Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Krishi Kalyan Cess CKB

Caricato da

Hasan Babu KothaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Krishi Kalyan Cess CKB

Caricato da

Hasan Babu KothaCopyright:

Formati disponibili

CA Chandra Kishore Bajpai

B.Com. FCA,LLB. DISA(ICAI)

Shop No. 24, Ground Floor, GDA Commercial Complex,

Nyay Khand-1, Near Bijali Ghar, Ghaziabad 201014

Mob:- 95600 37408, 7599 03 7599,

Email:- contact@cackbajpai.com

A Note on Krishi Kalyan Cess

In this write up, I have made an attempt to explain about Krishi Kalyan Cess

hoping that it will help you in your day to day compliance work. Though I have made all

efforts to make it error free but it is possible that some error might have crept, if it is so

please bring it in my notice and I will definitely remove it. If you have any suggestion

to improve this book, you are requested to forward the same to us.

I have compiled this information based on the various material available and this write

up is purely for informational purpose and sharing knowledge.

It is my

kind request to go through original statute, notification and circular etc before relying

on the matter given here.

If you feel that this has really helped you in improving your knowledge or

understanding of the subject matter, I request you to take few minutes out of your

precious time and provide your valuable feedback at cackbajpai@gmail.com.

Your feedback is important and will help in improving it.

With Thanks:

CA C.K.Bajpai

CA Chandra Kishore Bajpai

B.Com. FCA,LLB. DISA(ICAI)

Shop No. 24, Ground Floor, GDA Commercial Complex,

Nyay Khand-1, Near Bijali Ghar, Ghaziabad 201014

Mob:- 95600 37408, 7599 03 7599,

Email:- contact@cackbajpai.com

Honourable Finance minister in last budget(2015) had increased the service tax rate from 12.36

(including cess ) to 14% . We are at the verge of GST and under GST regime it is expected that

rate would be somewhere between 17%-18%, it seems that rate is slowly moving towards coming

GST regime rate, further in November 2015 a new levy naming Swachchh bharat Cess also

introduced and rate became 14.5% w.e.f. 15th November 2015.

Now in budget 2016, Honble Finance Minister announced & proposed a new cess named

KRISHI KALYAN CESS It would be imposed at the rate of 0.5% on all taxable service. Thus

effective rate of service would be 15% from 1st June 2016.

In this write up I am not going to discuss about GST or comparison between GST & present tax

structure but just making an effort to understand implementation of Krishi Kalyan Cess (KKC)

in following paragraphs.

A Cess is a tax which is collected by the government to be used for a specific

purpose. Thus collections from levy of cess can be used only for the purpose for

which

it has been collected and not for any other purpose, Finance Minister has

mentioned in his budget speech that proceeds of KKC would be exclusively used for

financing initiatives relating to improvement of agriculture and welfare of

farmers.

The Finance Minister made the following announcement (vide para 152 of Budget speech) on

Krishi Kalyan Cess"I propose to impose a Cess, called the Krishi Kalyan Cess, @ 0.5% on all taxable services,

proceeds of which would be exclusively used for financing initiatives relating to

improvement of agriculture and welfare of farmers. The Cess will come into force

with effect from 1st June 2016. Input Tax credit of this cess will be available for payment of

this cess."

Thus collection from KKC shall be exclusively used for the benefit of Agriculture & Farmers.

Chargeability of KKC

Clause 158 of Chapter VI of Finance Bill ( now Act w.e.f 14.05.2016) has levied KKC @0.5% on

the value of Taxable service and same shall be effective from 01st June 2016.

If value of taxable service is Rs.100 then tax would be calculated as under:-

CA Chandra Kishore Bajpai

B.Com. FCA,LLB. DISA(ICAI)

Shop No. 24, Ground Floor, GDA Commercial Complex,

Nyay Khand-1, Near Bijali Ghar, Ghaziabad 201014

Mob:- 95600 37408, 7599 03 7599,

Email:- contact@cackbajpai.com

Particulars

Value of taxable service

Service Tax @14%

Add:- Swachcha Bharat Cess @0.5%

Add:- Krishi Kalyan Cess @ 0.5%

Total Value including service tax & cess

Amount in Rs.

