Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Eimco Elecon Equity Research Report July 2016

Caricato da

sriramrangaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Eimco Elecon Equity Research Report July 2016

Caricato da

sriramrangaCopyright:

Formati disponibili

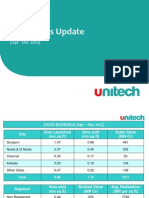

InitiatingCoverage

4July2016

Current

Previous

CMP:Rs396

Rating:BUY

Target:Rs678

Rating:NR

Target:NR

STOCKINFO

523708

EIMCOELECO

EEIINEQUITY

EIMC.BO

CapitalGoods

10

58

2,284

695/276

2,684

Market Leader in the underground coal mining equipment industry with 90%

marketshare

Coal ministry plans to revise equipment purchase policy to increase mining

efficiencywhichwouldboostEimcoEleconsearnings

(asonMarch2016)

Promoters

FIIs

DIIs

Public&Others

Readytominefavorablecoalcycle

Key Investment Rationale

SHAREHOLDINGPATTERN

EimcoElecon(India)Ltd

Eimco

Elecon (India) Ltd is in the business of Manufacturing, Marketing and

ServicingEquipmentforMiningandConstruction.Itisoneoftheleadingsuppliers

of

underground coal mining equipments in India. It was first to introduce the

intermediatetechnologyofSideDumpLoaders(SDLs),LoadHaulDumpers(LHDs)

and

Rocker Shovel Loaders in India to partially mechanize the underground Coal

andmetalliferrousminesandcontinuetobemarketleadersincethen.Inaddition

thesparesbusinesswhichisahighmarginbusinessprovidesastablecashflowand

contributes around 50% in overall sales. Introduction of new products and entry

into open cast mining products to act as a key catalyst for the stock. Further the

company has strong balance sheet with liquid investment of Rs.198/share. We

initiatecoverageonEimcoElecon(India)LtdandrecommendBUYonthestockwith

SOTPbasedtargetpriceofRs678.

(NRNotRated)

INDEX

BSE

NSE

Bloomberg

Reuters

Sector

FaceValue(Rs)

EquityCapital(Rsmn)

MktCap(Rsmn)

52wH/L(Rs)

AvgDailyVol(BSE+NSE)

SteadyrevenuefromSparesandcomponentssegment(highmarginbusiness)to

continuesupportearnings

74.1

4.8

21.1

Forayinopencastingminingwoulddriverevenueandprofitability

StrongBalanceSheetwithliquidinvestmentofRs.198/share

STOCKPERFORMANCE(%) 3m 6m 12m Strongparentcompanysupport

EEIINEQUITY

18.9 (16.6) (31.6)

SENSEX

6.9 5.9 (3.4)

Risk

Source:Bloomberg,IndiaNiveshResearch

HigherdependenceonCoalIndiaLtdanditssubsidiaries

EEIINEQUITYv/sSENSEX

Threatfromforeignplayersenteringintothissegment

Valuation

150.0

100.0

50.0

EEIIN

Jul16

Jun16

Apr16

May16

Mar16

Jan16

Feb16

Dec15

Oct15

Nov15

Sep15

Jul15

Aug15

0.0

SENSEX

Source:Bloomberg,IndiaNiveshResearch

DaljeetS.Kohli

HeadofResearch

Tel:+912266188826

daljeet.kohli@indianivesh.in

AbhishekJain

ResearchAnalyst

Tel:+912266188832

abhishek.jain@indianivesh.in

HarshrajAggarwal

ResearchAssociate

Tel:+912266188879

harshraj.aggarwal@indianivesh.in

IndiaNiveshSecuritiesLtd

Government

thrust to increase underground coal mining activity in India will have

positive effects on the demand for underground mining equipments. We believe

EmicoEleconwouldbethekeybeneficiaryoftheincreaseinequipmentdemand.We

expectthesalesofthecompanytogrowatCAGRof22%fromFY16FY18eonaccount

ofpickupincoalminingactivitiesandintroductionofnewproducts.AtCMPofRs396,

EimcoEleconistradingataP/Emultipleof11.7xFY17eand9.5xFY18e,EPSofRs33.8

andRs41.8respectively.EimcoEleconduringitspeakperiodofFY0409wastrading

at an average PE of 14.42x and during FY1016 it was trading at an average PE of

8.56x.TheaveragehistoricPEcomesto11.5xandsowevalueEimcoEleconat11.5x

FY18eEPSandInvestmentsatRs198.WerecommendBUYratingonthestockwith

SOTPbasedtargetofRs678.

FinancialPerformance

YEMarch

(RsMn)

FY14

NetSales

EBITDA

1,934

290

FY15

1,964

294

FY16

1,396

226

FY17E

1,685

262

FY18E

2,065

325

Source:Company,IndiaNiveshResearch

Adj.PAT Adj.EPS(Rs)

EBITDA

Margin

RoE(%)

34.9

37.3

28.8

33.8

41.8

15.0

15.0

16.2

15.6

15.7

11.3

11.0

7.9

8.6

9.8

202

215

166

195

241

Adj.P/E(x) EV/EBITDA(x)

11.3

10.6

13.7

11.7

9.5

IndiaNiveshSecuritiesLimited|ResearchAnalystSEBIRegistrationNo:INH0000000511

6.0

5.7

5.9

4.8

3.9

601&602,SukhSagar,N.S.PatkarMarg,GirgaumChowpatty,Mumbai400007.Tel:(022)66188800

IndiaNiveshResearchisalsoavailableonBloombergINNS,ThomsonFirstCall,ReutersandFactivaINDNIV.

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

InvestmentRationale

1.

MarketLeaderintheundergroundcoalminingequipmentindustry

The company is the market leader in underground coal mining equipments (high

technology drills, loaders etc) with a market share of 90%. The company has

technical collaboration agreements with Ahlmann Baumaschinen GmbH, Germany

for manufacture of Front End Articulated Loader and with Huta Stalowa Wola, S.A

Polandformanufactureof520GWheelLoader.

The company is the market leader

in

underground

equipments

(high

coal

EimcoEleconisanestablishedplayerinthisindustrywithover20yearstrackrecord,

85% of the business comes from CIL and its subsidiaries. The companys in house

facilitiesenablesthemtodesignandmanufacturewiderangeofequipments.Emtici

Engineeringisagroupcompanywhichhandlesthemarketingandaftersalesservices

for Eimco Elecons products. Emticis branch offices are spread across India which

helpsEimcoEleconremainclosertoitscustomersandofferquickmaintenanceand

breakdown support services. Further, introduction of new equipments will lead to

deriskingofthebusiness.Thecompanyhasdiversifieditscurrentbusinessandhas

forayedinanewproducttheChairLiftManRidingSystem.

mining

technology

drills, loaders etc) with a market

share of 90%.

Turnover(RsMn)

TunnelingLoaders

Airmotors(Captiveuse)

Spares

ConstructionEquip

ChairLiftSystem

Others

Total

FY11

877

5

904

40

0

17

1844

FY12

896

7

772

38

0

55

1768

FY13

621

6

1008

69

0

0

1704

FY14

781

4

1046

53

0

38

1922

FY15

886

4

990

49

29

0

1957

FY16

392

4

897

40

54

0

1388

FY17e

691

5

855

50

84

0

1685

FY18e

818

6

1038

56

148

0

2065

Source:Companyfilings,IndiaNiveshResearch

Governments thrust to increase underground mining activity in India will have

positiveeffectsonthedemandforundergroundminingequipments.Inthelinewith

growth of underground mining activity there will be growth in demand for

underground mining equipments and will be supported by the spare replacement

demand. As the equipments require frequent servicing and maintenance, a strong

aftersalesservicenetworkisthekeyrequirement.Thisactsasanentrybarrierfor

new players in the domestic market as well as for the products imported.

Competitors for Eimco Elecon in UG segment include Simplex Engineering &

FoundryWorks(~56%marketshare),TRF(ATataEnterprise)(<1%marketshare),

BEML Ltd (new entrant in the market) (<1% market share). International players

includeJoyMining&MachineryandBucyrusInternational.

Underground

activity to

Higher sale mining

of underground

grow

in India

drive the

equipment

will and

drivewill

revenue

for

demand

for underground mining

Spares business.

IndiaNiveshSecuritiesLtd

4Jul2016

2 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

EimcoElecon(India)LtdProducts:

CoalMiningLoaders:

811LoadHaulDumper

811LoadHaulDumper

(LowHeight)

Features include: It has high

strength and impact resistant

structure, extralarge cooling

system and tank capacity,

option of different types of

bucket

like

bidirectional

conveyor bucket, cross seating

operator position for better bi

directional visibility and safety

andsimplehydraulicsforeaseof

maintenance.

