community Survey - Final Public ReportDocumento34 pagineAlameda Community Survey - Final Public ReportAction Alameda NewsNessuna valutazione finora

- ACLU and AUSD Exchange On Maya Lin Black Lives Matter IncidentDocumento12 pagineACLU and AUSD Exchange On Maya Lin Black Lives Matter IncidentAction Alameda NewsNessuna valutazione finora

- ACLU Response To District Over BLM MessagesDocumento2 pagineACLU Response To District Over BLM MessagesAction Alameda NewsNessuna valutazione finora

- Alameda Citizens United Organizing Form 410Documento6 pagineAlameda Citizens United Organizing Form 410Action Alameda NewsNessuna valutazione finora

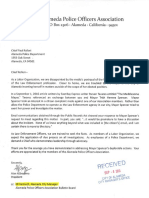

- Alameda POA LetterDocumento1 paginaAlameda POA LetterAction Alameda NewsNessuna valutazione finora

- Joel Spencer ClaimDocumento4 pagineJoel Spencer ClaimAction Alameda NewsNessuna valutazione finora

- April 1 2016 EmailsDocumento14 pagineApril 1 2016 EmailsAction Alameda NewsNessuna valutazione finora

- Alamedans United Forms 497Documento11 pagineAlamedans United Forms 497Action Alameda NewsNessuna valutazione finora

- FINAL Back To School Report 8-23-16Documento33 pagineFINAL Back To School Report 8-23-16Action Alameda NewsNessuna valutazione finora

- Measure L1 Rebuttals To Arguments For and AgainstDocumento2 pagineMeasure L1 Rebuttals To Arguments For and AgainstAction Alameda NewsNessuna valutazione finora

- Alameda Rent Control Measure L1 ArgumentsDocumento5 pagineAlameda Rent Control Measure L1 ArgumentsAction Alameda NewsNessuna valutazione finora

- Alameda Rent Control RebuttalsDocumento2 pagineAlameda Rent Control RebuttalsAction Alameda NewsNessuna valutazione finora

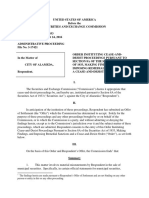

- SEC Administrative Action Against City of AlamedaDocumento6 pagineSEC Administrative Action Against City of AlamedaAction Alameda NewsNessuna valutazione finora

- Parcel Tax For PTAs PPT 4.25.16Documento12 pagineParcel Tax For PTAs PPT 4.25.16Action Alameda NewsNessuna valutazione finora

- Presentation REVISED 1Documento27 paginePresentation REVISED 1Action Alameda NewsNessuna valutazione finora

- City of Alameda Ginsburg Case June 2016Documento27 pagineCity of Alameda Ginsburg Case June 2016Action Alameda NewsNessuna valutazione finora

- Alameda Unified 2014 Teachers PayDocumento30 pagineAlameda Unified 2014 Teachers PayAction Alameda NewsNessuna valutazione finora

- 2016 2017 Salary Schedule Exec MGMT Conf Licensed Unrep FINALDocumento2 pagine2016 2017 Salary Schedule Exec MGMT Conf Licensed Unrep FINALAction Alameda NewsNessuna valutazione finora

- Alameda Rent Control ArgumentsDocumento4 pagineAlameda Rent Control ArgumentsAction Alameda NewsNessuna valutazione finora

- Tony Daysog Rent Control PetitionDocumento6 pagineTony Daysog Rent Control PetitionAction Alameda NewsNessuna valutazione finora

- AUSD Parcel Tax Resolution For Board Approval 6/28/16Documento14 pagineAUSD Parcel Tax Resolution For Board Approval 6/28/16Action Alameda NewsNessuna valutazione finora

- City of Alameda Street Repair 2016Documento1 paginaCity of Alameda Street Repair 2016Action Alameda NewsNessuna valutazione finora

- City of Alameda UMA PresentationDocumento23 pagineCity of Alameda UMA PresentationAction Alameda NewsNessuna valutazione finora

- Alameda UMA RebuttalsDocumento2 pagineAlameda UMA RebuttalsAction Alameda NewsNessuna valutazione finora

- Jean Sweeney Park Presentation (July 2016)Documento38 pagineJean Sweeney Park Presentation (July 2016)Action Alameda NewsNessuna valutazione finora

- 2016 Bay Area Council Survey ResultsDocumento17 pagine2016 Bay Area Council Survey ResultsAction Alameda NewsNessuna valutazione finora

- Alameda Homeowners and Private Property Rights ActDocumento5 pagineAlameda Homeowners and Private Property Rights ActAction Alameda NewsNessuna valutazione finora