100

14

0.5

0.5

115

KKC Applicability

KKC shall be levied with effect from 1st June, 2016, thus KKC shall be charged on all services

provided on or after 1st June, 2016

Disclosure of KKC on Invoice:KKC shall be chargeable on invoices separately as KKC like Swachh Bharat Cess. Charging

Service Tax @ 15 percent (14% Service Tax, 0.50% SBC and 0.50% KKC) is not legally correct.

KKC when abatement is available on the value of service

KKC shall be calculated on the value of taxable service after availing the benefit of abatement

for example in case of GTA services abatement is 70% thus service tax is leviable on 30% of the

value. Say GTA bill amount is Rs.1000/Particulars

Amount in Rs.

Gross value of taxable service

1000

Less:- Abatement@70%

700

Taxable Value of service

300

Service Tax @14%

42

Add:- Swachcha Bharat Cess @0.5%

1.5

Add:- Krishi Kalyan Cess @ 0.5%

1.5

Total Value including service tax & cess

45

KKC when liability is under Reverse charge Mechanism

The Central Government vide Notification No. 27/2016-ST dated May 26, 2016, has

amended/clarified that the Reverse Charge Notification shall be applicable mutatis mutandis

for the purposes of KKC also.

Thus Service recipient liable to pay under reverse charge (Full/partial) shall pay KKC alongwith

service tax on his liability portion.

KKC when services are exempt or falling under negative list

Notification No. 28/2016-ST dated 26 may 2016 has provided that KKC shall not be leviable on

services which are exempt by notification issues under section 93(1) or special order issued

CA Chandra Kishore Bajpai

B.Com. FCA,LLB. DISA(ICAI)

Shop No. 24, Ground Floor, GDA Commercial Complex,

Nyay Khand-1, Near Bijali Ghar, Ghaziabad 201014

Mob:- 95600 37408, 7599 03 7599,

Email:- contact@cackbajpai.com

under section 93(2) of the Finance Act 1994 or otherwise not leviable to service tax under

section 66B thereof.

Thus it is cleared that following would not be liable for KKC:(i)

Activity not falling within meaning of service under section 65B(44) of the Finance

Act,

(ii)

Services falling under section 66D of the Act i.e. Negative List,

(iii)

Service exempted by notification u/s 93(1) 0f the Act i.e.

(a) Exempted services under Mega exemption notification ( 25/2012-ST dated

20.06.2012 as amended time to time)

(b) Abatement value of Service on which certain percentage of the value is exempt

through Abatement Notification No 26/2012-ST dated 20.06.2012

(iv)

Services exempted by Special Order under section 93(2) of the Act

Determination of value of service for KKC purpose:For the purpose of KKC, Value of taxable services shall be the value as determined in

accordance with the Service Tax Valuation Rules. Thus value be determined first as applicable

rule in particular service like in case of works contract, Rule-2A shall determine the value of

taxable service then tax shall be calculated thereon.

How does KKC apply on Works Contract Service?

The value of services would be calculated as per Rule 2A of Service Tax (Determination of Value)

Rules, 2006. Tax needs to be applied on the value so arrived at the rate of 15%. Effective rate of

tax in case of original works and other than original works would be 6% (15%*40%) and 10.5%

(15%*70%) respectively.

Payment of KKC:KKC shall be paid in accounting head as given under:KKC

(Minor

Head)

Tax

Other

Deduct

Collection

Reciepts

Refunds

Penalties

(Interest)

0044-00-507

00441509

00441510

00441511

00441512

CA Chandra Kishore Bajpai

B.Com. FCA,LLB. DISA(ICAI)

Shop No. 24, Ground Floor, GDA Commercial Complex,

Nyay Khand-1, Near Bijali Ghar, Ghaziabad 201014

Mob:- 95600 37408, 7599 03 7599,

Email:- contact@cackbajpai.com

CENVAT of KKC:- ( Notification No. 28/2016-CE (N.T.) dated May 28, 2016)

The cenvat credit of KKC shall be available and shall be utilized only for the payment of KKC.

Thus, separate accounts needs to be maintained.

Cenvat credit in respect of KKC shall be utilised only towards payment of KKC.