Features include: It has high

strength and impact resistant

structure, extralarge cooling

system and tank capacity,

Option of different types of

bucket like bidirectional

conveyor bucket, cross seating

operator positionfor better bi

directional visibility and safety

and simple hydraulics for ease

ofmaintenance.

Features include: It has

higher payload for increased

productivity,

high

tilt

combination and mechanical

breakoutforceforefficientand

single pass loading, fingertip

controls for reduced fatigue

and simple hydraulics for ease

ofmaintenance

625SideDumpLoader

611SideDumpLoader

912ELoadHaulDumper

Coal Mining loaders form a major

part of revenue for Eimco Elecon.

912CHCoalHauler

Features

include:

All

operations are fully hydraulic,

higher payload for increased

productivity, simple hydraulics

foreaseofmaintenance,bottom

discharge hopper bucket for

effective unloading and less

maintenance, fingertip controls

forreducedfatigue.

Featuresinclude: Itisrobust

and versatile machine for

toughest

underground

application,

ergonomically

designed

machine

for

operator's comforts without

negotiating with the safety,

modular design for ease of

assembly, transportation and

maintenance, extra large tank

capacitywithHFBfluid.

Features include: It is a low

height machine, which can

operate in seam as low as 1.2

m, variable travel speed for

lowest cycle time visavis

highest productivity, fingertip

controls for reduced fatigue,

energy conservation through

loadsensingtrammingcontrols

and

30%

less

power

consumption.

612 UniversalDrillMachine

(LowHeight)

AirMotors(captiveuse)

CoalMiningdrillers:

611UniversalDrillMachine

Coal Mining drillers to remain as

key product for Eimco Elecon.

Air motors is used as a feedstock

by Eimco Elecon.

IndiaNiveshSecuritiesLtd

Features include: It has rotary

drill which ensures fast drilling

speed,with360rotationforfast

and easy face & roof drilling,

powerfulcrawlercarrierensured

fast and safe maneuvering in

narrowdriftsandunderlowcoal

seams, maximum penetration

Features include: It has

rotary drill which ensures fast

drilling speed with 360

rotationforfastandeasyface

& roof drilling, powerful

crawler carrier ensures fast

and safe maneuvering in

Featuresinclude:Itisusedas

captive feedstock where oil

slingers are permanently

fastened; to distribute oil to all

working parts and keep

cylinders well lubricated, Large

streamlined air passage reduce

4Jul2016

3 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

speed to complete full face

drilling in a minimum time and

tomaximizeproduction.

narrow drifts, compact feed

for low roof height and for

minimummaintenance.

dragandincreaseH.P.provide

efficientuseofconsumedair.

LowProfileDumpTruck

21BRockerShovelLoaders

MetalMiningLoaders:

912BMKIILoadHaulDumper

Metal mining loaders to continue

to remain a minor contributer for

Eimco Elecon.

824RockerShovelLoader

AL120Articulated

WheelLoader

150/1000BHopperLoader

AL520Articulated

WheelLoader

Features include: It has

hydrostatic steering system,

single

Lever

operation,

electrically

controlled

transmission

Chair lift man riding system a

new addition to the product lines

ChairLiftManRidingSystem:

This is a new product addition which saves time and increase the efficiency of

labourers. This system is safe and comfortable for transporting persons fast in

undergroundminesoverlongdistances.Thetransportationincludesminegradients

andcurves.

will improve revenues for Eimco

Elecon

and

serve

its

ChairLiftManRidingSystem

clients

better.

IndiaNiveshSecuritiesLtd

4Jul2016

4 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

2.

Coal ministry plans to revise equipment purchase policy to increase mining

efficiencywhichwouldboostEimcoEleconsearnings

CoalIndiaLimitedhas430minesofwhich227areunderground,175opencastand

28 mixed mines as on FY15. 301.56 Billion tonnes of Geological Resources of Coal

havesofarbeenestimatedinthecountryasonFY15.

CILproductioninmillionton (MT)

600

504.97

500

ProductioninMT

400

391.3

426.31

414.43

397.45

459.64

300

200

100

40.02

38.39

37.78

36.11

34.60

33.79

0

201011

201112

201213

UG

201314

201415

201516

93%

94%

OC

Source:Ministryofcoal;IndiaNiveshResearch

IndiasUG&OCshareoftotalproduction

100%

90%

Indias underground mining share

80%

stand at 6% which is quite low.

70%

60%

50%

91%

91%

92%

92%

9%

9%

8%

8%

7%

6%

201011

201112

201213

201314

201415

201516

40%

30%

20%

10%

0%

UG

OC

Source:Ministryofcoal;IndiaNiveshResearch

Theproductionofcoalfromunderground(UG)mineshasbeenonasteadydecline

fromFY90toFY07.Nearly41%ofthecoalreservesinIndiaarebelow300mdepth,

thecontributionofundergroundcoalproductionhasdeclinedfrom35%inFY90to

only6%inFY16.UGminescontribute~25%ofproductioninAustralia,~35%inthe

US and ~95% in China. China has maintained focus on underground mining as it

resultsinlesspollutionthanopencastmining.

CILsworkerproductivityie.Outputpermanshift(OMS)standsat4.92tonnewhich

is much below its target of 5.54 tonne. The global average is around 13 tonne per

manshift.Productivityinundergroundminingislessthanatonnepermaneachshift

againstaglobalaverageof10tonnepermaneachshift.CILabsorbsalossofnearly

Rs100bnayearonUGoperations,employing75percentofitsfourlakhworkforce.

IndiaNiveshSecuritiesLtd

4Jul2016

5 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

UndergroundMiningcontributioninleadingcountries

100%

5%

90%

80%

UG mines contribute ~25% of

70%

production in Australia, ~35% in

60%

the US and ~95% in China.

75%

65%

50%

95%

94%

40%

30%

20%

10%

25%

35%

6%

0%

Australia

USA

China

UG

India

OC

Source:ET;IndiaNiveshResearch

CIL

plans

to

boost

annual

production to 1 bn tonnes by

2020

through

introduction

of

better technological equipments.

TheGovernmenthasannouncedplanstoboostCoalIndia'sannualproductiontothe

level of 1 billion tonnes by 2020 and this requires significant investment in

mechanizationofexistingminesandfasttrackingminedevelopmentactivityinnew

mines.Thecoalministryisexpectedtosoonreviseitsequipmentprocurementpolicy

to increase mining efficiency. CIL strategy to improve mine productivity would be

throughtechnologyupgradationinopencastandundergroundmineswithinduction

of high capacity equipment. Improved technology will make underground mines

more efficient with addition of man riding system in major mines and use of tele

monitoringtechniques.

The planning commission, has recommended full mechanisation of underground

minesby2017.CoalMinistryiscurrentlydevelopinganincentivepackagethatmay

inject new life into its underground mining industry. Some of the incentives would

includethingslikedifferentialroyaltyratesandinvestmentlinkedtaxholidays.

WebelieveEmicoEleconwouldbethekeybeneficiaryoftheincreaseinequipment

demand. Also, as the average life of SDL (Side Dump Loader) /LHD (Load Haul

Dumper)equipmentisbetweensixandtenyears,thesparesreplacementdemand

willalsocontinuetosupportEimcoEleconsrevenues.

IndiaNiveshSecuritiesLtd

4Jul2016

6 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

3.

SteadyRevenuefromSparesandcomponentssegmenttocontinue

RevenueBreakup(FY16)

Construction

Equip

2.9%

In

FY16,

contributed

spares

about

ChairLift

System

3.9%

Tunneling

Loaders

28.3%

business

65%

and

loaders contributed about 28% to

the revenue.

Airmotors

0.3%

Spares

64.6%

Source:Companyfilings,IndiaNiveshResearch

RevenueBreakup(FY16)

2500

Eimco

Elecon

(India)

recently

70%

54%

2000

51%

65%

59%

50%

NetSales(Rs.Mn)

introduced Chair lift man riding

system which contributed about

3.9% in FY16.

1500

60%

40%

44%

30%

1000

20%

500

10%

0%

FY12

FY13

TotalRevenue

FY14

FY15

FY16

Sparebusinessshareas%ofTotal Revenue

Source:Companyfilings,IndiaNiveshResearch

Theminingequipmentsoperateinatoughenvironmentandhence,requirefrequent

replacement of hydraulics, electronics and other spares. Spares sales constitute

above50%inEleconsrevenuesandenjoyhighermarginsthanequipmentsales.In

FY16thisbusinesscontributedabout65%tototalrevenue.Asperourunderstanding

spare business earns about 3035% higher EBITDA margin than the equipment

business.Increasedsalesofequipmentinthefuturewillleadtoanimprovementin

thedemandforSpares.

