Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

United States Court of Appeals: Published

Caricato da

Scribd Government DocsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

United States Court of Appeals: Published

Caricato da

Scribd Government DocsCopyright:

Formati disponibili

PUBLISHED

UNITED STATES COURT OF APPEALS

FOR THE FOURTH CIRCUIT

In Re: MRRM, P.A., formerly

known as Law Offices of Ness,

Motley, Loadholt, Richardson &

Poole, former counsel to plaintiff

class,

Appellant,

In Re: RICHARDSON, PATRICK,

WESTBROOK & BRICKMAN,

Appellee,

and

In Re: SPEIGHTS & RUNYAN

CENTRAL WESLEYAN COLLEGE, on

behalf of itself and all others

similarly situated,

Plaintiff,

v.

W.R. GRACE & COMPANY; NATIONAL

GYPSUM COMPANY; UNITED STATES

GYPSUM COMPANY, a Delaware

Corporation; AC&S, INCORPORATED,

a Pennsylvania Corporation;

ACOUSTICS, INCORPORATED; A P

GREEN REFRACTORIES COMPANY, a

Delaware Corporation; AMCHEM

PRODUCTS, INCORPORATED; AMERICAN

ASBESTOS PRODUCTS COMPANY, a

California Corporation; AMERICAN

ENERGY PRODUCTS, INCORPORATED;

No. 04-1838

IN RE: MRRM, P.A.

ARMSTRONG WORLD INDUSTRIES,

INCORPORATED; ASBESTOS

CORPORATION, LIMITED; ASBESTOS

PRODUCT MANUFACTURING

CORPORATION; ASBESTOS

CORPORATION OF AMERICA

INCORPORATED; ASBESTOS FIBERS,

INCORPORATED; ASBESTOSPRAY

CORPORATION; ASTEN GROUP,

INCORPORATED; ATLAS ASBESTOS

CORPORATION, LIMITED; ATLAS

TURNER, INCORPORATED; BABCOCK &

WILCOX COMPANY, a Delaware

Corporation; BASIC, INCORPORATED, a

Delaware Corporation; BELL

ASBESTOS MINES, LIMITED; BRINCO

MINING LIMITED, formerly known as

Cassiar Resources Limited;

CALIFORNIA PRODUCTS CORPORATION;

CALIFORNIA PRODUCTS INTERNATIONAL

INCORPORATED; CAPE ASBESTOS

FIBRES, LIMITED; CAPE INDUSTRIES,

LIMITED; CAREY CANADA,

INCORPORATED; C. E. THURSTON &

SONS INCORPORATED, a Virginia

Corporation; THE CELOTEX

CORPORATION; CERTAINTEED

CORPORATION, a Maryland

Corporation; CERTAINTEED SALES

CORPORATION; CHARTER

CONSOLIDATED INVESTMENTS LIMITED;

CHARTER CONSOLIDATED, LIMITED;

CHARTER CONSOLIDATED SERVICES;

CHARTER INDUSTRIES; CHEMROCK

IN RE: MRRM, P.A.

CORPORATION; COMBUSTION

ENGINEERING, INCORPORATED; CROWN

CORK & SEAL COMPANY,

INCORPORATED, a New York

Corporation; DANA CORPORATION, a

Virginia Corporation; DODSON

MANUFACTURING COMPANY; EAGLEPICHER INDUSTRIES, INCORPORATED;

EMPIRE ACE INSULATION

MANUFACTURING CORPORATION, a

New York Corporation; EMPIRE

ASBESTOS PRODUCTS, INCORPORATED, a

New York Corporation; FIBREBOARD

CORPORATION; FLINTKOTE COMPANY, a

Massachusetts Corporation; FOSTER

WHEELER CORPORATION, Successorin-Interests to Forty-Eight

Insulations Incorporated, a New

York Corporation; GAF

CORPORATION; GARLOCK; GENERAL

REFRACTORIES COMPANY, US

Refractories Division; GEORGIA

PACIFIC CORPORATION, a Georgia

Corporation; GRANT WILSON,

INCORPORATED, an Illinois

Corporation; GREFCO, INCORPORATED,

Minerals Division; H & A

CONSTRUCTION CORPORATION,

formerly known as Spraycraft, a

New York Corporation; HAMILTON

MATERIALS, INCORPORATED, a

California Corporation; H. K.

PORTER INCORPORATED; HIGHLAND

STUCCO & LIME PRODUCTS,

INCORPORATED; HOLLYWOOD STUCCO

PRODUCTS, INCORPORATED;

IN RE: MRRM, P.A.

HUXLEY DEVELOPMENT CORPORATION;

IPA SYSTEMS, INCORPORATED, a

Pennsylvania Corporation; J. W.

ROBERTS, LIMITED; JOHN

CRANE-HOUDAILLE, INCORPORATED,

formerly known as Crane Packing

Company; KEENE CORPORATION;

KAISER REFRACTORIES, a division of

Kaiser Aluminum and Chemical

Corporation; KAISER GYPSUM

COMPANY; LAC DAMAINTE DU

QUEBEC, LTEE; NICOLET,

INCORPORATED; OHIO LIME COMPANY;

OWENS-CORNING FIBERGLAS

CORPORATION; OWENS-ILLINOIS,

INCORPORATED; PITTSBURGH-CORNING

CORPORATION; PFIZER, INCORPORATED;

QUIGLEY COMPANY, INCORPORATED;

RAYMARK INDUSTRIES, INCORPORATED;

ROCK WOOL MANUFACTURING

COMPANY, INCORPORATED; RYDER

INDUSTRIES, INCORPORATED, a Texas

Corporation; SEALTITE TEXTILE

CORPORATION, a Delaware

Corporation; SOUTHERN TEXTILE, a

Delaware Corporation; SPECIAL

ASBESTOS COMPANY, INCORPORATED;

SPRAYON INSULATION & ACOUSTIC,

INCORPORATED; SPRAYED INSULATION

CORPORATION; SPRAYON RESEARCH

CORPORATION; STARR-DAVIS

COMPANY, INCORPORATED, a North

Carolina Corporation; STANDARD

INSULATIONS, INCORPORATED;

STANDARD ASBESTOS

MANUFACTURING AND INSULATING

COMPANY, a Missouri Corporation;

IN RE: MRRM, P.A.