Point of Taxation for New Levy of KKC:

It is pertinent here to note that Explanation 1 & 2 to Rule 5 of Point of Taxation Rules, 2011

(the POT Rules) have been inserted w.e.f March 1, 2016. Explanation 1 provides that point of

taxation in case of new levy on services shall be governed by Rule 5 of the POT and as per

Explanation 2, new levy or tax shall be payable on all cases other than specified in Rule 5.

Rule 5 of the POT covers two specific situations where new levy shall not be payable:

1. Invoice issued and payment received against such invoice before such service becomes

taxable;

2. Payment received before the service becomes taxable and invoice has been issued within 14

days of the date when the service is taxed for the first time,

Point of taxation in case of new levy on services shall be governed by Rule 5 of POT Rules. As

per the Rule 5 read with explanations, only in two situations (mentioned above), the KKC shall

not be payable and in all others, KKC is to be paid.

Sl.No

1

Invoice

Invoice

Payment Date

value

date

received

payment

100000

28.05.2016

100000

29.5.2016

of

Remark

KKC not applicable

No KKC on amount received

before 01st June,16 & remaining

100000

28.5.2016

90000

29.5.2016

amount

would

be

taxable

if

payment received after 31st May

16

KKC

not

applicable,

because

receipt of payment before 1 st

3

100000

02.06.2016

100000

29.5.2016

June 2016 while invoice issued

within 14 days from taxability of

service.

CA Chandra Kishore Bajpai

B.Com. FCA,LLB. DISA(ICAI)

Shop No. 24, Ground Floor, GDA Commercial Complex,

Nyay Khand-1, Near Bijali Ghar, Ghaziabad 201014

Mob:- 95600 37408, 7599 03 7599,

Email:- contact@cackbajpai.com

Taxable because requirement of

4

100000

20.6.2016

100000

30.5.2016

issue of invoice within 14 days

from the date of service is not

fulfilled

Non

Taxable

to

the

extent of 60000 because invoice

Total value

5

of service is

Rs.100000

Invoice for

Rs.60000

issued

on

issed and payment received but

100000

30.5.2016

remaing

would

be

taxable as invoice was issued

after

29.5.2016

payment

14

days

from

the

date of service rendered /payment

received.

Point of Taxation for KKC under Reverse Charge:POT in case of reverse charge is governed by Rule 7 of the POT Rules, In terms of Rule 7 of the

POT Rules, point of taxation under reverse charge (except associated enterprises located outside

India), shall be as under:

Payment made within 3 months

Date of Payment

Payment not made within 3 months

Date immediately following the end of 3

months

In case of associated enterprises, where the person providing the service is located outside India,

POT shall be earlier of the following:

Date of debit in the books of account of service receiver;

Date of Payment

It would not be out of place here to mention that a proviso has been inserted in Rule 7 of the

POT Rules vide Notification No. 21/2016-ST dated March 30, 2016, to provide that where there

is change in the liability or extent of liability of Service tax to be paid under Reverse Charge:

Service has been provided and the invoice issued before the date of such change, but payment

has not been made as on such date, the POT shall be the date of issuance of invoice

Rebate of KKC fro exports

Vide Notification No. 29/2016-ST dated 26.05.2016, it has been notified that w.e.f. 1.6.2016,

rebate of duty or Service Tax used in providing taxable services which are exported, under

CA Chandra Kishore Bajpai

B.Com. FCA,LLB. DISA(ICAI)

Shop No. 24, Ground Floor, GDA Commercial Complex,

Nyay Khand-1, Near Bijali Ghar, Ghaziabad 201014

Mob:- 95600 37408, 7599 03 7599,

Email:- contact@cackbajpai.com

Notification No. 39/2012-ST dated 20.06.2012 shall also be available to Krishi Kalyan Cess

(KKC)

Refund of KKC to Special Economic Zone (SEZ)

Vide Notification No. 30/2016-ST dated 26.05.2016, it has been notified that w.e.f. 1.6.2016,

developer of Special Economic Zones (SEZ) or a unit in SEZ under Notification No. 12/2013-ST

dated 1.7.2013 shall be entitled to refund of Service Tax paid on specified services on which ab

initio exemption is admissible but not claimed and amount distributed to it as per clause III (a)

of Notification. Further, refund of KKC shall also be allowed like that of SBC by multiplying total