IndiaNiveshSecuritiesLtd

4Jul2016

7 of18

InitiatingCoverage|EimcoElecon(India)Ltd

4.

Eimco

Elecons

agreement

with

Readytominefavorablecoalcycle

Forayinopencastingminingwoulddriverevenueandprofitability

non-compete

Sandvik

is

coming to an end, which will help

them enter in open cast mining

equipments which will add to the

earnings

OpencastinginIndiacurrentlyconstitutesmorethan90%oftotalmining.Therisein

productionfromopencastmineshasbeenseenwhichisincreasingatagreaterrate

thanundergroundmines.

EquipmentutilisationbyCoalIndiaLimited(CIL)isstillnotatthelevelofglobalbest.

It needs to adopt better equipment utilisation practices from across the globe for

bestinclassmining.Someoftheleadingcompeitiorsintheworldthatsupplyopen

cast mining equipments include: Caterpillar Inc., Hitachi Construction Machinery,

JoyGlobalInc.,KomatsuLimited,SandvickAB,andAtlasCopco.

EimcoElecon(India)Ltdhadsignedanoncompeteagreementwithitsstakeholder

Sandvik that it would not enter open cast mining products for five years and had

sold its surface drilling machines business to them in FY11 for Rs 165 mn. This

agreementistoexpireinAugust2016whichwillallowEimcoElecontomanufacture

andsellproductsinopencastingsegment.EimcoEleconhasalreadystartedR&Don

new products that it could manufacture and serve its existing clients and add new

clients. This will improve the sales for the company andmake a mark in opencast

mining segment. It is also looking to manufacture open cast mining drillers.

Continous R&D facility and tieups for technology has helped Eimco Elecon develop

newproductstoservetheIndianmarket.

5.

StrongBalanceSheet

Eimco Eleconhas been maintaining its financial risk profile over the medium term,

supportedbyitshealthycapitalstructureandsteadycashaccruals.Thecompanyhas

remained debtfree since FY10 with steady accruals funding its nominal capital

expenditureandworkingcapitalrequirements.

The company has strong balance sheet with current and noncurrent investments

amounting to Rs 1140 mn (per share value of Rs 198). Under investments, non

current are mostly in listed shares, while current investments are mostly in liquid

mutualfunds.Thecompanyisdebtfreeasithasnoshorttermandlongtermloans.

Receivables,Inventoriesandotherworkingcapitalparametersarekeptunderstrict

checkbythecompanythroughcontinuousmonitoring.

Eimco Elecons strong balance sheet provides an added advantage to weather any

futuredownturns.

IndiaNiveshSecuritiesLtd

4Jul2016

8 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

Current&NoncurrentInvestments(Rs.mn)

1200.0

191.6

Investments(Rs.Mn)

1000.0

800.0

600.0

205.8

194.0

53.6

132.6

444.0

489.3

502.3

557.8

FY12

FY13

FY14

FY15

948.0

400.0

200.0

0.0

CurrentInvestments

FY16

NoncurrentInvestments

Source:Company,IndiaNiveshResearch

6.

Eimco Elecon has strong parental

support from Eimco group of

companies and Elecon group.

Strongparentcompanysupport

EimcoGroupofCompaniesSubsidiarydivisionnamedasEimcominingequipment

areworldleaderinproductionofundergroundminingmachinery.EleconEngineering

andEimcoGroupofCompaniesenteredintocollaborationunderwhichEImcoElecon

received necessary technical knowhow from Eimco Group of Companies for

productionofundergroundminingmachineries.

In1989,EimcoGroupofcompanieswereacquiredbyTamrockOY.,aworldleaderin

technology and manufacturing of rock excavation and breaking equipments for

surface and underground mines and civil engineering construction with production

andassemblyfacilitiesinvariouspartsoftheworldbackedbyworldwidesalesand

distributionnetwork.

Internationally, Tamrock holds close to 40% market share in the mining machinery

business. It is a leading supplier of drilling and loading equipments for hard rock

applications.

EimcoEleconwasestablishedin1974.

ItwasajointventurebetweenEleconEngineeringCompanyandEnvirotechCorporation,US(asubsidiaryofBakerHughes).

EnvirotechwasactiveintheminingbusinessthroughitsdivisionEimcoMiningEquipmentGroup.

In1989,theEimcominingdivisionwastakenoverbytheFinnishIndustrialOrganisationOYTampellawhosemining

equipmentdivision Tamrockwasamarketleaderwithover40%shareinternationally.

TamrockGreatBritainHoldings(asubsidiaryofOYTampella)heldaround39%ofEimcoElecon'sRs24.7mnequitytillthe

Dec1992 issue,laterit'sholdingdecreasedto25.1%.

Tamrock'smajorsharesandcontrollinginterestwasacquired bySandvikGroupofSwedenin1997 andthenamewas

changedtoTamrockCorp.

SandvikABholds25.1%stakeinEimcoElecon(India)Ltd

Source:Company;IndianiveshResearch

IndiaNiveshSecuritiesLtd

4Jul2016

9 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

Sandvikgroup,theforeignpromoter,currentlyholdsa25.1%stakeinEimcoElecon

throughitssubsidiaryTamrockGreatBritainHolding.

Elecongroupofcompaniescontinuestobemarketleadersinceitsestablishmentin

1951,inmanufactureofmaterialhandlingEquipment&relatedprojectsinIndiaand

having diversified interests in Wagon tipplers, Reclaimers, Industrial Gear Boxes,

Industrial Geared Motors, Industrial Electro Magnets, Wagon Loaders, Various

ElectronicEquipment,etc.

Financials:

NetsalestogrowatCAGRof22%fromFY16FY18e

NetSales(Rs.mn)andgrowth(%)

2500

20.7

Eimco Elecon (India) net sales is

20.0

12.7

expected to grow at CAGR of 22%

10.0

1.6

NetSales(Rs.Mn)

from FY16-FY18e.

30.0

1500

10.0

1000

20.0

growthin%

2000

22.6

500

30.0

28.9

0

40.0

FY14

FY15

FY16

NetSales

FY17E

FY18E

Growth(%)

Source:Company,IndiaNiveshResearch

Netsalesdegrewby28%inFY16duetolowerrevenuefromequipmentbusiness.

ThiswasonaccountoflowernumberofordersfromCoalIndia.Goingahead,Coal

India Ltd with a vision to produce 1 bn tonnes of coal by 2020 will lead to higher

numberoftendersandwillresultinincreasedsalesforEimcoElecon(India)Ltdwho

supplies about 90% of coal Indias underground equipment. We expect Eimco

Elecons revenues to grow at a CAGR of 22% from FY16FY18e. Overall equipment

sales are expected to grow at 44.4% CAGR over FY1618e to Rs 1.02 bn driven by

increased underground mining activity in India and new product launches by the

company.Sparessalesareexpectedtogrowat7.6%CAGRoverFY1618etoRs.1.04

bn.

IndiaNiveshSecuritiesLtd

4Jul2016

10 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

EBITDAmargintosustainnear15.516%

EBITDAandEBITDAmargin(%)

350

16.4

16.2

16.0

16.2

15.7

250

to

maintain

higher

EBITDA(Rs.Mn)

Eimco Elecon (India) to continue

EBITDA

margins due to higher share of

Spares business to revenue.

15.8

EBITDAMargin(%)

300

15.6

200

150

15.4

15.6

15.0

15.0

15.2

15.0

100

14.8

14.6

50

14.4

14.2

FY14

FY15

FY16

EBITDA

FY17E

FY18E

EBITDAMargin%

Source:Company,IndiaNiveshResearch

InFY16,Sparebusinessrevenueshareroseto65%(vs51%inFY15)whichhelpedit

achieve16.2%EBITDAmargin.Weexpectsparesbusinesswillcontinuetocontribute

around50%tototalrevenueandoverallEBITDAmargintosustainnear15.516%.

NetprofitexpectedtogrowatCAGRof20.34%forFY16FY18e

NetProfit(Rs.mn)

300

241

NetProfit(Rs.Mn)

250

Eimco Elecon (India) net profit is

expected to grow at CAGR of

20.34% for FY16-FY18e on back

of higher sales of better margin

business.

202

215

195

200

166

150

100

50

0

FY14

FY15

FY16

FY17E

FY18E

Adj.NetProfit

Source:Company,IndiaNiveshResearch

Net profit is expected to grow at CAGR of 20.34% for FY16FY18e on back of

improved sales and better EBITDA margin. Spares business will continue to drive

profits and new product Chair lift man riding system is also expected to grow as

coalextractorslooktouseimprovedtechnology.

