Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Dallas CBD Second Light Rail Alignment (D2)

Caricato da

SchutzeTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Dallas CBD Second Light Rail Alignment (D2)

Caricato da

SchutzeCopyright:

Formati disponibili

Dallas CBD Second Light Rail Alignment (D2)

Dallas, Texas

Core Capacity Project Development

(Rating Assigned November 2015)

Summary Description

Proposed Project: Light Rail

2.4 Miles, 5 Stations

Core Capacity Capital Cost ($YOE): $650.45 Million (Includes $43.7 million in finance charges)

Section 5309 Core Capacity Share ($YOE): $325.22 Million (50.0%)

Annual Operating Cost (opening year 2021): $3.27 Million

Existing Ridership in the Corridor: 19,200 Daily Linked Trips

5,872,400 Annual Linked Trips

Existing Useable Space per Passenger: 5.5 Square Feet

Overall Project Rating: Medium-High

Project Justification Rating: Medium-High

Local Financial Commitment Rating: Medium-High

Project Description: The Dallas Area Rapid Transit (DART) proposes to implement a second

light rail alignment through the Dallas Central Business District (CBD) to supplement the

existing alignment along Pacific Avenue and Bryan Street. The proposed project provides a new

route through downtown for the Orange and Green lines, which will allow enhanced Red line

service on the existing alignment. The proposed project includes a tunnel of approximately 0.75

miles and one underground station. DART estimates that when the project is complete, it will

increase capacity in the corridor by 100 percent, which exceeds the ten-percent minimum

required by law for Core Capacity projects.

Project Purpose: Continued high regional growth, highway congestion, regional transit

expansion, and the introduction of a privately-funded high speed rail project will continue to

increase DART system demand. At the same time, all four existing light rail lines presently

operate over the same downtown alignment, constraining operations and limiting capacity. The

project will address these capacity issues and increase operational flexibility to sustain the

DART system into the future.

The project will allow twice as many trains in the peak hour on the Red line, as well as the

flexibility to adjust operations on all four lines as future passenger loads demand. Additionally,

the project will increase schedule reliability, enhance operational flexibility to address incidents

and special events, and improve access to currently underserved downtown markets such as

Government Center and Farmers Market.

Project Development History, Status and Next Steps: The project entered Core Capacity

Project Development in November 2015. DART adopted a preliminary locally preferred

alternative (LPA) into the regions fiscally constrained long-range transportation plan in 2014.

DART adopted a revised LPA in September 2015. DART anticipates receipt of a Record of

Decision in December 2016, entry into Engineering in January 2017, receipt of a Full Funding

Grant Agreement in July 2018, and the start of revenue service in late 2021.

Locally Proposed Financial Plan

Source of Funds

Total Funds ($million)

Percent of Total

Federal:

Section 5309 Core Capacity

$325.22

50.0%

Local:

DART Senior Sales Tax Revenue Bonds

$325.22

50.0%

Total:

$650.45

100.0%

NOTE: The financial plan reflected in this table has been developed by the project sponsor and does not reflect a commitment

by DOT or FTA. The sum of the figures may differ from the total as listed due to rounding.

TX, Dallas, CBD Second Light Rail Alignment (D2)

(Rating Assigned November 2015)

Factor

Local Financial Commitment Rating

Non-Section 5309 Core Capacity

Share

Project Financial Plan

Capital and Operating Condition

(25% of plan rating)

Rating

Medium-High

N/A

Comments

The Core Capacity share of the project is 50.0 percent.

Medium-High

Medium-High

Commitment of Capital and Operating

Funds (25% of plan rating)

High

Capital and Operating Cost Estimates,

Assumptions and Financial Capacity

(50% of plan rating)

Medium

The average age of the bus fleet is 3.9 years, which is younger than the industry

average.

Dallas Area Rapid Transits (DART) most recent bond ratings, issued in

December 2014, are as follows: Moody's Investors Service Aa2, and Standard &

Poors Corporation AA+.

DARTs current ratio of assets to liabilities, as reported in its most recent

audited financial statement, is 2.49 (FY2014).

