Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cholamandalam Initiation Report

Caricato da

girishrajsTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cholamandalam Initiation Report

Caricato da

girishrajsCopyright:

Formati disponibili

Equity Research

INDIA

March 1, 2016

BSE Sensex: 23779

ADD

Cholamandalam Investment and Finance

Target price Rs700

Shareholding pattern

Promoters

Institutional

investors

MFs and UTI

FIIs

Other Inst

Others

Jun

15

57.7

Sep

15

53.2

Dec

15

53.2

35.4

8.2

17.0

10.2

6.9

40.4

7.5

10.0

22.9

6.4

39.8

8.4

31.3

15.0

7.1

I-Sec vs. Bbg* consensus

(% Var)

NII

PPP

PAT

*Bloomberg

FY16E

9.6

2.2

(1.3)

FY17E

8.9

5.1

5.3

Price chart

Mar-16

Mar-15

Sep-15

Mar-14

Sep-14

Mar-13

800

700

600

500

400

300

200

100

Sep-13

(Rs)

Rs649

On a steady path

NBFC

Reason for report: Initiating coverage

Impeccable in group pedigree, Cholamandalam Finance is primarily an auto

financing NBFC with a significant presence in home equity loans (~30% of AUM).

A brief and unsuccessful sortie into unsecured lending in FY07-09 had damaged

its balance sheet and arguably held it back from claiming its rightful share in its

core domain of CV financing (expertise spans the breadth of both tonnage class

and vehicle vintage). Through careful strategic recalibration that married legacy

strengths with new technology, it has increased its market share in the new

vehicle financing space from 2.8% in FY11 to 6% in FY15 and enjoyed earnings

CAGR of 95% since the bottom reached in FY10. In the same period RoE has

improved from 3.2% in FY10 to 15.9% in FY15. Based on a troika of (i) operating

leverage, (ii) ahead of schedule provisioning & GNPA recognition in FY16 and (iii)

asset growth that is relatively de-risked by diversification; we expect an earnings

CAGR of 15% over FY16-18E and RoE to touch 18% by FY17E. However, current

valuation at 2.4xFY17E P/B is at a significant premium (30-35%) to most of its

asset finance NBFC peers and reflect the relatively better asset quality (despite

significant LCV exposure) and higher earnings predictability. We set our target

multiple at 2.2x FY18E P/B which leads to a 12M target price of Rs700. We initiate

coverage with a recommendation of ADD. Key risks are; (i) asset quality risks in

its LAP portfolio and (ii) risks to the operating leverage thesis from lower asset

growth or increase in collection/ technology costs.

X Diversified vehicle finance play, housing foray improves capital productivity.

In the last four years, its market share in the M&HCV segment has almost tripled to

6-7% and LCV market share has been maintained at about 17-18% (still 24% of

vehicle finance AUM).The benefit of diversification was therefore critical to the 30.7%

vehicle AUM CAGR and we expect 13.2% over FY16E-18E. Despite lower margins

in home equity loans, significantly lower operating and credit costs ensure that it

boosts overall capital productivity (both segments have same risk weight).

X Technology, a key enabler of operating excellence. Technology has been an

area of significant investment & management attention and in terms of its integration

into business operations - Chola qualifies as a top quartile performer amongst peers.

This has complemented return to legacy strengths of a self employed customer

base, secured lending, deep distribution presence and empowered branches.

X Safer, but lower delta to cyclical revival than peers. Ahead of schedule asset

classification/provisioning, better underlying asset quality and growth certainty

benefits of diversification render Cholas earnings much more predictable than most

peers. However, the argument cuts both ways as the companys FY16E-17E credit

cost run rate is not as high compared to FY09-14 history, as it is for peers. These

peers earnings can therefore have much more northward delta in case of a cyclical

turnaround. Leverage headroom for asset growth acceleration (RoE accretive), in

such an eventuality, also seems higher in its peers (~15% less effective leverage).

Market Cap

Rs101bn/US$1.5bn

Year to March

Reuters/Bloomberg

CHLA.BO / CIFC IN

NII (Rs mn)

Shares Outstanding (mn)

52-week Range (Rs)

156.1

FY16E

FY17E

FY18E

20,768

24,096

27,463

4,352

5,211

7,020

8,558

EPS (Rs)

27.9

33.4

44.9

54.8

Free Float (%)

46.8

% Chg YoY

19.2

10.2

34.7

21.9

FII (%)

31.3

P/E (x)

23.3

19.5

14.4

11.8

santanu.chakrabarti@icicisecurities.com

Daily Volume (US$/'000)

906

P/BV (x)

3.2

2.8

2.4

2.1

+91 22 6637 7351

Absolute Return 3m (%)

1.4

Net NPA (%)

2.3

2.9

3.5

3.0

Harshit Toshniwal

Absolute Return 12m (%)

14.5

Dividend Yield (%)

0.5

0.7

0.9

1.1

Sensex Return 3m (%)

(9.1)

RoA (%)

1.9

2.0

2.4

2.6

(17.9)

RoE (%)

15.9

15.4

18.0

18.7

Research Analysts:

Santanu Chakrabarti

harshit.toshniwal@icicisecurities.com

+91 22 6637 7230

Sensex Return 12m (%)

721/547

Net Income (Rs mn)

FY15

17,034

Please refer to important disclosures at the end of this report

Cholamandalam Investment and Finance, March 1, 2016

ICICI Securities

TABLE OF CONTENTS

One of the leaders in vehicle finance ............................................................................ 3

Diversification complements core strengths in vehicle finance....................................... 4

Housing foray improves capital productivity................................................................ 8

It is not all a bed of roses though .................................................................................. 11

Technology a key enabler of operating excellence .................................................... 13

Operational strengths are revealed in deep dive .......................................................... 13

Technology has played a crucial role............................................................................ 17

In a nutshell, Chola has married old and new strengths ............................................... 18

Safer, but lower delta to cyclical revival than peers .................................................. 22

Earnings predictability higher than most peers ............................................................. 22

Earnings predictability cuts both ways .......................................................................... 26

12M target price set at Rs700 ....................................................................................... 29

Annexure 1: Vehicle finance sub-segments - analysis .............................................. 30

Light Commercial Vehicles remain a calling card ......................................................... 30

Passenger cars have become an important segment for Chola ................................... 32

HCV tailwind is despite multiple roadblocks ................................................................. 33

Used vehicles presence in both refinance as well as resale ..................................... 34

Tractor business - steady growth given segment realities ............................................ 35

3W and SCV clearly a pain point ............................................................................... 36

Annexure 2: Financials.................................................................................................. 38

Annexure 3: Company Profile....................................................................................... 41

Annexure 4: Index of Tables and Charts ..................................................................... 42

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

One of the leaders in vehicle finance

Cholamandalam Finance has a well-diversified presence in the Vehicle Finance (VF)

space (68% of loan AUM), spanning multiple product categories and tonnage classes.

Chart 1: Overall Cholamandalam loan AUM mix

Other Loans

2%

HCV

14%

LCV

24%

Tractor

10%

Vehicle Loan

68%

Home Equity Loan

30%

Car & MUV

17%

Older

Vehicles

13%

Refinance

15%

3W & SCV

7%

Source: Company data, I-Sec research

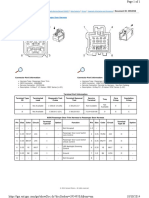

Table 1: Vehicle Finance business snapshot

Category

% of VF

Portfolio

AUM

(Rs

bn)

Market

share

estimate

(%)

45.3

2 year AUM

CAGR

(9 qtrs

figure

annualised)

(4.9)

LCVs

24

Passenger

Cars/

MUVs

16

30.2

MHCVs

14

Used

Vehicles

Refinance

Tractor

Distribution

model

LTV

Interest

rates (%)

17

Avg.

ticket

size

estimate

(Rs mn)

0.46

Dealer linked

8090%

~15%

57.5

0.40

Dealer linked

8090%

~14%

26.4

15.7

1.14

Dealer linked

8090%

~12-13%

13

24.5

6.0

NA

0.16

70%

~19-24%

15

28.3

2.1

NA

NA

70%

~15-19%

10

18.9

12.6

NA

0.37

Broker

sourced

Existing

relationship

Dealer linked

~16-19%

13.2

45.9

NA

NA

Dealer linked

Comm.