IndiaNiveshSecuritiesLtd

4Jul2016

11 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

ReturnRatios(%)

18.0%

16.0%

14.0%

12.0%

to improve on back of better

10.0%

Return(%)

Eimco Elecon (India) return ratios

revenues visibility

15.8%

13.4%

15.5%

11.8%

10.7%

11.3%

11.0%

8.0%

7.9%

6.0%

9.8%

8.6%

4.0%

2.0%

0.0%

FY14

FY15

ROE

FY16

FY17E

FY18E

ROCE

Source:Company,IndiaNiveshResearch

Current&NoncurrentInvestments(Rs.mn)

1200.0

191.6

Investments(Rs.Mn)

1000.0

800.0

600.0

205.8

194.0

53.6

132.6

444.0

489.3

502.3

557.8

FY12

FY13

FY14

FY15

948.0

400.0

200.0

0.0

CurrentInvestments

FY16

NoncurrentInvestments

Source:Company,IndiaNiveshResearch

The company has strong balance sheet with current and noncurrent investments

amounting to Rs 1140 mn in FY16. Noncurrent investments are mostly in listed

shares,whilecurrentinvestmentsaremostlyinliquidmutualfunds.Thecompanyis

debtfreeasithasnoshorttermandlongtermloans.Receivables,Inventoriesand

other working capital parameters are kept under strict check through continuous

monitoring.

IndiaNiveshSecuritiesLtd

4Jul2016

12 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

PeerComparison

Peergroupcomparison

(FY16)

EimcoElecon(India)Ltd

BEML

TRFLtd

RevathiEquipmentLtd

TILLtd

Sales

(Rsmn)

EBITDA

margin(%)

PAT

(Rsmn)

ROE(%)

ROCE(%)

1396

29574

11225

2455

16835

16.2

4.4

2.7

14.3

6.2

166

531

(363)

207

(436)

7.9

2.5

NA

13.8

NA

10.7

3.5

0.9

12.7

2.2

PE(X)

13.7

66.5

NA

11.4

NA

Source:Bloomberg;Capitaline;IndiaNiveshResearch

Eimco Elecon (India) Ltd is one of the leaders in mining equipments in India and

mainly serves CIL. It has better EBITDA margins and decent return ratios when

compared with its peers in mining equipment and material handling space. During

FY16 it witnessed its lowest sales in last five years due to lower revenue from

equipment business. This was on account of lower number of orders from CIL.

Reavthi Equipments has lower EBITDA margins, while BEML is a new entrant in

mining equipments space and is trading at very high PE. TRF Ltd and TIL Ltd are

mainlyintomaterialhandlingbusinessandcurrentlybotharemakinglosses.

EimcoEleconIndiaLimited(EEIL)isinthebusinessofManufacturing,Marketingand

Servicing Equipment for Mining and Construction. It is one of the major player in

Underground Mining Equipments. The range of equipments includes side dump

loaders,loadhauldumpers,rockershovelloaders,frontendloaders,blastholedrill,

coal haulers, dump truck, air motors, universal drilling machine and continuous

miners.

BEMLLimited,playsapivotalroleandservesIndiascoresectorslikeDefence,Rail,

Power, Mining and Infrastructure. It has three major Business verticals Mining &

Construction,DefenceandRail&Metroareservicedbyitsninemanufacturingunits.

BEML Limited offers a comprehensive and diverse range of mining machinery for

both opencast and underground mines. BEML produces machines such as Electric

RopeShovels,HydraulicExcavators,Bulldozers,WheelLoaders,WheelDozers,Dump

Trucks, Motor Graders, Pipe Layers, Tyre Handlers, Water Sprinklers and Backhoe

Loaders. Besides, BEML also manufactures mammoth Walking Draglines for cost

effective operations in the opencast mines. BEML has ventured into underground

mining with products such as Side Discharge Loader, Load Haul Dumper, Winch,

Winder,GranbyCar,Skipetc.

TRFL, formerly known as TataRobinsFraser, was incorporated in 1962. It services

coreindustrieslikepower,mining,coal,fertilisers,cement,ports,etc.Thecompany

is diversified to manufacture underground mining machinery like side discharge

loadersandloadhauldumpersandhasacquiredthestampchargingtechnologyfor

cokeoven machinery in technical collaboration with German firms. TRFL entered

into an agreement with Italiampianti, Italy, for the supply of the latest technology

coveringyardequipmentsuchasstackers,reclaimers,stackerscumreclaimers,ship

loaders, etc. It also provides engineering and technology for Mini Blast Furnaces,

Coal Dust Injection Systems for Blast Furnaces and Stamp Charging and Pushing

EquipmentforCokeOvens.

RevathiEquipmentLtd(REL)isaleadingmanufacturerofblastholedrillsandwater

welldrillsforvariousapplicationslikemining,construction,waterwell,exploration,

IndiaNiveshSecuritiesLtd

4Jul2016

13 of18

InitiatingCoverage|EimcoElecon(India)Ltd

Readytominefavorablecoalcycle

etc.RELsdrillingrigsareusedextensivelyinminessuchascoal,copper,gold,iron,

zinc,phosphate,bauxite,lignite,limestone,etc.Itoffersarangeofdrillrigs,suchas

C850,C750andC2532forminingapplications.Therigsareusedtodrillblastholesof

diameters ranging from 102 millimeters to 349 millimeters. The drills are crawler

mounted, diesel engine/electric motor driven, hydraulically operated and

rotary/downthehole(DTH).TheCompanyoffersJacklessdrillrigs,includingC625H,

HHTD and LHTD for construction activity, such as road, dam, irrigation canal and

quarrying, among others. The Company offers a range of hydraulic topdrive and

tabledriverigsforboreholedrilling.

TIL Limited is engaged in manufacturing and marketing of a range of material

handling, lifting, and port and road construction solutions, with customer support

and aftersales service. The Company's operating segments include Material

Handling Solutions (MHS), Construction and Mining Solutions (CMS), and Power

SystemsSolutions(PSS).MHSisengagedinmanufacturingandmarketingofvarious

material handling equipment, such as mobile cranes, port equipment, road

constructionequipmentandselfloadingtruckcranes,amongothers,anddealingin

sparesandprovidingservicestorelatedequipment.

KeyRisks

1. HigherdependenceonCoalIndiaLtd.

CILremainsthesinglelargestclientanditcontributesabout85%toEimcoElecons

revenue.EimcoEleconhasabout90%ofCILsundergroundequipmentmarketshare.

Despite efforts by the company to diversify its client base, we believe CIL would

remain the single largest client for Eimco Elecon over the next few years,

contributingover8285%torevenues.Theincreasingdevelopmentofcoalminesby

privatesectorplayersandthescaleupofconstructionequipmentbusinesswouldbe

criticalfordiversifyingtheclientrisk.

2. Threatfromforeignplayersandriseindomesticcompetition

Weseemoreandmoreforeignplayersenteringintothissegment,whichisathreat

forthecompanysgrowthandevendomesticcompetitionwillbeintensified.

Outlook&Valuation

Government thrust to increase underground coal mining activity in India will have

positive effects on the demand for underground mining equipments. We believe

Emico would be the key beneficiary of the increase in equipment demand. We

expect the sales of the company to grow at CAGR of 22% from FY16FY18e on

accountofpickupincoalminingactivitiesandintroductionofnewproducts.AtCMP

ofRs396,EimcoEleconistradingataP/Emultipleof11.7xFY17eand9.5xFY18e,

EPSofRs33.8andRs41.8respectively.EimcoEleconduringitspeakperiodofFY04

09wastradingatanaveragePEof14.42xandduringFY1016itwastradingatan

averagePEof8.56x.TheaveragehistoricPEcomesto11.5xandsowevalueEimco

Eleconat11.5xFY18eEPSandInvestmentsatRs198.WerecommendBUYrating

onthestockwithSOTPbasedtargetofRs678.

IndiaNiveshSecuritiesLtd

4Jul2016

14 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

CompanyBackground

Eimco Elecon India Limited is in the business of Manufacturing, Marketing and

ServicingEquipment for Mining and Construction. It wasincorporated in 1974 as a

joint ventureof ELECON Group of India andEimco. It is one ofthe major player in

Underground Mining Equipments. The range of equipments includes side dump

loaders,loadhauldumpers,rockershovelloaders,frontendloaders,blastholedrill,

coal haulers, dump truck, air motors, universal drilling machine and continuous

miners.IthasamanufacturingplantatVallabhVidyanagar.

Eimco Elecon (India) Limited was first to introduce the intermediate technology of

SideDumpLoaders(SDLs),LoadHaulDumpers(LHDs)andRockerShovelLoadersin

India to partially mechanize the underground Coal and metalliferrous mines

(minerals which cannot be called coal or lignite) and continue to be market leader

sincethen.