There have been no service cutbacks or cashflow shortfalls in recent years.

100 percent of the non-Section 5309 funds are committed or budgeted. Sources

of funds consist solely of sales tax-backed revenue bonds to be issued by DART

in 2018 and 2019.

99.9 percent of the funds needed to operate and maintain the transit system in the

first full year of operation are committed or budgeted. Sources of funds include

sales tax revenue, farebox revenue, and lease and rental income.

Assumed growth in revenues for the sales tax revenue is more conservative than

historical experience since 2005; however, this source of revenue has shown

variability in recent years.

The capital cost estimate is sufficient for this stage of the project.

The financial plan shows that DART has the financial capacity to cover cost

increases or funding shortfalls equal to at least 14 percent of estimated project

costs.

Farebox revenues are reasonable; other operating revenues, such as advertising

and lease and rental income, appear to be more optimistic than historical

experience.

Operating cost estimates appear to be more optimistic than historical experience.

Projected cash balances and reserve accounts are 16.5 percent of annual

systemwide operating expenses.

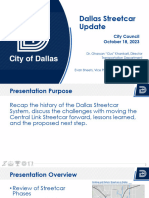

Victory

35E

C

TRE

uter

omm

Union

Station

MUSEUM WAY

Rail

35E

Union Station to Oak Cliff

Dallas Streetcar

West End

ER

S

RO

D

G

366

Li

ne

Tr

ol

le

y

Akard

V

U

Convention

Center

METRO CENTER

West Transfer

Center

LL

O

O

DA

W

St. Paul

Pearl/Arts

District

75

East Transfer

Center

Deep

Ellum

345

HARWOOD DISTRICT

GOVERNMENT CENTER

30

FARMERS MARKET

Baylor

EXISTING LRT STATION

D2 STATION

CBD TRANSFER CENTER

EXISTING LRT SYSTEM

PROPOSED D2

ALIGNMENT

Feet

1,000

FREEWAY LOOP

DALLAS CBD

SECOND LIGHT RAIL ALIGNMENT (D2)

DALLAS, TX

Potrebbero piacerti anche

- IL Chicago Red and Purple Modernization ProfileDocumento4 pagineIL Chicago Red and Purple Modernization Profilegshearod2uNessuna valutazione finora

- Overview and Initial Issues Identification SDOT / Transportation Operating FundDocumento18 pagineOverview and Initial Issues Identification SDOT / Transportation Operating FundtfooqNessuna valutazione finora

- 30-10 Intiative Project Acceleration MethodologiesDocumento24 pagine30-10 Intiative Project Acceleration MethodologiesMetro Los AngelesNessuna valutazione finora

- Rapid Transit Project ReportDocumento6 pagineRapid Transit Project ReportChris GothnerNessuna valutazione finora

- Executive Summary - Honolulu Rail Transit Financial Plan AssessmentDocumento21 pagineExecutive Summary - Honolulu Rail Transit Financial Plan AssessmentCraig GimaNessuna valutazione finora

- Annual Report On Funding Recommendations: Fiscal Year 2017Documento19 pagineAnnual Report On Funding Recommendations: Fiscal Year 2017Stella Padilla 4 MayorNessuna valutazione finora

- San Francisco County Transportation AuthorityDocumento12 pagineSan Francisco County Transportation AuthorityprowagNessuna valutazione finora

- Prioritizing The MTA's Critical Capital NeedsDocumento16 paginePrioritizing The MTA's Critical Capital NeedsBrian BrantNessuna valutazione finora

- Financial Feasibility AnalysisDocumento31 pagineFinancial Feasibility AnalysisbangipoolNessuna valutazione finora

- Are Public Private Transaction The Future Infrastructure FinanceDocumento6 pagineAre Public Private Transaction The Future Infrastructure FinanceNafis El-FariqNessuna valutazione finora

- Translink BC 2011 Yearend Financial and Performance ReportDocumento55 pagineTranslink BC 2011 Yearend Financial and Performance Reportgingerbeer1Nessuna valutazione finora

