Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Results, Limited Review Report For December 31, 2015 (Result)

Caricato da

Shyam SunderTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Results, Limited Review Report For December 31, 2015 (Result)

Caricato da

Shyam SunderCopyright:

Formati disponibili

Mudit Finleacse LLd.

Regd, Office : 202717, 3rd Floor

.l0055

Chuno Mondi, Pohorgonj, New Delhi-l

TEL, :

0l 1-23562145,23552146

E-moil : mudit finleose@rediffmoil,corn

(crN - 165993D11 989P1C035635)

Ref. No

Doted

'I'o

Date: L3tt' February, 20T6

'l'he Manager

Dept of Corporate Services

Bombay Stock Exchange,

Mumbai - 400001

Sub.

- : Reg. 33 - Outcome of Board Meeting held on L3l022016 - Adoption and Approval of Unaudited

Financial Results for the Ouarter and Nine Months ended 31't December 2015

Ref.

-: Scrip Code - 531919

I)ear Sir,

'Ihe Board of Directors of the Company at their Meeiing held on Saturday,

L3th

February,2016,have approved the

Un-audited Financial Results for the quarter and nine months ended 31't December,2015. As per Regulation 33 of

l.isting Regulations, the Financial Results and Limited Review Report are enclosed herewith for your record.

Kindly take the same on your records and acknowledge the receipt.

'I'hanking you,

Yours faithfully,

For

Mudit Finl

Pavel Garg

Managing Direc

DIN:00085167

Encl: As above

MudiL Finlease Ltd.

Regd, Office

: ZO2717,3rd Ftoor

Chuno Mondi, Pohorgonj, New Delhi_t .l0055

TEL, : 01 1-23562145,29562146

E-moil : rnudi,+ finleose@rediffmqil,com

(c['t - L55993DLl 989P1C035635)

Ref. No.

Doted

STA'I'EI,IENT OF STANDALONE TINAUDITED FINANCIAL RESULTS FOR THE

QUARTER AND NINE MONTHS ENDED 3IST DECEMBER.20I5

3

Months

ended

PARTICTJLARS

31/12t20t5

Preceding 3 Corresponding

Months ended 3 Months ended

30/09/201s

in the Previous

Year

3l/12/2014

PART-I

l.

(b)

(Unaudited

{Unaudited)

lncome f'rom operations

(a) Nel Sales/lncome lrorn Operations

(Net ofexcise duty)

30 56

(c) Changes in inventories offinished goods,

uo L-rr pro3.ess arrd srock-rn-rrade

(d) Ernployee benet'rts expense

(e) Depreciatio. and ailortisation expense

1l)Other expenses(Any item exceeding I 0o; ofthe total

expenses reiating to continuing operations to be

sho\ut sepalately)

096

lion

263

326

2 048't2

2.683 10

t,938 73

2,546.6a

13.89

(r 1.011

553 17

508 09

t,077 .-21

li.01

106 78

(t2.22)

212.07

654

5.54

1.24

6.14

I7 .'71

17.99

9.28

2',7.44

36.41

t7.52

23.61

5.73

6R

19

s.52

25.16

24 45

682 92

516.81

lf5'70)

2.015.57

(t1 34)

33 l5

l0

(26.4'1

(5.84)

(26.47

(5 84)

(26.47

(5

(l

I

ordinary activities before tax

-145

2,679 84

005

(26 47',

08)

5.54

23.81

2.6t9

4',t 4'7

62 88

(r

1.31

80 62

126.48

1.t'7

32 8l

8l

t1 46

il

1.34

79 45

93

(5.821

t1 46

(lt

Net

Pr

ofit / (L-oss) lrom ordinary activities after

(8 14

12

t8'

l4)

(18.t3

(r

66

ta\ (9-10)

F,rraorrli

,l

Share

rr1 rremr

79.45

93.67

2.8'7

l0 68

20.22

I 1.59

(t.62)

68 77

73.45

(.el ol ra\ <\nense Rs NIL

peilod(ll-ll)