The company has produced more than 2550 Nos. of machines, which are working

successfullyatvariousminingandconstructionsitesinIndiaandabroad.Itprovides

salesandaftersalessupportthroughthenetworkofbranchofficesandpartsdepots

across the country Asansol, Bilaspur, Dhanbad, Kolkata, Nagpur, Secunderabad,

Bangalore,Chennai,Jamshedpur,MumbaiandNewDelhi.

ShareholdingStructure

EimcoElecon(India)Ltd

25.1%

TamrockGreatBritainHolding

25.94%

PublicShareholding

16.62%

EleconEngineering

EmticiEngineering

14.19%

OtherEleconGroupCompanies

&Promoter

18.15%

Source:Company;IndianiveshResearch

IndiaNiveshSecuritiesLtd

4Jul2016

15 of18

InitiatingCoverage|EimcoElecon(India)Ltd

Readytominefavorablecoalcycle

Network

Source:Company;IndianiveshResearch

EMTICIEngineeringLtdisthemarketing&servicingcompanyforEIMCOproductsin

India. All its branches are equipped with exclusively trained application and after

sales service engineers to serve their clients. The company also have a closely knit

dealer network supported by a team of service engineers looking into daily

requirementsofclients.

EimcoEleconremainclosertoitscustomersandofferquickmaintenanceandbreak

down support services. Eimco Elecon collaborates with foreign partners for

technologysourcingandintroductionofnewerproducts.

AssociatedCompanies:

EimcoEleconElectricalsLimited

Companyholds47.62%ofEquitySharesofEimcoEleconElectricalsLtd.Itisinvolved

in manufacture of electric equipment for Material handling equipment, power

transmission products, air motors, hydraulic cylinders, load haul dumpers, drillers,

etc.

WizardFincapLimited

Companyholds24.95%ofEquitySharesofWizardFincapLtd.Itcameintoexistence

for financial intermediation other than that conducted by monetary institutions.

Currentlythecompanyisintologisticsactivities.

IndiaNiveshSecuritiesLtd

4Jul2016

16 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

IncomeStatement(Consolidated)

YEMarch(Rsm)

FY14

FY15

FY16

FY17E

FY18E

Netsales

1,934

1,964

1,396

1,685

2,065

Growth(%)

13

(29)

21

23

(1,644)

(1,670)

(1,170)

(1,422)

(1,741)

290

294

226

262

325

EBITDA

290

294

226

262

325

Growth(%)

Operatingexpenses

Operatingprofit

Otheroperatingincome

33.3

1.3

(23.2)

16.2

23.7

Depreciation

(51)

(43)

(37)

(42)

(52)

Otherincome

44

54

39

47

57

283

305

228

267

330

(5)

EBIT

Financecost

(3)

(5)

(3)

(4)

Exceptionalitem

Profitbeforetax

280

301

225

263

326

Tax(current+deferred)

(79)

(86)

(58)

(68)

(85)

Profit/(Loss)fortheperiod

202

215

166

195

241

Associates,MinInt

Reportednetprofit

202

215

166

195

241

Extraordinaryitem

Adjustednetprofit

202

215

166

195

241

33

(23)

17

24

FY14

FY15

FY16

FY17E

FY18E

58

58

58

58

58

Reserves&surplus

1,817

1,991

2,123

2,289

2,501

NetWorth

1,875

2,049

2,181

2,346

2,559

373

390

323

360

451

Noncurrentliabilities

Longtermborrowings

Deferredtaxliabilities

OtherLongtermliabilities

Growth(%)

Source:Company,IndiaNiveshResearch

BalanceSheet(Consolidated)

YEMarch(Rsm)

Sharecapital

MinorityInterest

TotalLiabilities

Longtermprovisions

CurrentLiabilities

Shorttermborrowings

Tradepayables

366

384

317

355

445

243

273

202

243

298

89

OthercurrentLiabilities

74

54

64

64

Shorttermprovisions

49

57

52

47

58

2,248

2,439

2,503

2,706

3,010

TotalLiabilitiesandEquity

NonCurrentAssets

411

530

528

598

686

NetBlock

175

281

301

360

446

Goodwill

206

194

192

192

192

NoncurrentInvestments

Longtermloansandadvances

30

48

26

37

39

DeferredtaxAssets

10

10

10

OthernoncurrentAssets

1,837

1,909

1,976

2,108

2,324

Inventories

253

309

377

312

382

SundryDebtors

957

884

518

655

803

Cash&BankBalances

40

43

15

75

62

OthercurrentAssets

84

115

117

118

128

CurrentAssets

Loans&Advances

CurrentInvestments

Total(Assets)

502

558

948

948

948

2,248

2,439

2,503

2,706

3,010

Source:Company,IndiaNiveshResearch

IndiaNiveshSecuritiesLtd

4Jul2016

17 of18

Readytominefavorablecoalcycle

InitiatingCoverage|EimcoElecon(India)Ltd

CashFlowStatement(Consolidated)

YEMarch(Rsm)

FY14

FY15

FY16

FY17E

FY18E

Profitbeforetax

280

301

225

263

326

51

43

37

42

52

Changeinworkingcapital

(93)

(14)

252

(47)

(140)

Totaltaxpaid

(83)

(93)

(62)

(68)

(85)

Others

(41)

(50)

(36)

(43)

(53)

Cashflowfromoperations(a)

114

187

416

147

100

Capitalexpenditure

(38)

(150)

(56)

(101)

(138)

Changeininvestments

(86)

(44)

(388)

44

54

39

47

57

(80)

(139)

(405)

(54)

(80)

76

37

360

46

(38)

Equityraised/(repaid)

Debtraised/(repaid)

23

29

29

29

29

Depreciation

Others

Cashflowfrominvesting(b)

Freecashflow(a+capex)

Dividend(incl.tax)

Others

(53)

(74)

(67)

(61)

(62)

Cashflowfromfinancing(c)

(30)

(45)

(38)

(33)

(32)

(13)

Netchangeincash(a+b+c)

(27)

60

ReconciliationofOtherbalances

40

43

15

75

62

CashasperBalanceSheet

Source:Company,IndiaNiveshResearch

KeyRatios(Consolidated)

YEMarch

FY14

FY15

FY16

FY17E

FY18E

AdjustedEPS(Rs)

34.9

37.3

28.8

33.8

41.8

Growth

33.4

6.8

(22.7)

17.1

23.7

4.0

5.0

5.0

5.0

5.0

Dividendpayoutratio

11.4

13.4

17.3

14.8

12.0

EBITDAmargin

15.0

15.0

16.2

15.6

15.7

EBITmargin

14.6

15.5

16.3

15.8

16.0

NetMargin

10.4

11.0

11.9

11.6

11.7

Taxrate(%)

Dividend/share(Rs)

28.1

28.4

25.9

26.0

26.0

Debt/Equity(x)

0.0

0.0

0.0

0.0

0.0

InventoryDays

48

57

99

68

68

SundryDebtorDays

181

164

135

142

142

TradePayableDays

46

51

53

53

10.4

11.0

11.9

11.6

11.7

Assetturnover(x)

0.9

0.8

0.6

0.6

0.7

Leveragefactor(x)

1.2

1.2

1.2

1.2

1.2

ROE(%)

11.3

11.0

7.9

8.6

9.8

RoCE(%)

15.8

15.5

10.7

11.8

13.4

DuPontAnalysisROE

Netmargin

Valuation(x)

53

PER

11.3

10.6

13.7

11.7

9.5

PCE

9.0

8.8

11.2

9.6

7.8

Price/Book

1.2

1.1

1.0

1.0

0.9

EV/EBITDA

6.0

5.7

5.9

4.8

3.9

Source:Company,IndiaNiveshResearch

IndiaNiveshSecuritiesLtd

4Jul2016

18 of18

InitiatingCoverage

Disclaimer:ThisreporthasbeenpreparedbyIndiaNiveshSecuritiesLimited(INSL)andpublishedinaccordancewiththeprovisionsofRegulation18oftheSecuritiesandExchangeBoardofIndia

(ResearchAnalysts)Regulations,2014,forusebytherecipientasinformationonlyandisnotforcirculationorpublicdistribution.INSLincludessubsidiaries,groupandassociatecompanies,promoters,

directors,employeesandaffiliates.Thisreportisnottobealtered,transmitted,reproduced,copied,redistributed,uploaded,publishedormadeavailabletoothers,inanyform,inwholeorinpart,for

anypurposewithoutpriorwrittenpermissionfromINSL.Theprojectionsandtheforecastsdescribedinthisreportarebaseduponanumberofestimatesandassumptionsandareinherentlysubjectto

significant uncertainties and contingencies. Projections and forecasts are necessarily speculative in nature, and it can be expected that one or more of the estimates on which the projections are

forecastswerebasedwillnotmaterializeorwillvarysignificantlyfromactualresultsandsuchvariationswilllikelyincreaseovertheperiodoftime.Alltheprojectionsandforecastsdescribedinthis

report have been prepared solely by authors of this report independently. None of the forecasts were prepared with a view towards compliance with published guidelines or generally accepted

accountingprinciples.

