Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Service Tax Rate Chart 01.06.2015

Caricato da

ashokkumar1992ashokDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Service Tax Rate Chart 01.06.2015

Caricato da

ashokkumar1992ashokCopyright:

Formati disponibili

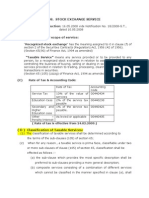

Service Tax Rate Chart wef from 01.06.2015 (www.simpletaxindia.

net)

Sr

No.

Description of taxable service

Abatement

%

Taxable

%

Effective

Rate %

100

14.00

90

70

70

10

30

30

1.400

4.200

4.200

A

B

1

2

3

All Services Not Covered in B-D

Services Covered Under Abatement

Financial leasing including hire purchase

Transport of goods by rail

Transport of passengers, by rail

Bundled service by way of supply of food or

any other article of human consumption or

any drink, in a premises ( including hotel,

convention center, club, pandal, shamiana or

any other place, specially arranged for

organizing a function) together with renting of

such premises

Transport of passengers by air, with or without

accompanied belongings (Only for Economy

class)

30

70

9.800

60

40

5.600

Other than Economy Class (means business

class /First class)

40

60

8.400

Renting of hotels, inns, guest houses, clubs,

campsites or other commercial places meant

for residential or lodging purposes.

40

60

8.400

Services of goods transport agency in relation

to transportation of goods.

70

30

4.200

8

9

Services provided in relation to chit

Renting of any motor vehicle designed to

carry passengers Including Radio taxi,

0

60

100

40

14.000

5.600

10

11

Transport of goods in a vessel

Services by a tour operator in relation to,(i) a package tour

70

75

30

25

4.200

3.500

(ii) a tour, if the tour operator is providing

services solely of arranging or booking

accommodation for any person in relation to a

tour

(iii) any services other than specified at (i) and

(ii) above.

Construction of a complex, building, civil

structure or a part thereof, intended for a sale

to a buyer, wholly or partly except where

entire consideration is received after issuance

of completion certificate by the competent

authority

(i)for residential unit having carpet area upto

2000 square feet or where the amount charged

is less than rupees one crore;

90

10

1.400

60

40

5.600

75

25

3.500

(ii) for other than the (i) above.

70

30

4.200

12

Valuation under rules

1 Service portion on execution of Works

Contract:

Value of service excluding material

Original Work

Repairs and Maintenance of any goods

Maintenance, Repairing, Completion Finishing of

immovable property

2 Restaurant Services

3 Outdoor Catering Services

100

40

70

70

14.000

5.600

9.800

9.800

40

60

5.600

8.400

D Increase in rates of service tax (in case of Composition scheme) for service provided by Air Travel agent,

Insurance service, Forex (money changing service) and service provided by lottery distributor and selling

agent.

Air Travel Agent:

In the case of

Domestic bookings of passage for

travel by air

International bookings of passage for

travel by air

Insurance Service:

Period

First year

Subsequent Year

Current Rate

0.6% of the basic fare

New Rate

0.7% of the basic fare

1.2% of the basic fare

1.4% of the basic fare

Current Rate

3% of the gross amount of

premium charged

1.5% of the gross amount of

premium charged

New Rate

3.5% of the gross amount of

premium charged

1.75% of the gross amount of

premium charged

Money Changing:

For an amount

Upto Rs.100,000

Current Rate

0.12% of the gross amount of currency

exchanged or Rs.30 whichever is

higher

New Rate

0.14% of the gross amount of

currency exchanged or Rs.35

whichever is higher

Exceeding Rs.1,00,000 and

upto Rs.10, 00, 000

Rs.120 + 0.06% of the (gross amount

of currency exchanged-Rs.1,00,000)

Exceeding Rs.10,00,000

Rs.660 + 0.012% of the (gross amount

of currency exchanged-Rs.10,00,000)

or Rs.6,000/- whichever is lower

Rs.140 + 0.07% of the (gross

amount of currency exchangedRs.1,00,000)

Rs.770 + 0.014% of the (gross

amount of currency exchanged Rs.10,00,000) or Rs.7,000/whichever is lower

Service provided by lottery distributor and selling agent:

Particulars

Current Rate

Where the guaranteed

Rs.7000/- on every Rs.10 Lakh (or part

lottery prize payout is >

of Rs.10 Lakh) of aggregate face value

80%

of lottery tickets printed by the

organising state for a draw.