1

1.9

*Started in

Equipment

FY16

Source: Company data, I-Sec research

NA

NA

8090%

8090%

8085%

3W & SCV

Key Commentary

With the slowdown in the

rural economy, the

company went on to

reduce the dependency on

LCVs for fuelling its AUM

growth and reduced it

share in the VF AUM.

To maintain the AUM

growth in times when rural

economy was slowing

down, the cars & MUV

segment became one of

the growth driver s for the

company and accordingly,

is share in the total AUM

has increased.

Despite industrial demand

not picking up at the

expected pace, the growth

of MHCV industry volumes

have remained robust and

Cholas share in the

overall VF AUM has

increased marginally.

~16-17%

~14%

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Diversification complements core strengths in vehicle finance

The company has gained significant market share in the new vehicle finance segment

over FY11-14, by maintaining it in the LCV segment and gaining significantly in

M&HCVs and passenger vehicles.

Table 2: Vehicle finance market share estimation

FY11

FY12

FY13

FY14

Industry Disbursements (Rs billion)

LCV & Mini LCVs

MHCV & Tractors

Car & MUVs

134

409

621

183

465

683

227

340

719

189

253

676

Individual Market Shares of Cholamandalam (%)

LCV & Mini LCVs

MHCV & Tractors

Car & MUVs

16.8

1.8

0.5

17.6

3.0

0.9

17.8

5.2

1.2

17.1

7.6

2.2

1,164

33

2.82

1,331

52

3.90

1,286

67

5.23

1,118

67

5.98

Total Industry Disbursements - New vehicles (Rsbn)

Chola Disbursements - New vehicles (Rsbn)

Market Share in new vehicles (%)

Source: Company data, I-Sec Research, CRISIL Research

Chart 2: New vehicle finance market share has increased steadily

New vehicle finance market share

7

6.0

6

5.2

(%)

5

3.9

4

3

2.8

2

1

0

FY11

FY12

Source: Company data, I-Sec Research, CRISIL Research

FY13

FY14

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 3: Market Share Trend in LCV and MHCV segmentsreflects the overall

strategic reaction to cyclical realities

MarketShare(%)

FY11

20.0

18.0

16.0

14.0

12.0

10.0

8.0

6.0

4.0

2.0

-

17.6

16.8

17.8

FY12

FY13

FY14

17.1

7.6

5.2

1.8

3.0

LCV

MHCV

Source: Company data, I-Sec Research, CRISIL Research

The obvious advantage to Cholas well diversified presence in the vehicle finance

segment is that cyclical vulnerability is comparatively lower than peers focusing on

specific niches. As both the rural economy and industrial activity has nosedived in

India in the last two years, this diversification has ensured that the company could be

nimble about the avenues to pursue asset growth in this segment.

Chart 4: Flexibility to switch segment focus, hedges the overall portfolio growth

against economy driven risks to individual segments

LCV

Car & MUV

MHCV & Tractors

Others

100

90

(% of VF AUM)

80

39

38

37

36

36

35

35

20

21

22

23

22

23

24

12

13

14

15

15

16

16

29

29

28

27

26

26

25

24

42

70

60

50

21

40

30

20

10

0

Q4FY14 Q1FY15 Q2FY15 Q3FY15 Q4FY15 Q1FY16 Q2FY16 Q3FY16

Source: Company data, I-Sec research

Although, credit costs in the business have gone up substantially in the last two years

(thanks to both cyclical headwinds as well NPA recognition norm migrations), margins

have improved, thanks to multiple relatively high yield segments and liability tailwinds.

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 5: Credit costs increasing sequentially in last two years

Credit Costs of VF business segment

2.5

2.2

1.9

2.0

(%)

1.5

1.5

1.0

1.9

1.8

2.0

2.1

2.1

1.6

1.4

0.6

0.6

Q1FY13

Q2FY13

Q3FY13

0.8

0.6

0.5

0.5

Q2FY16

Q3FY16

Q4FY15

Q1FY16

Q3FY15

Q3FY15

Q2FY15

6.9

Q2FY15

Q1FY15

7.5

6.7

7.2

Q1FY15

Q4FY14

Q3FY14

Q2FY14

Q1FY14

Q4FY13

0.0

8.1

8.1

8.2

Source: Company data, I-Sec research

Chart 6: NIM has improved

NIMs of VF business segment

7.3

Q3FY13

Q4FY13

7.3

7.1

7.0

7.1

Q4FY14

7.2

Q3FY14

7.1

Q2FY14

7.2

Q2FY13

Q1FY13

9

7

(%)

6

5

4

3

2

1

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q1FY14

Source: Company data, I-Sec research

Consequently, segmental pre-tax RoA has come down but not by much.

Chart 7: Segmental pre-tax RoA has reduced but not collapsed

Pre Tax RoA of VF Business segment

2.8

3.0

3.1

(%)

2.5

2.2

2.2

2.1

2.0

1.6

1.6

1.8

2.0

2.2

2.2

Q2FY16

2.7

Q1FY16

2.8

Q2FY15

3.0

Q1FY15

3.5

2.4

1.5

1.0

0.5

Source: Company data, I-Sec research

Q3FY16

Q4FY15

Q3FY15

Q4FY14

Q3FY14

Q2FY14

Q1FY14

Q4FY13

Q3FY13

Q2FY13

Q1FY13

0.0

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

We build in ~13.2% AUM growth for the vehicle finance business over FY16E-18E.

We feel that risks to these growth assumptions are significantly lower than most peers

due to diversification benefits.

Chart 8: Vehicle finance AUM growth over FY16E-FY18E to remain healthy but

not spectacular

VF AUM

YoY Growth rates (RHS)

16

300

12

(Rs bn)

200

10

8

150

100

YoY Growth (%)

14

250

4

50

2

0

0

FY15

FY16E

FY17E

FY18E

Source: Company data, I-Sec Research

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Housing foray improves capital productivity

Cholamandalam Finance seeded its home equity loans business back in FY08, much

before it was the popular NBFC/HFC loan product that it is today. The business really

picked up steam in FY10, when Cholamandalam started to realign its business

strategy towards its traditional strength in secured products after the disastrous foray

into unsecured lending in FY07-09.

Chart 9: Housing business AUM grew at a very fast pace

Home Equity AUM

80

70

(Rs bn)

60

50

40

30

20

10

0

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

Source: Company data, I-Sec research

Chart 10: as evidenced by a high disbursements growth in segment

Home Equity Disbursements

35

30

(Rs bn)

25

20

15

10

5

0

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

Source: Company data, I-Sec research

While the asset growth in the business has been impressive, it has also been led by

an expansion in average loan ticket size which currently stands at ~Rs5mn.

The company focuses on the self-employed non-professional segment of the

population in the B & C mid-level socio-economic categories (a traditional

strength). The loan tenor can be up to 10 years and the collateral is generally

limited to self-occupied residential property (a strong disincentive against the

moral hazard of opportunistic/speculative borrowing).