TAF INTERNATIONAL, LIMITED,

formerly known as Turner Asbestos

Fibres, Limited; TURNER ASBESTOS

FIBRES, LIMITED, a Foreign

Corporation; TURNER & NEWALL,

LIMITED, a Foreign Corporation;

UNIROYAL INCORPORATED; USG

CORPORATION, a Delaware

Corporation; UNITED STATES

MINERAL PRODUCTS COMPANY;

VERMONT ASBESTOS GROUP, a

Vermont Corporation; VIMASCO

CORPORATION; WESTERN MINERAL

PRODUCTS COMPANY, INCORPORATED;

H. K. PORTER ASBESTOS TRUST,

Defendants.

BASIL H. THOMSON, JR.; JOHN G.

HILL, JR.; ROBERT L. POTTS; EARL V.

BROWN; ESTELLE A. FISHBEIN;

BEVERLY E. LEDBETTER; DENNIS C.

HART,

Amicus Curiae,

HIGHLANDS INSURANCE COMPANY;

AMERICAN REINSURANCE COMPANY;

CONCORDIA COLLEGE; FURMAN

UNIVERSITY; CLAFLIN UNIVERSITY;

NEWBERRY COLLEGE,

Movants.

IN RE: MRRM, P.A.

In Re: MRRM, P.A., formerly

known as Law Offices of Ness,

Motley, Loadholt, Richardson &

Poole, former counsel to plaintiff

class,

Appellant,

In Re: RICHARDSON, PATRICK,

WESTBROOK & BRICKMAN,

Appellee,

and

In Re: SPEIGHTS & RUNYAN

CENTRAL WESLEYAN COLLEGE, on

behalf of itself and all others

similarly situated,

Plaintiff,

v.

W.R. GRACE & COMPANY; NATIONAL

GYPSUM COMPANY; UNITED STATES

GYPSUM COMPANY, a Delaware

Corporation; AC&S, INCORPORATED,

a Pennsylvania Corporation;

ACOUSTICS, INCORPORATED; A P

GREEN REFRACTORIES COMPANY, a

Delaware Corporation; AMCHEM

PRODUCTS, INCORPORATED; AMERICAN

ASBESTOS PRODUCTS COMPANY, a

California Corporation; AMERICAN

ENERGY PRODUCTS, INCORPORATED;

No. 04-1859

IN RE: MRRM, P.A.

ARMSTRONG WORLD INDUSTRIES,

INCORPORATED; ASBESTOS

CORPORATION, LIMITED; ASBESTOS

PRODUCT MANUFACTURING

CORPORATION; ASBESTOS

CORPORATION OF AMERICA

INCORPORATED; ASBESTOS FIBERS,

INCORPORATED; ASBESTOSPRAY

CORPORATION; ASTEN GROUP,

INCORPORATED; ATLAS ASBESTOS

CORPORATION, LIMITED; ATLAS

TURNER, INCORPORATED; BABCOCK &

WILCOX COMPANY, a Delaware

Corporation; BASIC, INCORPORATED, a

Delaware Corporation; BELL

ASBESTOS MINES, LIMITED; BRINCO

MINING LIMITED, formerly known as

Cassiar Resources Limited;

CALIFORNIA PRODUCTS CORPORATION;

CALIFORNIA PRODUCTS INTERNATIONAL

INCORPORATED; CAPE ASBESTOS

FIBRES, LIMITED; CAPE INDUSTRIES,

LIMITED; CAREY CANADA,

INCORPORATED; C. E. THURSTON &

SONS INCORPORATED, a Virginia

Corporation; THE CELOTEX

CORPORATION; CERTAINTEED

CORPORATION, a Maryland

Corporation; CERTAINTEED SALES

CORPORATION; CHARTER

CONSOLIDATED INVESTMENTS LIMITED;

CHARTER CONSOLIDATED, LIMITED;

CHARTER CONSOLIDATED SERVICES;

CHARTER INDUSTRIES; CHEMROCK

IN RE: MRRM, P.A.

CORPORATION; COMBUSTION

ENGINEERING, INCORPORATED; CROWN

CORK & SEAL COMPANY,

INCORPORATED, a New York

Corporation; DANA CORPORATION, a

Virginia Corporation; DODSON

MANUFACTURING COMPANY; EAGLEPICHER INDUSTRIES, INCORPORATED;

EMPIRE ACE INSULATION

MANUFACTURING CORPORATION, a

New York Corporation; EMPIRE

ASBESTOS PRODUCTS, INCORPORATED, a

New York Corporation; FIBREBOARD

CORPORATION; FLINTKOTE COMPANY, a

Massachusetts Corporation; FOSTER

WHEELER CORPORATION, Successorin-Interests to Forty-Eight

Insulations Incorporated, a New

York Corporation; GAF

CORPORATION; GARLOCK; GENERAL

REFRACTORIES COMPANY, US

Refractories Division; GEORGIA

PACIFIC CORPORATION, a Georgia

Corporation; GRANT WILSON,

INCORPORATED, an Illinois

Corporation; GREFCO, INCORPORATED,

Minerals Division; H & A

CONSTRUCTION CORPORATION,

formerly known as Spraycraft, a

New York Corporation; HAMILTON

MATERIALS, INCORPORATED, a

California Corporation; H. K.