Where the guaranteed

Rs.11000/- on every Rs.10 Lakh (or

lottery prize payout is <

part of Rs.10 Lakh) of aggregate face

80%

value of lottery tickets printed by the

organising state for a draw.

New Rate

Rs.8,200/- on every Rs.10 Lakh (or

part of Rs.10 Lakh) of aggregate face

value of lottery tickets printed by the

organising state for a draw.

Rs.12800/- on every Rs.10 Lakh (or

part of Rs.10 Lakh) of aggregate face

value of lottery tickets printed by the

organising state for a draw.

Note :

1. Abatement as shown in "B" above are subject to conditions ,which can be checked

from abatement Rate chart Here

2. Valuation of Works Contract is subject to few conditions which can be checked Here

3. Check Updated Version last updated 31.05.15(if any)

Changes in service Tax (Posts By CA Bimal Jain)

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

New Taxable Services from 01.06.2015

Increase in Service Tax rate to 14% Other Service Tax-CENVAT changes and Impact wef 01.06.2015

Changes in Central Excise and the Customs wef 14.05.2015 as Finance Bill, 2015 enacted

Service tax rate of 14% shall come into effect only from a date to be notified Finance Bill, 2015

enacted

Rajya Sabha clears the Finance Bill, 2015 as approved by Lok Sabha

Dealer Registration NOT mandatory for transit sale :CBEC clarifies

Education Cess & SHEC can be used for payment of Excise Duty by Manufacturers

Key Takeaways of the Foreign Trade Policy, 2015-2020

UNION BUDGET 2015: CHANGES IN THE CENVAT CREDIT RULES, 2004 AND ITS IMPACT

INCREASE IN TIME LIMIT FOR AVAILING CENVAT CREDIT ON INPUT SERVICES AND

INPUTS WHETHER APPLICABLE ON INVOICES ISSUED PRIOR TO MARCH 1, 2015?

INTEREST ON WRONG AVAILMENT OF CENVAT CREDIT BUT NOT UTILIZED :BUDGET

2015 CHANGES

DOUBTFUL FATE OF REFUND ON DEEMED EXPORTS

TAXABILITY OF NEWLY MADE TAXABLE SERVICES

UNION BUDGET 2015: CHANGES IN SERVICE TAX WITH EFFECTIVE DATES AND ITS

IMPACT

SERVICE TAX CHANGES APPLICABLE FROM THE DATE TO BE NOTIFIED AFTER DATE

OF ENACTMENT OF FINANCE BILL2015

Service Tax changes effective from 01.04.2015

SERVICE TAX CHANGES EFFECTIVE FROM 01.03.2015

HIKE IN RATE OF SERVICE TAX OPEN ISSUES

IMPACT OF PARTIAL REVERSE CHARGE TO FULL REVERSE CHARGE ON MANPOWER

SUPPLY AND SECURITY SERVICES IN TRANSITION PERIOD

Subsequent reversal of Cenvat credit initially availed but not utilized, tantamount to non-availment of

Cenvat credit

Changes under Service Tax in Budget 2015 detailed Analysis Clause by Clause By CA Bimal Jain &

Team

CHANGES IN EXCISE & CUSTOM RATES /ACT BUDGET -2015 CLAUSE BY CLAUSE BY CA

BIMAL JAIN

Potrebbero piacerti anche

- Fast-Track Tax Reform: Lessons from the MaldivesDa EverandFast-Track Tax Reform: Lessons from the MaldivesNessuna valutazione finora

- Finance Bill 2014Documento18 pagineFinance Bill 2014Tanvir Ahmed SyedNessuna valutazione finora

- Presentation On Service Tax AmendmentsDocumento19 paginePresentation On Service Tax AmendmentsSmriti KhannaNessuna valutazione finora

- Re: Service Tax-Change in CENVAT Credit Rules 2004Documento7 pagineRe: Service Tax-Change in CENVAT Credit Rules 2004Prakash BatwalNessuna valutazione finora

- Office of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002Documento11 pagineOffice of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002pmNessuna valutazione finora

- Tax Card 2013-14Documento1 paginaTax Card 2013-14Mudassir Ijaz100% (4)