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

With yields in the home equity loans business significantly lower than vehicle finance,

margins are obviously lower. This is however a significantly lower operating cost

segment, thanks to larger ticket size and lower collection intensity requirement. The

biggest benefit of the foray into this business however has been in credit costs, which

despite hardening, is significantly lower than the vehicle finance business.

Chart 11: Higher NIMs supported by higher yields in vehicle finance business

NIMs

9

Vehicle finance

(% of total assets)

Home Equity

7

6

5

4

3

2

1

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q3FY15

Q2FY15

Q1FY15

Q4FY14

Q3FY14

Q2FY14

Q1FY14

Source: Company data, I-Sec research

Chart 12: but higher operating costs associated with vehicle finance

Operational Costs

Vehicle finance

(% of total assets)

Home Equity

4

3

3

2

2

1

1

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q3FY15

Q2FY15

Q1FY15

Q4FY14

Q3FY14

Q2FY14

Q1FY14

Source: Company data, I-Sec research

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 13: and credit costs are significantly higher

Credit Costs

(% of total assets)

2.5

Vehicle finance

Home Equity

2.0

1.5

1.0

0.5

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q3FY15

Q2FY15

Q1FY15

Q4FY14

Q3FY14

Q2FY14

Q1FY14

0.0

Source: Company data, I-Sec research

This leads to significantly higher pre-tax RoA for the home equity loans business. With

risk weights for both segments at 100% and no difference in tax rates, home equity

loans have clearly been a RoE accretive diversification.

Chart 14: Home Equity Loans, a higher RoA business for the company

Pre Tax Return on Total Assets

Vehicle finance

4.0

Home Equity

(% of total assets)

3.5

3.0

2.5

2.0

1.5

1.0

0.5

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q3FY15

Q2FY15

Q1FY15

Q4FY14

Q3FY14

Q2FY14

Q1FY14

0.0

Source: Company data, I-Sec research

We build in a CAGR of 16.8% for the segment AUM over FY16E-18E. In the absence

of a major correction in real estate prices, the risks to these growth assumptions

appear low.

10

Cholamandalam Investment and Finance, March 1, 2016

ICICI Securities

It is not all a bed of roses though

The home equity loans or LAP (Loan against Property) business as it is called in India

has boomed in recent times and been a key growth driver for many NBFCs and

housing finance companies. While Cholas deep distribution reach, significant on

ground underwriting capabilities and reasonable loan ticket size/ pricing seem to

indicate that it is at the low to mid end of the risk spectrum in this product, we do have

some concerns about the segment as a whole. Our interactions with credit appraisers

and decision-makers at various HFCs/NBFCs suggest that they remain wary of the

inherent credit risk in the segment due to the following reasons:

Most lenders remain wary of customers financial position when they avail this

loan. With loan rates at 13-15%, apart from the cases where such borrowings are

deployed by customers into their own business, the general suspicion remains that

the borrower is in some sort of financial emergency.

Lenders do not like the fact that the ultimate end use of the money is not under

their direct control.

While the collateral may be enforceable in the case of individual LAP loans

through SARFAESI (not yet notified by RBI, although granted in the last Union

Budget), our contacts in credit underwriting businesses feel that the pool defaults

are likely to be higher than plain vanilla mortgages.

In order to mitigate the risks, the most prominent players are taking the following

precautions:

LTVs are much lower than the 80% maximum allowed for mortgage loans. For

most players, it tops out at 70% with 50-60% being the usual range.

Lenders try to gauge the cashflow pattern based repayment capacity of the

borrower and not just rely on the adequacy of collateral.

The exposure to this business line is capped to a limited portion of the overall

asset portfolio.

One rule of thumb we rely on, to gauge the risk inherent in a LAP portfolio, is to

focus on ticket size and loan pricing. Obviously, all other things remaining

equal, the smaller the better on both counts from a risk perspective. We also

believe that LTV in the case of LAP loans is a subjective opinion and should not

be accorded the same importance to analysis of portfolio risks, as one would

give it for judging an auto or mortgage portfolio. The simple reason is that for

the latter cases, valuation of asset is based on a transacted price of the asset

and therefore more objective in nature.

On both these counts, Cholamandalam Finance checks out reasonably well. As we

saw earlier, despite significant ticket size inflation current average ticket size of Rs5mn

is not excessive by sector standards. When we try to plot average interest income

yield from the home equity loans business, loan pricing also seems to suggest a focus

on the low to moderate risk end of the customer risk profile spectrum.

11

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 15: Home equity interest yields remain moderate a good sign

Home Equity - Interest Yield

14.5

13.3

14

12.9

12.0

12

11.9

10.6

(%)

10

8

6

4

2

0

FY10

FY11

FY12

FY13

FY14

FY15

Source: Company data, I-Sec research

Having said this, a LAP exposure remains somewhat vulnerable to risks from a sharp

real estate price correction, by its very nature. We indicate in our opening investment

thesis that asset quality of the LAP portfolio will remain a key risk to monitor for

existing and potential investors. Management also indicated in the Q3FY16 earnings

conference call that certain geographical pockets are seeing some stress.

12

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Technology a key enabler of operating excellence

Cholamandalam Finance is one of the pioneers in the CV financing business, starting

1978. Its departure from its traditional business strengths and customer base in FY0609 led to a disastrous asset quality outcome and perhaps missed opportunities to

claim its rightful stake in the CV financing pie. The strategic re-organisation of the

company after this period has rightly focussed on shifting focus back to areas of core

competence but with one added dimension. The company has been one of the

pioneers in technology adoption in day to day operations in the NBFC space. Before

we delve into the nuts and bolts of these efforts that we feel are key to

competitiveness in coming years, a look at what we mean by operational excellence

will be illustrative.

Operational strengths are revealed in deep dive

First and foremost, we note that the level of slipped assets for Chola is much lower

than most of its peer group (Sundaram Finance excepted) on apples to apples basis

(120 dpd GNPA recognition, estimates for peers derived from public management

commentary). In evaluating the comparison below, please keep in mind the fact that

even though home equity loans form ~30% of AUM, their GNPA levels are only

~88bps lower than the blended level of 4.8%.

Chart 16: NPA levels (120 days) vis--vis peers

Gross NPA (Based on 120 dpd recognition)

14

11.6

12

(%)

10

7.0

6.0

6

4.8

4

2.1

2

0

Cholamandalam M&M Financials Shriram City

Investments

Union Finance

Shriram

transport

Sundaram

Finance

Source: Company data, I-Sec research, Industry data

13

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

To understand why Chola has been able to pull off this level of relative

outperformance on asset quality, one has to look at their collection specific costs

which are separately provided within other operating expenses in their annual reports.

Chart 17: A higher expenditure on strengthening recovery efforts has helped the

asset quality to remain healthy A STITCH IN TIME, SAVES NINE

1,600

Collection costs

1,400

(Rs mn)

1,200

1,000

800

600

400

200

0

FY12

FY13

FY14

FY15

Source: Company data, I-Sec research

The increase in collection effort costs is illustrative of Cholas early response to

cyclical stress. The companys AUM growth had surpassed employee growth by a

margin in FY12-14, post which employee additions were sharp to boost on ground

presence for stepping up collection effort in a period of cyclical stress. After this step

jump in number of employees, there has once again been a steady increase in

AUM/employee.

Chart 18: AUM per employee has stabilised

AUM per employee

25

21

20

(Rs mn)

17

21

19

18

15

10

5

0

FY12

FY13

FY14

FY15

Q3FY16

Source: Company data, I-Sec research

However, the step up in collection costs emphasises the extent to which employees

have been reallocated towards collection management efforts, as the cycle turned

adverse. The company has managed the collection effort by creating separate teams

for overdue loan assets, depending on bucket of default. Employees managing higher

buckets handle lesser number of accounts on a per capita basis given higher intensity

of effort required per account.

