Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

IRS Reg 134417-13 - IRS Muzzle Rule

Caricato da

Daniel JohnsonCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

IRS Reg 134417-13 - IRS Muzzle Rule

Caricato da

Daniel JohnsonCopyright:

Formati disponibili

Federal Register / Vol. 78, No.

230 / Friday, November 29, 2013 / Proposed Rules

PART 1INCOME TAXES

Paragraph 1. The authority citation

for part 1 continues to read in part as

follows:

Authority: 26 U.S.C. 7805 * * *

Par. 2. Section 1.501(c)(4)1 is

proposed to be amended by revising the

first sentence of paragraph (a)(2)(ii) and

adding paragraphs (a)(2)(iii) and (c) to

read as follows:

sroberts on DSK5SPTVN1PROD with PROPOSALS

1.501(c)(4)1 Civic organizations and

local associations of employees.

(a) * * *

(2) * * *

(ii) * * * The promotion of social

welfare does not include direct or

indirect candidate-related political

activity, as defined in paragraph

(a)(2)(iii) of this section. * * *

(iii) Definition of candidate-related

political activity(A) In general. For

purposes of this section, candidaterelated political activity means:

(1) Any communication (as defined in

paragraph (a)(2)(iii)(B)(3) of this section)

expressing a view on, whether for or

against, the selection, nomination,

election, or appointment of one or more

clearly identified candidates or of

candidates of a political party that

(i) Contains words that expressly

advocate, such as vote, oppose,

support, elect, defeat, or reject;

or

(ii) Is susceptible of no reasonable

interpretation other than a call for or

against the selection, nomination,

election, or appointment of one or more

candidates or of candidates of a political

party;

(2) Any public communication

(defined in paragraph (a)(2)(iii)(B)(5) of

this section) within 30 days of a primary

election or 60 days of a general election

that refers to one or more clearly

identified candidates in that election or,

in the case of a general election, refers

to one or more political parties

represented in that election;

(3) Any communication the

expenditures for which are reported to

the Federal Election Commission,

including independent expenditures

and electioneering communications;

(4) A contribution (including a gift,

grant, subscription, loan, advance, or

deposit) of money or anything of value

to or the solicitation of contributions on

behalf of

(i) Any person, if the transfer is

recognized under applicable federal,

state, or local campaign finance law as

a reportable contribution to a candidate

for elective office;

(ii) Any section 527 organization; or

(iii) Any organization described in

section 501(c) that engages in candidate-

VerDate Mar<15>2010

17:32 Nov 27, 2013

Jkt 232001

related political activity within the

meaning of this paragraph (a)(2)(iii) (see

special rule in paragraph (a)(2)(iii)(D) of

this section);

(5) Conduct of a voter registration

drive or get-out-the-vote drive;

(6) Distribution of any material

prepared by or on behalf of a candidate

or by a section 527 organization

including, without limitation, written

materials, and audio and video

recordings;

(7) Preparation or distribution of a

voter guide that refers to one or more

clearly identified candidates or, in the

case of a general election, to one or more

political parties (including material

accompanying the voter guide); or

(8) Hosting or conducting an event

within 30 days of a primary election or

60 days of a general election at which

one or more candidates in such election

appear as part of the program.

(B) Related definitions. The following

terms are defined for purposes of this

paragraph (a)(2)(iii) only:

(1) Candidate means an individual

who publicly offers himself, or is

proposed by another, for selection,

nomination, election, or appointment to

any federal, state, or local public office

or office in a political organization, or

to be a Presidential or Vice-Presidential

elector, whether or not such individual

is ultimately selected, nominated,

elected, or appointed. Any officeholder

who is the subject of a recall election

shall be treated as a candidate in the

recall election.

(2) Clearly identified means the

name of the candidate involved appears,

a photograph or drawing of the

candidate appears, or the identity of the

candidate is apparent by reference, such

as by use of the candidates recorded

voice or of terms such as the Mayor,

your Congressman, the incumbent,

the Democratic nominee, or the

Republican candidate for County

Supervisor. In addition, a candidate

may be clearly identified by reference

to an issue or characteristic used to

distinguish the candidate from other

candidates.

(3) Communication means any

communication by whatever means,

including written, printed, electronic

(including Internet), video, or oral

communications.