PORTER INCORPORATED; HIGHLAND

STUCCO & LIME PRODUCTS,

INCORPORATED; HOLLYWOOD STUCCO

PRODUCTS, INCORPORATED;

IN RE: MRRM, P.A.

HUXLEY DEVELOPMENT CORPORATION;

IPA SYSTEMS, INCORPORATED, a

Pennsylvania Corporation; J. W.

ROBERTS, LIMITED; JOHN

CRANE-HOUDAILLE, INCORPORATED,

formerly known as Crane Packing

Company; KEENE CORPORATION;

KAISER REFRACTORIES, a division of

Kaiser Aluminum and Chemical

Corporation; KAISER GYPSUM

COMPANY; LAC DAMAINTE DU

QUEBEC, LTEE; NICOLET,

INCORPORATED; OHIO LIME COMPANY;

OWENS-CORNING FIBERGLAS

CORPORATION; OWENS-ILLINOIS,

INCORPORATED; PITTSBURGH-CORNING

CORPORATION; PFIZER, INCORPORATED;

QUIGLEY COMPANY, INCORPORATED;

RAYMARK INDUSTRIES, INCORPORATED;

ROCK WOOL MANUFACTURING

COMPANY, INCORPORATED; RYDER

INDUSTRIES, INCORPORATED, a Texas

Corporation; SEALTITE TEXTILE

CORPORATION, a Delaware

Corporation; SOUTHERN TEXTILE, a

Delaware Corporation; SPECIAL

ASBESTOS COMPANY, INCORPORATED;

SPRAYON INSULATION & ACOUSTIC,

INCORPORATED; SPRAYED INSULATION

CORPORATION; SPRAYON RESEARCH

CORPORATION; STARR-DAVIS

COMPANY, INCORPORATED, a North

Carolina Corporation; STANDARD

INSULATIONS, INCORPORATED;

STANDARD ASBESTOS

MANUFACTURING AND INSULATING

COMPANY, a Missouri Corporation;

10

IN RE: MRRM, P.A.

TAF INTERNATIONAL, LIMITED,

formerly known as Turner Asbestos

Fibres, Limited; TURNER ASBESTOS

FIBRES, LIMITED, a Foreign

Corporation; TURNER & NEWALL,

LIMITED, a Foreign Corporation;

UNIROYAL INCORPORATED; USG

CORPORATION, a Delaware

Corporation; UNITED STATES

MINERAL PRODUCTS COMPANY;

VERMONT ASBESTOS GROUP, a

Vermont Corporation; VIMASCO

CORPORATION; WESTERN MINERAL

PRODUCTS COMPANY, INCORPORATED;

H. K. PORTER ASBESTOS TRUST,

Defendants.

BASIL H. THOMSON, JR.; JOHN G.

HILL, JR.; ROBERT L. POTTS; EARL V.

BROWN; ESTELLE A. FISHBEIN;

BEVERLY E. LEDBETTER; DENNIS C.

HART,

Amicus Curiae,

HIGHLANDS INSURANCE COMPANY;

AMERICAN REINSURANCE COMPANY;

CONCORDIA COLLEGE; FURMAN

UNIVERSITY; CLAFLIN UNIVERSITY;

NEWBERRY COLLEGE,

Movants.

Appeals from the United States District Court

for the District of South Carolina, at Charleston.

Sol Blatt, Jr., Senior District Judge.

(CA-87-1860-2-8)

IN RE: MRRM, P.A.

11

Argued: March 16, 2005

Decided: April 18, 2005

Before WILKINSON, NIEMEYER, and MOTZ, Circuit Judges.

Affirmed by published opinion. Judge Wilkinson wrote the opinion,

in which Judge Niemeyer and Judge Motz joined.

COUNSEL

ARGUED: William Howell Morrison, MOORE & VAN ALLEN,

P.L.L.C., Charleston, South Carolina, for Appellant. Edward James

Westbrook, RICHARDSON, PATRICK, WESTBROOK & BRICKMAN, L.L.C., Mt. Pleasant, South Carolina, for Appellee. ON

BRIEF: Frederick C. Baker, MOTLEY RICE, L.L.C., Mt. Pleasant,

South Carolina, for Appellant.

OPINION

WILKINSON, Circuit Judge:

In this case we consider the appropriate allocation of a class action

attorney fee award among three law firms. The fee award itself was

previously approved and is not in controversy. Instead, one firm has

appealed the district courts distribution of that award, essentially

claiming that its share was insufficient.

We affirm, albeit with reservations about the conclusory nature of

the district courts order allocating the fee.

I.

For well over a decade, class counsel litigated and eventually set-

12

IN RE: MRRM, P.A.

tled an asbestos-related nationwide class action lawsuit on behalf of

colleges and universities. See Cent. Wesleyan Coll. v. W.R. Grace &

Co., 6 F.3d 177 (4th Cir. 1993) (affirming conditional certification of

the class). Class counsel were the firms Ness, Motley, Loadholt, Richardson & Poole ("Ness Motley")1 and Speights & Runyan. The eventual common fund totaled approximately $70 million.