- Service Tax: Some of The Major Services That Come Under The Ambit of Service Tax AreDocumento7 pagineService Tax: Some of The Major Services That Come Under The Ambit of Service Tax AreChetan ShivankarNessuna valutazione finora

- Indian Service TaxDocumento13 pagineIndian Service Taxanon_993677Nessuna valutazione finora

- C1 Indirect Taxes: Service TaxDocumento29 pagineC1 Indirect Taxes: Service TaxporzvtzoNessuna valutazione finora

- Tax RateDocumento10 pagineTax Rateusha chimariyaNessuna valutazione finora

- Budget 2012bookDocumento112 pagineBudget 2012bookSatish J. MakwanaNessuna valutazione finora

- Income Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationDocumento10 pagineIncome Tax: 2013-14 Brief Commentary On Major Proposed Amendments Salary Income TaxationUmar SulemanNessuna valutazione finora

- RMC 72-2004 PDFDocumento9 pagineRMC 72-2004 PDFBobby LockNessuna valutazione finora

- Cenvat Credit Rules, 2004 An Overview: Gopi Donthireddy Deputy CommissionerDocumento39 pagineCenvat Credit Rules, 2004 An Overview: Gopi Donthireddy Deputy CommissionerAnuragNessuna valutazione finora

- Tanzania Tax Guide 2012Documento14 pagineTanzania Tax Guide 2012Venkatesh GorurNessuna valutazione finora

- Stock Exchange Service (A) Date of IntroductionDocumento7 pagineStock Exchange Service (A) Date of Introductionarshad89057Nessuna valutazione finora

- q6 TaxDocumento13 pagineq6 Taxmajidpathan208Nessuna valutazione finora

- Composition Scheme SEC 10 - GST PDFDocumento20 pagineComposition Scheme SEC 10 - GST PDFTushar SinghNessuna valutazione finora

- 4/25/2016 21st MCMC 1Documento19 pagine4/25/2016 21st MCMC 1ShaniNessuna valutazione finora

- Group 6 Tax AssignmentDocumento14 pagineGroup 6 Tax Assignmentdianaowani2Nessuna valutazione finora

- Withholding Rules 2018Documento13 pagineWithholding Rules 2018Gul Muhammad NoonariNessuna valutazione finora

- Examples On Taxable Services A To L (Chapter 59)Documento6 pagineExamples On Taxable Services A To L (Chapter 59)kapilchandanNessuna valutazione finora

- Travel by Air ServicesDocumento15 pagineTravel by Air ServicesvijaykoratNessuna valutazione finora

- Service Tax: Aiaims Mms-ADocumento31 pagineService Tax: Aiaims Mms-AAbbas Haider NaqviNessuna valutazione finora

- Tax RTPDocumento40 pagineTax RTPlalaNessuna valutazione finora

- Withholding Tax Rates MalawiDocumento2 pagineWithholding Tax Rates Malawianraomca100% (1)

- RMC 72-04Documento9 pagineRMC 72-04ai0412Nessuna valutazione finora

- Withholding Tax at Source OR Expanded Withholding Tax (EWT)Documento32 pagineWithholding Tax at Source OR Expanded Withholding Tax (EWT)rickmortyNessuna valutazione finora

- Cenvat Credit PDFDocumento38 pagineCenvat Credit PDFsaumitra_mNessuna valutazione finora

- Chapter 9 - Service TaxDocumento5 pagineChapter 9 - Service TaxNURKHAIRUNNISANessuna valutazione finora

- Creditable Tax ReportDocumento131 pagineCreditable Tax ReportJieve Licca G. FanoNessuna valutazione finora

- 21 Useful Charts For Tax ComplianceDocumento24 pagine21 Useful Charts For Tax Compliancevrj1091Nessuna valutazione finora

- Withholding VAT Guideline 2015-2016Documento20 pagineWithholding VAT Guideline 2015-2016banglauserNessuna valutazione finora

- Current Tax Rates and Provisions NigeriaDocumento6 pagineCurrent Tax Rates and Provisions NigeriaVikky MehtaNessuna valutazione finora

- How Do You See It?: East Africa Quick Tax Guide 2012Documento11 pagineHow Do You See It?: East Africa Quick Tax Guide 2012Zimbo KigoNessuna valutazione finora

- Final Project On Service Tax 2017Documento21 pagineFinal Project On Service Tax 2017ansh patelNessuna valutazione finora