/ lLoss) after taxes, nrinorily interest

ofprofit / (loss) ofassociates (13 -t4 - 15)

6.Ner Proflt

Pard-up equity share capital

(face Valuc olthe Share shall be indicated)

E Reserve cxcluding Revaluation Reserves as per

(3.66)

|59

(1.62

68.'t'l

73.45

(r 8.

l3

(3 66)

li

59

(r 6l

6a 77

73.45

509.09

s09.09

509 09

509.09

509.09

t99 29

t0 00

t02 0t

l0 00

199.29

509.09

l0 00

t99 29

(0 36)

(0 36)

(0 07)

(0.07)

023

(0 03)

(0.03)

(0 36)

(0 07)

0.23

10 00

eet ot Dre\rous dccorntinc \chr

? I Ld'r"r'3s per 50dlc (oerore exrraorolnary ltem

'

(ofRs. i0/- each) (not annualised)

(a) Basrc

(b)

l3)

ce.l

Lr..la

(18

ofproiit / (loss) ofassociates

share

Diluted

0.23

9 i Earnings per sharc (afler extraordinarl items)

(olRs. l0l each) (not annualised):

(a)

(b)

6',7

(9'/)'

{.7is)

I

50

63.60

14 46

llnance costs but before exceptional iterns (5-6

Profit t (Loss)

2,046.09

5 l

fl -?\

7 Profit / (Loss) liom ordinary activities after

(Audired)

(Unaudited)

1,313.59

ended

31/03/2015

6'77 0A

885

/ (Loss) fionr ordinary activities before

finance costs and excepiional items (3+4)

Frnance cosls

511.77

123

I 1.07

Profi t

ended

31t12/2014

Previous year

3 1.05

575

finatrce costs and exceDtronrl irems

.1 Other lncome

Period

31/t2/2015

fUnrudife{l)

675.85

Other OperaliDq lncome

(a) Cost ofmaterials consumed

(b) Purchases of stock-in-trade

Year to date Year to date

figure for

figures for thr

Current

Previous Year

tJasrc

Diiuted

023

i02

(0 03)

ro 01)

r 0.00

102 0l

01

135

l.44

1.35

1.44

L35

1.11

1.44

35

NO'l ES :Tlle abore

Iinocial

results.

6 re\ie\ed

b! the Audil commiilee. $ere laken on record b! the Boffd

of

Direclors al the their meeting held

oi

l31h

Februar, 2016

in the limiled re\ietr reporl issued lbr lhe said period.

Iilerest inconle on loan ale crediLed at the end olfinmcial I ear

.+

_s

Interest e\penditure on unsecured

lom are chuged at the end ol'finorcjal \ea.

'fheConlpan\hasonlvsurgjereportablebusinesssegmeilllnleflnsofrequirenlentofAS,lT.

Frgures tor the prer ious peflod hare been regrouped or rearrmged. \rhererer consldered

necessan..

TheCompanrhasconplied\ittall.i-ele\mtrccounhn!stturdards

,r'

1 ..

Drte: 13/02/2016

Plice : New frclhi

'

..'-

>.

rs5!s.db\ tCAlnsapplicebletolheCompm\

]|

"/\

l7

a\

(Pavel Garg)

Irrrrging Director

f,^'|t^1

DIN:000851 67

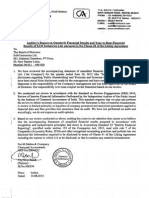

G. K. KEDIA & CO.

CHARTERED ACCOUNTANTS

(lSO 9001 :2008 Certified)

Limited Reuiew Report for the Quarter Ended 31.12.2015

Pursuant to Regulntion 33 of the SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015

We have reviewed the accompanying statement of unaudited financial results of MUDIT

FINLEASE LIMITED [CIN: L65993DL1989PLC035635], having its registered office at

2027/7,3rd Floor, Chuna Mandi, Paharganj, New Delhi - 110055, for the quarter ended

31'.12.2015. This statement is the responsibility of the Company's Management and has

been approved by the Board of Directors. Our responsibility is to issue a report on these

financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE)

2400, "Engagements to Review Financial Statements issued by the Institute of Chartered

Accountants of India". This standard requires that we plan and perform the review to

obtain moderate assurance as to whether the financial statements are free from material

misstatement. A review is [mited primarily to inquiries of company personnel and

analytical procedures applied to financial data and thus provide leis assurance than an

audit. We have not performed an audit and accordingly, we do not express an audit

opinion.