14

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Table 3: Employee classification bucketing system by Cholamandalam for

efficient collection mechanism

No. of month default bucket

1-2 bucket category

3-4 bucket old category

>4th bucket old customers

Source: Company Data

No. of Customers per officer

~130-160 accounts

~50-80 customer accounts

~30-45 customer accounts

Time/Visits devoted per customer

Low

Medium

Highest

Secondly, notice the trend in operating costs as a percentage of AUM in Chola. While

LAP is certainly a lower cost to assets business than vehicle finance, it cannot explain

all the improvement since FY12, nor can operating leverage.

Chart 19: Operating costs as a % of AUM

Total Opex as a % of Average AUM

4.5

4.0

4.0

3.6

3.5

3.1

3.1

3.2

FY14

FY15

9MFY16

(%)

3.0

2.5

2.0

1.5

1.0

0.5

FY12

FY13

Source: Company data, I-Sec research

Even if we strip out new disbursement related direct costs and the collection cost

(stepped up for cyclical stress) from operating costs it has remained stable over last 5

years. This bears testimony to productivity gains achieved with the intelligent use of

technology.

Chart 20: Business origination expense as a % of disbursements remain

constant over the period

1.5

1.5

FY15

1.4

FY14

1.4

FY13

1.5

FY12

1.5

FY11

1.6

FY10

Business origination expense as a % of disbursements

1.4

1.2

(%)

1.0

0.8

0.6

0.4

0.2

-

Source: Company data, I-Sec research

15

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 21: Operating expense excluding business origination & collection costs

has fallen as a % of AUM

2.0

1.79

1.72

FY15

Operating Expense (excl Business Origination & collection expense) as a % of AUM

2.28

2.07

FY14

2.5

(%)

1.5

1.0

0.5

Source: Company data, I-Sec research

16

FY13

FY12

0.0

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Technology has played a crucial role

Technology investments have been a part of Cholas strategy even in the challenging

days of FY10-11 when it was finding its feet after the large losses in the unsecured

lending business. Today, it is a key competitive advantage and deeply embedded in

most aspects of its business.

Chart 22: Technology impact map

Front End

OPERATIONS

RISK MANAGEMENT / CONTROL

Mobility Solutions: Tablet based application that the company is

in the process of implementing. It is a comprehensive solution

suite spanning credit, sales and collection. It will empower the field

staff with the ability to make instant decisions with access to CIBIL

scores, internal credit score, two way documentation transfer etc.

This should have significant impact on TAT and therefore

operating economics and customer satisfaction.

Credit Scoring Model. The company is developing a credit scoring model based on parametric business rules. Despite, the possibility for

a manual override this can work both as a first screen as well as a credit guidepost. It will also create a pool of data where the scoring

model can be back tested for efficiency once a viable data pool has been established in the future.

Risk Based Pricing. With the scoring model indicating credit

worthiness field staff can have risk based pricing freedom in

individual cases, subject to centrally set prudential limits.

Partner

sites

Back End

Core lending platform. The companys core lending platform,

Fin-One Suite is now being adopted to dovetail with its tablet

based mobility solution.

MIS. The company is developing a Hyperion based near real

time MIS, where managers can track their business dynamics

and parameters near-live. This would include P&L of each

branch which will be part of the branch managers KPI.

Planning & Budgeting. The same platform will also provide a

budgeting and business planning tool, capable of both bottom

up and top down analysis.

Dealer Portal. Online portal for vehicle dealers to manage their

business partnership with Chola.

Chola Money. A product for SME loan customers to manage

their loan account, including details of interest and repayment

calculation.

Source: I-Sec Research

17

Cholamandalam Investment and Finance, March 1, 2016

ICICI Securities

In a nutshell, Chola has married old and new strengths

Cholamandalam Finances history since its foray into unsecured lending is the story of

embracing progress without forgetting its roots. We have explored in the last subsection the role that new technology has played but in many aspects of its business it

has built on historical strengths. Some of these are as follows:

Return to its core customer base. The companys positioning in the vehicle finance

business targets micro and small enterprises often with agriculture linked

transportation. While these customers are not FTUs (First Time Users) graduating

from being drivers to vehicle owners that a Shriram Transport Finance would typically

target they are not large freight operators either (served by banks and Sundaram

Finance). These customers are not necessarily un-banked but remain definitely underbanked, especially when it comes to credit products.

Chart 23: Cholas positioning in the vehicle finance space

Source: Company Investor presentation

Collateral based secured lending in focus. Cholamanadalam Finances deep

branch penetration and credit underwriting knowhow is best manifest in livelihood

linked lending. This is where collateral linked products (vehicles and LAP) become so

important to the company. The advantage for Chola in such categories is that once it

can avoid moral hazard issues in customer selection, deep knowledge of cyclical risks

and dynamics in these segments make them a play on its strengths.

18

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Deepening of distribution reach. In the last six years, the company has grown its

branch network at 25% CAGR v/s 3.8% CAGR between FY06-09. The focus on

deepening its reach is a natural outcome of a return to its old asset classes, where

lending success depends on on-the-ground presence. The new businesses like rural

finance are also a benefit of this increased depth in presence.

Chart 24: Branch expansion post strategic realignment from FY10 has been

brisk till FY14 followed by current pause and consolidation

YoY Growth (RHS)

-20

100

-40

-60

Q3FY16

200

FY15

FY14

300

FY13

20

FY12

400

FY11

40

FY10

500

FY09

60

FY08

600

FY07

80

FY06

700

(%)

Number of Branches

Source: Company data, I-Sec research

Chart 25: A truly diversified geographical presence

Cholamandalam Regional Branch Distribution

East, 20%

South , 27%

West, 26%

North , 26%

Source: Company data, I-Sec research

19

Cholamandalam Investment and Finance, March 1, 2016

ICICI Securities

Chart 26: Branch distribution map

Source: Company Investor presentation

Positioning the branch as the rightful heart of the business. The company

understands that in the product-segments it focuses on businesses are made or

broken at the branch level. To this end, the company has clearly de-lineated sales,

credit and collection responsibilities to separate heads at the branch level. They have

also introduced a branch P&L as the branch managers responsibility. This is to

manage motivation and reduce moral hazard at its most granular and critical level of

presence the branch.

Table 4: Organizational hierarchy of the network

Type of office

Category A

Category B

Category C

Nomenclature

Zonal Office

Regional Office

Area Office

Primary Responsibility

Controlling

Controlling

Controlling / Operational

Category D

Category E

Branch Office

Sub Branch Office

Operational

Operational

Source: Company data

20

Additional Remark

Around 6 such offices

Around 20 such offices

Area Regional Manager/ Area Credit

Manager/ Area Collection Manager

Category E (+) Credit officer

~4-5 people (Sales, Collection, Cashier,

Branch Manager)

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Table 5: Business strategy environment outcome

Strategic action

Legacy strengths refocused

Connect with self-employed owners of

micro and small enterprises

Expansion of distribution reach to

maintain intensive customer connect and

leverage local know-how

Collection activity attuned to level of

cyclical stress early strategic resource

allocation response

Sticking to secure collateral based

lending

Maintaining a diversified presence both

geographical and product category to

avoid concentration risks to asset growth

and quality

New initiatives technology/ process

Empowerment of the branch while

delineating sales, credit, collection

responsibilities Branch manager given

individual P&L responsibility with state of

the art MIS to have key information

available at fingertips for course

correction

Moving to tablet based mobility platform

for field staff to cut down TAT

Credit scoring/ risk based pricing,

enabled live on the field through the

mobility platform

Significant analytical work on data from

loan pools for early warnings signs of

cyclical stress

Diversification into new areas like rural

finance building on customer-geography

strengths built up through deep regional

presence

Business environment

Stress in the rural economy from consecutive weak monsoons

Some weakness in LCV segment

Serious weakness in the SCV segment (thanks to overcapacity)