(4) Election means a general,

special, primary, or runoff election for

federal, state, or local office; a

convention or caucus of a political party

that has authority to nominate a

candidate for federal, state or local

office; a primary election held for the

selection of delegates to a national

nominating convention of a political

party; or a primary election held for the

PO 00000

Frm 00010

Fmt 4702

Sfmt 4702

71541

expression of a preference for the

nomination of individuals for election

to the office of President. A special

election or a runoff election is treated as

a primary election if held to nominate

a candidate. A convention or caucus of

a political party that has authority to

nominate a candidate is also treated as

a primary election. A special election or

a runoff election is treated as a general

election if held to elect a candidate. Any

election or ballot measure to recall an

individual who holds state or local

elective public office is also treated as

a general election.

(5) Public communication means

any communication (as defined in

paragraph (a)(2)(iii)(B)(3) of this

section)

(i) By broadcast, cable, or satellite;

(ii) On an Internet Web site;

(iii) In a newspaper, magazine, or

other periodical;

(iv) In the form of paid advertising; or

(v) That otherwise reaches, or is

intended to reach, more than 500

persons.

(6) Section 527 organization means

an organization described in section

527(e)(1) (including a separate

segregated fund described in section

527(f)(3)), whether or not the

organization has filed notice under

section 527(i).

(C) Attribution. For purposes of this

section, activities conducted by an

organization include activities paid for

by the organization or conducted by an

officer, director, or employee acting in

that capacity or by volunteers acting

under the organizations direction or

supervision. Communications made by

an organization include

communications the creation or

distribution of which is paid for by the

organization or that are made in an

official publication of the organization

(including statements or material posted

by the organization on its Web site), as

part of the program at an official

function of the organization, by an

officer or director acting in that

capacity, or by an employee, volunteer,

or other representative authorized to

communicate on behalf of the

organization and acting in that capacity.

(D) Special rule regarding

contributions to section 501(c)

organizations. For purposes of

paragraph (a)(2)(iii)(A)(4) of this section,

a contribution to an organization

described in section 501(c) will not be

treated as a contribution to an

organization engaged in candidaterelated political activity if

(1) The contributor organization

obtains a written representation from an

authorized officer of the recipient

organization stating that the recipient

E:\FR\FM\29NOP1.SGM

29NOP1

71542

Federal Register / Vol. 78, No. 230 / Friday, November 29, 2013 / Proposed Rules

organization does not engage in such

activity (and the contributor

organization does not know or have

reason to know that the representation

is inaccurate or unreliable); and

(2) The contribution is subject to a

written restriction that it not be used for

candidate-related political activity

within the meaning of this paragraph

(a)(2)(iii).

(c) Effective/applicability date.

Paragraphs (a)(2)(ii) and (iii) of this

section apply on and after the date of

publication of the Treasury decision

adopting these rules as final regulations

in the Federal Register.

John Dalrymple,

Deputy Commissioner for Services and

Enforcement.

[FR Doc. 201328492 Filed 112613; 4:15 pm]

BILLING CODE 483001P

DEPARTMENT OF THE TREASURY

Internal Revenue Service

26 CFR Part 31

[REG14662013]

RIN 1545BL92

Authority for Voluntary Withholding on

Other Payments

Internal Revenue Service (IRS),

Treasury.

ACTION: Notice of proposed rulemaking

and notice of proposed rulemaking by

cross reference to temporary regulations.

AGENCY:

This document contains

proposed regulations under the Internal

Revenue Code (Code) relating to

voluntary withholding agreements. In

the Rules and Regulations of this issue

of the Federal Register, the IRS is also

issuing temporary regulations to allow

the Secretary to issue guidance in the

Internal Revenue Bulletin to describe

payments for which the Secretary finds

that income tax withholding under a

voluntary withholding agreement would

be appropriate. The text of those

temporary regulations also generally

serves as the text of these proposed

regulations. The regulations affect

persons making and persons receiving

payments for which the IRS issues

subsequent guidance authorizing the

parties to enter into voluntary

withholding agreements.

DATES: Written or electronic comments

and requests for a public hearing must

be received by February 25, 2014.

ADDRESSES: Send submissions to:

CC:PA:LPD:PR (REG14662013), room

5203, Internal Revenue Service, PO Box

sroberts on DSK5SPTVN1PROD with PROPOSALS

SUMMARY:

VerDate Mar<15>2010

17:32 Nov 27, 2013

Jkt 232001

7604, Ben Franklin Station, Washington,

DC 20044. Submissions may be handdelivered Monday through Friday

between the hours of 8 a.m. and 4 p.m.

to CC:PA:LPD:PR (REG14662013),

Couriers Desk, Internal Revenue

Service, 1111 Constitution Avenue NW.,

Washington, DC, or sent electronically

via the Federal eRulemaking Portal at

http://www.regulations.gov (IRS REG

14662013).