Service Tax distributed to it by sum of effective rates of SBC and KKC and dividing the product

by rate of Service Tax as per section 66B of the Finance Act, 1994

CA Chandra Kishore Bajpai

B.Com. FCA,LLB. DISA(ICAI)

Shop No. 24, Ground Floor, GDA Commercial Complex,

Nyay Khand-1, Near Bijali Ghar, Ghaziabad 201014

Mob:- 95600 37408, 7599 03 7599,

Email:- contact@cackbajpai.com

Annexures

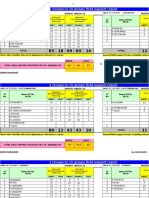

Rate of Service Tax post 01.06.2016 in case of Abated services

Rates Effective From 01.06.2016

S.No.

1

2

2A

3

5A

6

Taxable

Value

Income Heads

Services in relation 10%

to

financial

leasing

Transport of Goods 40%

in

containers by rail by

any person other than

di

il of Goods 30%

Transport

by

Rail other than as

Transport

of 30%

Passengers with or

without accompanied

belongings

by

R

il

Bundled service by 70%

way

of supply of food or

any

other article of human

consumption or any

drink, in a premises

(including

hotel,

convention

center,

club, pandal, shamiana

or any other place,

specially arranged for

organizing a function)

together with renting

Transport

of 40%

passengers

by air

with or

without accompanied

belongings

in

Transport

of 60%

passengers

Renting

of

inns, 60%

hotels,

Guest

houses,

clubs,

campsites or other

commercial

places

f

id i l

Effective

ST Rate

1.40%

Effective

SBC Rate

0.05%

Effective

KKC Rate

0.05%

Total

Effecti

ve Tax

R

t

1.50%

5.60%

0.20%

0.20%

6.00%

4.20%

0.15%

0.15%

4.50%

4.20%

0.15%

0.15%

4.50%

9.80%

0.35%

0.35%

10.50%

5.60%

0.20%

0.20%

6.00%

8.40%

0.30%

0.30%

9.00%

8.40%

0.30%

0.30%

9.00%

CA Chandra Kishore Bajpai

Shop No. 24, Ground Floor, GDA Commercial Complex,

Nyay Khand-1, Near Bijali Ghar, Ghaziabad 201014

Mob:- 95600 37408, 7599 03 7599,

B.Com. FCA,LLB. DISA(ICAI)

Email:- contact@cackbajpai.com

Services

of 30%

goods

transport agency in

to

relation

transportation

of

goods

other

than

h

h ld

d

4.20%

0.15%

0.15%

4.50%

Rate of services where alternate rate is provided post 01.06.2016

Service

Provider Services

Money

Services

in

relation

Changer to

purchase or sale of foreign

currency for an amount upto

Services in

relation

to

purchase or sale of foreign

currency for an amount

exceeding Rs. 100,000 but

upto rupees 1000,000

Lottery

Services

in

relation

to

purchase or sale of foreign

currency for an amount

di

Guarantee

payout more than

80%

Effective

Effective

Service Tax SBC

0.14%

0.005%

Effective

KKC

0.005%

Effective

Total Rate

0.15%

Rs. 140

0.07%

+ Rs.

Rs. 5 +

0.0025%

Rs. 150 +

0.075%

Rs. 770

0.014%

+ Rs.

27.5 Rs. 27.50

+ 0.0005%

+

0.0005%

5

+

0.0025%

Rs. 825 +

0.015%

Rs 8200 on

every Rs

10

Lakh

(or

part

thereof)

Guarantee payout less than Rs

12,800

80%

on every

RS 10 Lakh

(or

part

thereof)

Insurance First year of Policy

3.50%

Subsequent years

1.75%

Rs 293

on

every

Rs

10 Lakh

(or part

th

Rs 457f)

on

every

Rs

10

Lakh

(or

0.125%

0.063%

Rs 293

on every Rs 10

Lakh (or part

thereof)

Rs 8,786

on every Rs 10

Lakh (or part

thereof)

Rs 457

on every Rs

10 Lakh (or

part

thereof)

0.125%

0.063%

Rs 13,714on

every RS 10

Lakh (or

part

thereof)