Despite industrial slowdown, tailwind in HCV sales

Regulatory requirements of moving to tighter asset classification and

provisioning norms

Business outcomes

Asset quality at 120dpd significantly better than most peers

Loan AUM CAGR of 29.2% in last 5 years (FY11-15)

In recent times LCV business slack and SCV decline, compensated by sharp up

tick in Cars & MUVs and HCV business robustness

LAP business has scaled up fast to 30% of AUM and remains RoE accretive

(some segment risks remain though)

Asset classification and provisioning changes implemented on an accelerated

timeline way ahead of RBI stipulation

ROE has improved from 3.2% in the bottom of FY10 to 15.9% in FY15 and PAT

has registered a CAGR of 95% over the same period

Source: Company data, I-Sec research

21

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Safer, but lower delta to cyclical revival than peers

Earnings predictability higher than most peers

Cholamandalam Finance has a number of advantages over most vehicle financing

peers when it comes to earnings predictability over the next two years

The company has pre-emptively moved towards 90day GNPA recognition and

40bps standard asset provisioning at an accelerated pace far ahead of RBI

requirements as well as most peers

Asset growth is likely to be much more predictable given diversified base

Multiple liability side earnings levers still remain

Ahead of schedule on asset recognition & provisioning will have

advantage over peers in terms of incremental credit costs

Even though the RBI has mandated movement to 90 day GNPA recognition (180 day

norm earlier) and 40bps standard asset provisioning (25bps norm earlier) by Mar-18 in

3 equal steps over FY16, FY17 and FY18, Cholamandalam Finance has followed an

accelerated timeline.

The company has already moved to 120 day GNPA recognition and 35bps of standard

asset provisioning by Q2FY16, a Mar-17 requirement. We feel the remaining transition

will also be finished off latest by H1FY17E.

Chart 27: We expect transition to 90dpd GNPA recognition in H1FY17

5.1

5.0

4.9

4.8

Q2FY18E

Q3FY18E

Q4FY18E

Q1FY17E

5.1

Q1FY18E

4.2

5.2

Q4FY17E

4.2

5.2

Q3FY17E

4.3

Q4FY16E

3.3

4.4

Q3FY16

3.1

Q1FY16

(%)

Q4FY15

Q2FY16

Q2FY17E

GNPA

3

2

1

0

Source: Company data, I-Sec research

22

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Therefore we expect lower credit costs for Chola in FY17-18E, assuming that

provisioning norms do not change significantly, as the transition pain is largely already

absorbed.

Chart 28: Credit cost to reduce going forward

Credit Costs as a % of AUM

4

3.6

3.0

(%)

3

2.2

1.9

1.7

1.3

1.3

1.5

1.3

0.8

1

0.4

0

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15 FY16E FY17E FY18E

Source: Company data, I-Sec research

Chart 29: despite assuming reasonable coverage ratio

Coverage Ratio

100

87

90

80

73

80

77

69

67

(%)

70

63

60

50

35

40

40

40

45

30

20

10

0

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15 FY16E FY17E FY18E

Source: Company data, I-Sec research

Following is a comparison of the prudential norms as required by RBI and those as

followed by the company. A far more conservative approach of provisioning adopted

by the company adds to the earning predictability.

Table 6: RBI Prudential Norms

Due Period

Upto 6 months

From 6 months to 2 years

From 2 years to 3 years

From 3 years to 5 years

Beyond 5 years

Source: RBI guidelines

Provisioning %

0

10

20

30

50

23

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Table 7: Cholamandalam Provisioning Policy (much more conservative)

Due period

New Vehicle Finance Business

Upto 4 months

From 4 months to 6 months

From 6 months to 2 years

Beyond 2 years

Used Vehicle Finance / Refinance Business

Upto 4 months

From 4 months to 6 months

From 6 months to 1 year

Beyond 1 year

Tractor Finance Business

Upto 4 months

From 4 months to 6 months

From 6 months to 1 year

From 1 year to 2 year

Beyond 2 years

Housing Business

Upto 4 months

From 4 months to 6 months

From 6 months to 2 year

From 2 year to 5 years

Beyond 5 years

Source: Company data

Provisioning %

0

10

25

100

0

10

40

100

0

10

25

40

100

0

10

25

50

100

Higher predictability of asset growth

Barring one off credit events in the LAP space, it is a booster for overall asset growth.

While vehicle finance has been plagued by a slow rural economy and muted industrial

activity, a more urban LAP business geared more to real estate prices and overall

economy should grow faster. Therefore chances of single digit overall loan growth

remain low, given multiple engines for the same.

Segment CAGR (FY16E-18E)

36

17

14

Total Loan AUM

Total Vehicle AUM

CE

HCV

Tractor

Older Vehicles

Refinance

3W & SCV

17

13

10

Source: Company data, I-Sec research

24

15

Other Loans AUM

15

13

Home Equity Loan

AUM

20

Car & MUV

40

35

30

25

20

15

10

5

0

LCV

(%)

Chart 30: FY16E-18E CAGR of various loan AUM segments

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Liability side levers remain

We see two major levers from the liability side that could ease borrowing costs and

help margins for Cholamandalam Finance.

Firstly, we see possibility to improve its long term rating of AA. Peers with much

worse asset quality have one notch higher ratings despite similar levels of Tier-1

capitalization.

Secondly, bank financing remains a high proportion of borrowings and there is

much scope for substitution through bulk borrowings like non-convertible

debentures. The relative interest rate advantage would widen even more if the

rating upgrade does come through. However, in our opinion, in absence of a rating

upgrade the company is unlikely to start the substitution process in right earnest.

Table 8: Comparison of credit ratings with peers in the industry (Long term)

Credit Rating Analysis

Long Term

CRISIL

Cholamandalam Investments

AA

Shriram Transport

AA+

M&M Financials

AA+

Shriram City Union Finance

AASundaram Finance

AA+

Source: I-Sec Research, Industry sources

ICRA

AA

AA

AA

AA+

CARE

AAAA+

AAA

AA+

-

Commentary

While Shriram Transport, Sundaram Finance and

M&M Financials are rated slightly above

Cholamandalam and SCUF by the credit rating

agencies, even then Chola's current ratings are a

mark of strong long term stability.

Table 9: Comparison of credit ratings with peers in the industry (Short term)

Credit Rating Analysis

Short Term

CRISIL ICRA

Cholamandalam Investments

A1+

A1+

Shriram Transport

A1+

A1+

M&M Financials

A1+

Shriram City Union Finance

A1+

A1+

Sundaram Finance

A1+

A1+

Source: I-Sec Research, Industry sources

CARE

A1+

-

Commentary

Most of these NBFCs have a similar rating profile

for the short term horizon and enjoy a rating

indicative of a stable outlook.

Chart 31: Borrowings mix

Borrowing Mix

Tier II Capital

12%

Debentures

24%

Bank Term Loans

55%

Commercial

Paper

9%

Source: Company data, I-Sec research

25

Cholamandalam Investment and Finance, March 1, 2016

ICICI Securities

Earnings predictability cuts both ways

It would be remiss of us to not mention the flip side of our earlier arguments. In case of

a cyclical recovery, the delta to earnings for Cholamandalam Finance is not as high as

some of its peers. The reasons behind this are;

Credit costs are likely to shift downwards from current estimates much more

drastically for most peers of Chola, in case of a cyclical recovery

Although, Tier 1 capitalization level of Chola is comparable to its peer-set, actual

leverage defined as AUM (including off balance sheet loans)/ Equity is significantly

higher. For peers, the extra ability to leverage as asset growth picks up will

incrementally boost RoE more than Chola.