FOR FURTHER INFORMATION CONTACT:

Concerning the proposed regulations,

Linda L. Conway-Hataloski at (202)

3176798; concerning submission of

comments and request for hearing,

Oluwafunmilayo (Funmi) Taylor at

(202) 3175179 (not toll-free numbers).

SUPPLEMENTARY INFORMATION:

Background

Section 3402(p) allows for voluntary

income tax withholding agreements.

Section 3402(p)(3) authorizes the

Secretary to provide regulations for

withholding from (A) remuneration for

services performed by an employee for

the employees employer which does

not constitute wages, and (B) from any

other payment with respect to which the

Secretary finds that withholding would

be appropriate, if the employer and

employee, or the person making and the

person receiving such other type of

payment, agree to such withholding.

Section 3402(p)(3) also authorizes the

Secretary to prescribe in regulations the

form and manner of such agreement.

Section 31.3402(p)1 of the

Employment Tax Regulations describes

how an employer and an employee may

enter into an income tax withholding

agreement under section 3402(p) for

amounts that are excepted from the

definition of wages in section 3401(a).

Explanation of Provisions

The proposed regulations amend the

headings to paragraphs (a) and (b) of

31.3402(p)1 to clarify that those

paragraphs apply to voluntary

withholding agreements between an

employer and employee. Temporary

regulations in the Rules and Regulations

section of this issue of the Federal

Register also amend the Employment

Tax Regulations (26 CFR part 31) under

section 3402(p). The text of those

temporary regulations also serves as the

text of these proposed regulations. The

preamble to the temporary regulations

explains the amendments.

Special Analyses

It has been determined that this notice

of proposed rulemaking is not a

significant regulatory action as defined

in Executive Order 12866, as

supplemented by Executive Order

PO 00000

Frm 00011

Fmt 4702

Sfmt 4702

13563. Therefore, a regulatory

assessment is not required. It has also

been determined that 5 U.S.C. 533(b) of

the Administrative Procedure Act (5

U.S.C. chapter 5) does not apply to these

regulations and because the regulation

does not impose a collection of

information on small entities, the

Regulatory Flexibility Act (5 U.S.C.

chapter 6) does not apply. Pursuant to

section 7805(f) of the Internal Revenue

Code, these regulations have been

submitted to the Office of Chief Counsel

for Advocacy of the Small Business

Administration for comment on their

impact on small business.

Comments and Requests for Public

Hearing

Before these proposed regulations are

adopted as final regulations,

consideration will be given to any

comments that are submitted timely to

the IRS as prescribed in the ADDRESSES

heading in this preamble. The IRS and

Treasury Department request comments

on all aspects of the proposed

regulations. All comments will be

available at www.regulations.gov or

upon request.

A public hearing will be scheduled if

requested in writing by any person that

timely submits written comments. If a

public hearing is scheduled, notice of

the date, time, and place for the public

hearing will be published in the Federal

Register.

Drafting Information

The principal author of these

regulations is Linda L. ConwayHataloski, Office of Associate Chief

Counsel (Tax Exempt and Government

Entities). However, other personnel

from the IRS and Treasury Department

participated in their development.

List of Subjects in 26 CFR Part 31

Employment taxes, Income taxes,

Penalties, Pensions, Railroad retirement,

Reporting and recordkeeping

requirements, Social security,

Unemployment compensation.

Proposed Amendments to the

Regulations

Accordingly, 26 CFR part 31 is

proposed to be amended as follows:

PART 31EMPLOYMENT TAXES AND

COLLECTION OF INCOME TAX AT

SOURCE

Paragraph 1. The authority citation

for part 31 continues to read in part as

follows:

Authority: 26 U.S.C. 7805 * * *

Par. 2. Section 31.3402(p)1 is

amended by:

E:\FR\FM\29NOP1.SGM

29NOP1

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Acco 20173 Quiz 1Documento7 pagineAcco 20173 Quiz 1Lyra EscosioNessuna valutazione finora

- Solutions Institute 1Q Financial ReportDocumento2 pagineSolutions Institute 1Q Financial ReportDaniel JohnsonNessuna valutazione finora

- RCG Act of WY PDFDocumento3 pagineRCG Act of WY PDFDaniel JohnsonNessuna valutazione finora

- ActCon I Speaker ScheduleDocumento2 pagineActCon I Speaker ScheduleDaniel JohnsonNessuna valutazione finora

- RCG Resolution City CountyDocumento4 pagineRCG Resolution City CountyDaniel JohnsonNessuna valutazione finora

- RCG Ordinance City CountyDocumento4 pagineRCG Ordinance City CountyDaniel JohnsonNessuna valutazione finora