- Practice Tax AssDocumento14 paginePractice Tax AssAsfaw WossenNessuna valutazione finora

- 2011 Kenya Budget NewsletterDocumento9 pagine2011 Kenya Budget NewsletterImran OsmanNessuna valutazione finora

- Service Tax ProcedureDocumento23 pagineService Tax ProcedureBhavin ShahNessuna valutazione finora

- What Is Service Tax ?Documento15 pagineWhat Is Service Tax ?Nawab SahabNessuna valutazione finora

- Tax Icsi 2012Documento84 pagineTax Icsi 2012Janani ParameswaranNessuna valutazione finora

- Reverse Charge Mechanism by Bimal Jain Tax ExpertDocumento4 pagineReverse Charge Mechanism by Bimal Jain Tax ExpertYogesh ChaudhariNessuna valutazione finora

- Rates of Service TaxDocumento1 paginaRates of Service TaxRavi AroraNessuna valutazione finora

- Cpar Tax Problems ReviewerDocumento8 pagineCpar Tax Problems ReviewerAnonymous swtSOYwLrMNessuna valutazione finora

- Practice Note No.01/2019 Withholding Tax On Payment For Goods and Services As Per Income Tax Act, Cap 332Documento16 paginePractice Note No.01/2019 Withholding Tax On Payment For Goods and Services As Per Income Tax Act, Cap 332musaNessuna valutazione finora

- Important Changes Brought in by The Budget 2011Documento5 pagineImportant Changes Brought in by The Budget 2011harvinder thukralNessuna valutazione finora

- 1 Budget Impact 2012-13Documento5 pagine1 Budget Impact 2012-13Rajkamal TiwariNessuna valutazione finora

- FGFGDocumento13 pagineFGFGamir farooquiNessuna valutazione finora

- 7 Percentage TaxesDocumento38 pagine7 Percentage Taxesqaz qwertyNessuna valutazione finora

- New Payment Sections TemplateDocumento1 paginaNew Payment Sections Templateiaeste20078797Nessuna valutazione finora

- HBL Schedule of Bank ChargesDocumento25 pagineHBL Schedule of Bank ChargesJohn Wick60% (5)

- Changes in Income-Tax - 2020-21 PDFDocumento32 pagineChanges in Income-Tax - 2020-21 PDFmir makarim ahsanNessuna valutazione finora

- Ca Gaurav Gupta: 507 B, D-Mall, Netaji Subhash Place, Pitampura, Delhi - 110034 P: 011 - 32962487, 9811013940Documento5 pagineCa Gaurav Gupta: 507 B, D-Mall, Netaji Subhash Place, Pitampura, Delhi - 110034 P: 011 - 32962487, 9811013940Gaurav GuptaNessuna valutazione finora

- Cenvat - Overview: V S DateyDocumento33 pagineCenvat - Overview: V S Dateygsanjay84Nessuna valutazione finora

- Tax Updates For June 2012 ExamsDocumento37 pagineTax Updates For June 2012 ExamsShanky MalhotraNessuna valutazione finora

- Taxi & Limousine Service Revenues World Summary: Market Values & Financials by CountryDa EverandTaxi & Limousine Service Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- KNCCI Vihiga: enabling county revenue raising legislationDa EverandKNCCI Vihiga: enabling county revenue raising legislationNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionNessuna valutazione finora

- OM ZSE40A-IsE40A OMM0007EN-G Dig Pressure SwitchDocumento76 pagineOM ZSE40A-IsE40A OMM0007EN-G Dig Pressure SwitchcristiNessuna valutazione finora

- Chapter 3: The Partnership Section E: Fiduciary Duties 2. Codification of Fiduciary Duty and Contractual WaiverDocumento1 paginaChapter 3: The Partnership Section E: Fiduciary Duties 2. Codification of Fiduciary Duty and Contractual WaiverkraftroundedNessuna valutazione finora

- Wushu Rules of Sanshou (English)Documento43 pagineWushu Rules of Sanshou (English)api-289985470Nessuna valutazione finora

- The Tax Law of Private Foundations 2022 Cumulative Supplement (Bruce R. Hopkins, Shane T. Hamilton) (Z-Library)Documento305 pagineThe Tax Law of Private Foundations 2022 Cumulative Supplement (Bruce R. Hopkins, Shane T. Hamilton) (Z-Library)juridico.tributarioNessuna valutazione finora