Valuation for Chola is at a significant premium to most peers for similar RoEs. Rerating potential in case of a cyclical recovery is also therefore limited.

Credit cost relatively inelastic to cyclicality

Given the superior asset quality demonstrated by Cholamandalam Finance,

improvements from a cyclical upturn will also be more limited than peers. Consider the

following two examples from its peer set to understand this well.

Shriram Transport Finance has an obvious delta from an improvement in industrial

and construction activity in the asset quality of it CE subsidiary that has faced a

massive meltdown. Even in the core business, in the last 8 quarters, the company

has reported a cumulative credit cost of ~Rs27bn. Of this only ~Rs9.3bn has gone

towards increases in GNPA provisioning stock. A large part of the balance

therefore has come from write-offs. When the cycle turns and write-offs stop

(perhaps even be replaced by some write-backs), credit costs will reduce

significantly. The fact that its FY16E-17E credit cost run rate is 3.3%, as against

the average of annualised quarterly credit costs of last 6 years of 1.9%

demonstrate the efficacy of this argument.

M&M Financial Services current GNPA is 2.1x its FY11-15 average, which is

therefore clearly close to a cyclical peak, even after adjusting for dpd reporting

norms. In the same period coverage has moved from 82.5% to 57.3%.

Chola unfortunately will not have the same delta in credit costs for FY17E, if the

business cycle turns for the better. The fact that credit costs for peers like Shriram

transport Finance is currently expected to be elevated in FY17E due to reporting

transition, while Chola would have likely completed the journey, reduces the delta to

an already fairly moderate credit cost expectation.

26

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 32: Cholas FY16E-17E credit cost comparatively inelastic to cyclicality

Average FY16E-17E Credit Cost as a % of AUM

7 Year (FY09-15) Average Annual Credit Cost as a % of AUM

4.0

3.3

(%)

3.0

2.0

2.5

1.9

1.9

1.8

1.6

1.0

0.0

Cholamandalam

Shriram Transport

M&M Financials

Source: Company data, I-Sec research, Industry data

Despite high Tier-1, leverage possibilities are limited

The tier-1 capitalization of Chola is reasonable, but lower than peers.

Chart 33: Adequate Tier-1 capital

Tier 1 Capital

20

18

16

14

(%)

12

10

8

6

13.5

15.4

15.0

Shriram Transport

M&M Financials

4

2

0

Cholamandalam

Source: Company data, I-Sec research

27

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

However, when we look at total implied leverage defined as total assets (including off

balance sheet) divided by shareholders funds, Cholas effective gearing is much

higher than peers.

Chart 34: Crucially, significantly higher total implied leverage (even after

including off-book assets)

Total Assets (excl off-book assets) / Shareholders Funds

Total Assets (incl off-book assets) / Shareholders Funds

8.5

9.0

8.0

7.6

7.2

6.4

7.0

6.5

6.7

6.0

5.0

4.0

3.0

2.0

1.0

0.0

Cholamandalam

Shriram Transport

M&M Financials

Source: Company data, I-Sec research

The reason behind Cholas higher effective leverage is its higher use of bilateral

assignments which now no longer have a tier-1 capital implication, given absence of

credit enhancements. Since, the credit performance of the pools sold down under this

route have no direct bearing on Cholas financials, one may tend to argue that

significant leverage headroom remains. However, we feel that credit rating agencies

are unlikely to take this view and would indeed look at effective leverage

benchmarks. The fact remains that Chola would have to continue servicing all

originated loans, irrespective of whether they are sold down. An effective leverage

ceiling therefore keeps in check the extent to which its operating network is being

sweated.

28

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Valuation at a premium to most peers

Cholamandalam Finances valuation multiples reflect the relative earnings

predictability that we discussed above and is trading not only at a premium to most

peers but also at the top quality of its own trading range, when most peers are

languishing at the bottom quartile of its trading range. The possibility of significant

upward re-rating therefore remains remote.

Table 10: Peer comparison valuation matrix

P/E

P/B

Company

FY16E

FY17E

FY16E

FY17E

Cholamandalam Investment

19.0

15.2

2.8

2.4

Shriram Transport

15.1

11.8

1.9

1.7

Shriram City Union Finance

17.4

13.8

2.1

1.9

Mahindra & Mahindra Financial

15.5

9.5

1.9

1.6

Sundaram Finance

21.7

18.2

3.3

2.8

Source: I-Sec Research, Bloomberg (Based on prices as on March 1, 2016)

Chart 35: P/E band chart

EPS CAGR (%)

(FY15-17E)

17.9

26.2

10.3

17.2

14.5

Chart 36: P/B band chart

800

800

2.7x

17x

600

700

600

13x

2.0x

500

300

Source: I-Sec Research

May-15

Aug-14

Dec-13

Mar-13

Jul-12

Oct-11

Feb-11

0.8x

Apr-08

Jan-16

May-15

Aug-14

Dec-13

Mar-13

Jul-12

Oct-11

Feb-11

May-10

100

Sep-09

100

Dec-08

200

Apr-08

200

May-10

300

1.6x

400

Sep-09

7x

Dec-08

10x

400

(Rs)

500

Jan-16

700

(Rs)

RoE (%)

FY16E

FY17E

16.2

16.9

13.1

14.9

12.5

14.2

12.7

18.3

15.9

16.6

Source: I-Sec Research

12M target price set at Rs700

With RoE for Cholamandalam inching up to 18%+ by FY18E without any benefit of a

cyclical turnaround, we feel that its target multiple should be at a 20-25% premium to

its direct peers whose current RoE are ~300bps lower. The target multiple we use for

Shriram Transport Finance is 1.7x 1yr fwd P/B and accordingly the target multiple that

we choose for Cholamandalam is 2.2x (applied on Q4FY18E BVPS, of course). As an

aside, the target multiple we use for M&M Financials now is 1.5x 1 yr fwd P/B, but that

is necessitated by the extraordinarily high quantum of GNPA.

We concede that RoE for these two peer may actually converge with Chola and even

exceed it once the cycle turns and the valuation gap can even reverse on earnings

momentum. However, we feel that the premium we are according to Cholamandalam

above this peers is justified given; (i) significant differences in asset quality as well as

progress on 90dpd reporting (transition hits to earnings), (ii) much more predictable

earnings, (iii) no visibility on resurgence in the business cycle and (iv) the housing

piece in the pie which generally receives a higher market multiple (more comparable

with SME finance).

29

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Annexure 1: Vehicle finance sub-segments - analysis

Light Commercial Vehicles remain a calling card

Light Commercial Vehicle (LCV) finance remains a traditional strength of

Cholamandalam Finance. Although the segment has dropped from being 21% of

overall loan AUM in FY14 to 16% now, one has to keep in mind that the portfolio has

grown at 0.9% annualised which comfortably outpaces the volume decline for auto

manufacturers in the segment at 4.2% annualised.

Chart 37: LCV disbursement showing muted growth

8,000

CAGR = 0.9%

7,000

(Rs mn)

6,000

5,000

4,000

3,000

2,000

1,000

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q3FY15

Q2FY15

Q1FY15

Q4FY14

Source: Company data, I-Sec research

Chart 38: as against a 4.17% decline in the LCV sales volumes

120

Units ('000)

100

80

60

40

Source: Company data, I-Sec research

30

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q3FY15

Q2FY15

Q1FY15

Q4FY14

20

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 39: Company is maintaining a steady LCV finance market share

Market Share (LCV)

20

16.8

17.6

17.8

FY12

FY13

17.1

16

(%)

12

8

4

0

FY11

FY14

Source: Company data, I-Sec research

One of the key theses about the commercial vehicle industry in India is that mid-level

tonnage classes will eventually get phased / squeezed out and the overall logistics will

work in a hub and spoke model with LCVs dominating the spokes and HCVs handling

transport between hubs. The driving factors of this transition will be.

