Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Daily Commentary

Caricato da

silviu_catrinaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Daily Commentary

Caricato da

silviu_catrinaCopyright:

Formati disponibili

Please note and carefully read the

Important Disclosure on the last part

Daily FX & Market Commentary

August 5 2016

Published from Tuesday to Friday

Market Recap

U.S. stocks little changed: The S&P 500

Index stayed flat at 2,164 as investors

appeared reluctant to make big bets a day

ahead of the closely watched monthly jobs

report.

Crude oil rose: WTI crude oil gained 2.7%

to US$41.93 a barrel, amid speculation

that traders who had bet on falling prices

were buying back positions.

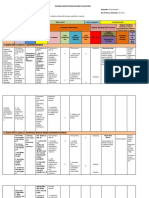

Table: Daily Market Movement (Aug 4 2016)

Equity Market Indices

U.S.

Close Change

% Commodity Futures

Energy & Metals

Close

S&P 500 Index

Dow Jones Industrial Average

NASDAQ Composite Index

Europe

2,164.25

18,352.05

5,166.25

+0.5

-3.0

+6.5

+0.0% WTI Crude Oil (USD/bbl)

0.0% Brent Crude (USD/bbl)

+0.1% Natural Gas (USD/MMBtu)

COMEX Gold (USD/oz)

41.93

44.29

2.83

1,362.7

+2.7%

+2.8%

-0.2%

+0.2%

Stoxx Europe 600 Index

DAX Index

Japan

TOPIX Index

Nikkei 225 Stock Average

China / Hong Kong

Hang Seng Index

Hang Seng China Enterprises

337.84

10,227.86

+2.3

+57.7

4,831.0

-0.9%

1,282.99

16,254.89

+11.0

+171.8

21,832.23

9,004.62

+93.1

+26.3

+0.7% LME Copper (USD/MT)

+0.6% Bond Yields & CNY

U.S. Treasuries - Yields

+0.9% 3-Month - Yield (%)

+1.1% 5-Year - Yield (%)

10-Year - Yield (%)

+0.4% 30-Year - Yield (%)

+0.3% USD/CNY

2,982.43

+4.0

Shanghai SE Composite

Close Change

0.25

-0.01

1.03

-0.04

-0.04

1.50

-0.04

2.25

Close

%

+0.1% China Renminbi Spot

6.64

+0.1%

Data Source: Bloomberg L.P.

Hot News: BOE announced rate cut and new asset purchases

Chart: UK 2016-18 Real GDP and CPI Inflation

Forecasts (%), Latest

Citi analysts views: Monetary Policy

The BOE cut the 2017 GDP growth forecast from

2.3% to 0.8%; the 2018 forecast from 2.3% to 1.8%.

The Bank Rate cut may affect retail deposit rates

and variable mortgage rates quickly and may thus

help boost household demand, in particular.

The PMIs, which will likely be the key data point to

watch, given the weight the BoE attaches to them,

currently point to outright recession.

We pencil in a 15bp rate cut to 0.10% for the

November meeting.

Note: (*) Consensus Economics projections for 2016-17, Bloomberg

projections for 2018.

Sources: BOE, Consensus Economics, Bloomberg

and Citi, as of Aug 4, 2016

The BOE announced a cut to Bank Rate by 25bp to

0.25% and a total of 70bn in new asset purchases

and a 100bn cheap funding facility for banks.

Details:

1. 60bn in new gilt purchases over 6 months

2. 10bn in new corporate bond purchases over

initially 18 months and

3. a new Term Funding Scheme (TFS) as part of the

Asset Purchase Facility, worth up to 100bn, taking

the total of the Asset Purchase Facility to 545bn.

Citi analysts views: UK equities

Given the FTSE 100 has 50% of sales/profits

outside of Europe and 70% outside of the UK,

weaker GBP should mean higher EPS for UK plc.

We expect post-Referendum GBP weakness to

support an inflection in UK EPS to positive territory

in 2017, for the first time in 5 years.

This may drive higher share prices over the next 1218 months; we expect FTSE 100 at 7000 (mid-2017)

& 7600 (end-2017).

The FTSE 100 Index closed up 1.6% to 6,740

yesterday.