Thisreportshouldnotbeconstruedasanoffertosellorthesolicitationofanoffertobuy,purchaseorsubscribetoanysecurities,andneitherthisreportnoranythingcontainedthereinshallformthe

basisoforberelieduponinconnectionwithanycontractorcommitmentwhatsoever.Itdoesnotconstituteapersonalrecommendationortakeintoaccounttheparticularinvestmentobjective,

financialsituationorneedsofindividualclients.TheresearchanalystsofINSLhaveadheredtothecodeofconductunderRegulation24(2)oftheSecuritiesandExchangeBoardofIndia(Research

Analysts) Regulations, 2014. The recipients of this report must make their own investment decisions, based on their own investment objectives, financial situation or needs andother factors. The

recipientsshouldconsiderandindependentlyevaluatewhetheritissuitableforits/his/her/theirparticularcircumstancesandifnecessary,seekprofessional/financialadviceasthereissubstantial

riskofloss.INSLdoesnottakeanyresponsibilitythereof.Anysuchrecipientshallberesponsibleforconductinghis/her/its/theirowninvestigationandanalysisoftheinformationcontainedorreferred

tointhisreportandofevaluatingthemeritsandrisksinvolvedinsecuritiesformingthesubjectmatterofthisreport.Thepriceandvalueoftheinvestmentreferredtointhisreportandincomefrom

themmaygoupaswellasdown,andinvestorsmayrealizeprofit/lossontheirinvestments.Pastperformanceisnotaguideforfutureperformance.Actualresultsmaydiffermateriallyfromthoseset

forthintheprojection.

Exceptforthehistoricalinformationcontainedherein,statementsinthisreport,whichcontainwordssuchaswill,would,etc.,andsimilarexpressionsorvariationsofsuchwordsmayconstitute

forwardlookingstatements.Theseforwardlookingstatementsinvolveanumberofrisks,uncertaintiesandotherfactorsthatcouldcauseactualresultstodiffermateriallyfromthosesuggestedby

theforwardlookingstatements.Forwardlookingstatementsarenotpredictionsandmaybesubjecttochangewithoutnotice.INSLundertakesnoobligationtoupdateforwardlookingstatementsto

reflecteventsorcircumstancesafterthedatethereof.INSLacceptsnoliabilitiesforanylossordamageofanykindarisingoutofuseofthisreport.

ThisreporthasbeenpreparedbyINSLbasedupontheinformationavailableinthepublicdomainandotherpublicsourcesbelievedtobereliable.Thoughutmostcarehasbeentakentoensureits

accuracyandcompleteness,norepresentationorwarranty,expressorimpliedismadebyINSLthatsuchinformationisaccurateorcompleteand/orisindependentlyverified.Thecontentsofthis

reportrepresenttheassumptionsandprojectionsofINSLandINSLdoesnotguaranteetheaccuracyorreliabilityofanyprojection,assurancesoradvicemadeherein.Nothinginthisreportconstitutes

investment,legal,accountingand/ortaxadviceorarepresentationthatanyinvestmentorstrategyissuitableorappropriatetorecipientsspecificcircumstances.Thisreportisbased/focusedon

fundamentalsoftheCompanyandforwardlookingstatementsassuch,maynotmatchwithareportonacompanystechnicalanalysisreport.Thisreportmaynotbefollowedbyanyspecificevent

update/followup.

Followingtablecontainsthedisclosureofinterestinordertoadheretoutmosttransparencyinthematter;

DisclosureofInterestStatement

1

DetailsofbusinessactivityofIndiaNiveshSecuritiesLimited(INSL)

DetailsofDisciplinaryHistoryofINSL

12

Research analyst or INSL or its relatives'/associates' financial interest in the subject company and

natureofsuchfinancialinterest

WhetherResearchanalystorINSLoritsrelatives'/associates'isholdingthesecuritiesofthesubject

company

Research analyst or INSL or its relatives'/associates' actual/beneficial ownership of 1% or more in

securities of the subject company, at the end of the month immediately preceding the date of

publicationofthedocument.

ResearchanalystorINSLoritsrelatives'/associates'anyothermaterialconflictofinterestatthetime

ofpublicationofthedocument

HasresearchanalystorINSLoritsassociatesreceivedanycompensationfromthesubjectcompany

inthepast12months

HasresearchanalystorINSLoritsassociatesmanagedorcomanagedpublicofferingofsecuritiesfor

thesubjectcompanyinthepast12months

HasresearchanalystorINSLoritsassociatesreceivedanycompensationforinvestmentbankingor

merchantbankingorbrokerageservicesfromthesubjectcompanyinthepast12months

Has research analyst or INSL or its associates received any compensation for products or services

otherthaninvestmentbankingormerchantbankingorbrokerageservicesfromthesubjectcompany

inthepast12months

HasresearchanalystorINSLoritsassociatesreceivedanycompensationorotherbenefitsfromthe

subjectcompanyorthirdpartyinconnectionwiththedocument.

Hasresearchanalystservedasanofficer,directororemployeeofthesubjectcompany

13

HasresearchanalystorINSLengagedinmarketmakingactivityforthesubjectcompany

No

14

Otherdisclosures

No

4

5

6

7

8

9

10

11

INSLisaStockBrokerregisteredwithBSE,NSEandMCXSXinallthemajorsegments

viz. Cash, F & O and CDS segments. INSL is also a Depository Participant and

registered with both Depository viz. CDSL and NSDL. Further, INSL is a Registered

PortfolioManagerandisregisteredwithSEBI.

Nodisciplinaryactionis/wasrunning/initiatedagainstINSL

No (except to the extent of shares held by Research analyst or INSL or its

relatives'/associates')

No

No

No

No

No

No

No

No

No

INSL,itsaffiliates,directors,itsproprietarytradingandinvestmentbusinessesmay,fromtimetotime,makeinvestmentdecisionsthatareinconsistentwithorcontradictorytotherecommendations

expressedherein.Theviewscontainedinthisdocumentarethoseoftheanalyst,andthecompanymayormaynotsubscribetoalltheviewsexpressedwithin.Thisinformationissubjecttochange,as

perapplicablelaw,withoutanypriornotice.INSLreservestherighttomakemodificationsandalternationstothisstatement,asmayberequired,fromtimetotime.

Definitionsofratings

BUY.Weexpectthisstocktodelivermorethan15%returnsoverthenext12months.

HOLD.Weexpectthisstocktodeliver15%to+15%returnsoverthenext12months.

SELL.Weexpectthisstocktodeliver<15%returnsoverthenext12months.

Ourtargetpricesareona12monthhorizonbasis.

Otherdefinitions

NR=NotRated.Theinvestmentratingandtargetprice,ifany,havebeenarrivedatduetocertaincircumstancesnotincontrolofINSL

CS=CoverageSuspended.INSLhassuspendedcoverageofthiscompany.

UR=UnderReview.Sucheinvestreviewhappenswhenanydevelopmentshavealreadyoccurredorlikelytooccurintargetcompany&INSLanalystis waitingforsomemoreinformationtodraw

conclusiononrating/target.

NA=NotAvailableorNotApplicable.Theinformationisnotavailablefordisplayorisnotapplicable.

NM=NotMeaningful.Theinformationisnotmeaningfulandisthereforeexcluded.

ResearchAnalysthasnotservedasanofficer,directororemployeeofSubjectCompany

OneyearPricehistoryofthedailyclosingpriceofthesecuritiescoveredinthisnoteisavailableatwww.nseindia.comandwww.economictimes.indiatimes.com/markets/stocks/stockquotes.(Choose

nameofcompanyinthelistbrowsecompaniesandselect1yeariniconYTDinthepricechart)

IndiaNiveshSecuritiesLimited

ResearchAnalystSEBIRegistrationNo.INH000000511

601&602,SukhSagar,N.S.PatkarMarg,GirgaumChowpatty,Mumbai400007.