In December 2001, class counsel petitioned the district court for

fees. They requested 28.75% of the cash recovery, amounting to

about $20 million. The district court approved the entire request, after

a thorough application of Barber v. Kimbrells, Inc., 577 F.2d 216,

226 (4th Cir. 1978) (adopting the twelve fee-shifting factors of Johnson v. Georgia Highway Express, Inc., 488 F.2d 714 (5th Cir. 1974)).

The Barber factors include such considerations as the time and labor

required, the novelty or difficulty of the issues litigated, customary

fees in similar situations, and the quality of the results involved. The

district court thoroughly examined each of them. See JA 758-70.

The court acknowledged that the fee was being awarded even

though the work had not been completed. Indeed, the administration

of the common fund continues to this day. The district judge emphasized that "it is important to note that there is still much work to be

done in this case." The fee award was thus predicated on class counsels duty to honor its obligations to the class.

Subsequent to the fee award, Edward Westbrook, a Ness Motley

partner, distributed 60% of the fee 50% to Ness Motley and 10%

to Speights & Runyan. The remaining 40% was withheld due to difficulties in determining its allocation. Westbrook was in a position to

do this because he had exercised primary leadership over the case

since its inception. However, in February 2002, several shareholders

including Westbrook left Ness Motley to form the new firm of

Richardson Patrick Westbook & Brickman ("RPWB"). The district

court, recognizing Westbrooks role, agreed that he and his new firm

1

Between December 2001 and the present the times most relevant

to this case Ness Motley has used a variety of different names.

Although it is currently known as MRRM, P.A., as shown in the caption

of this case, to minimize confusion we will refer to it throughout as

"Ness Motley."

IN RE: MRRM, P.A.

13

should continue as co-lead class counsel. Thus, there were now three

firms involved in the settlement, the administration, or both: Ness

Motley, Speights & Runyan, and RPWB.

In October 2003, following unsuccessful attempts among the three

firms to allocate the remaining 40% of the award, Westbrook petitioned the district court to divide it. On May 27, 2004, the district

court held oral argument for this purpose. It began by inviting Westbrook and Daniel Speights to meet privately in the courthouse library

and emerge with a recommendation. Unsurprisingly, an attorney for

Ness Motley objected to being excluded from this meeting. Westbrook and Speights nonetheless met and agreed that the entire fee be

divided such that, out of the total, Ness Motley receive 51%, Speights

& Runyan receive 34%, and RPWB receive 15%. The court allowed

Ness Motley an opportunity to respond with its own proposal

namely, that it deserved the entire remaining unallocated fee (or 90%

of the total), that Speights & Runyan should receive only the 10% that

it already had been given, and RPWB deserved nothing at all.

Roughly half-way through the hearing, the district judge commented that "Im impressed by the I can visualize trying to pay out

this money to all these colleges, that job is going to be one terrific job,

I understand that." During oral argument before the court of appeals,

in fact, counsel continually repeated this very sentence in attempting

to assure us that adequate reasons for the allocation existed. At the

end of the district court hearing, without having explained what it was

that particularly persuaded him, the judge stated:

Well, its got to end. The whole thing has got to end. Ive

listened to the argument, the arguments have been convincing. Im going to write a very short order, based on the arguments this day heard. And I think that the arguments have

caused me to change my mind somewhat.

The judge then stated that his allocation was based on $20 million:

Im going to award Speights and Runyan six million five;

[Ness Motley], eleven million; and [RPWB], two million

five. Now, thats it. Im going to put that in the order, based

14

IN RE: MRRM, P.A.

on a twenty million dollar fee, and direct the attorneys to

work out the mechanics.

He made no further explanation, but before departing the bench, the

judge acknowledged "that there isnt anybody particularly happy with

the division, but I guess you cant satisfy everybody. If there were a

way to do that, Id like to do it. But after listening to the arguments,

I think thats a reasonable division."

On June 28, 2004, the district court entered an order reflecting this

allocation, "[f]or the reasons stated at hearing, and in consideration of

the applicable law and facts . . . ." The court stated that RPWB was

to be compensated for its work, as were the other firms. The district

court alluded generally to this point in a footnote in its order.2

Ness Motley timely appealed. We review fee allocations, like the

initial award of an attorney fee, under an abuse of discretion standard

of review. Barber, 577 F.2d at 226. Because Ness Motley has given

us no reason sufficient to reverse under this deferential standard, we

affirm, albeit with reservation.

II.

Ness Motley raises substantive and procedural challenges to the

allocation in favor of RPWB.

A.

Ness Motley believes that the district court erred in awarding

RPWB any fees at all, and that even if RPWB is entitled to some fees,

the district court awarded it too great a share. Ness Motley emphasizes that the fee has already been awarded, explicitly conditioned on

counsel continuing to administer the common fund and to meet all

2

The footnote explained: "This amount is awarded to cover the work

the Richardson, Patrick firm must expend, independent of the former

Ness, Motley firm, to resolve all remaining issues regarding December

21, 2001 Settlement Fund. This includes the costs which may be incurred

to research and finalize a potential re-calculation of the total attorneys

fees award due to an unforeseen tax issue."

IN RE: MRRM, P.A.

15

other obligations class counsel owes to the class. According to Ness

Motley, RPWB, largely composed of individuals who have already

been paid from Ness Motleys share of the fee (and who, consistent

with their separation agreement, will receive a portion of any future

allocations), should not be paid "twice." Had Westbrook not withheld

40% of the fee before leaving Ness Motley, it says, there would be

no more money for RPWB to claim.