3.75%

1.88%

Air

0.025%

0.050%

0.025%

0.050%

0.75%

1.50%

el

Domestic Travel

Trav Foreign Travel

0.70%

1.40%

Effective Rate of Service Tax post 01.06.2016 in case of Valuation

Particular

Works Contract - Original Works

Works Contract - Others

Restaurant

Taxable

Value

40%

70%

40%

Effecti

ve

Service

T

5.60%

9.80%

5.60%

Effective

SBC

0.20%

0.35%

0.20%

Effective

KKC

0.20%

0.35%

0.20%

Total

Effecti

ve Tax

R t

6.00%

10.50%

6.00%

CA Chandra Kishore Bajpai

Shop No. 24, Ground Floor, GDA Commercial Complex,

Nyay Khand-1, Near Bijali Ghar, Ghaziabad 201014

Mob:- 95600 37408, 7599 03 7599,

B.Com. FCA,LLB. DISA(ICAI)

Email:- contact@cackbajpai.com

60%

8.40%

0.30%

0.30%

Outdoor Catering

Effective Rate of services in case of reverse charge post 01.06.2016

9.00%

S.No.

1

Service

Rent A Cab - with abatement

Rates Effective From June 1, 2016

Effective

Swac

Effeciv

h

e

Effecti

Bhar

Krishi

Taxable ve

Kalya

Service at

Value

C

C

T

40%

5.60%

0.20%

0.20%

2

3

4

5

6

7

Rent A Cab - without abatement

Manpower Supply

Security Services

Payment to Advocates and Lawyers

Payment for Spnsorship

Transportation of Goods By Road

50%

100%

100%

100%

100%

30%

7.00%

14.00%

14.00%

14.00%

14.00%

4.20%

0.25%

0.50%

0.50%

0.50%

0.50%

0.15%

0.25%

0.50%

0.50%

0.50%

0.50%

0.15%

7.50%

15.00%

15.00%

15.00%

15.00%

4.50%

8

9

9

10

Payment to Independent Director

Works Contract- For Original

W

k Contract- For Other Works

Works

Payment to Arbiteral tribunal

100%

20%

35%

100%

14.00%

2.80%

4.90%

14.00%

0.50%

0.10%

0.18%

0.50%

0.50%

0.10%

0.18%

0.50%

15.00%

3.00%

5.25%

15.00%

Total

effectiv

e Tax

6.00%

CORPORATE SEMINARS

We believe that in todays rapidly evolving business scenarios, corporate and business leaders need

to stay updated about latest policies, best practices and industry developments.

In line with our beliefs, we assists organizations in transforming themselves into industry leaders by

empowering professionals at all levels. We organize various seminars to educate corporate and

professionals about Indirect Taxation Law i.e. Excise, Service Tax, Custom VAT & CST.

Our esteemed panel of experienced speakers, industry veterans, subject matter experts and domain

specialists conduct seminars and create an environment to bolster learning and corporate growth.

These seminars are geared towards enabling organizations to increase their knowledge base and

maximize efficiency.

TOPICS:

GST

Excise

Service Tax

All India VAT

Please feel free for any queries related to conducting seminars in your organization.

85888 27340, contact@cackbajpai.com

CST

Potrebbero piacerti anche

- July 2020 Claims UpcountryDocumento18 pagineJuly 2020 Claims UpcountryHasan Babu KothaNessuna valutazione finora

- MRS - Nacharam - 11 01 2021 NewDocumento32 pagineMRS - Nacharam - 11 01 2021 NewHasan Babu KothaNessuna valutazione finora

- TS GT Scheme CodesDocumento4 pagineTS GT Scheme CodesHasan Babu KothaNessuna valutazione finora

- Indian Languages - Working KnowledgeDocumento46 pagineIndian Languages - Working KnowledgeHasan Babu KothaNessuna valutazione finora

- Excel VBA IntroDocumento95 pagineExcel VBA Introgh19612005Nessuna valutazione finora

- TodayDocumento1 paginaTodayHasan Babu KothaNessuna valutazione finora

- YesterdayDocumento1 paginaYesterdayHasan Babu KothaNessuna valutazione finora

- 24 Male Male MR - Suleym 25 Male Male Mrs - Osbor 26 Male FemaleDocumento1 pagina24 Male Male MR - Suleym 25 Male Male Mrs - Osbor 26 Male FemaleHasan Babu KothaNessuna valutazione finora