2016 Citibank

Citibank and Arc Design is a registered service mark of Citibank, N.A. or Citigroup Inc. Citibank (Hong Kong) Limited

Please note and carefully read the

Important Disclosure on the last part

Daily FX & Market Commentary

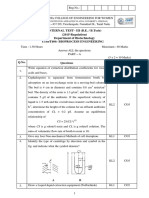

FX & Commodity Technical Corner

YESTERDAY PERFORMANCE

FX TREND

TECHNICAL

CCY

USD

EUR/USD

USD/JPY

GBP/USD

USD/CAD

AUD/USD

NZD/USD

USD/CHF

USD/CNY

USD/CNH

USD/SGD

GOLD

Close Price

Day High

Day Low

95.76

1.1130

101.22

1.3107

1.3019

0.7628

0.7173

0.9741

6.6418

6.6465

1.3420

1361.15

95.90

1.1156

101.67

1.3346

1.3089

0.7641

0.7201

0.9750

6.6469

6.6537

1.3439

1365.15

95.42

1.1114

100.86

1.3103

1.2997

0.7584

0.7147

0.9721

6.6304

6.6335

1.3396

1349.20

Short Term

Comment

Neutral

Neutral

Bearish

Bearish

Neutral

Neutral

Neutral

Neutral

Neutral

Neutral

Neutral

Bullish

Support

Resistance

92.60

1.0941

99.02

1.2798

1.2987

0.7409

0.6952

0.9500

-6.6405

1.3286

$1,312

97.82

1.1358

102.83

1.3372

1.3312

0.7835

0.7325

1.0093

-6.7195

1.4000

$1,375

Citi Foreign Exchange

Forecast:

0-3

Months

92.92

1.10

106.00

1.25

1.30

0.77

0.69

0.99

6.73

-1.38

1400

6-12

Months

94.13

1.15

105.00

1.28

1.26

0.78

0.70

0.96

6.80

-1.39

1280

FX Rate Source: Bloomberg L.P. (cut off time is NY Time 5:00pm)

GBP tumbled: The BoE announced to cut the rate by 25bps, launched 70 bln pound asset purchase program and

Term Funding Scheme (worth 100bln) for banks to borrow close to BOE base rate to offset low rates

AUD rose although Australian retail sales came in at 0.1% MoM, lower than forecast 0.4%.

US non-farm payrolls: We expect NFP may grow 170K in July, in line with the 6-month average of 172K. If job

growth reaches 250K or above, it may boost expectation of rate hikes.

Daily FX Focus

GBP/USD may test lower to 1.2798:

1.3372-1.3481

(2Aug & 15 Jul

top)

1.2798 (Jul low)

Source: Bloomberg L.P., data as of Aug 5 2016

GBP Outlook:

Cut GDP forecast: Growth is projected to slow to

0.1% in Q3. The BOE cut the 2017 GDP growth

forecast from 2.3% to 0.8% (Citi 1.0%) and the

2018 forecast from 2.3% to 1.8% (Citi 1.6%).

Expect further rate cut: The minutes said most

members back further rate cut to near zero in

2016 if incoming data in line with forecast. Hence,

we pencil in a 15bp rate cut to 0.10% in Nov.

Confidence is the key in future: This may

depend on how quickly the UK government adopts

a feasible goal and strategy for the upcoming exit

negotiations with the EU.

Technical Analysis:

Yesterdays sharp fall suggests the pair may test lower to 1.2798, with resistance at 1.3372 1.3481. A break

of 1.2798 may bring further fall toward 1.25 (0-3 months forecast).

NOTE: The brackets are the exchange rates in terms of Hong Kong dollar, with HKD $7.75 exchange rate for reference, and 1,000 yen per unit for JPY/HKD.

2016 Citibank

Citibank and Arc Design is a registered service mark of Citibank, N.A. or Citigroup Inc. Citibank (Hong Kong) Limited

Please note and carefully read the

Important Disclosure on the last part

Daily FX & Market Commentary

AUD/NZD may trade inside 1.0450-1.0772:

1.0703-1.0772 (fibo

0.618 & Jul top)

AUD/NZD Outlook:

RBNZ rate decision next Thur: We expect

the RBNZ may cut the interest rate by 25 bps,

which may make NZD underperform.