We are not persuaded that any of these arguments require that, as

a matter of law, RPWB receive no part of the fee. RPWB continues

to perform significant services on behalf of the class. The allocation

does not pay anyone "twice." The simple fact that the case now

involves three parties and the members of one party were formerly

employed by another does not render their continued remuneration

objectionable. The allocation instead simply adjusts the payment

among the parties to reflect the efforts of each. We find no abuse of

discretion in including RPWB.

B.

We are more concerned, however, about the procedural question

Ness Motley has raised. While we agree that RPWB is entitled to

some portion of the fee, the district court has made it difficult for us

to ascertain why RPWB has been given the particular amount that the

court found appropriate. On this basis, Ness Motley urges us to vacate

the allocation and remand for application of the Barber factors.

We fully recognize that the district courts close familiarity with

this case extends to the issue of attorney fees. Indeed, the district

court demonstrated such familiarity in its thorough application of the

Barber factors to award attorney fees in the first place. For this reason, we cannot accept Ness Motleys invitation to impose Barber

once more. Many of the Barber factors are inapplicable to questions

of how a fee should be divided. Moreover, when, as here, Barber has

clearly been meticulously applied and a significant portion of the

resulting fee divided without objection, a rule requiring reapplication

of Barber for every subsequent dispute would eviscerate the abuse of

discretion standard and encourage vexatious application to the court.

In declining to require district courts to apply Barber in this context, we join other courts of appeals which have approved fee alloca-

16

IN RE: MRRM, P.A.

tions among co-counsel for reasons that did not involve the Barber

factors. See, e.g., In re FPI/Agretech Sec. Litig., 105 F.3d 469 (9th

Cir. 1997); Smiley v. Sincoff, 958 F.2d 498 (2d Cir. 1992). Yet while

these courts did not require anything like reapplication of the Barber

factors, neither were they willing to accept an allocation without reasons spelled out by the district court. In Smiley, the Ninth Circuit was

able to quote at length from the district courts allocation order. Id.

at 502. FPI/Agretech, in turn, repeated that, in the allocation context,

"[s]o long as the district court provides a concise but clear explanation of its reasons, and those reasons are supported by the record, the

reviewing court should accept its decision." FPI/Agretech, 105 F.3d

at 473 (quoting id.).

Thus, the district courts familiarity with the case should have led

to a greater precision and effort in explaining fee allocation decisions

than the district court provided, especially considering the substantial

sums involved and the somewhat speculative nature of the future services. Without precise reasons from the district court, appellate courts

are in danger of being left without any real basis to review the decision. See James v. Jacobson, 6 F.3d 233, 239 (4th Cir. 1993). The district court stated that it found the allocation to be "reasonable," but

declined to offer us much basis as to why this was so.

We nonetheless decline to remand. A charitable construction of

comments from the bench especially the recognition that the continuing administration of the fund is "one terrific job" might link

the eventual allocation to the fact that RPWB has substantial continuing obligations to the class. Those obligations were explained in great

detail by counsel, both below and on appeal, and the courts comments hint that this explanation of the work was what influenced its

decision. For instance, RPWB must guard millions of dollars of the

classs fund that have been jeopardized by IRS action. It must protect

part of the settlement itself particularly the $25 million W.R.

Grace rebate within the confines of bankruptcy law. And even

assuming away any threat to the class recovery itself, the process of

distributing the common fund in a manner that satisfies the members

of the class and the Settlement Advisory Committee will require

energy, patience, and diplomacy.

We recognize that this circuit has not heretofore given specific

instructions to district courts as to the nature of their discretion in this

IN RE: MRRM, P.A.

17

precise context. Although we do not anticipate from district courts a

full-blown Barber analysis when faced with issues of this sort, something more than threadbare justification is to be expected when a fee

allocation involves large sums for future services. In short, district

courts should explain in clear terms, even if only briefly, the reasons

that an allocation this substantial is justified. We affirm this allocation, because the circumstances of this case have allowed us to surmise the basis for the exercise of the district courts discretion and

because appellant has given us no real reason to believe that this discretion has been abused.

III.

For the foregoing reasons, the judgment of the district court is

AFFIRMED.

Potrebbero piacerti anche

- In Re Natural Gas Royalties, 562 F.3d 1032, 10th Cir. (2009)Documento32 pagineIn Re Natural Gas Royalties, 562 F.3d 1032, 10th Cir. (2009)Scribd Government DocsNessuna valutazione finora

- Lisa Covington v. MCIC, Incorporated, 4th Cir. (2016)Documento6 pagineLisa Covington v. MCIC, Incorporated, 4th Cir. (2016)Scribd Government DocsNessuna valutazione finora

- United States Court of Appeals: PublishedDocumento44 pagineUnited States Court of Appeals: PublishedScribd Government DocsNessuna valutazione finora

- Joyce Barlow v. Colgate Palmolive Company, 4th Cir. (2014)Documento3 pagineJoyce Barlow v. Colgate Palmolive Company, 4th Cir. (2014)Scribd Government DocsNessuna valutazione finora

- UnpublishedDocumento12 pagineUnpublishedScribd Government DocsNessuna valutazione finora

- Vietnam Assn, Court of District deDocumento233 pagineVietnam Assn, Court of District deKien TranNessuna valutazione finora

- 5 F.3d 51 24 Envtl. L. Rep. 20,036Documento14 pagine5 F.3d 51 24 Envtl. L. Rep. 20,036Scribd Government DocsNessuna valutazione finora