Tel:(022)66188800/Fax:(022)66188899

email:research@indianivesh.in|Website:www.indianivesh.in

Potrebbero piacerti anche

- Initiating Coverage Maruti SuzukiDocumento13 pagineInitiating Coverage Maruti SuzukiAditya Vikram JhaNessuna valutazione finora

- Equity Research ReportDocumento7 pagineEquity Research Reportjyoti_prakash_11Nessuna valutazione finora

- WhiteMonk HEG Equity Research ReportDocumento15 pagineWhiteMonk HEG Equity Research ReportgirishamrNessuna valutazione finora

- Aegis Logistics-Initiating Coverage - 10.07.2020 - EquirisDocumento49 pagineAegis Logistics-Initiating Coverage - 10.07.2020 - EquirisP VinayakamNessuna valutazione finora

- Nintendo Equity Report 1.4 Large FontsizeDocumento41 pagineNintendo Equity Report 1.4 Large FontsizeAnthony ChanNessuna valutazione finora

- Cirtek Holdings Corp. Equity Research ReportDocumento5 pagineCirtek Holdings Corp. Equity Research ReportunicapitalresearchNessuna valutazione finora

- 09 JAZZ Equity Research ReportDocumento9 pagine09 JAZZ Equity Research ReportAfiq KhidhirNessuna valutazione finora

- RC Equity Research Report Essentials CFA InstituteDocumento3 pagineRC Equity Research Report Essentials CFA InstitutetheakjNessuna valutazione finora

- Equity Research Report - CIMB 27 Sept 2016Documento14 pagineEquity Research Report - CIMB 27 Sept 2016Endi SingarimbunNessuna valutazione finora

- KORS Equity Research ReportDocumento21 pagineKORS Equity Research ReportJeremy_Edwards11Nessuna valutazione finora

- Equity ResearchDocumento4 pagineEquity ResearchDevangi KothariNessuna valutazione finora

- ACC Cement Research Report and Equity ValuationDocumento12 pagineACC Cement Research Report and Equity ValuationSougata RoyNessuna valutazione finora

- Equity Research Report ExpediaDocumento18 pagineEquity Research Report ExpediaMichelangelo BortolinNessuna valutazione finora

- Equity ResearchDocumento3 pagineEquity Researchanil100% (2)

- CFA Research Challenge Report on ACB BankDocumento21 pagineCFA Research Challenge Report on ACB BankNguyễnVũHoàngTấnNessuna valutazione finora

- SAIL Equity Research ReportDocumento21 pagineSAIL Equity Research Reportsantosh sableNessuna valutazione finora

- JPM - 021914 - 123336 Bloomberg Report (Luxottica Group)Documento6 pagineJPM - 021914 - 123336 Bloomberg Report (Luxottica Group)reginetalucodNessuna valutazione finora

- PVR Research ReportDocumento3 paginePVR Research ReportAnik MitraNessuna valutazione finora

- Chapter 10: Equity Valuation & AnalysisDocumento22 pagineChapter 10: Equity Valuation & AnalysisMumbo JumboNessuna valutazione finora

- Educomp Solutions Equity Research ReportDocumento0 pagineEducomp Solutions Equity Research ReportSudipta BoseNessuna valutazione finora

- RBC Equity ResearchDocumento18 pagineRBC Equity ResearchRio PrestonniNessuna valutazione finora

- Eco ProjectDocumento29 pagineEco ProjectAditya SharmaNessuna valutazione finora

- Research Report CowenDocumento14 pagineResearch Report CowenzevioNessuna valutazione finora

- Jazz Pharmaceuticals Investment Banking Pitch BookDocumento20 pagineJazz Pharmaceuticals Investment Banking Pitch BookAlexandreLegaNessuna valutazione finora

- NTPC ReportDocumento15 pagineNTPC ReportKaushal Jaiswal100% (1)

- M& A Version 1.1Documento34 pagineM& A Version 1.1goelabhishek90Nessuna valutazione finora

- AdvanceAutoPartsConference Call Presentation101613Documento18 pagineAdvanceAutoPartsConference Call Presentation101613aedcbf123Nessuna valutazione finora

- RATIOS AnalysisDocumento61 pagineRATIOS AnalysisSamuel Dwumfour100% (1)

- q2 Valuation Insights Second 2020 PDFDocumento20 pagineq2 Valuation Insights Second 2020 PDFKojiro FuumaNessuna valutazione finora

- Cole Park CLO LimitedDocumento22 pagineCole Park CLO Limitedeimg20041333Nessuna valutazione finora

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialDocumento37 pagineTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialRaman BajpaiNessuna valutazione finora

- Valuation Final ProjectDocumento31 pagineValuation Final ProjectsidchorariaNessuna valutazione finora

- A Review of Valuation Tech - 13-1-09Documento22 pagineA Review of Valuation Tech - 13-1-09weiycheeNessuna valutazione finora

- An Investment Analysis Case StudyDocumento4 pagineAn Investment Analysis Case Studyella marie toscanoNessuna valutazione finora

- Helius Medical Technologies Mackie Initiation June 2016Documento49 pagineHelius Medical Technologies Mackie Initiation June 2016Martin TsankovNessuna valutazione finora

- HDFC Bank Impressive Performance Bright ProspectsDocumento5 pagineHDFC Bank Impressive Performance Bright ProspectsPankaj MishraNessuna valutazione finora

- Gensol Engg Initial (JP Morgan)Documento14 pagineGensol Engg Initial (JP Morgan)beza manojNessuna valutazione finora

- Business Valuation ManagementDocumento42 pagineBusiness Valuation ManagementRakesh SinghNessuna valutazione finora

- HDFC Bank Equity Research ReportDocumento4 pagineHDFC Bank Equity Research ReportNikhil KumarNessuna valutazione finora

- UQAM CFA ResearchChallenge2014Documento22 pagineUQAM CFA ResearchChallenge2014tomz678Nessuna valutazione finora

- PepsicoDocumento12 paginePepsicomonish147852Nessuna valutazione finora

- CFA Equity Research Challenge 2011 - Team 9Documento15 pagineCFA Equity Research Challenge 2011 - Team 9Rohit KadamNessuna valutazione finora

- GICS MapbookDocumento52 pagineGICS MapbookVivek AryaNessuna valutazione finora

- Leverage Buyout - LBO Analysis: Investment Banking TutorialsDocumento26 pagineLeverage Buyout - LBO Analysis: Investment Banking Tutorialskarthik sNessuna valutazione finora

- Critical Financial Review: Understanding Corporate Financial InformationDa EverandCritical Financial Review: Understanding Corporate Financial InformationNessuna valutazione finora

- Starboard Value LP LetterDocumento4 pagineStarboard Value LP Lettersumit.bitsNessuna valutazione finora

- Choosing the Most Relevant Industry MultiplesDocumento11 pagineChoosing the Most Relevant Industry MultiplesSabina BuzoiNessuna valutazione finora

- Credit Suisse (Incl. NPV Build Up)Documento23 pagineCredit Suisse (Incl. NPV Build Up)rodskogjNessuna valutazione finora

- Equity TrainingDocumento224 pagineEquity TrainingSang Huynh100% (3)

- KKR - Consolidated Research ReportsDocumento60 pagineKKR - Consolidated Research Reportscs.ankur7010Nessuna valutazione finora

- Sector GuideDocumento194 pagineSector Guidebookworm1234123412341234Nessuna valutazione finora

- Industry Handbook - The Banking IndustryDocumento9 pagineIndustry Handbook - The Banking IndustryTMc1908Nessuna valutazione finora

- Precision Drilling Announces Middle East New Build Award and Proposed Private OfferingDocumento4 paginePrecision Drilling Announces Middle East New Build Award and Proposed Private OfferingzNessuna valutazione finora

- 2005 Winter - The Capital Structure Puzzle - The Evidence RevisitedDocumento12 pagine2005 Winter - The Capital Structure Puzzle - The Evidence Revisitedsuhaspujari93Nessuna valutazione finora

- Hikal ResearchNote 09oct2012Documento15 pagineHikal ResearchNote 09oct2012equityanalystinvestorNessuna valutazione finora

- Myriad Genetics Coverage ReportDocumento8 pagineMyriad Genetics Coverage ReportChazz262Nessuna valutazione finora

- Petroplus Overview (1.26.12)Documento15 paginePetroplus Overview (1.26.12)Chris BrunkNessuna valutazione finora

- Risk Premium DamodaranDocumento208 pagineRisk Premium DamodaranVeronica GetaNessuna valutazione finora

- Wyeth ValuationDocumento54 pagineWyeth ValuationSaurav GoyalNessuna valutazione finora

- Pennar Industries Q4fy17 Investor Presentation FinalDocumento29 paginePennar Industries Q4fy17 Investor Presentation FinalsriramrangaNessuna valutazione finora