- C Map Staff ReportDocumento19 pagineC Map Staff ReportTodd J. BehmeNessuna valutazione finora

- TransLink Efficiency ReviewDocumento118 pagineTransLink Efficiency ReviewThe Vancouver SunNessuna valutazione finora

- CDOT Monthly Cash Balance and Construction UpdatesDocumento33 pagineCDOT Monthly Cash Balance and Construction UpdatesAmir Mustakim Bin SuwandiNessuna valutazione finora

- Income-Based Fare Program Implementation PlanDocumento139 pagineIncome-Based Fare Program Implementation PlanThe Urbanist100% (1)

- Tolling Options For The Gardiner Expressway and Don Valley ParkwayDocumento17 pagineTolling Options For The Gardiner Expressway and Don Valley ParkwayCityNewsTorontoNessuna valutazione finora

- Resolution No. R2020-12: Proposed ActionDocumento6 pagineResolution No. R2020-12: Proposed ActionThe UrbanistNessuna valutazione finora

- 2018 July Financial Plan 2019 - 2022: Presentation To The BoardDocumento15 pagine2018 July Financial Plan 2019 - 2022: Presentation To The BoardSarath KumarNessuna valutazione finora

- Council Questions - Fiscal Year 2013 Budget Discussion March 2012Documento6 pagineCouncil Questions - Fiscal Year 2013 Budget Discussion March 2012Richard G. FimbresNessuna valutazione finora

- 2014-2018 Jackson County Capital Improvement ProgramDocumento59 pagine2014-2018 Jackson County Capital Improvement ProgramLivewire Printing CompanyNessuna valutazione finora

- Release 2011-07-27 2012 Budget and Capital ProgramDocumento3 pagineRelease 2011-07-27 2012 Budget and Capital ProgramElizabeth BenjaminNessuna valutazione finora

- Program Budget Request - Activity A: Required Questions Form Agency: Department of Transportation (DOT01)Documento6 pagineProgram Budget Request - Activity A: Required Questions Form Agency: Department of Transportation (DOT01)togoxNessuna valutazione finora

- Federal Analysis of The BART's San Jose ExtensionDocumento145 pagineFederal Analysis of The BART's San Jose ExtensionBayAreaNewsGroupNessuna valutazione finora

- Projected Year-End Financial Results - Third QuarterDocumento7 pagineProjected Year-End Financial Results - Third QuarterpkGlobalNessuna valutazione finora

- 12th Five Year PlanDocumento11 pagine12th Five Year PlanElizabethDarcyNessuna valutazione finora

- Gateway Financial Plan 2021 Submittal LetterDocumento4 pagineGateway Financial Plan 2021 Submittal LetterGersh KuntzmanNessuna valutazione finora

- Proposal 9:: Funding Transportation Infrastructure With User FeesDocumento11 pagineProposal 9:: Funding Transportation Infrastructure With User FeesDinas Perhubungan Kab. PekalonganNessuna valutazione finora

- SRC FundingStrategyMemoDocumento6 pagineSRC FundingStrategyMemoGeoffrey JamesNessuna valutazione finora

- Waterloo Region LRT Contract Report Mar 4 2014Documento70 pagineWaterloo Region LRT Contract Report Mar 4 2014WR_RecordNessuna valutazione finora

- DPWH Year End Report (Final)Documento37 pagineDPWH Year End Report (Final)theengineer3100% (1)

- Goldman v. Richmond (2019) Count 2 Documents: Consolidated Questions & ResponsesDocumento122 pagineGoldman v. Richmond (2019) Count 2 Documents: Consolidated Questions & ResponsesActivate VirginiaNessuna valutazione finora

- Dallas Parking Study RFQ Draft Specs Final SpecificationsDocumento16 pagineDallas Parking Study RFQ Draft Specs Final SpecificationsRobert WilonskyNessuna valutazione finora

- E Mac Item 45Documento2 pagineE Mac Item 45Metro Los AngelesNessuna valutazione finora