- Your Wedding, Your Way: The Modern Couple's Guide to Destination Elopements, Courthouse Ceremonies, Intimate Dinner Parties, and Other Nontraditional NuptialsDa EverandYour Wedding, Your Way: The Modern Couple's Guide to Destination Elopements, Courthouse Ceremonies, Intimate Dinner Parties, and Other Nontraditional NuptialsNessuna valutazione finora

- FinalfaDocumento330 pagineFinalfarajeshdnisNessuna valutazione finora

- Adventure Resources v. Holland, 4th Cir. (1998)Documento25 pagineAdventure Resources v. Holland, 4th Cir. (1998)Scribd Government DocsNessuna valutazione finora

- NYS Dem Committee 2013 13734 0Documento39 pagineNYS Dem Committee 2013 13734 0Nick ReismanNessuna valutazione finora

- In Re Financial Oversight & MGMT BD For Puerto Rico v. Cooperative de Ahorro y Credito Abraham Rosa, No. 22-1119P (1st Cir. July 18, 2022) ADocumento31 pagineIn Re Financial Oversight & MGMT BD For Puerto Rico v. Cooperative de Ahorro y Credito Abraham Rosa, No. 22-1119P (1st Cir. July 18, 2022) ARHTNessuna valutazione finora

- In Re Fin. Oversight & MGMT Bd. For Puerto Rico v. Cooperativa de Ahorro y Credito Abraham Rosa, No. 22-1092 (1st Cir. Aug. 22, 2023)Documento36 pagineIn Re Fin. Oversight & MGMT Bd. For Puerto Rico v. Cooperativa de Ahorro y Credito Abraham Rosa, No. 22-1092 (1st Cir. Aug. 22, 2023)RHTNessuna valutazione finora

- Landmark Land Car v. Barton, 4th Cir. (1996)Documento28 pagineLandmark Land Car v. Barton, 4th Cir. (1996)Scribd Government DocsNessuna valutazione finora

- Snyder Et Al vs. Acord Et AlDocumento311 pagineSnyder Et Al vs. Acord Et AlColoradoanNessuna valutazione finora

- Published United States Court of Appeals For The Fourth CircuitDocumento15 paginePublished United States Court of Appeals For The Fourth CircuitScribd Government DocsNessuna valutazione finora

- Smuckers V River West Brands ComplaintDocumento19 pagineSmuckers V River West Brands Complaintpropertyintangible100% (1)

- Following Is A List of S&P500 Companies Who Have Arthur Andersen As Auditor (Source:-Bloomberg 14/02/2002)Documento8 pagineFollowing Is A List of S&P500 Companies Who Have Arthur Andersen As Auditor (Source:-Bloomberg 14/02/2002)Anonymous lsKrEIKvrNessuna valutazione finora

- Accrued Financial v. Prime Retail Inc, 4th Cir. (2002)Documento27 pagineAccrued Financial v. Prime Retail Inc, 4th Cir. (2002)Scribd Government DocsNessuna valutazione finora

- Air Products' Delaware Lawsuit Against AirgasDocumento18 pagineAir Products' Delaware Lawsuit Against AirgasDealBookNessuna valutazione finora

- PetroinvlistDocumento1 paginaPetroinvlistanooshkzNessuna valutazione finora

- LA Equipment Leak Data: 35 Facilities' Fugitive EmissionsDocumento1 paginaLA Equipment Leak Data: 35 Facilities' Fugitive EmissionscalvinabsNessuna valutazione finora

- City of Cabuyao Toptaxpayers 2022Documento4 pagineCity of Cabuyao Toptaxpayers 2022Anne YasuzukaNessuna valutazione finora

- Top 100 Contractors Report Fiscal Year 2010Documento156 pagineTop 100 Contractors Report Fiscal Year 2010Ansh ShuklaNessuna valutazione finora

- Stock CodesDocumento19 pagineStock CodesEloisa PascualNessuna valutazione finora

- Sherman Antitrust ActDocumento1 paginaSherman Antitrust ActRaul Enrique TrejoNessuna valutazione finora

- Certificate of ServiceDocumento2 pagineCertificate of ServiceChapter 11 DocketsNessuna valutazione finora

- Lipsky Vs Range 2011Documento46 pagineLipsky Vs Range 2011tom_fowler7438Nessuna valutazione finora

- OCW23Pre-reg ListDocumento16 pagineOCW23Pre-reg Listtanwarhimanshi00Nessuna valutazione finora

- Declaration of Jonathan S Green of Miller, Canfield, Paddock & Stone, P.L.C., Pursuant To Federal Rule of Bankruptcy Procedure 2019Documento3 pagineDeclaration of Jonathan S Green of Miller, Canfield, Paddock & Stone, P.L.C., Pursuant To Federal Rule of Bankruptcy Procedure 2019Chapter 11 DocketsNessuna valutazione finora

- UssymsDocumento149 pagineUssymsmgsalesNessuna valutazione finora

- 29 Usa CompanyDocumento29 pagine29 Usa CompanysalesNessuna valutazione finora

- United States Court of Appeals, Fifth CircuitDocumento44 pagineUnited States Court of Appeals, Fifth CircuitScribd Government DocsNessuna valutazione finora

- Joc Top 100 ExportersDocumento6 pagineJoc Top 100 Exportershnt001Nessuna valutazione finora

- Food TraderDocumento492 pagineFood TraderLarah BuhaweNessuna valutazione finora

- RockfellerDocumento12 pagineRockfellerRajarshi MukherjeeNessuna valutazione finora

- On Rehearing en Banc PublishedDocumento40 pagineOn Rehearing en Banc PublishedScribd Government DocsNessuna valutazione finora