Based on our review conducted as above, nothing has come to our attention that causes us

to believe that the accompanying statement of unaudited financial results prepared in

accordance with applicable accounting standards and other recognized accounting

practices and policies has not disclosed the information required to be disclosed in terms of

Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations,

2015 including the manner in which it is to be disclosed, or that it contains any material

misstatement.

For G. K. Kedia & Co.

Chartered Accountants

FRN: 013016N

(r7h

A^U>c,. WY'\'cr

Satish Kumar Singh

Partner

M. No.525888

Place: New Delhi

Date: 13.02.2016

Head Office : 914, Naurang House, 21, Kasturba Gandhi Marg, New Delhi-110001 Ph : 46259900'Fax '.43562700

Regd. Office :204416, Chitra Gupta Road, Chuna Mandi, Pahar Ganj, New Delhi-110055 Ph. : 23562244 Fax: 23561200

All lndia Toll Free No. : 1800110099 E-mail : mail@gkkediaandco.com Web-site : www.gkkediaandco.com

Potrebbero piacerti anche

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Documento8 pagineFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento6 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 pagineStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 pagineStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento9 pagineStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento5 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento8 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Documento5 pagineAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Documento6 pagineStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento2 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento11 pagineStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento3 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Documento7 pagineStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 pagineStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosDa EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNessuna valutazione finora

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosDa EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNessuna valutazione finora

- Supply Chain Management and Business Performance: The VASC ModelDa EverandSupply Chain Management and Business Performance: The VASC ModelNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNessuna valutazione finora

- HINDUNILVR: Hindustan Unilever LimitedDocumento1 paginaHINDUNILVR: Hindustan Unilever LimitedShyam SunderNessuna valutazione finora

- JUSTDIAL Mutual Fund HoldingsDocumento2 pagineJUSTDIAL Mutual Fund HoldingsShyam SunderNessuna valutazione finora

- Mutual Fund Holdings in DHFLDocumento7 pagineMutual Fund Holdings in DHFLShyam SunderNessuna valutazione finora

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocumento2 pagineSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNessuna valutazione finora

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Documento1 paginaPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNessuna valutazione finora

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocumento6 pagineOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNessuna valutazione finora

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocumento5 pagineExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNessuna valutazione finora

- Financial Results For Mar 31, 2014 (Result)Documento2 pagineFinancial Results For Mar 31, 2014 (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Results, Limited Review Report For December 31, 2015 (Result)Documento4 pagineFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Results For June 30, 2014 (Audited) (Result)Documento3 pagineFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento4 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocumento2 pagineSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNessuna valutazione finora

- Financial Results For Dec 31, 2013 (Result)Documento4 pagineFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For September 30, 2013 (Result)Documento2 pagineFinancial Results For September 30, 2013 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- PDF Processed With Cutepdf Evaluation EditionDocumento3 paginePDF Processed With Cutepdf Evaluation EditionShyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento3 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento11 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Financial Results For June 30, 2013 (Audited) (Result)Documento2 pagineFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For June 30, 2016 (Result)Documento2 pagineStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 pagineTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNessuna valutazione finora

- Investor Presentation For December 31, 2016 (Company Update)Documento27 pagineInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Alert users about duplicate productsDocumento6 pagineAlert users about duplicate productsgovindNessuna valutazione finora