- RCG Act CongressDocumento2 pagineRCG Act CongressDaniel JohnsonNessuna valutazione finora

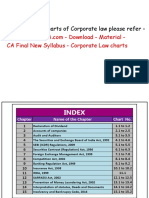

- Advanced Performance ManagementDocumento22 pagineAdvanced Performance ManagementAli Tahir HashmiNessuna valutazione finora

- HW - AFM - E7-25, E7-28, P7-42 - Kelompok 8Documento7 pagineHW - AFM - E7-25, E7-28, P7-42 - Kelompok 8swear to the skyNessuna valutazione finora

- Financial Accounting and Reporting Final ExaminationDocumento13 pagineFinancial Accounting and Reporting Final ExaminationBernardino PacificAce100% (1)

- Chapter 1 The U.S Business EnvironmentDocumento40 pagineChapter 1 The U.S Business EnvironmentYusuf Abdurrachman82% (11)

- Chapter 13 Lecture Notes (TA 2020) - Non-Financial and Current LiabilitiesDocumento20 pagineChapter 13 Lecture Notes (TA 2020) - Non-Financial and Current LiabilitiesTSEvansNessuna valutazione finora

- Comparative Statement of Profit and LossDocumento6 pagineComparative Statement of Profit and LossHimanshi ChopraNessuna valutazione finora

- Barangay Tax Code SampleDocumento16 pagineBarangay Tax Code Sampleleng11mher21Nessuna valutazione finora

- CH 13Documento40 pagineCH 13Ehab hobaNessuna valutazione finora

- Equity MasterDocumento24 pagineEquity Mastersambasiva_gelivi6645100% (1)

- Oil and Gas Valuation ConsiderationDocumento34 pagineOil and Gas Valuation ConsiderationBagus Deddy AndriNessuna valutazione finora

- 29 PDFDocumento58 pagine29 PDFAradhna BhasinNessuna valutazione finora

- Project of T.Y BbaDocumento49 pagineProject of T.Y BbaJeet Mehta0% (1)

- Business Mathematics (OBE)Documento10 pagineBusiness Mathematics (OBE)irene apiladaNessuna valutazione finora

- Comparison of Two CompaniesDocumento12 pagineComparison of Two CompaniesJose SermenoNessuna valutazione finora

- Transforming Nonprofit Business Models 2014Documento3 pagineTransforming Nonprofit Business Models 2014winnielongNessuna valutazione finora

- FRP Grating of Thickness 30mmDocumento4 pagineFRP Grating of Thickness 30mmkasvikrajNessuna valutazione finora

- Group 3 - MetabicalDocumento28 pagineGroup 3 - MetabicalArieviana Ayu LaksmiNessuna valutazione finora

- Salary For New Teachers 23-05-2008Documento10 pagineSalary For New Teachers 23-05-2008gsreddy100% (3)

- Bonifacio Gas v. CIRDocumento31 pagineBonifacio Gas v. CIRaudreydql5Nessuna valutazione finora

- Sample Profit and LossDocumento3 pagineSample Profit and Losssharoneyezs6791100% (1)

- Upfcl ProjectttttDocumento95 pagineUpfcl ProjectttttgoswamiphotostatNessuna valutazione finora

- China Fishery Group Limited: Rooms 3312-14, Hong Kong Plaza, 188 Connaught Road West, Hong KongDocumento6 pagineChina Fishery Group Limited: Rooms 3312-14, Hong Kong Plaza, 188 Connaught Road West, Hong Kongtungaas20011Nessuna valutazione finora

- Kontni Okvir - Layout of Chart of AccountsDocumento9 pagineKontni Okvir - Layout of Chart of AccountszgorescribidNessuna valutazione finora

- Insurance Acc - PPDocumento72 pagineInsurance Acc - PPDhivyaNessuna valutazione finora

- Tax Audit Remembering TrickDocumento2 pagineTax Audit Remembering TrickTejNessuna valutazione finora

- IDirect KalpataruPower Q2FY20Documento10 pagineIDirect KalpataruPower Q2FY20QuestAviatorNessuna valutazione finora

- dl932 PDFDocumento2 paginedl932 PDFrudy gonzalesNessuna valutazione finora

- VA-Request For Approval of School AttendanceDocumento3 pagineVA-Request For Approval of School AttendanceDesiree Erin Madrigal AcostaNessuna valutazione finora

- Match The Concepts With Their Definitions. Look at The ExampleDocumento2 pagineMatch The Concepts With Their Definitions. Look at The ExampleJenny Zulay SUAREZ SOLANO100% (1)