- 5 10 06 Recognition Procedure Agreement Appendix 1.1Documento8 pagine5 10 06 Recognition Procedure Agreement Appendix 1.1DemrakNessuna valutazione finora

- Labour LawDocumento16 pagineLabour LawZain KhanNessuna valutazione finora

- Judicial Review in Kenya The Ambivalent Legacy of English LawDocumento36 pagineJudicial Review in Kenya The Ambivalent Legacy of English Lawstephen maseseNessuna valutazione finora

- Mock Trial ObjectionsDocumento35 pagineMock Trial ObjectionsBenedict Ontal100% (1)

- International Human Rights Law and Human Rights Laws in The PhilippinesDocumento28 pagineInternational Human Rights Law and Human Rights Laws in The PhilippinesFrancis OcadoNessuna valutazione finora

- Msds UMBDocumento9 pagineMsds UMBDwi April YantoNessuna valutazione finora

- One Hundred Merrie and Delightsome Stories Right Pleasaunte To Relate in All Goodly Companie by Way of Joyance and JollityDocumento16 pagineOne Hundred Merrie and Delightsome Stories Right Pleasaunte To Relate in All Goodly Companie by Way of Joyance and JollityGutenberg.orgNessuna valutazione finora

- 3 Collector V de LaraDocumento5 pagine3 Collector V de LaraAngelie ManingasNessuna valutazione finora

- Vda. de Mistica V NaguiatDocumento9 pagineVda. de Mistica V NaguiatZannyRyanQuirozNessuna valutazione finora

- Petron CaseDocumento3 paginePetron CaseKara Aglibo100% (1)

- Persuasive EssayDocumento3 paginePersuasive Essayapi-252319989Nessuna valutazione finora

- Velarde v. Court of AppealsDocumento6 pagineVelarde v. Court of Appealscmv mendozaNessuna valutazione finora

- Crim Pro Outline-Case ChartDocumento42 pagineCrim Pro Outline-Case ChartMichael MroczkaNessuna valutazione finora

- MSC Circ 1084 Hot Work PrinciplesDocumento2 pagineMSC Circ 1084 Hot Work PrinciplesThurdsuk NoinijNessuna valutazione finora

- BylawsDocumento4 pagineBylawsPallavi Dalal-Waghmare100% (1)

- Criminal ResponsibilityDocumento4 pagineCriminal ResponsibilityPaolo Jamer0% (1)

- BS7889PVCDocumento2 pagineBS7889PVCdropsy24Nessuna valutazione finora

- GoalDocumento3 pagineGoalabhi_gkNessuna valutazione finora

- BN 194 of 2017 Fit and Proper June 2020 2Documento48 pagineBN 194 of 2017 Fit and Proper June 2020 2Sin Ka YingNessuna valutazione finora

- G.R. Nos. 136066-67 February 4, 2003 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, BINAD SY CHUA, Accused-AppellantDocumento90 pagineG.R. Nos. 136066-67 February 4, 2003 PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, BINAD SY CHUA, Accused-AppellantHartel BuyuccanNessuna valutazione finora

- The Dialectics of Law - Chhatrapati SinghDocumento11 pagineThe Dialectics of Law - Chhatrapati SinghPranav Kumar VasishtaNessuna valutazione finora

- Chapter 5 Worksheets KeyDocumento4 pagineChapter 5 Worksheets KeyMikhaela TorresNessuna valutazione finora

- RTTNA-037 Rev 1 (Cold Vulcanizing Fluid-Flammable) 02022017 JFODocumento2 pagineRTTNA-037 Rev 1 (Cold Vulcanizing Fluid-Flammable) 02022017 JFOAlexis FernandezNessuna valutazione finora

- Non-Cooperation Movement by - Ayush Mani MishraDocumento6 pagineNon-Cooperation Movement by - Ayush Mani Mishraanon_579871068100% (1)

- Guidance For Completing The PHV Driver Licence Application Form Phv202Documento12 pagineGuidance For Completing The PHV Driver Licence Application Form Phv202jjohn29Nessuna valutazione finora

- Legal Notice Public Procurement and Asset Disposal Regulations, 2017 - Amendments 24 Oct. 17Documento143 pagineLegal Notice Public Procurement and Asset Disposal Regulations, 2017 - Amendments 24 Oct. 17Olakachuna AdonijaNessuna valutazione finora