Better highway coverage allowing really heavy tonnage class vehicles

Stricter vigilance on overloading

Stricter emission norms and compliance limiting the length of life of a CV on

National Highways

Implementation of the GST removing interstate taxes for the large trucks leading to

the share of higher tonnage trucks going up within the HCV space, due to be

better cost benefit.

The recent slowdown in LCV sales is hardly a surprise given

A rural economy hit by two consecutive sub-par monsoons

Given the paucity of freight related to application of higher tonnage CVs

(construction, roads etc.) some of the larger tonnage vehicles are migrating to the

local agricultural produce, consumer goods transportation markets

Massive overcapacity in the SCV (Small Commercial Vehicle) segment triggered

by easy finance schemes driven blockbuster sales in earlier years

We feel that the near term fortunes of the LCV cycle will be closely linked to the

fortunes of the rural economy. This in turn would depend on

Winter crop outcome

Early sentiments about monsoon driven by rainfall estimates

Actual quantum of rains and distribution

MSP hikes in the coming fiscal

Use of funds from endowment schemes like MNREGA (budget allocation

significantly higher this year compared to last)

We build in low growth maintaining adequate margin of safety.

31

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 40: LCV AUM expected to grow at a moderate pace

YoY Growth (RHS)

10

5

0

Q4FY18E

Q3FY18E

Q2FY18E

Q1FY18E

Q4FY17E

Q3FY17E

Q2FY17E

Q1FY17E

-10

Q4FY16E

Q3FY16

Q2FY16

Q1FY16

-5

YoY Growth (%)

15

Q4FY15

(Rs bn)

LCV AUM

54

52

50

48

46

44

42

40

Source: Company data, I-Sec research

Passenger cars have become an important segment for Chola

Cholas presence in the passenger cars and MUV (Medium Utility Vehicle) segment

has increased significantly despite the recent downturn in UV sales. From being 6% of

AUM in FY14 it now stands at 11% of AUM. Its AUM in this segment has registered a

CAGR of 57.5% vis--vis overall vehicle finance AUM CAGR of 6% over the same

period.

Chart 41: Passenger car related disbursements have remained strong

Passenger Car & MUVs Disbursements

6,000

(Rs mn)

5,000

4,000

3,000

2,000

Source: Company data, I-Sec research

32

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q3FY15

Q2FY15

Q1FY15

Q4FY14

1,000

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 42: Passenger car & MUV segment AUM has grown fast

Passenger Car & MUVs AUM

35

30

(Rs bn)

25

20

15

10

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q3FY15

Q2FY15

Q1FY15

Q4FY14

Source: Company data, I-Sec research

We are assuming a AUM CAGR of 12.5% over FY16E-18E given the relatively lesser

degree of cyclicality in this business versus commercial vehicles. Dependence, if any,

is to the rural income cycle and direct industrial activity related vulnerability is lower.

HCV tailwind is despite multiple roadblocks

As the I-Sec Auto Research team members Nishant Vass & Jeetendra Khatri write in

their report entitled Rising consumer demands on products & technology on

November 21, 2015

M&HCV segment witnessed voluminous buying on the back of fleet replacement

cycle, better freight economics due to lower fuel prices and ABS legislation driven prebuying in recent months

However, there are a lot of issues with freight volumes in the HCV business that could

get redressed over a period of time, leading to further buoyancy.

Mining activity is yet to pick up in a major way (some improvement has happened)

Road construction is nowhere near budgetary targets

Large scale industrial project related demand remains almost missing

Infrastructure projects are practically at a standstill

If the cash for clunkers program takes off, it could support new vehicle prices by

creating more buoyancy in the operator eco-system

Its share in AUM has been relatively stable at ~9% in FY14 and now as well. Its AUM

in this segment has registered a CAGR of 15.7% vis--vis overall vehicle finance AUM

CAGR of 6% over the same period.

33

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 43: Cholas market share in MHCV and Tractor financing segment (not

separately available for M&HCV)

Market Share (MHCV & tractors)

7.6

8

7

6

5.2

(%)

5

4

3.0

3

1.8

2

1

0

FY11

FY12

FY13

FY14

Source: Company data, I-Sec research, CRISIL Research

We build in a healthy 20.5% AUM CAGR over FY16E-18E.

Chart 44: HCV AUM expected to grow at a healthy 20.5% over FY16-18E

45

40

35

30

25

20

15

10

5

0

YoY Growth (RHS)

35

25

20

15

10

YoY Growth (%)

30

Q4FY18E

Q3FY18E

Q2FY18E

Q1FY18E

Q4FY17E

Q3FY17E

Q2FY17E

Q1FY17E

Q4FY16E

Q3FY16

Q2FY16

Q1FY16

Q4FY15

(Rs bn)

HCV AUM

Source: Company data, I-Sec research

Used vehicles presence in both refinance as well as resale

Cholamandalam Finance has about 10.1% of its AUM in the vehicle refinance

segment. These are mostly old Chola customers who are given a loan after the earlier

ones run down. While the yield on this segment is more lucrative at 15-19% (~300

bps) higher than new vehicle loan pricing, they are even higher (~19-24%) on

financing resale of old vehicles which now forms 8.8% of loan AUM. Shriram Transport

Finance is a virtual monopoly in the old CV resale financing business with segment

AUM at Rs609.4bn. Cholamandalam is one of the other larger players in this highly

specialised segment. Given the lower cyclical vulnerability of these segments, we build

in FY16E-18E AUM CAGRs of 15.4% and 15.2% on used vehicle finance and

refinance business respectively.

34

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 45: Used vehicle finance expected to grow at ~15.4% over FY16-18E

Used Vehicles

YoY Growth (RHS)

20

30

15

(Rs bn)

25

20

10

15

10

0

5

0

YoY Growth (%)

35

Q4FY18E

Q3FY18E

Q2FY18E

Q1FY18E

Q4FY17E

Q3FY17E

Q2FY17E

Q1FY17E

Q4FY16E

Q3FY16

Q2FY16

Q1FY16

Q4FY15

-5

Source: Company data, I-Sec research

Chart 46: Refinance business AUM expected to grow at ~15.2% over FY16-18E

YoY Growth (RHS)

15

10

5

0

YoY Growth (%)

20

45

40

35

30

25

20

15

10

5

0

Q4FY18E

Q3FY18E

Q2FY18E

Q1FY18E

Q4FY17E

Q3FY17E

Q2FY17E

Q1FY17E

Q4FY16E

Q3FY16

Q2FY16

Q1FY16

-5

Q4FY15

(Rs bn)

Refinance

Source: Company data, I-Sec research

Tractor business - steady growth given segment realities

Amongst all the vehicle finance categories that Cholamandalam Finance has a

presence in, tractors are obviously most closely geared to the currently weak rural

income cycle. Organised tractor finance in India has proved a challenge for most

incumbents with success stories few and far between. Tractor finance has a few

challenges that are unique in nature:

When in agricultural usage, a tractor is not a commercial asset. By this, we mean

that the cashflows / revenues from agricultural produce are not directly mapped to

the vehicle. Moreover, it is a productivity enhancer in most cases given the

average agricultural landholding size in India, rather than an absolute necessity.

Thus, credit default behaviour mimics a discretionary rather than a livelihoodlinked commercial asset.