AUD may outperform, as the high yield, AAA

credit rating and stable political status may

trigger further fund inflow.

1.0450 (2 Aug low)

Source: Bloomberg L.P., data as of Aug 5, 2016

Technical Analysis:

AUD/NZD rebounded strongly with RSI turning up. We expect the pair may trade inside 1.0450 -1.0772 with

upside bias.

Important Economic Data (August 1, 2016 August 5, 2016)

Time

Importance

Event

Source: Bloomberg L.P.

(K = Thousand, M = Million, B = Billion)

Period

Actual

Survey

Prior

Jun

Aug

-3195m

1.50%

-2000m

1.50%

-2418m

1.75%

Jul

Jul

---

6.90%

10.0k

6.80%

-0.7k

Jul

Jul

49.9

53.9

50

--

50

53.7

Jul

52.0

51.9

51.9

2Q

0.40%

0.50%

0.40%

Australia

08/02/2016 09:30

08/02/2016 12:30

Tue

Tue

!

!!!

Trade Balance

RBA Cash Rate Target

08/05/2016 20:30

08/05/2016 20:30

Fri

Fri

!!

!!

Unemployment Rate

Net Change in Employment

08/01/2016 09:00

08/01/2016 09:00

Mon

Mon

!!

!!

Manufacturing PMI

Non-manufacturing PMI

Canada

China

Euro Area

08/01/2016 16:00

Mon

!!

Markit Eurozone Manufacturing PMI

New Zealand

08/03/2016 06:45

Wed

!!

Pvt Wages Ex Overtime QoQ

U.K.

08/01/2016 16:30

Mon

!!

Markit UK PMI Manufacturing SA

Jul

48.2

49.1

49.1

08/04/2016 19:00

Thu

!!!

Bank of England Bank Rate

Aug

0.25%

0.25%

0.50%

08/04/2016 19:00

Thu

!!!

Bank of England Inflation Report

Aug

52.6

0.20%

0.40%

179k

269k

-3.90%

---

53

0.30%

0.30%

170k

265k

-4.00%

180k

4.80%

53.2

0.20%

0.40%

176k

266k

-4.00%

287k

4.90%

U.S.

08/01/2016 22:00

08/02/2016 20:30

08/02/2016 20:30

08/03/2016 20:15

08/04/2016 20:30

08/04/2016 22:00

08/05/2016 20:30

08/05/2016 20:30

Mon

Tue

Tue

Wed

Thu

Thu

Fri

Fri

!!

!!

!!

!!

!!

!!

!!!

!!!

ISM Manufacturing

Personal Income

Personal Spending

ADP Employment Change

Initial Jobless Claims

Durable Goods Orders

Change in Nonfarm Payrolls

Unemployment Rate

Jul

Jun

Jun

Jul

Jul

Jun

Jul

Jul

NOTE: The brackets are the exchange rates in terms of Hong Kong dollar, with HKD $7.75 exchange rate for reference, and 1,000 yen per unit for JPY/HKD.

2016 Citibank

Citibank and Arc Design is a registered service mark of Citibank, N.A. or Citigroup Inc. Citibank (Hong Kong) Limited

Daily FX & Market Commentary

Important Disclosure

Citi analysts refers to investment professionals within Citi Research (CR) and Citi Global Markets (CGM) and

voting members of the Global Investment Committee of Global Wealth Management.

Citibank N.A. and its affiliates / subsidiaries provide no independent research or analysis in the substance or

preparation of this document. Investment products are not available to US persons and not all products and

services are provided by all affiliates or are available at all locations.

This document is for general informational purposes only and is not intended as a recommendation or an offer or

solicitation for the purchase or sale of any security, currency, investment, service or to attract any funds or deposits.

Information in this document has been prepared without taking account of the objectives, financial situation or

needs of any particular investor. Therefore, investment products mentioned in this document may not be suitable

for all investors. Any person considering an investment should seek independent advice on the suitability or

otherwise of a particular investment. Before making any investment, each investor must obtain the investment

offering materials, which include a description of the risks, fees and expenses and the performance history, if any,

which may be considered in connection with making an investment decision. Each investor should carefully

consider the risks associated with the investment and make a determination based upon the investors own

particular circumstances, that the investment is consistent with the investors investment objectives.