- All Primary English SentencesDocumento14 pagineAll Primary English SentencesSrinivas CherukuNessuna valutazione finora

- ADILABAD1CDocumento222 pagineADILABAD1CHasan Babu KothaNessuna valutazione finora

- ADocumento1 paginaAHasan Babu KothaNessuna valutazione finora

- Karim NagaDocumento93 pagineKarim NagaHasan Babu KothaNessuna valutazione finora

- Two Way Lookup in ExcelDocumento1 paginaTwo Way Lookup in ExcelHasan Babu KothaNessuna valutazione finora

- VBA - Basics and AdvancedDocumento136 pagineVBA - Basics and Advancedmanjukn100% (5)

- Khan Muhammad Kawser AhmedDocumento1 paginaKhan Muhammad Kawser AhmedHasan Babu KothaNessuna valutazione finora

- New Microsoft Office Excel WorksheetDocumento1 paginaNew Microsoft Office Excel WorksheetHasan Babu KothaNessuna valutazione finora

- New Text DocumentDocumento2 pagineNew Text DocumentHasan Babu KothaNessuna valutazione finora

- Navata Road Transport Walkin Drive For Experience On 25th To 27th August 2016Documento2 pagineNavata Road Transport Walkin Drive For Experience On 25th To 27th August 2016Hasan Babu KothaNessuna valutazione finora

- Cash Management in MNCDocumento20 pagineCash Management in MNCHasan Babu KothaNessuna valutazione finora

- Overview of TDS: by C.A. Manish JathliyaDocumento21 pagineOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNessuna valutazione finora

- New Scribdword DocumentDocumento1 paginaNew Scribdword DocumentHasan Babu KothaNessuna valutazione finora

- Monthly Return For Value Added Tax: 1% Rate PurchasesDocumento3 pagineMonthly Return For Value Added Tax: 1% Rate PurchasesHasan Babu KothaNessuna valutazione finora

- Cash Management in MNCDocumento20 pagineCash Management in MNCHasan Babu KothaNessuna valutazione finora

- Share CommDocumento1 paginaShare CommHasan Babu KothaNessuna valutazione finora

- Tally Basic Short Cut KeysDocumento2 pagineTally Basic Short Cut KeysgsparunNessuna valutazione finora

- New Microsoft Office Excel WorksheetDocumento250 pagineNew Microsoft Office Excel WorksheetHasan Babu KothaNessuna valutazione finora

- New Microsoft Excel WorksheetDocumento4 pagineNew Microsoft Excel WorksheetHasan Babu KothaNessuna valutazione finora

- New Scribdword DocumentDocumento1 paginaNew Scribdword DocumentHasan Babu KothaNessuna valutazione finora

- Share CommDocumento1 paginaShare CommHasan Babu KothaNessuna valutazione finora

- Bambino Agro Industries Ltd closing stock report as of 19/10/2016Documento147 pagineBambino Agro Industries Ltd closing stock report as of 19/10/2016Hasan Babu KothaNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Renewal Regular Passport Application Form (Adult) : Department of Foreign AffairsDocumento2 pagineRenewal Regular Passport Application Form (Adult) : Department of Foreign AffairsabogadieNessuna valutazione finora

- Pakistan'S Foreign Policy: An Analysis OF Pakistani Fears and InterestsDocumento11 paginePakistan'S Foreign Policy: An Analysis OF Pakistani Fears and InterestsDanyal KhanNessuna valutazione finora

- Contingent Health Care Worker Manual Fillable - 2023Documento33 pagineContingent Health Care Worker Manual Fillable - 2023Nhi Vu Yen MaiNessuna valutazione finora

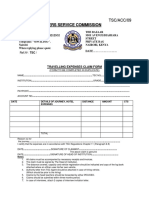

- TSC - Travelling Claim FormDocumento1 paginaTSC - Travelling Claim FormMuruthi B.MNessuna valutazione finora

- Plea Agreement 5.31.22 - Derek MillerDocumento5 paginePlea Agreement 5.31.22 - Derek MillerWXYZ-TV Channel 7 DetroitNessuna valutazione finora

- Coa NSDL New Format-202109011551001360379Documento2 pagineCoa NSDL New Format-202109011551001360379DrSyed ShujauddinNessuna valutazione finora