- NEDA-ODA Review Main Report (2009)Documento38 pagineNEDA-ODA Review Main Report (2009)ivy4iskoNessuna valutazione finora

- Detroit Lakes City Council 5-Year Plan and Special Assessment Policy, June 20, 2023Documento58 pagineDetroit Lakes City Council 5-Year Plan and Special Assessment Policy, June 20, 2023Michael AchterlingNessuna valutazione finora

- Memorandum: M C P DDocumento4 pagineMemorandum: M C P DM-NCPPCNessuna valutazione finora

- Metro FY 2011 Financial Plan North/Red LineDocumento76 pagineMetro FY 2011 Financial Plan North/Red LineTexas WatchdogNessuna valutazione finora

- New York State Dedicated Highway and Bridge Trust Fund CrossroadsDocumento18 pagineNew York State Dedicated Highway and Bridge Trust Fund CrossroadsNews10NBCNessuna valutazione finora

- IAB Transport Funding FINALDocumento29 pagineIAB Transport Funding FINALBen RossNessuna valutazione finora

- Class 5 - Transportation InfrastructureDocumento21 pagineClass 5 - Transportation InfrastructureSmr OnlyNessuna valutazione finora

- Sioux City Proposed Capital Improvement Budget 2014-2018Documento551 pagineSioux City Proposed Capital Improvement Budget 2014-2018Sioux City JournalNessuna valutazione finora

- The PlanDocumento82 pagineThe PlanMetro Los AngelesNessuna valutazione finora

- Case Study On DELHIDocumento12 pagineCase Study On DELHIFrancis LieNessuna valutazione finora

- Northern Middlesex Council of Governments: Paul Cohen, Town ManagerDocumento5 pagineNorthern Middlesex Council of Governments: Paul Cohen, Town ManagerAndy SylviaNessuna valutazione finora

- CM Fimbres Fiscal Year 2013 Recommended BudgetDocumento2 pagineCM Fimbres Fiscal Year 2013 Recommended BudgetRichard G. FimbresNessuna valutazione finora

- Metro Project Acceleration PlanDocumento48 pagineMetro Project Acceleration PlanMetro Los AngelesNessuna valutazione finora

- Project Proposal FOR BOCDocumento3 pagineProject Proposal FOR BOCmhackzporcallaNessuna valutazione finora

- Sound Transit - Resolution R2021-05 - Adopted August 5, 2021Documento8 pagineSound Transit - Resolution R2021-05 - Adopted August 5, 2021The UrbanistNessuna valutazione finora

- Budget Message: To: From: Date: Subject: Proposed Budget For The Fiscal Year Ending December 31, 2013Documento40 pagineBudget Message: To: From: Date: Subject: Proposed Budget For The Fiscal Year Ending December 31, 2013heneghanNessuna valutazione finora

- Sound Transit - Draft Realignment Plan Hybrid Resolution - July 21, 2021Documento4 pagineSound Transit - Draft Realignment Plan Hybrid Resolution - July 21, 2021The UrbanistNessuna valutazione finora

- Practical No 14: Importance of A Financial Feasibility StudyDocumento5 paginePractical No 14: Importance of A Financial Feasibility Studyskjlf sljdfNessuna valutazione finora

- Kitchener 2013 Budget Preview Nov 5 2012Documento52 pagineKitchener 2013 Budget Preview Nov 5 2012WR_RecordNessuna valutazione finora

- Indian Road Sector: Performance Review For Q3, FY2012Documento22 pagineIndian Road Sector: Performance Review For Q3, FY2012raulreeeeNessuna valutazione finora

- House Hearing, Innovative Finance, 2010-03Documento8 pagineHouse Hearing, Innovative Finance, 2010-03ehllNessuna valutazione finora

- Road Project Proposal Report Template January 2021Documento26 pagineRoad Project Proposal Report Template January 2021Jomari BojosNessuna valutazione finora

- Sound Transit - Substitute Resolution R2021-05 With Exhibits A and BDocumento7 pagineSound Transit - Substitute Resolution R2021-05 With Exhibits A and BThe UrbanistNessuna valutazione finora