- Jhon D RockefellerDocumento15 pagineJhon D RockefellerDaniel CarvajalNessuna valutazione finora

- Top US government vendors by obligationsDocumento152 pagineTop US government vendors by obligationsFhreewayNessuna valutazione finora

- NEW CINGULAR WIRELESS HEADQUARTERS LLC Et Al v. MARSH & MCLENNAN COMPANIES INC ComplaintDocumento88 pagineNEW CINGULAR WIRELESS HEADQUARTERS LLC Et Al v. MARSH & MCLENNAN COMPANIES INC ComplaintACELitigationWatchNessuna valutazione finora

- United States Court of Appeals, Eleventh CircuitDocumento2 pagineUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNessuna valutazione finora

- EmployersDocumento822 pagineEmployersuhlsys0% (1)

- UnpublishedDocumento24 pagineUnpublishedScribd Government DocsNessuna valutazione finora

- Publish United States Court of Appeals For The Tenth CircuitDocumento297 paginePublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNessuna valutazione finora

- Gadsden Water 3m LawsuitDocumento16 pagineGadsden Water 3m LawsuitJeff WyattNessuna valutazione finora

- Recriutment and Selection - P&GDocumento28 pagineRecriutment and Selection - P&GRuchita Desai90% (21)

- Republic Vs SandiganbayanDocumento10 pagineRepublic Vs SandiganbayanSu Kings AbetoNessuna valutazione finora

- Unpublished United States Court of Appeals For The Fourth CircuitDocumento19 pagineUnpublished United States Court of Appeals For The Fourth CircuitScribd Government DocsNessuna valutazione finora

- February 2013 IcsslDocumento63 pagineFebruary 2013 IcsslMichael AllenNessuna valutazione finora

- In Re Corn Derivatives Antitrust Litigation (MDL 414) - Appeal of JOHN E. KOERNER & CO., INC., Imperial Products Corporation, and Pan-O-Gold, IncDocumento14 pagineIn Re Corn Derivatives Antitrust Litigation (MDL 414) - Appeal of JOHN E. KOERNER & CO., INC., Imperial Products Corporation, and Pan-O-Gold, IncScribd Government DocsNessuna valutazione finora

- Moción para Solicitar Paralización Del PDADocumento106 pagineMoción para Solicitar Paralización Del PDATaiyania K. Rosado PagánNessuna valutazione finora

- Gadsden Water Works and Sewer Board LawsuitDocumento16 pagineGadsden Water Works and Sewer Board LawsuitBen CulpepperNessuna valutazione finora

- EQT Production Company v. Robert Adair, 4th Cir. (2014)Documento56 pagineEQT Production Company v. Robert Adair, 4th Cir. (2014)Scribd Government DocsNessuna valutazione finora

- BPI Securities Corporation - Symbol GuideDocumento7 pagineBPI Securities Corporation - Symbol Guidescrib07Nessuna valutazione finora

- G.R. No. 166859 Entitled Republic of The Philippines vs. Sandiganbayan (E-SCRA)Documento267 pagineG.R. No. 166859 Entitled Republic of The Philippines vs. Sandiganbayan (E-SCRA)Rhei BarbaNessuna valutazione finora

- Abhay Company Law LLMDocumento15 pagineAbhay Company Law LLMabhay kaulNessuna valutazione finora

- Membership List: Russell 3000® IndexDocumento33 pagineMembership List: Russell 3000® IndexJordi Oller SánchezNessuna valutazione finora

- 101 Ways to Score Higher on your NCLEX: What You Need to Know About the National Council Licensure Examination Explained SimplyDa Everand101 Ways to Score Higher on your NCLEX: What You Need to Know About the National Council Licensure Examination Explained SimplyValutazione: 3.5 su 5 stelle3.5/5 (10)

- How to win Fortune: and The Gospel of WealthDa EverandHow to win Fortune: and The Gospel of WealthValutazione: 5 su 5 stelle5/5 (1)

- United States v. Garcia-Damian, 10th Cir. (2017)Documento9 pagineUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Kieffer, 10th Cir. (2017)Documento20 pagineUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Payn v. Kelley, 10th Cir. (2017)Documento8 paginePayn v. Kelley, 10th Cir. (2017)Scribd Government Docs50% (2)

- Wilson v. Dowling, 10th Cir. (2017)Documento5 pagineWilson v. Dowling, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Documento100 pagineHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Olden, 10th Cir. (2017)Documento4 pagineUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Coyle v. Jackson, 10th Cir. (2017)Documento7 pagineCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Brown v. Shoe, 10th Cir. (2017)Documento6 pagineBrown v. Shoe, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Documento21 pagineCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Greene v. Tennessee Board, 10th Cir. (2017)Documento2 pagineGreene v. Tennessee Board, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Documento22 pagineConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Apodaca v. Raemisch, 10th Cir. (2017)Documento15 pagineApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Kearn, 10th Cir. (2017)Documento25 pagineUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Roberson, 10th Cir. (2017)Documento50 pagineUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Pecha v. Lake, 10th Cir. (2017)Documento25 paginePecha v. Lake, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Magnan, 10th Cir. (2017)Documento27 pagineUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Publish United States Court of Appeals For The Tenth CircuitDocumento10 paginePublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNessuna valutazione finora

- Publish United States Court of Appeals For The Tenth CircuitDocumento24 paginePublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNessuna valutazione finora