In any event, past performance is no guarantee of future results, and future results may not meet our expectations

due to a variety of economic, market and other factors. Further, any projections of potential risk or return are

illustrative and should not be taken as limitations of the maximum possible loss or gain. Investments are not

deposits or other obligations of, guaranteed or insured by Citibank N.A., Citigroup Inc., or any of their affiliates or

subsidiaries, or by any local government or insurance agency, and are subject to investment risk, including the

possible loss of the principal amount invested. Investors investing in funds denominated in non-local currency

should be aware of the risk of exchange rate fluctuations that may cause a loss of principal.

Neither Citigroup nor its affiliates can accept responsibility for the tax treatment of any investment product, whether

or not the investment is purchased by a trust or company administered by an affiliate of Citigroup. Citigroup

assumes that, before making any commitment to invest, the investor and (where applicable, its beneficial owners)

have taken whatever tax, legal or other advice the investor/beneficial owners consider necessary and have

arranged to account for any tax lawfully due on the income or gains arising from any investment product provided

by Citigroup. If an investor changes country of residence, citizenship, nationality, or place of work, it is his/her

responsibility to understand how his/her investment transactions are affected by such change and comply with all

applicable laws and regulations as and when such becomes applicable.

Although information in this document has been obtained from sources believed to be reliable, Citigroup and its

affiliates do not guarantee its accuracy or completeness and accept no liability for any direct or consequential

losses arising from its use. Opinions expressed herein may differ from the opinions expressed by other businesses

or affiliates of Citigroup, and are not intended to be a forecast of future events, a guarantee of future results or

investment advice, and are subject to change based on market and other conditions. The information contained

herein is also not intended to be an exhaustive discussion of the strategies or concepts.

At any time, Citigroup companies may compensate affiliates and their representatives for providing products and

services to clients.

This is not an official statement of Citigroup Inc. and may not reflect all of your investments with or made through

Citibank. For an accurate record of your accounts and transactions, please consult your official statement.

If this document shows information coming from Citi Research, please refer to the attached link:

https://www.citivelocity.com/cvr/eppublic/citi_research_disclosures , which contains the important disclosures

regarding companies covered by Citi's Equity Research analysts, and please refer to the attached link:

https://ir.citi.com/PuXs6xELNHAu7UqkjgvWxnihtUeLtAtDxeEh%2B2qaPpPb7uukpx8Qw1vzcuidtMtqgn1BWqJqak

8%3D for details on the Citi Research ratings system.

This document may not be reproduced or circulated without Citigroup written authority. The manner of circulation

and distribution may be restricted by law or regulation in certain countries. Persons who come into possession of

this document are required to inform themselves of, and to observe such restrictions. Any unauthorised use,

duplication, or disclosure of this document is prohibited by law and may result in prosecution.

This document is distributed in Hong Kong by Citibank (Hong Kong) Limited (CHKL). Prices and availability of

financial instruments can be subject to change without notice. Certain high-volatility investments can be subject to

sudden and large falls in value that could equal the amount invested.

Daily FX & Market Commentary

Important Disclosure

Risk relating to RMB If you choose RMB as the base currency or the alternate currency, you should also note the

following:

RMB is currently not freely convertible through banks in Hong Kong. Due to exchange controls and/or restrictions

imposed on the convertibility, utilisation or transferability of RMB (if any) which in turn is affected by, amongst other

things, the PRC government's control, there is no guarantee that disruption in the transferability, convertibility or

liquidity of RMB will not occur. There is thus a likelihood that you may not be able to convert RMB received into

other freely convertible currencies.

CNH exchange rates and CNY exchange rates are currently quoted in different markets with different exchange

rates, whereby their exchange rate movements may not be in the same direction or magnitude. Therefore, the

CNH exchange rate may be different from the CNY exchange rate.