- Venkys Financial Results 31.03.17Documento7 pagineVenkys Financial Results 31.03.17sriramrangaNessuna valutazione finora

- SC Arunchal - JudgmentDocumento331 pagineSC Arunchal - JudgmentFirstpostNessuna valutazione finora

- The Murder of The MahatmaDocumento65 pagineThe Murder of The MahatmaKonkman0% (1)

- Rural Electrification Corp. Ltd. Initiating CoverargeDocumento5 pagineRural Electrification Corp. Ltd. Initiating CoverargesriramrangaNessuna valutazione finora

- 53rd Annual Report 2013-2014Documento127 pagine53rd Annual Report 2013-2014sriramrangaNessuna valutazione finora

- NDR Presentation (Company Update)Documento28 pagineNDR Presentation (Company Update)Shyam SunderNessuna valutazione finora

- Voltamp Annual Report F.Y - 2015-16Documento67 pagineVoltamp Annual Report F.Y - 2015-16sriramrangaNessuna valutazione finora

- Annual Report 2015-16 Key HighlightsDocumento57 pagineAnnual Report 2015-16 Key HighlightssriramrangaNessuna valutazione finora

- Navkar Corporation - SPA ResearchDocumento4 pagineNavkar Corporation - SPA ResearchanjugaduNessuna valutazione finora

- Annual Report 2015: Quality and Benchmarks Drive GrowthDocumento192 pagineAnnual Report 2015: Quality and Benchmarks Drive GrowthsriramrangaNessuna valutazione finora

- Annual Report Highlights JAL's FY 2014-15 ResultsDocumento212 pagineAnnual Report Highlights JAL's FY 2014-15 ResultsGagan SinghNessuna valutazione finora

- Force Motors Annual Report 2013-14 HighlightsDocumento78 pagineForce Motors Annual Report 2013-14 HighlightssriramrangaNessuna valutazione finora

- Angel Union Budget 2015-16 PreviewDocumento51 pagineAngel Union Budget 2015-16 PreviewsriramrangaNessuna valutazione finora

- Deloitte Regulatory Alert - Companies Act 2013 - RulesDocumento10 pagineDeloitte Regulatory Alert - Companies Act 2013 - RulessriramrangaNessuna valutazione finora

- LGBalakrishnan Annualreport13-14Documento120 pagineLGBalakrishnan Annualreport13-14sriramrangaNessuna valutazione finora

- General - Circular - 8 - Commencement Date of Certain SectionsDocumento2 pagineGeneral - Circular - 8 - Commencement Date of Certain SectionssriramrangaNessuna valutazione finora

- 12 Large Cap Blue Chip StocksDocumento52 pagine12 Large Cap Blue Chip StocksAnonymous W7lVR9qs25Nessuna valutazione finora

- KPMG Flash News - Additional Guidelines On Employment Visa and Business ...Documento3 pagineKPMG Flash News - Additional Guidelines On Employment Visa and Business ...sriramrangaNessuna valutazione finora

- Operational Update 31dec 2013Documento64 pagineOperational Update 31dec 2013sriramrangaNessuna valutazione finora

- Nhai Im 2013-14 02-04-13Documento30 pagineNhai Im 2013-14 02-04-13Pankaj GoyenkaNessuna valutazione finora

- Astral PolytechnikDocumento58 pagineAstral PolytechniksriramrangaNessuna valutazione finora

- Deloitte International Tax Alert - E-Fund CorpDocumento7 pagineDeloitte International Tax Alert - E-Fund CorpsriramrangaNessuna valutazione finora

- PWC News Alert 11 February 2014 e Funds Ruling A Silver Lining For Contract Service ProvidersDocumento3 paginePWC News Alert 11 February 2014 e Funds Ruling A Silver Lining For Contract Service ProviderssriramrangaNessuna valutazione finora

- Capital Gains Accounts Scheme, 1988Documento9 pagineCapital Gains Accounts Scheme, 1988sriramrangaNessuna valutazione finora

- 08 MCN F 29062013Documento12 pagine08 MCN F 29062013sriramrangaNessuna valutazione finora

- Capital Gains Accounts Scheme, 1988Documento9 pagineCapital Gains Accounts Scheme, 1988sriramrangaNessuna valutazione finora

- Deloitte BusinessTax Alert - Dolphin Drilling LTDDocumento3 pagineDeloitte BusinessTax Alert - Dolphin Drilling LTDsriramrangaNessuna valutazione finora

- Limited Risk Models - Sept 4 2013Documento40 pagineLimited Risk Models - Sept 4 2013sriramrangaNessuna valutazione finora

- Aerospace Industry in IndiaDocumento6 pagineAerospace Industry in IndiahasanshabrezNessuna valutazione finora

- Marketing Plan Construction MachineryDocumento17 pagineMarketing Plan Construction MachineryShailesh KhodkeNessuna valutazione finora

- Eimco Elecon Equity Research Report July 2016Documento19 pagineEimco Elecon Equity Research Report July 2016sriramrangaNessuna valutazione finora

- MBA ProjectDocumento93 pagineMBA ProjectMitesh PatilNessuna valutazione finora

- Escorts ConstructionDocumento56 pagineEscorts ConstructionNEERAJ DWIVEDI0% (1)

- Working Capital Management at BEMLDocumento20 pagineWorking Capital Management at BEMLadharav malikNessuna valutazione finora

- Internship Report: Training Centre - Mysore ComplexDocumento28 pagineInternship Report: Training Centre - Mysore Complexshubhashini K NNessuna valutazione finora

- A Study On Employee Welfare of Beml Limited, BangaloreDocumento115 pagineA Study On Employee Welfare of Beml Limited, BangalorePrashanth PB100% (2)

- December 2018 Issue PDFDocumento60 pagineDecember 2018 Issue PDFJichen LiuNessuna valutazione finora

- Beml PPT Dipam PDFDocumento22 pagineBeml PPT Dipam PDFsanjeevNessuna valutazione finora

- Delhi Metro Rail Corporation (DMRC) RS2 Train Features and SystemsDocumento21 pagineDelhi Metro Rail Corporation (DMRC) RS2 Train Features and SystemsRicha VermaNessuna valutazione finora

- Working Capital On BEMLDocumento103 pagineWorking Capital On BEMLAjay Karthik100% (2)

- IMME - 2014 - Show - Preview - 23 - 10-2014Documento55 pagineIMME - 2014 - Show - Preview - 23 - 10-2014kavenindia0% (1)

- ROB - No No of Visit PO. No & Date Customer NameDocumento34 pagineROB - No No of Visit PO. No & Date Customer NameAkash TomarNessuna valutazione finora

- Competency MappingDocumento70 pagineCompetency MappingSunil Sunil SNessuna valutazione finora

- BemlDocumento34 pagineBemlgeniusb250% (2)

- List of Approved Sub-Contractors and Vendors for Hydraulic and Pneumatic EquipmentDocumento27 pagineList of Approved Sub-Contractors and Vendors for Hydraulic and Pneumatic Equipmentkoushik42000Nessuna valutazione finora

- Beml PresentationDocumento19 pagineBeml PresentationgvikasrNessuna valutazione finora

- Employee's Performance Appraisal in Psu's With Special Reference To Beml Limited" BangaloreDocumento124 pagineEmployee's Performance Appraisal in Psu's With Special Reference To Beml Limited" BangalorePrashanth PBNessuna valutazione finora

- Mysore BemlDocumento8 pagineMysore BemlSawan Singh HNessuna valutazione finora

- Internship Report On BemlDocumento28 pagineInternship Report On BemlRam Prathap100% (5)

- BEML Company ProfileDocumento21 pagineBEML Company Profileali1msNessuna valutazione finora

- Construction Equipment: September 2009Documento34 pagineConstruction Equipment: September 2009Dhruv DaveNessuna valutazione finora

- UdayDocumento84 pagineUdayRaju VeluruNessuna valutazione finora

- Case Presentation: Bharat Earth Movers Limited (bEML)Documento21 pagineCase Presentation: Bharat Earth Movers Limited (bEML)Arju AliNessuna valutazione finora

- Mining Construction EquipmentDocumento48 pagineMining Construction Equipmentanil_ajinkyaNessuna valutazione finora

- Tatra DealDocumento18 pagineTatra DealpravuNessuna valutazione finora

- Standardisation IndigenisationDocumento16 pagineStandardisation IndigenisationatulNessuna valutazione finora

- Delhi Metro Rolling Stock GuideDocumento3 pagineDelhi Metro Rolling Stock GuideSunnyGosarNessuna valutazione finora

- Bangalore Metro Rail ProjectDocumento91 pagineBangalore Metro Rail Projectdhruva kumar90% (10)