- Proposition 13 Base Year Breakdown 2015-2016Documento1 paginaProposition 13 Base Year Breakdown 2015-2016Action Alameda NewsNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Pay Slip Records for Tuition Centre StaffDocumento12 paginePay Slip Records for Tuition Centre StaffThana BalanNessuna valutazione finora

- Musthtaq Azeem Atl Challan PDFDocumento1 paginaMusthtaq Azeem Atl Challan PDFFarhan AliNessuna valutazione finora

- F160 1 Manual en 200607Documento84 pagineF160 1 Manual en 200607nameNessuna valutazione finora

- Udhemy CourcesDocumento1 paginaUdhemy CourcesRam Sri100% (1)

- Financial Terminology Definition of The Financial TermDocumento36 pagineFinancial Terminology Definition of The Financial TermRajeev TripathiNessuna valutazione finora

- v11 n1 Article8Documento24 paginev11 n1 Article8Farapple24Nessuna valutazione finora

- Detail P&LDocumento2 pagineDetail P&LPuteh BeseryNessuna valutazione finora

- Case Study On The Quantitative Restriction On Rice Imports in The PhilippinesDocumento18 pagineCase Study On The Quantitative Restriction On Rice Imports in The PhilippinesSai Sapnu100% (2)

- 221102a pr150 Davis Shawoo Loss and Damage 2210g PDFDocumento40 pagine221102a pr150 Davis Shawoo Loss and Damage 2210g PDFRahadian AhmadNessuna valutazione finora

- Business Development Control SheetDocumento45 pagineBusiness Development Control SheetTatenda Leona MwedziNessuna valutazione finora

- Power Point Slides To Chapter 09Documento46 paginePower Point Slides To Chapter 09Ankit RoushaNessuna valutazione finora

- Barangay ClearanceDocumento2 pagineBarangay ClearanceRuth BolongaitaNessuna valutazione finora

- General Purpose Cost StatementDocumento36 pagineGeneral Purpose Cost StatementShatrughna SamalNessuna valutazione finora

- The PILOT - June 2018Documento20 pagineThe PILOT - June 2018Redwood Shores Community AssociationNessuna valutazione finora

- Corporate Level StrategyDocumento35 pagineCorporate Level StrategyDr Rushen Singh100% (1)

- Amended LLC Operating Agreement SummaryDocumento36 pagineAmended LLC Operating Agreement Summarymbortz-1Nessuna valutazione finora

- Income Taxation - Ampongan (SolMan)Documento25 pagineIncome Taxation - Ampongan (SolMan)John Dale Mondejar77% (13)

- "Christmas in Goodhue" Celebrated December 7: Tower Investments Offers Land For New Pine Island Elementary SchoolDocumento14 pagine"Christmas in Goodhue" Celebrated December 7: Tower Investments Offers Land For New Pine Island Elementary SchoolKristina HicksNessuna valutazione finora

- MFM Tender SpecDocumento39 pagineMFM Tender Specsahil4INDNessuna valutazione finora

- Consumption Tax On ImportationDocumento27 pagineConsumption Tax On ImportationOwncoebdief100% (1)

- Contract of Lease With Option To PurchaseDocumento8 pagineContract of Lease With Option To PurchaseLeahNessuna valutazione finora

- Centeno Vs PornillosDocumento5 pagineCenteno Vs PornillosDovahsosNessuna valutazione finora

- MyLegalWhiz - Deed of Conditional Sale Condominium UnitDocumento2 pagineMyLegalWhiz - Deed of Conditional Sale Condominium UnitConcon FabricanteNessuna valutazione finora

- Local Tax - SyllabusDocumento8 pagineLocal Tax - Syllabusmark_aure_1Nessuna valutazione finora

- Assesment of Jewels & JewelleryDocumento41 pagineAssesment of Jewels & Jewellerykhushic2401Nessuna valutazione finora

- JSW SteelsDocumento41 pagineJSW SteelsAthiraNessuna valutazione finora

- Amazon InvoiceDocumento2 pagineAmazon InvoiceSumit RoyNessuna valutazione finora

- Global Insurance Industry Insights An In-Depth PerspectiveDocumento32 pagineGlobal Insurance Industry Insights An In-Depth PerspectiveSzilvia SzabóNessuna valutazione finora

- CITY OF DAVAO vs. RTC DIGESTDocumento2 pagineCITY OF DAVAO vs. RTC DIGESTLayaNessuna valutazione finora

- Bommai Budget SpeechDocumento136 pagineBommai Budget SpeechPrajwal D'SouzaNessuna valutazione finora