- BIMSTEC Master Plan for Transport ConnectivityDa EverandBIMSTEC Master Plan for Transport ConnectivityNessuna valutazione finora

- Public–Private Partnership Monitor: PakistanDa EverandPublic–Private Partnership Monitor: PakistanNessuna valutazione finora

- Philippines: Management of Contingent Liabilities Arising from Public-Private Partnership ProjectsDa EverandPhilippines: Management of Contingent Liabilities Arising from Public-Private Partnership ProjectsNessuna valutazione finora

- Denshaw Group Report of Investigation No. 2 - DraftDocumento6 pagineDenshaw Group Report of Investigation No. 2 - DraftSchutze100% (2)

- LongRangeWaterSupplyPlanUpdate 091714 PDFDocumento82 pagineLongRangeWaterSupplyPlanUpdate 091714 PDFSchutzeNessuna valutazione finora

- Sabine River Authority Settlement BriefingDocumento3 pagineSabine River Authority Settlement BriefingTristan HallmanNessuna valutazione finora

- August 1 and August 8 Emails Susan Alvarez Director City of Dallas Flood Plain and Drainage ManagementDocumento1 paginaAugust 1 and August 8 Emails Susan Alvarez Director City of Dallas Flood Plain and Drainage ManagementSchutzeNessuna valutazione finora

- Dallas Letter To The Corps of EngineersDocumento12 pagineDallas Letter To The Corps of EngineersRobert Wilonsky100% (1)

- A17-010 - Audit of Business Partners Oversight - Arts District 08-25-2017Documento42 pagineA17-010 - Audit of Business Partners Oversight - Arts District 08-25-2017loristahl8340Nessuna valutazione finora

- Dallas City Council Resolution Calling For Removal of Confederate MemorialsDocumento4 pagineDallas City Council Resolution Calling For Removal of Confederate MemorialsSchutzeNessuna valutazione finora

- FPRDG Qualifications Presentation REVISED PDFDocumento16 pagineFPRDG Qualifications Presentation REVISED PDFSchutze100% (1)

- Memo To Create Confederate Monuments Task Force ProcessDocumento2 pagineMemo To Create Confederate Monuments Task Force ProcessSchutzeNessuna valutazione finora

- A Great Park For A Great City - FinalDocumento29 pagineA Great Park For A Great City - FinalSchutze100% (3)

- HUD LetterDocumento14 pagineHUD LetterSchutzeNessuna valutazione finora

- Binder1 PDFDocumento79 pagineBinder1 PDFSchutzeNessuna valutazione finora

- Dpfps V AlexanderDocumento18 pagineDpfps V AlexanderSchutzeNessuna valutazione finora

- McCollum V Livingston Prison Heat Death 83-Page OrderDocumento83 pagineMcCollum V Livingston Prison Heat Death 83-Page OrderSchutzeNessuna valutazione finora

- Pena VHMKDocumento30 paginePena VHMKSchutze100% (1)

- Moodys Dallas PDFDocumento22 pagineMoodys Dallas PDFSchutzeNessuna valutazione finora

- Dallas Mayor Letter From Dan FlynnDocumento3 pagineDallas Mayor Letter From Dan FlynnTristan HallmanNessuna valutazione finora

- Petition For Writ of Habeas Corpus For MR IssaDocumento11 paginePetition For Writ of Habeas Corpus For MR IssaSchutze100% (1)

- Khraish Topletz Carney 5 Point PlanDocumento7 pagineKhraish Topletz Carney 5 Point PlanSchutzeNessuna valutazione finora

- Dpfps V Alexander CounterclaimDocumento36 pagineDpfps V Alexander CounterclaimSchutzeNessuna valutazione finora

- Kroll 73 Lors - Release This FileDocumento1 paginaKroll 73 Lors - Release This FileSchutzeNessuna valutazione finora

- State Fair of Texas 2014 990Documento52 pagineState Fair of Texas 2014 990SchutzeNessuna valutazione finora