- Islamic Personal Law-Ii Gift or Hiba: Ghulam Mujtaba MalikDocumento9 pagineIslamic Personal Law-Ii Gift or Hiba: Ghulam Mujtaba MalikJarar AleeNessuna valutazione finora

- 623 Dick Bentley Productions Ltd. and Another V Harold Smith (Motors) Ltd.Documento7 pagine623 Dick Bentley Productions Ltd. and Another V Harold Smith (Motors) Ltd.igcsegeoNessuna valutazione finora

- Society of Kukatpallt W.P.Documento8 pagineSociety of Kukatpallt W.P.RatanSinghSinghNessuna valutazione finora

- Moot Court Memorandum on Acid Attack CaseDocumento12 pagineMoot Court Memorandum on Acid Attack CaseAbhilash SaikiaNessuna valutazione finora

- Roman Catholic Church Land RightsDocumento2 pagineRoman Catholic Church Land RightsLenette LupacNessuna valutazione finora

- Suit by Indegent Person.Documento4 pagineSuit by Indegent Person.Śańthôsh Ķūmař PNessuna valutazione finora

- Pagbilao Cba (10 03 08)Documento20 paginePagbilao Cba (10 03 08)api-3729402Nessuna valutazione finora

- 2 Dallong Galicinao vs. Castro - DigestDocumento2 pagine2 Dallong Galicinao vs. Castro - DigestKarren Quilang50% (2)

- Procjena Rizika I Mjere PDFDocumento54 pagineProcjena Rizika I Mjere PDFdalmatinac1959Nessuna valutazione finora

- Doctrinal Digest:: Cir Vs Bpi G.R. No. 147375, June 26, 2006Documento10 pagineDoctrinal Digest:: Cir Vs Bpi G.R. No. 147375, June 26, 2006JMANessuna valutazione finora

- Assignment 1 - EssayDocumento7 pagineAssignment 1 - Essayapi-511804400Nessuna valutazione finora

- Homicide CaseDocumento18 pagineHomicide CaseJj Ragasa-MontemayorNessuna valutazione finora

- Diversity Management Critical Review and Future AgendaDocumento40 pagineDiversity Management Critical Review and Future AgendaAnaNessuna valutazione finora

- Philippine National Police: (Sample Format of Spot Report)Documento4 paginePhilippine National Police: (Sample Format of Spot Report)Jenerwin Ottao Nera NeraNessuna valutazione finora

- The QLA 7 Step Deep Dive Boot Camp Step 6 - Financing Your DealDocumento2 pagineThe QLA 7 Step Deep Dive Boot Camp Step 6 - Financing Your DealJuan GalvanNessuna valutazione finora

- Alsa Mini Moot Comp - Appellant Written SubmissionDocumento13 pagineAlsa Mini Moot Comp - Appellant Written SubmissionIfwat JaneNessuna valutazione finora

- When and How 24 States Legalized Adult-Use Cannabis in The US: A Timeline With Current Tax RatesDocumento2 pagineWhen and How 24 States Legalized Adult-Use Cannabis in The US: A Timeline With Current Tax RatesTony LangeNessuna valutazione finora

- Equifax Case StudyDocumento15 pagineEquifax Case Studyapi-545476983Nessuna valutazione finora

- LORIA Vs MUÑOZDocumento4 pagineLORIA Vs MUÑOZMaria CerillesNessuna valutazione finora

- RFC Liable for Sales Rep's Illegal DismissalDocumento3 pagineRFC Liable for Sales Rep's Illegal DismissalninaNessuna valutazione finora

- EndingTheWarOnDurgs BriefDocumento10 pagineEndingTheWarOnDurgs BriefTamizh TamizhNessuna valutazione finora

- People VS QuianzonDocumento2 paginePeople VS QuianzonGroot GrootNessuna valutazione finora

- Contract Law Lecture Notes: Defences, Damages and RemediesDocumento15 pagineContract Law Lecture Notes: Defences, Damages and RemediesNur Un NaharNessuna valutazione finora

- Silahis Marketing Corp V Intermediate Appellate Courtand de LeonDocumento2 pagineSilahis Marketing Corp V Intermediate Appellate Courtand de LeonCinNessuna valutazione finora