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Income Statement, Its Elements, Usefulness and LimitationsDocumento5 pagineIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNessuna valutazione finora

- Fidp ResearchDocumento3 pagineFidp ResearchIn SanityNessuna valutazione finora

- Enerparc - India - Company Profile - September 23Documento15 pagineEnerparc - India - Company Profile - September 23AlokNessuna valutazione finora

- My CoursesDocumento108 pagineMy Coursesgyaniprasad49Nessuna valutazione finora

- The Rise of Populism and The Crisis of Globalization: Brexit, Trump and BeyondDocumento11 pagineThe Rise of Populism and The Crisis of Globalization: Brexit, Trump and Beyondalpha fiveNessuna valutazione finora

- GR L-38338Documento3 pagineGR L-38338James PerezNessuna valutazione finora

- Sophia Program For Sustainable FuturesDocumento128 pagineSophia Program For Sustainable FuturesfraspaNessuna valutazione finora

- L1 L2 Highway and Railroad EngineeringDocumento7 pagineL1 L2 Highway and Railroad Engineeringeutikol69Nessuna valutazione finora

- Online EarningsDocumento3 pagineOnline EarningsafzalalibahttiNessuna valutazione finora

- Convention On The Rights of Persons With Disabilities: United NationsDocumento13 pagineConvention On The Rights of Persons With Disabilities: United NationssofiabloemNessuna valutazione finora

- Basic of An Electrical Control PanelDocumento16 pagineBasic of An Electrical Control PanelJim Erol Bancoro100% (2)

- HealthInsuranceCertificate-Group CPGDHAB303500662021Documento2 pagineHealthInsuranceCertificate-Group CPGDHAB303500662021Ruban JebaduraiNessuna valutazione finora

- XgxyDocumento22 pagineXgxyLïkïth RäjNessuna valutazione finora

- Ishares Core S&P/TSX Capped Composite Index Etf: Key FactsDocumento2 pagineIshares Core S&P/TSX Capped Composite Index Etf: Key FactsChrisNessuna valutazione finora

- Section 8 Illustrations and Parts List: Sullair CorporationDocumento1 paginaSection 8 Illustrations and Parts List: Sullair CorporationBisma MasoodNessuna valutazione finora

- FIRE FIGHTING ROBOT (Mini Project)Documento21 pagineFIRE FIGHTING ROBOT (Mini Project)Hisham Kunjumuhammed100% (2)

- Photon Trading - Market Structure BasicsDocumento11 paginePhoton Trading - Market Structure Basicstula amar100% (2)

- A Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Documento73 pagineA Novel Adoption of LSTM in Customer Touchpoint Prediction Problems Presentation 1Os MNessuna valutazione finora

- Year 9 - Justrice System Civil LawDocumento12 pagineYear 9 - Justrice System Civil Lawapi-301001591Nessuna valutazione finora

- Termination LetterDocumento2 pagineTermination Letterultakam100% (1)

- How To Control A DC Motor With An ArduinoDocumento7 pagineHow To Control A DC Motor With An Arduinothatchaphan norkhamNessuna valutazione finora

- SILABO 29-MT247-Sensors-and-Signal-ConditioningDocumento2 pagineSILABO 29-MT247-Sensors-and-Signal-ConditioningDiego CastilloNessuna valutazione finora

- Interruptions - 02.03.2023Documento2 pagineInterruptions - 02.03.2023Jeff JeffNessuna valutazione finora

- PVAI VPO - Membership FormDocumento8 paginePVAI VPO - Membership FormRajeevSangamNessuna valutazione finora

- Saet Work AnsDocumento5 pagineSaet Work AnsSeanLejeeBajan89% (27)

- ST JohnDocumento20 pagineST JohnNa PeaceNessuna valutazione finora

- Properties of Moist AirDocumento11 pagineProperties of Moist AirKarthik HarithNessuna valutazione finora

- Binary File MCQ Question Bank For Class 12 - CBSE PythonDocumento51 pagineBinary File MCQ Question Bank For Class 12 - CBSE Python09whitedevil90Nessuna valutazione finora

- A PDFDocumento2 pagineA PDFKanimozhi CheranNessuna valutazione finora

- How Yaffs WorksDocumento25 pagineHow Yaffs WorkseemkutayNessuna valutazione finora