35

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Agricultural cashflows in themselves are also lumpy with payoffs generally

happening twice a year. This means that repayment instalments have to be

generally quarterly and half-yearly and even one single payment default puts the

asset in the NPA category (as per the 180-day NPA norm).

Over-invoicing at the dealers end has been a consistent problem that financing

companies have faced as asset values have often been overstated.

This is a highly people-centric business with the collection effort needing

continuous monitoring and cash-handling at the customers doorstep. This has

proven a challenge to non-specialised players or players with fast asset growth

aspirations.

Repossession of defaulted assets has been complicated in some cases with

agricultural implements being a touchy and politically sensitive subject.

The countrys large size ensures that every year some part of India or the other

has a relatively low agricultural produce due to poor rainfall, drought etc.

With two consecutive weak monsoons and the overall weakness in the rural economy,

the company has shown some growth in its tractor AUM, albeit at a slower pace than

its overall growth rate. We build in a small recovery in FY17E and 9.5% AUM CAGR

over FY16E-18E.

Chart 47: Tractor AUM expected to grow at 9.5% over FY16-18E

Tractor AUM

YoY Growth (RHS)

(Rs bn)

20

15

15

10

10

5

Q4FY18E

Q3FY18E

Q2FY18E

Q1FY18E

Q4FY17E

Q3FY17E

Q2FY17E

Q1FY17E

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q4FY16E

YoY Growth (%)

20

25

Source: Company data, I-Sec research

3W and SCV clearly a pain point

Small commercial vehicles segment in India has been struggling from overcapacity

driven by a sales boom that rode on easy and plentiful finance and lasted up until two

years ago. With freight demand relevant to the segment in the doldrums, the

companys AUM in the segment has decreased substantially. From being 10% of AUM

in FY14 it now stands at 5% of AUM. Its AUM in this segment has registered a decline

of 25.6% vis--vis overall vehicle finance AUM CAGR of 6% over the same period.

We do not build in any major recovery even in FY18E as the overcapacity in the

segment is significant. However, given the current contracted base, we build in an

AUM CAGR of 9.5% over FY16E-18E.

36

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Chart 48: Disbursements have remained low in this segment

3W&SCV Disbursements

4,500

4,000

(Rs mn)

3,500

3,000

2,500

2,000

1,500

1,000

500

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q3FY15

Q2FY15

Q1FY15

Q4FY14

Source: Company data, I-Sec research

Chart 49: 3W and SCV AUM showed a 25.6% annualised decline

3W&SCV AUM

25

Linear (3W&SCV AUM )

20

(Rs bn)

15

10

5

Q3FY16

Q2FY16

Q1FY16

Q4FY15

Q3FY15

Q2FY15

Q1FY15

Q4FY14

Source: Company data, I-Sec research

37

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Annexure 2: Financials

Table 11: Profit and Loss Statement

(Rs mn, year ending March 31)

Particulars

Interest earned

Interest expended

Net interest income

FY14

32,226

17,711

14,515

FY15

36,638

19,604

17,034

FY16E

41,158

20,390

20,768

FY17E

45,787

21,691

24,096

FY18E

51,112

23,648

27,463

402

274

148

170

196

Staff cost

Depreciation

Other operating expenses

Total operating cost

1,875

236

4,471

6,582

2,217

292

4,979

7,489

2,505

202

5,785

8,491

2,988

219

5,839

9,046

3,631

247

6,312

10,190

Pre-provisioning op profit

8,335

9,819

12,424

15,220

17,469

Provisions & contingencies

2,833

3,247

4,485

4,584

4,502

Profit before tax & exceptional items

Exceptional items

Profit before tax & exceptional items

5,502

5,502

6,572

6,572

7,939

7,939

10,636

10,636

12,966

12,966

Income taxes

1,862

2,221

2,727

3,616

4,409

3,640

4,352

5,211

7,020

8,558

FY14

1,433

21,514

22,947

FY15

1,437

30,289

31,727

FY16E

1,562

34,535

36,097

FY17E

1,562

40,477

42,038

FY18E

1,562

47,722

49,284

1,80,932

1,94,752

2,22,866

2,53,581

2,89,629

3,515

8,074

3,858

8,388

6,132

8,602

8,256

8,328

9,941

8,724

Total liabilities & stockholders' equity

2,15,468

2,38,732

2,73,697

3,12,203

3,57,578

Loans & advances

1,94,281

2,21,835

2,50,883

2,86,525

3,28,677

Investments

Cash and Balance

824

8,008

675

3,407

615

4,317

692

4,859

779

5,468

729

11,625

683

12,132

1,006

16,877

1,133

18,995

1,275

21,379

2,15,468

2,38,732

2,73,697

3,12,203

3,57,578

Other income

PAT

Source: Company data, I-Sec research

Table 12: Balance Sheet

(Rs mn, year ending March 31)

Particulars

Capital

Reserves & surplus

Net worth

Pref. shares/ Share application money

Total borrowings

Provisions

Other Liabilities

Fixed Assets

Current & other assets

Total Assets

Source: Company data, I-Sec research

38

ICICI Securities

Cholamandalam Investment and Finance, March 1, 2016

Table 13: Key Ratios

(Year ending March 31)

Particulars

Growth (%):

AUM

Disbursements

Loan book (on balance sheet)

Net Interest Income (NII)

Non-interest income

Pre provisioning operating profits (PPoP)

PAT

EPS

FY14

FY15

FY16E

FY17E

FY18E

22.4

8.2

16.4

31.1

6.7

44.9

18.7

18.7

9.5

(2.3)

14.3

17.4

(32.0)

17.8

19.5

19.2

12.9

19.7

14.5

21.9

(46.0)

26.5

19.8

10.2

14.2

15.3

14.2

16.0

15.0

22.5

34.7

34.7

14.7

14.9

14.7

14.0

15.0

14.8

21.9

21.9

6.9

17.2

10.6

6.6

5.0

7.0

16.8

10.4

6.4

5.3

7.7

16.5

9.8

6.7

5.0

7.8

16.0

9.1

6.9

5.0

7.8

15.6

8.7

6.9

5.0

Operating efficiencies

Non-interest income as % of net income

Cost to income ratio (%)

Op.costs / avg AUM (%)

No of employees (including off rolls)

Average annual salary (Rs)

Annual inflation in average salary(%)

Salaries as % of non-int. costs (%)

NII /employee (Rs mn)

AUM/employee(Rs mn)

2.7

44.1

3.1

11,187

1,67,604

15.7

28.5

1.30

20.8

1.6

43.3

3.1

13,090

1,69,395

1.1

29.6

1.30

19.4

0.7

40.6

3.1

13,489

1,85,703

9.6

29.5

1.54

21.3

0.7

37.3

2.9

15,180

1,96,820

6.0

33.0

1.59

21.6

0.7

36.8

2.9

17,084

2,12,566

8.0

35.6

1.61

22.0

Capital Structure

Debt-Equity ratio

Leverage (x)

CAR (%)

Tier 1 CAR (%)

Tier 2 CAR (%)

Tier 1 Capital (Rs mn)

Tier 2 Capital (Rs mn)

RWA

7.9

9.4

17.2

10.5

6.8

20,793

13,475

1,98,852

6.1

7.5

21.2

13.0

8.2

29,712

18,773

2,28,222

6.2

7.6

19.8

12.8

7.0

33,557

18,392

2,62,749

6.0

7.4

20.1

13.1

7.0

39,180

20,980

2,99,715

5.9

7.3

20.4

13.4

7.0

46,066

24,029

3,43,275

1.9

0.7

4,418

1,628

2.3

0.8

63.2

1.34

3.1

2.0

7,890

5,091

3.6

2.3

35.5

1.33

4.2