- Withholding Tax Explained With Example - Sap Concept HubDocumento3 pagineWithholding Tax Explained With Example - Sap Concept HubAnanthakumar ANessuna valutazione finora

- NEGODocumento24 pagineNEGOTj AllasNessuna valutazione finora

- Sapota PDFDocumento6 pagineSapota PDFRajNessuna valutazione finora

- Case Spreadsheet NewDocumento6 pagineCase Spreadsheet NewUsman Ch0% (2)

- HSIL's Transformation Drives Tangible ValueDocumento168 pagineHSIL's Transformation Drives Tangible Valueavijit10Nessuna valutazione finora

- 6.3. Net Present Value TablesDocumento6 pagine6.3. Net Present Value TablesTemoteo L Pupa IIINessuna valutazione finora

- Sales FinalsDocumento11 pagineSales FinalsgielitzNessuna valutazione finora

- Risk and The Cost of Capital: Principles of Corporate FinanceDocumento34 pagineRisk and The Cost of Capital: Principles of Corporate FinanceLi Jean TanNessuna valutazione finora

- Il Cantante 2013 - FinanceDocumento21 pagineIl Cantante 2013 - FinanceOliviane Theodora WennoNessuna valutazione finora

- Banking Quiz on Assets, Liabilities, Basel Accords & MoreDocumento5 pagineBanking Quiz on Assets, Liabilities, Basel Accords & Morenatasha100% (1)

- Rule 16-33 - Case DigestsDocumento38 pagineRule 16-33 - Case DigestsAldrich JoshuaNessuna valutazione finora

- CMH Workforce Strategy Forum - InvitationDocumento2 pagineCMH Workforce Strategy Forum - InvitationSharon A StockerNessuna valutazione finora

- CIDADocumento6 pagineCIDAHasitha AthukoralaNessuna valutazione finora

- Chapter 3 Tax AnswersDocumento55 pagineChapter 3 Tax Answersawby04100% (2)

- RCBC vs. CA, 289 Scra 292Documento9 pagineRCBC vs. CA, 289 Scra 292Kimberly SendinNessuna valutazione finora

- Finite Math Final ProjectDocumento14 pagineFinite Math Final Projectapi-396001914Nessuna valutazione finora

- Case DigestDocumento3 pagineCase DigestKisha Karen ArafagNessuna valutazione finora

- UTS - READING COMPREHENSION-dikonversiDocumento3 pagineUTS - READING COMPREHENSION-dikonversipniel kellyNessuna valutazione finora

- Pampanga Practical Accounting 2 PreweekDocumento22 paginePampanga Practical Accounting 2 PreweekYaj CruzadaNessuna valutazione finora

- Executive SummaryDocumento27 pagineExecutive Summaryasimkhan2014Nessuna valutazione finora

- BSNL Bill 10240750870009Documento1 paginaBSNL Bill 10240750870009Uday JoshiNessuna valutazione finora

- Banking Sector 2Documento28 pagineBanking Sector 2Anirban MisraNessuna valutazione finora

- FINC 655 Exam #1 Problems and SolutionsDocumento7 pagineFINC 655 Exam #1 Problems and SolutionsSheikh HasanNessuna valutazione finora

- Harvard Case Study-YashaswiniDocumento5 pagineHarvard Case Study-Yashaswiniankit__bansal100% (1)

- Filipinas Marble vs. IACDocumento2 pagineFilipinas Marble vs. IACPia Janine ContrerasNessuna valutazione finora

- Attorneys For Venmar CES, IncDocumento5 pagineAttorneys For Venmar CES, IncChapter 11 DocketsNessuna valutazione finora

- Money CollocationsDocumento4 pagineMoney CollocationsTaoufik RadiNessuna valutazione finora

- Banker and Customer Relationship PDFDocumento25 pagineBanker and Customer Relationship PDFaaditya01Nessuna valutazione finora

- California Real Estate PrinciplesDocumento22 pagineCalifornia Real Estate PrinciplesWayne Chu100% (3)