- Casto Housing Discrimination Complaint LetterDocumento8 pagineCasto Housing Discrimination Complaint LetterSchutzeNessuna valutazione finora

- Dallas Mayor Mike Rawlings Letter To Dallas Police and Fire Pension SystemDocumento2 pagineDallas Mayor Mike Rawlings Letter To Dallas Police and Fire Pension SystemSchutzeNessuna valutazione finora

- Lockey 17 FI R06 00315 RedactedDocumento2 pagineLockey 17 FI R06 00315 RedactedSchutzeNessuna valutazione finora

- EmailsDocumento7 pagineEmailsSchutzeNessuna valutazione finora

- Housing Discrimination Complaint 6-13-16Documento4 pagineHousing Discrimination Complaint 6-13-16SchutzeNessuna valutazione finora

- Khraish Restraining OrderDocumento2 pagineKhraish Restraining OrderSchutzeNessuna valutazione finora

- The State Fair of Texas, Plaintiffs, v. Riggs & Ray, Defendants, Motion For RecusalDocumento36 pagineThe State Fair of Texas, Plaintiffs, v. Riggs & Ray, Defendants, Motion For RecusalSchutzeNessuna valutazione finora

- HMK Notice of ClosureDocumento10 pagineHMK Notice of ClosureRobert WilonskyNessuna valutazione finora

- Dart / Tre / Texrail / Dcta: Rail System MapDocumento1 paginaDart / Tre / Texrail / Dcta: Rail System MapSudhit SethiNessuna valutazione finora

- The Transit Bus Niche Market For Alternative FuelsDocumento26 pagineThe Transit Bus Niche Market For Alternative FuelsPaulo PereiraNessuna valutazione finora

- Texas Live Police, Fire, and EMS Scanners On RadioReferenceDocumento6 pagineTexas Live Police, Fire, and EMS Scanners On RadioReferenceZeke Almager100% (1)

- Dallas: Dallas/Fort Worth Area MapDocumento2 pagineDallas: Dallas/Fort Worth Area MapLivin XaviNessuna valutazione finora

- EssayDocumento5 pagineEssayapi-576369118Nessuna valutazione finora

- Complaint Exhibits - ADELMAN V DART Et Al - 9-9-2016Documento74 pagineComplaint Exhibits - ADELMAN V DART Et Al - 9-9-2016Avi S. AdelmanNessuna valutazione finora

- Streetcar Status UpdateDocumento23 pagineStreetcar Status UpdateApril ToweryNessuna valutazione finora

- Frequently Asked Questions: 2013 National Red Bull Flugtag Dallas/Fort WorthDocumento6 pagineFrequently Asked Questions: 2013 National Red Bull Flugtag Dallas/Fort Worthapi-236105003Nessuna valutazione finora

- DART Schedules: Bus Route 554Documento1 paginaDART Schedules: Bus Route 554file3323Nessuna valutazione finora

- Numerical Analysis of Rail Structure Interaction and Resonance in Railway BridgesDocumento11 pagineNumerical Analysis of Rail Structure Interaction and Resonance in Railway BridgesJEETENDRA PRAKASHNessuna valutazione finora

- DART Mobile Ticketing PresentationDocumento25 pagineDART Mobile Ticketing PresentationRobert WilonskyNessuna valutazione finora

- Dallas Land Use PlansDocumento6 pagineDallas Land Use PlansJorge Esteban-MaddoxNessuna valutazione finora

- SGC 2013 Program GuideDocumento35 pagineSGC 2013 Program GuideSean HinzNessuna valutazione finora

- DART 2030 Transit System PlanDocumento89 pagineDART 2030 Transit System PlanScott SchaeferNessuna valutazione finora

- VP Construction Project Manager in Dallas FT Worth TX Resume Rick JakusDocumento3 pagineVP Construction Project Manager in Dallas FT Worth TX Resume Rick JakusRickJakusNessuna valutazione finora

- Writing Sample - GIS ProjectDocumento19 pagineWriting Sample - GIS ProjectNitin Warrier100% (28)