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Documento9 pagineNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Voog, 10th Cir. (2017)Documento5 pagineUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Webb v. Allbaugh, 10th Cir. (2017)Documento18 pagineWebb v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Publish United States Court of Appeals For The Tenth CircuitDocumento14 paginePublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Windom, 10th Cir. (2017)Documento25 pagineUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Henderson, 10th Cir. (2017)Documento2 pagineUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Northglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Documento10 pagineNorthglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Kundo, 10th Cir. (2017)Documento7 pagineUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Muhtorov, 10th Cir. (2017)Documento15 pagineUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- United States v. Magnan, 10th Cir. (2017)Documento4 pagineUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Publish United States Court of Appeals For The Tenth CircuitDocumento17 paginePublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNessuna valutazione finora

- Pledger v. Russell, 10th Cir. (2017)Documento5 paginePledger v. Russell, 10th Cir. (2017)Scribd Government DocsNessuna valutazione finora

- Case Review James GilbertDocumento4 pagineCase Review James Gilbertapi-298716765Nessuna valutazione finora

- Vs. Court of Appeals, Ricardo Bagtas and Miguel: DecisionDocumento10 pagineVs. Court of Appeals, Ricardo Bagtas and Miguel: DecisionMaria ThereseNessuna valutazione finora

- Reply For Quo WarrantoDocumento5 pagineReply For Quo Warrantobhem silverioNessuna valutazione finora

- Valencia v. Court of AppealsDocumento6 pagineValencia v. Court of AppealsRubyNessuna valutazione finora

- 03 HD202 Family Life CycleDocumento3 pagine03 HD202 Family Life CycleBarlo Yñigo Alcantara0% (1)

- Overcoming Challenges in Civic EducationThe title "OVERCOMING CHALLENGES IN CIVIC EDUCATIONDocumento68 pagineOvercoming Challenges in Civic EducationThe title "OVERCOMING CHALLENGES IN CIVIC EDUCATIONDøps Maløne100% (11)

- Sahara Private PlacementDocumento26 pagineSahara Private PlacementRahul MishraNessuna valutazione finora

- MMDA Billboard Clearance Application FormDocumento1 paginaMMDA Billboard Clearance Application FormLenin Rey PolonNessuna valutazione finora

- High Court Ruling: Andrews V ANZDocumento2 pagineHigh Court Ruling: Andrews V ANZABC News OnlineNessuna valutazione finora

- Curriculum Map EthicsDocumento6 pagineCurriculum Map Ethicswena grace lahoylahoyNessuna valutazione finora

- Causation in Tort LawDocumento16 pagineCausation in Tort LawAayush KumarNessuna valutazione finora

- Ethics Case StudyDocumento11 pagineEthics Case StudyNamoMeenaNessuna valutazione finora

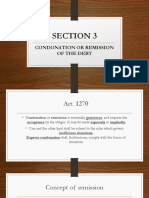

- Section 3: Condonation or Remission of The DebtDocumento19 pagineSection 3: Condonation or Remission of The DebtRomar TaroyNessuna valutazione finora

- Sample 492376Documento39 pagineSample 492376NPScribAccountNessuna valutazione finora

- Barnett V Dunn, Brown, Bowen, Kelley, EACDocumento132 pagineBarnett V Dunn, Brown, Bowen, Kelley, EACPamela BarnettNessuna valutazione finora

- NHA V BasaDocumento3 pagineNHA V BasaKayeNessuna valutazione finora

- Module in Negotiable Instrument LawDocumento10 pagineModule in Negotiable Instrument LawKheen AndalNessuna valutazione finora

- Cesar J. Labetoria JRDocumento13 pagineCesar J. Labetoria JRJudeRamosNessuna valutazione finora

- REPORT and CASE DIGEST ART. 21 OF THE CIVIL CODE OF THE PHIL. Persons & Family RelationsDocumento2 pagineREPORT and CASE DIGEST ART. 21 OF THE CIVIL CODE OF THE PHIL. Persons & Family RelationsCristinaNessuna valutazione finora

- Annotated BibliographyDocumento5 pagineAnnotated Bibliographyapi-302719126Nessuna valutazione finora

- The Plight of Rosario and Other Exploited ChildrenDocumento5 pagineThe Plight of Rosario and Other Exploited ChildrenLansingNessuna valutazione finora

- Motion For Leave To File DemurrerDocumento2 pagineMotion For Leave To File DemurrerJANNNessuna valutazione finora

- Affidavit of Discrepancy-Date of BirthDocumento2 pagineAffidavit of Discrepancy-Date of BirthNancy96% (24)

- Didhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersDocumento20 pagineDidhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersAndré Le RouxNessuna valutazione finora

- Application For Enrolment: 1 2 3 4 A B C DDocumento2 pagineApplication For Enrolment: 1 2 3 4 A B C DArnold MukaratiNessuna valutazione finora

- LUTZ v. ARANETA 98 PHIL. 145 December 22, 1955 (Case Digest)Documento8 pagineLUTZ v. ARANETA 98 PHIL. 145 December 22, 1955 (Case Digest)sonskiNessuna valutazione finora

- Dr. Patricia Schloesser v. The Kansas Department of Health and Environment and Stanley C. Grant, 991 F.2d 806, 10th Cir. (1993)Documento4 pagineDr. Patricia Schloesser v. The Kansas Department of Health and Environment and Stanley C. Grant, 991 F.2d 806, 10th Cir. (1993)Scribd Government Docs100% (1)

- Oral EvidenceDocumento10 pagineOral EvidenceDhriti Sharma100% (1)

- Alewine V Windsor Green Et AlDocumento20 pagineAlewine V Windsor Green Et AlABC15 NewsNessuna valutazione finora